Outdoor lifestyle products brand (NYSE:YETI) beat analysts' expectations in Q2 CY2024, with revenue up 15.1% year on year to $463.5 million. It made a non-GAAP profit of $0.70 per share, improving from its profit of $0.57 per share in the same quarter last year.

Is now the time to buy YETI? Find out in our full research report.

YETI (YETI) Q2 CY2024 Highlights:

- Revenue: $463.5 million vs analyst estimates of $452.4 million (2.4% beat)

- EPS (non-GAAP): $0.70 vs analyst estimates of $0.63 (10.3% beat)

- EPS (non-GAAP) guidance for the full year is $2.63 at the midpoint, beating analyst estimates by 2%

- Gross Margin (GAAP): 57%, up from 53.4% in the same quarter last year

- EBITDA Margin: 17.2%, down from 19.6% in the same quarter last year

- Free Cash Flow of $44.97 million is up from -$114.3 million in the previous quarter

- Market Capitalization: $3.16 billion

Matt Reintjes, President and Chief Executive Officer, commented, “YETI delivered another great quarter, highlighted by our Coolers & Equipment category and continued growth of our business outside the United States. Supported by a strong lineup of new innovation, we were well positioned to capitalize on cooler demand, which we saw steadily build throughout the quarter. Additionally, our Drinkware category performance was punctuated by strong sell-through in the Wholesale channel and the continued successful expansion and broadening of our product portfolio. This product portfolio, combined with our uniquely relevant brand across broad communities of users, not only supported our domestic growth but also drove a third consecutive quarter of over 30% growth in our international business. Finally, we continued to realize excellent gross margin expansion, which enabled us to deliver operating margin improvement while continuing to invest across our strategic priorities.”

Founded by two brothers from Texas, YETI (NYSE:YETI) specializes in durable outdoor goods including coolers, drinkware, and other gear tailored to adventure enthusiasts.

Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

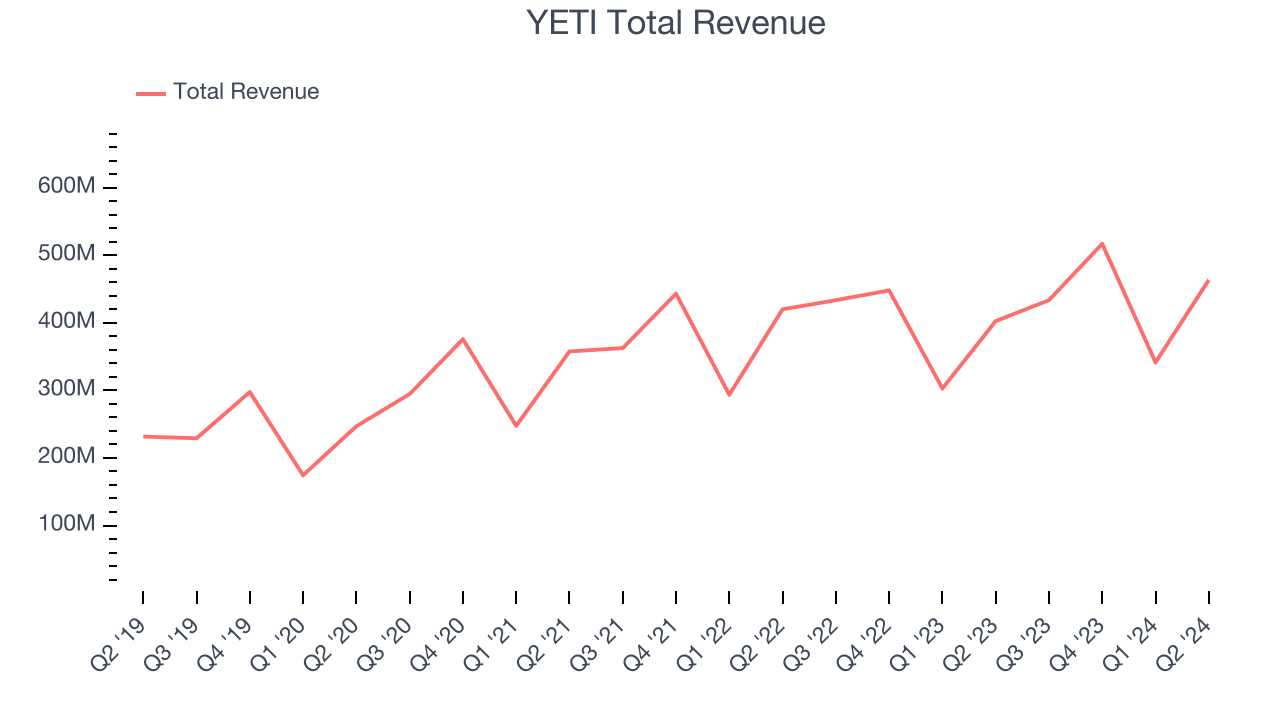

Sales Growth

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones tend to grow for years. Luckily, YETI's sales grew at a decent 16.3% compounded annual growth rate over the last five years. This shows it was successful in expanding, a useful starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. YETI's recent history shows its demand slowed as its annualized revenue growth of 7.5% over the last two years is below its five-year trend.

This quarter, YETI reported robust year-on-year revenue growth of 15.1%, and its $463.5 million of revenue exceeded Wall Street's estimates by 2.4%. Looking ahead, Wall Street expects sales to grow 7.1% over the next 12 months, a deceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

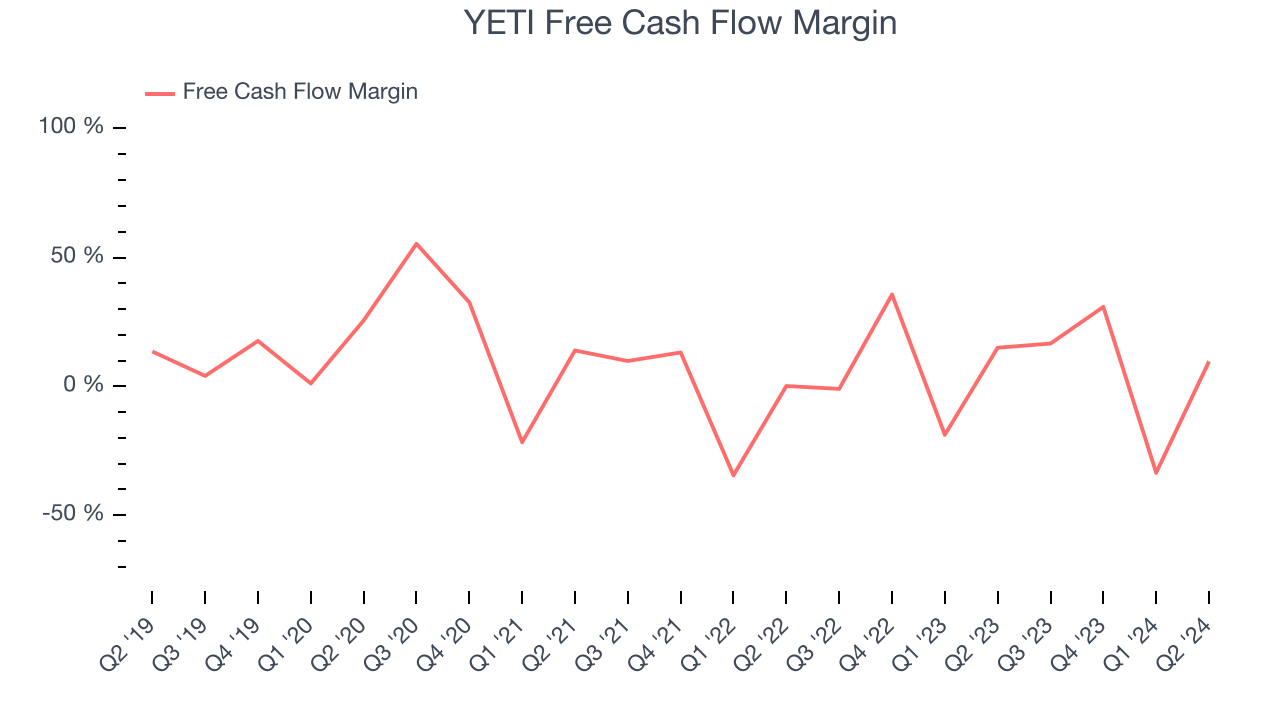

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

YETI has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 9.6%, subpar for a consumer discretionary business.

YETI's free cash flow clocked in at $44.97 million in Q2, equivalent to a 9.7% margin. The company's cash profitability regressed as it was 5.3 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren't a big deal because investment needs can be seasonal, but we'll be watching to see if the trend extrapolates into future quarters.

Over the next year, analysts predict YETI's cash conversion will fall. Their consensus estimates imply its free cash flow margin of 9.2% for the last 12 months will decrease to 5%.

Key Takeaways from YETI's Q2 Results

It was good to see YETI beat analysts' EPS expectations this quarter. We were also glad its revenue outperformed Wall Street's estimates. Overall, this quarter was mixed but with some key positives. The stock traded up 8% to $40 immediately following the results.

YETI may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.