Tecnoglass (TGLS)

We aren’t fans of Tecnoglass. Its poor sales growth and falling returns on capital suggest its growth opportunities are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why Tecnoglass Is Not Exciting

The first-ever Colombian company to trade on the NASDAQ, Tecnoglass (NYSE:TGLS) is a manufacturer of architectural glass, windows, and aluminum products.

- One positive is that its annual revenue growth of 21.2% over the last five years was superb and indicates its market share increased during this cycle

Tecnoglass is skating on thin ice. We see more attractive opportunities in the market.

Why There Are Better Opportunities Than Tecnoglass

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Tecnoglass

At $45.55 per share, Tecnoglass trades at 12.7x forward P/E. Tecnoglass’s multiple may seem like a great deal among industrials peers, but we think there are valid reasons why it’s this cheap.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Tecnoglass (TGLS) Research Report: Q4 CY2025 Update

Glass and windows manufacturer Tecnoglass (NYSE:TGLS) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 2.4% year on year to $245.3 million. The company’s full-year revenue guidance of $1.10 billion at the midpoint came in 1.1% above analysts’ estimates. Its non-GAAP profit of $0.63 per share was 25.2% below analysts’ consensus estimates.

Tecnoglass (TGLS) Q4 CY2025 Highlights:

- Revenue: $245.3 million vs analyst estimates of $241.2 million (2.4% year-on-year growth, 1.7% beat)

- Adjusted EPS: $0.63 vs analyst expectations of $0.84 (25.2% miss)

- Adjusted EBITDA: $62.24 million vs analyst estimates of $70.35 million (25.4% margin, 11.5% miss)

- EBITDA guidance for the upcoming financial year 2026 is $285 million at the midpoint, below analyst estimates of $326.7 million

- Operating Margin: 18.3%, down from 28% in the same quarter last year

- Free Cash Flow Margin: 4.7%, down from 14.8% in the same quarter last year

- Market Capitalization: $2.29 billion

Company Overview

The first-ever Colombian company to trade on the NASDAQ, Tecnoglass (NYSE:TGLS) is a manufacturer of architectural glass, windows, and aluminum products.

The company’s products increase the aesthetics and functionality of the buildings they are used in. Because its products are highly customizable, they support architects, builders, and homeowners in designing a brand-new space or adding to a current space. The company also helps its customers install their newly ordered products.

The company's lineup extends beyond architectural glass to include high-impact windows, doors, and curtain walls, all designed for both aesthetic appeal and durability. Tecnoglass also offers shading and acoustic solutions to living and work spaces. Its products can be found in some prominent buildings around the world, like Trump Plaza in Panama and Salesforce Tower in San Francisco.

The company generates revenue through the sale of its architectural glass and aluminum products to construction companies and architects in residential and commercial projects. Despite being headquartered in Colombia, the United States accounts for the very vast majority of its revenue, made through direct sales, a network of distributors, and project-based sales.

4. Building Materials

Traditionally, building materials companies have built competitive advantages with economies of scale, brand recognition, and strong relationships with builders and contractors. More recently, advances to address labor availability and job site productivity have spurred innovation. Additionally, companies in the space that can produce more energy-efficient materials have opportunities to take share. However, these companies are at the whim of construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of building materials companies.

Other companies in the glass, windows, and aluminum industries include Saint-Gobain (EPA:SGO), Apogee (NASDAQ:APOG), and privately held company Oldcastle BuildingEvelope.

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, Tecnoglass’s 21.2% annualized revenue growth over the last five years was incredible. Its growth beat the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Tecnoglass’s annualized revenue growth of 8.6% over the last two years is below its five-year trend, but we still think the results were respectable.

This quarter, Tecnoglass reported modest year-on-year revenue growth of 2.4% but beat Wall Street’s estimates by 1.7%.

Looking ahead, sell-side analysts expect revenue to grow 9.7% over the next 12 months, similar to its two-year rate. This projection is admirable and suggests its newer products and services will catalyze better top-line performance.

6. Gross Margin & Pricing Power

Tecnoglass has bad unit economics for an industrials company, giving it less room to reinvest and develop new offerings. As you can see below, it averaged a 23.3% gross margin over the last five years. Said differently, Tecnoglass had to pay a chunky $76.68 to its suppliers for every $100 in revenue.

Tecnoglass’s gross profit margin was negative 298% this quarter. The company’s full-year margin was also negative, suggesting it needs to change its business model quickly.

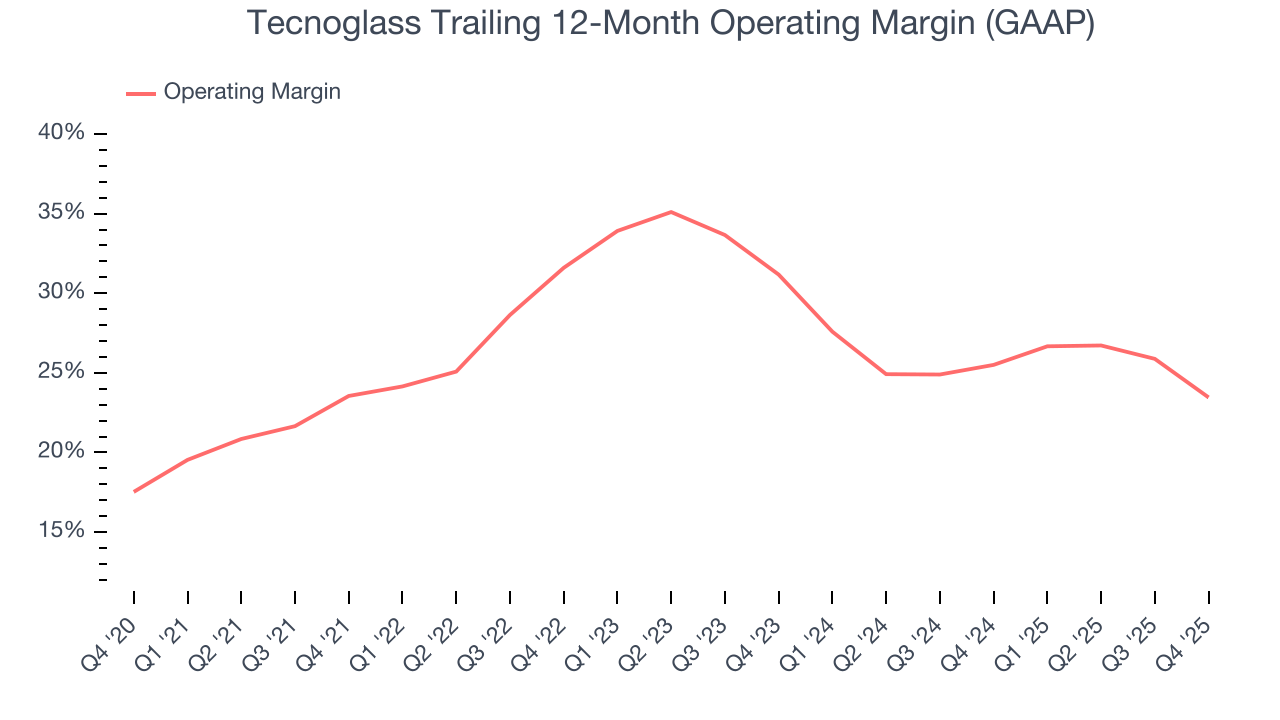

7. Operating Margin

Tecnoglass’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 27.1% over the last five years. This profitability was elite for an industrials business thanks to its efficient cost structure and economies of scale. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, Tecnoglass’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Tecnoglass generated an operating margin profit margin of 18.3%, down 9.8 percentage points year on year. Since Tecnoglass’s gross margin decreased more than its operating margin, we can assume its recent inefficiencies were driven more by weaker leverage on its cost of sales rather than increased marketing, R&D, and administrative overhead expenses.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Tecnoglass’s EPS grew at an astounding 34.9% compounded annual growth rate over the last five years, higher than its 21.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Tecnoglass’s earnings to better understand the drivers of its performance. A five-year view shows that Tecnoglass has repurchased its stock, shrinking its share count by 1.1%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Tecnoglass, its two-year annual EPS declines of 5.2% mark a reversal from its (seemingly) healthy five-year trend. We hope Tecnoglass can return to earnings growth in the future.

In Q4, Tecnoglass reported adjusted EPS of $0.63, down from $1.05 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects Tecnoglass’s full-year EPS of $3.58 to grow 13.3%.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Tecnoglass has shown robust cash profitability, enabling it to comfortably ride out cyclical downturns while investing in plenty of new offerings and returning capital to investors. The company’s free cash flow margin averaged 11.9% over the last five years, quite impressive for an industrials business.

Taking a step back, we can see that Tecnoglass’s margin dropped by 9.7 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

Tecnoglass’s free cash flow clocked in at $11.44 million in Q4, equivalent to a 4.7% margin. The company’s cash profitability regressed as it was 10.1 percentage points lower than in the same quarter last year, suggesting its historical struggles have dragged on.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Tecnoglass hasn’t been the highest-quality company lately, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 30.5%, splendid for an industrials business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Tecnoglass’s ROIC has unfortunately decreased. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

11. Balance Sheet Assessment

Tecnoglass reported $104.1 million of cash and $171.6 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $291.3 million of EBITDA over the last 12 months, we view Tecnoglass’s 0.2× net-debt-to-EBITDA ratio as safe. We also see its $789,000 of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Tecnoglass’s Q4 Results

It was encouraging to see Tecnoglass beat analysts’ revenue expectations this quarter. We were also glad its full-year revenue guidance slightly exceeded Wall Street’s estimates. On the other hand, its full-year EBITDA guidance missed and its EBITDA fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 1% to $48.60 immediately after reporting.

13. Is Now The Time To Buy Tecnoglass?

Updated: February 27, 2026 at 10:28 PM EST

Before making an investment decision, investors should account for Tecnoglass’s business fundamentals and valuation in addition to what happened in the latest quarter.

Tecnoglass’s business quality ultimately falls short of our standards. Although its revenue growth was exceptional over the last five years, it’s expected to deteriorate over the next 12 months and its diminishing returns show management's prior bets haven't worked out. And while the company’s backlog growth has been marvelous, the downside is its cash profitability fell over the last five years.

Tecnoglass’s P/E ratio based on the next 12 months is 12.7x. This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $69 on the company (compared to the current share price of $45.55).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.