Asure Software (ASUR)

Asure Software is in for a bumpy ride. Its underwhelming revenue growth and failure to generate meaningful free cash flow is a concerning trend.― StockStory Analyst Team

1. News

2. Summary

Why We Think Asure Software Will Underperform

Operating in the often-overlooked smaller metropolitan markets where HR expertise can be scarce, Asure Software (NASDAQ:ASUR) provides cloud-based human capital management software and services that help small and medium-sized businesses manage payroll, taxes, time tracking, and HR compliance.

- Sales trends were unexciting over the last two years as its 4% annual growth was well below the typical software company

- Operating margin failed to increase over the last year, indicating the company couldn’t optimize its expenses

- Persistent operating margin losses suggest the business manages its expenses poorly

Asure Software’s quality isn’t great. There are more promising alternatives.

Why There Are Better Opportunities Than Asure Software

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Asure Software

Asure Software is trading at $9.42 per share, or 1.7x forward price-to-sales. Asure Software’s valuation may seem like a bargain, but we think there are valid reasons why it’s so cheap.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. Asure Software (ASUR) Research Report: Q3 CY2025 Update

HR software provider Asure Software (NASDAQ:ASUR) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 23.7% year on year to $36.25 million. The company expects next quarter’s revenue to be around $39 million, coming in 2.3% above analysts’ estimates. Its GAAP loss of $0.19 per share was significantly below analysts’ consensus estimates.

Asure Software (ASUR) Q3 CY2025 Highlights:

- Revenue: $36.25 million vs analyst estimates of $35.69 million (23.7% year-on-year growth, 1.6% beat)

- EPS (GAAP): -$0.19 vs analyst estimates of -$0.05 (significant miss)

- Adjusted EBITDA: $8.10 million vs analyst estimates of $7.97 million (22.3% margin, 1.6% beat)

- Revenue Guidance for Q4 CY2025 is $39 million at the midpoint, above analyst estimates of $38.12 million

- EBITDA guidance for Q4 CY2025 is $11 million at the midpoint, in line with analyst expectations

- Operating Margin: -9.7%, up from -12.4% in the same quarter last year

- Free Cash Flow was $1.85 million, up from -$747,000 in the previous quarter

- Billings: $35.76 million at quarter end, up 26.1% year on year

- Market Capitalization: $223.2 million

Company Overview

Operating in the often-overlooked smaller metropolitan markets where HR expertise can be scarce, Asure Software (NASDAQ:ASUR) provides cloud-based human capital management software and services that help small and medium-sized businesses manage payroll, taxes, time tracking, and HR compliance.

Asure's software suite includes five main product lines that work together to reduce administrative burdens for employers throughout the entire employee lifecycle. Its Payroll & Tax solution handles wage calculations, benefits, overtime, garnishments, and direct deposits while ensuring compliance with federal, state, and local tax regulations. The Tax Management Solutions offers specialized tax processing services, including bulk filing for Employee Retention Tax Credits. For tracking work hours, Asure's Time & Attendance product integrates with biometric time clocks and mobile apps that use geo-positioning to verify employee locations.

The company's HR Compliance services provide varying levels of support, from on-demand resources to complete HR outsourcing. A distinctive offering is AsureMarketplace, which connects the company's systems with third-party applications to extend capabilities for both employers and employees, including services like income verification and earned wage access.

Asure follows a dual distribution strategy, selling directly to clients and through partners. Regional payroll providers and trusted SMB advisors (like CPAs and regional banks) can white-label Asure's solutions as "Reseller Partners" or simply refer clients as "Referral Partners." This partnership network has become a primary acquisition source, allowing Asure to expand into specific geographic areas and industry niches while minimizing technology integration risks.

4. HR Software

Modern HR software has two powerful benefits: cost savings and ease of use. For cost savings, businesses large and small much prefer the flexibility of cloud-based, web-browser-delivered software paid for on a subscription basis rather than the hassle and complexity of purchasing and managing on-premise enterprise software. On the usability side, the consumerization of business software creates seamless experiences whereby multiple standalone processes like payroll processing and compliance are aggregated into a single, easy-to-use platform.

Asure Software competes with larger, national players in the HR software space including ADP, Paychex, UKG, Paylocity, Paycor, Paycom, Ceridian, and newer entrants like Gusto. For its time tracking products, it specifically competes with UKG, Paychex, ADP and Time Simplicity.

5. Revenue Growth

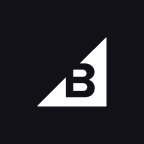

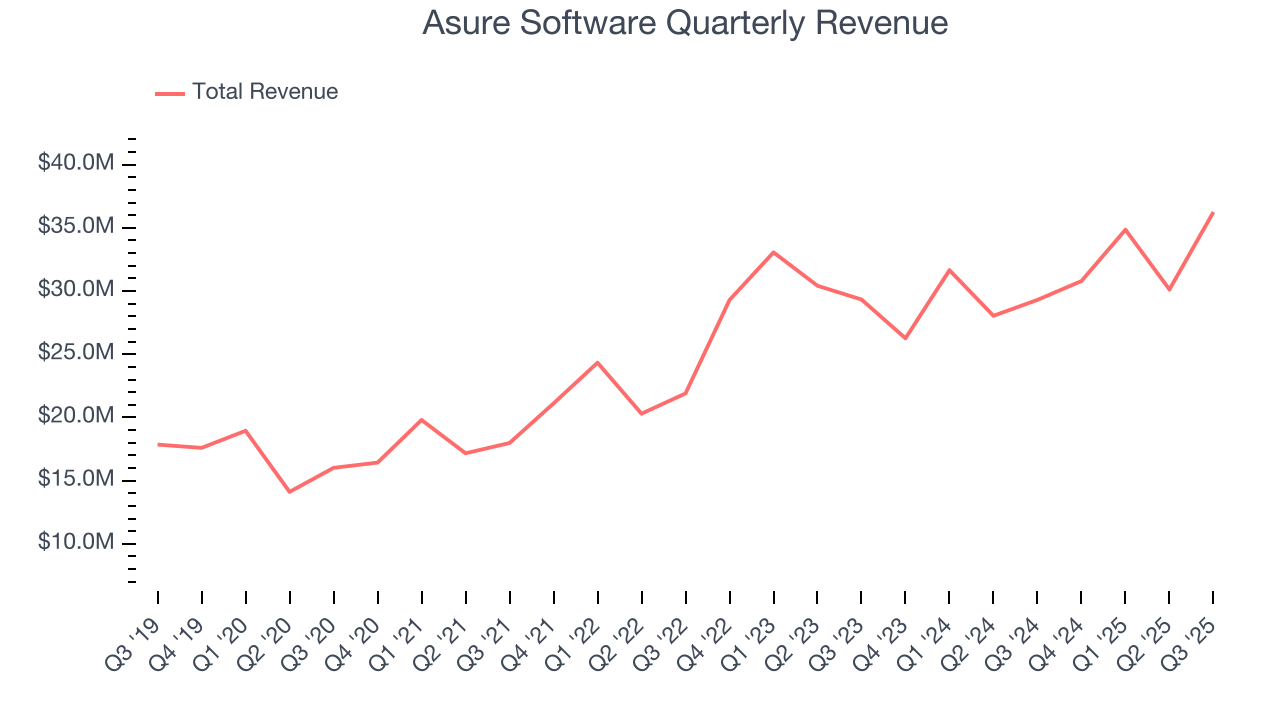

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Asure Software grew its sales at a 14.6% annual rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the software sector, which enjoys a number of secular tailwinds.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. Asure Software’s recent performance shows its demand has slowed as its annualized revenue growth of 4% over the last two years was below its five-year trend.

This quarter, Asure Software reported robust year-on-year revenue growth of 23.7%, and its $36.25 million of revenue topped Wall Street estimates by 1.6%. Company management is currently guiding for a 26.7% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 16.1% over the next 12 months, an improvement versus the last two years. This projection is above the sector average and indicates its newer products and services will spur better top-line performance.

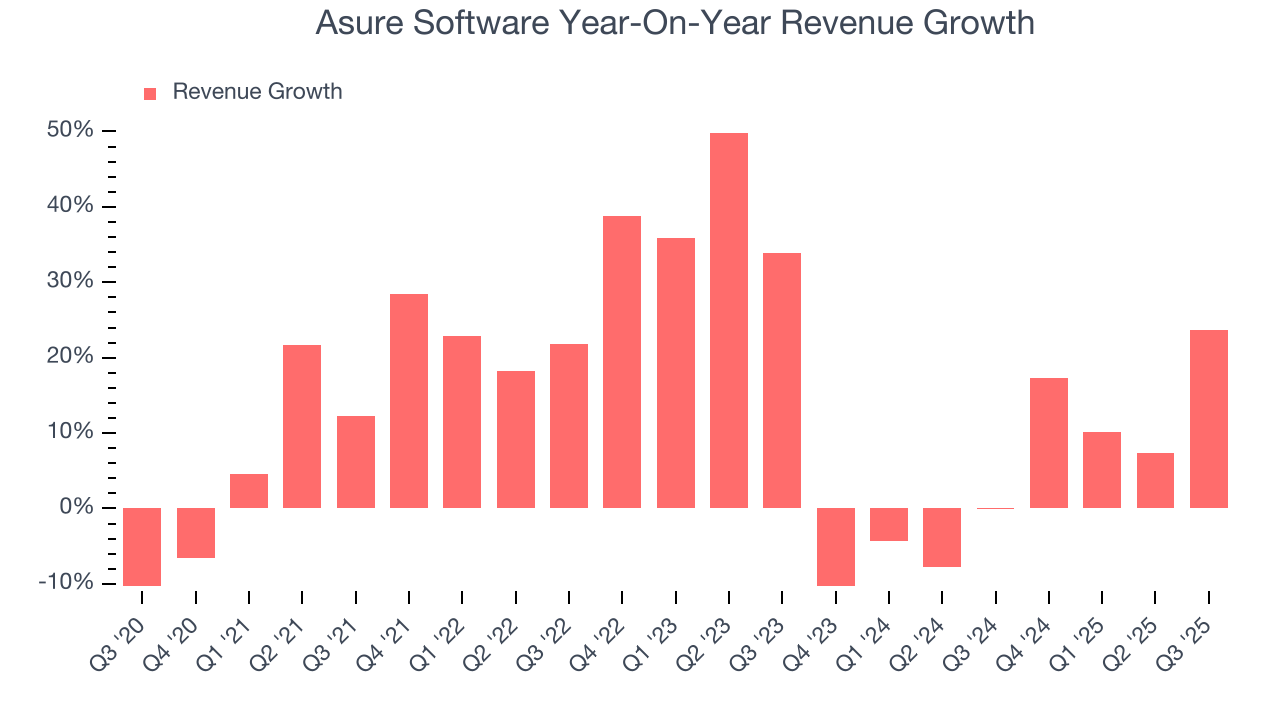

6. Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Asure Software’s billings came in at $35.76 million in Q3, and over the last four quarters, its growth slightly lagged the sector as it averaged 14% year-on-year increases. This performance mirrored its total sales and suggests that increasing competition is causing challenges in acquiring/retaining customers.

7. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Asure Software is extremely efficient at acquiring new customers, and its CAC payback period checked in at 6.3 months this quarter. The company’s rapid recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

8. Gross Margin & Pricing Power

For software companies like Asure Software, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

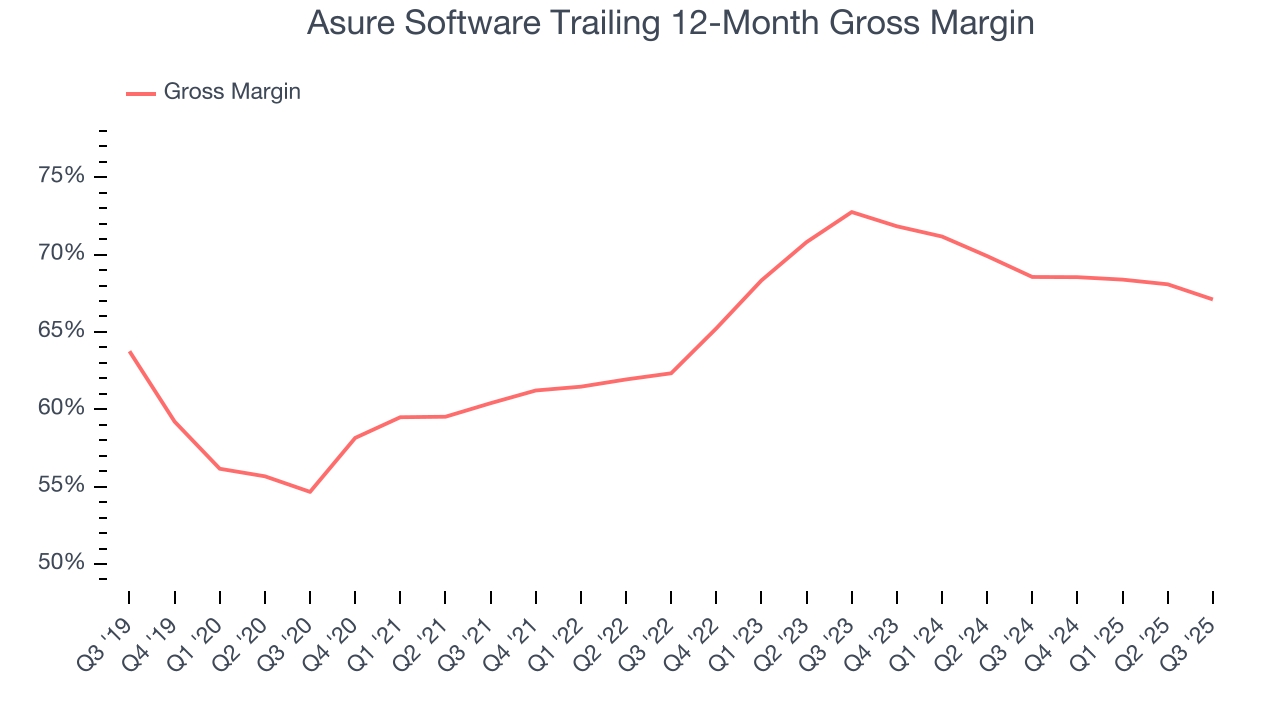

Asure Software’s gross margin is worse than the software industry average, giving it less room than its competitors to hire new talent that can expand its products and services. As you can see below, it averaged a 67.1% gross margin over the last year. Said differently, Asure Software had to pay a chunky $32.90 to its service providers for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Asure Software has seen gross margins decline by 5.6 percentage points over the last 2 year, which is among the worst in the software space.

Asure Software’s gross profit margin came in at 63.8% this quarter, down 3.4 percentage points year on year. Asure Software’s full-year margin has also been trending down over the past 12 months, decreasing by 1.5 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs.

9. Operating Margin

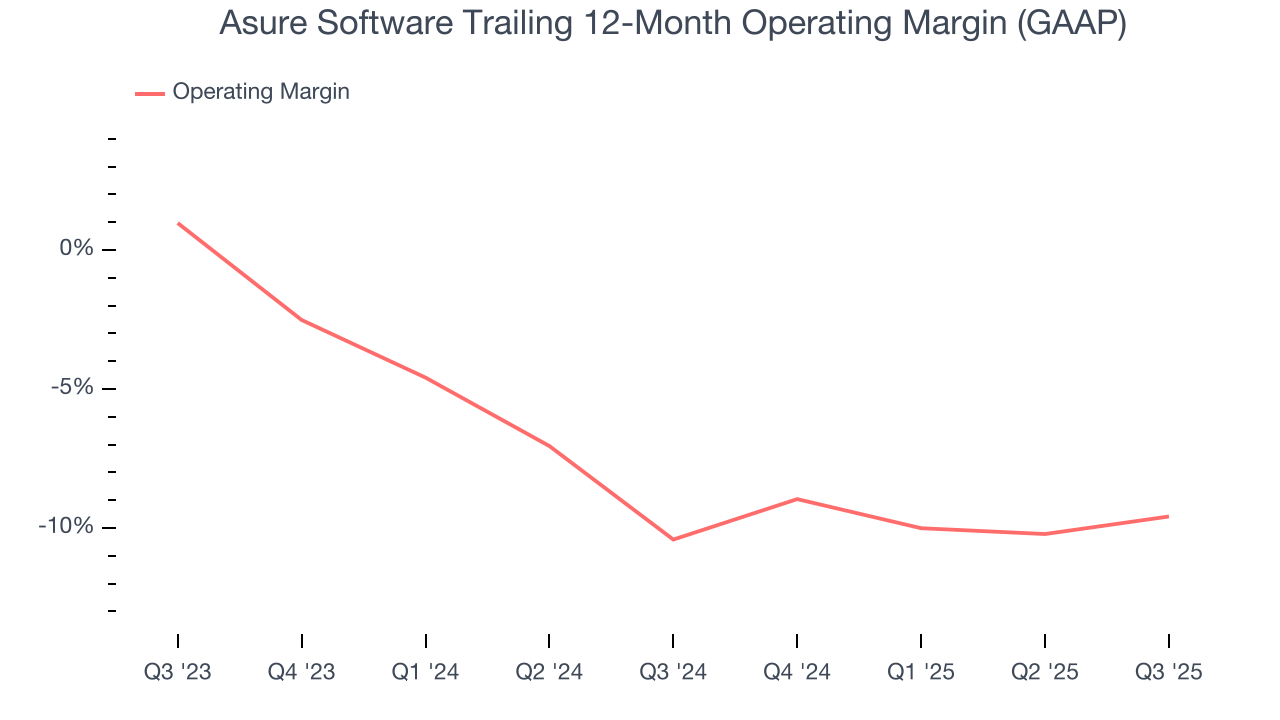

Asure Software’s expensive cost structure has contributed to an average operating margin of negative 9.6% over the last year. Unprofitable software companies require extra attention because they spend heaps of money to capture market share. As seen in its historically underwhelming revenue performance, this strategy hasn’t worked so far, and it’s unclear what would happen if Asure Software reeled back its investments. Wall Street seems to be optimistic about its growth, but we have some doubts.

Looking at the trend in its profitability, Asure Software’s operating margin might fluctuated slightly but has generally stayed the same over the last two years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q3, Asure Software generated a negative 9.7% operating margin. The company's consistent lack of profits raise a flag.

10. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

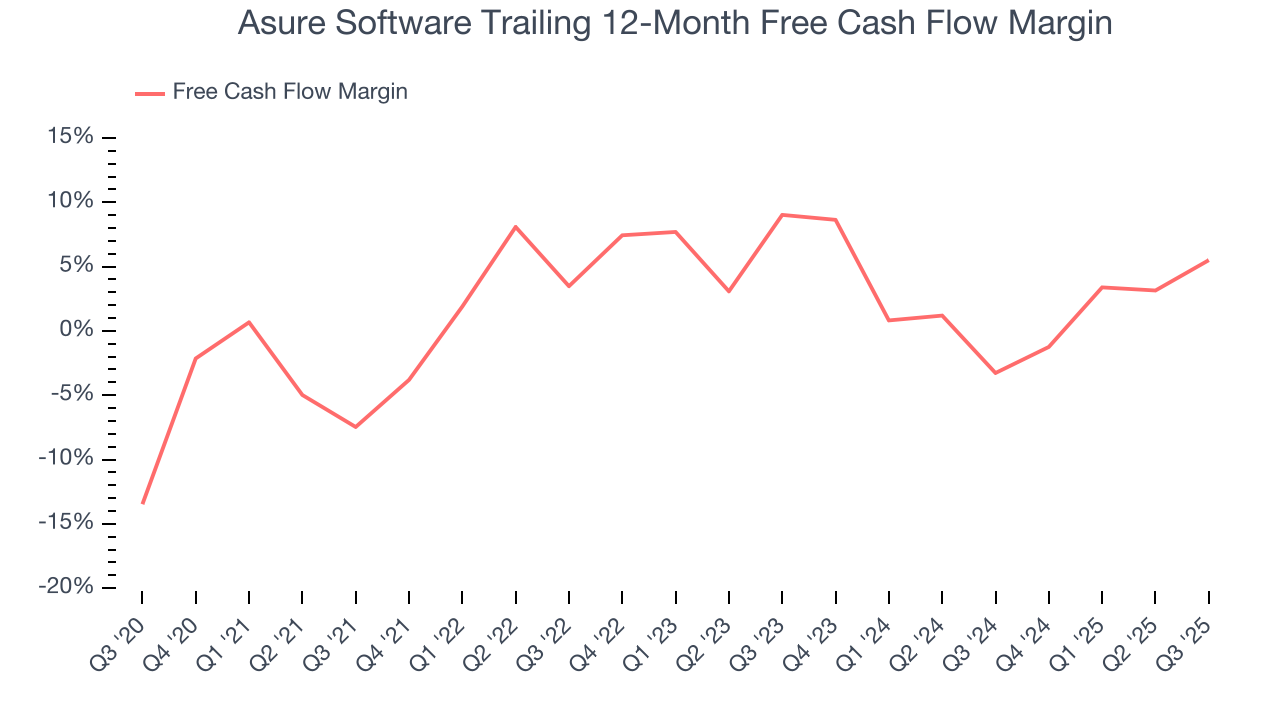

Asure Software has shown weak cash profitability over the last year, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 5.5%, subpar for a software business.

Asure Software’s free cash flow clocked in at $1.85 million in Q3, equivalent to a 5.1% margin. Its cash flow turned positive after being negative in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends carry greater meaning.

11. Balance Sheet Assessment

Asure Software reported $21.52 million of cash and $77.17 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $26.89 million of EBITDA over the last 12 months, we view Asure Software’s 2.1× net-debt-to-EBITDA ratio as safe. We also see its $693,000 of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Asure Software’s Q3 Results

We enjoyed seeing Asure Software beat analysts’ billings expectations this quarter. We were also glad its revenue guidance for next quarter exceeded Wall Street’s estimates. On the other hand, its full-year revenue guidance missed. Zooming out, we think this was a mixed quarter. The market seemed to be hoping for more, and the stock traded down 1.8% to $8.00 immediately after reporting.

13. Is Now The Time To Buy Asure Software?

Updated: January 22, 2026 at 9:16 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Asure Software.

We see the value of companies addressing major business pain points, but in the case of Asure Software, we’re out. To begin with, its revenue growth was a little slower over the last five years. And while its efficient sales strategy allows it to target and onboard new users at scale, the downside is its operating margin hasn't moved over the last year. On top of that, its operating margins reveal poor profitability compared to other software companies.

Asure Software’s price-to-sales ratio based on the next 12 months is 1.7x. While this valuation is fair, the upside isn’t great compared to the potential downside. There are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $13.22 on the company (compared to the current share price of $9.42).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.