Generac (GNRC)

We’re skeptical of Generac. Its poor sales growth and falling returns on capital suggest its growth opportunities are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why We Think Generac Will Underperform

With its name deriving from a combination of “generating” and “AC”, Generac (NYSE:GNRC) offers generators and other power products for residential, industrial, and commercial use.

- Performance over the past five years shows its incremental sales were less profitable as its earnings per share were flat

- A consolation is that its projected revenue growth of 15.4% for the next 12 months is above its two-year trend, pointing to accelerating demand

Generac falls short of our expectations. We’re on the lookout for more interesting opportunities.

Why There Are Better Opportunities Than Generac

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Generac

At $220.86 per share, Generac trades at 26.4x forward P/E. This multiple is quite expensive for the quality you get.

Paying a premium for high-quality companies with strong long-term earnings potential is preferable to owning challenged businesses with questionable prospects. That helps the prudent investor sleep well at night.

3. Generac (GNRC) Research Report: Q4 CY2025 Update

Power generation products company Generac (NYSE:GNRC) missed Wall Street’s revenue expectations in Q4 CY2025, with sales falling 11.6% year on year to $1.09 billion. Its non-GAAP profit of $1.61 per share was 9% below analysts’ consensus estimates.

Generac (GNRC) Q4 CY2025 Highlights:

- Revenue: $1.09 billion vs analyst estimates of $1.16 billion (11.6% year-on-year decline, 5.9% miss)

- Adjusted EPS: $1.61 vs analyst expectations of $1.77 (9% miss)

- Adjusted EBITDA: $184.4 million vs analyst estimates of $197.8 million (16.9% margin, 6.8% miss)

- Operating Margin: -0.9%, down from 16% in the same quarter last year

- Free Cash Flow Margin: 11.9%, down from 23.2% in the same quarter last year

- Market Capitalization: $10.7 billion

Company Overview

With its name deriving from a combination of “generating” and “AC”, Generac (NYSE:GNRC) offers generators and other power products for residential, industrial, and commercial use.

Generac was founded in 1959 as a small manufacturer of portable generators. Over time, the company was able to expand by making various acquisitions. Its acquisition strategy is geared towards both consolidation within its core markets and diversification into new product offerings. For example, its acquisition of ECM in 2020 allowed it to expand its portfolio of outdoor power equipment including pressure washers.

Generac’s product portfolio includes generators, power storage systems (store electricity), pressure washers (use high-pressure water to clean surfaces), and other power products. The company is particularly well-known for its residential standby generators which provide homeowners with reliable backup power during outages. In addition, the company supplies portable and standby generators for commercial use and industrial generators and power systems for large-scale facilities that require continuous power. While it mainly focuses on selling equipment, it also offers maintenance and repair services for its products.

Generac primarily sells through one-time sales distribution through dealers, retailers, and online platforms. While it mainly focuses on selling equipment, it also offers maintenance and repair services for its products. Specifically, it engages in long-term service contracts that typically range from one to five years.

4. Renewable Energy

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

Competitors of Generac include Cummins (NYSE:CMI), Eaton (NYSE:ETN), and private company Kohler.

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, Generac’s 11.1% annualized revenue growth over the last five years was impressive. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Generac’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 2.3% over the last two years was well below its five-year trend.

Generac also breaks out the revenue for its most important segments, Residential and Commercial and Industrial, which are 52.4% and 36.6% of revenue. Over the last two years, Generac’s Residential revenue (sales to consumers) averaged 6.5% year-on-year growth while its Commercial and Industrial revenue (sales to contractors and pros) was flat.

This quarter, Generac missed Wall Street’s estimates and reported a rather uninspiring 11.6% year-on-year revenue decline, generating $1.09 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 12% over the next 12 months, an improvement versus the last two years. This projection is commendable and suggests its newer products and services will spur better top-line performance.

6. Gross Margin & Pricing Power

Generac’s unit economics are great compared to the broader industrials sector and signal that it enjoys product differentiation through quality or brand. As you can see below, it averaged an excellent 36.1% gross margin over the last five years. Said differently, roughly $36.13 was left to spend on selling, marketing, R&D, and general administrative overhead for every $100 in revenue.

In Q4, Generac produced a 36.3% gross profit margin, down 4.3 percentage points year on year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

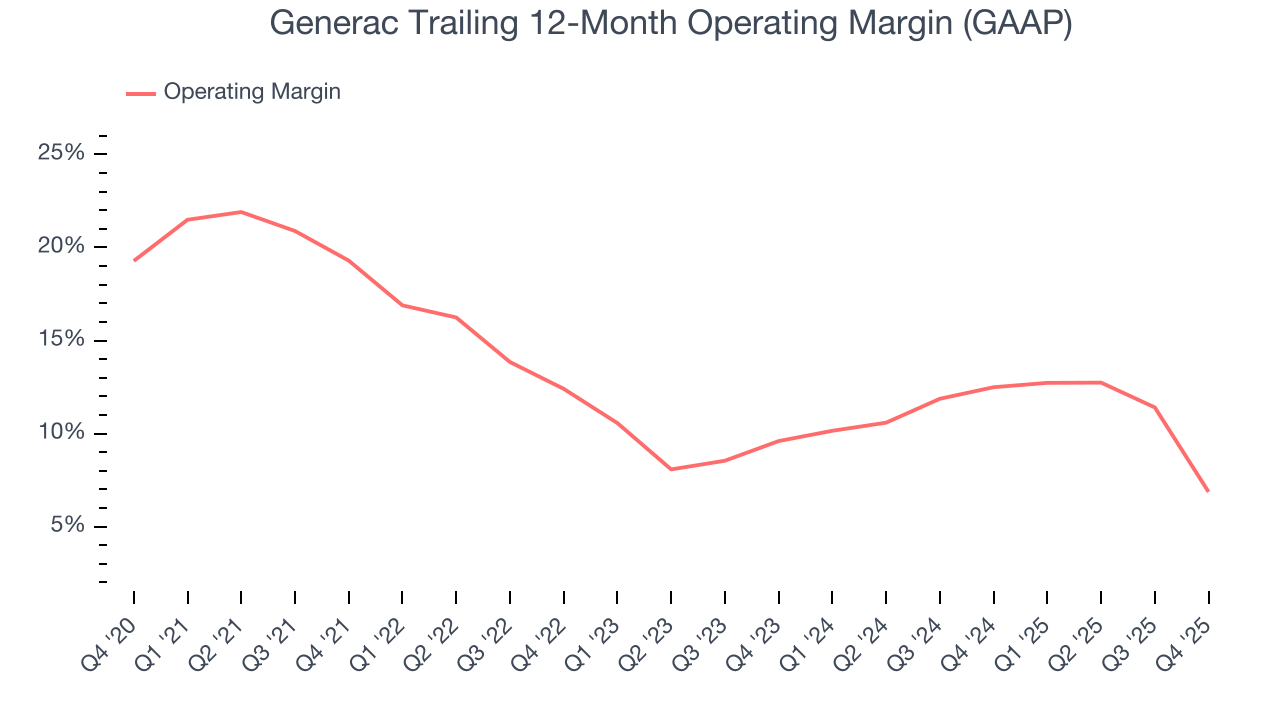

7. Operating Margin

Generac has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 12%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Generac’s operating margin decreased by 12.4 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, Generac’s breakeven margin was -0.9%, down 16.9 percentage points year on year. Since Generac’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

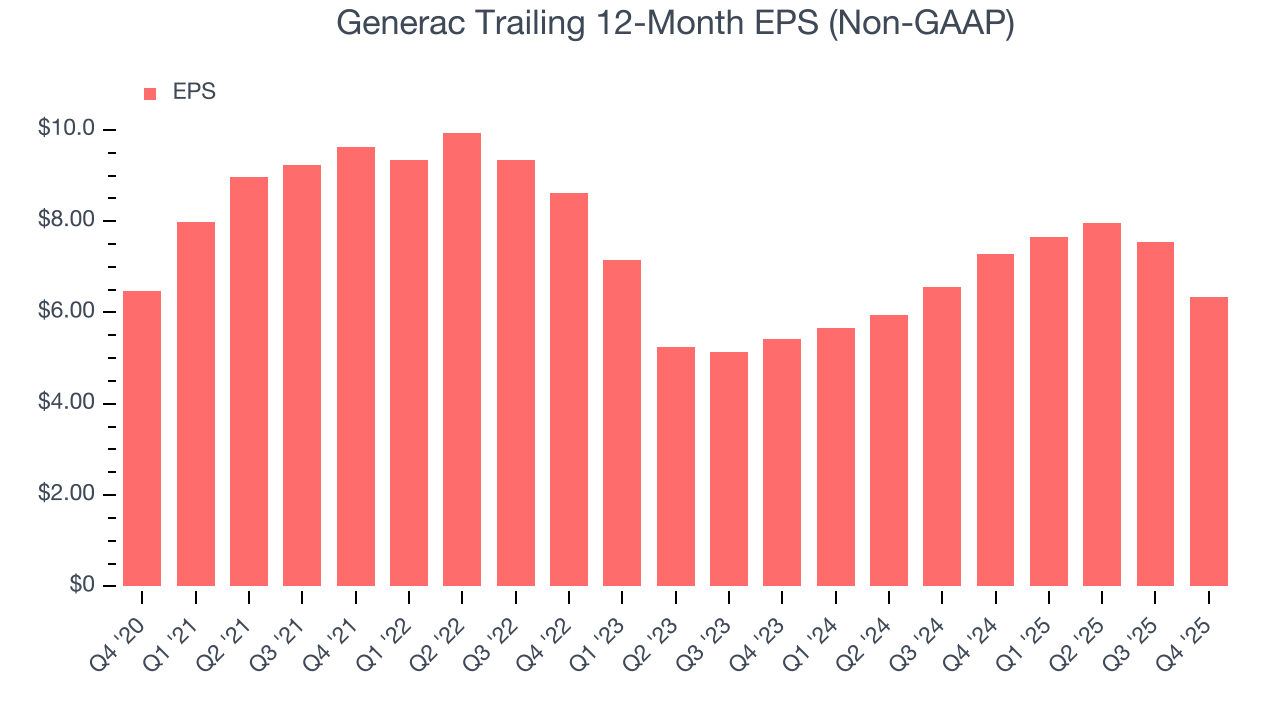

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Generac’s flat EPS over the last five years was below its 11.1% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

Diving into the nuances of Generac’s earnings can give us a better understanding of its performance. As we mentioned earlier, Generac’s operating margin declined by 12.4 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Generac, its two-year annual EPS growth of 8.2% was higher than its five-year trend. Accelerating earnings growth is almost always an encouraging data point.

In Q4, Generac reported adjusted EPS of $1.61, down from $2.80 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Generac’s full-year EPS of $6.35 to grow 27.1%.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

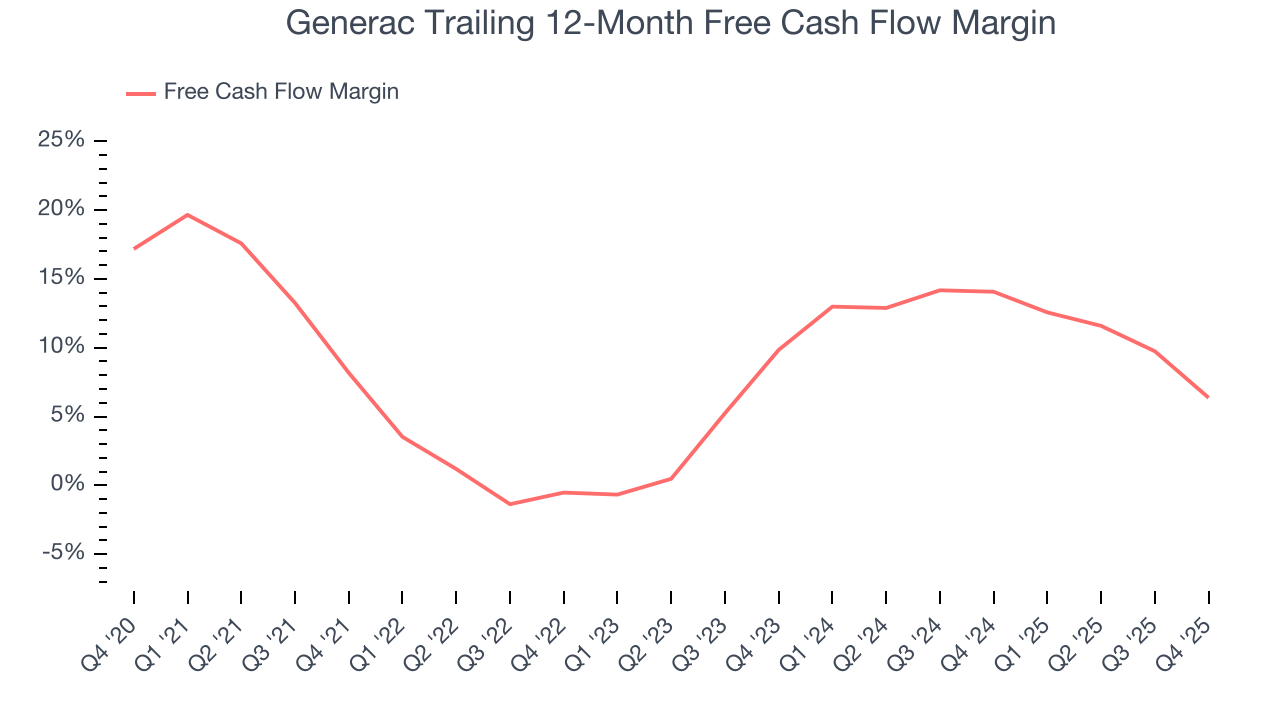

Generac has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 7.4% over the last five years, slightly better than the broader industrials sector.

Taking a step back, we can see that Generac’s margin dropped by 1.8 percentage points during that time. Continued declines could signal it is in the middle of an investment cycle.

Generac’s free cash flow clocked in at $129.9 million in Q4, equivalent to a 11.9% margin. The company’s cash profitability regressed as it was 11.3 percentage points lower than in the same quarter last year, but it’s still above its five-year average. We wouldn’t read too much into this quarter’s decline because capital expenditures can be seasonal and companies often stockpile inventory in anticipation of higher demand, leading to short-term swings. Long-term trends carry greater meaning.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Generac hasn’t been the highest-quality company lately because of its poor bottom-line (EPS) performance, it historically found a few growth initiatives that worked. Its five-year average ROIC was 13%, higher than most industrials businesses.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Generac’s ROIC has decreased significantly over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

11. Balance Sheet Assessment

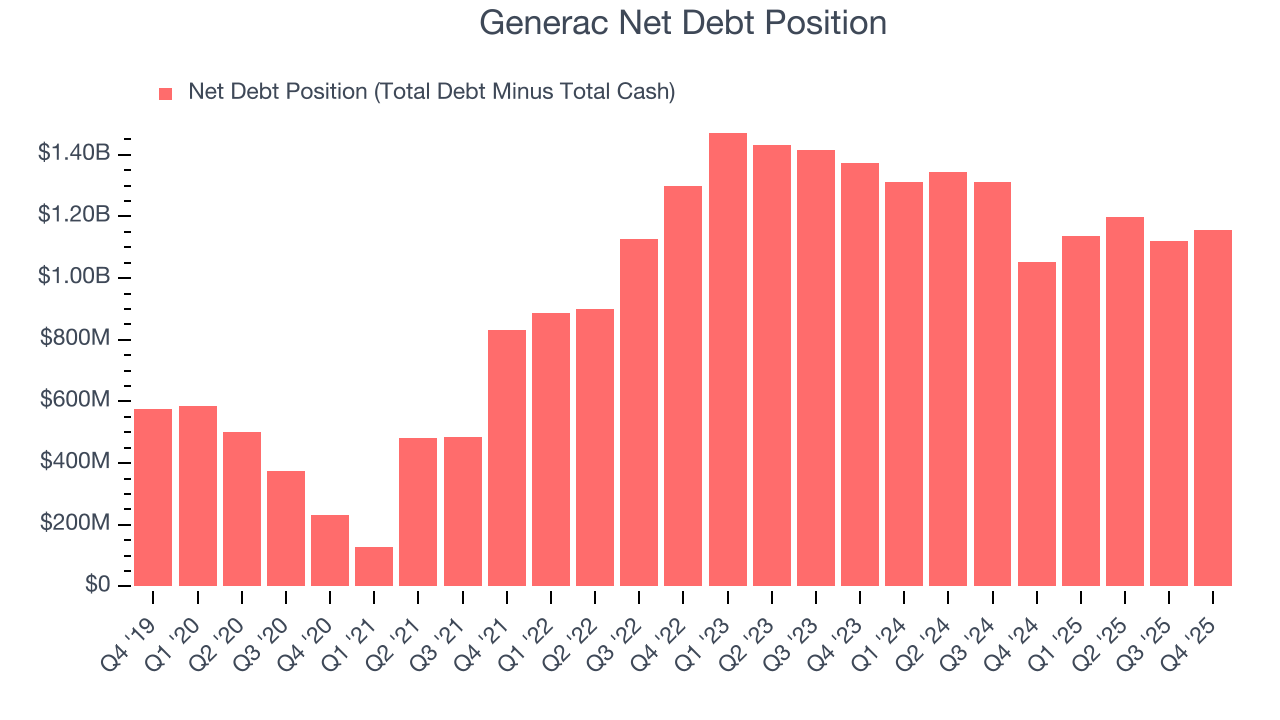

Generac reported $341.4 million of cash and $1.50 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $714.8 million of EBITDA over the last 12 months, we view Generac’s 1.6× net-debt-to-EBITDA ratio as safe. We also see its $33.37 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Generac’s Q4 Results

We were impressed by how significantly Generac blew past analysts’ Commercial and Industrial revenue expectations this quarter. On the other hand, its Residential revenue missed and its revenue fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded up 1.3% to $184.67 immediately following the results.

13. Is Now The Time To Buy Generac?

Updated: March 4, 2026 at 10:46 PM EST

Are you wondering whether to buy Generac or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

Generac’s business quality ultimately falls short of our standards. Although its revenue growth was impressive over the last five years and is expected to accelerate over the next 12 months, its diminishing returns show management's prior bets haven't worked out. And while the company’s projected EPS for the next year implies the company’s fundamentals will improve, the downside is its weak EPS growth over the last five years shows it’s failed to produce meaningful profits for shareholders.

Generac’s P/E ratio based on the next 12 months is 26.4x. Beauty is in the eye of the beholder, but we don’t really see a big opportunity at the moment. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $241.65 on the company (compared to the current share price of $220.86).