Strategic Education (STRA)

Strategic Education is in for a bumpy ride. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Strategic Education Will Underperform

Formed through the merger of Strayer Education and Capella Education in 2018, Strategic Education (NASDAQ:STRA) is a career-focused higher education provider.

- Annual revenue growth of 4.1% over the last five years was below our standards for the consumer discretionary sector

- Earnings per share fell by 1.7% annually over the last five years while its revenue grew, showing its incremental sales were much less profitable

- Subpar operating margin constrains its ability to invest in process improvements or effectively respond to new competitive threats

Strategic Education doesn’t pass our quality test. More profitable opportunities exist elsewhere.

Why There Are Better Opportunities Than Strategic Education

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Strategic Education

At $82.45 per share, Strategic Education trades at 12x forward P/E. Strategic Education’s valuation may seem like a bargain, especially when stacked up against other consumer discretionary companies. We remind you that you often get what you pay for, though.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Strategic Education (STRA) Research Report: Q4 CY2025 Update

Higher education company Strategic Education (NASDAQ:STRA) met Wall Street’s revenue expectations in Q4 CY2025, with sales up 3.8% year on year to $323.2 million. Its non-GAAP profit of $1.75 per share was 23.8% above analysts’ consensus estimates.

Strategic Education (STRA) Q4 CY2025 Highlights:

- Revenue: $323.2 million vs analyst estimates of $322.3 million (3.8% year-on-year growth, in line)

- Adjusted EPS: $1.75 vs analyst estimates of $1.41 (23.8% beat)

- Adjusted EBITDA: $75.34 million vs analyst estimates of $65.04 million (23.3% margin, 15.8% beat)

- Operating Margin: 16%, up from 11.6% in the same quarter last year

- Free Cash Flow Margin: 8.3%, up from 1.5% in the same quarter last year

- Domestic Students: 85,306, down 3,554 year on year

- Market Capitalization: $1.77 billion

Company Overview

Formed through the merger of Strayer Education and Capella Education in 2018, Strategic Education (NASDAQ:STRA) is a career-focused higher education provider.

Strategic Education operates through several divisions. Strayer University offers undergraduate and graduate degree programs for adult learners, focusing on business administration, accounting, information technology, and public administration. Capella University is known for its competency-based online learning model, offering degree programs in fields like nursing, business, counseling, and education.

Both universities offer flexible learning options, catering to the unique needs of working adults. This includes online classes, hybrid courses, and evening and weekend study options, allowing students to balance their education with work and family commitments.

In addition to degree programs, Strategic Education has expanded its offerings to include professional education and training. This includes short courses, professional certificates, and training programs in emerging fields such as digital marketing, cybersecurity, and data analytics.

Another aspect of Strategic Education's operations is its international segment. The company has invested in educational institutions in Australia, New Zealand, and other regions to broaden its global footprint.

4. Consumer Discretionary - Education Services

The Consumer Discretionary sector, by definition, is made up of companies selling non-essential goods and services. When economic conditions deteriorate or tastes shift, consumers can easily cut back or eliminate these purchases. For long-term investors with five-year holding periods, this creates a structural challenge: the sector is inherently hit-driven, with low switching costs and fickle customers. As a result, only a handful of companies can reliably grow demand and compound earnings over long periods, which is why our bar is high and High Quality ratings are rare.

Education services companies provide postsecondary instruction, professional certifications, test preparation, and corporate training, both online and in-person. Tailwinds include lifelong-learning demand driven by rapid technological change, employer-sponsored upskilling programs, and growing acceptance of online credentials. Headwinds are substantial: heavy regulatory oversight—particularly around student-loan eligibility and enrollment practices—can abruptly alter business models. Reputational risk from scrutiny over student outcomes and debt burdens constrains marketing strategies. Competition from free or low-cost digital alternatives (MOOCs, employer-built academies) pressures pricing.

Strategic Education's competitors include Adtalem Global Education (NYSE:ATGE), Grand Canyon Education (NASDAQ:LOPE), Perdoceo Education (NASDAQ:PRDO), and American Public Education (NASDAQ:APEI).

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Regrettably, Strategic Education’s sales grew at a weak 4.1% compounded annual growth rate over the last five years. This fell short of our benchmark for the consumer discretionary sector and is a tough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Strategic Education’s annualized revenue growth of 5.8% over the last two years is above its five-year trend, which is encouraging.

Strategic Education also discloses its number of domestic students and international students, which clocked in at 85,306 and 19,514 in the latest quarter. Over the last two years, both metrics have been flat. Because this performance is worse than its revenue during the same period, we can conclude the company’s monetization has risen.

This quarter, Strategic Education grew its revenue by 3.8% year on year, and its $323.2 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 3.5% over the next 12 months, a slight deceleration versus the last two years. This projection doesn't excite us and implies its products and services will see some demand headwinds.

6. Operating Margin

Strategic Education’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 13.3% over the last two years. This profitability was inadequate for a consumer discretionary business and caused by its suboptimal cost structure.

This quarter, Strategic Education generated an operating margin profit margin of 16%, up 4.4 percentage points year on year. This increase was a welcome development and shows it was more efficient.

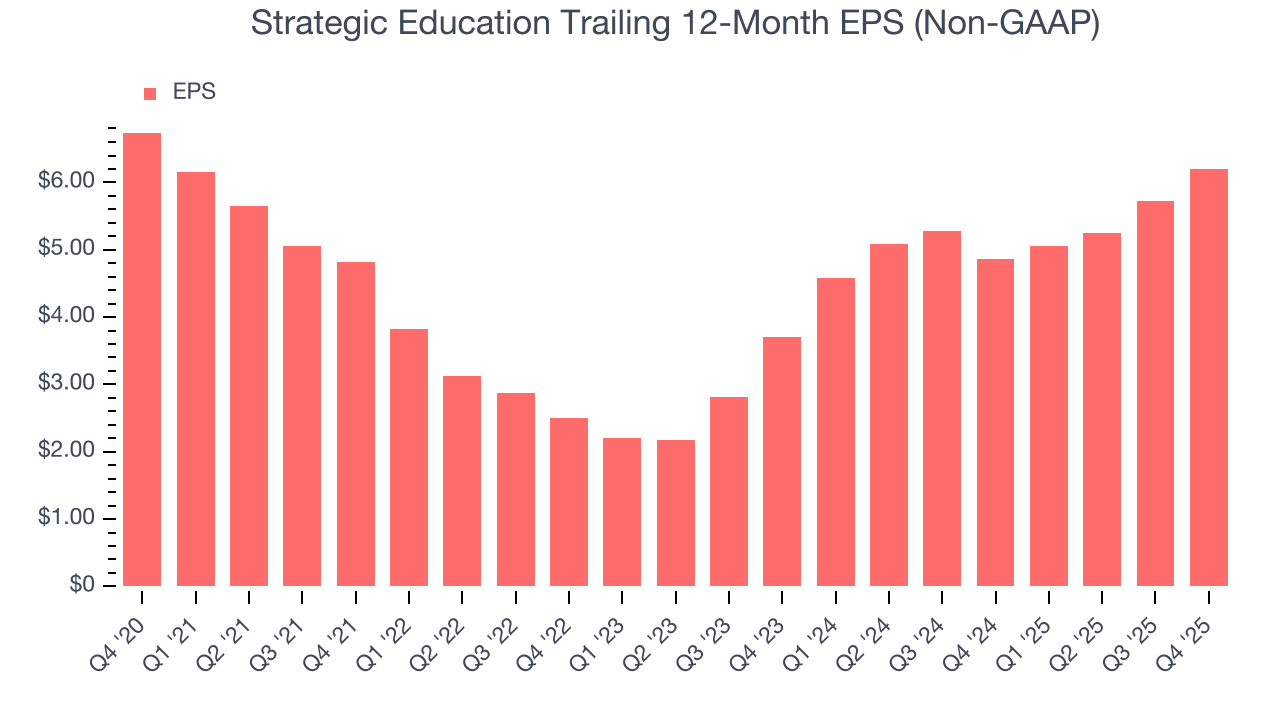

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Strategic Education, its EPS declined by 1.7% annually over the last five years while its revenue grew by 4.1%. We can see the difference stemmed from higher interest expenses or taxes as the company actually improved its operating margin and repurchased its shares during this time.

In Q4, Strategic Education reported adjusted EPS of $1.75, up from $1.27 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Strategic Education’s full-year EPS of $6.20 to grow 3.5%.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Strategic Education has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 11.4%, lousy for a consumer discretionary business.

Strategic Education’s free cash flow clocked in at $26.95 million in Q4, equivalent to a 8.3% margin. This result was good as its margin was 6.8 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends carry greater meaning.

Over the next year, analysts predict Strategic Education’s cash conversion will slightly fall. Their consensus estimates imply its free cash flow margin of 12.1% for the last 12 months will decrease to 10.8%.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Strategic Education historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 4.4%, lower than the typical cost of capital (how much it costs to raise money) for consumer discretionary companies.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Strategic Education’s ROIC averaged 4.7 percentage point increases each year. This is a good sign, and we hope the company can continue improving.

10. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

Strategic Education is a profitable, well-capitalized company with $148.1 million of cash and $109.1 million of debt on its balance sheet. This $38.93 million net cash position is 2.2% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from Strategic Education’s Q4 Results

It was good to see Strategic Education beat analysts’ EPS expectations this quarter. We were also glad its EBITDA outperformed Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 1.9% to $79.88 immediately following the results.

12. Is Now The Time To Buy Strategic Education?

Updated: March 8, 2026 at 10:53 PM EDT

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

Strategic Education doesn’t pass our quality test. On top of that, Strategic Education’s number of international students has disappointed, and its Forecasted free cash flow margin for next year suggests the company will fail to improve its cash conversion.

Strategic Education’s P/E ratio based on the next 12 months is 12x. While this valuation is reasonable, we don’t see a big opportunity at the moment. There are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $98.33 on the company (compared to the current share price of $82.45).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.