Electronic equipment provider Vontier (NYSE:VNT) reported Q3 CY2024 results beating Wall Street’s revenue expectations, but sales fell 2% year on year to $750 million. The company expects next quarter’s revenue to be around $770 million, close to analysts’ estimates. Its non-GAAP profit of $0.73 per share was also 6.2% above analysts’ consensus estimates.

Is now the time to buy Vontier? Find out in our full research report.

Vontier (VNT) Q3 CY2024 Highlights:

- Revenue: $750 million vs analyst estimates of $729.2 million (2.8% beat)

- Adjusted EPS: $0.73 vs analyst estimates of $0.69 (6.2% beat)

- EBITDA: $171.5 million vs analyst estimates of $164.6 million (4.2% beat)

- Revenue Guidance for Q4 CY2024 is $770 million at the midpoint, roughly in line with what analysts were expecting

- Management reiterated its full-year Adjusted EPS guidance of $2.89 at the midpoint

- Gross Margin (GAAP): 47.2%, in line with the same quarter last year

- Operating Margin: 17.5%, down from 18.6% in the same quarter last year

- EBITDA Margin: 22.9%, in line with the same quarter last year

- Free Cash Flow Margin: 13.8%, down from 14.9% in the same quarter last year

- Organic Revenue rose 3% year on year (-2.6% in the same quarter last year)

- Market Capitalization: $5.24 billion

Company Overview

A spin-off of a spin-off, Vontier (NYSE:VNT) provides electronic products and systems to the transportation, automotive, and manufacturing sectors.

Internet of Things

Industrial Internet of Things (IoT) companies are buoyed by the secular trend of a more connected world. They often specialize in nascent areas such as hardware and services for factory automation, fleet tracking, or smart home technologies. Those who play their cards right can generate recurring subscription revenues by providing cloud-based software services, boosting their margins. On the other hand, if the technologies these companies have invested in don’t pan out, they may have to make costly pivots.

Sales Growth

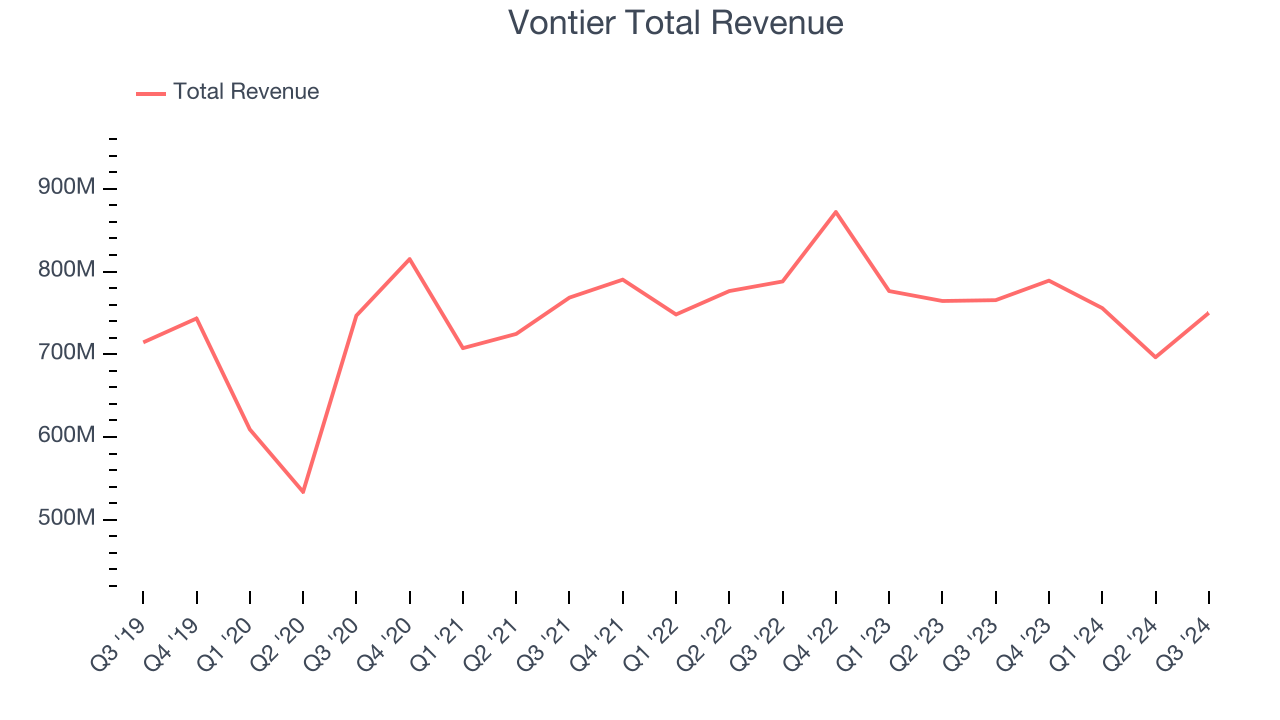

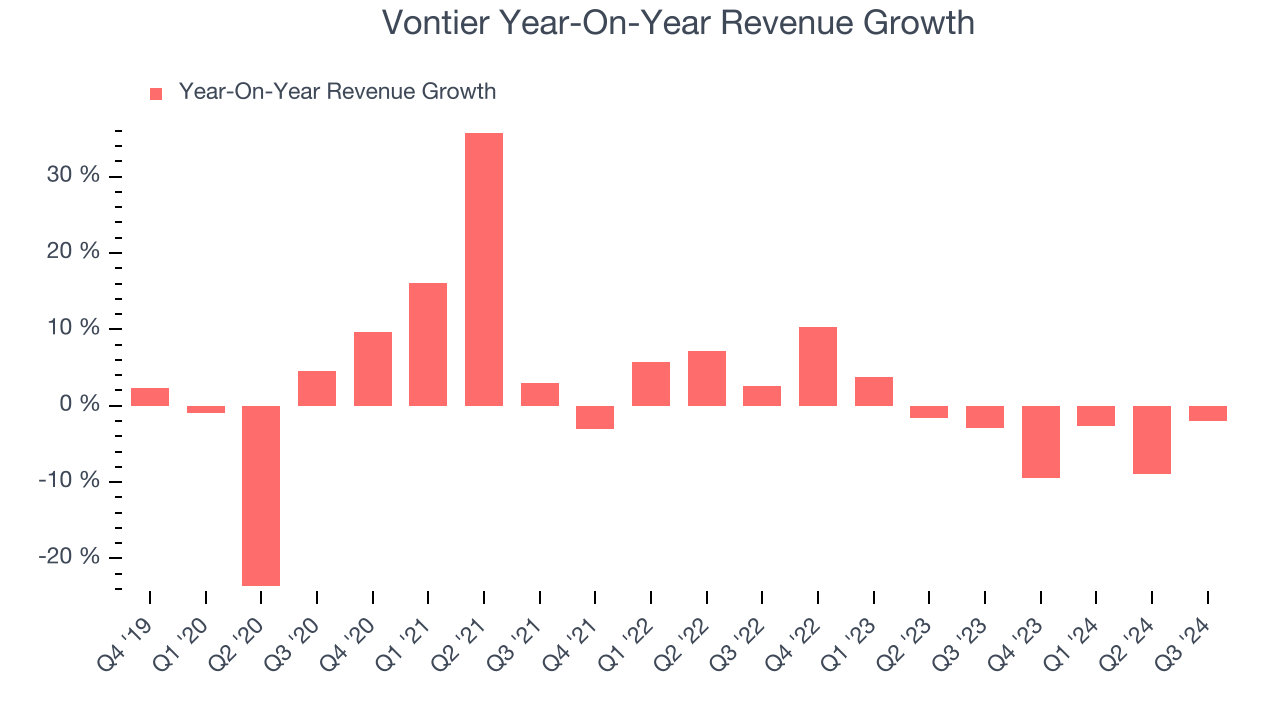

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Vontier’s 1.7% annualized revenue growth over the last five years was sluggish. This shows it failed to expand in any major way, a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Vontier’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 1.8% annually. Vontier isn’t alone in its struggles as the Internet of Things industry experienced a cyclical downturn, with many similar businesses seeing lower sales at this time.

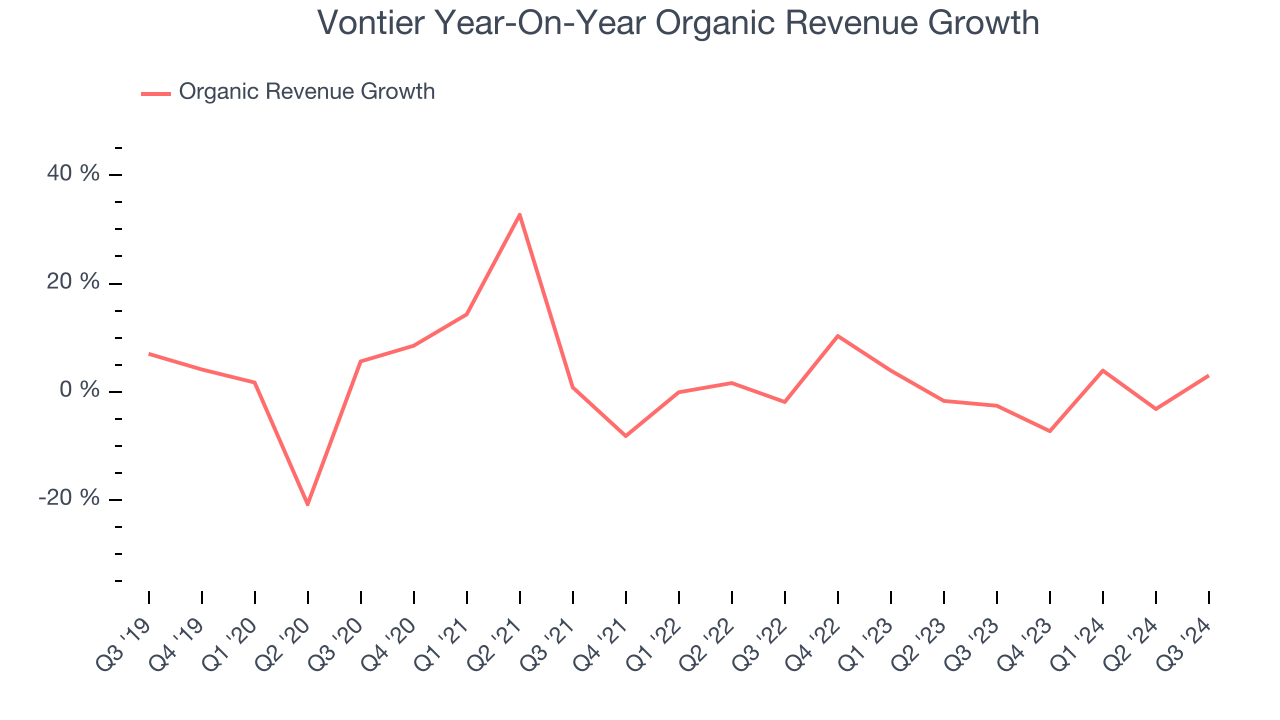

We can dig further into the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations because they don’t accurately reflect its fundamentals. Over the last two years, Vontier’s organic revenue was flat. Because this number is better than its normal revenue growth, we can see that some mixture of divestitures and foreign exchange rates dampened its headline performance.

This quarter, Vontier’s revenue fell 2% year on year to $750 million but beat Wall Street’s estimates by 2.8%. Management is currently guiding for a 2.4% year-on-year decline next quarter.

Looking further ahead, sell-side analysts expect revenue to remain flat over the next 12 months, an improvement versus the last two years. Although this projection indicates the market thinks its newer products and services will catalyze better performance, it is still below the sector average.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling them, and, most importantly, keeping them relevant through research and development.

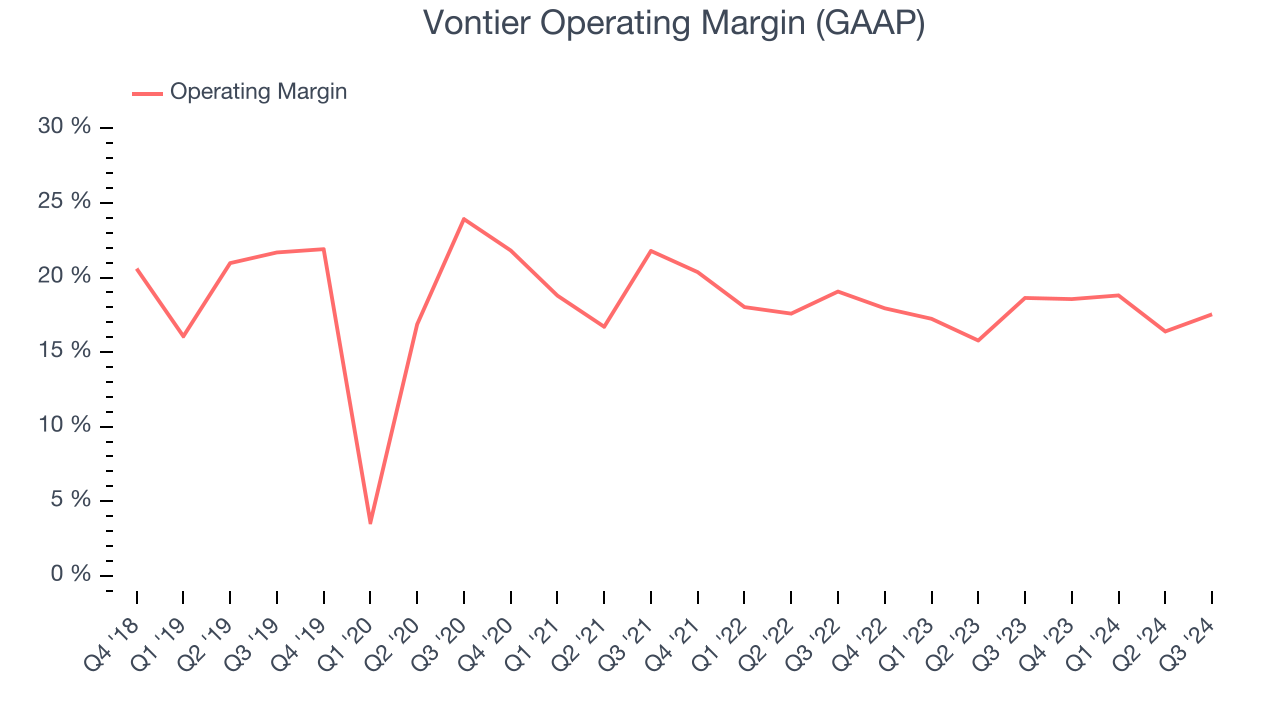

Vontier has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 18.2%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Vontier’s annual operating margin might have seen some fluctuations but has generally stayed the same over the last five years, highlighting the long-term consistency of its business.

This quarter, Vontier generated an operating profit margin of 17.5%, down 1.1 percentage points year on year. Since Vontier’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

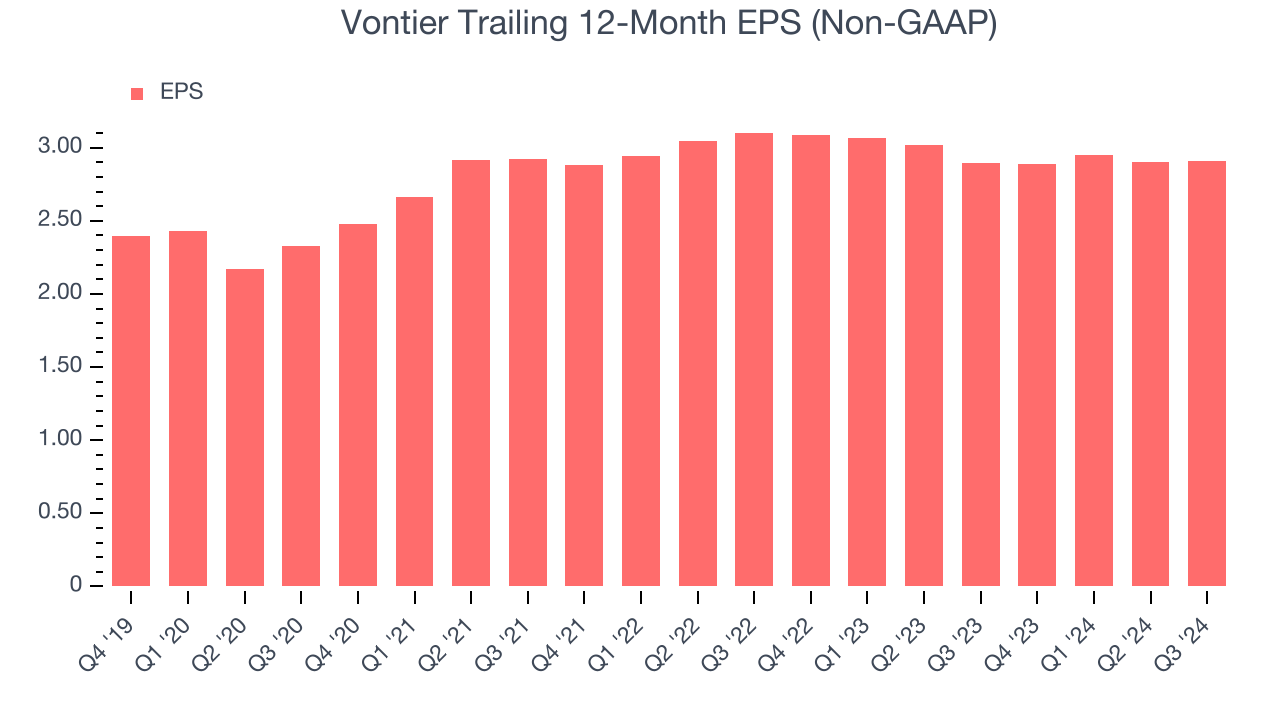

Earnings Per Share

Analyzing revenue trends tells us about a company’s historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

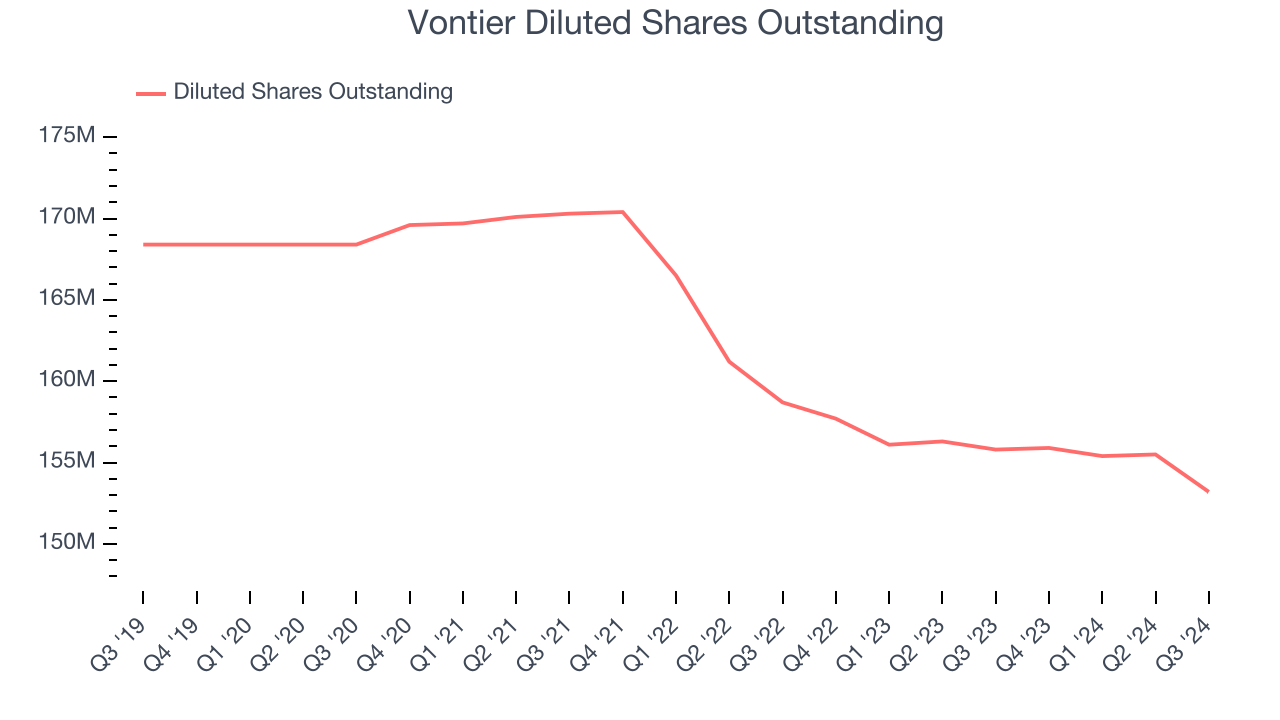

Vontier’s EPS grew at an unimpressive 4.7% compounded annual growth rate over the last five years. This performance was better than its 1.7% annualized revenue growth but doesn’t tell us much about its business quality because its operating margin didn’t expand.

We can take a deeper look into Vontier’s earnings to better understand the drivers of its performance. A five-year view shows that Vontier has repurchased its stock, shrinking its share count by 9%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business.

For Vontier, its two-year annual EPS declines of 3.2% show it’s continued to underperform. These results were bad no matter how you slice the data.In Q3, Vontier reported EPS at $0.73, in line with the same quarter last year. This print beat analysts’ estimates by 6.2%. Over the next 12 months, Wall Street expects Vontier’s full-year EPS of $2.91 to grow by 6.4%.

Key Takeaways from Vontier’s Q3 Results

We were impressed by how significantly Vontier blew past analysts’ organic revenue expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 1.8% to $34.70 immediately after reporting.

Indeed, Vontier had a rock-solid quarterly earnings result, but is this stock a good investment here? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.