The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Wabash (NYSE:WNC) and the rest of the heavy transportation equipment stocks fared in Q2.

Heavy transportation equipment companies are investing in automated vehicles that increase efficiencies and connected machinery that collects actionable data. Some are also developing electric vehicles and mobility solutions to address customers’ concerns about carbon emissions, creating new sales opportunities. Additionally, they are increasingly offering automated equipment that increases efficiencies and connected machinery that collects actionable data. On the other hand, heavy transportation equipment companies are at the whim of economic cycles. Interest rates, for example, can greatly impact the construction and transport volumes that drive demand for these companies’ offerings.

The 14 heavy transportation equipment stocks we track reported a satisfactory Q2. As a group, revenues were in line with analysts’ consensus estimates.

The Fed cut its policy rate by 50bps (half a percent) in September 2024, the first in roughly four years. This marks the end of its most pointed inflation-busting campaign since the 1980s. While CPI (inflation) readings have been supportive lately, employment measures have bordered on worrisome. The markets will be assessing whether this rate cut's timing (and more potential ones in 2024 and 2025) is ideal for supporting the economy or a bit too late for a macro that has already cooled too much.

While some heavy transportation equipment stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 4% since the latest earnings results.

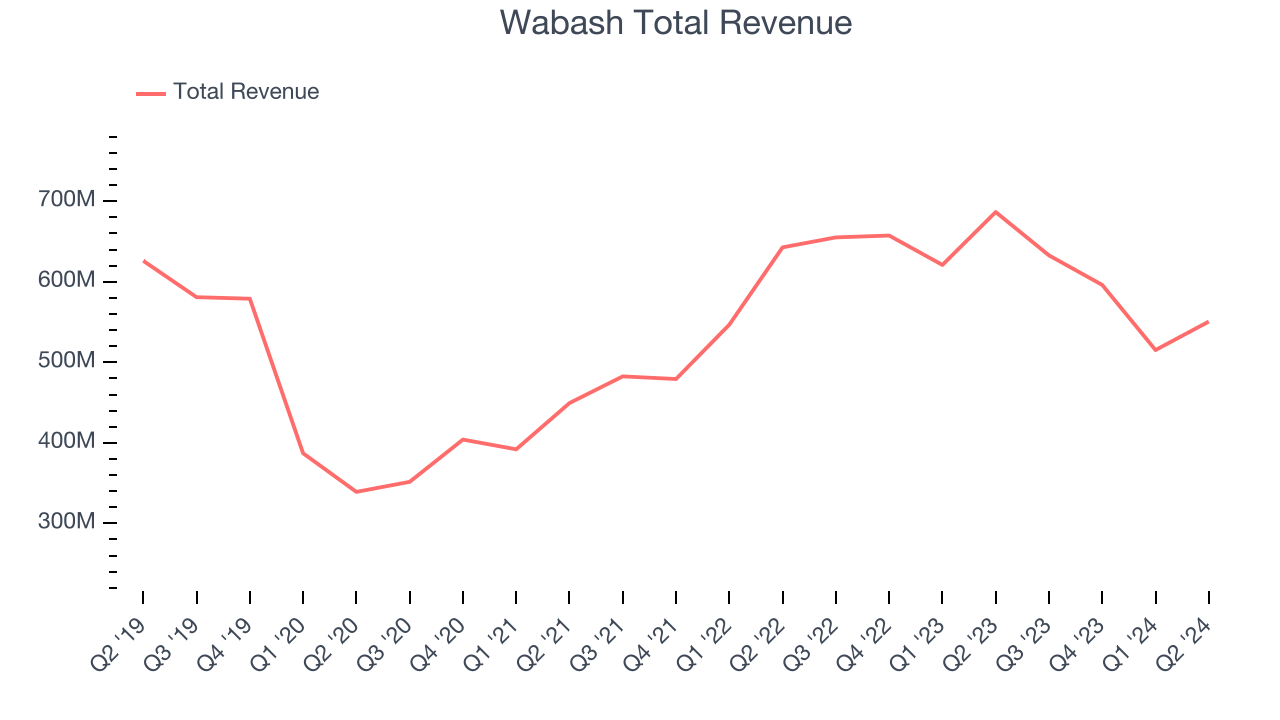

Wabash (NYSE:WNC)

With its first trailer reportedly built on two sawhorses, Wabash (NYSE:WNC) offers semi trailers, liquid transportation containers, truck bodies, and equipment for moving goods.

Wabash reported revenues of $550.6 million, down 19.8% year on year. This print fell short of analysts’ expectations by 7.4%. Overall, it was a slower quarter for the company with a miss of analysts’ backlog sales estimates.

"While the demand environment has incrementally weakened during the first half of 2024, our team has executed well, as shown by second quarter EPS generation that exceeded our prior outlook range," said Brent Yeagy, president and chief executive officer.

Unsurprisingly, the stock is down 19% since reporting and currently trades at $18.26.

Read our full report on Wabash here, it’s free.

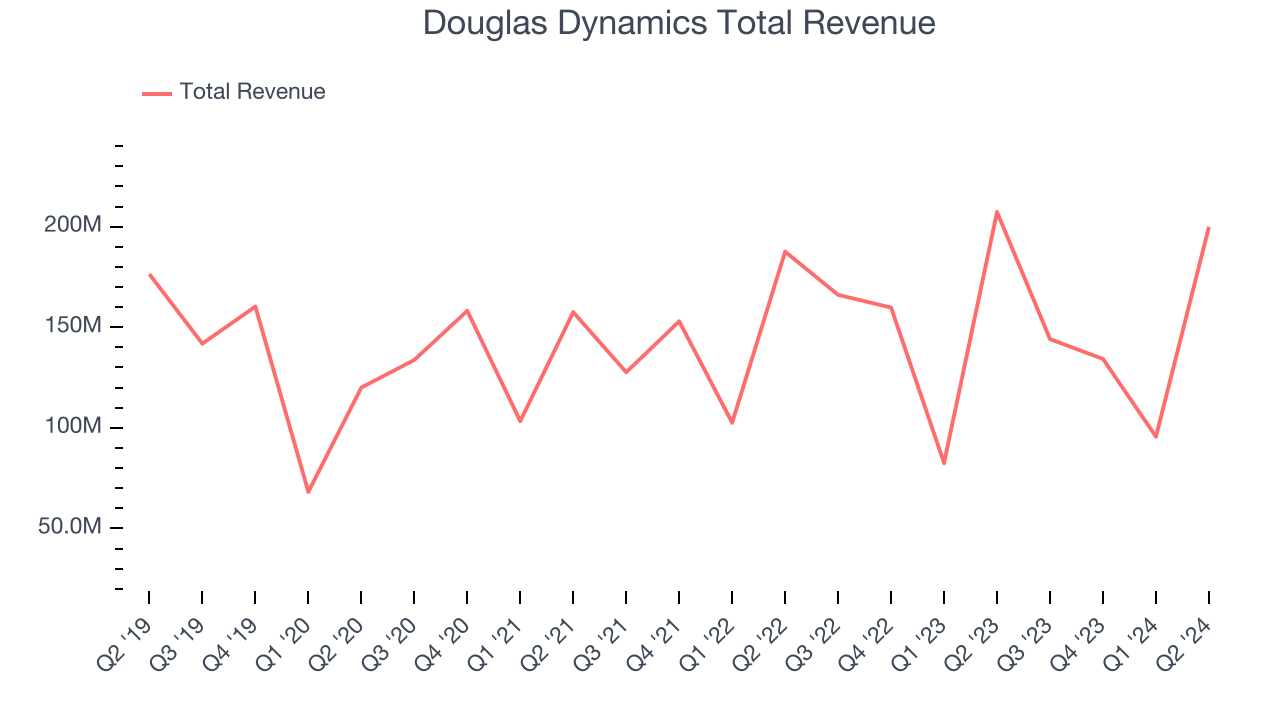

Best Q2: Douglas Dynamics (NYSE:PLOW)

Once manufacturing snowplows designed for the iconic jeep vehicle precursor, Douglas Dynamics (NYSE:PLOW) offers snow and ice equipment for the roads and sidewalks.

Douglas Dynamics reported revenues of $199.9 million, down 3.6% year on year, outperforming analysts’ expectations by 9.4%. The business had an incredible quarter with an impressive beat of analysts’ earnings estimates.

The market seems content with the results as the stock is up 1.8% since reporting. It currently trades at $26.89.

Is now the time to buy Douglas Dynamics? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Commercial Vehicle Group (NASDAQ:CVGI)

Formed from a partnership between two distinct companies, CVG (NASDAQ:CVGI) offers various components used in vehicles and systems used in warehouses.

Commercial Vehicle Group reported revenues of $229.9 million, down 12.3% year on year, falling short of analysts’ expectations by 3.3%. It was a disappointing quarter as it posted a miss of analysts’ earnings estimates.

As expected, the stock is down 33.2% since the results and currently trades at $3.16.

Read our full analysis of Commercial Vehicle Group’s results here.

PACCAR (NASDAQ:PCAR)

Founded more than a century ago, PACCAR (NASDAQ:PCAR) designs and manufactures commercial trucks of various weights and sizes for the commercial trucking industry.

PACCAR reported revenues of $8.26 billion, down 2.1% year on year. This number met analysts’ expectations. It was a strong quarter as it also put up an impressive beat of analysts’ organic revenue estimates.

The stock is down 6.7% since reporting and currently trades at $101.70.

Read our full, actionable report on PACCAR here, it’s free.

Trinity (NYSE:TRN)

Trinity Industries, Inc. (NYSE: TRN) is a provider of railcar products and services in North America, operating under the trade name TrinityRail.

Trinity reported revenues of $841.4 million, up 16.5% year on year. This print beat analysts’ expectations by 14%. Overall, it was a very strong quarter as it also recorded an impressive beat of analysts’ earnings estimates.

Trinity delivered the biggest analyst estimates beat among its peers. The stock is flat since reporting and currently trades at $33.33.

Read our full, actionable report on Trinity here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.