Dayforce (DAY)

We aren’t fans of Dayforce. Its growth has decelerated and its failure to generate meaningful free cash flow makes us question its prospects.― StockStory Analyst Team

1. News

2. Summary

Why We Think Dayforce Will Underperform

Rebranded from Ceridian in January 2024 to highlight its flagship product, Dayforce (NYSE:DAY) provides cloud-based software that helps organizations manage their entire employee lifecycle, including HR, payroll, workforce management, benefits, and talent development.

- Gross margin of 50.9% is way below its competitors, leaving less money to invest in areas like marketing and R&D

- Operating margin was unchanged over the last year, suggesting it failed to gain leverage on its fixed costs

- One positive is that its user-friendly software enables clients to ramp up spending quickly, leading to the speedy recovery of customer acquisition costs

Dayforce’s quality is lacking. There are superior opportunities elsewhere.

Why There Are Better Opportunities Than Dayforce

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Dayforce

Dayforce’s stock price of $69.43 implies a valuation ratio of 5.2x forward price-to-sales. Yes, this valuation multiple is lower than that of other software peers, but we’ll remind you that you often get what you pay for.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. Dayforce (DAY) Research Report: Q3 CY2025 Update

Human capital management software company Dayforce (NYSE:DAY) met Wall Streets revenue expectations in Q3 CY2025, with sales up 9.5% year on year to $481.6 million. Its non-GAAP profit of $0.37 per share was 33.2% below analysts’ consensus estimates.

Dayforce (DAY) Q3 CY2025 Highlights:

- In light of the pending Thoma Bravo Transaction, Dayforce will not be providing forward-looking guidance or updates to previously issued guidance and will not host an earnings conference call or webcast for its third quarter fiscal 2025 results and does not expect to do so for any future quarters.

- Revenue: $481.6 million vs analyst estimates of $481.4 million (9.5% year-on-year growth, in line)

- Adjusted EPS: $0.37 vs analyst expectations of $0.55 (33.2% miss)

- Adjusted EBITDA: $147.3 million vs analyst estimates of $145.3 million (30.6% margin, 1.4% beat)

- Operating Margin: 6.3%, up from 4.7% in the same quarter last year

- Free Cash Flow Margin: 1%, down from 18.7% in the previous quarter

- Billings: $473.9 million at quarter end, up 8.6% year on year

- Market Capitalization: $10.81 billion

Company Overview

Rebranded from Ceridian in January 2024 to highlight its flagship product, Dayforce (NYSE:DAY) provides cloud-based software that helps organizations manage their entire employee lifecycle, including HR, payroll, workforce management, benefits, and talent development.

Dayforce's platform is built on a single application with continuous real-time calculations, giving administrators and managers access to up-to-date workforce data. The company serves organizations of all sizes, from those with 100 employees to enterprises with over 100,000 workers across more than 200 countries and territories.

At the core of Dayforce's business is its comprehensive HCM suite that includes human resources record-keeping, global payroll processing, workforce scheduling, benefits administration, and talent intelligence tools powered by AI. One distinctive offering is Dayforce Wallet, which allows employees to access their earned wages on-demand before traditional payday through a digital payment solution.

The company generates revenue primarily through subscription fees for its cloud software, implementation services, and "float revenue" earned by holding customer funds before disbursement. For smaller Canadian businesses with fewer than 100 employees, Dayforce offers Powerpay, a simplified payroll and HR solution.

Dayforce employs a direct sales force organized by customer size and geography, with additional distribution through third-party channels. The company has steadily expanded globally, using both company-owned payroll engines and partner solutions to provide a consistent experience for multinational organizations while addressing regional compliance requirements.

4. HR Software

Modern HR software has two powerful benefits: cost savings and ease of use. For cost savings, businesses large and small much prefer the flexibility of cloud-based, web-browser-delivered software paid for on a subscription basis rather than the hassle and complexity of purchasing and managing on-premise enterprise software. On the usability side, the consumerization of business software creates seamless experiences whereby multiple standalone processes like payroll processing and compliance are aggregated into a single, easy-to-use platform.

Dayforce competes with other human capital management software providers including Workday (NASDAQ:WDAY), ADP (NASDAQ:ADP), Oracle (NYSE:ORCL), SAP (NYSE:SAP), and Ultimate Kronos Group (UKG), which is privately held.

5. Revenue Growth

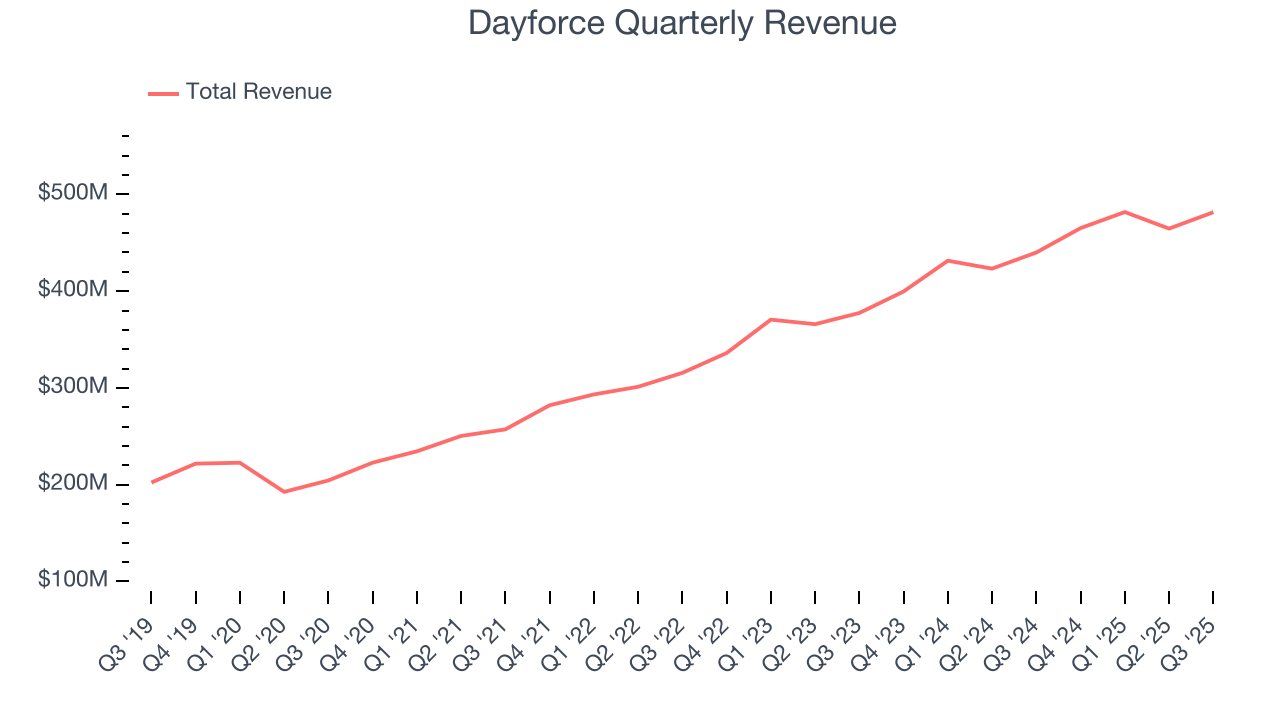

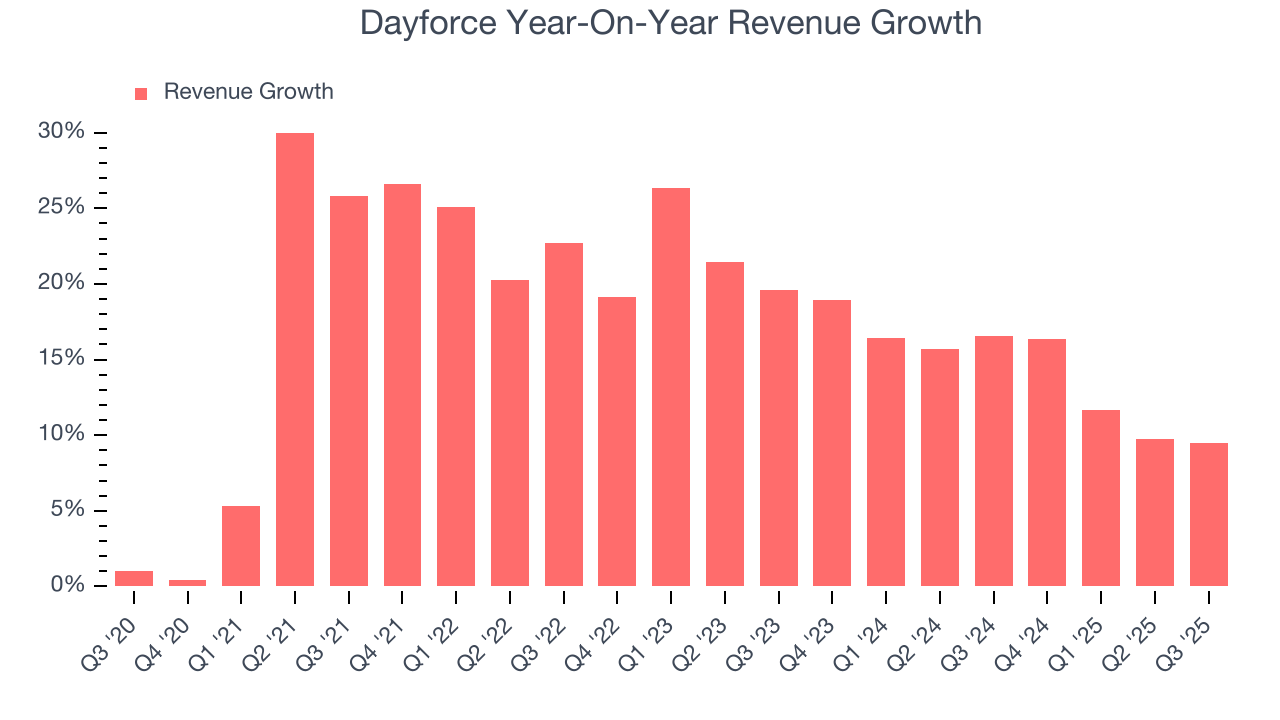

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Dayforce’s 17.6% annualized revenue growth over the last five years was decent. Its growth was slightly above the average software company and shows its offerings resonate with customers.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. Dayforce’s recent performance shows its demand has slowed as its annualized revenue growth of 14.3% over the last two years was below its five-year trend.

This quarter, Dayforce grew its revenue by 9.5% year on year, and its $481.6 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 11.8% over the next 12 months, a slight deceleration versus the last two years. This projection doesn't excite us and suggests its products and services will see some demand headwinds.

6. Billings

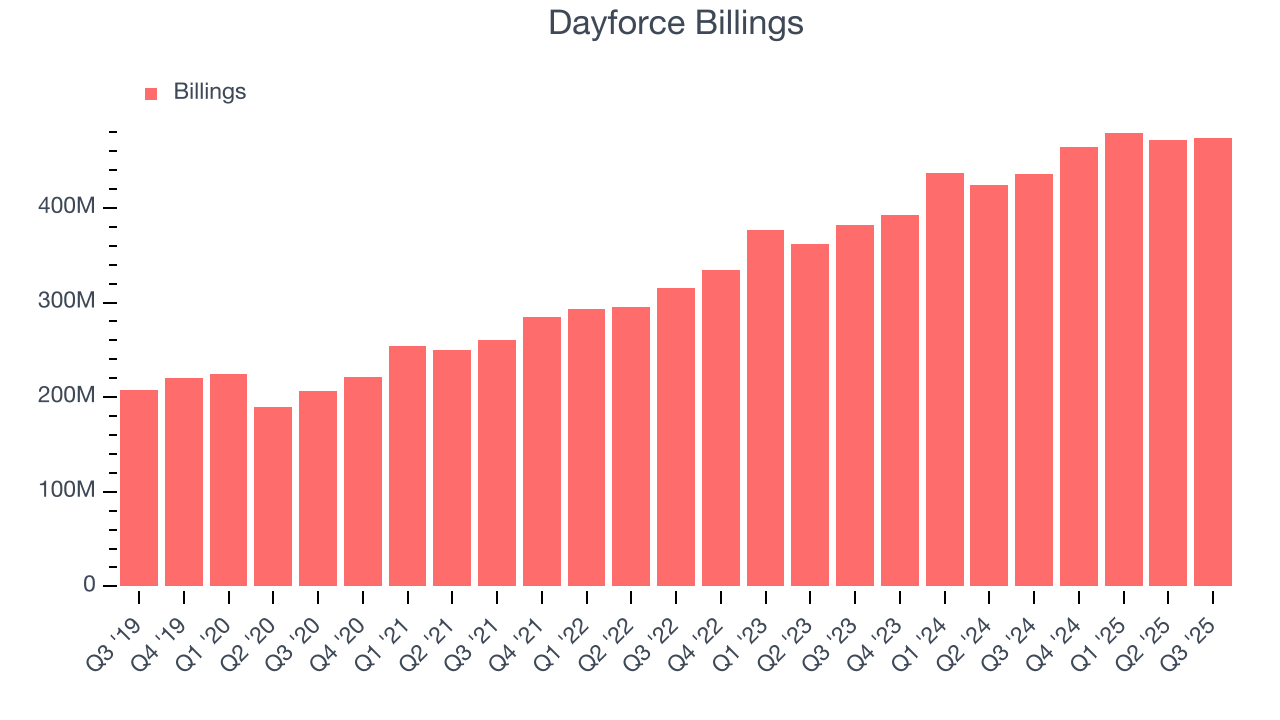

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Dayforce’s billings came in at $473.9 million in Q3, and over the last four quarters, its growth was underwhelming as it averaged 12% year-on-year increases. This performance mirrored its total sales and suggests that increasing competition is causing challenges in acquiring/retaining customers.

7. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Dayforce is extremely efficient at acquiring new customers, and its CAC payback period checked in at 11.9 months this quarter. The company’s rapid recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

8. Gross Margin & Pricing Power

For software companies like Dayforce, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

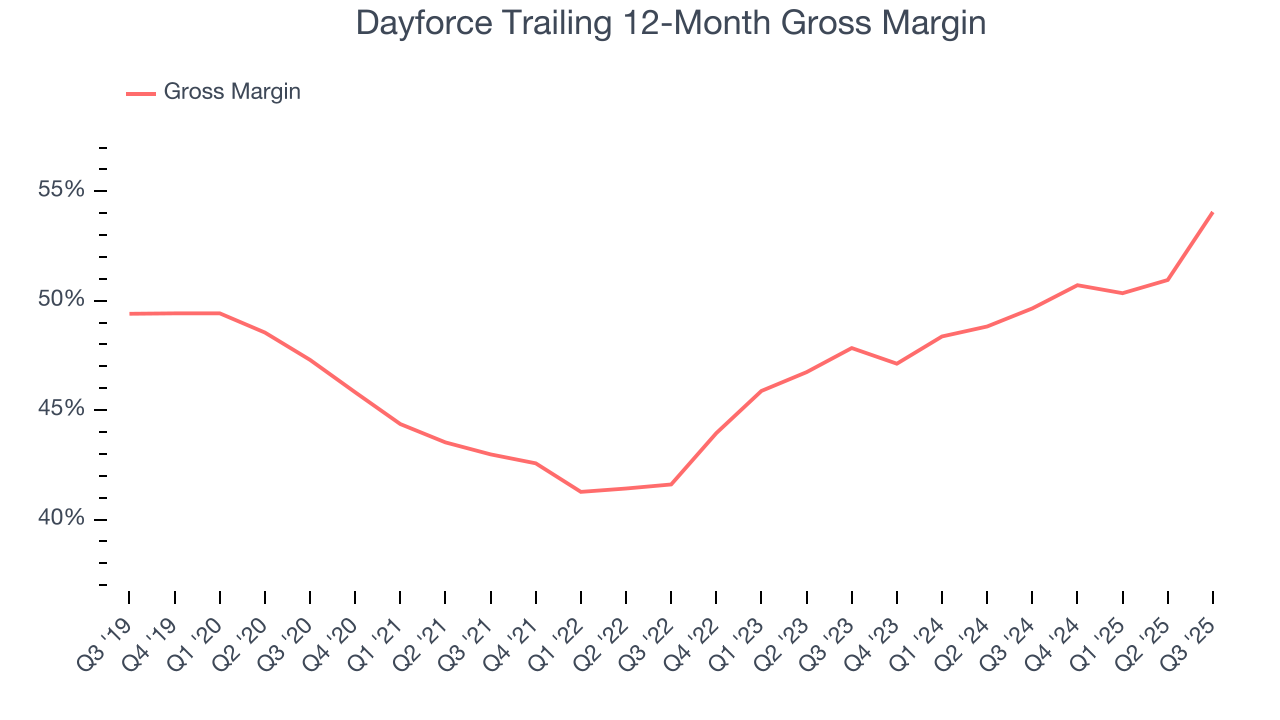

Dayforce’s gross margin is substantially worse than most software businesses, signaling it has relatively high infrastructure costs compared to asset-lite businesses like ServiceNow. As you can see below, it averaged a 54.1% gross margin over the last year. Said differently, Dayforce had to pay a chunky $45.95 to its service providers for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Dayforce has seen gross margins improve by 6.2 percentage points over the last 2 year, which is elite in the software space.

This quarter, Dayforce’s gross profit margin was 62.7%, marking a 12.3 percentage point increase from 50.5% in the same quarter last year. Dayforce’s full-year margin has also been trending up over the past 12 months, increasing by 4.4 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as servers).

9. Operating Margin

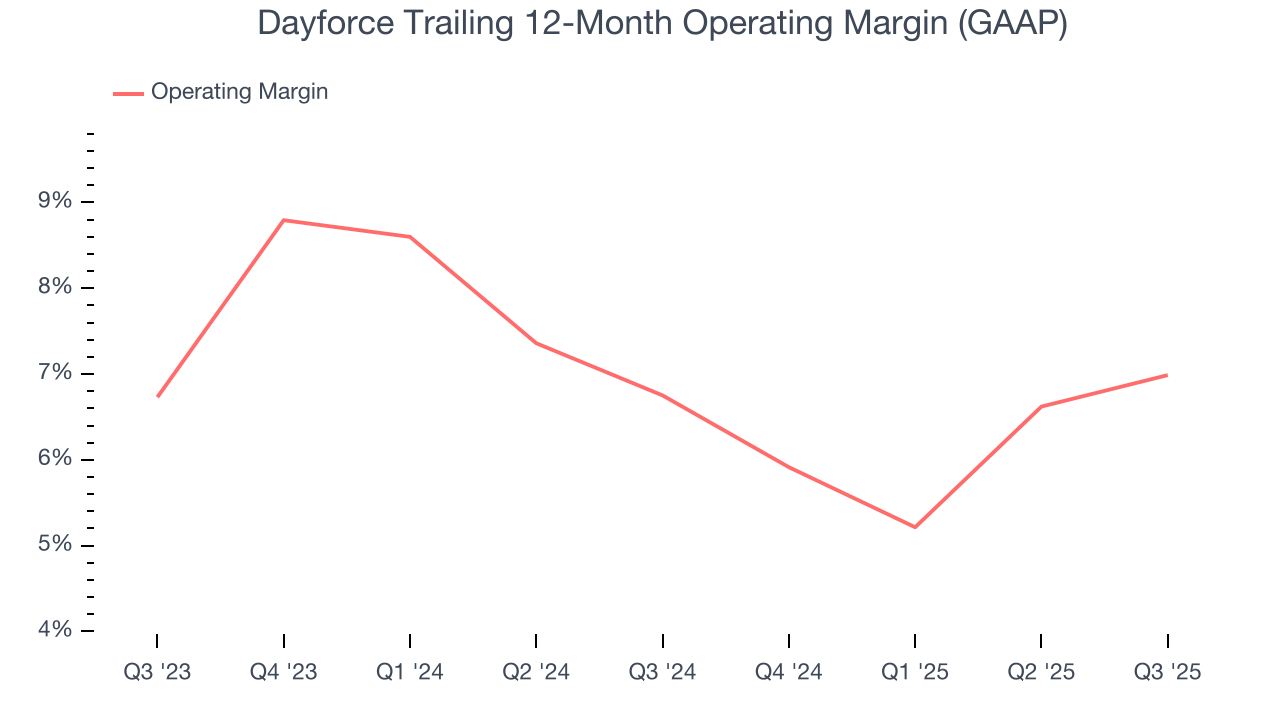

Dayforce has managed its cost base well over the last year. It demonstrated solid profitability for a software business, producing an average operating margin of 7%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, Dayforce’s operating margin might fluctuated slightly but has generally stayed the same over the last two years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Dayforce generated an operating margin profit margin of 6.3%, up 1.6 percentage points year on year. Since its gross margin expanded more than its operating margin, we can infer that leverage on its cost of sales was the primary driver behind the recently higher efficiency.

10. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

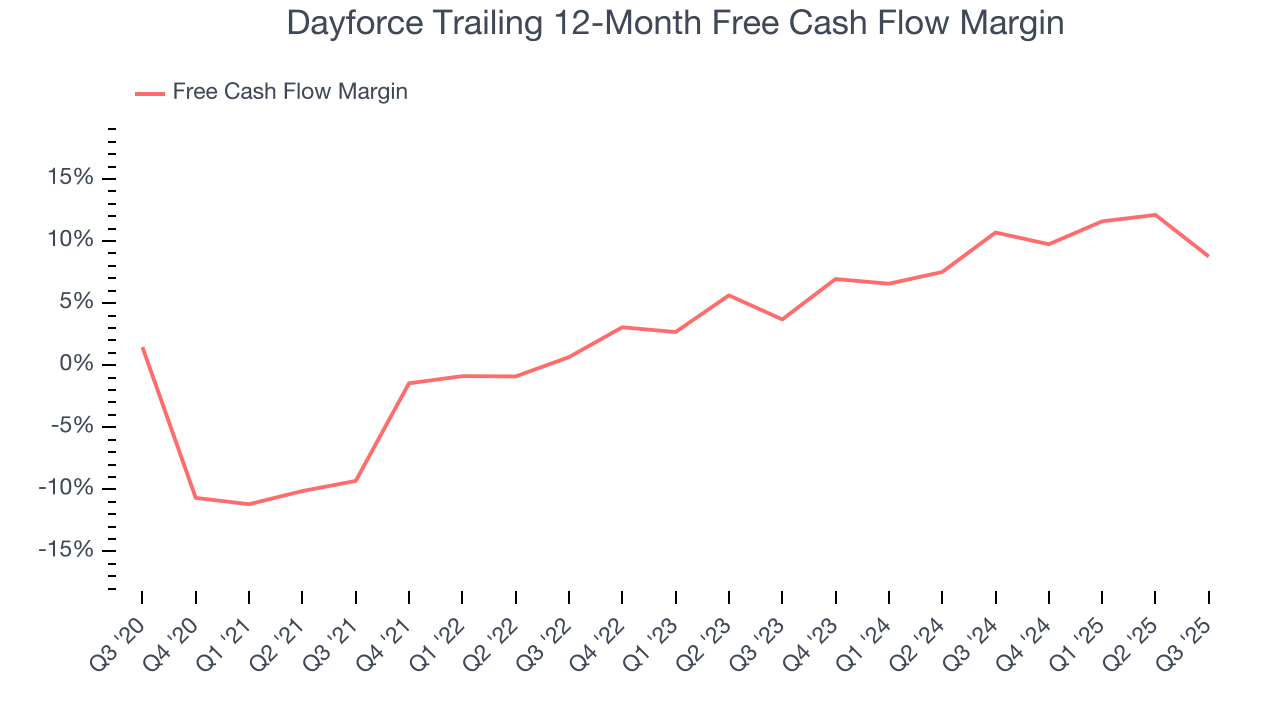

Dayforce has shown weak cash profitability over the last year, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 8.8%, subpar for a software business. The divergence from its good operating margin stems from its capital-intensive business model, which requires Dayforce to make large cash investments in working capital (i.e., stocking inventories) and capital expenditures (i.e., building new facilities).

Dayforce’s free cash flow clocked in at $5 million in Q3, equivalent to a 1% margin. The company’s cash profitability regressed as it was 13.4 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Over the next year, analysts predict Dayforce’s cash conversion will improve. Their consensus estimates imply its free cash flow margin of 8.8% for the last 12 months will increase to 15.4%, it options for capital deployment (investments, share buybacks, etc.).

11. Balance Sheet Assessment

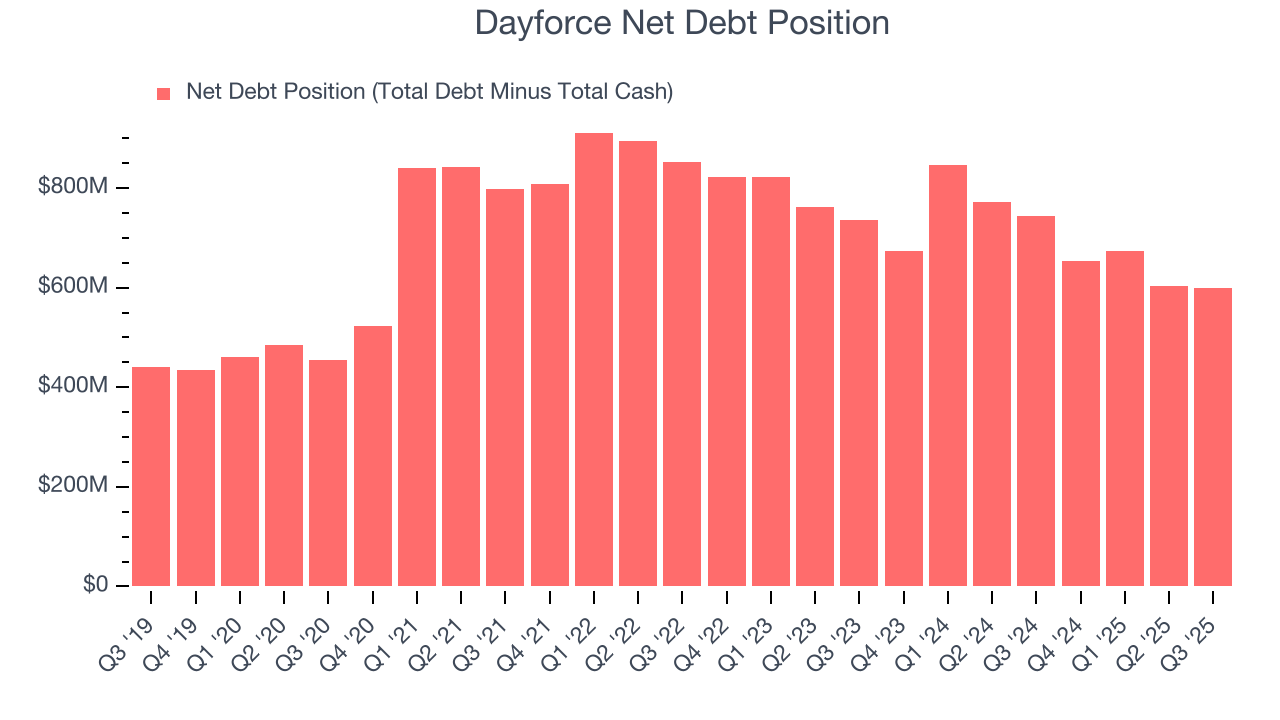

Dayforce reported $627.6 million of cash and $1.23 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $580.4 million of EBITDA over the last 12 months, we view Dayforce’s 1.0× net-debt-to-EBITDA ratio as safe. We also see its $15.7 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Dayforce’s Q3 Results

Billings and EPS both missed. Overall, this was a softer quarter. The stock remained flat at $68.36 immediately after reporting.

13. Is Now The Time To Buy Dayforce?

Updated: January 24, 2026 at 9:24 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Dayforce.

Dayforce isn’t a terrible business, but it doesn’t pass our quality test. Although its revenue growth was solid over the last five years, it’s expected to deteriorate over the next 12 months and its gross margins show its business model is much less lucrative than other companies. And while the company’s efficient sales strategy allows it to target and onboard new users at scale, the downside is its operating margin hasn't moved over the last year.

Dayforce’s price-to-sales ratio based on the next 12 months is 5.2x. This valuation multiple is fair, but we don’t have much faith in the company. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $69.92 on the company (compared to the current share price of $69.43).