Outdoor equipment company Toro (NYSE:TTC) fell short of analysts’ expectations in Q2 CY2024, with revenue up 6.9% year on year to $1.16 billion. It made a GAAP profit of $1.14 per share, improving from its loss of $0.14 per share in the same quarter last year.

Is now the time to buy The Toro Company? Find out in our full research report.

The Toro Company (TTC) Q2 CY2024 Highlights:

- Revenue: $1.16 billion vs analyst estimates of $1.26 billion (8.1% miss)

- EPS: $1.14 vs analyst expectations of $1.22 (6.8% miss)

- Gross Margin (GAAP): 34.8%, in line with the same quarter last year

- Free Cash Flow Margin: 14.7%, up from 5.3% in the same quarter last year

- Market Capitalization: $9.45 billion

“Our team executed with discipline and delivered top- and bottom-line growth in a very dynamic environment,” said Richard M. Olson, chairman and chief executive officer.

Ceasing all production to support the war effort during World War II, Toro (NYSE:TTC) offers outdoor equipment for residential, commercial, and agricultural use.

Agricultural Machinery

Agricultural machinery companies are investing to develop and produce more precise machinery, automated systems, and connected equipment that collects analyzable data to help farmers and other customers improve yields and increase efficiency. On the other hand, agriculture is seasonal and natural disasters or bad weather can impact the entire industry. Additionally, macroeconomic factors such as commodity prices or changes in interest rates–which dictate the willingness of these companies or their customers to invest–can impact demand for agricultural machinery.

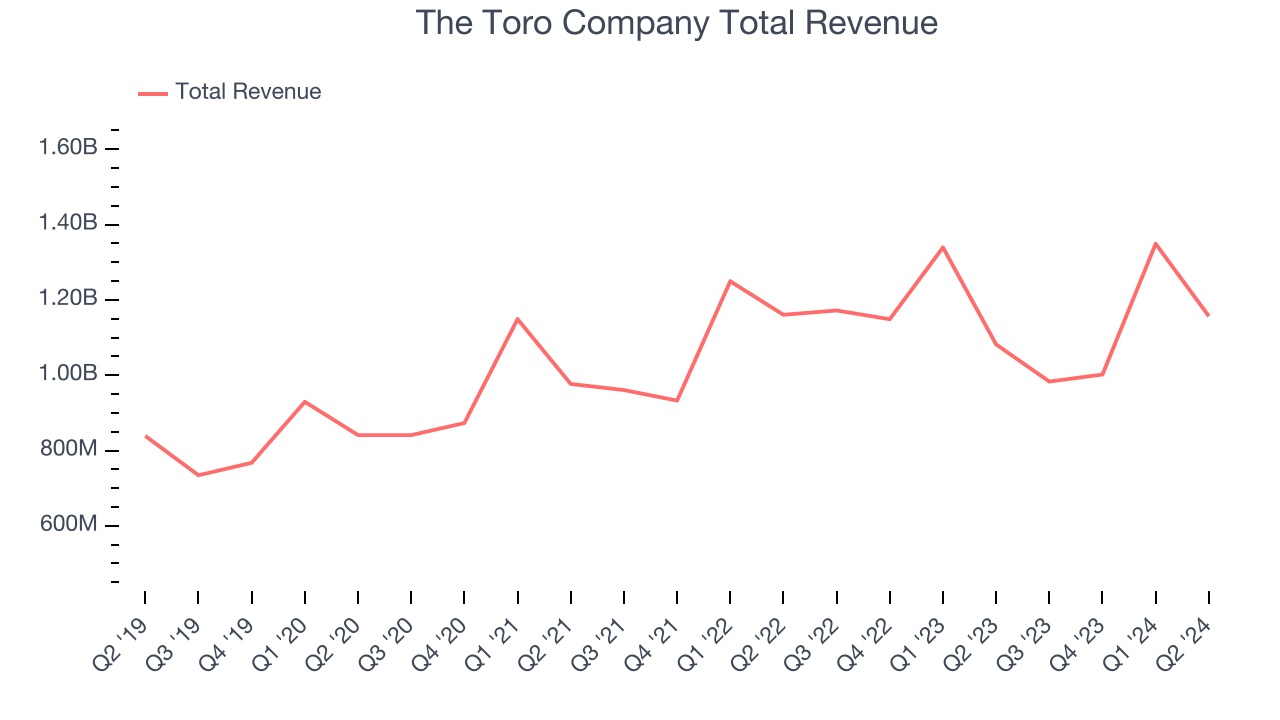

Sales Growth

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Thankfully, The Toro Company’s 8.8% annualized revenue growth over the last five years was decent. This shows it was successful in expanding, a useful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. The Toro Company’s recent history shows its demand slowed as its annualized revenue growth of 2.2% over the last two years is below its five-year trend.

The Toro Company also breaks out the revenue for its most important segments, Professional and Residential , which are 76.1% and 23.1% of revenue. Over the last two years, The Toro Company’s Professional revenue (sales to contractors) averaged 5.3% year-on-year growth. On the other hand, its Residential revenue (sales to homeowners) averaged 1.6% declines.

This quarter, The Toro Company’s revenue grew 6.9% year on year to $1.16 billion, missing Wall Street’s estimates. Looking ahead, Wall Street expects sales to grow 9% over the next 12 months, an acceleration from this quarter.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

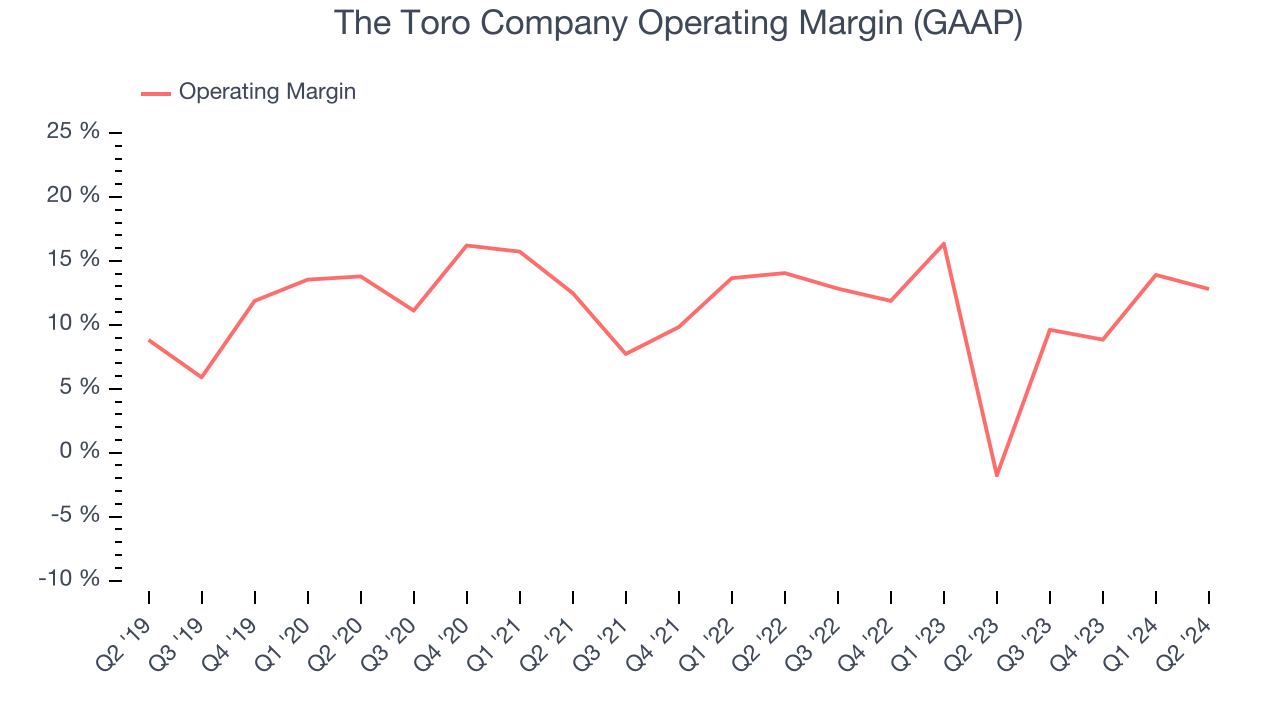

Operating Margin

The Toro Company has managed its expenses well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 11.7%. This result isn’t too surprising as its gross margin gives it a favorable starting point.

Looking at the trend in its profitability, The Toro Company’s annual operating margin might have seen some fluctuations but has remained more or less the same over the last five years, highlighting the long-term consistency of its business.

This quarter, The Toro Company generated an operating profit margin of 12.8%, up 14.6 percentage points year on year. This increase was solid, and since the company’s operating margin rose more than its gross margin, we can infer it was recently more efficient with expenses such as sales, marketing, R&D, and administrative overhead.

EPS

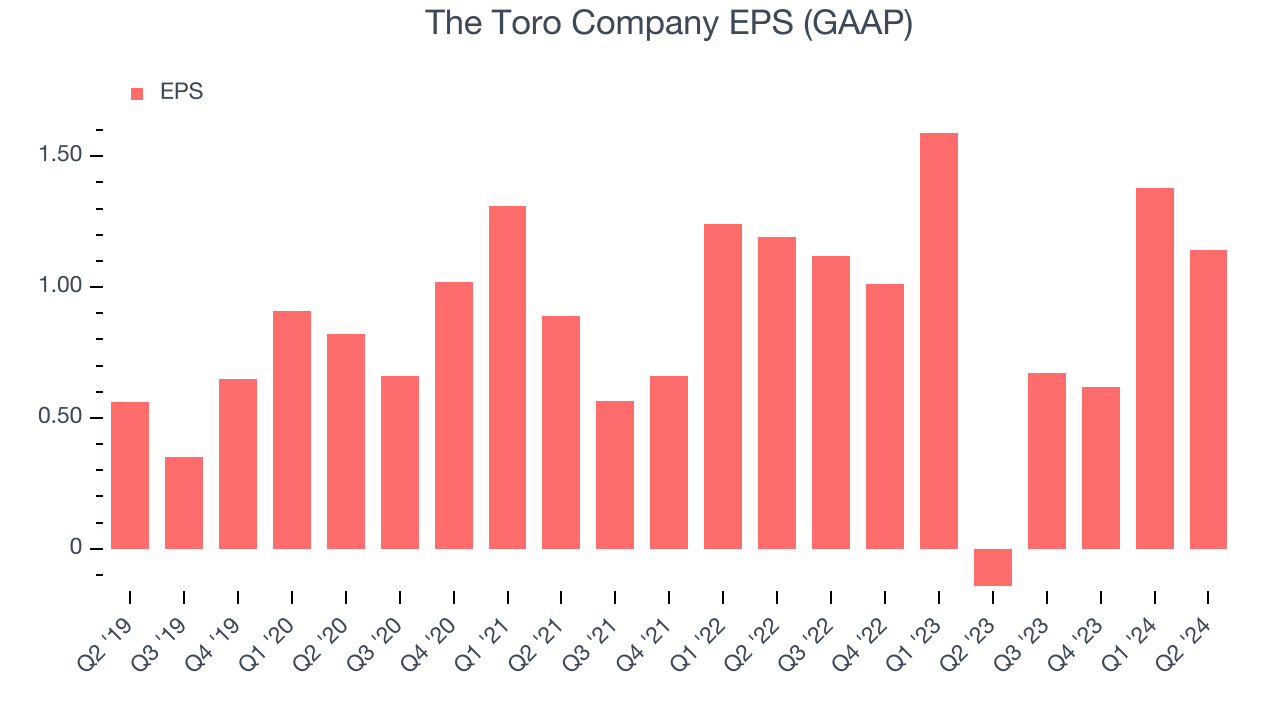

We track the long-term growth in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

The Toro Company’s EPS grew at an unimpressive 7.6% compounded annual growth rate over the last five years, lower than its 8.8% annualized revenue growth. However, its operating margin didn’t change during this timeframe, telling us non-fundamental factors affected its ultimate earnings.

Like with revenue, we also analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business. For The Toro Company, its two-year annual EPS growth of 2.1% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q2, The Toro Company reported EPS at $1.14, up from negative $0.14 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street expects The Toro Company to grow its earnings. Analysts are projecting its EPS of $3.81 in the last year to climb by 22% to $4.65.

Key Takeaways from The Toro Company’s Q2 Results

We struggled to find many strong positives in these results. Its revenue unfortunately missed and its EPS fell short of Wall Street’s estimates. Overall, this was a mediocre quarter. The stock traded down 7.7% to $84 immediately after reporting.

The Toro Company may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.