C.H. Robinson Worldwide (CHRW)

We’re skeptical of C.H. Robinson Worldwide. Its plummeting sales and returns on capital show its profits are shrinking as demand fizzles out.― StockStory Analyst Team

1. News

2. Summary

Why We Think C.H. Robinson Worldwide Will Underperform

Engaging in contracts with tens of thousands of transportation companies, C.H. Robinson (NASDAQ:CHRW) offers freight transportation and logistics services.

- Competitive supply chain dynamics and steep production costs are reflected in its low gross margin of 7.4%

- Sales stagnated over the last five years and signal the need for new growth strategies

- On the bright side, its ROIC punches in at 24%, illustrating management’s expertise in identifying profitable investments

C.H. Robinson Worldwide is skating on thin ice. We believe there are better businesses elsewhere.

Why There Are Better Opportunities Than C.H. Robinson Worldwide

High Quality

Investable

Underperform

Why There Are Better Opportunities Than C.H. Robinson Worldwide

C.H. Robinson Worldwide’s stock price of $179.42 implies a valuation ratio of 30.4x forward P/E. This multiple is higher than most industrials companies, and we think it’s quite expensive for the weaker revenue growth you get.

There are stocks out there similarly priced with better business quality. We prefer owning these.

3. C.H. Robinson Worldwide (CHRW) Research Report: Q4 CY2025 Update

Freight transportation intermediary C.H. Robinson (NASDAQ:CHRW) missed Wall Street’s revenue expectations in Q4 CY2025, with sales falling 6.5% year on year to $3.91 billion. Its non-GAAP profit of $1.23 per share was 9.2% above analysts’ consensus estimates.

C.H. Robinson Worldwide (CHRW) Q4 CY2025 Highlights:

- Revenue: $3.91 billion vs analyst estimates of $3.99 billion (6.5% year-on-year decline, 1.9% miss)

- Adjusted EPS: $1.23 vs analyst estimates of $1.13 (9.2% beat)

- Adjusted EBITDA: $207.8 million vs analyst estimates of $211.2 million (5.3% margin, 1.6% miss)

- Operating Margin: 4.6%, in line with the same quarter last year

- Free Cash Flow Margin: 7.4%, up from 6% in the same quarter last year

- Market Capitalization: $21.31 billion

Company Overview

Engaging in contracts with tens of thousands of transportation companies, C.H. Robinson (NASDAQ:CHRW) offers freight transportation and logistics services.

C.H. Robinson was founded in 1905 as a small brokerage house specializing in sourcing fresh produce. The company entered new markets throughout the 20th century and established itself as a middleman sourcing operation for shippable goods. As it continues to grow, the company primarily focuses on making acquisitions which align with its offerings today and expand its existing fleet. C.H. Robinson notably acquired Phoenix International in 2012 which doubled its ocean freight capacity.

Today, the company serves as the middleman and arranges freight deliveries between those needing goods transported and transportation companies. It does not own or operate its own fleet of trucks, planes, or ships to physically make deliveries. Instead, C.H. Robinson manages services such as coordinating pickup and delivery schedules, managing shipment tracking, and handling all necessary documentation.

C.H. Robinson manages shipments that vary in size and weight, ranging from deliveries that could just include a few boxes to entire truckloads of goods. It charges a transactional fee based on the current market rate or a prearranged contractual rate. Most of its contractual rate commitments are for no longer than a year and allow for renegotiation. In addition to its freight services, the company also offers logistical services such as warehousing and inventory management.

4. Air Freight and Logistics

The growth of e-commerce and global trade continues to drive demand for expedited shipping services, presenting opportunities for air freight companies. The industry continues to invest in advanced technologies such as automated sorting systems and real-time tracking solutions to enhance operational efficiency. Despite the advantages of speed and global reach, air freight and logistics companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins.

Competitors offering similar products include Expeditors (NYSE:EXPD), UPS (NYSE:UPS), and FedEx (NYSE:FDX).

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, C.H. Robinson Worldwide struggled to consistently increase demand as its $16.23 billion of sales for the trailing 12 months was close to its revenue five years ago. This was below our standards and suggests it’s a lower quality business.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. C.H. Robinson Worldwide’s recent performance shows its demand remained suppressed as its revenue has declined by 4% annually over the last two years. C.H. Robinson Worldwide isn’t alone in its struggles as the Air Freight and Logistics industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

We can dig further into the company’s revenue dynamics by analyzing its most important segments, North American surface transportation and Global Forwarding, which are 71.8% and 18.7% of revenue. Over the last two years, C.H. Robinson Worldwide’s North American surface transportation revenue (transportation brokerage) averaged 3.6% year-on-year declines. On the other hand, its Global Forwarding revenue (worldwide ocean, air, customers ) averaged 4.8% growth.

This quarter, C.H. Robinson Worldwide missed Wall Street’s estimates and reported a rather uninspiring 6.5% year-on-year revenue decline, generating $3.91 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 4.1% over the next 12 months. While this projection implies its newer products and services will spur better top-line performance, it is still below average for the sector.

6. Gross Margin & Pricing Power

C.H. Robinson Worldwide has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 7.7% gross margin over the last five years. That means C.H. Robinson Worldwide paid its suppliers a lot of money ($92.25 for every $100 in revenue) to run its business.

In Q4, C.H. Robinson Worldwide produced a 16.8% gross profit margin, up 8.8 percentage points year on year. C.H. Robinson Worldwide’s full-year margin has also been trending up over the past 12 months, increasing by 3 percentage points. If this move continues, it could suggest better unit economics due to some combination of stable to improving pricing power and input costs (such as raw materials).

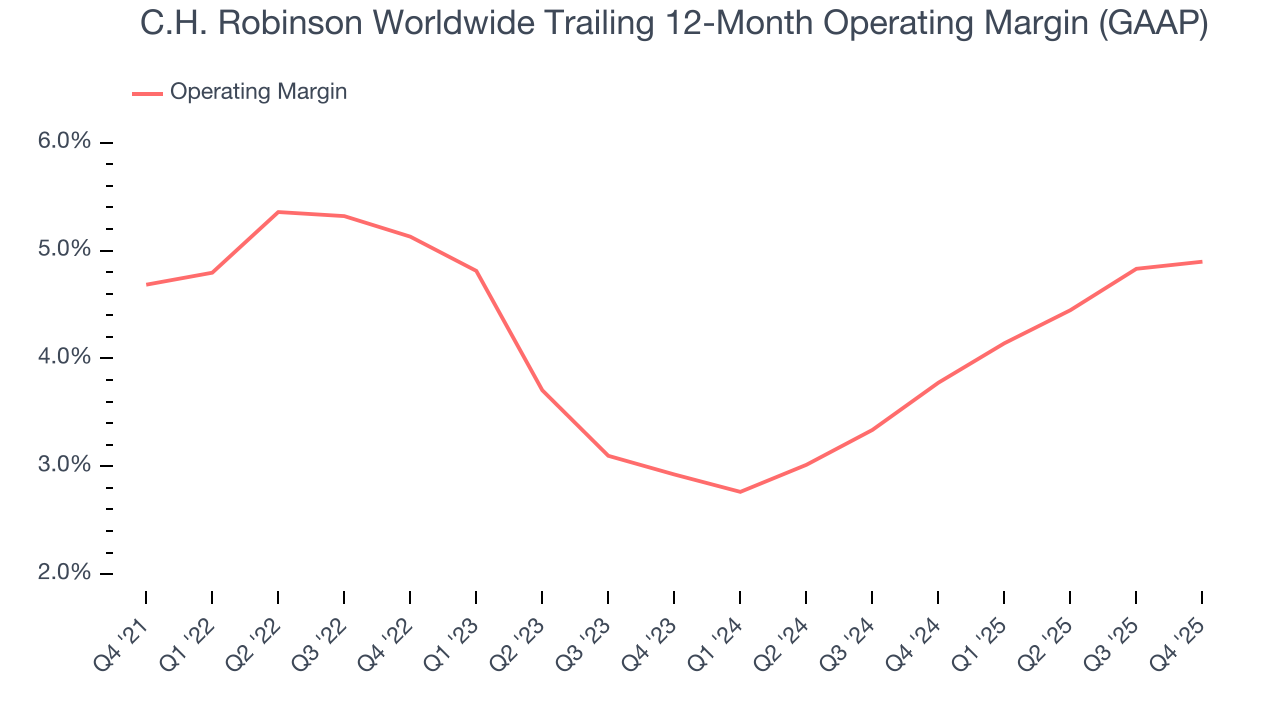

7. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

C.H. Robinson Worldwide’s operating margin has risen over the last 12 months and averaged 4.4% over the last five years. The company’s higher efficiency is a breath of fresh air, but its suboptimal cost structure means it still sports lousy profitability for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Looking at the trend in its profitability, C.H. Robinson Worldwide’s operating margin might fluctuated slightly but has generally stayed the same over the last five years, meaning it will take a fundamental shift in the business model to change. C.H. Robinson Worldwide’s performance was poor, but we noticed this is a broad theme as many similar Air Freight and Logistics companies saw their margins fall (along with revenue, as mentioned above) because the cycle turned in the wrong direction.

In Q4, C.H. Robinson Worldwide generated an operating margin profit margin of 4.6%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

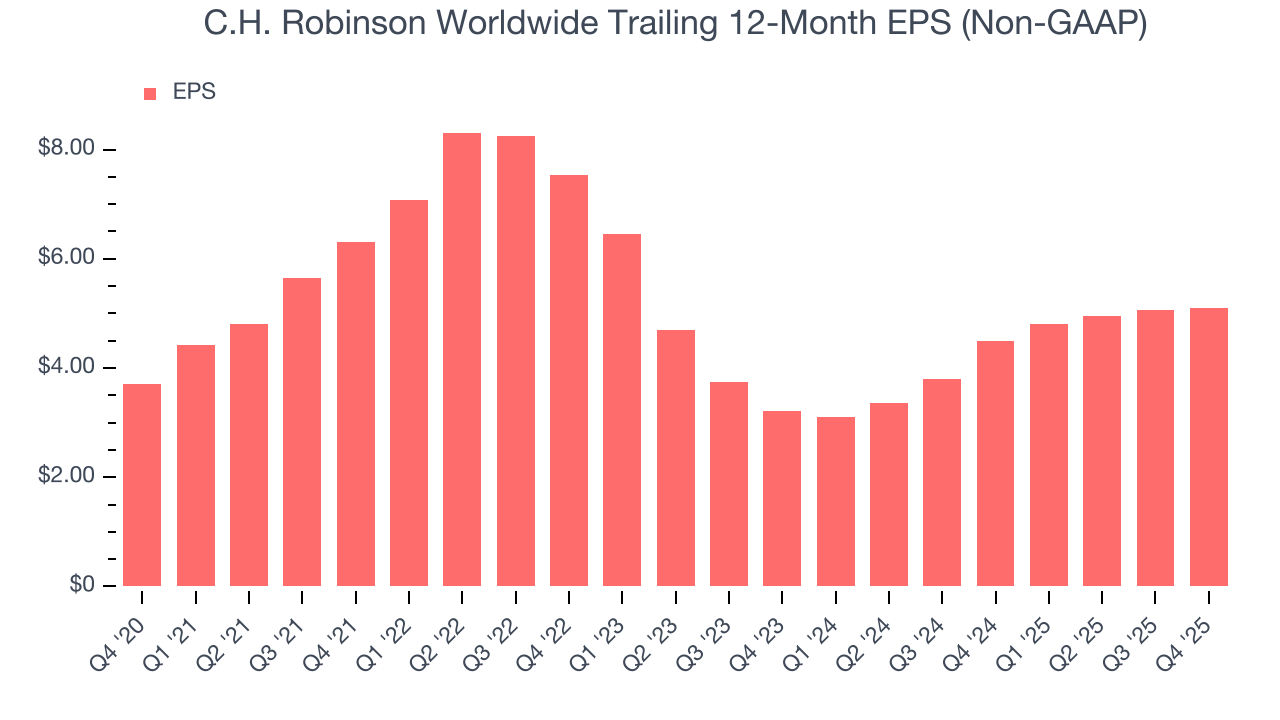

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

C.H. Robinson Worldwide’s EPS grew at an unimpressive 6.5% compounded annual growth rate over the last five years. This performance was better than its flat revenue but doesn’t tell us much about its business quality because its operating margin didn’t improve.

We can take a deeper look into C.H. Robinson Worldwide’s earnings to better understand the drivers of its performance. A five-year view shows that C.H. Robinson Worldwide has repurchased its stock, shrinking its share count by 11.3%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For C.H. Robinson Worldwide, its two-year annual EPS growth of 25.7% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.

In Q4, C.H. Robinson Worldwide reported adjusted EPS of $1.23, up from $1.21 in the same quarter last year. This print beat analysts’ estimates by 9.2%. Over the next 12 months, Wall Street expects C.H. Robinson Worldwide’s full-year EPS of $5.09 to grow 18%.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

C.H. Robinson Worldwide has shown weak cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.5%, subpar for an industrials business.

Taking a step back, an encouraging sign is that C.H. Robinson Worldwide’s margin expanded by 5.1 percentage points during that time. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability was flat.

C.H. Robinson Worldwide’s free cash flow clocked in at $289.7 million in Q4, equivalent to a 7.4% margin. This result was good as its margin was 1.4 percentage points higher than in the same quarter last year, building on its favorable historical trend.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although C.H. Robinson Worldwide hasn’t been the highest-quality company lately because of its poor top-line performance, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 24%, splendid for an industrials business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, C.H. Robinson Worldwide’s ROIC has decreased significantly over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

11. Balance Sheet Assessment

C.H. Robinson Worldwide reported $160.9 million of cash and $1.40 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $920.5 million of EBITDA over the last 12 months, we view C.H. Robinson Worldwide’s 1.3× net-debt-to-EBITDA ratio as safe. We also see its $64.08 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from C.H. Robinson Worldwide’s Q4 Results

It was good to see C.H. Robinson Worldwide beat analysts’ EPS expectations this quarter. We were also glad its Global Forwarding revenue topped Wall Street’s estimates. On the other hand, its revenue missed and its North American surface transportation revenue fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded up 7% to $197.20 immediately after reporting.

13. Is Now The Time To Buy C.H. Robinson Worldwide?

Updated: March 7, 2026 at 9:08 PM EST

Are you wondering whether to buy C.H. Robinson Worldwide or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

C.H. Robinson Worldwide isn’t a terrible business, but it isn’t one of our picks. First off, its revenue growth was weak over the last five years. While its rising cash profitability gives it more optionality, the downside is its diminishing returns show management's prior bets haven't worked out. On top of that, its low gross margins indicate some combination of competitive pressures and high production costs.

C.H. Robinson Worldwide’s P/E ratio based on the next 12 months is 30.4x. This valuation tells us a lot of optimism is priced in - we think there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $193.52 on the company (compared to the current share price of $179.42).