As Q2 earnings season comes to a close, it’s time to take stock of this quarters’ best and worst performers amongst the vertical software stocks, including Veeva Systems (NYSE:VEEV) and its peers.

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, there are industries that have very specific needs. Whether it is life-sciences, education or banking, the demand for so called vertical software, addressing industry specific workflows, is growing, fueled by the pressures on improving productivity and quality of offerings.

The 12 vertical software stocks we track reported a weaker Q2; on average, revenues missed analyst consensus estimates by 0.53%, while on average next quarter revenue guidance was 3.23% under consensus. There has been a stampede out of high valuation technology stocks as raising interest encourage investors to value profits over growth again and vertical software stocks have not been spared, with share price down 20.6% since the previous earnings results, on average.

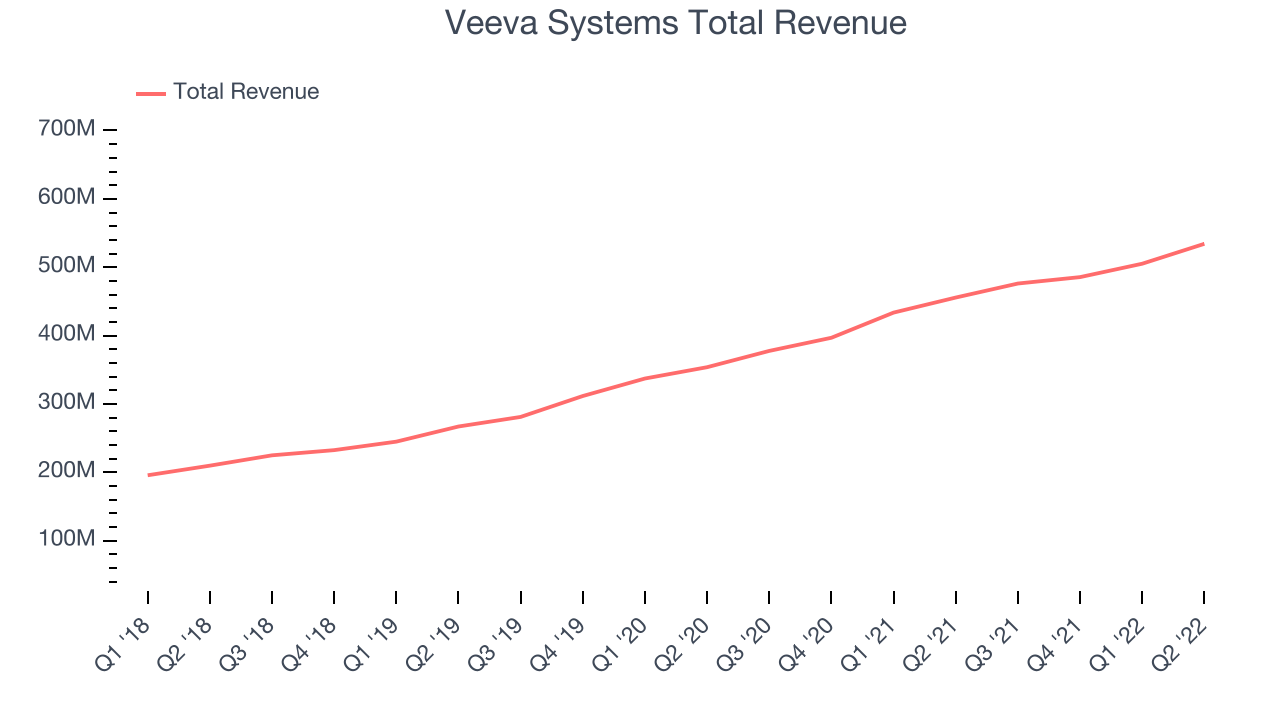

Veeva Systems (NYSE:VEEV)

Built on top of Salesforce as one of the first vertical-focused cloud platforms, Veeva (NYSE:VEEV) provides data and customer relationship management (CRM) software for organizations in the life sciences industry.

Veeva Systems reported revenues of $534.2 million, up 17.2% year on year, in line with analyst expectations. It was a weak quarter for the company, with a full year guidance missing analysts' expectations and an underwhelming revenue guidance for the next quarter.

"Our innovation engine is delivering more value to our customers than ever as we continue making progress with established and newly launched products in commercial and R&D," said CEO Peter Gassner.

The stock is down 17% since the results and currently trades at $165.42.

Is now the time to buy Veeva Systems? Access our full analysis of the earnings results here, it's free.

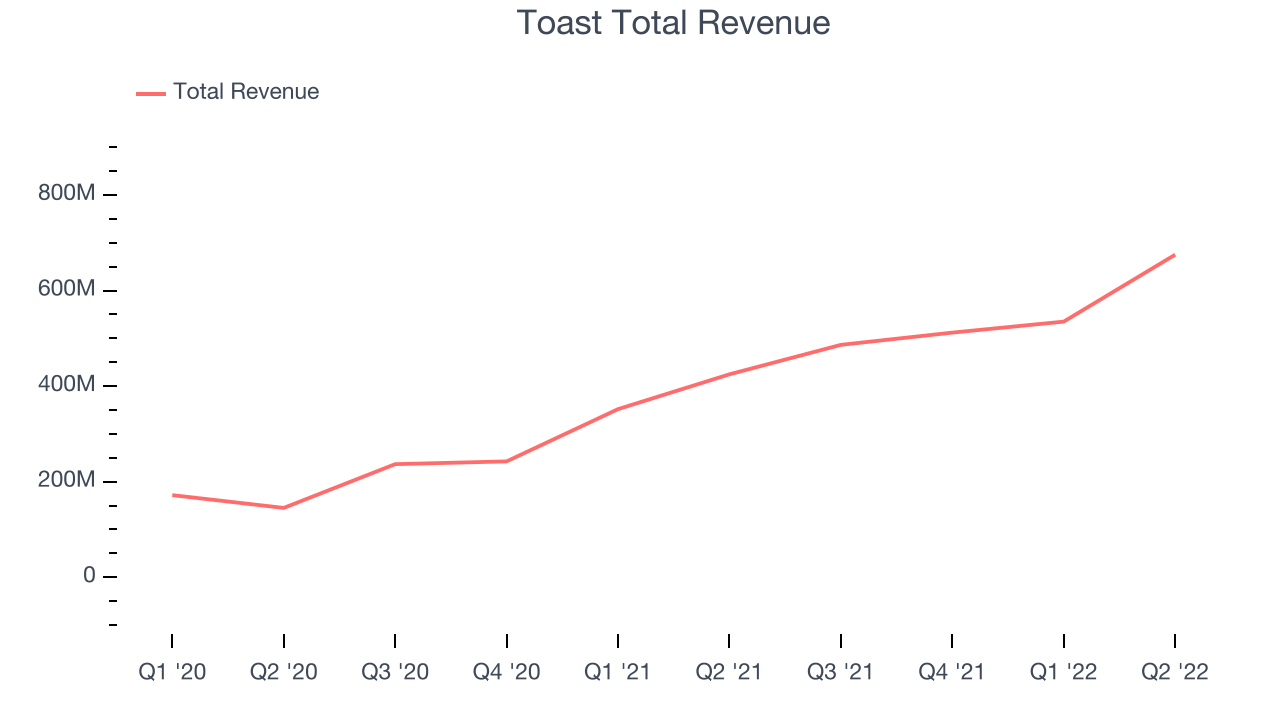

Best Q2: Toast (NYSE:TOST)

Founded by three MIT engineers at a local Cambridge bar, Toast (NYSE:TOST) provides integrated point of sale (POS) hardware, software, and payments solutions for restaurants.

Toast reported revenues of $675 million, up 58.9% year on year, beating analyst expectations by 4.22%. It was an impressive quarter for the company, with a very optimistic guidance for the next quarter and an exceptional revenue growth.

Toast pulled off the strongest analyst estimates beat and fastest revenue growth among its peers. The stock is down 0.33% since the results and currently trades at $18.07.

Is now the time to buy Toast? Access our full analysis of the earnings results here, it's free.

Slowest Q2: Unity (NYSE:U)

Started as a game studio by three friends in a Copenhagen apartment, Unity (NYSE:U) is a software as a service platform that makes it easier to develop and monetize new games and other visual digital experiences.

Unity reported revenues of $297 million, up 8.58% year on year, missing analyst expectations by 0.67%. It was a weak quarter for the company, with guidance for both the next quarter and full year missing analysts' expectations. Unity previously announced that it has entered into an agreement to merge with ironSource.

The stock is down 31% since the results and currently trades at $34.55.

Read our full analysis of Unity's results here.

Upstart (NASDAQ:UPST)

Founded by the former head of Google's enterprise business Dave Girouard, Upstart (NASDAQ:UPST) is an AI-powered lending platform that helps banks better evaluate the risk of lending money to a person and provide loans to more customers.

Upstart reported revenues of $228.1 million, up 16.7% year on year, missing analyst expectations by 3.03%. It was a weak quarter for the company, with an underwhelming revenue guidance for the next quarter and a miss of the top line analyst estimates.

The stock is down 29.7% since the results and currently trades at $22.65.

Read our full, actionable report on Upstart here, it's free.

2U (NASDAQ:TWOU)

Originally named 2tor after the founder's dog Tor, 2U (NASDAQ:TWOU) provides software for universities and colleges to deliver online degree programs and courses.

2U reported revenues of $241.4 million, up 1.79% year on year, missing analyst expectations by 5.03%. It was a weak quarter for the company, with a full year guidance missing analysts' expectations and a miss of the top line analyst estimates.

2U had the weakest full year guidance update among the peers. The stock is down 39.1% since the results and currently trades at $6.30.

Read our full, actionable report on 2U here, it's free.

The author has no position in any of the stocks mentioned