BILL (BILL)

We wouldn’t recommend BILL. Its revenue growth has decelerated and its historical operating losses don’t give us confidence in a turnaround.― StockStory Analyst Team

1. News

2. Summary

Why We Think BILL Will Underperform

Transforming the messy back-office financial operations that plague small business owners, BILL (NYSE:BILL) provides a cloud-based platform that automates accounts payable, accounts receivable, and expense management for small and midsize businesses.

- Static operating margin over the last year shows it couldn’t become more efficient

- Extended payback periods on sales investments suggest the company’s platform isn’t resonating enough to drive efficient sales conversions

- Persistent operating margin losses suggest the business manages its expenses poorly

BILL doesn’t meet our quality criteria. We see more lucrative opportunities elsewhere.

Why There Are Better Opportunities Than BILL

High Quality

Investable

Underperform

Why There Are Better Opportunities Than BILL

BILL’s stock price of $42.42 implies a valuation ratio of 2.4x forward price-to-sales. This certainly seems like a cheap stock, but we think there are valid reasons why it trades this way.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. BILL (BILL) Research Report: Q4 CY2025 Update

Financial automation platform BILL (NYSE:BILL) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 14.4% year on year to $414.7 million. Guidance for next quarter’s revenue was better than expected at $402.5 million at the midpoint, 1.8% above analysts’ estimates. Its non-GAAP profit of $0.64 per share was 14.2% above analysts’ consensus estimates.

BILL (BILL) Q4 CY2025 Highlights:

- Revenue: $414.7 million vs analyst estimates of $400.1 million (14.4% year-on-year growth, 3.7% beat)

- Adjusted EPS: $0.64 vs analyst estimates of $0.56 (14.2% beat)

- Adjusted Operating Income: $74.09 million vs analyst estimates of $66.46 million (17.9% margin, 11.5% beat)

- The company lifted its revenue guidance for the full year to $1.64 billion at the midpoint from $1.61 billion, a 1.8% increase

- Management raised its full-year Adjusted EPS guidance to $2.37 at the midpoint, a 8.7% increase

- Operating Margin: -4.4%, up from -6% in the same quarter last year

- Free Cash Flow Margin: 22%, up from 20.8% in the previous quarter

- Market Capitalization: $3.73 billion

Company Overview

Transforming the messy back-office financial operations that plague small business owners, BILL (NYSE:BILL) provides a cloud-based platform that automates accounts payable, accounts receivable, and expense management for small and midsize businesses.

BILL's integrated platform connects businesses with their suppliers and clients to streamline financial workflows. The system automates the entire lifecycle of transactions—from capturing invoice data and routing approvals to processing payments and reconciling with accounting software. This automation eliminates manual data entry and paper-based processes that traditionally burden small business accounting departments.

For accounts payable, BILL uses artificial intelligence to extract key information from incoming bills, route them through customizable approval workflows, and schedule payments. On the accounts receivable side, businesses can create and send professional invoices electronically, track when clients view them, and accept various payment methods. The company's spend management solution includes corporate cards with built-in controls and real-time budget tracking.

A construction company, for example, might use BILL to automatically process supplier invoices for building materials, route them to project managers for approval, schedule timely payments, and sync everything back to their accounting system—all while monitoring cash flow in real-time.

BILL generates revenue through subscription fees and payment processing services. Its platform connects to popular accounting software like QuickBooks, Xero, and NetSuite, making it attractive to small businesses and their accountants. The company's network effects strengthen as more businesses join, making it easier for users to pay and get paid electronically without sharing sensitive banking information.

4. Finance and Accounting Software

Finance and accounting software benefits from dual trends around costs savings and ease of use. First is the SaaS-ification of businesses, large and small, who much prefer the flexibility of cloud-based, web-browser delivered software paid for on a subscription basis than the hassle and expense of purchasing and managing on-premise enterprise software. Second is the consumerization of business software, whereby multiple standalone processes like supply chain and tax management are aggregated into a single, easy to use platforms.

BILL competes with financial software providers like Intuit (NASDAQ:INTU), Oracle NetSuite (NYSE:ORCL), and Sage Group (LON:SGE), payment processors including PayPal (NASDAQ:PYPL) and Stripe (private), and expense management platforms such as SAP Concur (NYSE:SAP) and Expensify (NASDAQ:EXFY).

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, BILL’s 53.3% annualized revenue growth over the last five years was incredible. Its growth beat the average software company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. BILL’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 14.1% over the last two years was well below its five-year trend.

This quarter, BILL reported year-on-year revenue growth of 14.4%, and its $414.7 million of revenue exceeded Wall Street’s estimates by 3.7%. Company management is currently guiding for a 12.4% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 10% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and suggests its products and services will see some demand headwinds.

6. Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

BILL’s billings came in at $414.9 million in Q4, and over the last four quarters, its growth was underwhelming as it averaged 11.7% year-on-year increases. This performance mirrored its total sales and suggests that increasing competition is causing challenges in acquiring/retaining customers.

7. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

BILL’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its incremental sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a highly competitive environment where there is little differentiation between BILL’s products and its peers.

8. Gross Margin & Pricing Power

For software companies like BILL, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

BILL’s gross margin is one of the highest in the software sector, an output of its asset-lite business model and strong pricing power. It also enables the company to fund large investments in new products and sales during periods of rapid growth to achieve outsized profits at scale. As you can see below, it averaged an elite 82.6% gross margin over the last year. Said differently, roughly $82.63 was left to spend on selling, marketing, and R&D for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. BILL has seen gross margins decline by 3 percentage points over the last 2 year, which is among the worst in the software space.

This quarter, BILL’s gross profit margin was 79.8%, down 4.7 percentage points year on year. BILL’s full-year margin has also been trending down over the past 12 months, decreasing by 2.4 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs.

9. Operating Margin

BILL’s expensive cost structure has contributed to an average operating margin of negative 5.8% over the last year. Unprofitable, high-growth software companies require extra attention because they spend heaps of money to capture market share. As seen in its fast historical revenue growth, this strategy seems to have worked so far, but it’s unclear what would happen if BILL reeled back its investments. Wall Street seems to think it will face some obstacles, and we tend to agree.

Analyzing the trend in its profitability, BILL’s operating margin might fluctuated slightly but has generally stayed the same over the last two years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, BILL generated a negative 4.4% operating margin.

10. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

BILL has shown impressive cash profitability, driven by its attractive business model that gives it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 21.4% over the last year, better than the broader software sector. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

BILL’s free cash flow clocked in at $91.13 million in Q4, equivalent to a 22% margin. This result was good as its margin was 2.1 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends trump fluctuations.

Over the next year, analysts’ consensus estimates show they’re expecting BILL’s free cash flow margin of 21.4% for the last 12 months to remain the same.

11. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

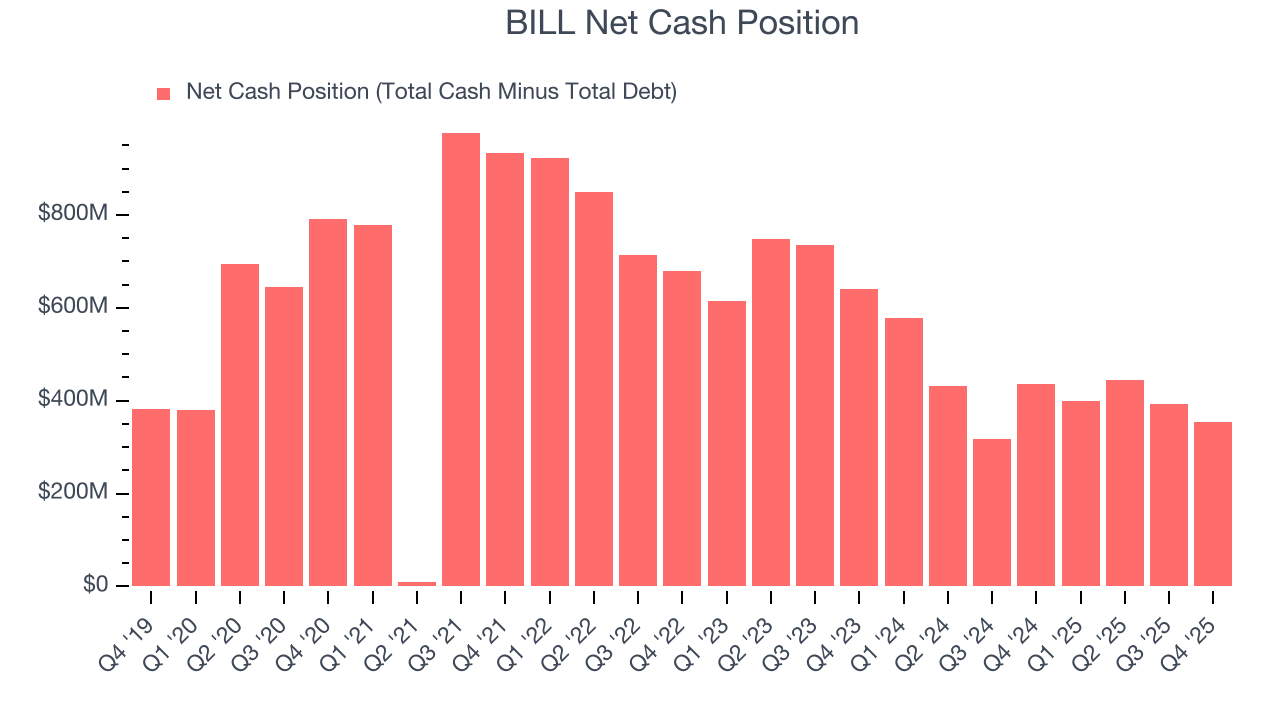

BILL is a well-capitalized company with $2.24 billion of cash and $1.89 billion of debt on its balance sheet. This $354.4 million net cash position is 7.3% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from BILL’s Q4 Results

We were impressed by BILL’s optimistic EPS guidance for next quarter, which blew past analysts’ expectations. We were also glad its full-year EPS guidance trumped Wall Street’s estimates. Zooming out, we think this was a solid print. The stock traded up 12.2% to $40.05 immediately following the results.

13. Is Now The Time To Buy BILL?

Updated: February 24, 2026 at 9:13 PM EST

Before making an investment decision, investors should account for BILL’s business fundamentals and valuation in addition to what happened in the latest quarter.

BILL doesn’t pass our quality test. Although its revenue growth was exceptional over the last five years, it’s expected to deteriorate over the next 12 months and its operating margin hasn't moved over the last year. And while the company’s admirable gross margin indicates excellent unit economics, the downside is its customer acquisition is less efficient than many comparable companies.

BILL’s price-to-sales ratio based on the next 12 months is 2.4x. This valuation multiple is fair, but we don’t have much confidence in the company. There are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $57.86 on the company (compared to the current share price of $42.42).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.