Knowles (KN)

Knowles keeps us up at night. Its low returns on capital and plummeting sales suggest it struggles to generate demand and profits, a red flag.― StockStory Analyst Team

1. News

2. Summary

Why We Think Knowles Will Underperform

With roots dating back to 1946 and a focus on components that must perform flawlessly in critical situations, Knowles (NYSE:KN) designs and manufactures specialized electronic components like high-performance capacitors, microphones, and speakers for medical technology, defense, and industrial applications.

- Sales tumbled by 4.9% annually over the last five years, showing market trends are working against its favor during this cycle

- Subscale operations are evident in its revenue base of $593.2 million, meaning it has fewer distribution channels than its larger rivals

- ROIC of 8.2% reflects management’s challenges in identifying attractive investment opportunities, and its shrinking returns suggest its past profit sources are losing steam

Knowles is skating on thin ice. There are superior stocks for sale in the market.

Why There Are Better Opportunities Than Knowles

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Knowles

Knowles’s stock price of $24.99 implies a valuation ratio of 19.9x forward P/E. This multiple is quite expensive for the quality you get.

Paying a premium for high-quality companies with strong long-term earnings potential is preferable to owning challenged businesses with questionable prospects. That helps the prudent investor sleep well at night.

3. Knowles (KN) Research Report: Q4 CY2025 Update

Electronic components manufacturer Knowles (NYSE:KN) reported revenue ahead of Wall Street’s expectations in Q4 CY2025, with sales up 13.8% year on year to $162.2 million. On top of that, next quarter’s revenue guidance ($148 million at the midpoint) was surprisingly good and 3.4% above what analysts were expecting. Its non-GAAP profit of $0.36 per share was in line with analysts’ consensus estimates.

Knowles (KN) Q4 CY2025 Highlights:

- Revenue: $162.2 million vs analyst estimates of $156.2 million (13.8% year-on-year growth, 3.8% beat)

- Adjusted EPS: $0.36 vs analyst estimates of $0.35 (in line)

- Adjusted EBITDA: $41.3 million vs analyst estimates of $40.5 million (25.5% margin, 2% beat)

- Revenue Guidance for Q1 CY2026 is $148 million at the midpoint, above analyst estimates of $143.1 million

- Adjusted EPS guidance for Q1 CY2026 is $0.24 at the midpoint, above analyst estimates of $0.22

- Operating Margin: 15.9%, up from 12.9% in the same quarter last year

- Free Cash Flow Margin: 20.5%, similar to the same quarter last year

- Market Capitalization: $2.07 billion

Company Overview

With roots dating back to 1946 and a focus on components that must perform flawlessly in critical situations, Knowles (NYSE:KN) designs and manufactures specialized electronic components like high-performance capacitors, microphones, and speakers for medical technology, defense, and industrial applications.

Knowles operates through two main business segments: Precision Devices (PD) and Medtech & Specialty Audio (MSA). The PD segment produces high-performance capacitors and radio frequency filtering solutions that can withstand extreme conditions like high voltage, high temperature, and environments requiring exceptional reliability. These components are essential in defense systems like radar equipment, medical implantable devices, and various industrial applications where failure is not an option.

The MSA segment specializes in balanced armature speakers and microphones primarily serving the hearing health industry. These miniaturized components deliver high-quality sound reproduction while maintaining extremely small form factors, making them ideal for hearing aids and premium audio products. The company's expertise in this area has positioned it to capitalize on emerging markets like Over-the-Counter hearing aids, which became available to consumers following regulatory changes.

A medical device manufacturer might use Knowles' capacitors in implantable cardiac monitors that require components with guaranteed reliability and longevity, while a hearing aid company might incorporate Knowles' balanced armature speakers to deliver clear sound in a tiny package that fits comfortably in a user's ear.

Knowles generates revenue by selling directly to original equipment manufacturers, their contract manufacturers, and through distributors worldwide. The company maintains a global footprint with sales, support, and engineering facilities across North America, Europe, and Asia, with manufacturing strategically located near key customers – primarily in North America for Precision Devices and Asia for Medtech & Specialty Audio products.

In late 2024, Knowles completed the sale of its Consumer MEMS Microphones segment to Syntiant Corp, reflecting its strategic focus on higher-value, specialized electronic components rather than consumer electronics.

4. Electronic Components & Manufacturing

The sector could see higher demand as the prevalence of advanced electronics increases in industries such as automotive, healthcare, aerospace, and computing. The high-performance components and contract manufacturing expertise required for autonomous vehicles and cloud computing datacenters, for instance, will benefit companies in the space. However, headwinds include geopolitical risks, particularly U.S.-China trade tensions that could disrupt component sourcing and production as the Trump administration takes an increasingly antagonizing stance on foreign relations. Additionally, stringent environmental regulations on e-waste and emissions could force the industry to pivot in potentially costly ways.

Knowles' Precision Devices segment competes with electronic component manufacturers like Kyocera AVX, Yageo Corporation (which owns Kemet products), and Vishay Intertechnology (NYSE:VSH), along with various specialty companies. In the Medtech & Specialty Audio segment, its primary competitor is Sonion.

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $593.2 million in revenue over the past 12 months, Knowles is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels.

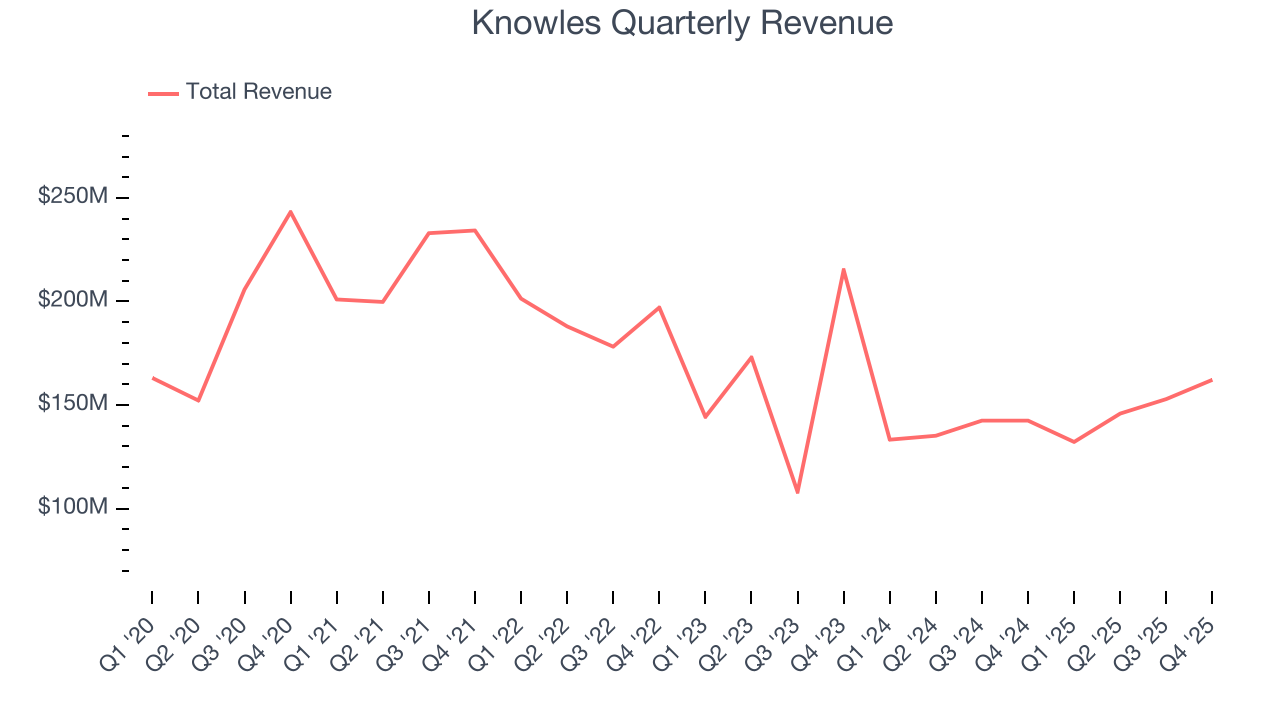

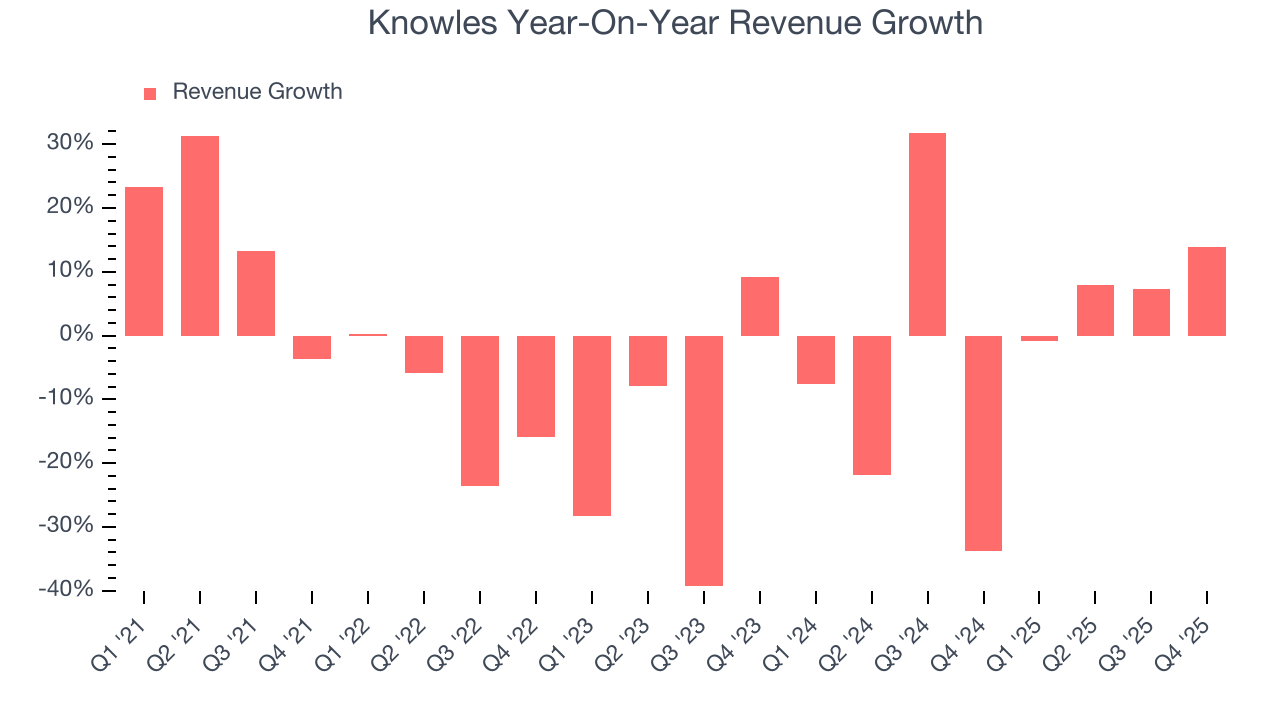

As you can see below, Knowles struggled to generate demand over the last five years. Its sales dropped by 4.9% annually, a poor baseline for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Knowles’s annualized revenue declines of 3.8% over the last two years suggest its demand continued shrinking.

This quarter, Knowles reported year-on-year revenue growth of 13.8%, and its $162.2 million of revenue exceeded Wall Street’s estimates by 3.8%. Company management is currently guiding for a 12% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 4.8% over the next 12 months. Although this projection suggests its newer products and services will fuel better top-line performance, it is still below the sector average.

6. Operating Margin

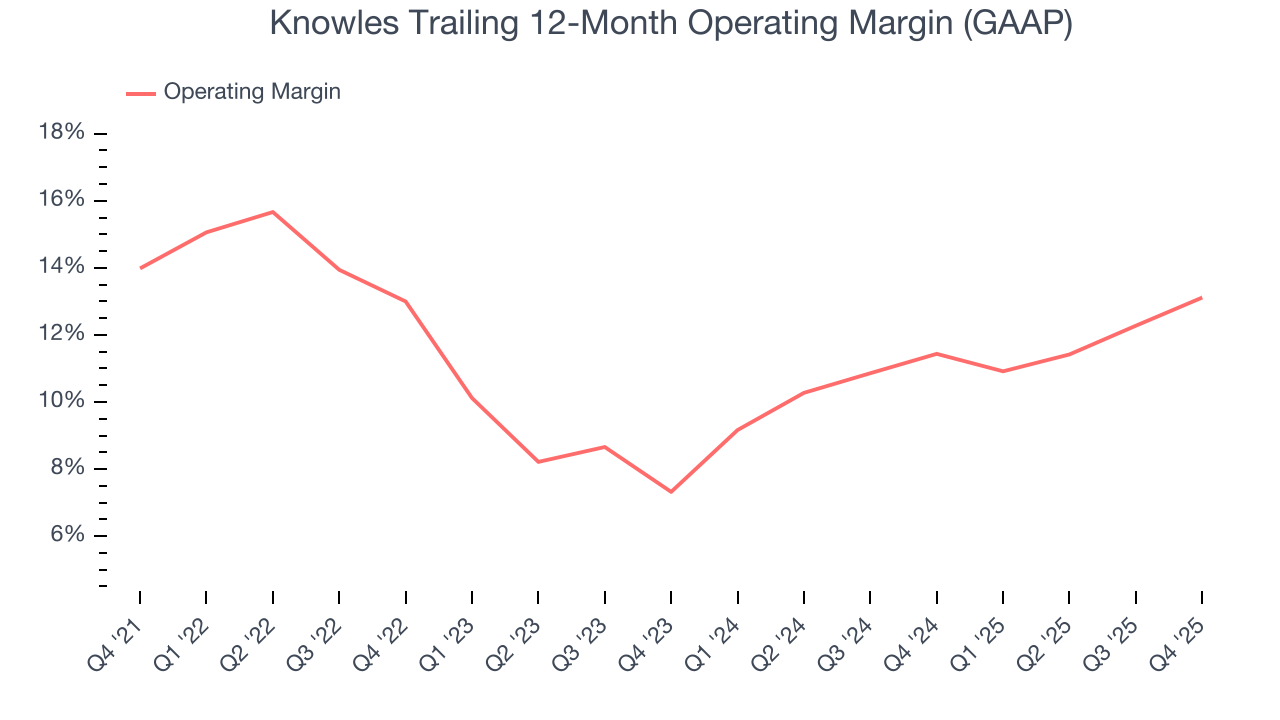

Knowles’s operating margin has been trending up over the last 12 months and averaged 12% over the last five years. Its profitability was higher than the broader business services sector, showing it did a decent job managing its expenses.

Looking at the trend in its profitability, Knowles’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. Shareholders will want to see Knowles grow its margin in the future.

In Q4, Knowles generated an operating margin profit margin of 15.9%, up 3 percentage points year on year. This increase was a welcome development and shows it was more efficient.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

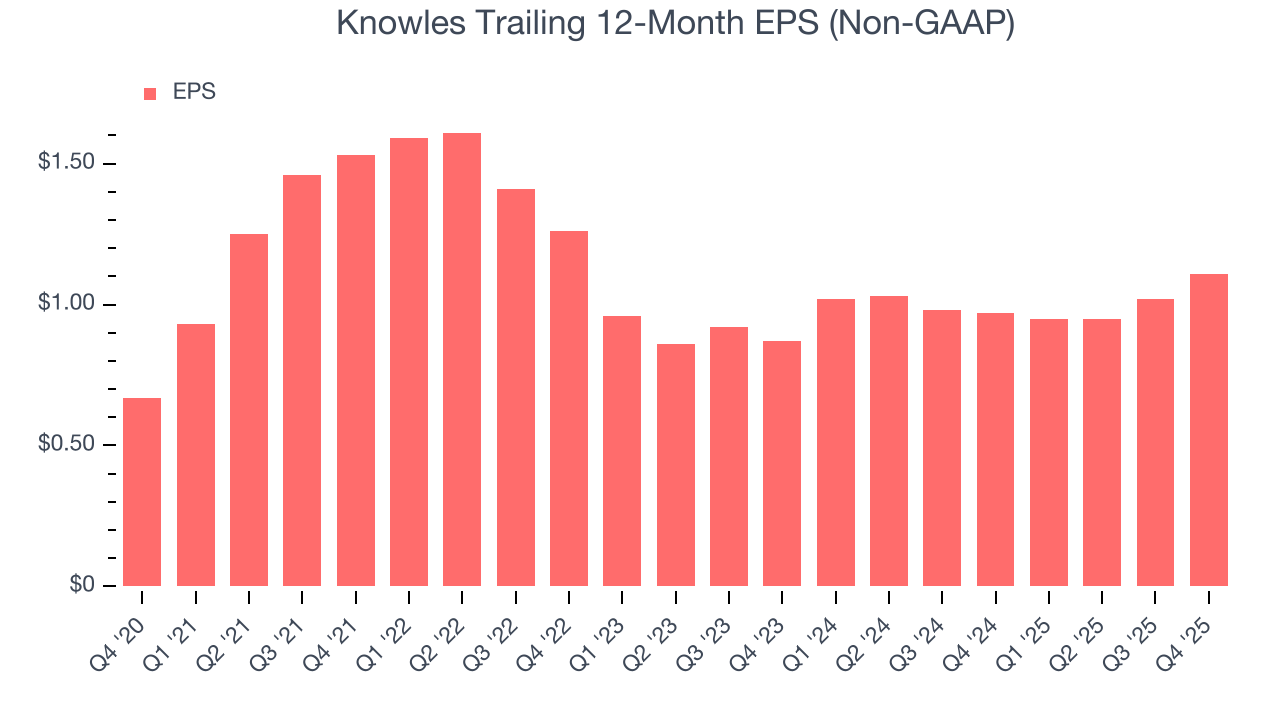

Knowles’s EPS grew at a remarkable 10.6% compounded annual growth rate over the last five years, higher than its 4.9% annualized revenue declines. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t improve.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Knowles, its two-year annual EPS growth of 13% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, Knowles reported adjusted EPS of $0.36, up from $0.27 in the same quarter last year. This print beat analysts’ estimates by 2.1%. Over the next 12 months, Wall Street expects Knowles’s full-year EPS of $1.11 to grow 9.9%.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

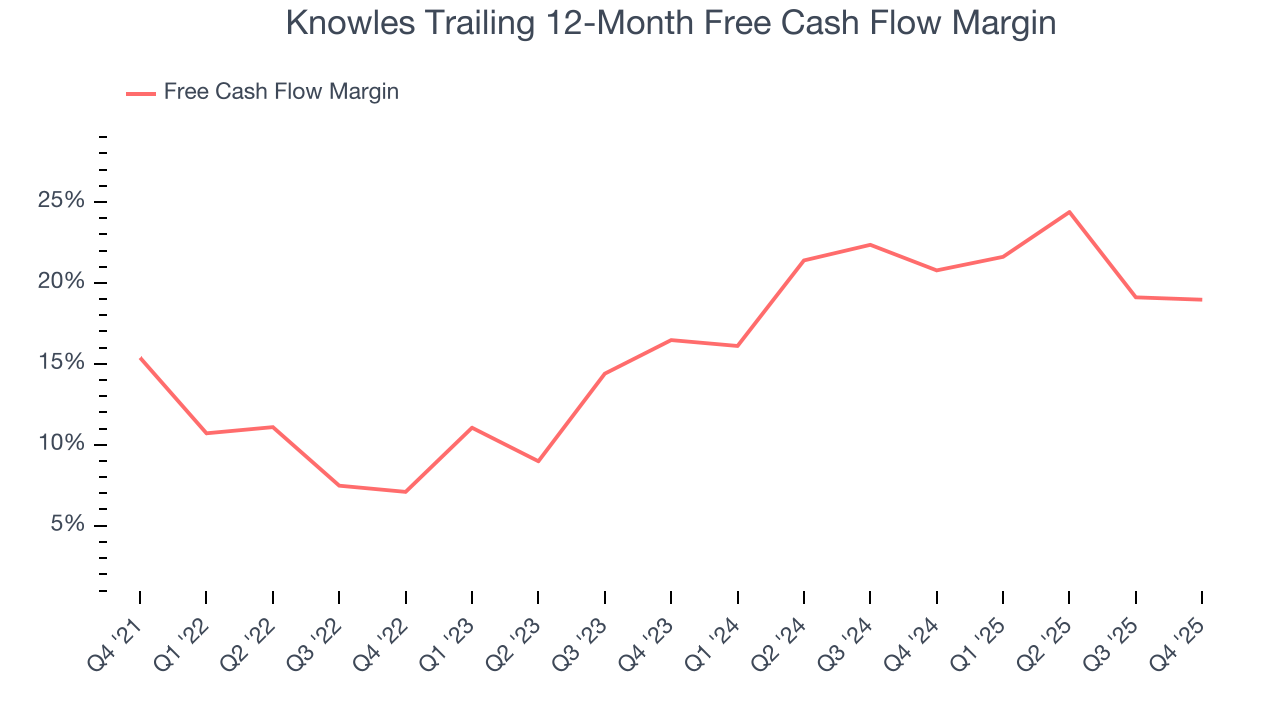

Knowles has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the business services sector, averaging 15.2% over the last five years.

Taking a step back, we can see that Knowles’s margin expanded by 3.6 percentage points during that time. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability was flat.

Knowles’s free cash flow clocked in at $33.2 million in Q4, equivalent to a 20.5% margin. This cash profitability was in line with the comparable period last year and above its five-year average.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

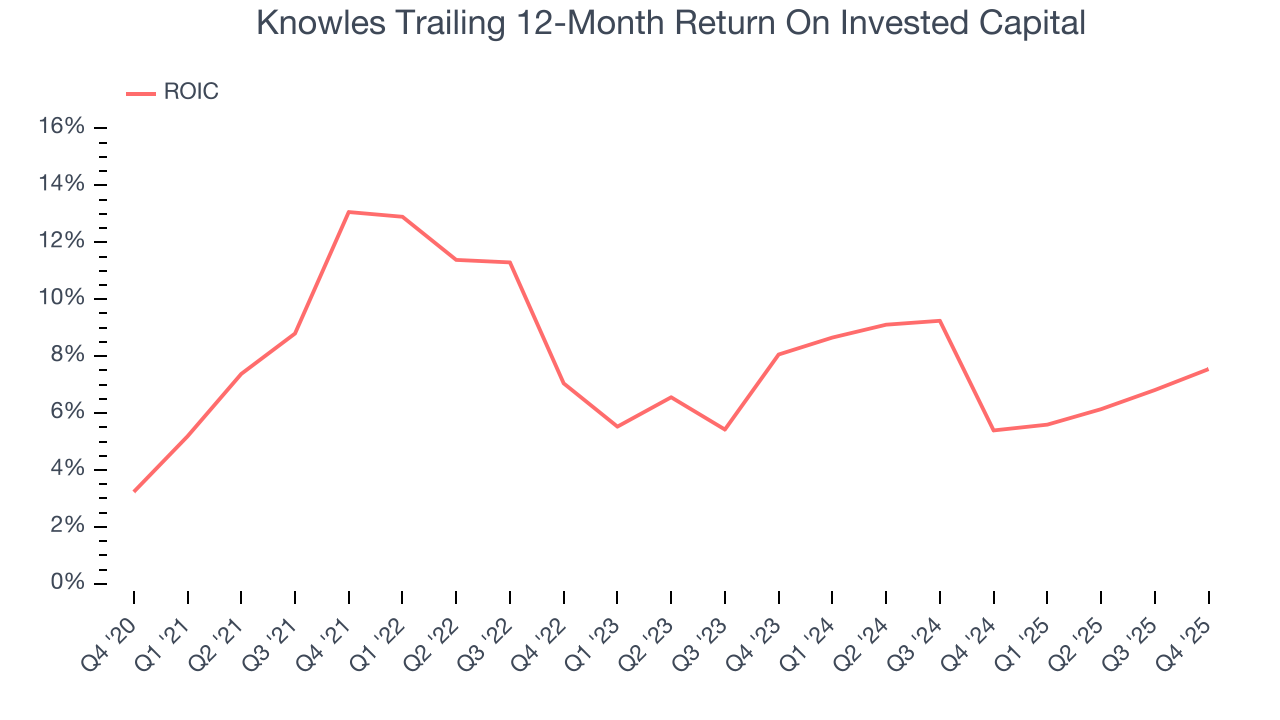

Knowles historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 8.2%, somewhat low compared to the best business services companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Knowles’s ROIC averaged 3.6 percentage point decreases each year. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

10. Balance Sheet Assessment

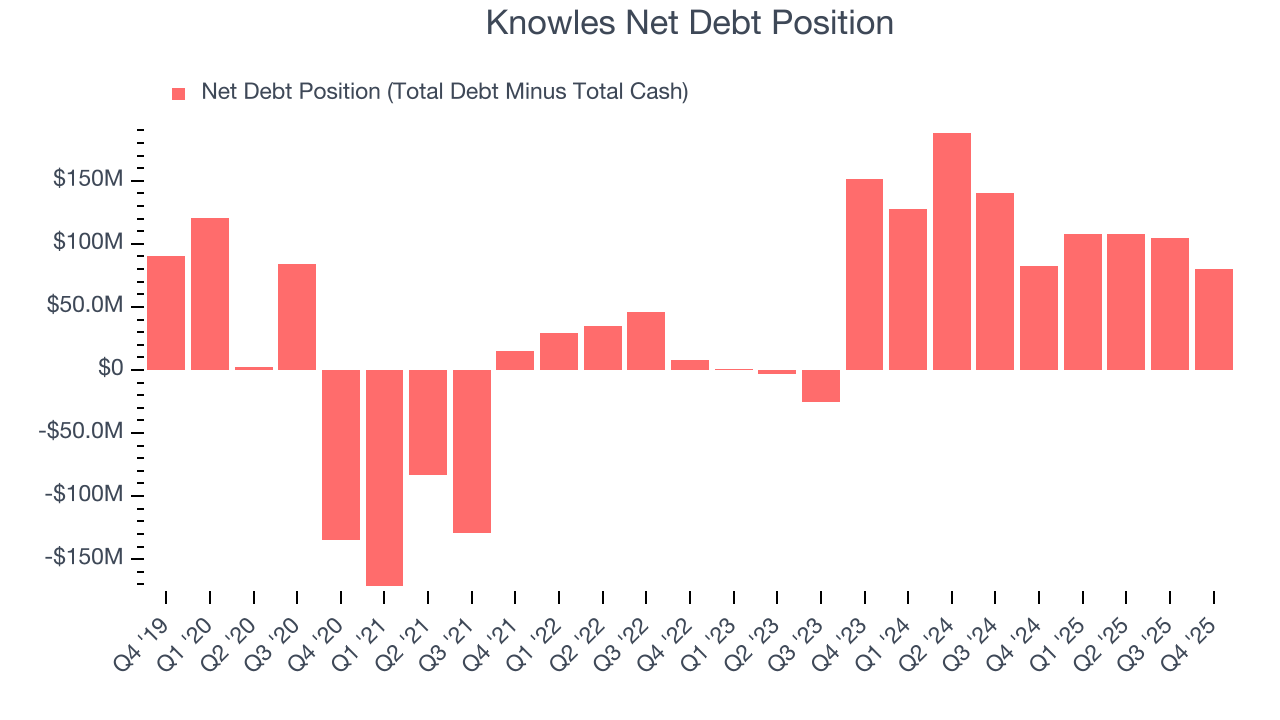

Knowles reported $54.2 million of cash and $134.2 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $136.4 million of EBITDA over the last 12 months, we view Knowles’s 0.6× net-debt-to-EBITDA ratio as safe. We also see its $5.7 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Knowles’s Q4 Results

We were impressed by how significantly Knowles blew past analysts’ EPS guidance for next quarter expectations this quarter. We were also glad its revenue guidance for next quarter trumped Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock remained flat at $24.99 immediately following the results.

12. Is Now The Time To Buy Knowles?

Updated: February 5, 2026 at 10:50 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Knowles.

We cheer for all companies making their customers lives easier, but in the case of Knowles, we’ll be cheering from the sidelines. To kick things off, its revenue has declined over the last five years. And while its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits, the downside is its subscale operations give it fewer distribution channels than its larger rivals. On top of that, its diminishing returns show management's prior bets haven't worked out.

Knowles’s P/E ratio based on the next 12 months is 19.9x. At this valuation, there’s a lot of good news priced in - we think there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $26.50 on the company (compared to the current share price of $24.99).