Bally's (BALY)

Bally's faces an uphill battle. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Bally's Will Underperform

Headquartered in Providence, Rhode Island, Bally's Corporation (NYSE:BALY) is a diversified global casino-entertainment company that owns and manages casinos, resorts, and online gaming platforms.

- 2% annual revenue growth over the last two years was slower than its consumer discretionary peers

- Performance over the past five years shows its incremental sales were much less profitable, as its earnings per share fell by 75.4% annually

- Unfavorable liquidity position could lead to additional equity financing that dilutes shareholders

Bally's doesn’t satisfy our quality benchmarks. We’ve identified better opportunities elsewhere.

Why There Are Better Opportunities Than Bally's

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Bally's

At $13.41 per share, Bally's trades at 10.9x forward EV-to-EBITDA. While valuation is appropriate for the quality you get, we’re still on the sidelines for now.

We prefer to invest in similarly-priced but higher-quality companies with superior earnings growth.

3. Bally's (BALY) Research Report: Q3 CY2025 Update

Gaming, betting and entertainment company Bally's Corporation (NYSE:BALY) missed Wall Street’s revenue expectations in Q3 CY2025, but sales rose 5.4% year on year to $663.7 million. Its GAAP loss of $1.70 per share was significantly below analysts’ consensus estimates.

Bally's (BALY) Q3 CY2025 Highlights:

- Revenue: $663.7 million vs analyst estimates of $668.5 million (5.4% year-on-year growth, 0.7% miss)

- EPS (GAAP): -$1.70 vs analyst estimates of -$0.48 (significant miss)

- Adjusted EBITDA: $130.6 million vs analyst estimates of $128.9 million (19.7% margin, 1.4% beat)

- Operating Margin: 0.1%, up from -25% in the same quarter last year

- Free Cash Flow was -$161.2 million compared to -$55.52 million in the same quarter last year

- Market Capitalization: $799.7 million

Company Overview

Headquartered in Providence, Rhode Island, Bally's Corporation (NYSE:BALY) is a diversified global casino-entertainment company that owns and manages casinos, resorts, and online gaming platforms.

Bally's Corporation provides a wide range of services and products, primarily centered around casino gaming. This includes a variety of slot machines and table games along with digital gaming and sports betting platforms. The company also offers non-gaming amenities such as hotel accommodations, dining experiences, live entertainment, and recreational facilities. Its offerings seek to provide a comprehensive entertainment experience, catering to both gaming enthusiasts and casual visitors.

The company's revenue streams are diversified across different channels. These include earnings from casino operations, hotel accommodations, food and beverage services, and online gaming platforms. Bally's business model is built on a mix of direct revenue generation from its properties and partnerships in the digital gaming sectors.

4. Casino Operator

Casino operators enjoy limited competition because gambling is a highly regulated industry. These companies can also enjoy healthy margins and profits. Have you ever heard the phrase ‘the house always wins’? Regulation cuts both ways, however, and casinos may face stroke-of-the-pen risk that suddenly limits what they can or can't do and where they can do it. Furthermore, digitization is changing the game, pun intended. Whether it’s online poker or sports betting on your smartphone, innovation is forcing these players to adapt to changing consumer preferences, such as being able to wager anywhere on demand.

Competitors operating in the casino-entertainment sector include Caesars Entertainment (NASDAQ:CZR), MGM Resorts (NYSE:MGM), and Wynn Resorts (NASDAQ:WYNN).

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, Bally’s sales grew at an incredible 45.5% compounded annual growth rate over the last five years. Its growth beat the average consumer discretionary company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Bally’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 2% over the last two years was well below its five-year trend. Note that COVID hurt Bally’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

Bally's also breaks out the revenue for its most important segments, Gaming and Non-gaming, which are 82% and 18% of revenue. Over the last two years, Bally’s Gaming revenue (casino games, racing, sports betting) averaged 24.9% year-on-year growth while its Non-gaming revenue (hotel, food, retail) averaged 12.4% growth.

This quarter, Bally’s revenue grew by 5.4% year on year to $663.7 million, missing Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 13.3% over the next 12 months, an improvement versus the last two years. This projection is above average for the sector and suggests its newer products and services will fuel better top-line performance.

6. Operating Margin

Bally’s operating margin has risen over the last 12 months, but it still averaged negative 11.5% over the last two years. This is due to its large expense base and inefficient cost structure.

In Q3, Bally’s breakeven margin was up 25.2 percentage points year on year. This increase was a welcome development and shows it was more efficient.

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Bally’s earnings losses deepened over the last five years as its EPS dropped 76.2% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. Consumer Discretionary companies are particularly exposed to this, and if the tide turns unexpectedly, Bally’s low margin of safety could leave its stock price susceptible to large downswings.

In Q3, Bally's reported EPS of negative $1.70, up from negative $5.10 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street expects Bally's to improve its earnings losses. Analysts forecast its full-year EPS of negative $7.31 will advance to negative $2.32.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Over the last two years, Bally’s demanding reinvestments to stay relevant have drained its resources, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 6.6%, meaning it lit $6.63 of cash on fire for every $100 in revenue.

Bally's burned through $161.2 million of cash in Q3, equivalent to a negative 24.3% margin. The company’s cash burn increased from $55.52 million of lost cash in the same quarter last year.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Bally’s five-year average ROIC was negative 0.8%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer discretionary sector.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Bally’s ROIC has decreased significantly over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

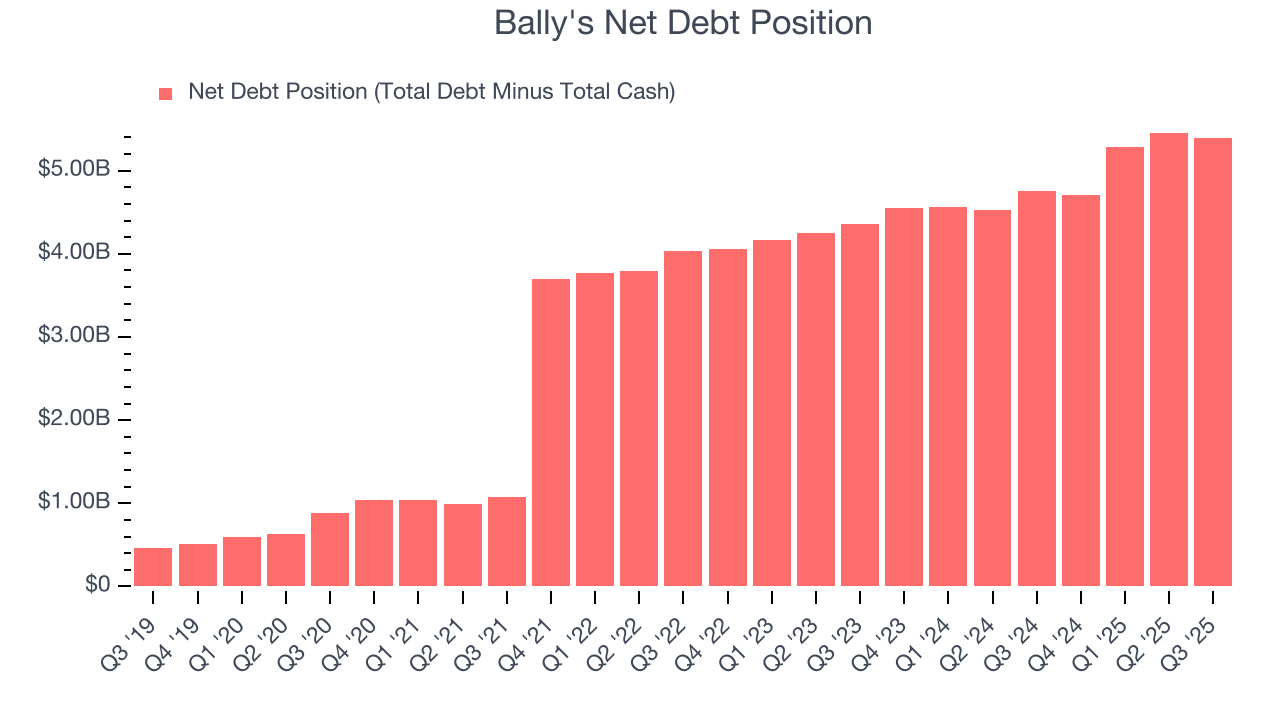

10. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Bally's burned through $276.5 million of cash over the last year, and its $5.63 billion of debt exceeds the $239.9 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the Bally’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of Bally's until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

11. Key Takeaways from Bally’s Q3 Results

We struggled to find many positives in these results. Its adjusted operating income missed and its EPS fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded up 2.1% to $16.65 immediately after reporting.

12. Is Now The Time To Buy Bally's?

Updated: March 8, 2026 at 11:01 PM EDT

Before making an investment decision, investors should account for Bally’s business fundamentals and valuation in addition to what happened in the latest quarter.

We cheer for all companies serving everyday consumers, but in the case of Bally's, we’ll be cheering from the sidelines. Although its revenue growth was good over the last five years, it’s expected to deteriorate over the next 12 months and its declining EPS over the last five years makes it a less attractive asset to the public markets. And while the company’s projected EPS for the next year implies the company’s fundamentals will improve, the downside is its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

Bally’s EV-to-EBITDA ratio based on the next 12 months is 10.9x. This valuation is reasonable, but the company’s shaky fundamentals present too much downside risk. There are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $16.25 on the company (compared to the current share price of $13.41).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.