An Attractive Network Effect At A Silly Price

Match Group (MTCH) has certainly been in the doldrums recently. And as investors, we often don't get out of bed for a turnaround story because, ultimately, most turnarounds never turn. But Match isn't like the rest–it has a powerful network effect that keeps users coming back, making it extremely difficult for competitors to make any headway.

Better yet, the company's recent results show its new strategy is already working. Revenue and operating income both improved in Q3 FY 2023, and the share price is still languishing near 5-year lows. This presents a rare buying opportunity. We recommended the stock exclusively to members of StockStory Edge on December 8th, 2023.

While it’s great to see the share price gaining a little since our members bought in, we think this story is only beginning to gain steam because sentiment is still very weak. Once we think sentiment has returned to more bullish levels, we may well issue a sell rating on the stock. But in the meantime, there is plenty of room for growth.

And, of course, paying members of StockStory Edge will be first to know about it if and when we change our view.

As our way of welcoming you aboard our free membership tier, we hope you enjoy this abridged version of our full recommendation, which is only available to members of StockStory Edge.

Match Group (MTCH): Stock Of The Month For December 2023

Match Group is the leader in a growing market, but the stock trades at a value price of less than 14x forward P/E. It wasn’t always this way.

The company’s grip on online dating and fast, profitable growth once made it a stock market darling–until its fall from grace.

Over the last two years, Match’s sputtering subscriber base has investors debating whether its business is broken, which we find an overreaction. The market doesn’t realize there is a logical explanation behind its recent slump–higher churn due to a one-off, significant price increase–and that its apps are still the go-to for young adults seeking connection.

This makes a rare opportunity to own a high-quality cash flow machine for cheap.

What Is Match Group?

Spun out of media and internet conglomerate IAC in 2019, Match is the world’s largest online dating company with over 10 distinct brands and 15.7 million paying subscribers (“payers”). Its largest app is Tinder (known for its swipe feature), which has 10.4 million paying subscribers, and its rising star is Hinge (known for its focus on long-term relationships) with 1.3 million paying subscribers. Rounding out the group’s portfolio are its Asia-focused, emerging, and evergreen (legacy) brands.

Why We're Smitten With The Online Dating Industry

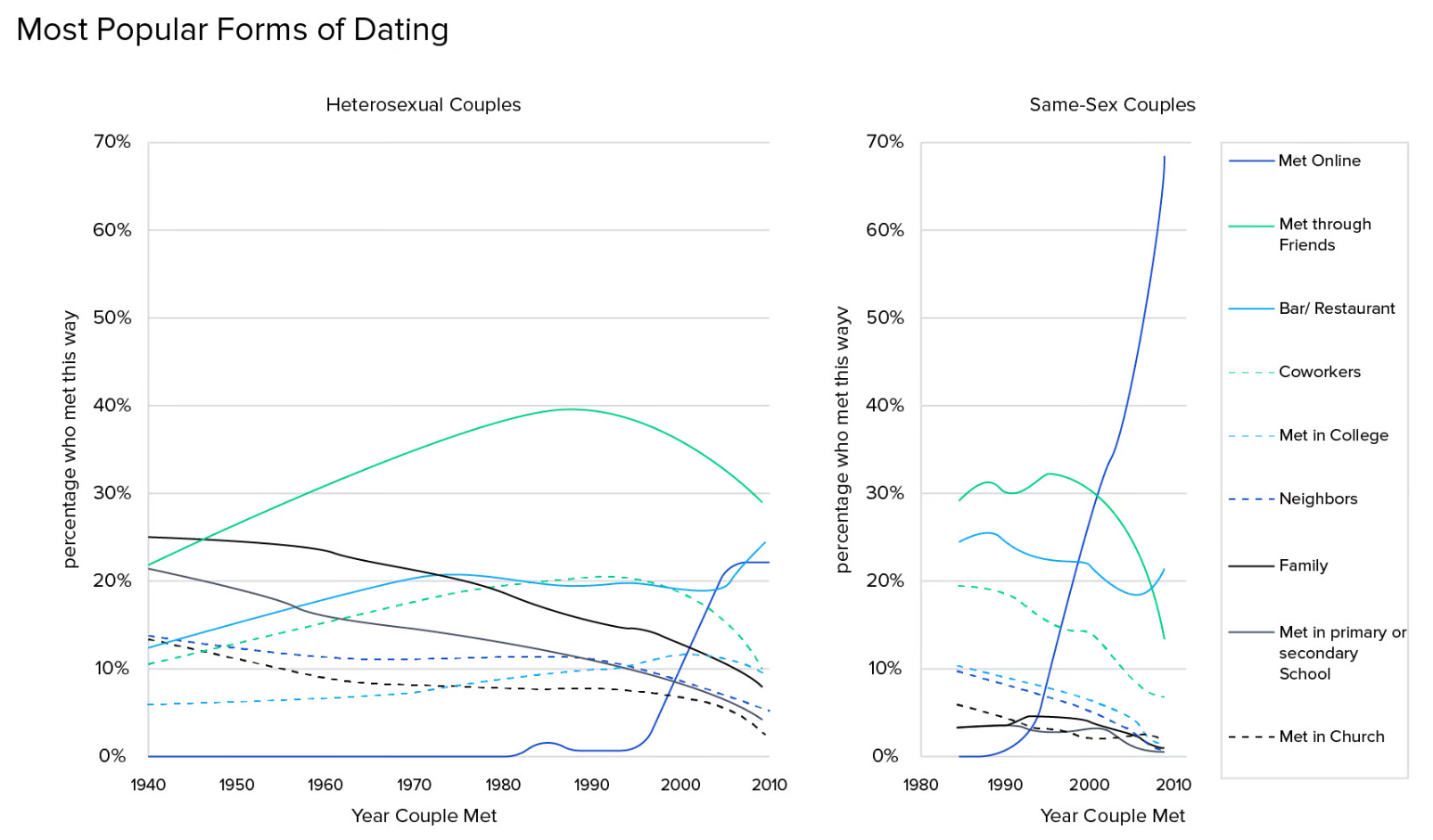

Today, over 20% of all relationships start online, and thanks to its immense reach, over 50% of them begin on a Match brand. With each new generation becoming more digitally native and open to finding that special someone through an app, we see compelling growth potential for the industry. Just look at Gen Z–they’re the first generation to grow up with the internet, are now entering the prime dating age of 18-to-25 years old, and are already Tinder’s largest cohort of users.

From a business model standpoint, we also like how online dating seems to be a ‘winner-take-most’ market where the scaled platforms have the most fruitful dating pools, making them the most attractive hubs for new singles to meet.

Would you rather find dates on an app with 80 people or 80,000?

The answer is obvious.

And that’s what makes it so hard for new players to compete: it’s hard to get scale without scale since the first users are likely wasting their time. Even tech giant Meta (formerly Facebook), which had all the raw materials for success–a huge user base and heaps of cash to fund its venture–tried to enter the space with Facebook Dating but failed because of the incumbent platforms’ popularity.

Who Does Match Compete Against?

Because of the network effect of online dating, we think the current landscape is a three-horse race between Tinder, Hinge, and Bumble. Sure, there are niche platforms like Raya and Grindr, along with others for people of similar religions and races, but the biggest apps have the brand recognition, diverse user base, and technology chops to legitimately compete for the mass market. Most importantly, MTCH owns two of the three.

Although Bumble, which prides itself on having women make the first move, is a fundamentally sound business, we prefer Match because Bumble is dealing with massive leadership uncertainty–in late 2023, Founder and CEO Whitney Wolfe Herd announced she would be stepping down in 2024, muddying the company’s strategic direction.

Is Now The Time To Buy Match?

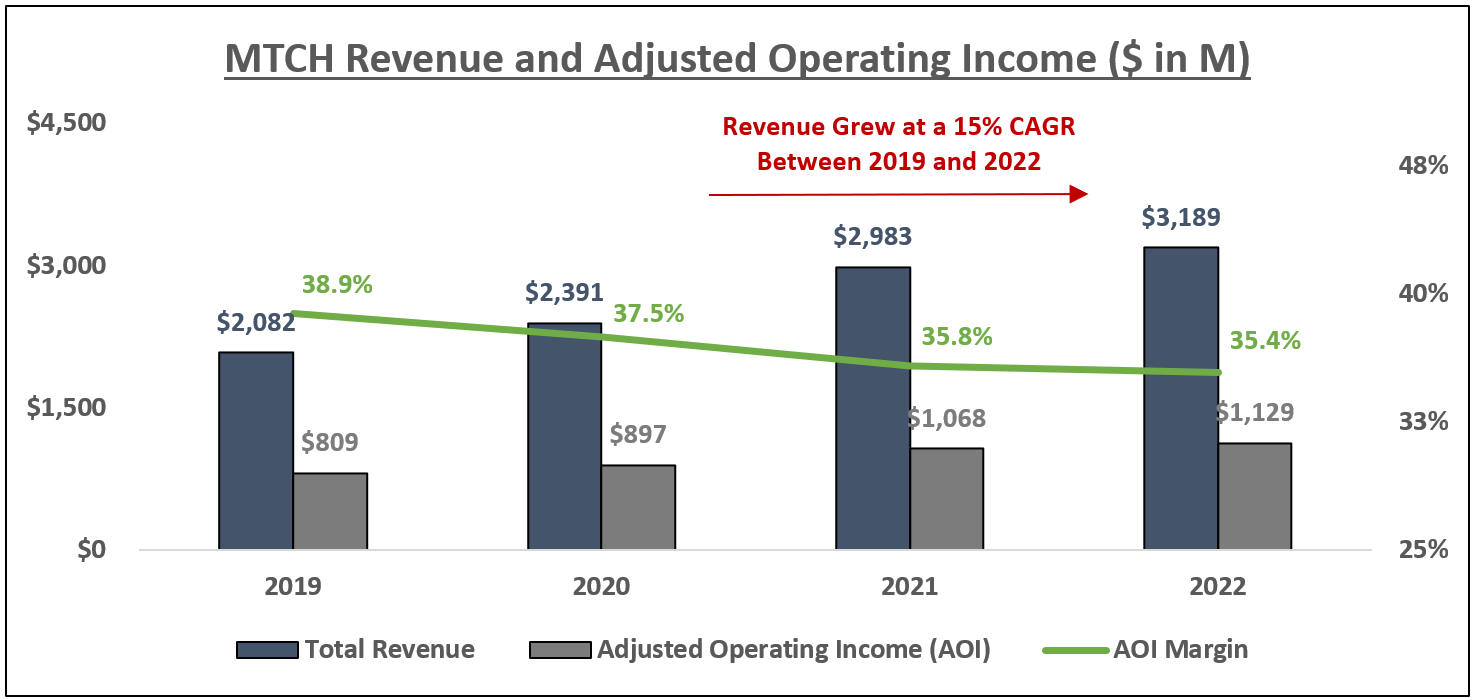

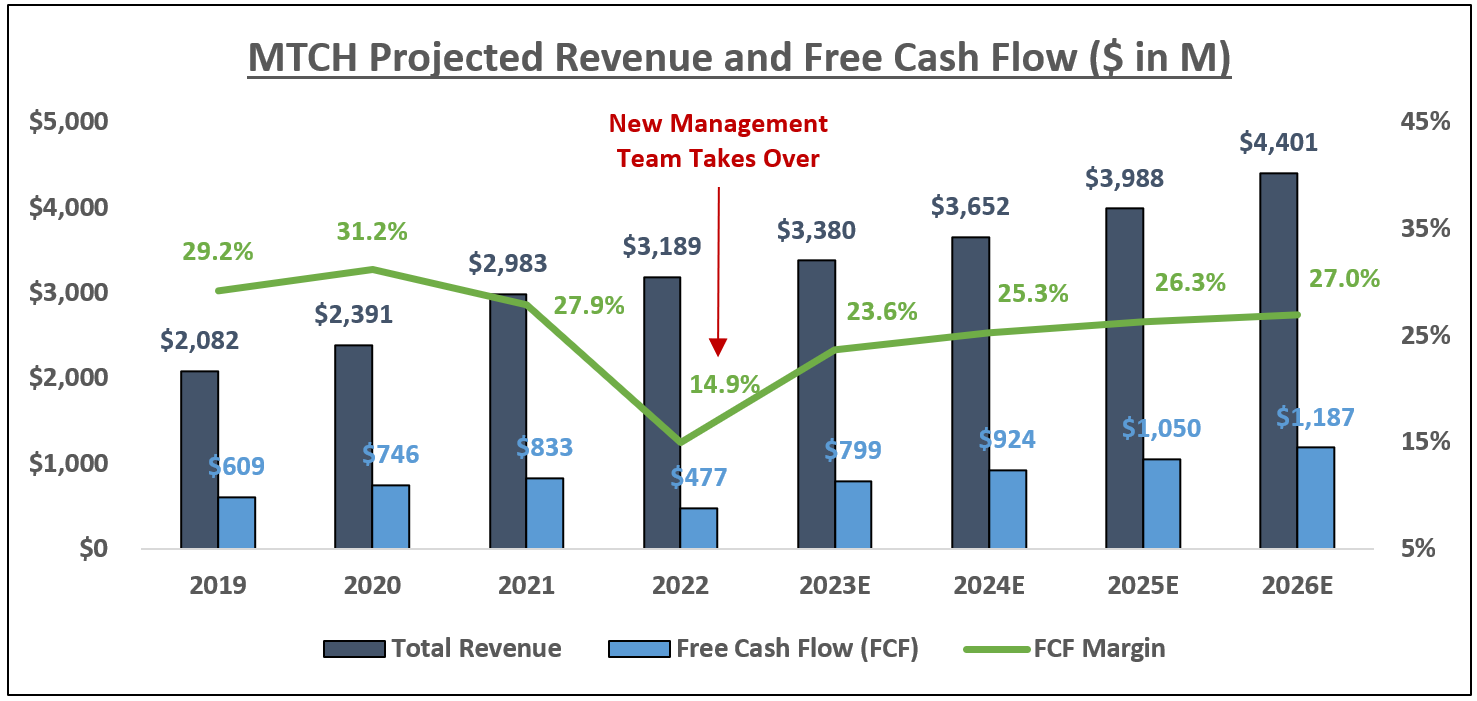

As you can see below, Match Group compounded its revenue at a 15% annual growth rate while producing an average adjusted operating profit margin of 37% between 2019 and 2022.

The share price has been on a rollercoaster, though, and shrinking user numbers (arising from price rises) have smashed the share price well below its highs.

But market pessimism, just like optimism, often swings too far to one side, and we believe Match’s troubles are temporary.

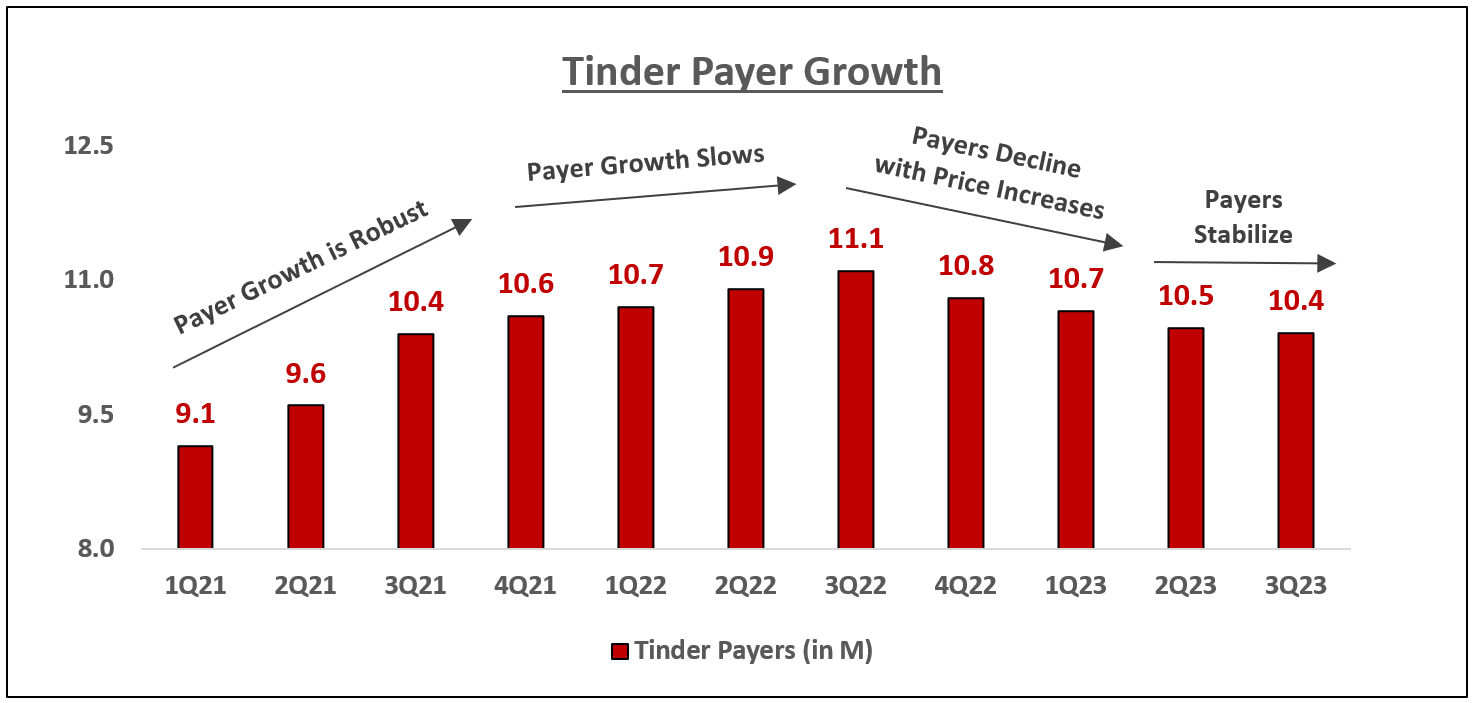

After years of rapid growth, Match’s payer (aka subscriber) additions began decelerating at the end of 2021, and it started losing payers at the end of 2022. But we believe Match’s troubles are temporary.

The payer declines from the company’s dramatic, one-time price shock finally stabilized in Q3 2023 as Tinder payers were sequentially flat, and the broader company returned to sequential growth in payers.

We believe this represents a turning point in Match’s story and that a recovery is en route. The dust has settled, and a new foundation of higher-spending users will rise from the ashes.

What Does Match's Future Hold?

Match’s future excites us because a stable and growing payer base willing to spend more translates into accelerated revenue growth.

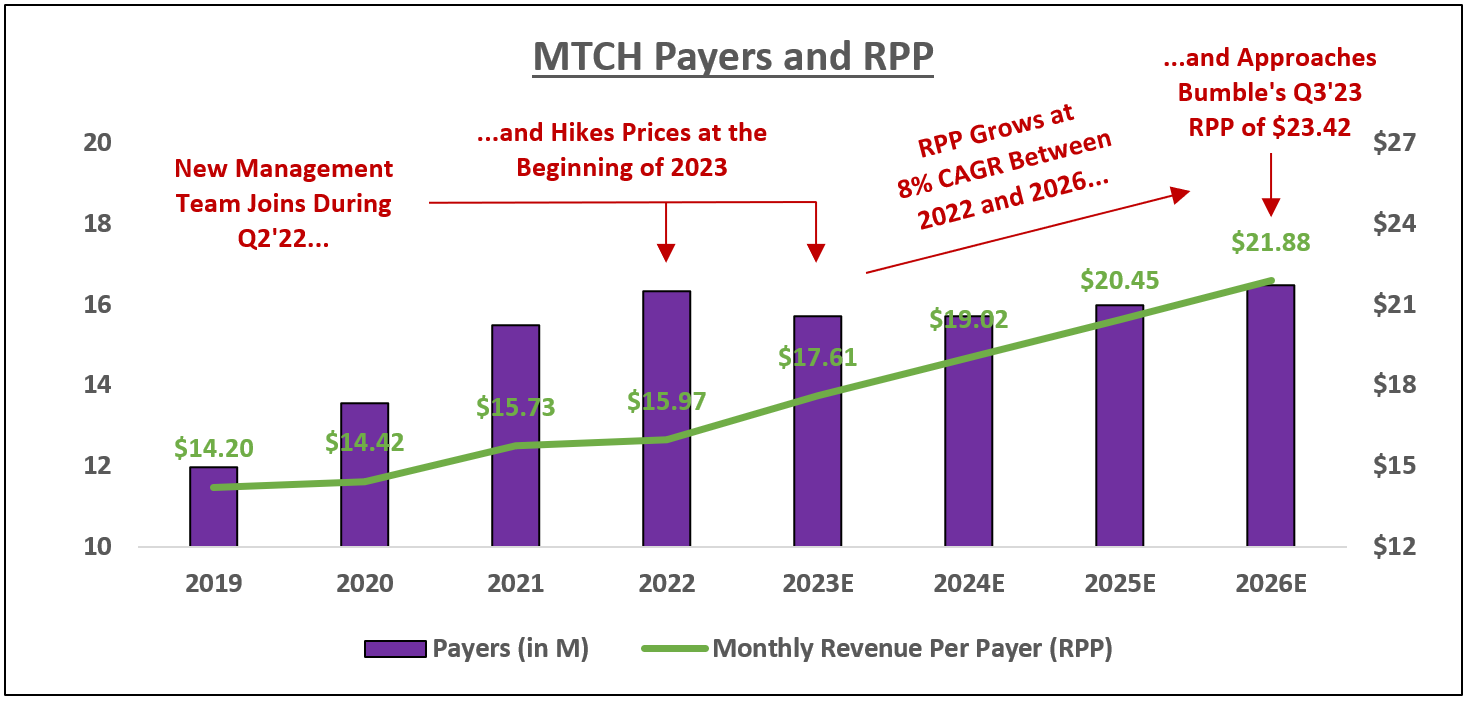

You can see in the chart below how we expect its payers to return to modest growth while revenue per payer should continue to increase towards the competition (Bumble).

Closing the pricing gap between Match and Bumble is low-hanging fruit because it unleashes the company’s power users, or “whales.”

These whales are invaluable assets who spend unbelievable amounts of money online–documents from the 2020 Epic Games v. Apple court case revealed that only 0.5% of Apple’s users generated 50%+ of App Store fees, each spending $1,800+ on average per year. This speaks to the impact of a platform’s most prolific users, and it’s no wonder Match is leaning in aggressively, going as far as launching a new subscription tier called Tinder Select that charges users $500 per month.

Meanwhile, Hinge is the hidden crown jewel within the company, with a track record of growing revenue at 40%+. Management expects growth to accelerate, and we see a long runway for payer additions as it expands internationally–the app is only live in 20 countries compared to 200 for Tinder.

Summing it up, we believe Match’s payer base has bottomed as the one-time, 60%+ price increase is behind us. As you can see below, this translates into strong forecasted free cash flow growth thanks to its asset-lite business model. Match Group has stated it’ll use half its free cash flow to repurchase its stock, so we think if free cash flow increases strongly, the stock price will follow.

What Are The Key Risks And How Do We Feel About Them?

Here at StockStory, we believe it's crucial to identify and think through the risks in our investment thesis. For MTCH, we’ve boiled them down into the three most important: Tinder payer weakness, a worsening user experience, and competition.

If the crux of our thesis is that Tinder’s payer weakness is temporary and will recover, then it follows that lack of recovery is a major risk. We argue that Match’s pricing optimization is the right decision and the main reason behind Tinder’s falling payers. But if payers continue to leave the ecosystem over the next year, not because of pricing but a worsening user experience, there could be further declines in the stock price.

In terms of user experience, in theory, every incremental user that joins a platform makes it more valuable because it increases selection for existing users. But in reality, Tinder suffers from low-quality accounts that are unlikely to add value to paying users.

Although it sounds harsh, the lower-quality profiles detract from the product, potentially causing some users to get frustrated and unsubscribe. If Match is unable to keep user quality at a reasonable level, it could suffer meaningful brand damage.

Wrapping up our list of concerns is competition. The barriers to entry for developing a mobile app are low, so someone with the relevant technical skills could create a competitor app quickly with limited resources. TikTok, which offers a new content discovery algorithm and seemingly caught fire overnight, is a prime example.

TikTok’s success shows how innovation and virality are tailwinds that help new entrants scale. Luckily, with the market pessimism surrounding the online dating space and higher interest rates that make venture capital investments less attractive, we see a lower probability of more online dating startups being funded. We’ve also got a few singles on our team who are willing and able to scan the landscape for up-and-coming competitors

Closing Thoughts

Match digitized dating and was rewarded for it with brand equity, a leading market position, and financials that most would swipe right on. Although it’s faced some speed bumps lately, we’re confident its payer numbers will recover, making the stock a catch.

It’s not every day we see a no-brainer like this, but when we do, we pull the trigger while the stock is still cheap.

Please note that members of StockStory hold shares in Match Group. Our money is where our mouth is.

If you enjoyed this abridged version of our Stock of the Month for December 2023 you’ll love the full version. Not only that, but when you become a member of StockStory Edge, you’ll get instant access to all our past recommendations; and you’ll be among the first to receive our next one!

Do you want know what moves the stocks you care about? When a stocks moves more than 5% on material news, we’ll drop an analysis explaining it right into your inbox. Similarly, our actionable earnings analysis is delivered within minutes of the results being released, giving you an edge over other investors. Set up your FREE watchlist now.

Publication Date: January 21, 2024