Workiva (WK)

Workiva piques our interest. Its elite ARR growth suggests it not only generates recurring revenue but also is winning market share.― StockStory Analyst Team

1. News

2. Summary

Why Workiva Is Interesting

Nicknamed "the Excel killer" by some finance professionals for its ability to eliminate spreadsheet chaos, Workiva (NYSE:WK) provides a cloud-based platform that enables organizations to streamline financial reporting, ESG, and compliance processes with connected data and automation.

- Ability to secure long-term commitments with customers is evident in its 21.7% ARR growth over the last year

- Software is difficult to replicate at scale and results in a premier gross margin of 78.5%

- A drawback is its operating profits and efficiency rose over the last year as it benefited from some fixed cost leverage

Workiva is solid, but not perfect. If you like the story, the valuation looks fair.

Why Is Now The Time To Buy Workiva?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Workiva?

At $64.41 per share, Workiva trades at 3.4x forward price-to-sales. Price is what you pay, and value is what you get. Considering this, we think the current valuation is quite a good deal.

Now could be a good time to invest if you believe in the story.

3. Workiva (WK) Research Report: Q4 CY2025 Update

Cloud reporting platform Workiva (NYSE:WK) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 19.5% year on year to $238.9 million. Guidance for next quarter’s revenue was optimistic at $245 million at the midpoint, 2.1% above analysts’ estimates.

Workiva (WK) Q4 CY2025 Highlights:

- Revenue: $238.9 million vs analyst estimates of $235.1 million (19.5% year-on-year growth, 1.6% beat)

- Revenue Guidance for Q1 CY2026 is $245 million at the midpoint, above analyst estimates of $240 million

- Operating Margin: 3.3%, up from -6.7% in the same quarter last year

- Free Cash Flow Margin: 21.2%, similar to the previous quarter

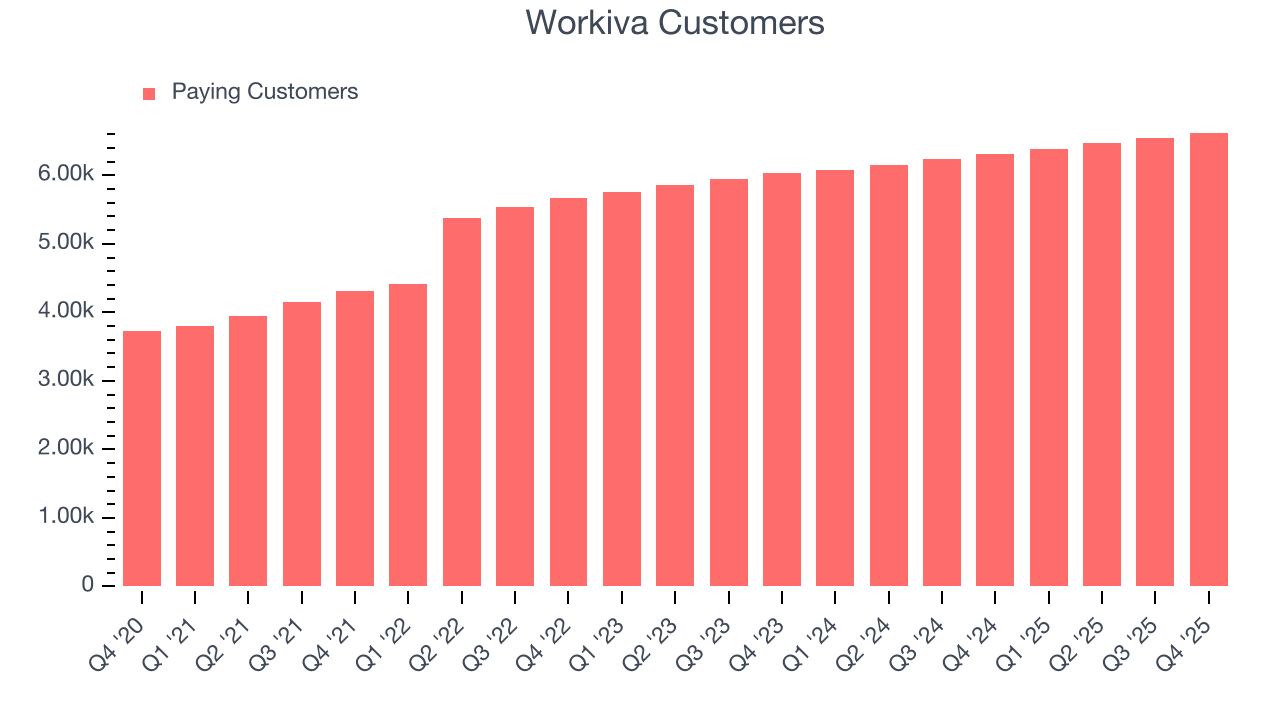

- Customers: 6,624, up from 6,541 in the previous quarter

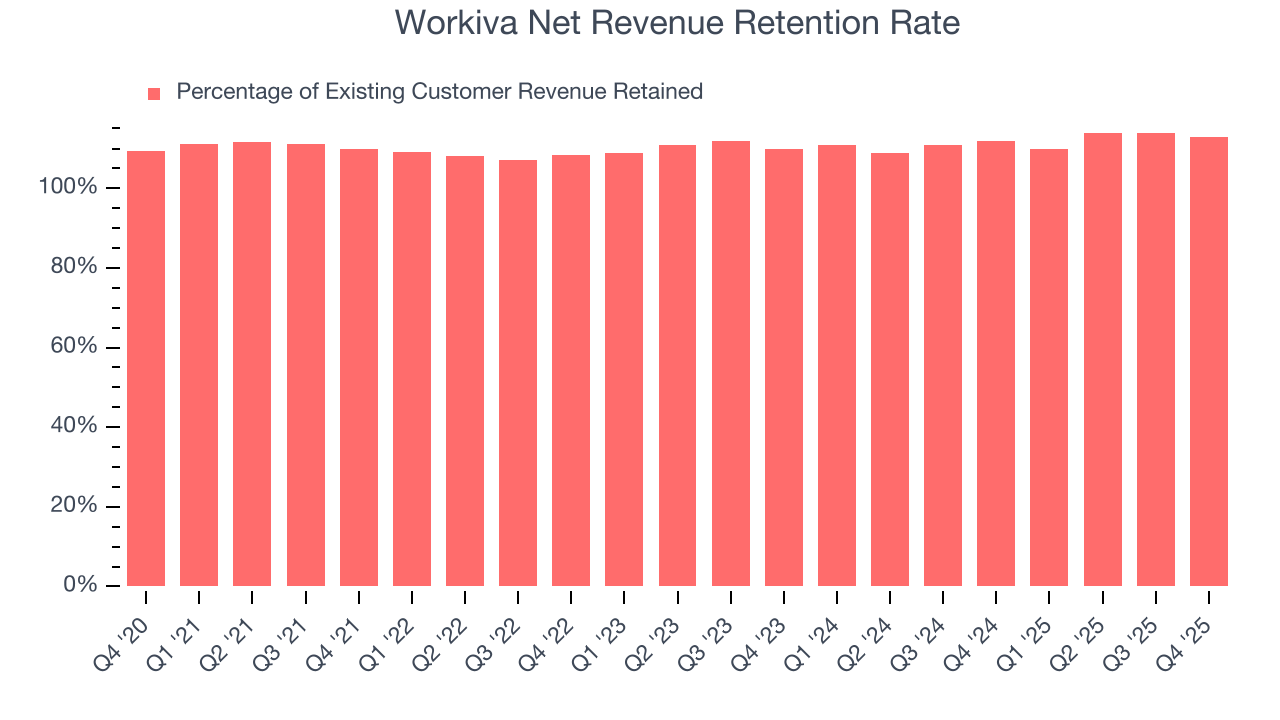

- Net Revenue Retention Rate: 113%, down from 114% in the previous quarter

- Billings: $294.8 million at quarter end, up 20.1% year on year

- Market Capitalization: $3.26 billion

Company Overview

Nicknamed "the Excel killer" by some finance professionals for its ability to eliminate spreadsheet chaos, Workiva (NYSE:WK) provides a cloud-based platform that enables organizations to streamline financial reporting, ESG, and compliance processes with connected data and automation.

At its core, Workiva solves a universal business problem: the complexity of collecting, managing, and reporting critical data across large organizations. The platform connects directly to enterprise systems like ERP, CRM, and HCM applications, allowing teams to import data, transform it, and link it throughout documents, spreadsheets, and presentations. When data changes in one place, it updates automatically everywhere it's used—eliminating manual updates that often lead to errors.

Companies use Workiva for numerous reporting challenges, with three primary solution areas forming the backbone of their business. The Financial Reporting solutions help public and private companies manage everything from SEC filings and financial statements to management reports. The ESG solutions enable sustainability reporting across various frameworks and standards. The Governance, Risk, and Compliance offerings assist with internal controls, SOX compliance, and enterprise risk management.

For example, when a global corporation prepares its quarterly earnings release, teams can pull data from multiple systems into Workiva, collaboratively draft the report with full audit trails of all changes, and ensure numbers remain consistent throughout the filing, press release, and presentation deck. Workiva generates revenue through subscription fees based on platform access, functionality, and user counts, with additional revenue from professional services that help customers implement and optimize their reporting processes.

Operating globally but with particularly strong adoption in North America, Workiva serves thousands of organizations ranging from small businesses to the majority of Fortune 500 companies across industries including financial services, energy, healthcare, technology, and government.

4. Compliance Software

The demand for software platforms that automate compliances processes is rising as keeping up with the latest financial reporting regulations and standards is difficult and expensive, especially as companies increasingly operate across several geographical regions with varying rules.

Workiva competes with various software providers depending on the solution area, including financial reporting tools from Donnelley Financial Solutions (NYSE:DFIN) and Toppan Merrill, ESG reporting platforms like Enablon and Sphera, and GRC solutions from ServiceNow (NYSE:NOW), Diligent, and IBM (NYSE:IBM).

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, Workiva’s 20.3% annualized revenue growth over the last five years was decent. Its growth was slightly above the average software company and shows its offerings resonate with customers.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. Workiva’s annualized revenue growth of 18.5% over the last two years is below its five-year trend, but we still think the results were good.

This quarter, Workiva reported year-on-year revenue growth of 19.5%, and its $238.9 million of revenue exceeded Wall Street’s estimates by 1.6%. Company management is currently guiding for a 18.8% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 15.2% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is above average for the sector and implies the market sees some success for its newer products and services.

6. Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Workiva’s billings punched in at $294.8 million in Q4, and over the last four quarters, its growth was impressive as it averaged 21.5% year-on-year increases. This performance aligned with its total sales growth, indicating robust customer demand. The high level of cash collected from customers also enhances liquidity and provides a solid foundation for future investments and growth.

7. Customer Base

Workiva reported 6,624 customers at the end of the quarter, a sequential increase of 83. That’s a little better than last quarter and a fair bit above the typical growth we’ve seen over the previous year. Shareholders should take this as an indication that Workiva’s go-to-market strategy is working well.

8. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Workiva is efficient at acquiring new customers, and its CAC payback period checked in at 41.9 months this quarter. The company’s relatively fast recovery of its customer acquisition costs gives it the option to accelerate growth by increasing its sales and marketing investments.

9. Customer Retention

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

Workiva’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 113% in Q4. This means Workiva would’ve grown its revenue by 12.7% even if it didn’t win any new customers over the last 12 months.

Workiva has a good net retention rate, proving that customers are satisfied with its software and getting more value from it over time, which is always great to see.

10. Gross Margin & Pricing Power

For software companies like Workiva, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Workiva’s robust unit economics are better than the broader software industry, an output of its asset-lite business model and pricing power. They also enable the company to fund large investments in new products and sales during periods of rapid growth to achieve outsized profits at scale. As you can see below, it averaged an excellent 78.5% gross margin over the last year. Said differently, roughly $78.47 was left to spend on selling, marketing, and R&D for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Workiva has seen gross margins improve by 3 percentage points over the last 2 year, which is very good in the software space.

In Q4, Workiva produced a 80.7% gross profit margin, up 3.5 percentage points year on year. Workiva’s full-year margin has also been trending up over the past 12 months, increasing by 1.8 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as servers).

11. Operating Margin

Although Workiva was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 4.8% over the last year. Unprofitable, high-growth software companies require extra attention because they spend heaps of money to capture market share. This happened because the company spent loads of money to capture market share. As seen in its fast revenue growth, the aggressive strategy has paid off so far, and Wall Street’s estimates suggest the party will continue. We tend to agree and believe the business has a good chance of reaching profitability upon scale.

Over the last two years, Workiva’s expanding sales gave it operating leverage as its margin rose by 5.6 percentage points. Still, it will take much more for the company to show consistent profitability.

This quarter, Workiva generated an operating margin profit margin of 3.3%, up 10 percentage points year on year. The increase was solid, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

12. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Workiva has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 15.6% over the last year, slightly better than the broader software sector.

Workiva’s free cash flow clocked in at $50.74 million in Q4, equivalent to a 21.2% margin. This cash profitability was in line with the comparable period last year and above its one-year average.

Over the next year, analysts predict Workiva’s cash conversion will slightly fall. Their consensus estimates imply its free cash flow margin of 15.6% for the last 12 months will decrease to 15.6%.

13. Balance Sheet Assessment

Companies with more cash than debt have lower bankruptcy risk.

Workiva is a well-capitalized company with $891.6 million of cash and $720.6 million of debt on its balance sheet. This $171 million net cash position is 5.1% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

14. Key Takeaways from Workiva’s Q4 Results

We were impressed by how significantly Workiva blew past analysts’ billings expectations this quarter. We were also glad its revenue guidance for next quarter exceeded Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 7.5% to $63.75 immediately after reporting.

15. Is Now The Time To Buy Workiva?

Updated: March 6, 2026 at 9:15 PM EST

When considering an investment in Workiva, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

In our opinion, Workiva is a good company. To kick things off, its revenue growth was solid over the last five years. And while its expanding operating margin shows it’s becoming more efficient at building and selling its software, its splendid ARR growth shows it’s securing more long-term contracts and becoming a more predictable business. On top of that, its gross margin suggests it can generate sustainable profits.

Workiva’s price-to-sales ratio based on the next 12 months is 3.6x. When scanning the software space, Workiva trades at a fair valuation. If you trust the business and its direction, this is an ideal time to buy.

Wall Street analysts have a consensus one-year price target of $89.45 on the company (compared to the current share price of $64.88), implying they see 37.9% upside in buying Workiva in the short term.