Wingstop (WING)

We like Wingstop. Its rare blend of high growth, robust profitability, and a strong outlook makes it a wonderful asset.― StockStory Analyst Team

1. News

2. Summary

Why We Like Wingstop

The passion project of two chicken wing aficionados in Texas, Wingstop (NASDAQ:WING) is a popular fast-food chain known for its flavorful and crispy chicken wings offered in a variety of sauces and seasonings.

- Rapid rollout of new restaurants to capitalize on market opportunities makes sense given its strong same-store sales performance

- Impressive 24.1% annual revenue growth over the last six years indicates it’s winning market share

- Successful business model is illustrated by its impressive operating margin

We expect great things from Wingstop. There are plenty of reasons to like the stock.

Is Now The Time To Buy Wingstop?

High Quality

Investable

Underperform

Is Now The Time To Buy Wingstop?

Wingstop’s stock price of $254.15 implies a valuation ratio of 50.1x forward P/E. There’s no arguing the market has lofty expectations given its premium multiple.

Are you a fan of the business model? If so, we suggest a small position as the long-term outlook seems promising. Keep in mind that its premium valuation could result in rocky short-term stock performance.

3. Wingstop (WING) Research Report: Q4 CY2025 Update

Fast-food chain Wingstop (NASDAQ:WING) fell short of the market’s revenue expectations in Q4 CY2025, but sales rose 8.6% year on year to $175.7 million. Its non-GAAP profit of $1 per share was 20% above analysts’ consensus estimates.

Wingstop (WING) Q4 CY2025 Highlights:

- Revenue: $175.7 million vs analyst estimates of $177.8 million (8.6% year-on-year growth, 1.2% miss)

- Adjusted EPS: $1 vs analyst estimates of $0.83 (20% beat)

- Adjusted EBITDA: $61.88 million vs analyst estimates of $58.14 million (35.2% margin, 6.4% beat)

- Operating Margin: 26.7%, in line with the same quarter last year

- Locations: 3,056 at quarter end, up from 2,563 in the same quarter last year

- Same-Store Sales fell 5.8% year on year (10.1% in the same quarter last year)

- Market Capitalization: $7.00 billion

Company Overview

The passion project of two chicken wing aficionados in Texas, Wingstop (NASDAQ:WING) is a popular fast-food chain known for its flavorful and crispy chicken wings offered in a variety of sauces and seasonings.

The company was founded in 1994 by Antonio Swad and Bernadette Fiaschetti, who had an unwavering focus on quality. This ethos is reflected in its wings, which use fresh, never-frozen chicken cooked with unique techniques, ensuring consistently crispy and golden exteriors.

What earned Wingstop such a loyal following was not only its affordable, high-quality wings but also its assortment of tantalizing sauces and seasonings that include flavors like original hot and hickory smoked BBQ to innovative creations like mango habanero and lemon pepper.

Wingstop's commitment to exceptional dining experiences extends beyond its mouthwatering sauce-covered wings. The company seeks to creating a welcoming and vibrant atmosphere in its restaurants, inviting customers to savor their meals in a comfortable and friendly setting. Customers typically order at a counter with a register and can enjoy their meals at tables or booths.

For those seeking convenience, Wingstop also has a mobile app and website that provide seamless online ordering, takeout, and delivery options, ensuring that customers can enjoy their favorite wings wherever and whenever they please.

4. Modern Fast Food

Modern fast food is a relatively newer category representing a middle ground between traditional fast food and sit-down restaurants. These establishments feature an expanded menu selection priced above traditional fast food options, often incorporating fresher and cleaner ingredients to serve customers prioritizing quality. These eateries are capitalizing on the perception that your drive-through burger and fries joint is detrimental to your health because of inferior ingredients.

Some competitors with counter service concepts include Noodles & Company (NASDAQ:NDLS), Potbelly (NASDAQ:PBPB), Shake Shack (NYSE:SHAK), and The Habit Burger Grill (owned by YUM! Brands, NYSE:YUM).

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

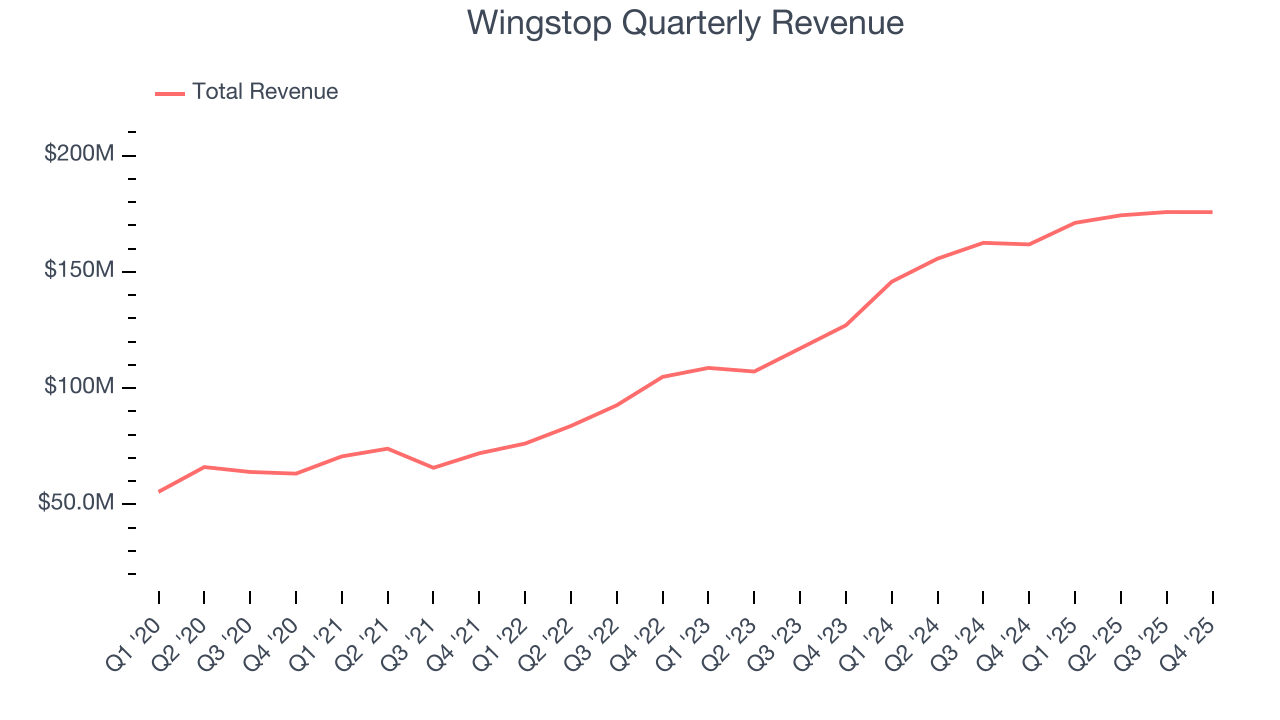

With $696.9 million in revenue over the past 12 months, Wingstop is a small restaurant chain, which sometimes brings disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale. On the bright side, it can grow faster because it has more white space to build new restaurants.

As you can see below, Wingstop’s sales grew at an incredible 23.2% compounded annual growth rate over the last six years as it opened new restaurants and increased sales at existing, established dining locations.

This quarter, Wingstop’s revenue grew by 8.6% year on year to $175.7 million, missing Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 17.2% over the next 12 months, a deceleration versus the last six years. Still, this projection is admirable and implies the market is forecasting success for its menu offerings.

6. Restaurant Performance

Number of Restaurants

A restaurant chain’s total number of dining locations influences how much it can sell and how quickly revenue can grow.

Wingstop sported 3,056 locations in the latest quarter. Over the last two years, it has opened new restaurants at a rapid clip by averaging 17.3% annual growth, among the fastest in the restaurant sector. This gives it a chance to scale into a mid-sized business over time. Additionally, one dynamic making expansion more seamless is the company’s franchise model, where franchisees are primarily responsible for opening new restaurants while Wingstop provides support.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

Same-Store Sales

A company's restaurant base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales provides a deeper understanding of this issue because it measures organic growth at restaurants open for at least a year.

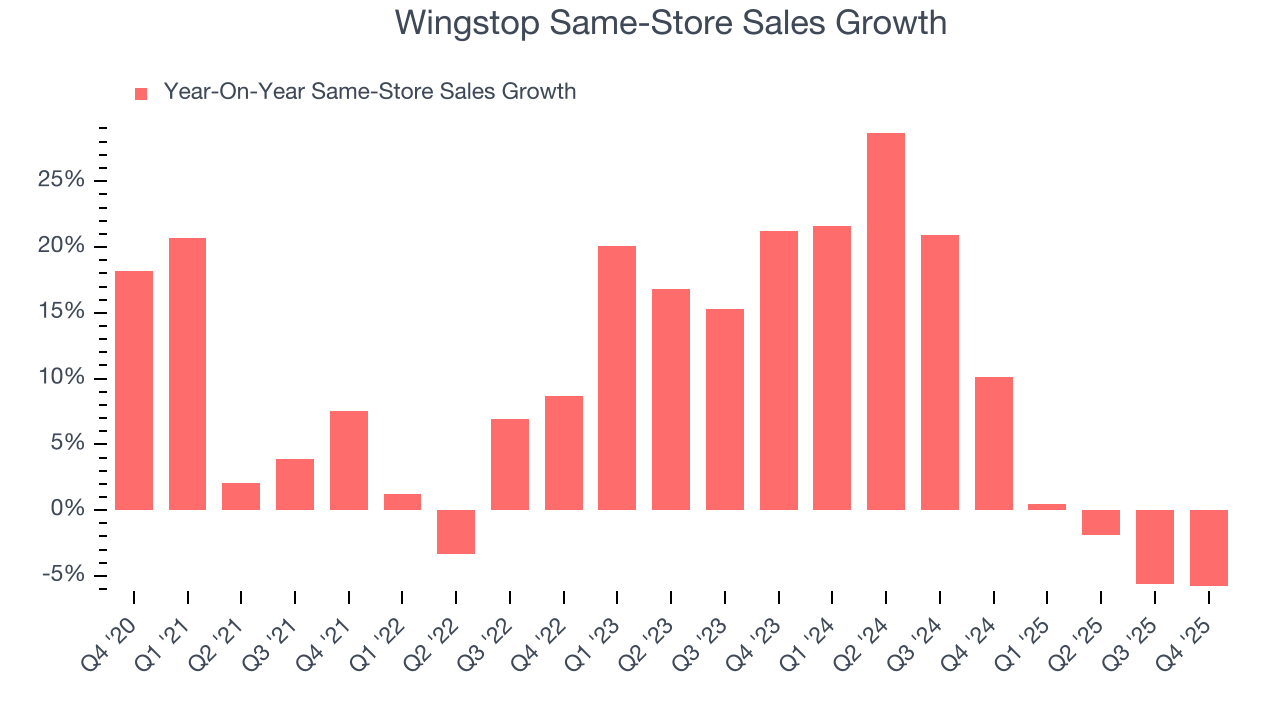

Wingstop has been one of the most successful restaurant chains over the last two years thanks to skyrocketing demand within its existing dining locations. On average, the company has posted exceptional year-on-year same-store sales growth of 8.6%. This performance along with its meaningful buildout of new restaurants suggest it’s playing some aggressive offense.

In the latest quarter, Wingstop’s same-store sales fell by 5.8% year on year. This decline was a reversal from its historical levels. A one quarter hiccup shouldn’t deter you from investing in a business, and we’ll be monitoring the company to see how things progress.

7. Gross Margin & Pricing Power

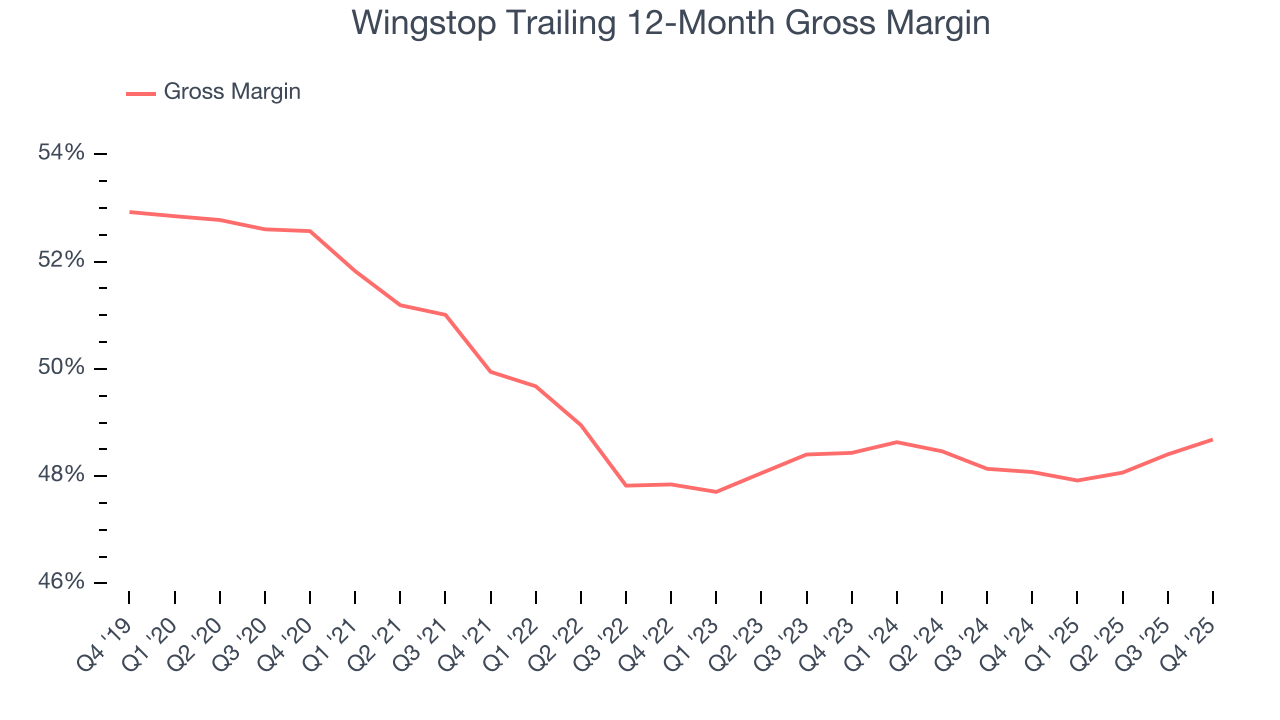

Wingstop has best-in-class unit economics for a restaurant company, enabling it to invest in areas such as marketing and talent. As you can see below, it averaged an elite 48.4% gross margin over the last two years. That means Wingstop only paid its suppliers $51.60 for every $100 in revenue.

This quarter, Wingstop’s gross profit margin was 49.3%, up 1.1 percentage points year on year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as ingredients and transportation expenses) have been stable and it isn’t under pressure to lower prices.

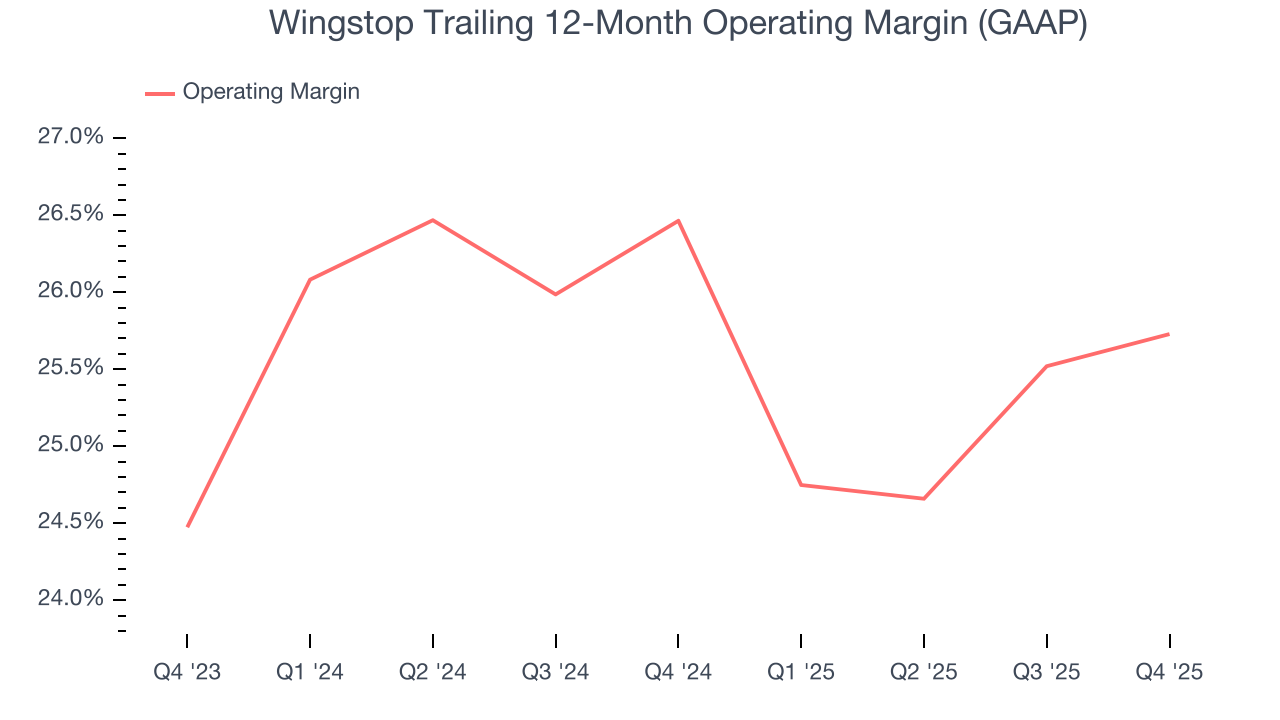

8. Operating Margin

Wingstop’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 26.1% over the last two years. This profitability was elite for a restaurant business thanks to its efficient cost structure and economies of scale. This is seen in its fast historical revenue growth and healthy gross margin, which is why we look at all three data points together.

Looking at the trend in its profitability, Wingstop’s operating margin might fluctuated slightly but has generally stayed the same over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Wingstop generated an operating margin profit margin of 26.7%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

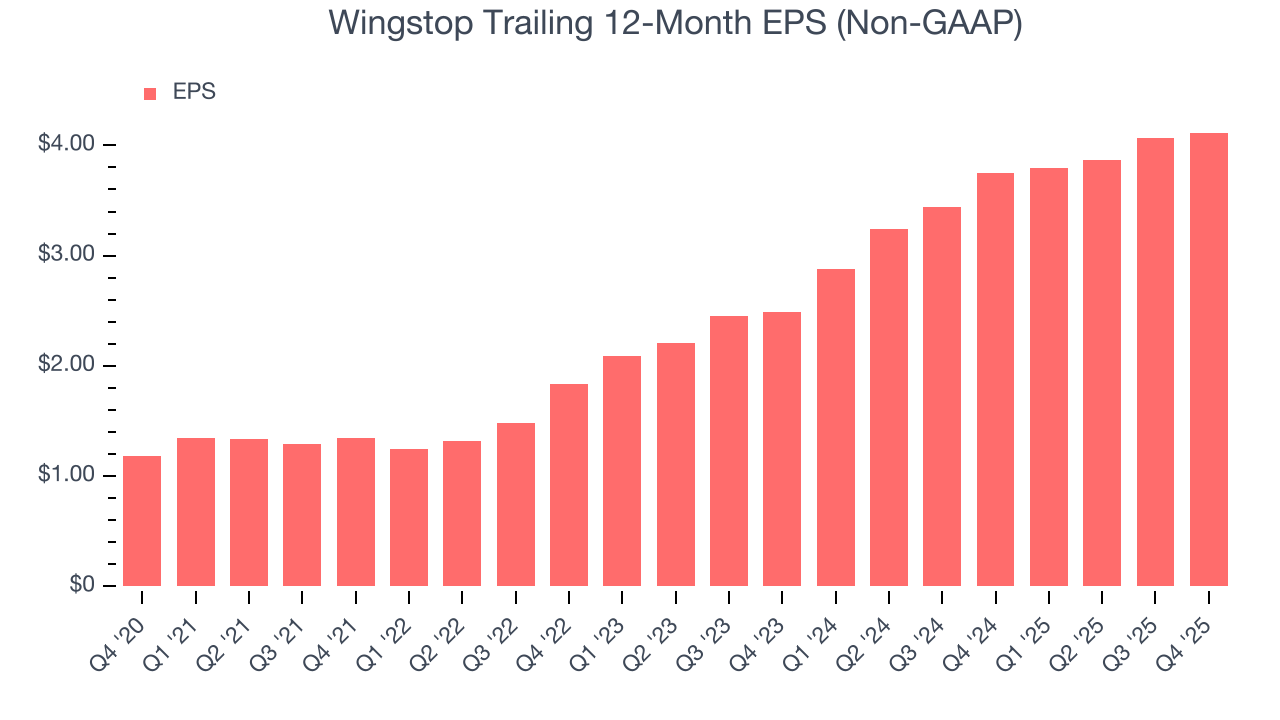

9. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Wingstop’s EPS grew at a remarkable 33.4% compounded annual growth rate over the last six years, higher than its 23.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

In Q4, Wingstop reported adjusted EPS of $1, up from $0.95 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Wingstop’s full-year EPS of $4.12 to grow 15.7%.

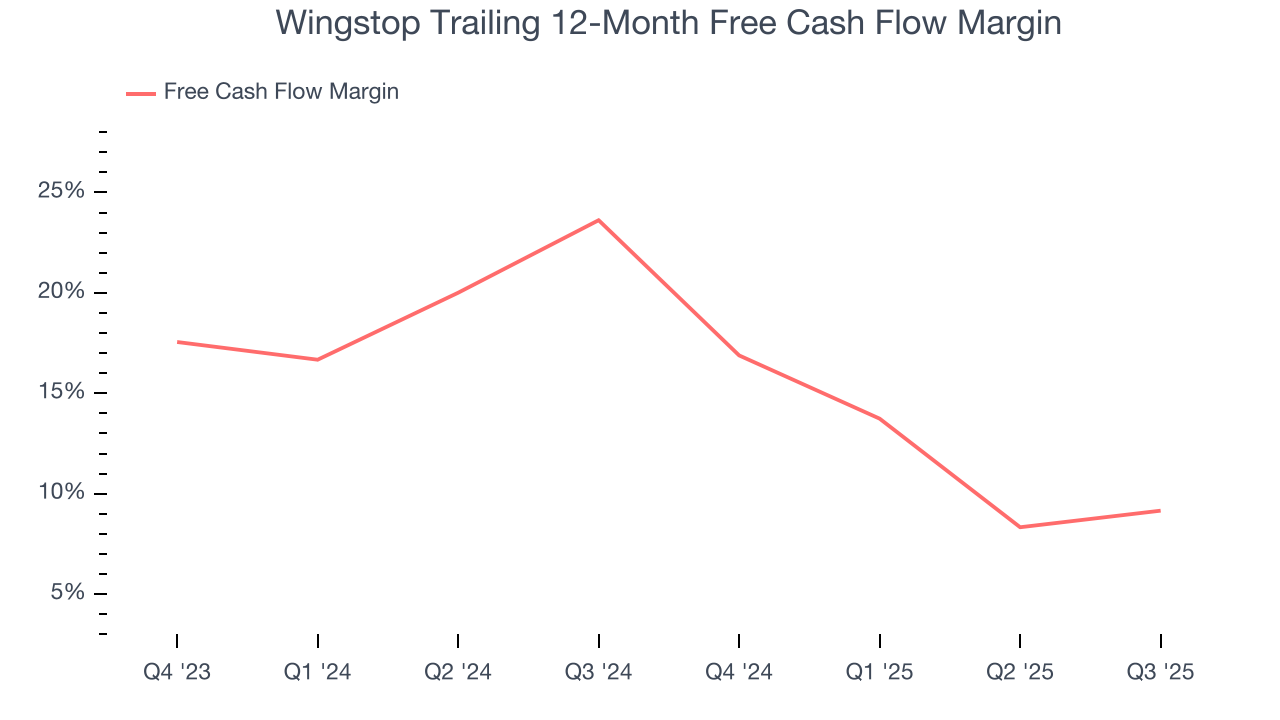

10. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Wingstop has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition. The company’s free cash flow margin was among the best in the restaurant sector, averaging 15.4% over the last two years.

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Wingstop’s five-year average ROIC was 56.3%, placing it among the best restaurant companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

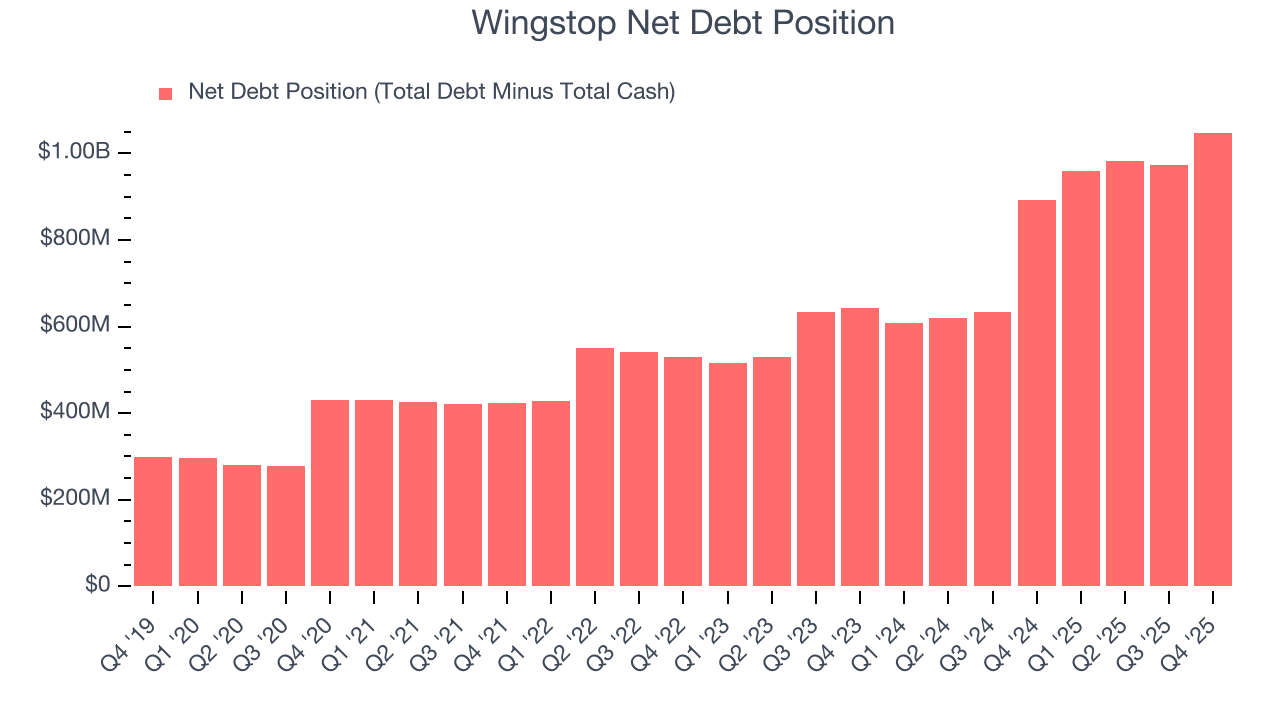

12. Balance Sheet Assessment

Wingstop reported $222.6 million of cash and $1.27 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $226.6 million of EBITDA over the last 12 months, we view Wingstop’s 4.6× net-debt-to-EBITDA ratio as safe. We also see its $76.46 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

13. Key Takeaways from Wingstop’s Q4 Results

We enjoyed seeing Wingstop beat analysts’ EBITDA expectations this quarter. We were also glad its same-store sales outperformed Wall Street’s estimates. On the other hand, its revenue slightly missed. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 12.6% to $283.51 immediately following the results.

14. Is Now The Time To Buy Wingstop?

Updated: February 18, 2026 at 7:56 AM EST

Before making an investment decision, investors should account for Wingstop’s business fundamentals and valuation in addition to what happened in the latest quarter.

Wingstop is an amazing business ranking highly on our list. For starters, its revenue growth was exceptional over the last six years. And while its brand caters to a niche market, its marvelous same-store sales growth is on another level. On top of that, Wingstop’s new restaurant openings have increased its brand equity.

Wingstop’s P/E ratio based on the next 12 months is 52.9x. Expectations are high given its premium multiple, but we’ll happily own Wingstop as its fundamentals illustrate it’s clearly doing something special. We’re in the camp that investments like this should be held for at least three to five years to negate the short-term price volatility that can come with high valuations.

Wall Street analysts have a consensus one-year price target of $324.21 on the company (compared to the current share price of $283.51).