Rocket Lab (RKLB)

Rocket Lab piques our interest. Although it has burned cash, its growth shows it’s deploying the Jeff Bezos reinvestment strategy.― StockStory Analyst Team

1. News

2. Summary

Why Rocket Lab Is Interesting

Becoming the first private company in the Southern Hemisphere to reach space, Rocket Lab (NASDAQ:RKLB) offers rockets designed for launching small satellites.

- Annual revenue growth of 76.5% over the last five years was superb and indicates its market share increased during this cycle

- Expected revenue growth of 41.6% for the next year suggests its market share will rise

- A downside is its suboptimal cost structure is highlighted by its history of operating margin losses

Rocket Lab has some noteworthy aspects. If you like the company, the price seems fair.

Why Is Now The Time To Buy Rocket Lab?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Rocket Lab?

At $69.67 per share, Rocket Lab trades at 47x forward price-to-sales. Looking at the industrials landscape right now, Rocket Lab trades at a pretty interesting price. If you’re a fan of the business and management team, now is a good time to scoop up some shares.

Now could be a good time to invest if you believe in the long-term prospects of the business.

3. Rocket Lab (RKLB) Research Report: Q4 CY2025 Update

Aerospace and defense company Rocket Lab (NASDAQ:RKLB) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 35.7% year on year to $179.7 million. On the other hand, next quarter’s revenue guidance of $192.5 million was less impressive, coming in 3.3% below analysts’ estimates. Its GAAP loss of $0.09 per share was in line with analysts’ consensus estimates.

Rocket Lab (RKLB) Q4 CY2025 Highlights:

- Revenue: $179.7 million vs analyst estimates of $177.2 million (35.7% year-on-year growth, 1.4% beat)

- EPS (GAAP): -$0.09 vs analyst estimates of -$0.10 (in line)

- Adjusted EBITDA: -$17.37 million (-9.7% margin, 25.1% year-on-year growth)

- Revenue Guidance for Q1 CY2026 is $192.5 million at the midpoint, below analyst estimates of $199 million

- EBITDA guidance for Q1 CY2026 is -$24 million at the midpoint, below analyst estimates of -$15.8 million

- Adjusted EBITDA Margin: -9.7%, up from -17.5% in the same quarter last year

- Free Cash Flow was -$114.2 million compared to -$23.94 million in the same quarter last year

- Market Capitalization: $37.5 billion

Company Overview

Becoming the first private company in the Southern Hemisphere to reach space, Rocket Lab (NASDAQ:RKLB) offers rockets designed for launching small satellites.

Rocket Lab was founded in 2006 and established itself in the commercial space and rapidly improved its space technologies by making various acquisitions. Specifically, the acquisitions of Planetary Systems in 2019 and Sinclair Interplanetary in 2020 were pivotal for improving the company’s satellite technology, components, and systems. Rocket Lab would go on to become a public traded company in 2021 through a merger with Vector Acquisition.

Rocket Lab's primary product is the Electron rocket, designed specifically for launching small satellites which are crucial for scientific research, Earth imaging, communications, and navigation systems. Its rocket is designed to handle smaller payloads meaning that it can launch satellites for different customers at different times, either on its own or as part of a shared mission with other payloads. This is important because this allows its customers to get satellites into space without waiting for a large, expensive rocket launch.

The company offers dedicated launch services, where a single customer uses the entire rocket, and rideshare missions, where multiple customers share the launch vehicle. Costs are determined based on factors such as payload size, mission complexity, and specific customer requirements. Contract durations can vary, ranging from a few months for straightforward launches to several years for complex, multi-mission agreements.

Looking ahead, Rocket Lab is gearing up for its next big leap with the Neutron rocket, a larger and partially reusable launch vehicle. Neutron aims to further expand Rocket Lab's capabilities in delivering payloads to orbit and support larger satellite constellations.

4. Aerospace

Aerospace companies often possess technical expertise and have made significant capital investments to produce complex products. It is an industry where innovation is important, and lately, emissions and automation are in focus, so companies that boast advances in these areas can take market share. On the other hand, demand for aerospace products can ebb and flow with economic cycles and geopolitical tensions, which can be particularly painful for companies with high fixed costs.

Competitors offering similar products include Space X (private), Astra (NASDAQ:ASTR), and Virgin Orbit (NASDAQ:VORB).

5. Revenue Growth

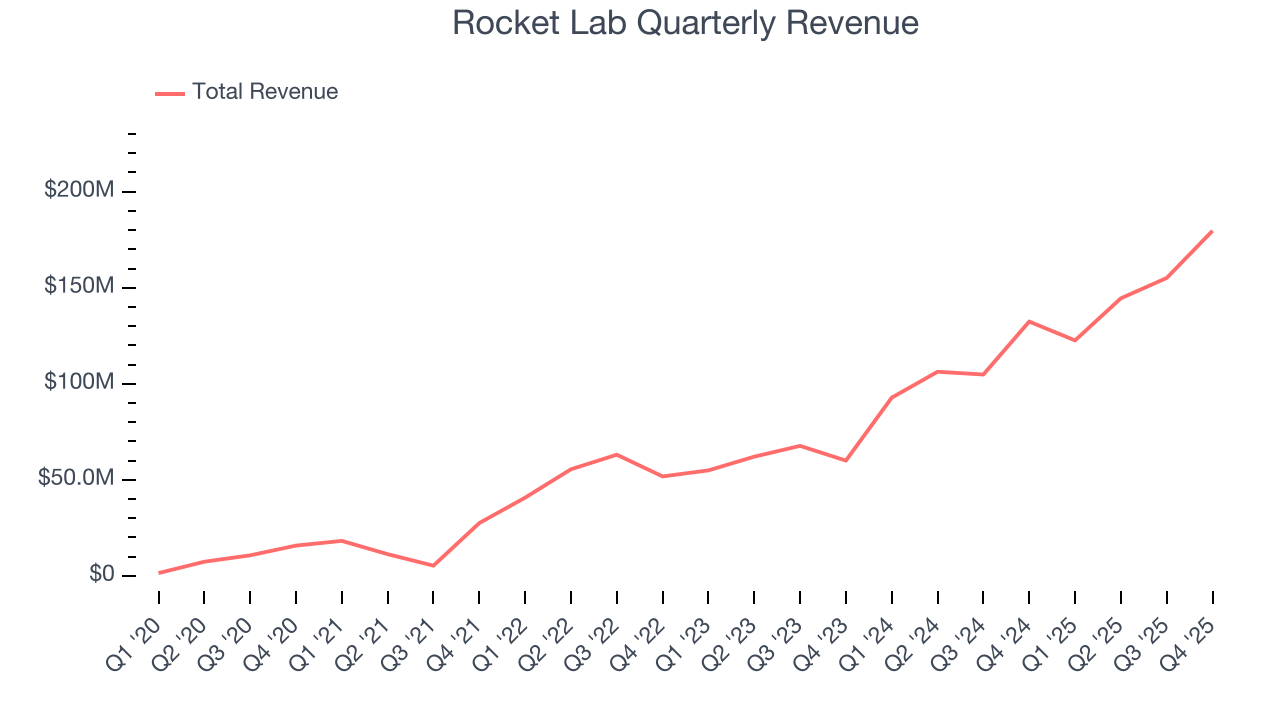

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, Rocket Lab’s sales grew at an incredible 76.5% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Rocket Lab’s annualized revenue growth of 56.9% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Rocket Lab reported wonderful year-on-year revenue growth of 35.7%, and its $179.7 million of revenue exceeded Wall Street’s estimates by 1.4%. Company management is currently guiding for a 57.1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 50.2% over the next 12 months, a deceleration versus the last two years. Still, this projection is admirable and suggests the market sees success for its products and services.

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Rocket Lab’s high expenses have contributed to an average operating margin of negative 53.6% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Rocket Lab’s operating margin rose over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to reach long-term profitability.

In Q4, Rocket Lab generated a negative 28.4% operating margin.

7. Earnings Per Share

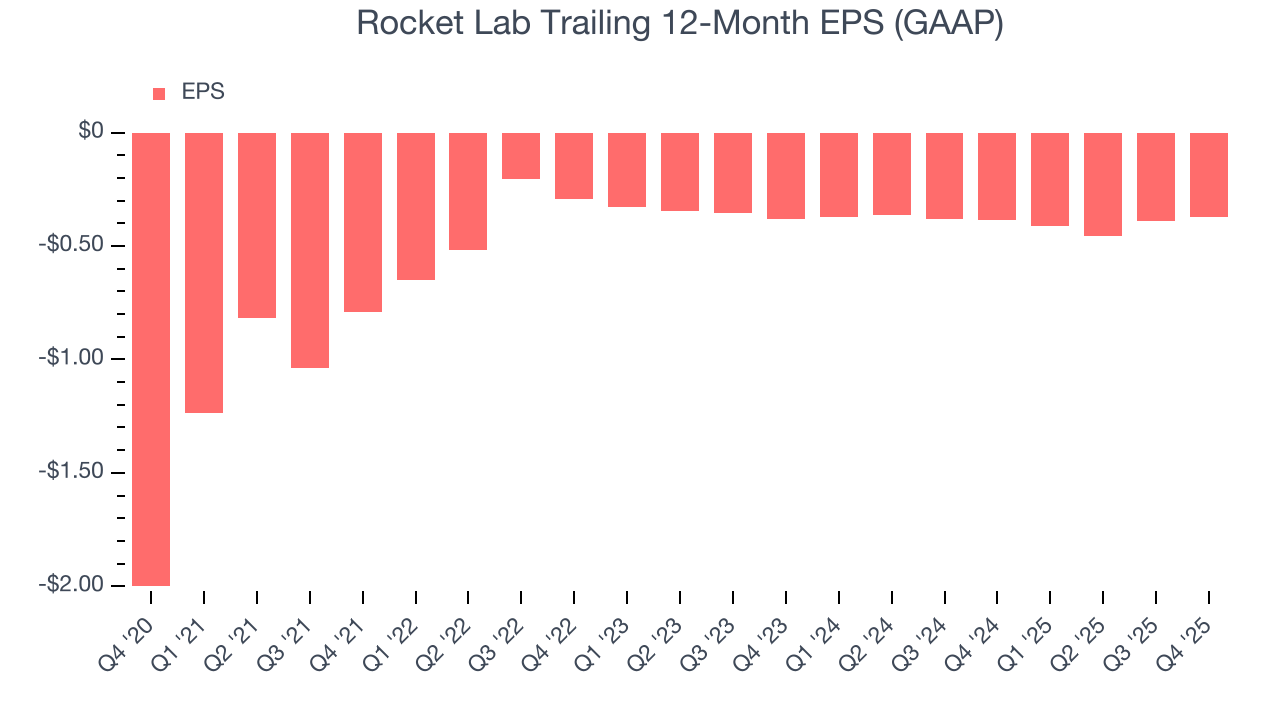

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Although Rocket Lab’s full-year earnings are still negative, it reduced its losses and improved its EPS by 28.5% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability. We hope to see an inflection point soon.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Rocket Lab, EPS didn’t budge over the last two years, a regression from its five-year trend. We hope it can revert to earnings growth in the coming years.

In Q4, Rocket Lab reported EPS of negative $0.09, up from negative $0.10 in the same quarter last year. This print beat analysts’ estimates by 8.2%. Over the next 12 months, Wall Street expects Rocket Lab to improve its earnings losses. Analysts forecast its full-year EPS of negative $0.37 will advance to negative $0.24.

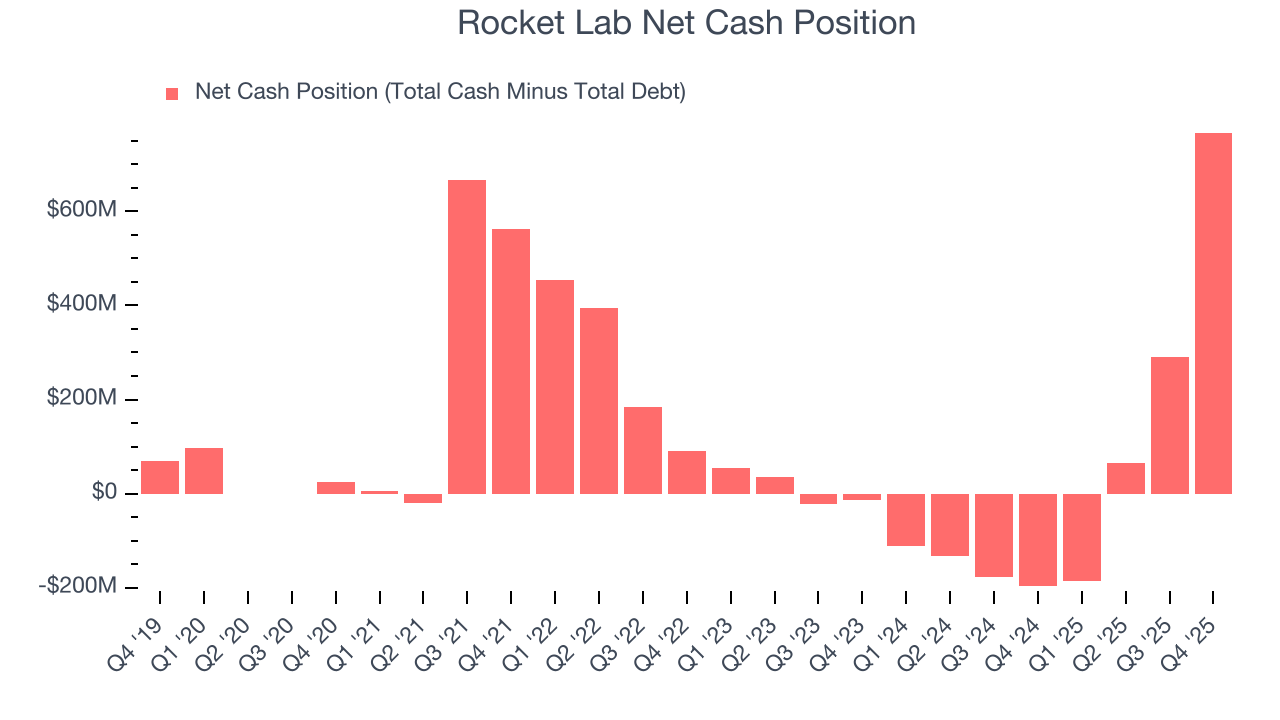

8. Cash Is King

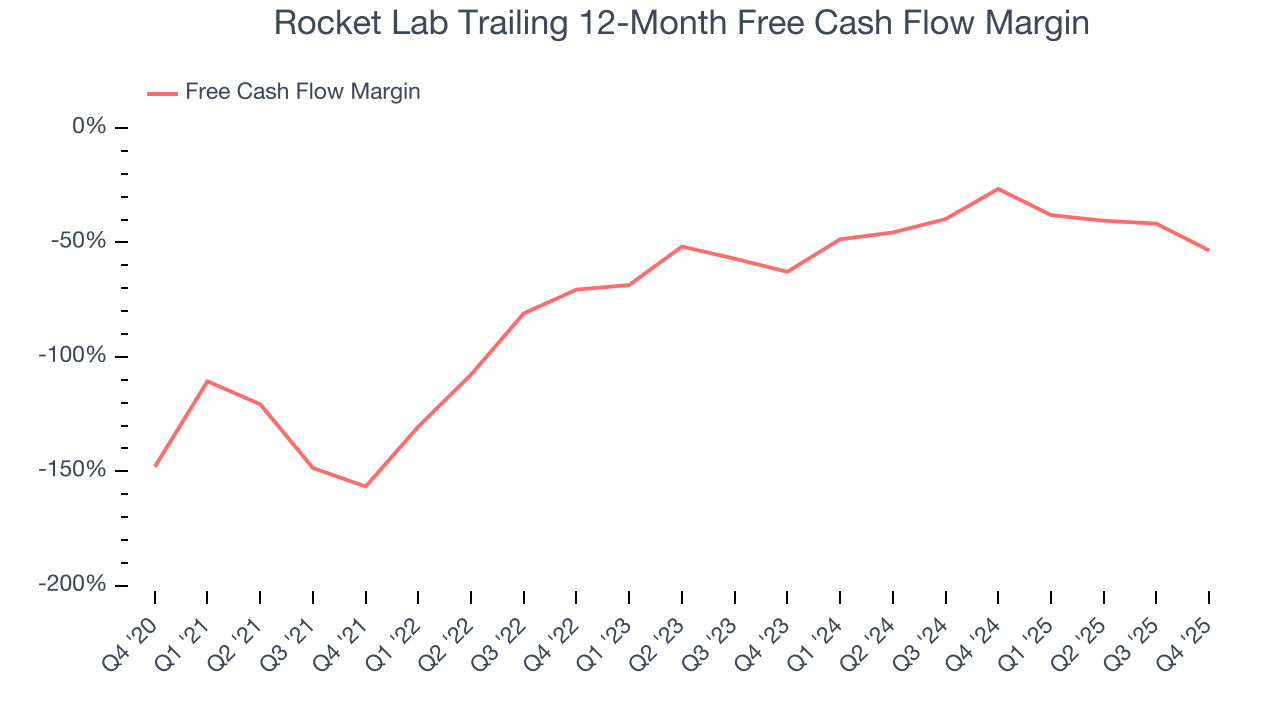

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Rocket Lab’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 53.8%, meaning it lit $53.85 of cash on fire for every $100 in revenue.

Taking a step back, an encouraging sign is that Rocket Lab’s margin expanded during that time. In light of its glaring cash burn, however, this improvement is a bucket of hot water in a cold ocean.

Rocket Lab burned through $114.2 million of cash in Q4, equivalent to a negative 63.6% margin. The company’s cash burn increased from $23.94 million of lost cash in the same quarter last year.

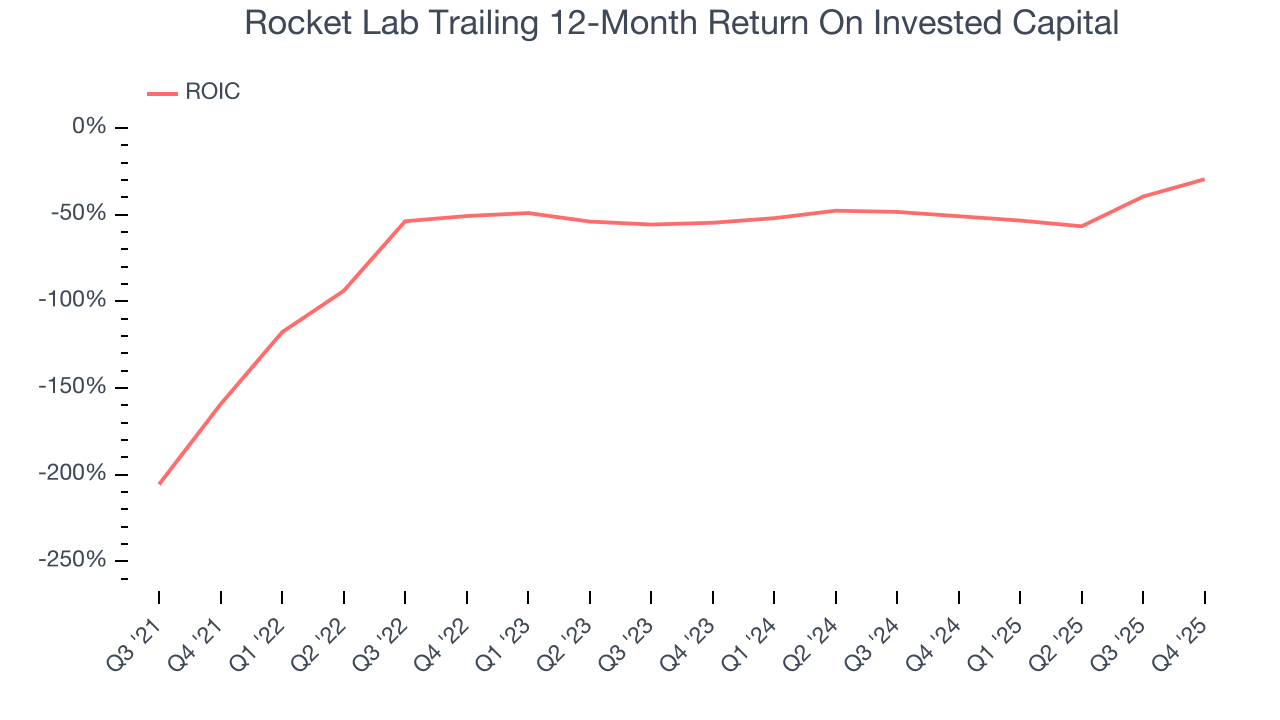

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Rocket Lab’s four-year average ROIC was negative 46.4%, meaning management lost money while trying to expand the business. Its returns were among the worst in the industrials sector.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Rocket Lab’s ROIC has increased. This is a good sign, but we recognize its lack of profitable growth during the COVID era was the primary reason for the change.

10. Balance Sheet Assessment

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

Rocket Lab is a well-capitalized company with $1.02 billion of cash and $254 million of debt on its balance sheet. This $767.5 million net cash position is 2% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from Rocket Lab’s Q4 Results

We were impressed by how significantly Rocket Lab blew past analysts’ EBITDA expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. On the other hand, its EBITDA guidance for next quarter missed and its revenue guidance for next quarter fell short of Wall Street’s estimates. Overall, this print was mixed but still had some key positives. The market seemed to be hoping for more, and the stock traded down 1.5% to $71.65 immediately after reporting.

12. Is Now The Time To Buy Rocket Lab?

Updated: March 6, 2026 at 10:26 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Rocket Lab.

Rocket Lab possesses a number of positive attributes. To kick things off, its revenue growth was exceptional over the last five years. And while its relatively low ROIC suggests management has struggled to find compelling investment opportunities, its rising cash profitability gives it more optionality. On top of that, its expanding operating margin shows the business has become more efficient.

Rocket Lab’s forward price-to-sales ratio is 47x. Looking at the industrials landscape right now, Rocket Lab trades at a pretty interesting price. If you’re a fan of the business and management team, now is a good time to scoop up some shares.

Wall Street analysts have a consensus one-year price target of $89.88 on the company (compared to the current share price of $69.67), implying they see 29% upside in buying Rocket Lab in the short term.