Purple (PRPL)

Purple keeps us up at night. Its falling revenue and negative returns on capital suggest it’s destroying value as demand fizzles out.― StockStory Analyst Team

1. News

2. Summary

Why We Think Purple Will Underperform

Founded by two brothers, Purple (NASDAQ:PRPL) creates sleep and home comfort products such as mattresses, pillows, and bedding accessories.

- Products and services aren't resonating with the market as its revenue declined by 5.3% annually over the last five years

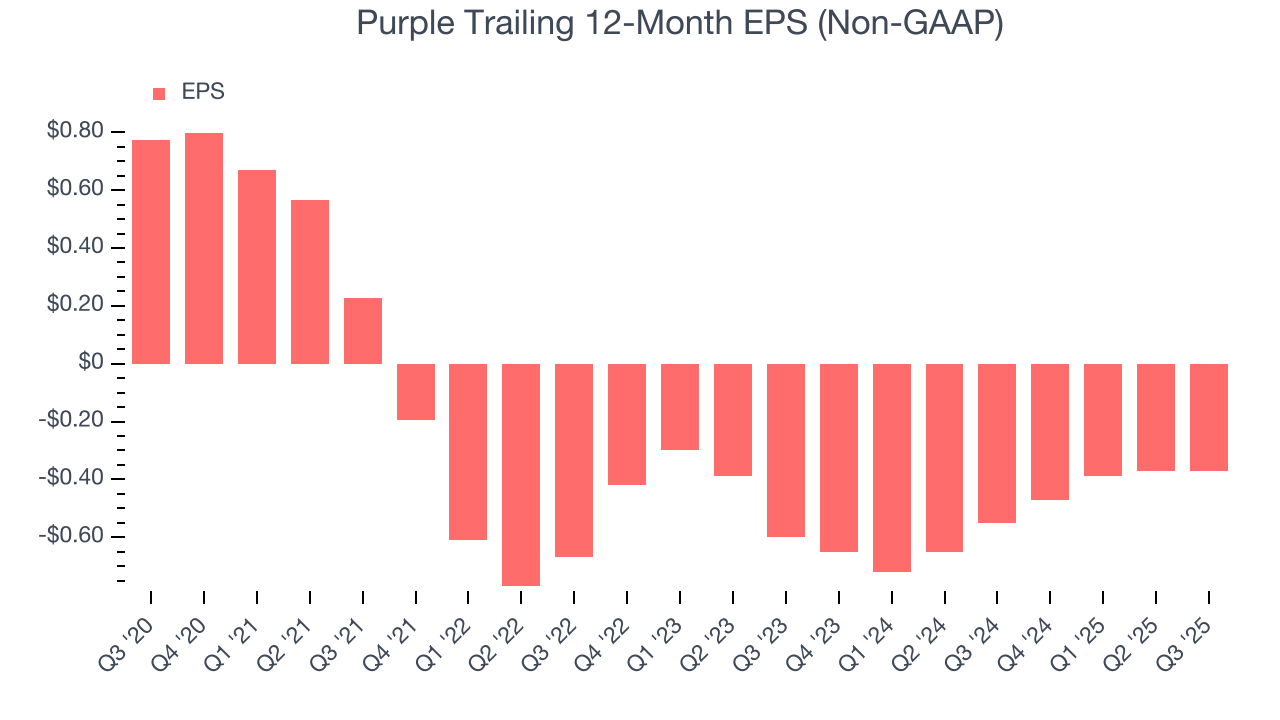

- Sales were less profitable over the last five years as its earnings per share fell by 19.9% annually, worse than its revenue declines

- Depletion of cash reserves could lead to a fundraising event that triggers shareholder dilution

Purple doesn’t check our boxes. You should search for better opportunities.

Why There Are Better Opportunities Than Purple

Why There Are Better Opportunities Than Purple

Purple’s stock price of $0.66 implies a valuation ratio of 17.2x forward EV-to-EBITDA. Not only does Purple trade at a premium to companies in the consumer discretionary space, but this multiple is also high for its top-line growth.

We’d rather invest in similarly-priced but higher-quality companies with more reliable earnings growth.

3. Purple (PRPL) Research Report: Q3 CY2025 Update

Bedding and comfort retailer Purple (NASDAQ:PRPL) missed Wall Street’s revenue expectations in Q3 CY2025, with sales flat year on year at $118.8 million. On the other hand, the company’s full-year revenue guidance of $475 million at the midpoint came in 0.6% above analysts’ estimates. Its non-GAAP loss of $0.08 per share was 17.9% above analysts’ consensus estimates.

Purple (PRPL) Q3 CY2025 Highlights:

- Revenue: $118.8 million vs analyst estimates of $123.2 million (flat year on year, 3.6% miss)

- Adjusted EPS: -$0.08 vs analyst estimates of -$0.10 (17.9% beat)

- Adjusted EBITDA: $189,000 vs analyst estimates of -$42,500 (0.2% margin, relatively in line)

- The company reconfirmed its revenue guidance for the full year of $475 million at the midpoint

- Operating Margin: -10.2%, up from -39.5% in the same quarter last year

- Market Capitalization: $86.28 million

Company Overview

Founded by two brothers, Purple (NASDAQ:PRPL) creates sleep and home comfort products such as mattresses, pillows, and bedding accessories.

Purple's origins trace back to the founders' earlier ventures in cushioning technology, including collaborations with globally recognized brands like Nike. Their breakthrough came with the development of a hyper-elastic polymer material designed to provide better support and comfort. This invention laid the foundation for Purple's products, addressing the need for better sleep solutions.

The company offers a range of products, including the Purple Mattress, known for its 'No Pressure' support and cooling features. It also manufactures and sells pillows, seat cushions, and bedding accessories designed with the same technology.

Purple employs a hybrid sales strategy, combining direct-to-consumer (DTC) sales through its online platform and physical retail stores with wholesale distribution through third-party retailers. This approach allows Purple to maintain close customer relationships and brand control while expanding its market reach.

4. Home Furnishings

A healthy housing market is good for furniture demand as more consumers are buying, renting, moving, and renovating. On the other hand, periods of economic weakness or high interest rates discourage home sales and can squelch demand. In addition, home furnishing companies must contend with shifting consumer preferences such as the growing propensity to buy goods online, including big things like mattresses and sofas that were once thought to be immune from e-commerce competition.

Competitors in the mattress and sleep products sector include Tempur Sealy (NYSE:TPX), Sleep Number (NASDAQ:SNBR), Haverty Furniture (NYSE:HVT) and private company Casper.

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Purple struggled to consistently generate demand over the last five years as its sales dropped at a 5.3% annual rate. This was below our standards and suggests it’s a low quality business.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Purple’s annualized revenue declines of 5.2% over the last two years align with its five-year trend, suggesting its demand has consistently shrunk.

This quarter, Purple’s $118.8 million of revenue was flat year on year, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 15% over the next 12 months, an improvement versus the last two years. This projection is noteworthy and indicates its newer products and services will catalyze better top-line performance.

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Purple’s operating margin has risen over the last 12 months, but it still averaged negative 15.5% over the last two years. This is due to its large expense base and inefficient cost structure.

In Q3, Purple generated a negative 10.2% operating margin. The company's consistent lack of profits raise a flag.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Purple, its EPS declined by 19.9% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

In Q3, Purple reported adjusted EPS of negative $0.08, in line with the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Purple to improve its earnings losses. Analysts forecast its full-year EPS of negative $0.37 will advance to negative $0.20.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Over the last two years, Purple’s demanding reinvestments to stay relevant have drained its resources, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 7.3%, meaning it lit $7.34 of cash on fire for every $100 in revenue.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Purple’s five-year average ROIC was negative 24.9%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer discretionary sector.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Purple’s ROIC has decreased significantly over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

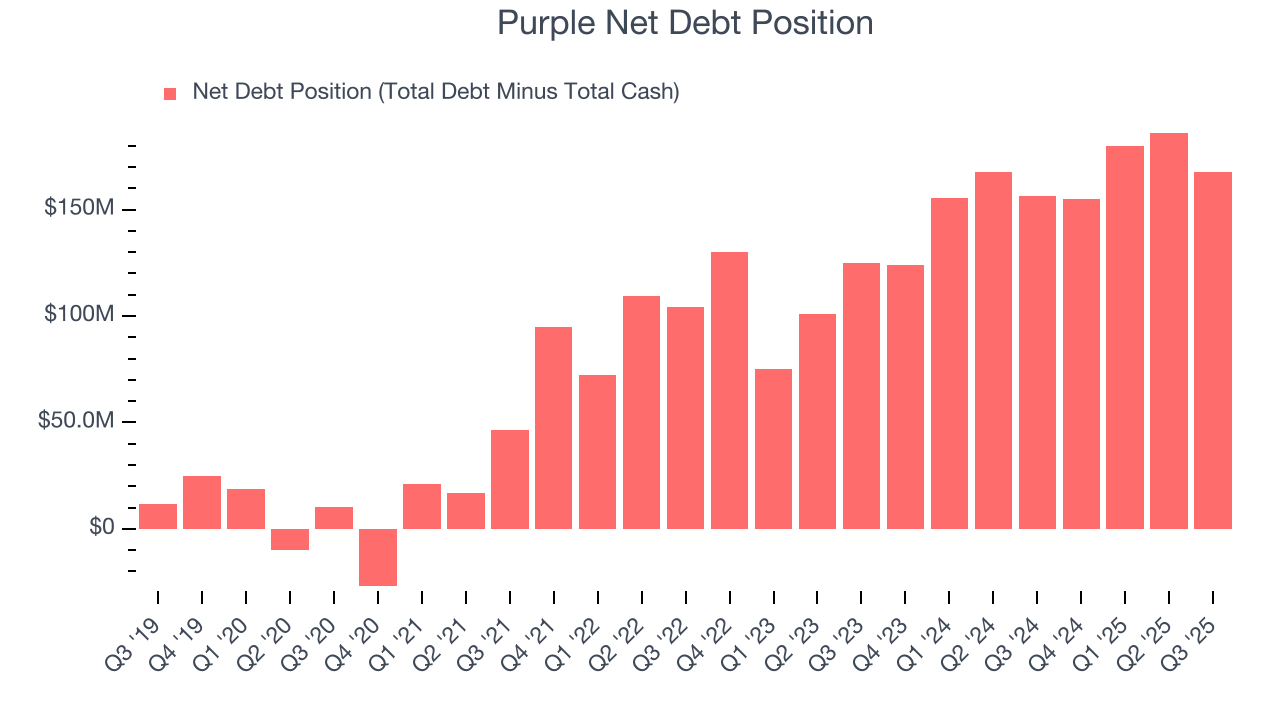

10. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Purple posted negative $4.03 million of EBITDA over the last 12 months, and its $200.1 million of debt exceeds the $32.36 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

We implore our readers to tread carefully because credit agencies could downgrade Purple if its unprofitable ways continue, making incremental borrowing more expensive and restricting growth prospects. The company could also be backed into a corner if the market turns unexpectedly. We hope Purple can improve its profitability and remain cautious until then.

11. Key Takeaways from Purple’s Q3 Results

We were impressed by how significantly Purple blew past analysts’ EPS expectations this quarter. On the other hand, its revenue missed. Overall, this print had some key positives. Investors were likely hoping for more, and shares traded down 5% to $0.76 immediately following the results.

12. Is Now The Time To Buy Purple?

Updated: February 22, 2026 at 11:10 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Purple, you should also grasp the company’s longer-term business quality and valuation.

We see the value of companies helping consumers, but in the case of Purple, we’re out. While its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its declining EPS over the last five years makes it a less attractive asset to the public markets. On top of that, its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

Purple’s EV-to-EBITDA ratio based on the next 12 months is 17.2x. This valuation tells us a lot of optimism is priced in - we think there are better opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $2.53 on the company (compared to the current share price of $0.66).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.