Alphabet (GOOGL)

We like Alphabet. Its rare blend of high growth, robust profitability, and a strong outlook makes it a wonderful asset.― StockStory Analyst Team

1. News

2. Summary

Why We Like Alphabet

Started by Stanford students Larry Page and Sergey Brin in a Menlo Park garage, Alphabet (NASDAQ:GOOGL) is the parent company of the eponymous Google Search engine, Google Cloud Platform, and YouTube.

- Alphabet’s dominant Google Search sits on the pantheon of the best businesses ever. This is reflected in its robust long-term revenue growth and elite operating margin.

- The company’s profit margins have become even higher over time, speaking to its scale advantages and operating efficiency not only in its core Search business but also in Google Cloud Platform and YouTube.

- Revenue growth and increasing operating margins are the key ingredients for strong EPS growth. Google has these, and when also factoring in its share repurchases, you can see why EPS has exploded over the long term.

We see a bright future for Alphabet. This is one of the best consumer internet stocks in the world.

Is Now The Time To Buy Alphabet?

Is Now The Time To Buy Alphabet?

Alphabet is trading at $301.95 per share, or 26.7x forward price-to-earnings. The pricey valuation means expectations are high for this company over the near to medium term.

If you like the business model and believe the bull case, you can own a smaller position; our work shows that high-quality companies outperform the market over a multi-year period regardless of entry price.

3. Alphabet (GOOGL) Research Report: Q4 CY2025 Update

Online advertising giant Alphabet (NASDAQ:GOOGL) reported revenue ahead of Wall Street’s expectations in Q4 CY2025, with sales up 18% year on year to $113.8 billion. Its GAAP profit of $2.82 per share was 7% above analysts’ consensus estimates.

Alphabet (GOOGL) Q4 CY2025 Highlights:

- Revenue: $113.8 billion vs analyst estimates of $111.4 billion (2.2% beat)

- Operating Profit (GAAP): $35.93 billion vs analyst estimates of $36.93 billion (2.7% miss)

- EPS (GAAP): $2.82 vs analyst estimates of $2.64 (7% beat)

- Google Search Revenue: $63.07 billion vs analyst estimates of $61.31 billion (2.9% beat)

- Google Cloud Revenue: $17.66 billion vs analyst estimates of $16.29 billion (8.5% beat)

- YouTube Revenue: $11.38 billion vs analyst estimates of $11.83 billion (3.8% miss)

- Google Services Operating Profit: $40.13 billion vs analyst estimates of $38.17 billion (5.1% beat)

- Google Cloud Operating Profit: $5.31 billion vs analyst estimates of $3.74 billion (42.1% beat)

- Operating Margin: 31.6%, in line with the same quarter last year

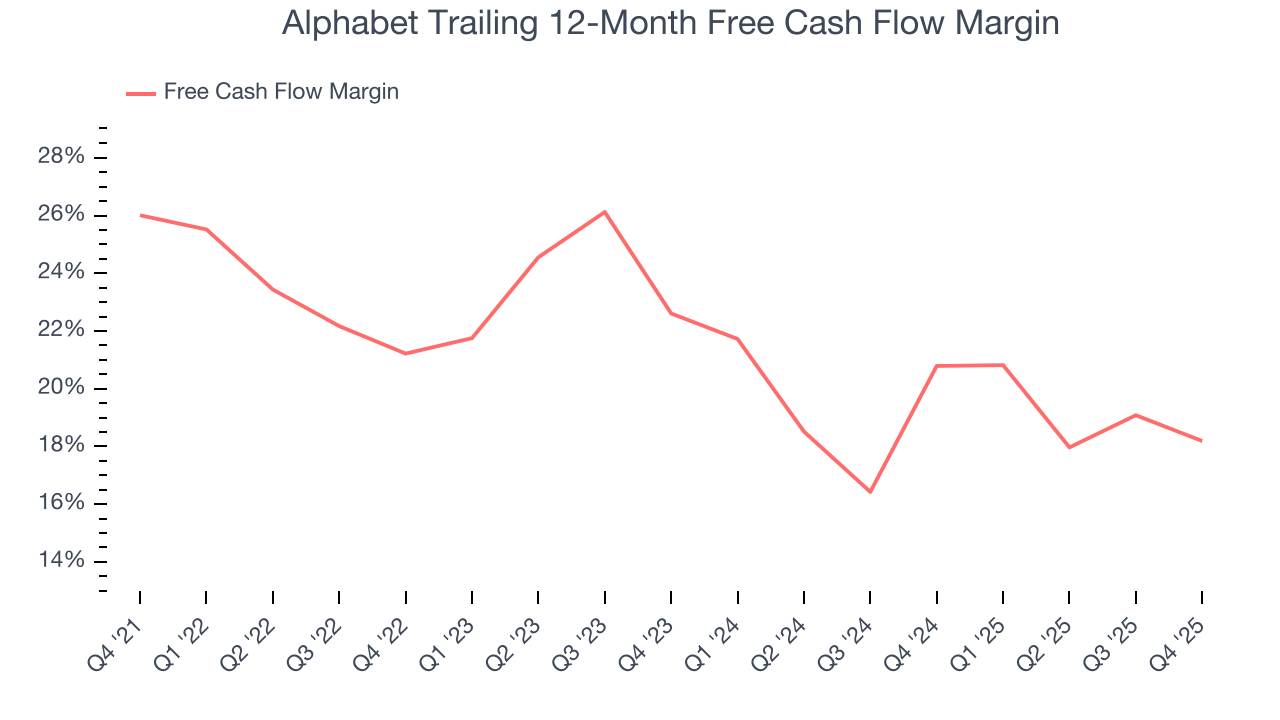

- Free Cash Flow Margin: 21.6%, down from 25.7% in the same quarter last year

- Expects 2026 capex to be in the range of $175 to $185 billion, almost double 2025 spend

- Market Capitalization: $4.10 trillion

Key Topics & Areas Of Debate

The key question surrounding Alphabet today isn’t whether Google will survive the AI wave (it has increasingly proven it will), but whether it can monetize it as effectively as it did the mobile internet. Investors are asking whether Alphabet’s integration of Gemini into Search, YouTube, and Cloud enhances user experience without eroding the high-margin ad clicks that drive its profits.

Search still accounts for a meaningful portion of Alphabet’s total revenue, and its global share remains near 90% despite the rise of generative-AI assistants. While Microsoft’s Bing benefits from its integration with ChatGPT and Copilot, its gains seem to have plateaued. The more relevant competitive shift is toward conversational interfaces such as ChatGPT, Claude, Perplexity, Meta AI, and Apple Intelligence—all vying for “discovery time” once dominated by Google.

Beyond Search, Gemini’s deep integration into Google Cloud and Workspace positions Alphabet as both an AI application and infrastructure provider—a dual advantage few can match. The long-term debate has shifted from existential risk to execution risk: can Alphabet scale its AI ecosystem and monetize Gemini’s capabilities across Search, Cloud, and YouTube without cannibalizing ad revenue or running afoul of regulators? For investors, that balance between innovation and profitability will define the next leg of Alphabet’s growth story.

Alphabet competes with Microsoft often, as both companies offer productivity tools. Microsoft is also one of its primary adversaries in the public cloud services market along with Amazon’s formidable AWS (NASDAQ:AMZN). Finally, Netflix (NASDAQ:NFLX), Disney (NYSE:DIS), and many other video streaming platforms go head-to-head against the company’s YouTube segment.

4. Company Overview

Started by Stanford students Larry Page and Sergey Brin in a Menlo Park garage, Alphabet (NASDAQ:GOOGL) is the parent company of the eponymous Google Search engine, Google Cloud Platform, and YouTube.

The Google Search engine – Alphabet’s initial product – is used for 80%+ of internet searches, and the scale of data it generates makes the company the largest recipient of online advertising dollars globally. Google Search’s ad tools and ad units are some of the most effective in the market as search queries remove the guesswork for advertisers by directly showing intent, making it one of the most effective forms of online advertising.

Along with Google Search, Alphabet's video-sharing site YouTube has over 2.5 billion monthly users and it has an additional 1 billion+ users across its Gmail, Chrome web browser, and Google Maps products. Lastly, its mobile operating system, Android, is a big competitor to Apple's iOS operating system and is used by almost half of the Earth’s population.

On the business services side, the company operates the fast-growing Google Cloud Platform (GCP), a large cloud computing service that competes with Amazon's AWS and Microsoft Azure in cloud-based storage, computing, and database management. Rounding out Alphabet is a variety of other bets, which include autonomous driving company Waymo and life sciences research company Verily.

Alphabet's artificial intelligence and machine learning tools are considered amongst the most sophisticated in the world, and the question is if it can leverage these advantages to take more share in search and cloud computing while maybe even creating the next new technology.

5. Revenue Growth

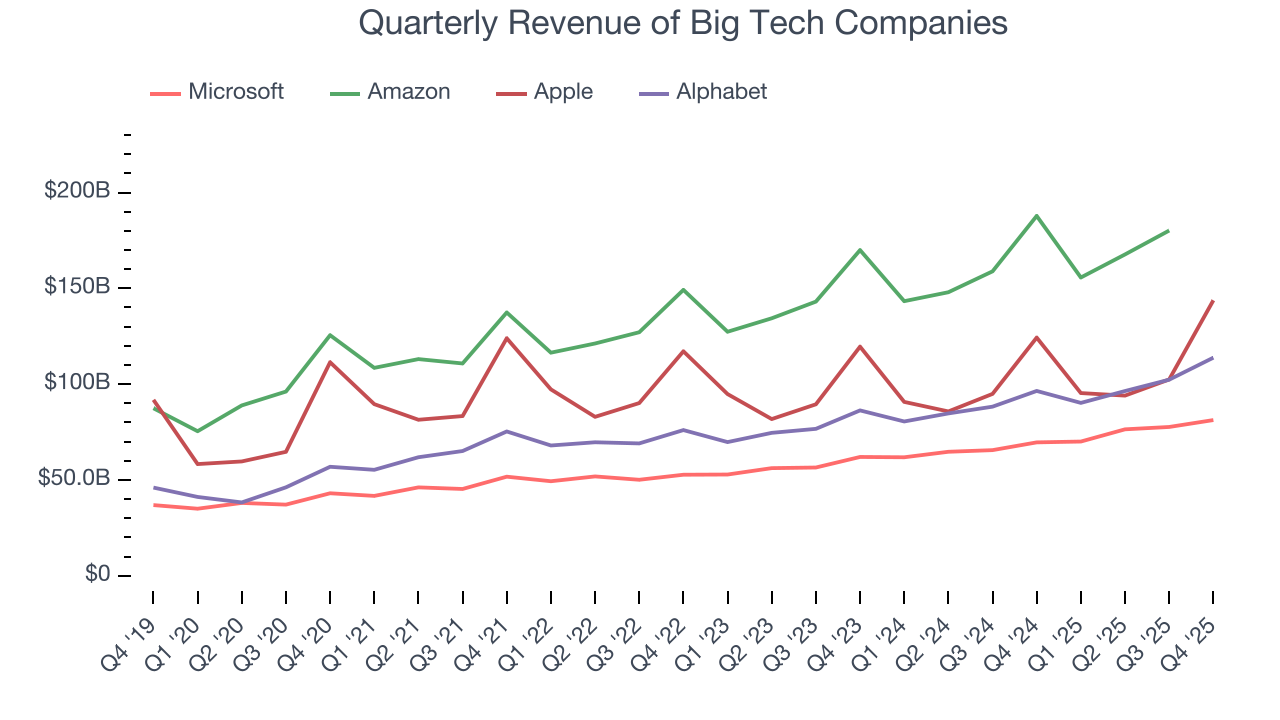

Alphabet proves that huge, scaled companies can still grow quickly. The company’s revenue base of $182.5 billion five years ago has more than doubled to $402.8 billion in the last year, translating into an incredible 17.2% annualized growth rate.

Alphabet’s growth over the same period was also higher than its big tech peers, Amazon (14.1%), Microsoft (14.8%), and Apple (8.2%). This is an important consideration because investors often use the comparisons as a starting point for their valuations. With these benchmarks in mind, we think Alphabet is a bit expensive (but still worth owning).

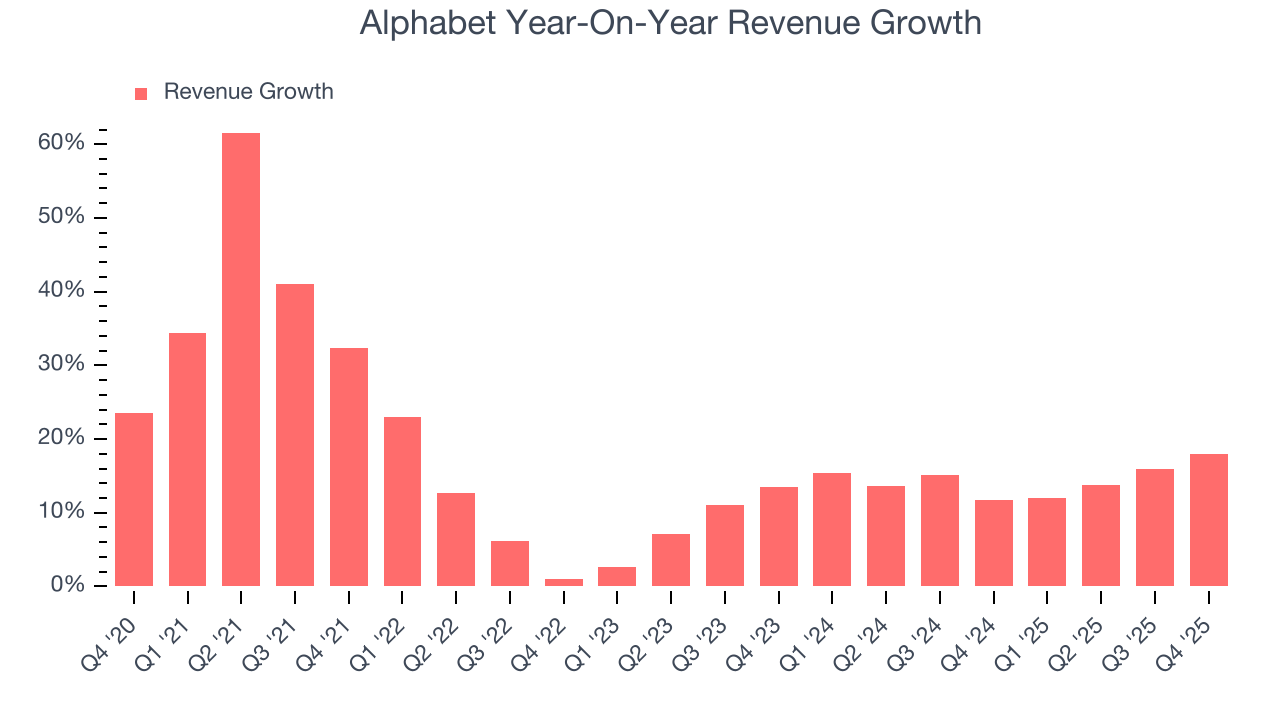

We at StockStory emphasize long-term growth, but for big tech companies, a half-decade historical view may miss emerging trends in AI. Alphabet’s annualized revenue growth of 14.5% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Alphabet reported year-on-year revenue growth of 18%, and its $113.8 billion of revenue exceeded Wall Street’s estimates by 2.2%. Looking ahead, sell-side This projection is admirable for a company of its scale and illustrates the market sees some success for its newer AI-enabling products.

6. Google Search: Alphabet’s Bread-and-Butter

The most topical question surrounding Alphabet today is: “Will new Generative-AI products like ChatGPT and Meta AI disrupt Google Search and its 80%+ market share?”.

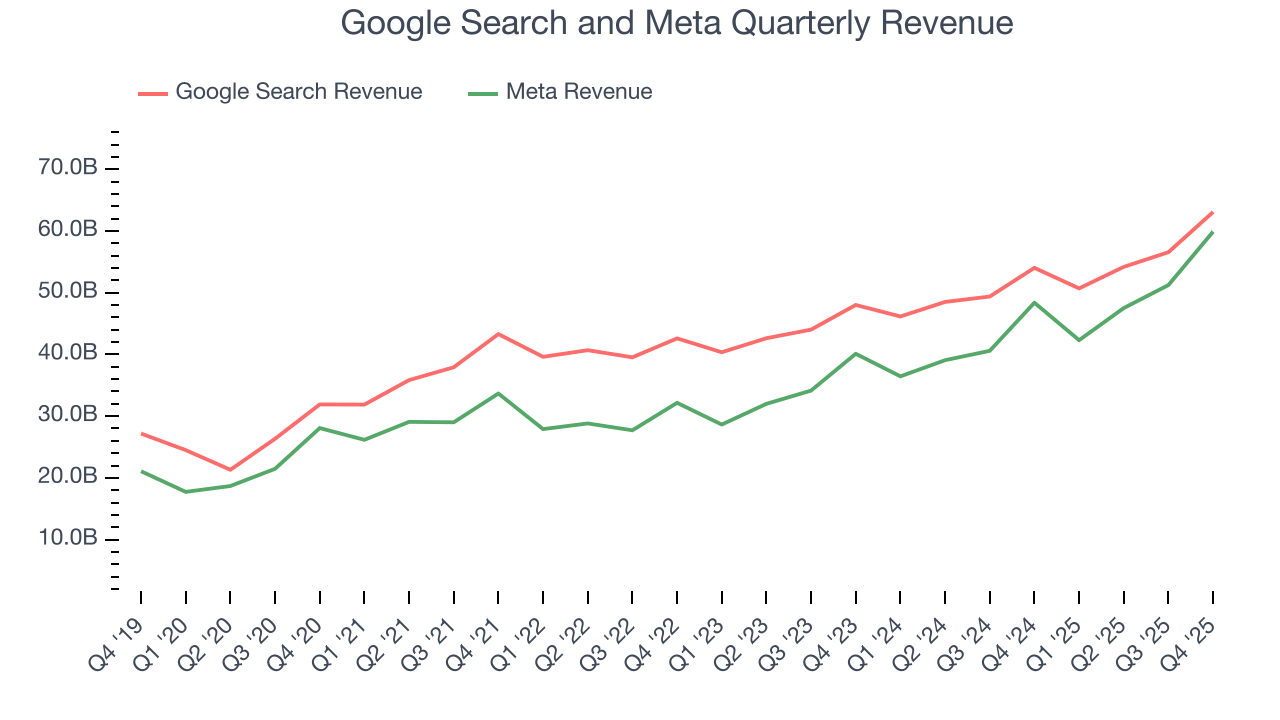

Although OpenAI (creator of ChatGPT) doesn’t disclose its financials, we can gain further insight by comparing Google Search to Meta and Microsoft’s Bing. Meta essentially has a monopoly in social media advertising and is creeping into search with Meta AI, which is powered by its Llama large language model, while Bing is the distant number two search engine that benefits from its integration with ChatGPT.

Starting with Alphabet, Google Search is by far the most considerable portion of its revenue at 55.7%, and it grew at a 16.6% annualized rate over the last five years, in line with its total revenue. The previous two years saw deceleration as it grew by 13.3% annually, though this isn’t concerning since it’s still expanding quickly.

On the other hand, its two-year result was lower than Meta’s 22.1%, showing digital advertising dollars could be flowing to Meta because of its improved AI algorithms and targeting capabilities. Alphabet bulls would argue this trend could reverse because the return on investment from keyword-driven advertising is more tangible, but that hasn’t been the case lately.

Quarterly performance is particularly relevant for Alphabet because it captures the growth of AI and signals whether investors are overestimating its competitive impact. Bulls can rejoice as Google Search revenue exceeded expectations in Q4, outperforming Wall Street Consensus by 2.9%. The segment recorded a hearty year-on-year increase of 16.7%.

7. Google Cloud Platform: The Fast-Growing Horse

Almost all modern internet applications are built on public cloud infrastructure. AWS is a massive success for Amazon, and it is no surprise that Alphabet wants a slice of the pie. But can it catch up?

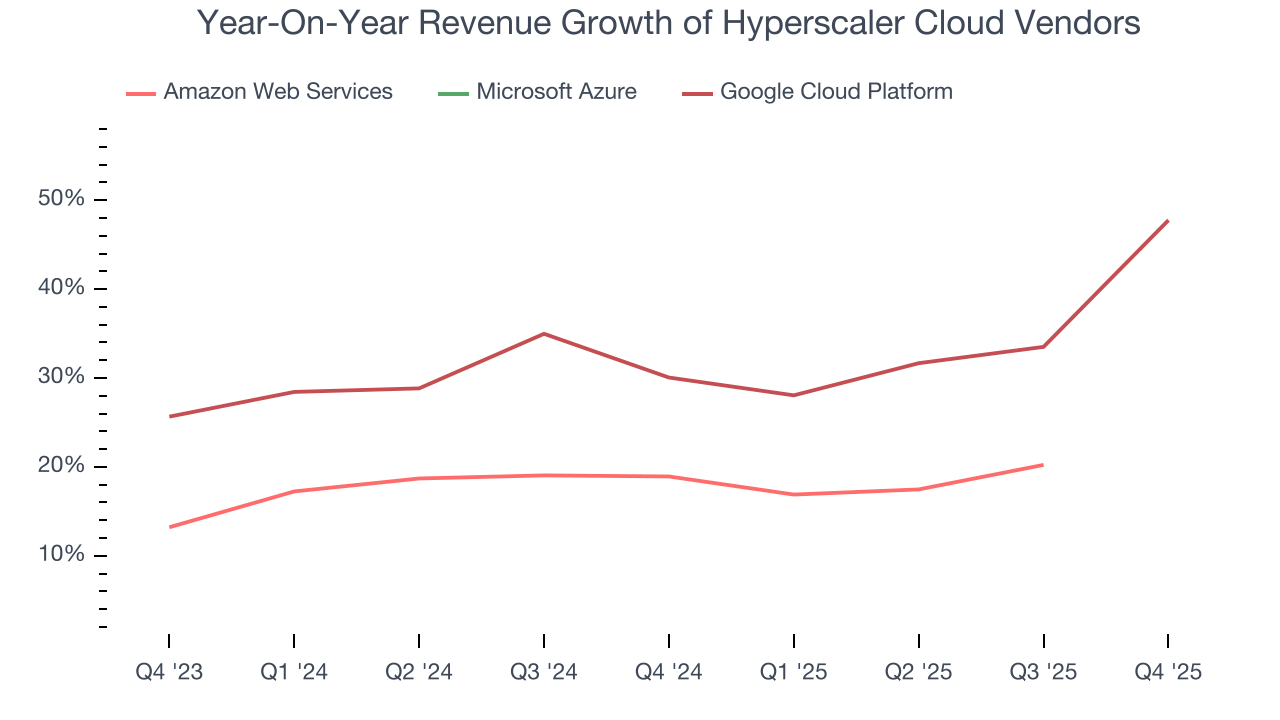

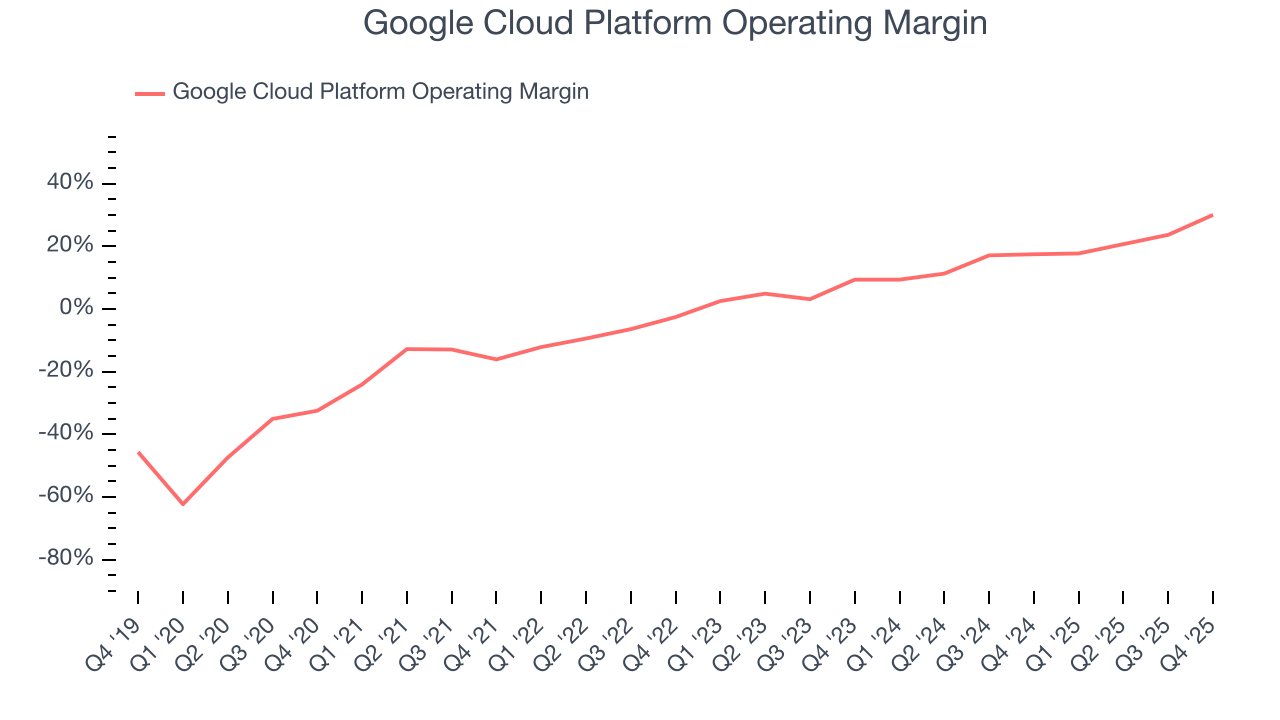

Revenue in Alphabet’s Google Cloud Platform (GCP) grew at a spectacular pace over the last five years, clocking in at 35.1% annualized. On a two-year basis, growth was 33.2%. This was slower than its five-year rate, but it’s impressive nonetheless.

Since 2020, GCP has expanded from 7.2% of consolidated revenue to 14.6% today, and the segment’s size should increase over time as its growth is expected to outpace Search and the overall business.

However, when comparing GCP to its "hyperscaler" peers, we can see it’s far behind in third - its run-rate revenue (current quarter’s sales times four) is around $70 billion while AWS and Azure (a subset of Microsoft’s Intelligent Cloud segment) are on track for roughly $150 billion and $150 billion, respectively. GCP’s smaller revenue base makes it easier to grow, but the looming question is if it can catch up in scale and exhibit the same profit margins.

This quarter, GCP revenue grew by 47.8%, beating expectations by 8.5%. Its growth was also faster than AWS’s 20.2% and Azure’s 28.2%, implying it’s taking some market share. Given the scale differences, GCP must consistently outgrow its rivals for an extended period to have any chance of besting the competition.

8. YouTube: Netflix’s Rival

Online video streaming platforms make money through subscription fees, advertising, or some combination of both. Advertising is the bigger chunk of sales for YouTube, and like GCP, it is a smaller segment for Alphabet at 10% of revenue. Still, YouTube is a focus for investors given its large addressable market and 2.5 billion+ monthly active users.

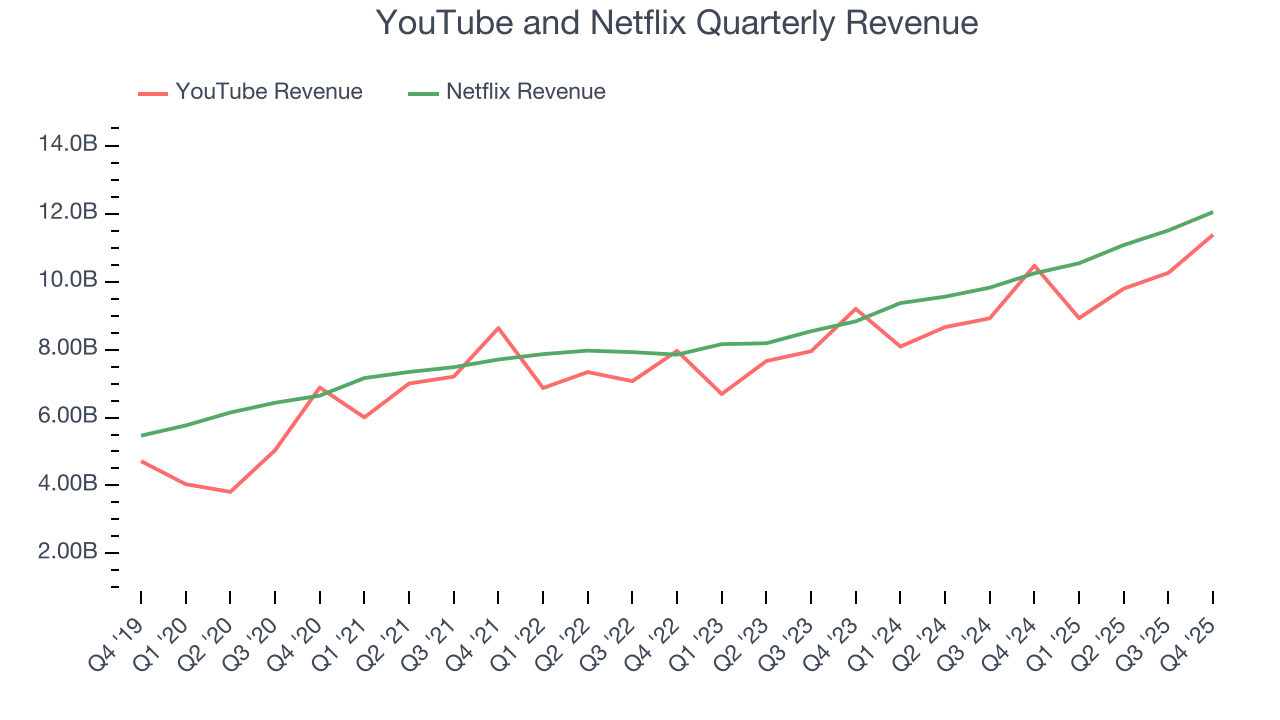

Over the last five years, YouTube’s 15.3% annualized revenue growth was strong but lagged the broader company’s performance. In recent years, the segment also decelerated a bit, as seen by its 13.2% two-year annual growth. This is still healthy, and some level of deceleration is expected with a large revenue base.

At the same time, YouTube’s growth was below Netflix’s 15.8% annualized rate over the last two years, though comparisons aren’t exactly apples-to-apples because Netflix mainly generates revenue through subscriptions (you can see this in YouTube’s choppier advertising revenue in the chart below). We’ll continue monitoring the situation closely as Netflix’s new ad-supported tier could increase competition for online video ad dollars.

In Q4, YouTube’s $11.38 billion of revenue missed expectations by 3.8% but grew by 8.7% year on year. Despite the good print, the number was lower than its two-year result, suggesting its new initiatives like YouTube Creator Awards aren’t accelerating growth just yet.

9. Gross Margin

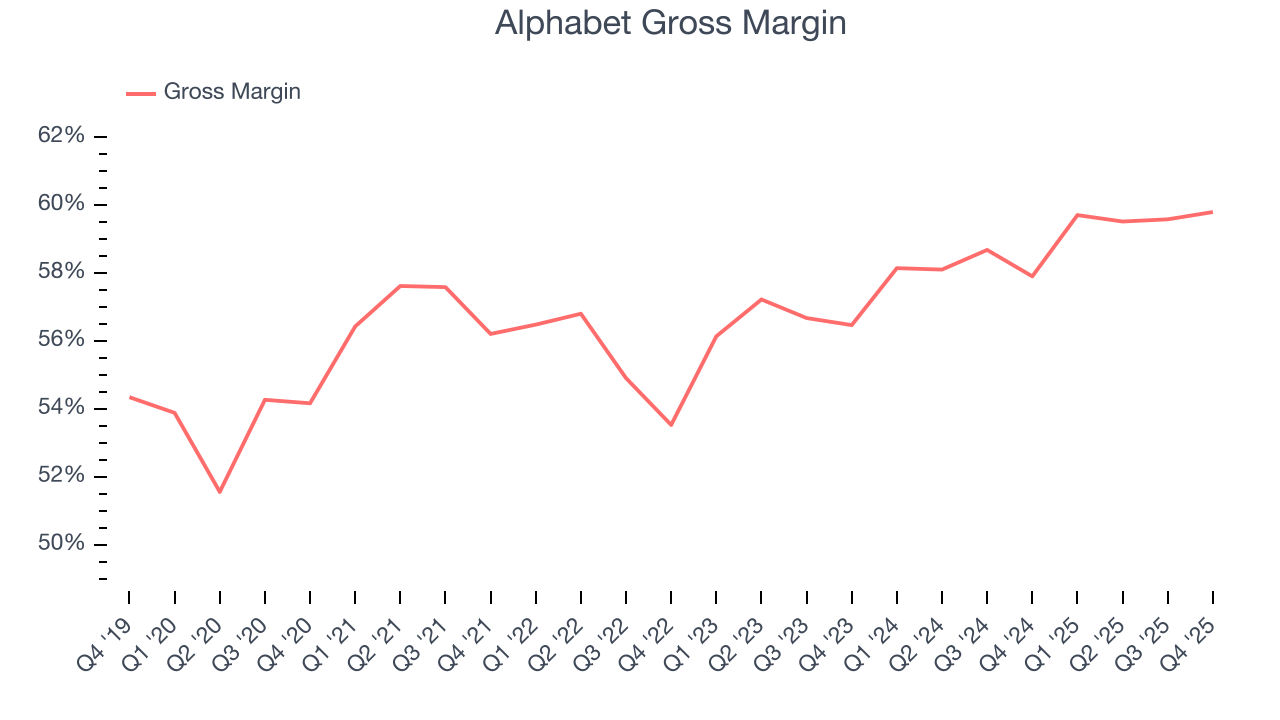

Alphabet’s biggest source of revenue, advertising from Google Search, is also quite profitable. Its gross margin routinely punches in above 75% because its cost of goods sold is low - they mostly consist of traffic acquisition costs, or payments made to browsers and mobile carriers for directing web traffic to google.com.

The company’s other businesses like GCP and YouTube, with their data center and content costs, have lower gross margins than Search, so they drag overall unit economics down. Still, Alphabet’s consolidated gross margin is rock-solid as it averaged 57.6% over the last five years. This serves as a nice starting point for ultimate operating profitability and free cash flow.

Alphabet’s gross margin was 59.8% in Q4, up from 57.9% in the same quarter last year. That means for every $100 in revenue, $59.79 was left to invest in sales, marketing, R&D, and general administrative overhead.

10. Operating Margin

Operating margin is the key profitability measure for Alphabet. It’s the portion of revenue left after accounting for all operating expenses – everything from the IT infrastructure powering online searches to product development and administrative expenses.

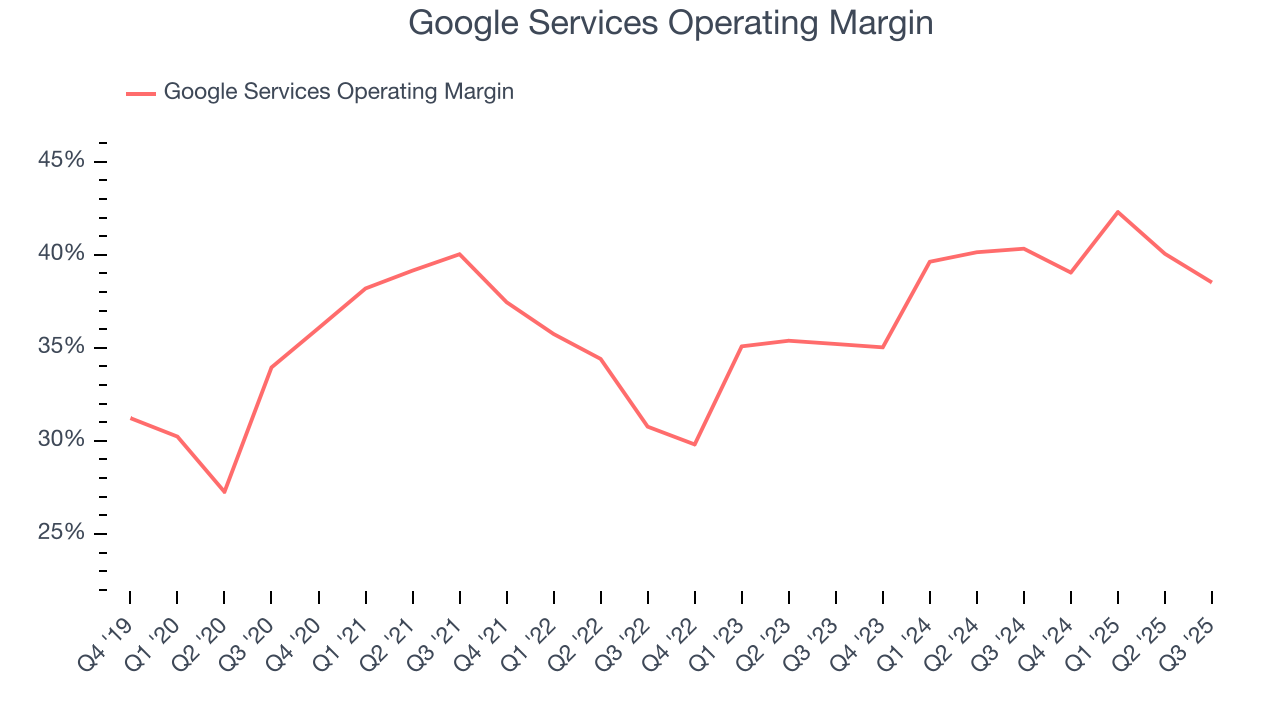

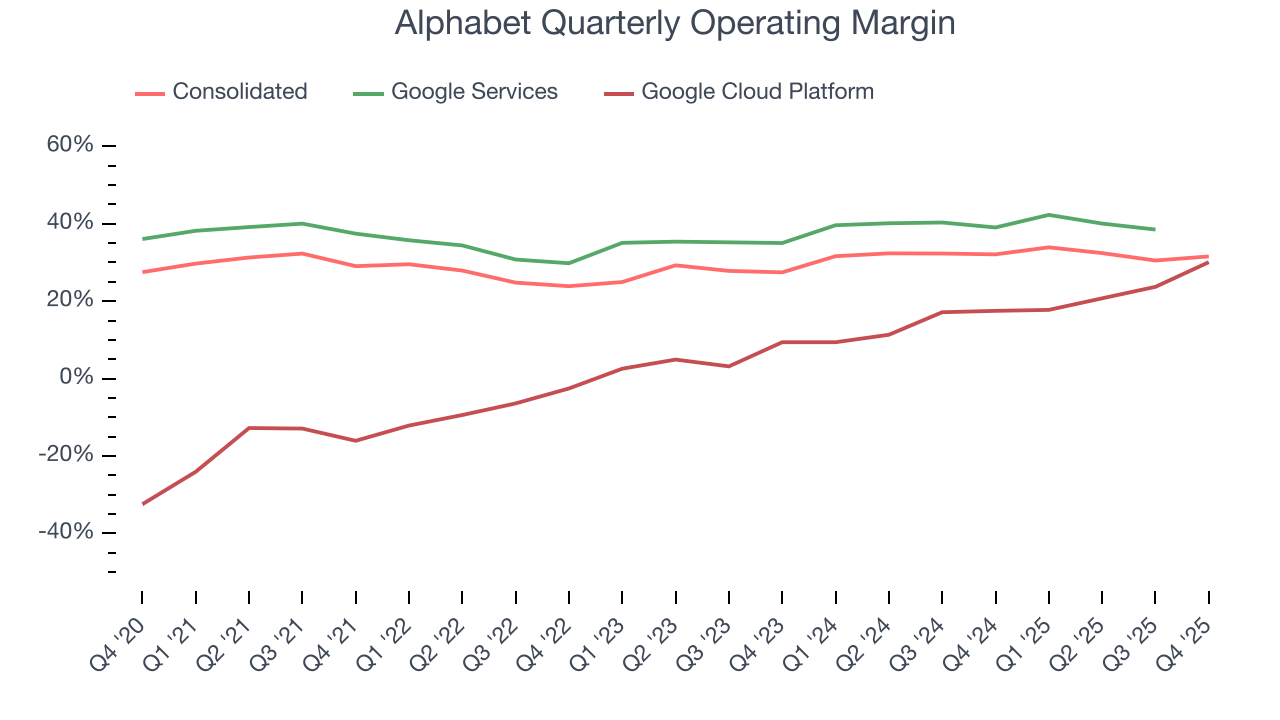

Alphabet has been a well-oiled machine over the last five years. It demonstrated elite profitability for a consumer internet business, boasting an average operating of 29.9%. A closer examination is required, however, because the company’s individual business lines have very different margin profiles.

The Google Services segment, which includes Search, YouTube, the Pixel smartphone, and other advertising revenues, boasted an average operating margin of 37.3% over the last five years (Search and YouTube standalone profitability is not disclosed).

Google Cloud was also profitable, recording an average operating margin of 9.3% at the same time. The cherry on top was this quarter’s margin of 30.1%, which shows the business is gaining operating leverage. Still, GCP’s most recent margin is below AWS’s 34.6% quarterly print. GCP has a long way to catch up on both scale and margins, which isn’t surprising since the second dynamic very much depends on the first.

Putting it all together, Alphabet’s operating rose by 1.5 percentage points over the last five years. This expansion was driven by operating leverage across its businesses, and if Alphabet can avoid overhiring, company-level margins could tick even higher.

In Q4, Alphabet generated an operating profit margin of 31.6%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

In the coming year, Wall Street expects Alphabet to become more profitable. Analysts are expecting the company’s trailing 12-month operating of 32% to rise to 33.8%. The direction of consolidated operating margins historically plus the expected increase over the next year suggest Alphabet is reaping some benefits from AI, whether it be internally or through higher revenues and operating leverage.

11. Earnings Per Share

We track the long-term change in earnings per share (EPS) alongside revenue and margins because it shows whether a company’s growth is profitable and what else affects shareholder returns.

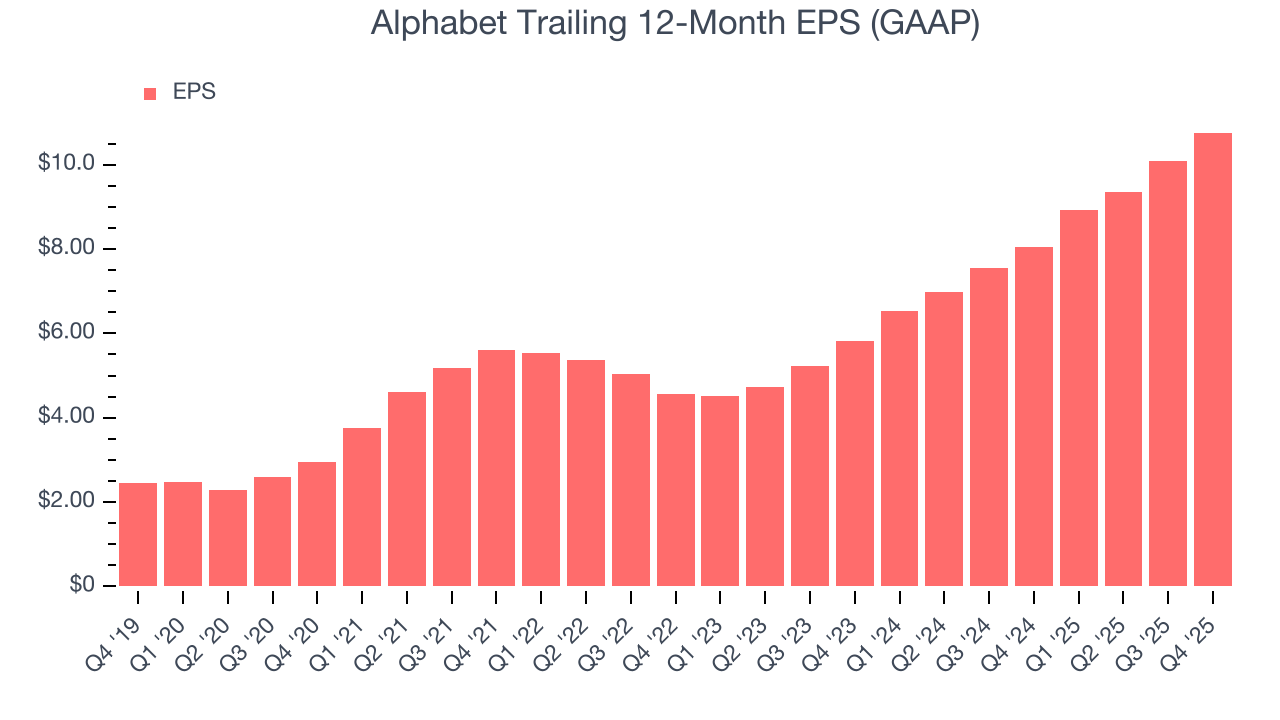

Alphabet’s EPS grew at an astounding 29.6% compounded annual growth rate over the last five years, higher than its 17.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

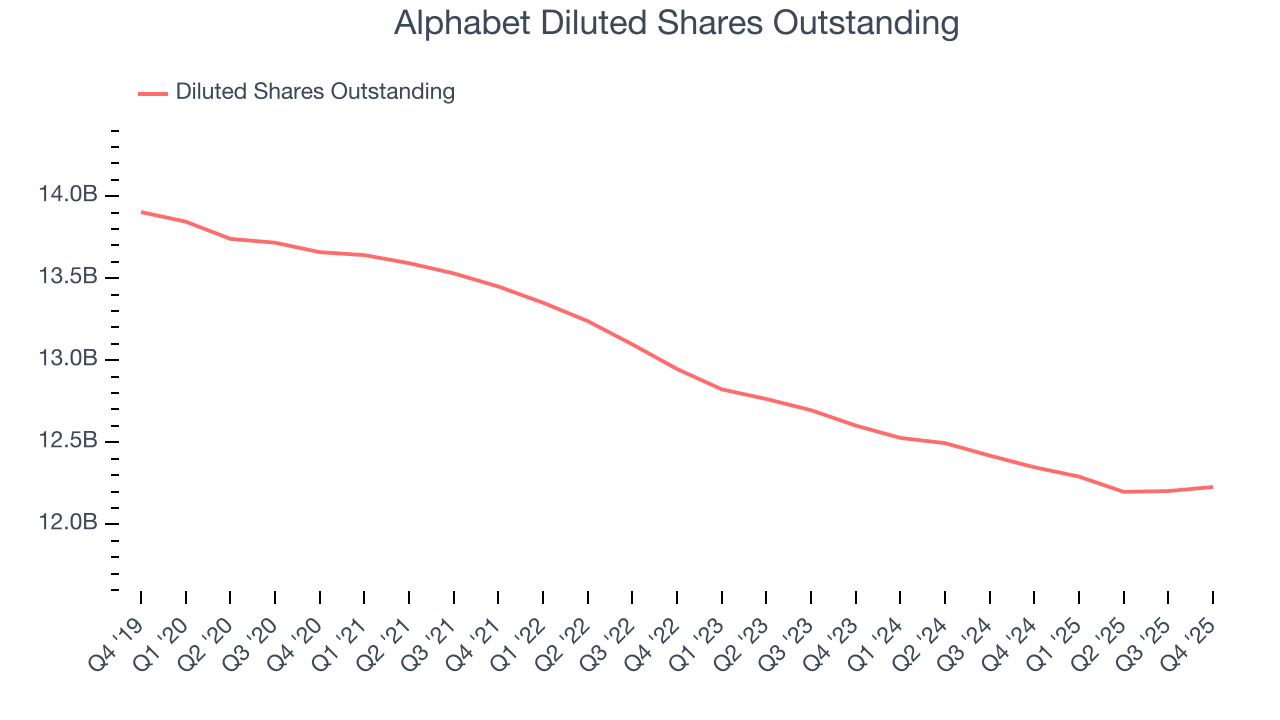

Diving into Alphabet’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, Alphabet’s operating was flat this quarter but expanded by 1.5 percentage points over the last five years. On top of that, its share count shrank by 10.5%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Alphabet, its two-year annual EPS growth of 36.1% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, Alphabet reported EPS of $2.82, up from $2.15 in the same quarter last year. This print beat analysts’ estimates by 7%. Over the next 12 months, Wall Street expects Alphabet’s full-year EPS of $10.76 to grow 3.8%.

12. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Alphabet has shown robust cash profitability, driven by its attractive business model that enables it to reinvest or return capital to investors while maintaining a cash cushion. The company’s free cash flow margin averaged 21.4% over the last five years, quite impressive for a consumer internet business.

Taking a step back, we can see that Alphabet’s margin dropped by 7.8 percentage points over the last five years. Continued declines could signal it is in the middle of an investment cycle as it competes for the best AI chips to power its products.

Alphabet’s free cash flow clocked in at $24.55 billion in Q4, equivalent to a 21.6% margin. The company’s cash profitability regressed as it was 4.2 percentage points lower than in the same quarter last year, which isn’t ideal considering its longer-term trend.

Over the next year, analysts predict Alphabet’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 18.2% for the last 12 months will decrease to 15.7%.

13. Return on Invested Capital (ROIC)

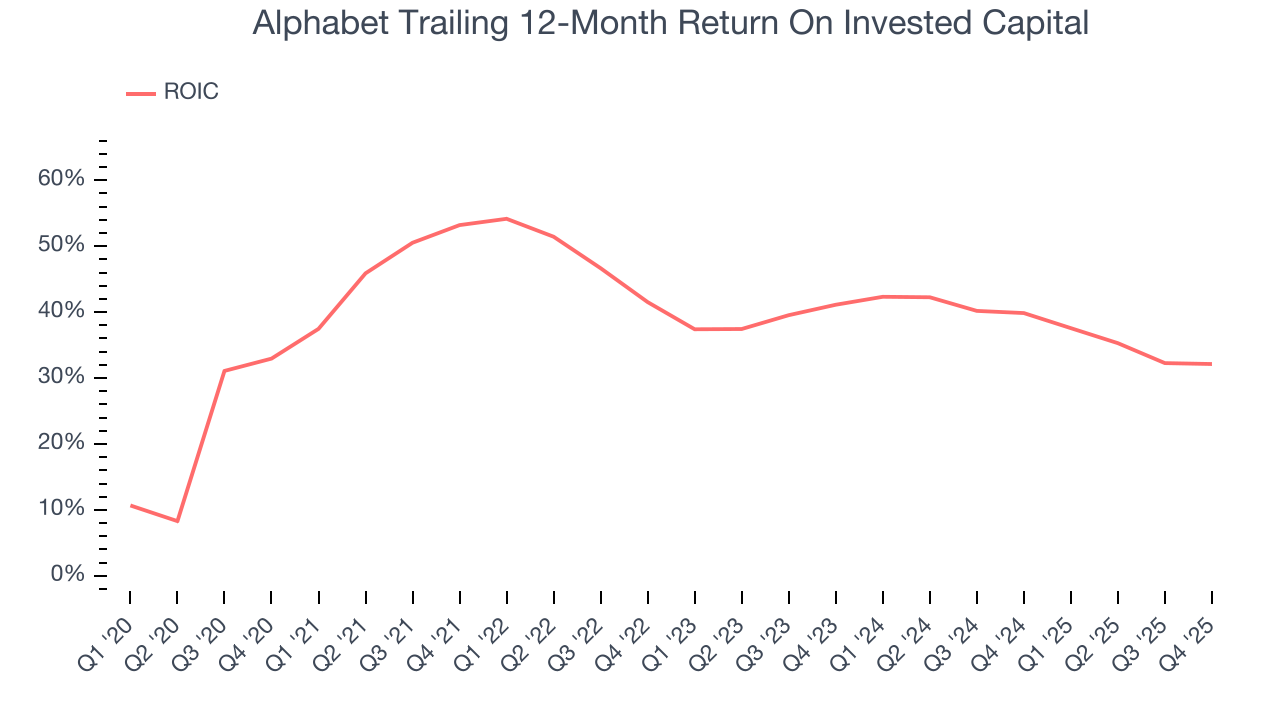

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Alphabet’s five-year average ROIC was 41.6%, placing it among the best consumer internet companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Alphabet’s ROIC has unfortunately decreased significantly. This is because it’s investing aggressively to capture the AI opportunity. Only time will tell if these investments bear fruit in higher long-term ROICs.

14. Balance Sheet Assessment

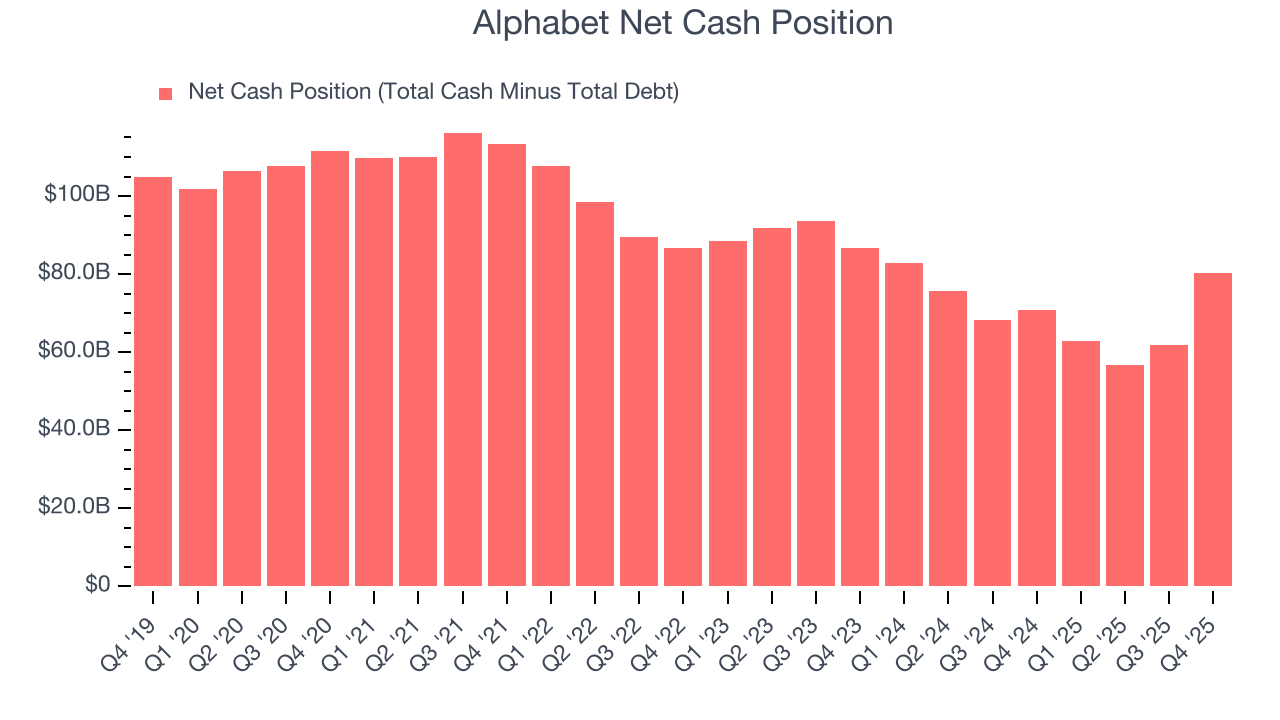

Big corporations like Alphabet are attractive to many investors in times of instability thanks to their fortress balance sheets that buffer pockets of soft demand.

Alphabet has an eye-popping $126.8 billion of cash on its balance sheet (that’s no typo) compared to $46.55 billion of debt. This $80.3 billion net cash position is 2% of its market cap and shockingly larger than the value of most public companies, giving it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

15. Key Takeaways from Alphabet’s Q4 Results

We enjoyed seeing Alphabet beat analysts’ revenue expectations this quarter. Revenue beats in Google Cloud Platform and Google Search trumped the miss in YouTube. On the other hand, its operating income missed. Additionally, capex guidance for 2026 is nearly double 2025 levels, showing that the company must spend big to win in AI. Overall, this print was mixed, with some topline strength but higher-than-expected spending. The stock remained flat at $332.08 immediately after reporting.

16. Is Now The Time To Buy Alphabet?

Updated: February 11, 2026 at 9:31 PM EST

Before investing in or passing on Alphabet, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

Alphabet is a high-quality business worth owning. First of all, the company’s superb long-term revenue growth driven by Google Cloud Platform signals it has an untapped market opportunity ahead of it. And while its falling cash profitability means it’s investing heavily to keep pace in the AI-race, its projected revenue growth for the next year indicates its demand will accelerate and that hot new players like ChatGPT will have little to no impact on its performance. Additionally, Alphabet’s lean cost base results in a strong operating margin.

Alphabet’s price-to-earnings ratio based on the next 12 months is 27.9x. Some good news is baked into the stock given its multiple, but we’ll happily own Alphabet as its fundamentals really stand out. We’re in the camp that investments like this should be held for at least three to five years to negate the short-term price volatility that can come with relatively high valuations.

Wall Street analysts have a consensus one-year price target of $372.52 on the company (compared to the current share price of $311.70).