Decarbonization and emissions reductions have become urgent themes due to their impact on climate change. It is a huge business opportunity where companies can do good and do well.

Look at Tesla. Here’s a company that addressed this business opportunity beginning about two decades ago, and in the process, saw its stock go from under $2 per share (split adjusted) in 2010 to over $250 a share today. That’s well over a 100x return.

Commercial transportation–the trucks and railcars moving our commodities and consumables–is next up. Over the next few years, companies in this space will need to spend big to bring their fleets in line with regulation.

EPA 2027 is one regulatory catalyst. It is a set of standards established by the US Environmental Protection Agency targeting commercial trucks. By 2027, these vehicles will need to hit strict emissions reduction targets.

CARB (not that type of carb!) is another catalyst. The California Air Resources Board (CARB) also aims to reduce greenhouse gas emissions by targeting a broad range of industries, but we notice that it has very specific requirements for rail. Old locomotives will be banned in short order and down the line, only zero-emissions locomotives will be allowed to operate in the state.

You’ve heard enough about Tesla. Here are two lesser-known stocks that are perfectly positioned to ride the clean transportation wave.

PACCAR (NASDAQ:PCAR)

Trucking is the lifeblood of the US economy, as the country depends on these hulking vehicles to deliver ten billion tons of nearly every commodity consumed. 72% of all the freight transported in this country in 2023 was carried by almost 40 million commercial trucks.

With 25-30% share of the all-important Class 8 truck (one of the most common on American highways), PACCAR designs and manufactures trucks of various weights and sizes for the commercial transportation industry. In addition to its namesake brand, PACCAR operates multiple other brands such Kenworth, Peterbilt, and DAF, each of which boast history and a strong reputation in the global trucking industry.

The company’s trucks are used for long-haul transportation and heavy-duty hauling of everything from common consumer goods to construction and mining supplies.

PACCAR principally sells its trucks through a network of independent dealers, although the company leases and rents its trucks as well. The company’s largest customers are usually those in the logistics industries who need massive trucking fleets, and as such these customers engage in high-volume purchases or leases of PACCAR’s products and maintenance services.

PACCAR is a high-quality business that flies under the radar. For a company that designs, manufactures, and sells commercial trucks, PACCAR is surprisingly stable. It has been profitable and has paid a dividend for over 80 straight years.

Within our coverage, we are always on the lookout for quality compounders or companies that not only generate high returns on invested capital (ROIC) but reinvest those returns at similarly high rates, leading to explosive growth in revenue and earnings over time. Over the last five years, PACCAR has been a poster child of this.

The company boasts an average ROIC of over 30%. We are impressed with companies that cross the 20% threshold so 30+% makes our jaws drop. Similarly, PACCAR’s ROIC over five years has generally shown an increasing trend, signaling that its moat is strengthening. This has led to annualized revenue growth over the last two years of 20+% and EPS growth over that period of 50+%.

In addition to being a stellar business, the regulatory backdrop will be a major tailwind for PACCAR in the coming years. When there is a technological shift–whether catalyzed by the free hand of the market or by regulatory forces–the dominant companies tend to win because they have the resources to invest in the new technology. PACCAR fits the bill.

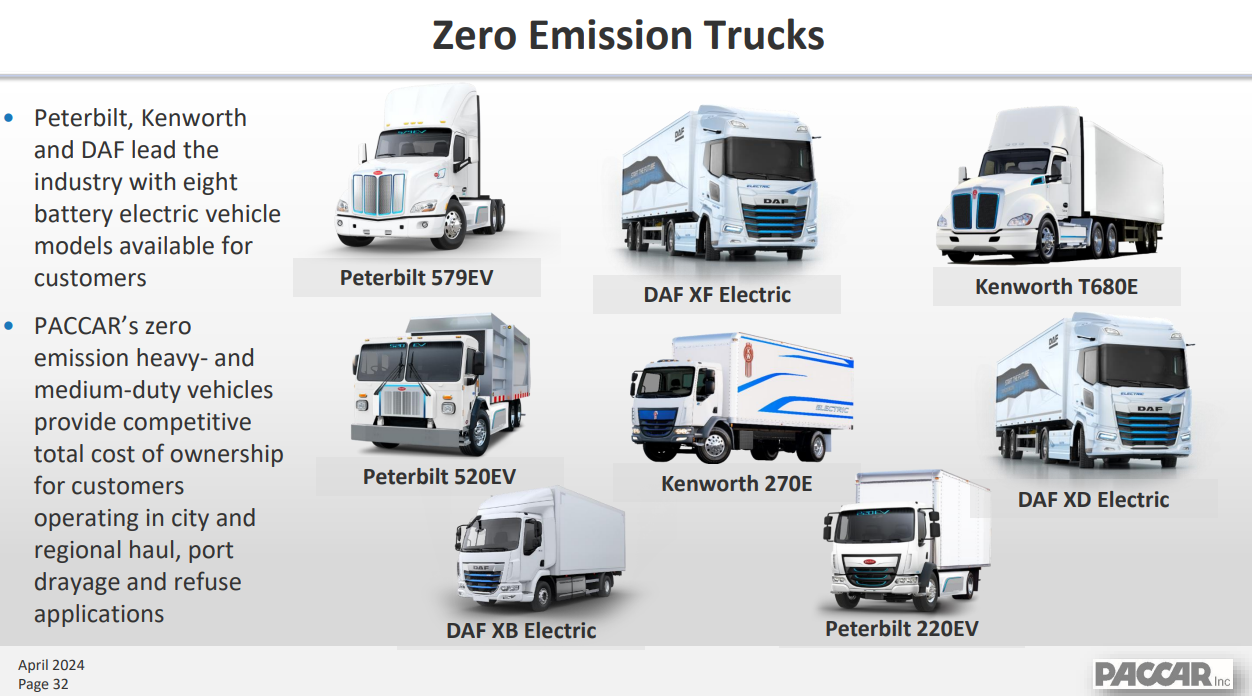

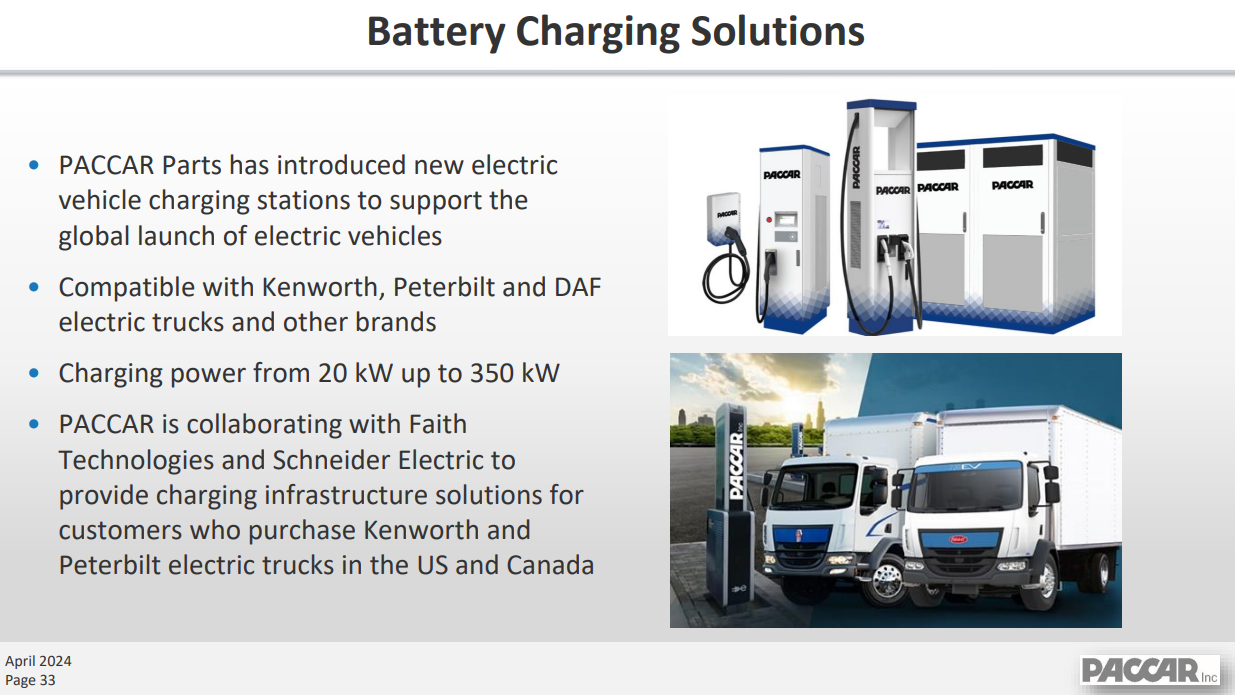

In this case, government bodies all over the world are nudging lower or zero-emission vehicles forward, creating incremental demand as owners of older models will have to replace them regardless of whether they want to or not. The company has been investing in a broad portfolio of powertrain (everything that creates energy and transfers it to the road to move the truck) options ahead of this demand surge, including: clean diesel, battery electric vehicles, hydrogen fuel cell, and various hybrid offerings. As smaller companies with fewer resources and less-recognized brands struggle to move as quickly to release new powertrain options, we think that PACCAR will gain share.

As evidence, PACCAR recently announced a new clean diesel engine that fully meets 2024 CARB standards. Not only will regulatory standards force incremental demand, but the company added that it expects higher pricing on cleaner engines in the range of $10,000 to $15,000.

Longer term as a higher and higher percentage of the company’s production and sales will come from hybrid and zero-emission vehicles, there are aftermarket opportunities. The company estimated that battery electric trucks would generate $5,000 to $10,000 in incremental parts revenue versus diesel trucks over the life of the vehicle, for example.

We also note that this is an opportune time for long-term, patient investors to initiate a position in PACCAR. The market–which tends to be most focused on the next six to twelve months of performance–is wringing its hands over demand for the company’s Class 8 trucks for the rest of 2024 after rates seemed to dampen orders this past spring. We urge investors to look past this short-term uncertainty and focus on the longer-term prize–the demand increase from lower-emissions vehicles.

Click here to read our full, regularly updated research report on PCAR

Westinghouse Air Brake Technologies (NYSE:WAB)

The company better known as Wabtec manufactures and sells locomotives, equipment, and systems to the rail industry. The company also provides services related to those products mentioned.

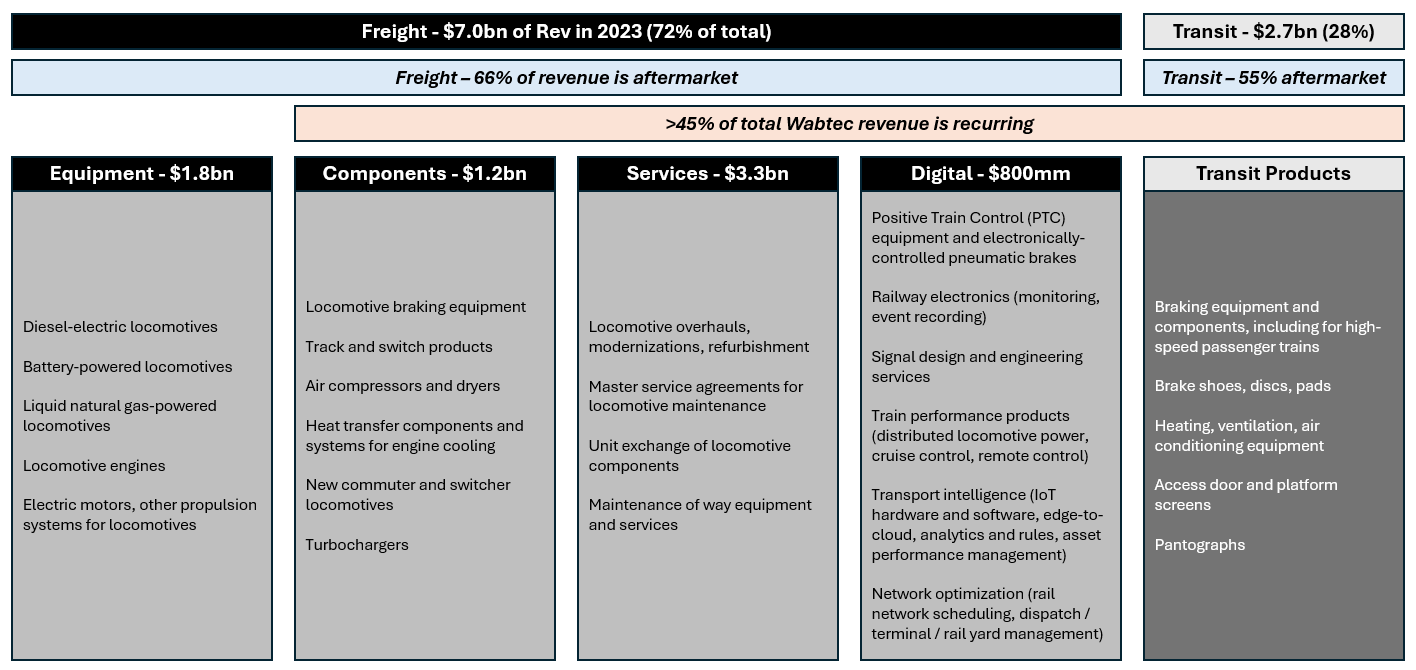

Companies like Union Pacific (NYSE:UNP) are loyal Wabtec customers. Broadly, the company serves both the freight (moving things) and transit (moving people) markets, with the former generating nearly three-quarters of Wabtec’s revenue. But Wabtec doesn’t just sell locomotives and rail cars in North America (although that is the company’s core geography). In fact, North American sales of new locomotives and modifications of existing ones are less than 10% of total revenue.

Roughly 60% of Wabtec’s revenue is from aftermarket parts and services to existing locomotives. Replacement brake discs, turbochargers, and radiators are a few examples. Furthermore, over 45% of its total revenue is recurring, and multi-year master service agreements to maintain existing locomotives generate much of this revenue. We love when an industrials company–many of which are heavily impacted by the macro–shows predictable, steady revenues.

We also love Wabtec’s dominance. The company has roughly 50% market share in North America for its bread-and-butter locomotive braking equipment and top positions for most other product lines. Additionally, Wabtec has roughly 16,000 of its locomotives in operation in North America and 24,000 globally. This is the largest installed base in the market, and it importantly drives demand for everything from locomotive modifications and upgrades to aftermarket components to maintenance services.

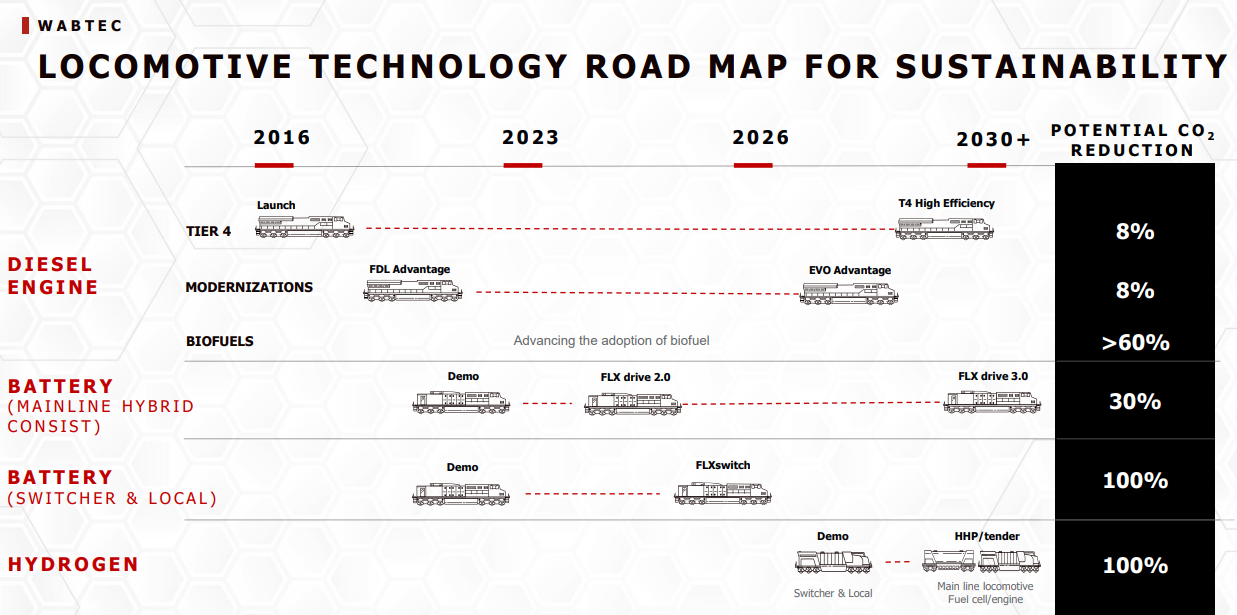

As for how Wabtec is riding a huge megatrend, let’s start with CARB, or The California Air Resources Board. It is a state agency responsible for air quality and emissions regulations and will ban any locomotive older than 23 years from operating in California starting in 2030. That year will also mark when CARB will mandate that all switch, industrial, and passenger locomotives have zero emissions to operate in the state. By 2035, all locomotives must have zero emissions.

Wabtec is the unquestioned industry leader when it comes to decarbonization technology. The company’s oldest solution is a set of on-board digital capabilities that have been available since 2009. This solution proactively plans for every turn and grade on the track in the most energy-efficient way possible and can reduce locomotive emissions by up to 22%. In aggregate, 400 million gallons of diesel fuel have been saved by Wabtec customers, and CO2 emissions have been reduced by 4.5 million tons since 2009. That is a pretty compelling value proposition.

The next phase of Wabtec’s decarbonization efforts revolves around biodiesel and renewable diesel engines. Beyond that, Wabtec is also working on its FLXdrive and FLXswitch products, which are the first battery electric locomotives. The ultimate goal with FLXswitch is to reduce emissions by 100% once an electric battery can operate as the sole power source in a locomotive.

In short, this stock is a rare combination of a high-quality, proven company combined with a huge, defined catalyst on the horizon. We’d probably recommend owning Wabtec over the next five years without the decarbonization theme, but with it, this investment borders on no-brainer status.

Click here to read our full, regularly updated research report on WAB

Closing Thoughts

We hope you enjoyed this abridged version of our research.

You can get so much value from StockStory!

AI-enabled research is revolutionizing stock investing, but so far only large institutions and funds have benefitted from it. But we believe everyday investors deserve to have access to the same tools as the Wall St bigwigs.

StockStory is a new service that uses AI to help individual investors like you grow your wealth and beat the market. Since launching in 2020, some of our top picks have returned 259%, 436%, and even 794% to date –crushing the S&P 500 by 3x, 5x, and nearly 9x. We recommended Nvidia to our users already in November 2022 – well BEFORE the generative AI burst onto the scene.

And now we’re on the hunt to add to those winners.

Harnessing the power of AI, the StockStory team has identified 6 top stocks that we believe everyday investors should buy right now.

And you can get the name of these stocks with full research reports for FREE by clicking here!