Looking back on industrial machinery stocks' Q2 earnings, we examine this quarter's best and worst performers, including Worthington (NYSE:WOR) and its peers.

Automation that increases efficiency and connected equipment that collects analyzable data have been trending, generating new demand for industrial machinery and components. Companies that innovate and create digitized solutions can spur sales and speed up replacement cycles while those resting on their laurels can see dwindling market positions. Like the broader industrials sector, industrial machinery and components companies are also at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

The 6 industrial machinery stocks we track reported a mixed Q2; on average, revenues missed analyst consensus estimates by 0.7%. while next quarter's revenue guidance was 2.3% below consensus. Stocks--especially those trading at higher multiples--had a strong end of 2023, but 2024 has seen periods of volatility. Mixed signals about inflation have led to uncertainty around rate cuts, and while some of the industrial machinery stocks have fared somewhat better than others, they collectively declined, with share prices falling 2.2% on average since the previous earnings results.

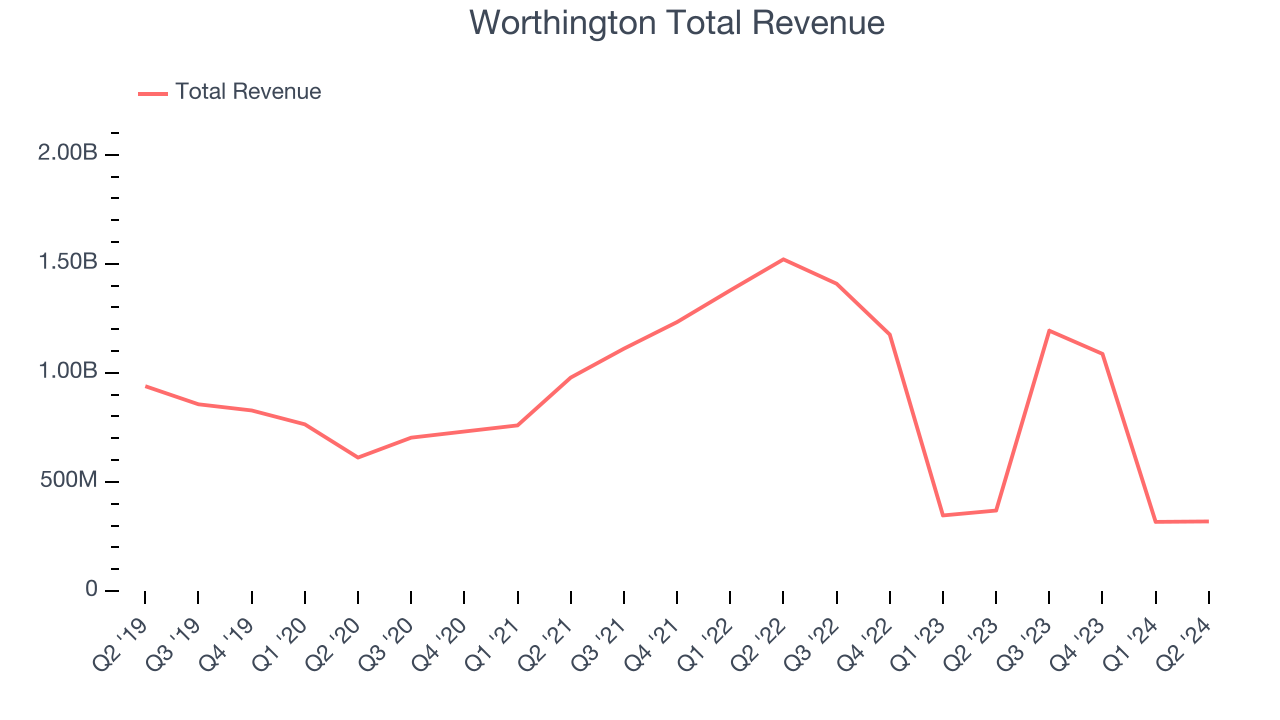

Weakest Q2: Worthington (NYSE:WOR)

Worthington Industries is an industrial manufacturing company with history dating back to 1955.

Worthington reported revenues of $318.8 million, down 13.6% year on year, falling short of analysts' expectations by 9.6%. Overall, it was a weak quarter for the company with a miss of analysts' earnings estimates and a miss of analysts' Building Products revenue estimates.

“We finished our fiscal year with a respectable fourth quarter delivering adjusted earnings per share of $0.74,” said Worthington Enterprises President and CEO Andy Rose.

Worthington delivered the weakest performance against analyst estimates of the whole group. The stock is flat since reporting and currently trades at $50.08.

Read our full report on Worthington here, it's free.

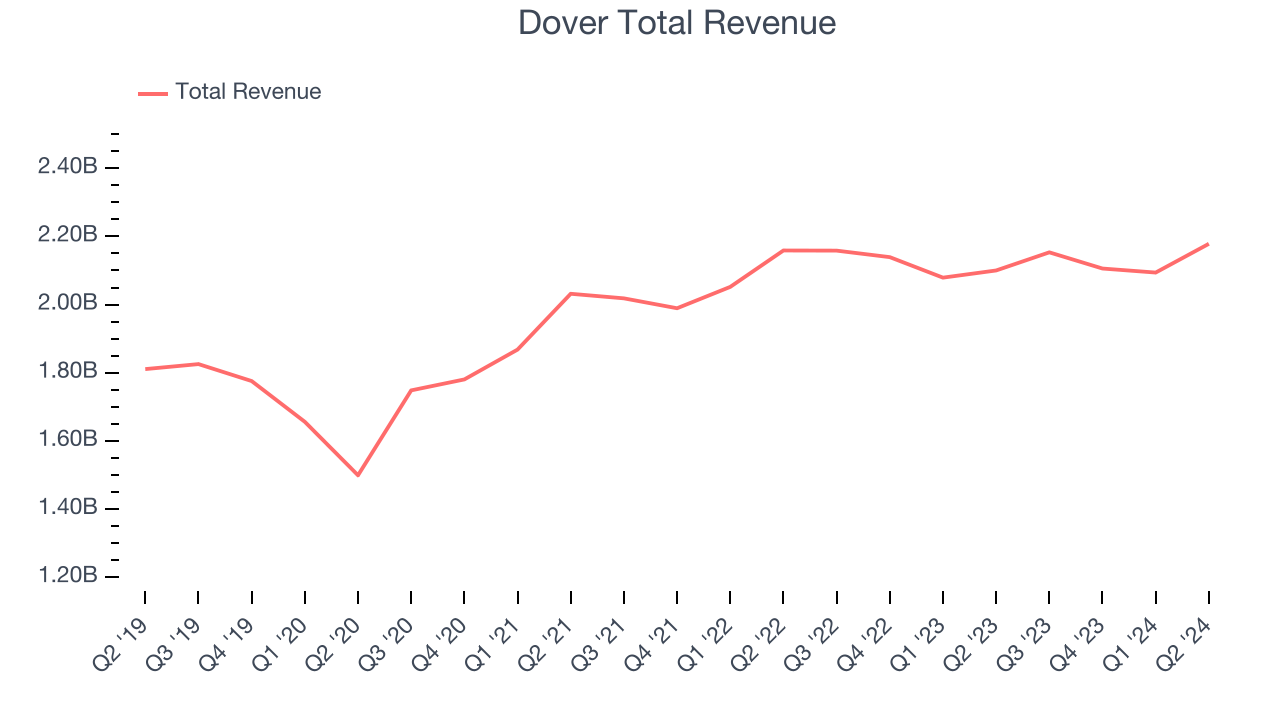

Best Q2: Dover (NYSE:DOV)

A company who manufactured critical equipment for the United States military during World War II, Dover (NYSE:DOV) manufactures engineered components and specialized equipment for numerous industries.

Dover reported revenues of $2.18 billion, up 3.7% year on year, outperforming analysts' expectations by 1.4%. It was a strong quarter for the company with a solid beat of analysts' organic revenue estimates and a decent beat of analysts' earnings estimates.

The market seems happy with the results as the stock is up 5.7% since reporting. It currently trades at $186.32.

Is now the time to buy Dover? Access our full analysis of the earnings results here, it's free.

Otis (NYSE:OTIS)

Credited with inventing the first hydraulic passenger elevator, Otis Worldwide (NYSE:OTIS) is an elevator and escalator manufacturing, installation and service company.

Otis reported revenues of $3.60 billion, down 3.2% year on year, falling short of analysts' expectations by 3.4%. It was a weak quarter for the company with a miss of analysts' organic revenue estimates and full-year revenue guidance missing analysts' expectations.

As expected, the stock is down 6.4% since the results and currently trades at $92.15.

Read our full analysis of Otis's results here.

Honeywell (NASDAQ:HON)

Originally founded in 1906 as a thermostat company, Honeywell (NASDAQ:HON) is an aerospace and defense manufacturing company building technologies, performance materials, and safety and productivity solutions.

Honeywell reported revenues of $9.58 billion, up 4.7% year on year, surpassing analysts' expectations by 1.7%. Overall, it was a very strong quarter for the company with an impressive beat of analysts' organic revenue estimates and full-year revenue guidance exceeding analysts' expectations.

Honeywell delivered the fastest revenue growth and highest full-year guidance raise among its peers. The stock is down 5.5% since reporting and currently trades at $201.99.

Read our full, actionable report on Honeywell here, it's free.

General Electric (NYSE:GE)

One of the original 12 companies on the Dow Jones Industrial Average, General Electric (NYSE:GE) is a multinational conglomerate providing technologies for various sectors including aviation, power, renewable energy, and healthcare.

General Electric reported revenues of $9.09 billion, down 42.6% year on year, surpassing analysts' expectations by 6.4%. Zooming out, it was a decent quarter for the company with an impressive beat of analysts' earnings estimates but a miss of analysts' organic revenue estimates.

General Electric scored the biggest analyst estimates beat but had the slowest revenue growth among its peers. The stock is up 1.9% since reporting and currently trades at $165.81.

Read our full, actionable report on General Electric here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.