McCormick (MKC)

McCormick doesn’t excite us. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why McCormick Is Not Exciting

The classic red Heinz ketchup bottle’s competitor, McCormick (NYSE:MKC) sells food-flavoring products like condiments, spices, and seasoning mixes.

- Lackluster 2.5% annual revenue growth over the last three years indicates the company is losing ground to competitors

- ROIC of 8.9% reflects management’s challenges in identifying attractive investment opportunities

- A silver lining is that its demand will likely accelerate over the next 12 months as its forecasted revenue growth of 14.5% is above its three-year trend

McCormick’s quality doesn’t meet our expectations. We’d rather invest in businesses with stronger moats.

Why There Are Better Opportunities Than McCormick

High Quality

Investable

Underperform

Why There Are Better Opportunities Than McCormick

McCormick is trading at $65.98 per share, or 21.1x forward P/E. Not only is McCormick’s multiple richer than most consumer staples peers, but it’s also expensive for its revenue characteristics.

We prefer to invest in similarly-priced but higher-quality companies with superior earnings growth.

3. McCormick (MKC) Research Report: Q4 CY2025 Update

Food flavoring company McCormick (NYSE:MKC) announced better-than-expected revenue in Q4 CY2025, with sales up 2.9% year on year to $1.85 billion. Its non-GAAP profit of $0.86 per share was 1.8% below analysts’ consensus estimates.

McCormick (MKC) Q4 CY2025 Highlights:

- Revenue: $1.85 billion vs analyst estimates of $1.83 billion (2.9% year-on-year growth, 0.9% beat)

- Adjusted EPS: $0.86 vs analyst expectations of $0.88 (1.8% miss)

- Adjusted EBITDA: $416.5 million vs analyst estimates of $388.3 million (22.5% margin, 7.3% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $3.09 at the midpoint, missing analyst estimates by 3.5%

- Operating Margin: 16.8%, in line with the same quarter last year

- Free Cash Flow Margin: 24.8%, up from 20.8% in the same quarter last year

- Sales Volumes were flat year on year (2.2% in the same quarter last year)

- Market Capitalization: $17.86 billion

Company Overview

The classic red Heinz ketchup bottle’s competitor, McCormick (NYSE:MKC) sells food-flavoring products like condiments, spices, and seasoning mixes.

McCormick synthesizes, markets, and distributes its spices and condiments to supermarkets and grocery stores as well as restaurants, school cafeterias, hospitals, and OEM food manufacturers.

The company’s main product offerings include spices and herbs such as pepper and basil, seasoning mixes for popular dishes like tacos, and classic condiments like ketchup, mustard, and mayonnaise. Additional examples of the company’s products include flavor enhancers for food manufacturers and extracts like vanilla and food colorings.

McCormick generates revenue by selling its food flavoring products to everyday consumers, food services businesses, and food manufacturers, with a common strategy of providing bulk sales to its large customers. Consumers will use its products in everyday cooking while business customers will blend its products into their packaged foods or serve them with their meals.

4. Shelf-Stable Food

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences. The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

Competitors of McCormick include Kraft Heinz (NASDAQ:KHC), Nestle (SWX:NESN), and Unilever (NYSE:UL).

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $6.84 billion in revenue over the past 12 months, McCormick is one of the larger consumer staples companies and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because there are only so many big store chains to sell into, making it harder to find incremental growth. To expand meaningfully, McCormick likely needs to tweak its prices, innovate with new products, or enter new markets.

As you can see below, McCormick’s 2.5% annualized revenue growth over the last three years was sluggish, but to its credit, consumers bought more of its products.

This quarter, McCormick reported modest year-on-year revenue growth of 2.9% but beat Wall Street’s estimates by 0.9%.

Looking ahead, sell-side analysts expect revenue to grow 10.7% over the next 12 months, an acceleration versus the last three years. This projection is admirable and implies its newer products will spur better top-line performance.

6. Volume Growth

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

McCormick’s average quarterly volume growth was a healthy 1% over the last two years. This is pleasing because it shows consumers are purchasing more of its products.

In McCormick’s Q4 2025, year on year sales volumes were flat. This result was a meaningful deceleration from its historical levels. We’ll be watching closely to see if McCormick can reaccelerate demand for its products.

7. Gross Margin & Pricing Power

All else equal, we prefer higher gross margins because they usually indicate that a company sells more differentiated products, has a stronger brand, and commands pricing power.

McCormick has good unit economics for a consumer staples company, giving it the opportunity to invest in areas such as marketing and talent to stay competitive. As you can see below, it averaged an impressive 38.2% gross margin over the last two years. That means for every $100 in revenue, $61.78 went towards paying for raw materials, production of goods, transportation, and distribution.

McCormick produced a 38.9% gross profit margin in Q4, marking a 1.2 percentage point decrease from 40.2% in the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

8. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

McCormick’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 15.7% over the last two years. This profitability was top-notch for a consumer staples business, showing it’s an well-run company with an efficient cost structure. This result isn’t too surprising as its gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, McCormick’s operating margin might fluctuated slightly but has generally stayed the same over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, McCormick generated an operating margin profit margin of 16.8%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

9. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

McCormick’s EPS grew at a decent 5.8% compounded annual growth rate over the last three years, higher than its 2.5% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

In Q4, McCormick reported adjusted EPS of $0.86, up from $0.80 in the same quarter last year. Despite growing year on year, this print slightly missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects McCormick’s full-year EPS of $3 to grow 7.3%.

10. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

McCormick has shown robust cash profitability, driven by its attractive business model that enables it to reinvest or return capital to investors. The company’s free cash flow margin averaged 10.2% over the last two years, quite impressive for a consumer staples business.

Taking a step back, we can see that McCormick’s margin expanded by 1.2 percentage points over the last year. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability was flat.

McCormick’s free cash flow clocked in at $458.3 million in Q4, equivalent to a 24.8% margin. This result was good as its margin was 4 percentage points higher than in the same quarter last year, building on its favorable historical trend.

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

McCormick historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 8.9%, somewhat low compared to the best consumer staples companies that consistently pump out 20%+.

12. Balance Sheet Assessment

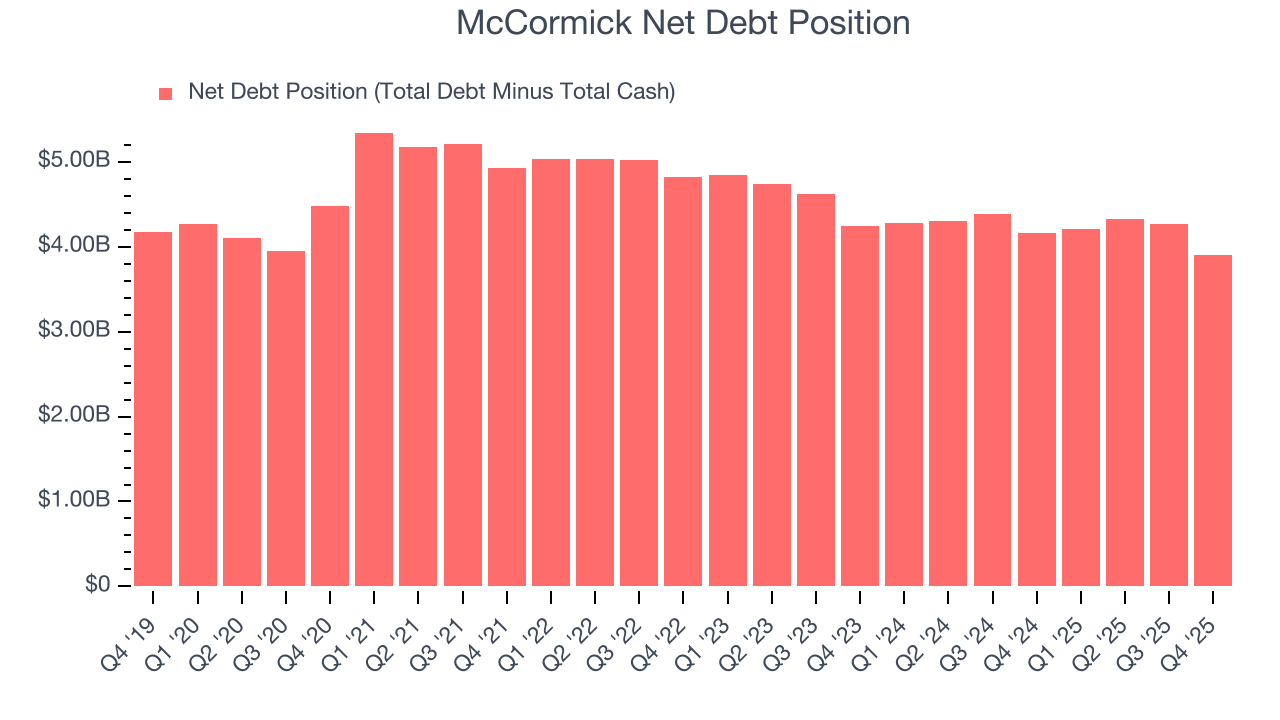

McCormick reported $95.9 million of cash and $4.00 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.37 billion of EBITDA over the last 12 months, we view McCormick’s 2.9× net-debt-to-EBITDA ratio as safe. We also see its $103.2 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

13. Key Takeaways from McCormick’s Q4 Results

We enjoyed seeing McCormick beat analysts’ EBITDA expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. On the other hand, its gross margin missed and its full-year EPS guidance fell short of Wall Street’s estimates, and the latter seems to be weighing heavily on shares. Zooming out, we think this was a mixed quarter. The market seemed to be hoping for more, and the stock traded down 6.2% to $62.46 immediately after reporting.

14. Is Now The Time To Buy McCormick?

Updated: March 8, 2026 at 11:02 PM EDT

Are you wondering whether to buy McCormick or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

McCormick isn’t a terrible business, but it isn’t one of our picks. To kick things off, its revenue growth was uninspiring over the last three years. While its strong free cash flow generation allows it to invest in growth initiatives while maintaining an ample cushion, the downside is its projected EPS for the next year is lacking. On top of that, its mediocre ROIC lags the market and is a headwind for its stock price.

McCormick’s P/E ratio based on the next 12 months is 21.1x. Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $73.85 on the company (compared to the current share price of $65.98).