Fluence Energy (FLNC)

We admire Fluence Energy. The electric demand for its offerings has propelled a significant increase in its deployed megawatts for digital contracts.― StockStory Analyst Team

1. News

2. Summary

Why We Like Fluence Energy

Pioneering the use of lithium-ion batteries for grid storage, Fluence (NASDAQ:FLNC) helps store renewable energy sources with battery systems.

- Annual revenue growth of 32.2% over the past five years was outstanding, reflecting market share gains this cycle

- Earnings per share grew by 36.4% annually over the last three years and trumped its peers

- Demand for the next 12 months is expected to accelerate above its two-year trend as Wall Street forecasts robust revenue growth of 48%

Fluence Energy is a market leader. There’s a lot to like here.

Is Now The Time To Buy Fluence Energy?

High Quality

Investable

Underperform

Is Now The Time To Buy Fluence Energy?

At $26.88 per share, Fluence Energy trades at 96x forward EV-to-EBITDA. There’s no denying that the lofty valuation means there’s much good news priced into the stock.

If you’re a fan of the business, we suggest making it a smaller position as our analysis shows high-quality companies outperform the market over a multi-year period regardless of valuation.

3. Fluence Energy (FLNC) Research Report: Q3 CY2025 Update

Electricity storage and software provider Fluence (NASDAQ:FLNC) missed Wall Street’s revenue expectations in Q3 CY2025, with sales falling 15.2% year on year to $1.04 billion. On the other hand, the company’s full-year revenue guidance of $3.4 billion at the midpoint came in 5% above analysts’ estimates. Its GAAP profit of $0.13 per share was 34.1% below analysts’ consensus estimates.

Fluence Energy (FLNC) Q3 CY2025 Highlights:

- Revenue: $1.04 billion vs analyst estimates of $1.39 billion (15.2% year-on-year decline, 24.8% miss)

- EPS (GAAP): $0.13 vs analyst expectations of $0.20 (34.1% miss)

- Adjusted EBITDA: $72.19 million vs analyst estimates of $62.89 million (6.9% margin, 14.8% beat)

- EBITDA guidance for the upcoming financial year 2026 is $50 million at the midpoint, below analyst estimates of $57.75 million

- Operating Margin: 4.7%, in line with the same quarter last year

- Free Cash Flow Margin: 24.6%, up from 0.4% in the same quarter last year

- Backlog: $5.3 billion at quarter end, up 17.8% year on year

- Market Capitalization: $2.02 billion

Company Overview

Pioneering the use of lithium-ion batteries for grid storage, Fluence (NASDAQ:FLNC) helps store renewable energy sources with battery systems.

Fluence was established in 2018 as a joint venture between Siemens and AES, originating from AES's work in energy storage. Over the years, Fluence has grown by making acquisitions such as Nispera’s software services in 2022. This was significant as it provided technologies that improved predictions and maintenance of renewable energy systems.

Today, Fluence helps store and manage electricity from renewable sources like solar and wind. It makes products like Gridstack, Sunstack, and Edgestack, which are big battery systems that can be customized and expanded. These systems help keep the electric grid stable by storing extra energy when demand is low and releasing it when demand is high.

Additionally, Fluence offers software that monitors energy use to help detect problems before happening and ensure the energy systems are functioning properly. The software is typically offered on a subscription basis rather than as a one-time purchase, and it is an additional service that customers pay for separately from the equipment.

Fluence’s customers include power companies, grid managers, and renewable energy developers who typically purchase its products in large quantities to outfit large-scale projects. It offers volume discounts for customers who buy its products in bulk as an incentive for large-scale acquisitions. Many customers supplement their equipment purchases by entering into service agreements with Fluence, which span the equipment’s operational lifetime. These service contracts generate additional revenue for Fluence.

4. Renewable Energy

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

Competitors of Fluence Energy include Tesla (NASDAQ:TSLA) and private companies LG Chem Energy SOlutions and BYD Company.

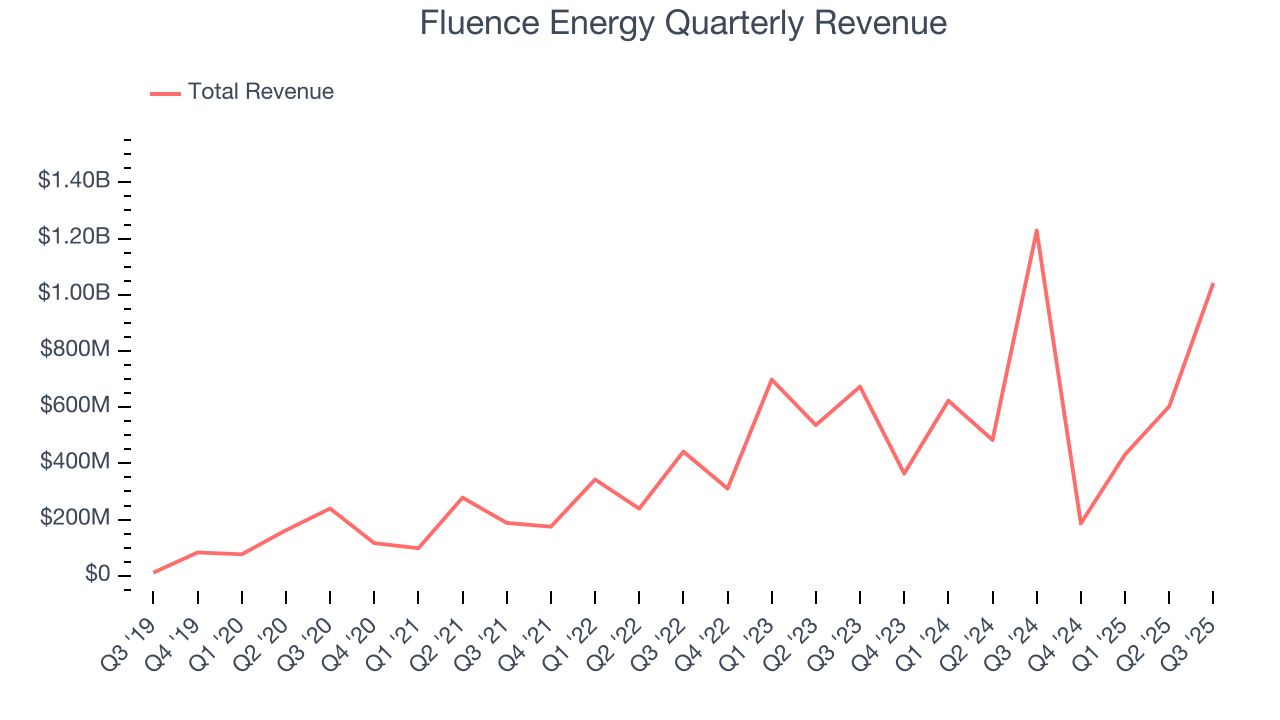

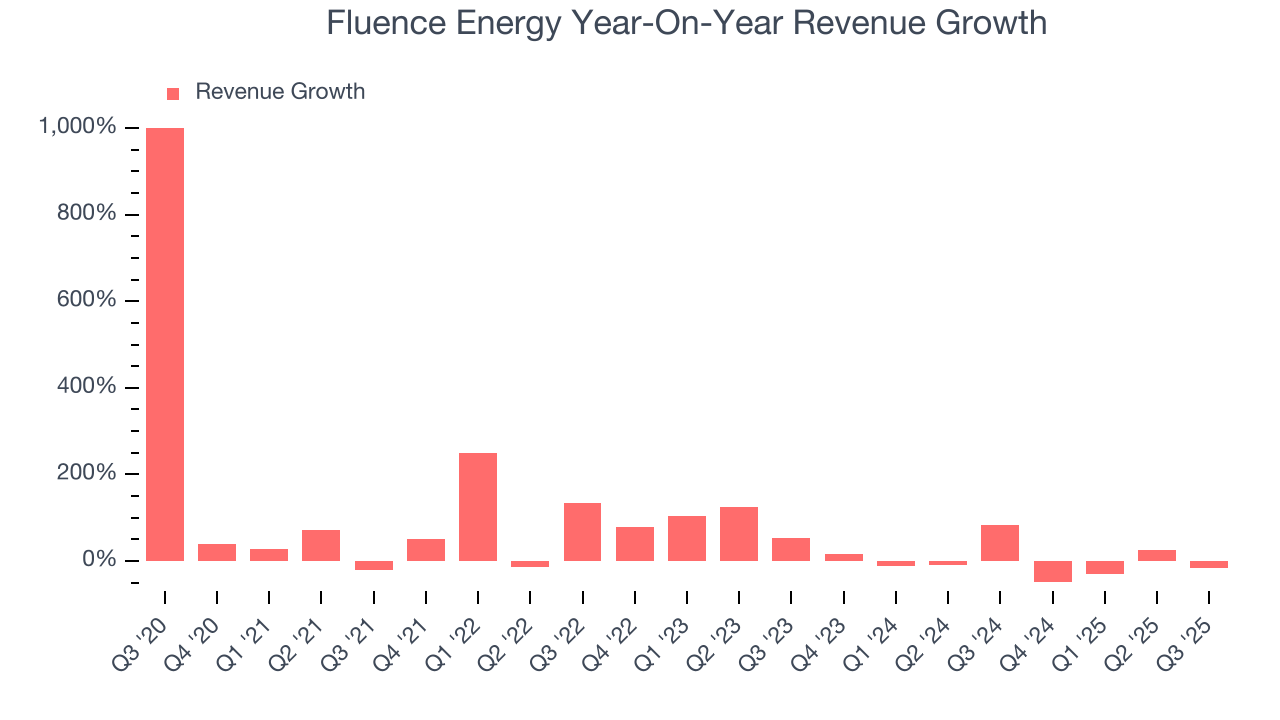

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Fluence Energy’s 32.2% annualized revenue growth over the last five years was incredible. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Fluence Energy’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 1% over the last two years was well below its five-year trend.

This quarter, Fluence Energy missed Wall Street’s estimates and reported a rather uninspiring 15.2% year-on-year revenue decline, generating $1.04 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 40.9% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and suggests its newer products and services will fuel better top-line performance.

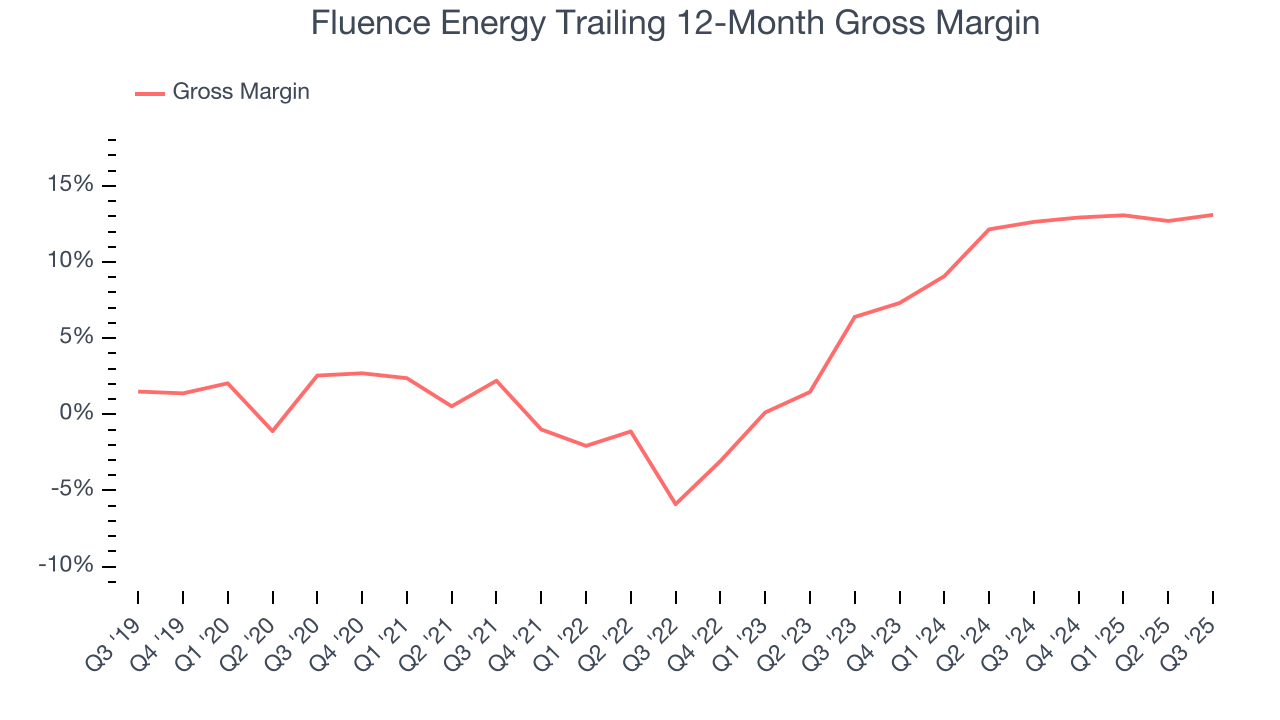

6. Gross Margin & Pricing Power

Gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor.

Fluence Energy has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 8% gross margin over the last five years. That means Fluence Energy paid its suppliers a lot of money ($92.01 for every $100 in revenue) to run its business.

Fluence Energy produced a 13.7% gross profit margin in Q3, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

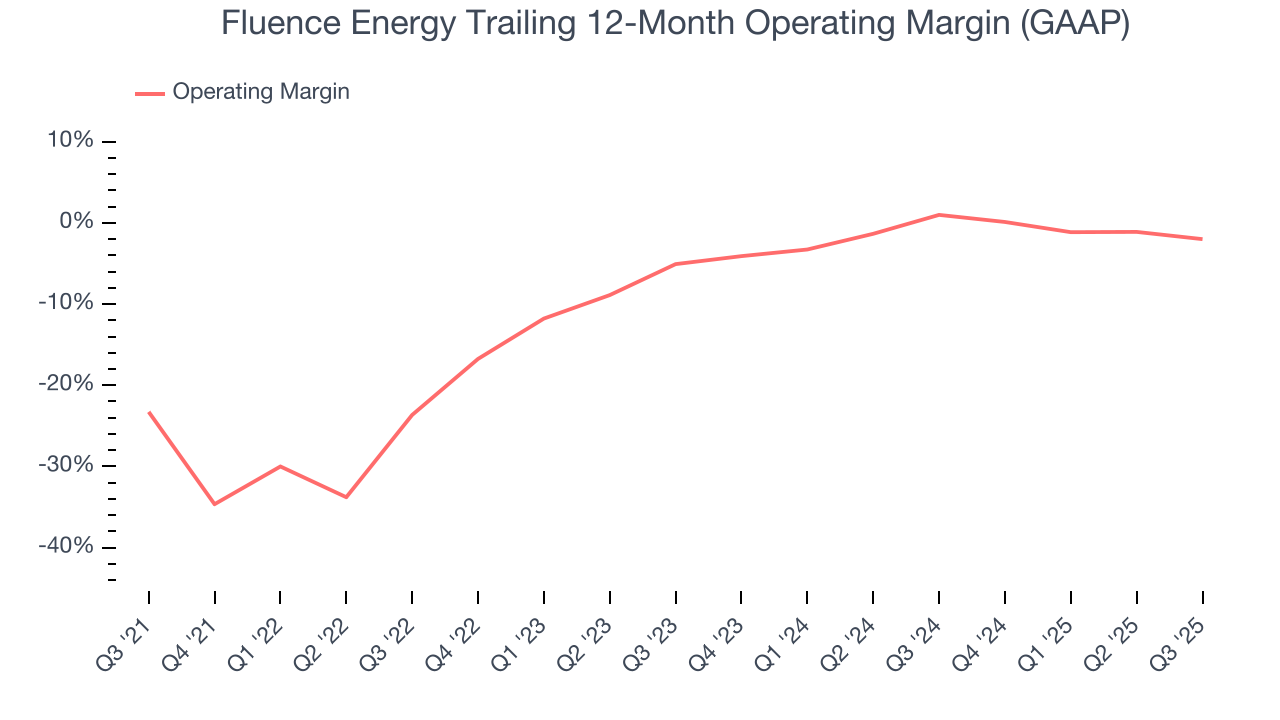

Although Fluence Energy was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 6.3% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Fluence Energy’s operating margin rose by 21.3 percentage points over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to show consistent profitability.

This quarter, Fluence Energy generated an operating margin profit margin of 4.7%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

8. Earnings Per Share

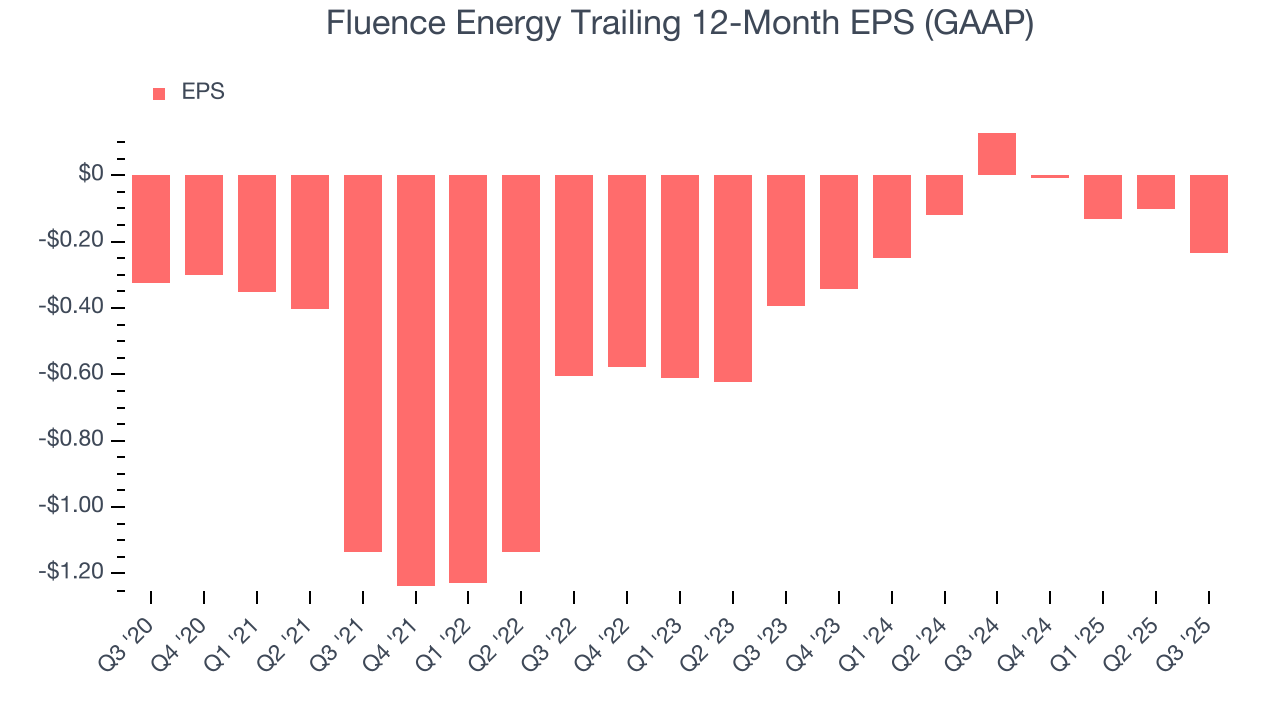

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Although Fluence Energy’s full-year earnings are still negative, it reduced its losses and improved its EPS by 6.2% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability. We hope to see an inflection point soon.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Fluence Energy, its two-year annual EPS growth of 22.7% was higher than its five-year trend. Its improving earnings is an encouraging data point, but a caveat is that its EPS is still in the red.

In Q3, Fluence Energy reported EPS of $0.13, down from $0.26 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Fluence Energy to improve its earnings losses. Analysts forecast its full-year EPS of negative $0.23 will advance to negative $0.06.

9. Cash Is King

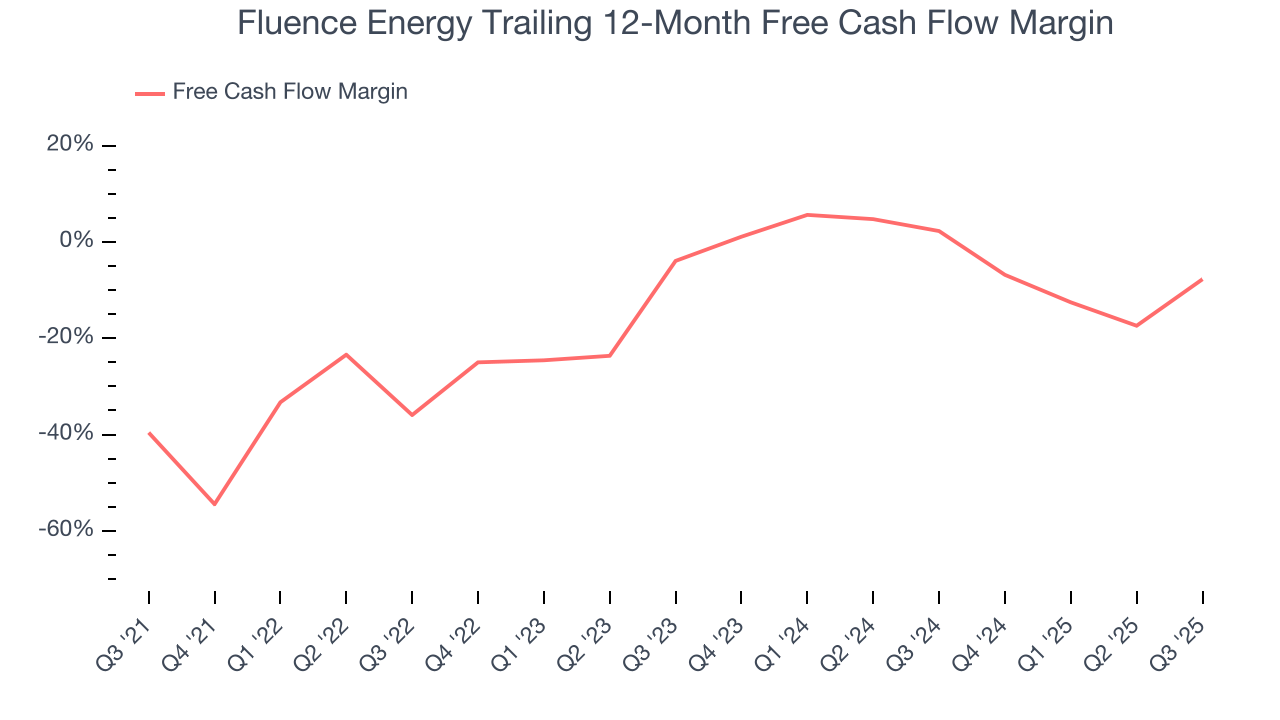

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

While Fluence Energy posted positive free cash flow this quarter, the broader story hasn’t been so clean. Fluence Energy’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 10%, meaning it lit $9.96 of cash on fire for every $100 in revenue.

Taking a step back, an encouraging sign is that Fluence Energy’s margin expanded by 31.8 percentage points during that time. The company’s improvement and free cash flow generation this quarter show it’s heading in the right direction, and continued increases could help it achieve long-term cash profitability.

Fluence Energy’s free cash flow clocked in at $256 million in Q3, equivalent to a 24.6% margin. This result was good as its margin was 24.2 percentage points higher than in the same quarter last year, building on its favorable historical trend.

10. Balance Sheet Assessment

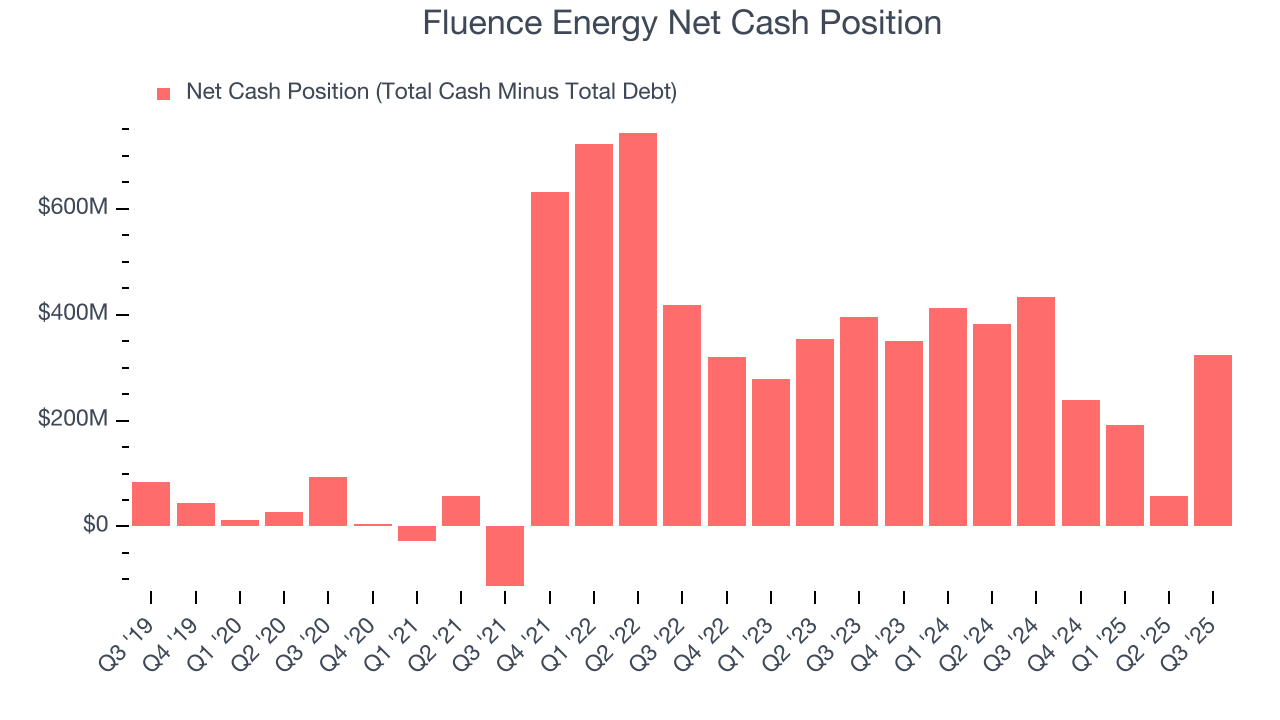

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

Fluence Energy is a well-capitalized company with $714.6 million of cash and $390.8 million of debt on its balance sheet. This $323.8 million net cash position is 16.1% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from Fluence Energy’s Q3 Results

We were impressed by how significantly Fluence Energy blew past analysts’ EBITDA expectations this quarter. We were also glad its full-year revenue guidance trumped Wall Street’s estimates. On the other hand, its full-year EBITDA guidance missed and its revenue fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded up 6.7% to $16.98 immediately after reporting.

12. Is Now The Time To Buy Fluence Energy?

Updated: January 21, 2026 at 10:34 PM EST

When considering an investment in Fluence Energy, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

Fluence Energy is a rock-solid business worth owning. For starters, its revenue growth was exceptional over the last five years and is expected to accelerate over the next 12 months. And while its operating margins reveal poor profitability compared to other industrials companies, its backlog growth has been marvelous. On top of that, Fluence Energy’s rising cash profitability gives it more optionality.

Fluence Energy’s EV-to-EBITDA ratio based on the next 12 months is 89.4x. There’s no doubt it’s a bit of a market darling given the lofty multiple, but we don’t mind owning a high-quality business, even if it’s expensive. Investments like this should be held patiently for at least three to five years as they benefit from the power of long-term compounding, which more than makes up for any short-term price volatility that comes with high valuations.

Wall Street analysts have a consensus one-year price target of $17.84 on the company (compared to the current share price of $26.66).