Financial and compliance reporting software company Workiva (NYSE:WK) reported Q1 FY2021 results topping analyst expectations, with revenue up 21.4% year on year to $104 million. Workiva made a GAAP loss of $7.32 million, improving on its loss of $10.5 million, in the same quarter last year.

Workiva (WK) Q1 FY2021 Highlights:

- Revenue: $104 million vs analyst estimates of $100 million (3.77% beat)

- EPS (non-GAAP): $0.12 vs analyst estimates of $0.07 ($0.05 beat)

- Revenue guidance for Q2 2021 is $101 million at the midpoint, above analyst estimates of $99.1 million

- The company lifted revenue guidance for the full year, from $410 million to $419 million at the midpoint, a 2.19% increase

- Net Revenue Retention Rate: 111%, in line with previous quarter

- Customers: 3,800, up from 3,723 in previous quarter

- Gross Margin (GAAP): 77.2%, up from 74.7% previous quarter

“Secular tailwinds from macro business trends, such as digital transformations, changes in the regulatory landscape, and remote workplaces, continue to generate strong demand for our open, intelligent and intuitive platform. We entered 2021 with strong momentum, which continued throughout the first quarter," said Marty Vanderploeg, Chief Executive Officer.

Financial Reporting in the Cloud

Workiva offers software as a service product that makes financial and compliance reporting easier, especially for publicly traded corporations. The platform automatically gathers and updates data from various internal company sources like accounting software or spreadsheets and joins it together in the cloud, removing the need for accounting teams to do it manually. Workiva users can then connect the data directly to financial, regulatory, and performance reports and presentations and know that they are always using the correct, approved and most up-to-date, version of it.

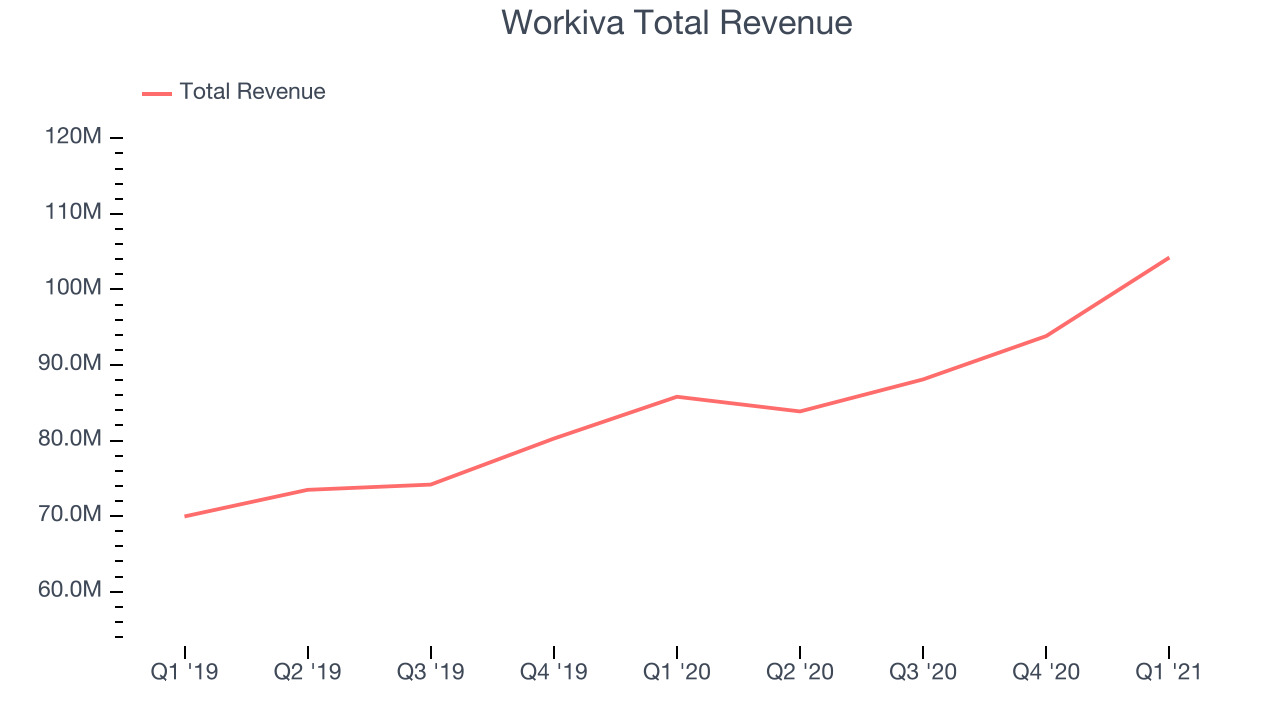

As you can see below, Workiva's revenue growth has been solid over the last twelve months, growing from $85.8 million to $104 million.

This quarter, Workiva's quarterly revenue was up a very solid 21.4% year on year, which is above average for the company. On top of that, revenue increased $10.3 million quarter on quarter, a very strong improvement on the $5.73 million increase in Q4 2020, which shows re-acceleration of growth, and is great to see.

Living in the Enterprise World

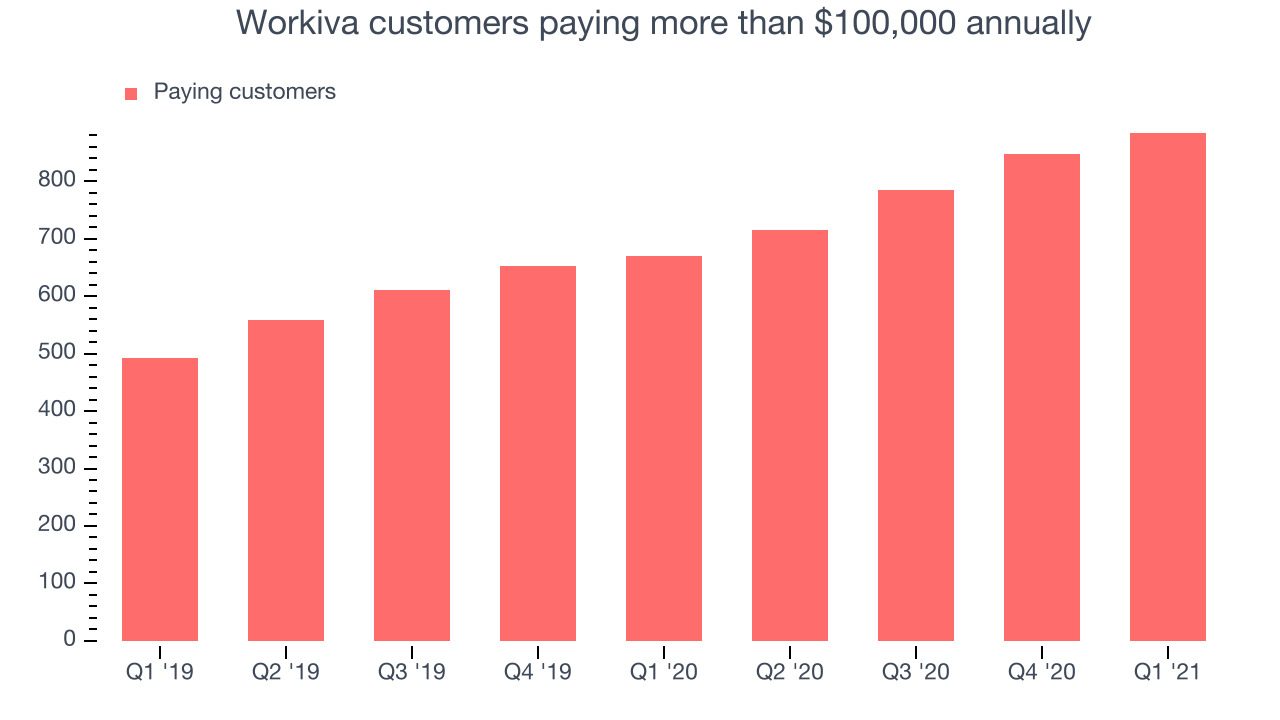

Workiva's target market are enterprises and big institutions that have large volumes of data distributed across various sources and a lot of reporting requirements at the same time.

You can see below that at the end of the quarter Workiva reported 884 enterprise customers paying more than $100,000 annually, an increase of 37 on last quarter. That is a bit less contract wins than last quarter and also quite a bit below what we have typically seen over the past couple of quarters, suggesting that the sales momentum with large customers is slowing down.

Key Takeaways from Workiva's Q1 Results

With market capitalisation of $4.54 billion and more than $540 million in cash, the company has the capacity to continue to prioritise growth.

Workiva' revenue guidance for the next quarter looks quite a bit better than what the analysts were expecting. And we were also excited to see it that it outperformed Wall St’s revenue expectations. On the other hand, it was disappointing to see the slowdown in new contract wins. Overall, this quarter's results seemed pretty positive and shareholders can feel optimistic. Workiva was already worth watching for its growth, and these results confirmed that.

PS. Have you noticed we published this analysis in less than 300 seconds since Workiva made their numbers public? We use technology until now only reserved for the top hedge funds to provide you with the fastest earnings analysis on the market. Get investing superpowers with StockStory. Signup here for early access.

The author has no position in any of the stocks mentioned.