Repligen (RGEN)

Repligen is in for a bumpy ride. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Repligen Will Underperform

With over 13 strategic acquisitions since 2012 to build its comprehensive bioprocessing portfolio, Repligen (NASDAQ:RGEN) develops and manufactures specialized technologies that improve the efficiency and flexibility of biological drug manufacturing processes.

- Subscale operations are evident in its revenue base of $738.3 million, meaning it has fewer distribution channels than its larger rivals

- Flat earnings per share over the last five years underperformed the sector average

- Below-average returns on capital indicate management struggled to find compelling investment opportunities, and its falling returns suggest its earlier profit pools are drying up

Repligen doesn’t pass our quality test. We’d rather invest in businesses with stronger moats.

Why There Are Better Opportunities Than Repligen

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Repligen

Repligen is trading at $124.97 per share, or 65.6x forward P/E. This valuation multiple seems a bit much considering the quality you get.

We’d rather invest in similarly-priced but higher-quality companies with more reliable earnings growth.

3. Repligen (RGEN) Research Report: Q4 CY2025 Update

Biopharma manufacturing company Repligen Corporation (NASDAQ:RGEN) announced better-than-expected revenue in Q4 CY2025, with sales up 18.1% year on year to $197.9 million. The company expects the full year’s revenue to be around $825 million, close to analysts’ estimates. Its non-GAAP profit of $0.49 per share was 10.4% above analysts’ consensus estimates.

Repligen (RGEN) Q4 CY2025 Highlights:

- Revenue: $197.9 million vs analyst estimates of $192.8 million (18.1% year-on-year growth, 2.7% beat)

- Adjusted EPS: $0.49 vs analyst estimates of $0.44 (10.4% beat)

- Adjusted EBITDA: $39.54 million vs analyst estimates of $36.64 million (20% margin, 7.9% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $1.97 at the midpoint, missing analyst estimates by 5.1%

- Operating Margin: 9%, up from -21.8% in the same quarter last year

- Organic Revenue rose 14% year on year (beat)

- Market Capitalization: $7.62 billion

Company Overview

With over 13 strategic acquisitions since 2012 to build its comprehensive bioprocessing portfolio, Repligen (NASDAQ:RGEN) develops and manufactures specialized technologies that improve the efficiency and flexibility of biological drug manufacturing processes.

Repligen's technologies are organized into four main franchises: filtration, chromatography, process analytics, and proteins. These products are used throughout the biopharmaceutical manufacturing workflow, from the initial cell culture stages (upstream) through purification and final formulation (downstream).

The company's filtration franchise, its largest business segment, includes systems like XCell ATF for cell retention, which allows bioreactors to run continuously with higher cell densities and increased product yields. Its TangenX and KrosFlo product lines provide various filtration solutions for downstream processing. The chromatography franchise features OPUS pre-packed columns, which arrive ready to use with customers' choice of resin, eliminating the need for manual column packing and reducing setup time.

In process analytics, Repligen offers systems like the SoloVPE and FlowVPE devices that use slope spectroscopy to measure protein concentration in real-time during manufacturing, allowing for immediate process adjustments rather than waiting for laboratory results. The proteins franchise includes Protein A affinity ligands, which are essential components in the purification of monoclonal antibody drugs, as well as specialized affinity resins for gene therapy applications.

A pharmaceutical company developing a new monoclonal antibody drug might use Repligen's XCell ATF system during initial production to achieve higher cell densities, then employ OPUS pre-packed columns for purification, while monitoring the entire process with FlowVPX analytics technology. This integrated approach helps manufacturers reduce production time and increase yields.

Repligen generates revenue primarily through the sale of consumable and single-use products rather than hardware and equipment. The company has been shifting from selling individual products to offering integrated systems that can support entire manufacturing processes, providing customers with complete solutions rather than individual components.

4. Drug Development Inputs & Services

Companies specializing in drug development inputs and services play a crucial role in the pharmaceutical and biotechnology value chain. Essential support for drug discovery, preclinical testing, and manufacturing means stable demand, as pharmaceutical companies often outsource non-core functions with medium to long-term contracts. However, the business model faces high capital requirements, customer concentration, and vulnerability to shifts in biopharma R&D budgets or regulatory frameworks. Looking ahead, the industry will likely enjoy tailwinds such as increasing investment in biologics, cell and gene therapies, and advancements in precision medicine, which drive demand for sophisticated tools and services. There is a growing trend of outsourcing in drug development for nimbleness and cost efficiency, which benefits the industry. On the flip side, potential headwinds include pricing pressures as efforts to contain healthcare costs are always top of mind. An evolving regulatory backdrop could also slow innovation or client activity.

Repligen competes with several large life sciences and laboratory equipment companies, including Danaher Corporation (which owns both Pall Corporation and Cytiva), Thermo Fisher Scientific, MilliporeSigma (the life science business of Merck KGaA), and Sartorius.

5. Revenue Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $738.3 million in revenue over the past 12 months, Repligen is a small company in an industry where scale matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive.

6. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Repligen grew its sales at a solid 15% compounded annual growth rate. Its growth beat the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Repligen’s annualized revenue growth of 8% over the last two years is below its five-year trend, but we still think the results were respectable.

Repligen also reports organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Repligen’s organic revenue averaged 6% year-on-year growth. Because this number is lower than its two-year revenue growth, we can see that some mixture of acquisitions and foreign exchange rates boosted its headline results.

This quarter, Repligen reported year-on-year revenue growth of 18.1%, and its $197.9 million of revenue exceeded Wall Street’s estimates by 2.7%.

Looking ahead, sell-side analysts expect revenue to grow 11.8% over the next 12 months, an improvement versus the last two years. This projection is admirable and implies its newer products and services will fuel better top-line performance.

7. Adjusted Operating Margin

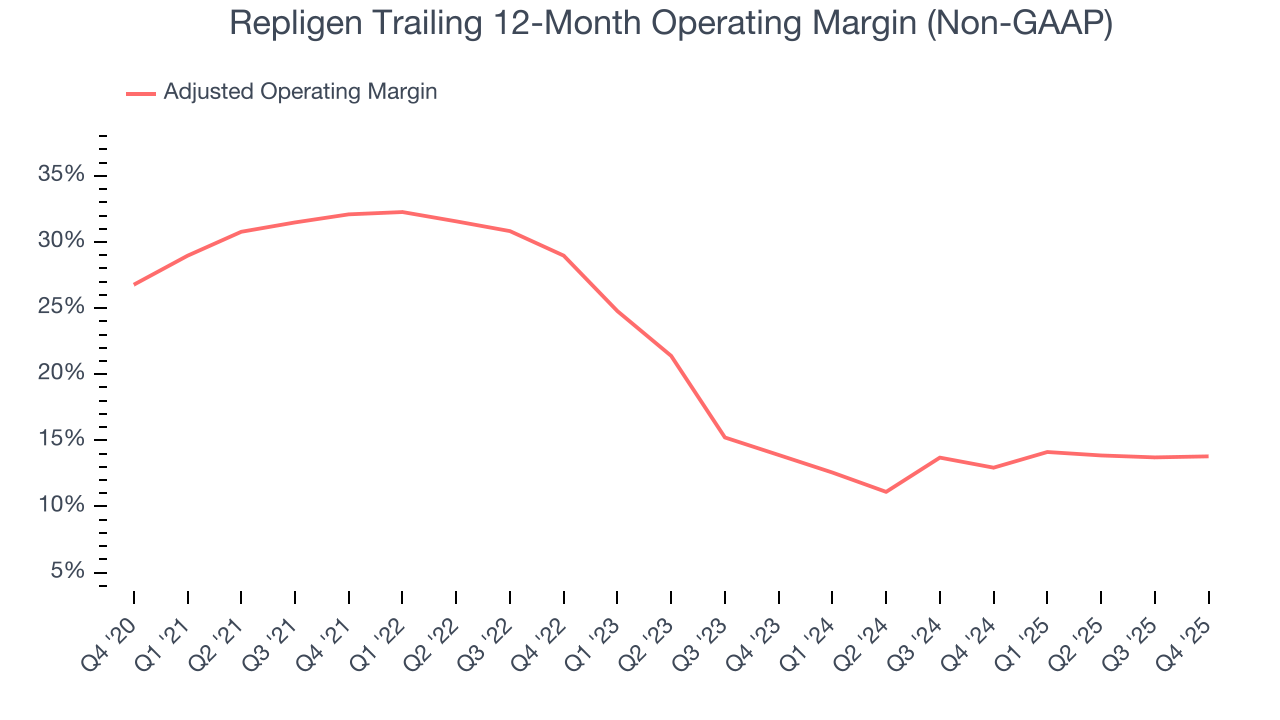

Repligen has been an efficient company over the last five years. It was one of the more profitable businesses in the healthcare sector, boasting an average adjusted operating margin of 20.7%.

Looking at the trend in its profitability, Repligen’s adjusted operating margin decreased by 18.3 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, Repligen generated an adjusted operating margin profit margin of 15%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

8. Earnings Per Share

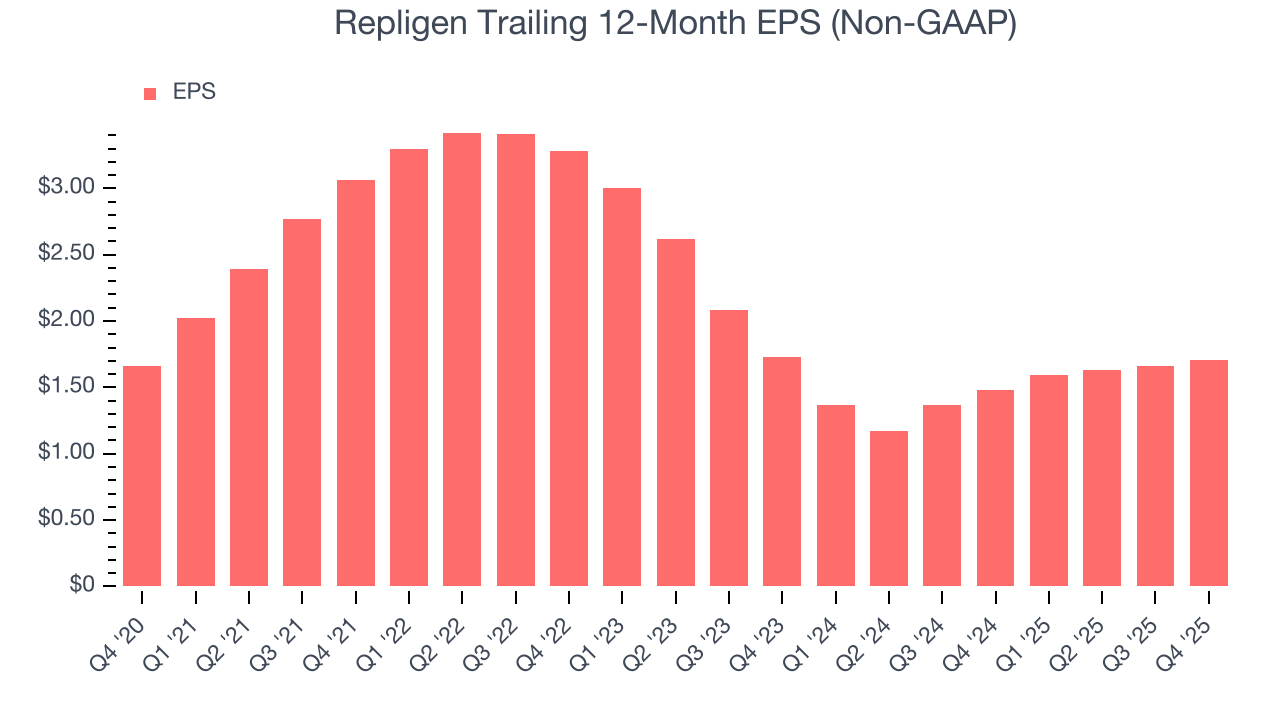

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Repligen’s flat EPS over the last five years was below its 15% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

We can take a deeper look into Repligen’s earnings to better understand the drivers of its performance. As we mentioned earlier, Repligen’s adjusted operating margin was flat this quarter but declined by 18.3 percentage points over the last five years. Its share count also grew by 3%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q4, Repligen reported adjusted EPS of $0.49, up from $0.44 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Repligen’s full-year EPS of $1.71 to grow 21.5%.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Repligen has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 13.5% over the last five years, better than the broader healthcare sector.

Taking a step back, we can see that Repligen’s margin expanded by 7 percentage points during that time. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell.

10. Return on Invested Capital (ROIC)

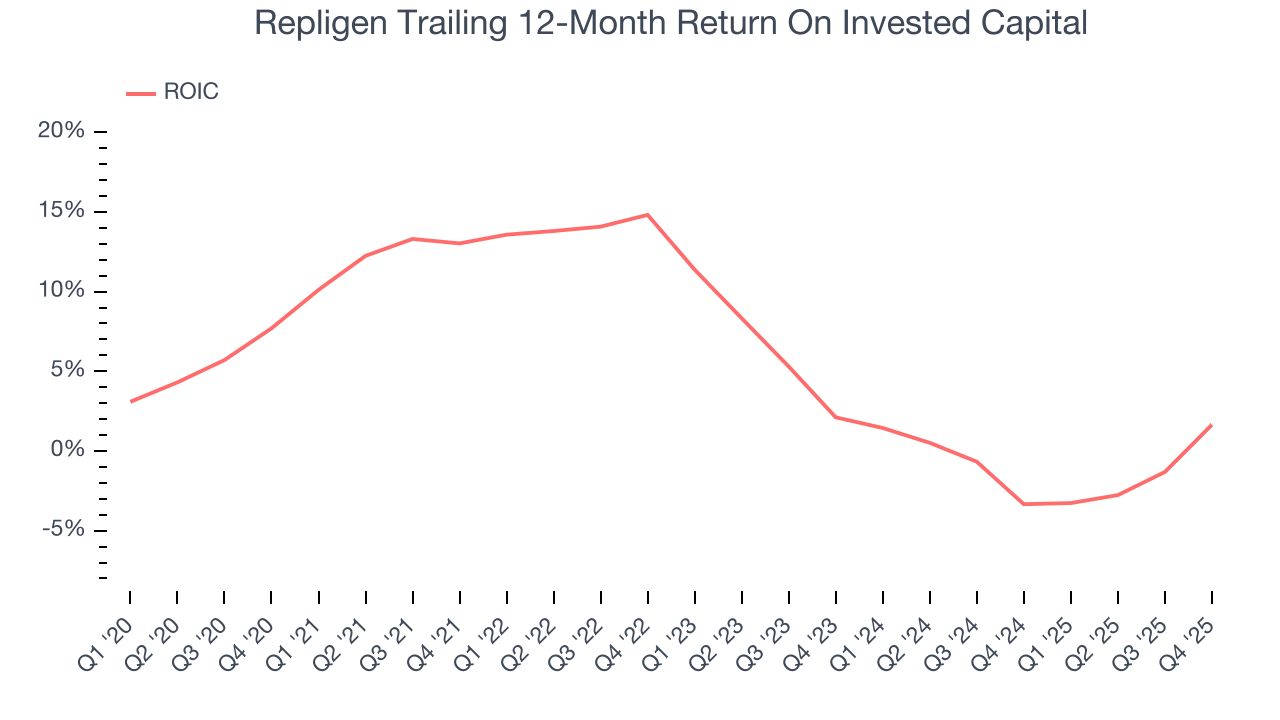

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Repligen historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 5.7%, somewhat low compared to the best healthcare companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Repligen’s ROIC has decreased significantly over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

11. Balance Sheet Assessment

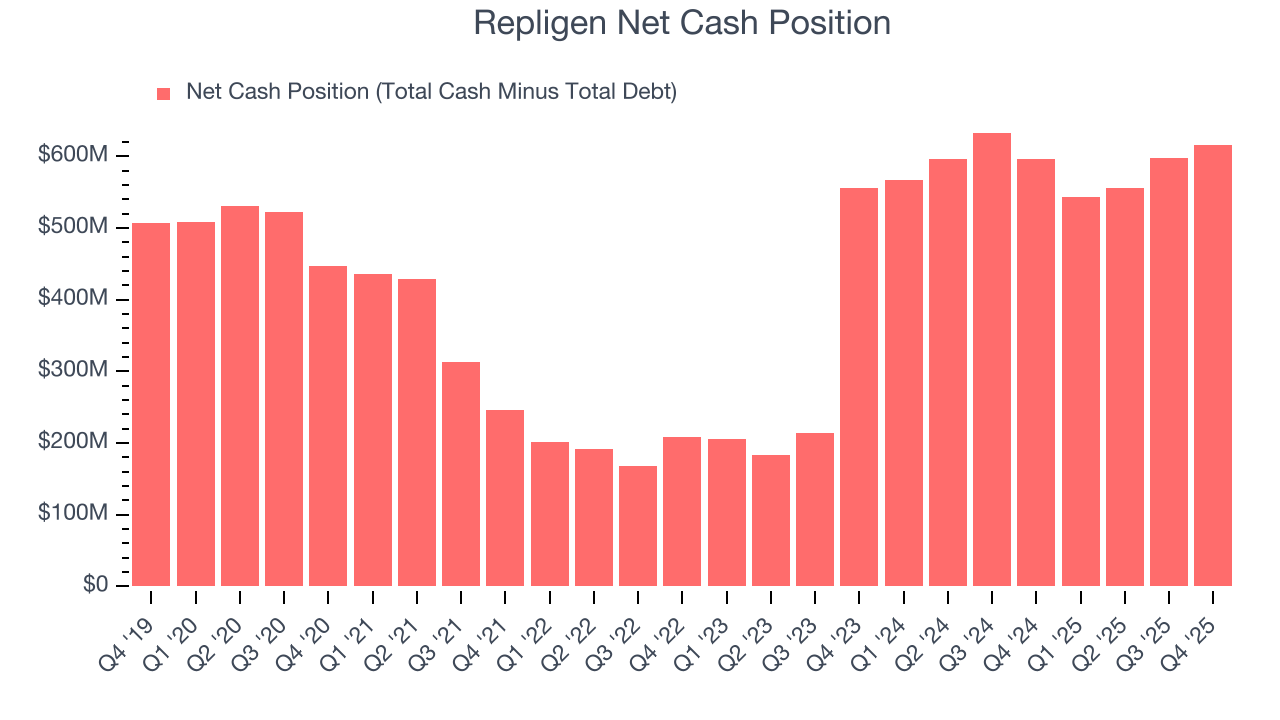

Businesses that maintain a cash surplus face reduced bankruptcy risk.

Repligen is a profitable, well-capitalized company with $767.6 million of cash and $151.4 million of debt on its balance sheet. This $616.2 million net cash position is 8.1% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Repligen’s Q4 Results

We enjoyed seeing Repligen beat analysts’ organic revenue expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. On the other hand, its full-year EPS guidance missed. Zooming out, we think this was a mixed quarter. Investors were likely hoping for more on the guidance front, and shares traded down 2.3% to $132.35 immediately following the results.

13. Is Now The Time To Buy Repligen?

Updated: March 2, 2026 at 11:39 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Repligen, you should also grasp the company’s longer-term business quality and valuation.

Repligen falls short of our quality standards. Although its revenue growth was solid over the last five years, it’s expected to deteriorate over the next 12 months and its declining adjusted operating margin shows the business has become less efficient. And while the company’s rising cash profitability gives it more optionality, the downside is its diminishing returns show management's prior bets haven't worked out.

Repligen’s P/E ratio based on the next 12 months is 65.6x. This multiple tells us a lot of good news is priced in - we think there are better opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $186.28 on the company (compared to the current share price of $124.97).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.