Axon (AXON)

We’d invest in Axon. Its elite ARR growth shows it not only generates recurring revenue but also is winning market share.― StockStory Analyst Team

1. News

2. Summary

Why We Like Axon

Providing body cameras and tasers for first responders, AXON (NASDAQ:AXON) develops technology solutions and weapons products for military, law enforcement, and civilians.

- Market share has increased this cycle as its 32.5% annual revenue growth over the last five years was exceptional

- Earnings per share grew by 30.8% annually over the last five years, massively outpacing its peers

- Notable projected revenue growth of 29.4% for the next 12 months hints at market share gains

We expect great things from Axon. No coincidence the stock is up 297% over the last five years.

Is Now The Time To Buy Axon?

High Quality

Investable

Underperform

Is Now The Time To Buy Axon?

Axon’s stock price of $572.97 implies a valuation ratio of 73.6x forward P/E. The premium valuation means there’s much good news priced into the stock - we certainly can’t argue with that.

If you love the business, we suggest making it a small position as the long-term outlook is bright. We’d still note its valuation could cause choppy short-term results.

3. Axon (AXON) Research Report: Q4 CY2025 Update

Self defense company AXON (NASDAQ:AXON) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 38.5% year on year to $796.7 million. The company’s full-year revenue guidance of $6 billion at the midpoint came in 74.4% above analysts’ estimates. Its non-GAAP profit of $2.15 per share was 34.5% above analysts’ consensus estimates.

Axon (AXON) Q4 CY2025 Highlights:

- Revenue: $796.7 million vs analyst estimates of $756.2 million (38.5% year-on-year growth, 5.4% beat)

- Adjusted EPS: $2.15 vs analyst estimates of $1.60 (34.5% beat)

- Adjusted EBITDA: $206.3 million vs analyst estimates of $181.9 million (25.9% margin, 13.4% beat)

- Operating Margin: -6.3%, down from -2.7% in the same quarter last year

- Free Cash Flow Margin: 19.5%, down from 39.4% in the same quarter last year

- Market Capitalization: $33.64 billion

Company Overview

Providing body cameras and tasers for first responders, AXON (NASDAQ:AXON) develops technology solutions and weapons products for military, law enforcement, and civilians.

Axon, originally known as TASER International, was founded in 1993 with the goal of making bullet-free defense tools accessible to law enforcement agencies. The company gained prominence with its TASER conducted electrical weapons, which became widely adopted by police departments across the United States for non-lethal force applications. In the mid-2010s, Axon expanded its product range to include body cameras and a digital evidence management system, rebranding itself as Axon Enterprise in 2017 to reflect its broader focus on public safety technology products.

Axon’s offerings encompass body-worn and in-car cameras, TASER energy devices, and a robust suite of software solutions, including real-time operations platforms and digital evidence management systems. For instance, their TASER devices, which are recognized for reducing incidents of injury when used by law enforcement, are part of a broader strategy to equip officers with tools that enhance safety and de-escalate potentially volatile situations.

In the realm of digital tools, Axon's software and sensors work cohesively to enhance policing efficiency and transparency. Its Axon Evidence software, for example, not only supports law enforcement in maintaining accountability but also streamlines data management, making it easier for officers to access and analyze important information on the go.

Axon generates revenue primarily through direct sales, leveraging its sales force and customer relationships to engage U.S. federal, state and local governments, international government entities, and commercial enterprises. Sales are conducted through online platforms, direct channels, and, to a lesser extent, distribution partners and third-party resellers.

Axon serves a diverse range of end markets, including traditional law enforcement agencies and also expanding to fire and emergency medical services, corrections, the military, and various commercial sectors. Seasonality affects Axon's sales patterns, with a noticeable increase in net sales during the fourth quarter of the fiscal year. This surge is attributed to the timing of municipal budget cycles, where government entities are more likely to make year-end purchases to utilize remaining budget allocations.

4. Law Enforcement Suppliers

Many law enforcement suppliers companies require licensing and clearance to manufacture products such as firearms. These companies can enjoy long-term contracts with law enforcement and corrections bodies, leading to more predictable revenue. It is still unclear how the recent focus on excessive force and police accountability will impact longer-term demand. On the one hand, lethal force products could become less popular. On the other hand, products such as body cams that aid in the transparency of policing could become standard. Generally, the sector’s fate will also ebb and flow with state or local budgets, and there is high reputational risk, as one mishap or bad headline can change a company’s fortunes.

AXON’s peers and competitors include MSA Safety (NYSE:MSA) and Motorola Solutions (NYSE:MSI)

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Axon grew its sales at an incredible 32.5% compounded annual growth rate. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Axon’s annualized revenue growth of 33.5% over the last two years aligns with its five-year trend, suggesting its demand was predictably strong.

This quarter, Axon reported wonderful year-on-year revenue growth of 38.5%, and its $796.7 million of revenue exceeded Wall Street’s estimates by 5.4%.

Looking ahead, sell-side analysts expect revenue to grow 23.8% over the next 12 months, a deceleration versus the last two years. Still, this projection is admirable and suggests the market is forecasting success for its products and services.

6. Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Axon was roughly breakeven when averaging the last five years of quarterly operating profits, inadequate for an industrials business.

On the plus side, Axon’s operating margin rose by 17.2 percentage points over the last five years, as its sales growth gave it immense operating leverage.

This quarter, Axon generated an operating margin profit margin of negative 6.3%, down 3.6 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

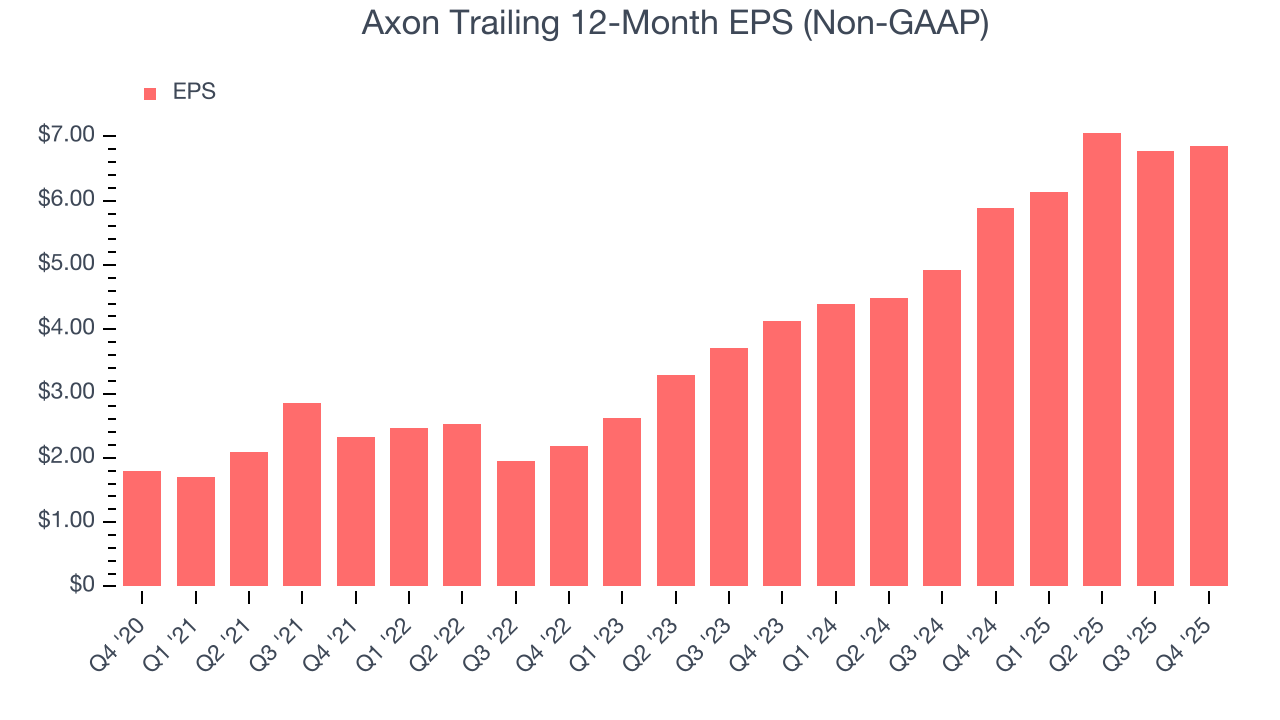

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Axon’s astounding 30.8% annual EPS growth over the last five years aligns with its revenue performance. This tells us its incremental sales were profitable.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Although it performed well, Axon’s two-year annual EPS growth of 28.8% lower than its 33.5% two-year revenue growth.

Diving into Axon’s quality of earnings can give us a better understanding of its performance. Axon’s operating margin has declined over the last two yearswhile its share count has grown 8.7%. This means the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q4, Axon reported adjusted EPS of $2.15, up from $2.08 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Axon’s full-year EPS of $6.85 to grow 8.3%.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Axon has shown robust cash profitability, enabling it to comfortably ride out cyclical downturns while investing in plenty of new offerings and returning capital to investors. The company’s free cash flow margin averaged 10.1% over the last five years, quite impressive for an industrials business. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Taking a step back, we can see that Axon’s margin dropped by 6.8 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

Axon’s free cash flow clocked in at $155.4 million in Q4, equivalent to a 19.5% margin. The company’s cash profitability regressed as it was 19.9 percentage points lower than in the same quarter last year, but it’s still above its five-year average. We wouldn’t put too much weight on this quarter’s decline because capital expenditures can be seasonal and companies often stockpile inventory in anticipation of higher demand, causing short-term swings. Long-term trends trump temporary fluctuations.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although Axon has shown solid business quality lately, it struggled to grow profitably in the past. Its five-year average ROIC was negative 2.9%, meaning management lost money while trying to expand the business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Axon’s ROIC has increased. This is a good sign, but we recognize its lack of profitable growth during the COVID era was the primary reason for the change.

10. Balance Sheet Assessment

Axon reported $1.71 billion of cash and $1.91 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $710.2 million of EBITDA over the last 12 months, we view Axon’s 0.3× net-debt-to-EBITDA ratio as safe. We also see its $3.57 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Axon’s Q4 Results

It was good to see Axon beat analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this quarter featured some important positives. The stock traded up 15.1% to $506.02 immediately following the results.

12. Is Now The Time To Buy Axon?

Updated: March 8, 2026 at 11:05 PM EDT

Before making an investment decision, investors should account for Axon’s business fundamentals and valuation in addition to what happened in the latest quarter.

There is a lot to like about Axon. First of all, the company’s revenue growth was exceptional over the last five years. And while its relatively low ROIC suggests management has struggled to find compelling investment opportunities, its ARR growth has been marvelous. Additionally, Axon’s expanding operating margin shows the business has become more efficient.

Axon’s P/E ratio based on the next 12 months is 73.6x. There’s no doubt it’s a bit of a market darling given the lofty multiple, but we don’t mind owning a high-quality business, even if it’s expensive. Investments like this should be held patiently for at least three to five years as they benefit from the power of long-term compounding, which more than makes up for any short-term price volatility that comes with high valuations.

Wall Street analysts have a consensus one-year price target of $735.01 on the company (compared to the current share price of $572.97).