AMETEK (AME)

AMETEK is intriguing. It not only produces heaps of cash but also has improved its profitability, showing its quality is rising.― StockStory Analyst Team

1. News

2. Summary

Why AMETEK Is Interesting

Started from its humble beginnings in motor repair, AMETEK (NYSE:AME) manufactures electronic devices used in industries like aerospace, power, and healthcare.

- Disciplined cost controls and effective management have materialized in a strong operating margin, and it turbocharged its profits by achieving some fixed cost leverage

- Powerful free cash flow generation enables it to reinvest its profits or return capital to investors consistently, and its rising cash conversion increases its margin of safety

- The stock is slightly expensive, and we suggest waiting until its quality rises or its valuation falls

AMETEK shows some promise. This is a good stock to keep your eye on.

Why Should You Watch AMETEK

High Quality

Investable

Underperform

Why Should You Watch AMETEK

At $226.84 per share, AMETEK trades at 29.2x forward P/E. This valuation is richer than that of industrials peers.

AMETEK can improve its fundamentals over time by putting up good numbers quarter after quarter, year after year. Once that happens, we’ll be happy to recommend the stock.

3. AMETEK (AME) Research Report: Q4 CY2025 Update

Electronic products manufacturer AMETEK (NYSE:AME) reported revenue ahead of Wall Streets expectations in Q4 CY2025, with sales up 13.4% year on year to $2.00 billion. The company expects next quarter’s revenue to be around $1.91 billion, close to analysts’ estimates. Its non-GAAP profit of $2.01 per share was 3.4% above analysts’ consensus estimates.

AMETEK (AME) Q4 CY2025 Highlights:

- Revenue: $2.00 billion vs analyst estimates of $1.95 billion (13.4% year-on-year growth, 2.6% beat)

- Adjusted EPS: $2.01 vs analyst estimates of $1.94 (3.4% beat)

- Revenue Guidance for Q1 CY2026 is $1.91 billion at the midpoint, roughly in line with what analysts were expecting

- Adjusted EPS guidance for the upcoming financial year 2026 is $7.97 at the midpoint, in line with analyst estimates

- Operating Margin: 25.3%, down from 26.6% in the same quarter last year

- Free Cash Flow Margin: 26.4%, down from 28.3% in the same quarter last year

- Market Capitalization: $52.42 billion

Company Overview

Started from its humble beginnings in motor repair, AMETEK (NYSE:AME) manufactures electronic devices used in industries like aerospace, power, and healthcare.

AMETEK was founded in 1930 as a manufacturer of heavy-duty air-moving motors and compressors. In the 1960s, AMETEK began to diversify its product line, branching into instruments and precision components, which laid the groundwork for its future focus on electronic instruments and electromechanical devices. This period marked a significant pivot from its original industrial roots to more specialized markets, including aerospace and defense.

Today, AMETEK's product offerings span a range of highly engineered solutions, including advanced instruments for the aerospace sector, such as aircraft sensors and power quality monitoring instruments, as well as precision motion control systems used in medical and semiconductor manufacturing. The company also produces a variety of consumables for industrial applications, including specialized electrical connectors and electronics packaging used in aerospace, defense, and medical industries. Furthermore, under its diverse brand portfolio, AMETEK provides critical components like heat exchangers and environmental control systems for aerospace and defense.

AMETEK markets its products through a combination of direct sales forces and specialized distributors and sales representatives, tailored to the needs of each business segment and market. For its highly technical products, the company utilizes direct sales teams, complemented by specialized distributors who help reach broader markets. In the aerospace sector, AMETEK engages directly with a specialized customer base, including aircraft and jet engine manufacturers, through sales engineers who are equipped to handle the technical aspects of the products.

AMETEK's revenue is primarily derived from the sale of its wide range of highly engineered electrical and electronic instruments and electromechanical devices. Additionally, the company generates significant revenue from aftermarket services, which are a crucial part of its business model. These services include spare part sales, repairs, and overhaul services. The company’s aftermarket services help to ensure customer retention and provide a steady flow of revenue beyond initial product sales. This includes providing ongoing maintenance and support for the sophisticated devices and systems they supply. These services not only extend the life cycle of the products but also enhance customer reliance on AMETEK for continuous operational efficiency.

AMETEK's aggressive acquisition strategy is central to its growth model, with the company actively pursuing acquisitions that strategically complement its existing operations. For instance, from 2019-2023, AMETEK successfully integrated 15 companies with combined annual sales of approximately $1.6 billion.

4. Internet of Things

Industrial Internet of Things (IoT) companies are buoyed by the secular trend of a more connected world. They often specialize in nascent areas such as hardware and services for factory automation, fleet tracking, or smart home technologies. Those who play their cards right can generate recurring subscription revenues by providing cloud-based software services, boosting their margins. On the other hand, if the technologies these companies have invested in don’t pan out, they may have to make costly pivots.

Competitors of AMETEK include Danaher (NYSE:DHR), Agilent (NYSE:A), and Honeywell (NASDAQ:HON).

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, AMETEK’s 10.3% annualized revenue growth over the last five years was solid. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. AMETEK’s recent performance shows its demand has slowed as its annualized revenue growth of 5.9% over the last two years was below its five-year trend.

This quarter, AMETEK reported year-on-year revenue growth of 13.4%, and its $2.00 billion of revenue exceeded Wall Street’s estimates by 2.6%. Company management is currently guiding for a 10% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 6.8% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and implies its newer products and services will not accelerate its top-line performance yet.

6. Gross Margin & Pricing Power

Gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor.

AMETEK’s gross margin is good compared to other industrials businesses and signals it sells differentiated products, not commodities. As you can see below, it averaged an impressive 35.6% gross margin over the last five years. That means for every $100 in revenue, roughly $35.61 was left to spend on selling, marketing, R&D, and general administrative overhead.

AMETEK produced a 36% gross profit margin in Q4, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

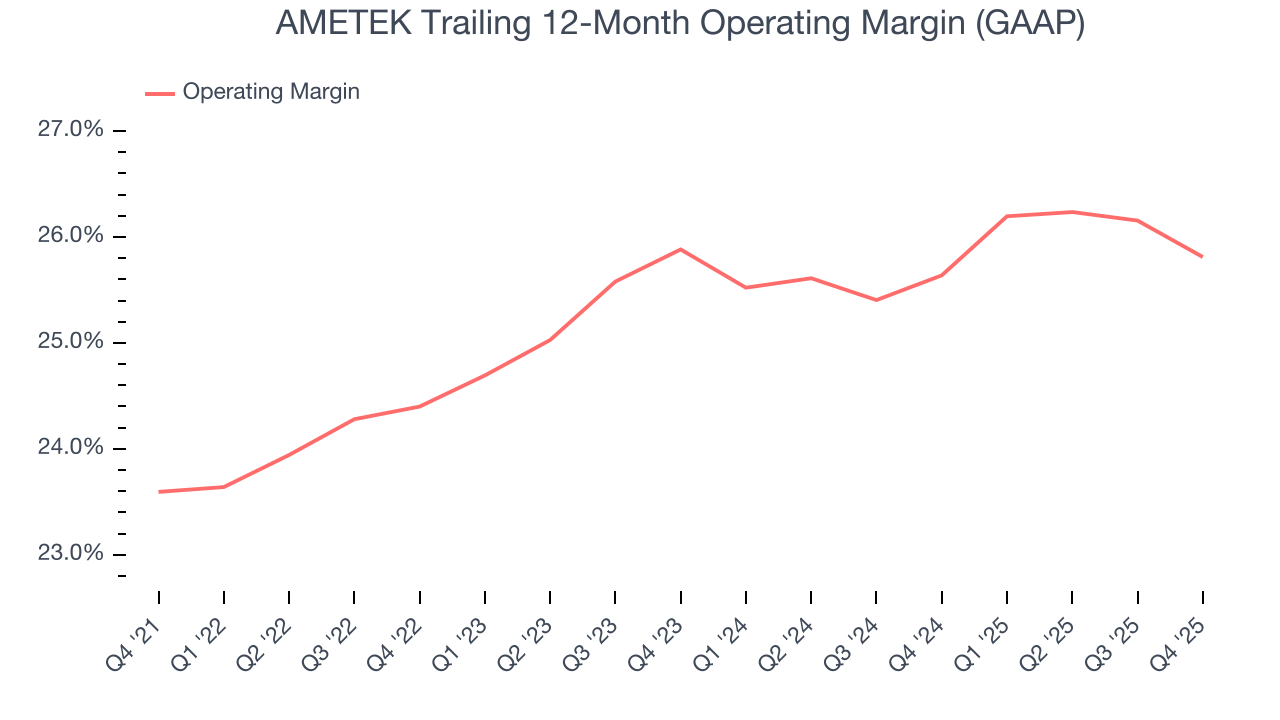

AMETEK has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 25.1%. This result isn’t too surprising as its gross margin gives it a favorable starting point.

Looking at the trend in its profitability, AMETEK’s operating margin rose by 2.2 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, AMETEK generated an operating margin profit margin of 25.3%, down 1.3 percentage points year on year. Since AMETEK’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

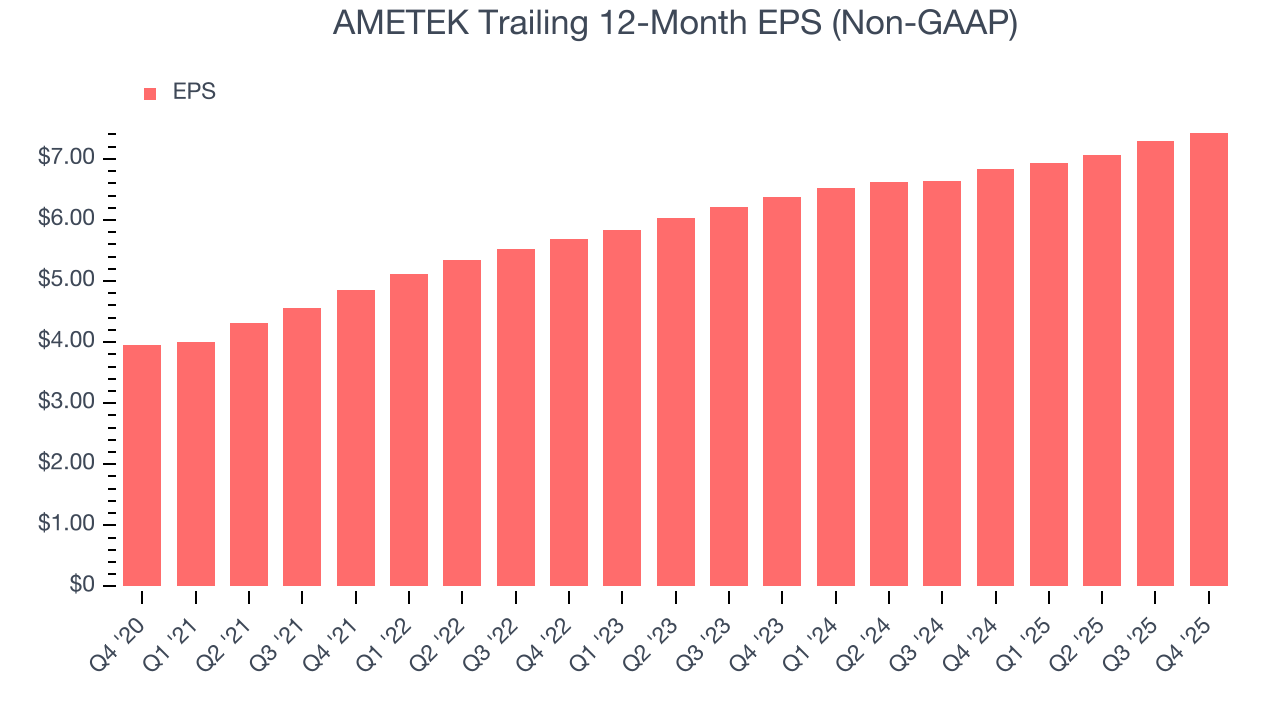

AMETEK’s EPS grew at a remarkable 13.5% compounded annual growth rate over the last five years, higher than its 10.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into AMETEK’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, AMETEK’s operating margin declined this quarter but expanded by 2.2 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For AMETEK, its two-year annual EPS growth of 7.9% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q4, AMETEK reported adjusted EPS of $2.01, up from $1.87 in the same quarter last year. This print beat analysts’ estimates by 3.4%. Over the next 12 months, Wall Street expects AMETEK’s full-year EPS of $7.43 to grow 7.8%.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

AMETEK has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 21.5% over the last five years.

Taking a step back, we can see that AMETEK’s margin expanded by 3.7 percentage points during that time. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

AMETEK’s free cash flow clocked in at $527.3 million in Q4, equivalent to a 26.4% margin. The company’s cash profitability regressed as it was 1.9 percentage points lower than in the same quarter last year, but it’s still above its five-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, leading to short-term swings. Long-term trends are more important.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although AMETEK hasn’t been the highest-quality company lately, it historically found a few growth initiatives that worked. Its five-year average ROIC was 12.9%, higher than most industrials businesses.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Uneventfully, AMETEK’s ROIC has stayed the same over the last few years. Given the company’s underwhelming financial performance in other areas, we’d like to see its returns improve before recommending the stock.

11. Balance Sheet Assessment

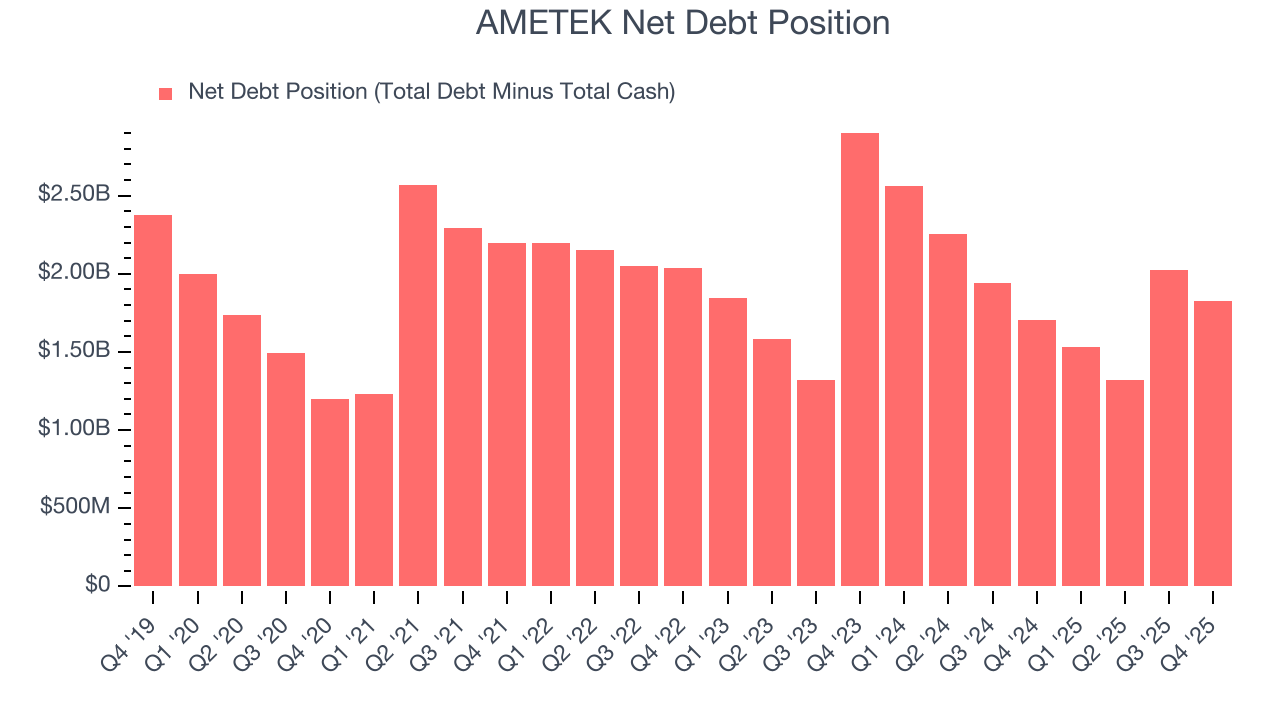

AMETEK reported $458 million of cash and $2.28 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $2.36 billion of EBITDA over the last 12 months, we view AMETEK’s 0.8× net-debt-to-EBITDA ratio as safe. We also see its $35.47 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from AMETEK’s Q4 Results

We enjoyed seeing AMETEK beat analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its EPS guidance for next quarter slightly missed and its full-year EPS guidance was in line with Wall Street’s estimates. Overall, this print was mixed. The stock remained flat at $228.09 immediately following the results.

13. Is Now The Time To Buy AMETEK?

Updated: March 5, 2026 at 10:32 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in AMETEK.

There are some positives when it comes to AMETEK’s fundamentals. First off, its revenue growth was solid over the last five years. On top of that, AMETEK’s powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits, and its impressive operating margins show it has a highly efficient business model.

AMETEK’s P/E ratio based on the next 12 months is 29.2x. This valuation tells us it’s a bit of a market darling with a lot of good news priced in. This is a good one to add to your watchlist - there are better opportunities elsewhere at the moment.

Wall Street analysts have a consensus one-year price target of $249.18 on the company (compared to the current share price of $226.84).