TransDigm (TDG)

TransDigm is an amazing business. Its rare blend of high growth, robust profitability, and a strong outlook makes it a wonderful asset.― StockStory Analyst Team

1. News

2. Summary

Why We Like TransDigm

Supplying parts for nearly all aircraft currently in service, TransDigm (NYSE:TDG) develops and manufactures components and systems for military and commercial aviation.

- Impressive 15.8% annual revenue growth over the last two years indicates it’s winning market share this cycle

- Incremental sales significantly boosted profitability as its annual earnings per share growth of 20.9% over the last five years outstripped its revenue performance

- Excellent operating margin highlights the strength of its business model, and its operating leverage amplified its profits over the last five years

TransDigm is a standout company. The valuation seems fair based on its quality, and we think now is a prudent time to invest in the stock.

Why Is Now The Time To Buy TransDigm?

High Quality

Investable

Underperform

Why Is Now The Time To Buy TransDigm?

TransDigm’s stock price of $1,415 implies a valuation ratio of 36.8x forward P/E. Many industrials names may carry a lower valuation multiple, but TransDigm’s price is fair given its business quality.

Entry price certainly impacts returns, but over a long-term, multi-year period, business quality matters much more than where you buy a stock.

3. TransDigm (TDG) Research Report: Q3 CY2025 Update

Aerospace and defense company TransDigm (NYSE:TDG) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 11.5% year on year to $2.44 billion. On the other hand, the company’s full-year revenue guidance of $9.85 billion at the midpoint came in 1.1% below analysts’ estimates. Its non-GAAP profit of $10.82 per share was 7.6% above analysts’ consensus estimates.

TransDigm (TDG) Q3 CY2025 Highlights:

- Revenue: $2.44 billion vs analyst estimates of $2.4 billion (11.5% year-on-year growth, 1.6% beat)

- Adjusted EPS: $10.82 vs analyst estimates of $10.05 (7.6% beat)

- Adjusted EBITDA: $1.32 billion vs analyst estimates of $1.29 billion (54.2% margin, 2.3% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $37.51 at the midpoint, missing analyst estimates by 7%

- EBITDA guidance for the upcoming financial year 2026 is $5.15 billion at the midpoint, below analyst estimates of $5.27 billion

- Operating Margin: 47.6%, up from 43.2% in the same quarter last year

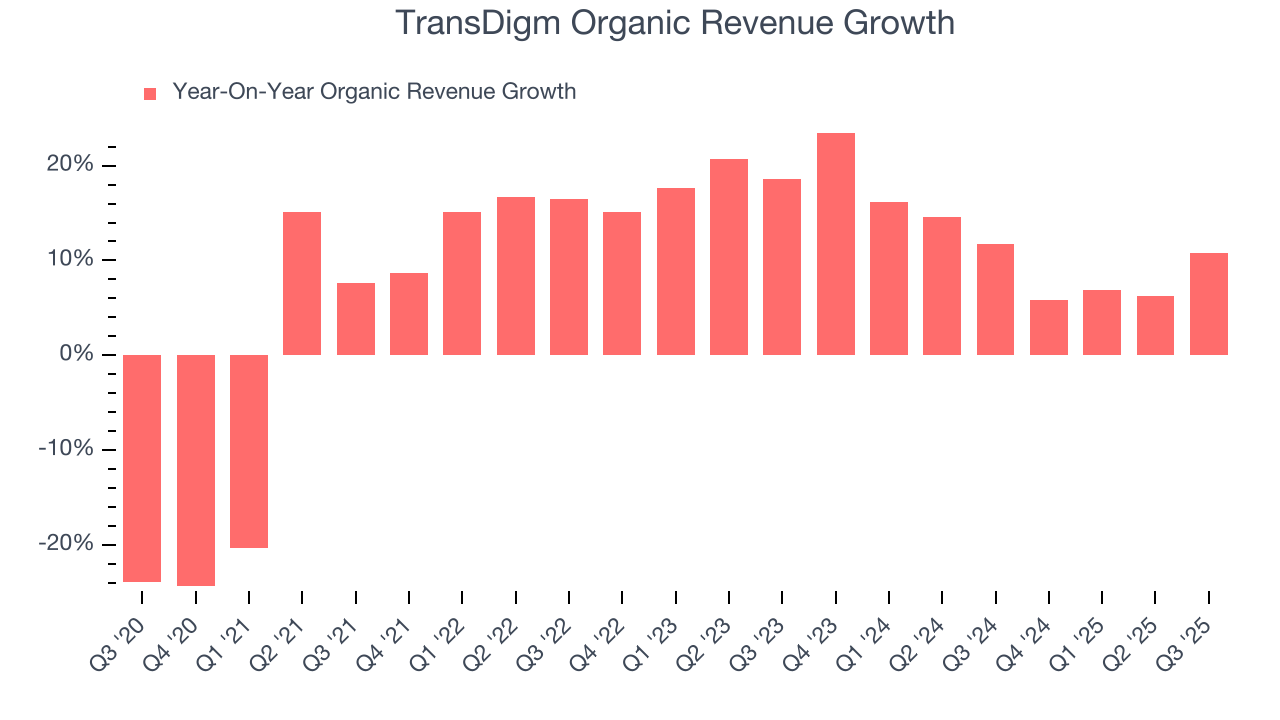

- Organic Revenue rose 10.8% year on year vs analyst estimates of 8.7% growth (206.6 basis point beat)

- Market Capitalization: $72.92 billion

Company Overview

Supplying parts for nearly all aircraft currently in service, TransDigm (NYSE:TDG) develops and manufactures components and systems for military and commercial aviation.

TransDigm was formed through a merger of four industrial aerospace companies and originally sold a small array of aircraft components such as batteries and pumps. A key part of its business model is to acquire airplane parts companies and raise prices. In its first 25 years of operating, it acquired over 60 businesses, enabling it to manufacture not only aircraft systems but also a range of aircraft components like engines, electronics, and interiors.

TransDigm generally sells its products to four types of customers: defense organizations, commercial airlines, original equipment manufacturers (OEM), and maintenance, repair, and overhaul providers. The company’s products are used by OEMs to create new aircraft while overhaul providers, defense organizations, and commercial airlines use its components for maintenance and upgrading of existing aircraft.

Due to the specificity and wear-and-tear of aircraft components, TransDigm usually enters long-term contracts with most of its customers. A majority of sales come from aftermarket services, and the company uses third-party distributors to reach broader markets.

A potential risk for TransDigm is regulators stepping in and limiting its ability to acquire more businesses and raise prices. The company has come under regulatory security several times, but as of today, continues to march along.

4. Aerospace

Aerospace companies often possess technical expertise and have made significant capital investments to produce complex products. It is an industry where innovation is important, and lately, emissions and automation are in focus, so companies that boast advances in these areas can take market share. On the other hand, demand for aerospace products can ebb and flow with economic cycles and geopolitical tensions, which can be particularly painful for companies with high fixed costs.

TransDigm’s peers and competitors include Raytheon (NYSE:RTX), L3Harris Technologies (NYSE:LHX), and Moog Inc. (NYSE:MOG.A).

5. Revenue Growth

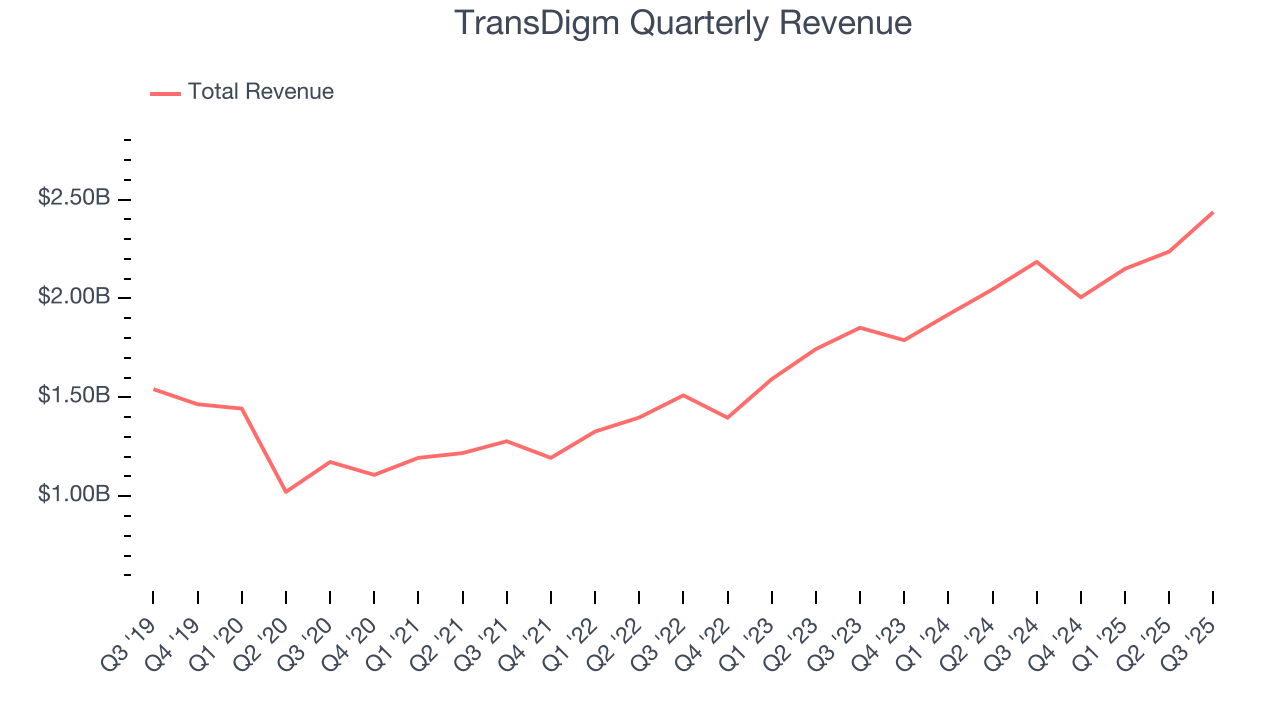

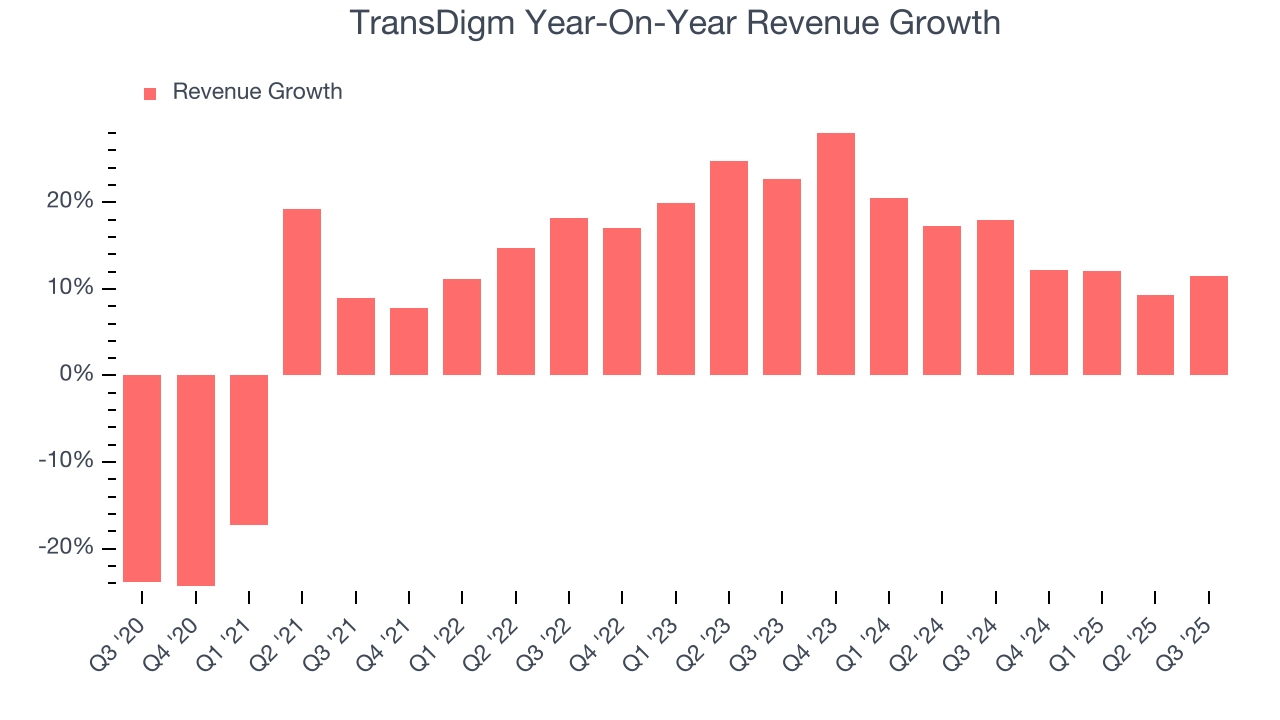

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, TransDigm grew its sales at an impressive 11.6% compounded annual growth rate. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. TransDigm’s annualized revenue growth of 15.8% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

We can better understand the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, TransDigm’s organic revenue averaged 12% year-on-year growth. Because this number is lower than its two-year revenue growth, we can see that some mixture of acquisitions and foreign exchange rates boosted its headline results.

This quarter, TransDigm reported year-on-year revenue growth of 11.5%, and its $2.44 billion of revenue exceeded Wall Street’s estimates by 1.6%.

Looking ahead, sell-side analysts expect revenue to grow 11.4% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is admirable and implies the market is forecasting success for its products and services.

6. Operating Margin

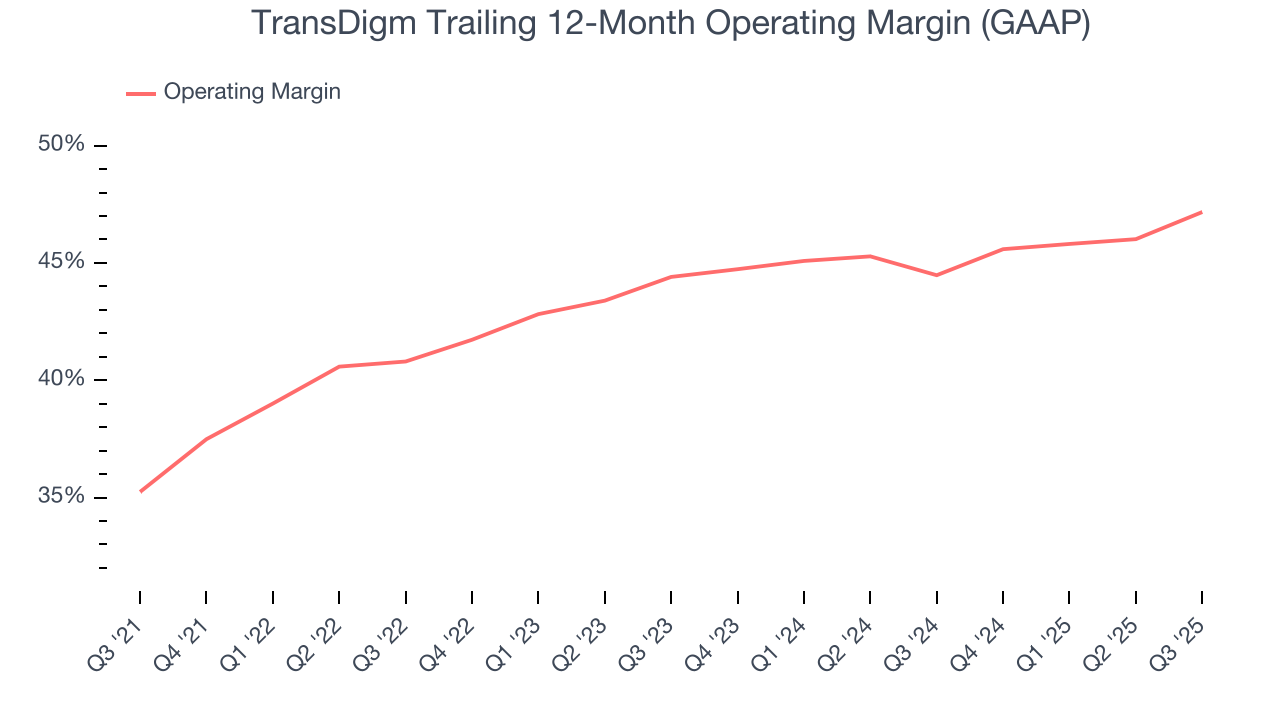

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

TransDigm has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 43.3%.

Looking at the trend in its profitability, TransDigm’s operating margin rose by 11.9 percentage points over the last five years, as its sales growth gave it immense operating leverage.

This quarter, TransDigm generated an operating margin profit margin of 47.6%, up 4.5 percentage points year on year. This increase was a welcome development and shows it was more efficient.

7. Earnings Per Share

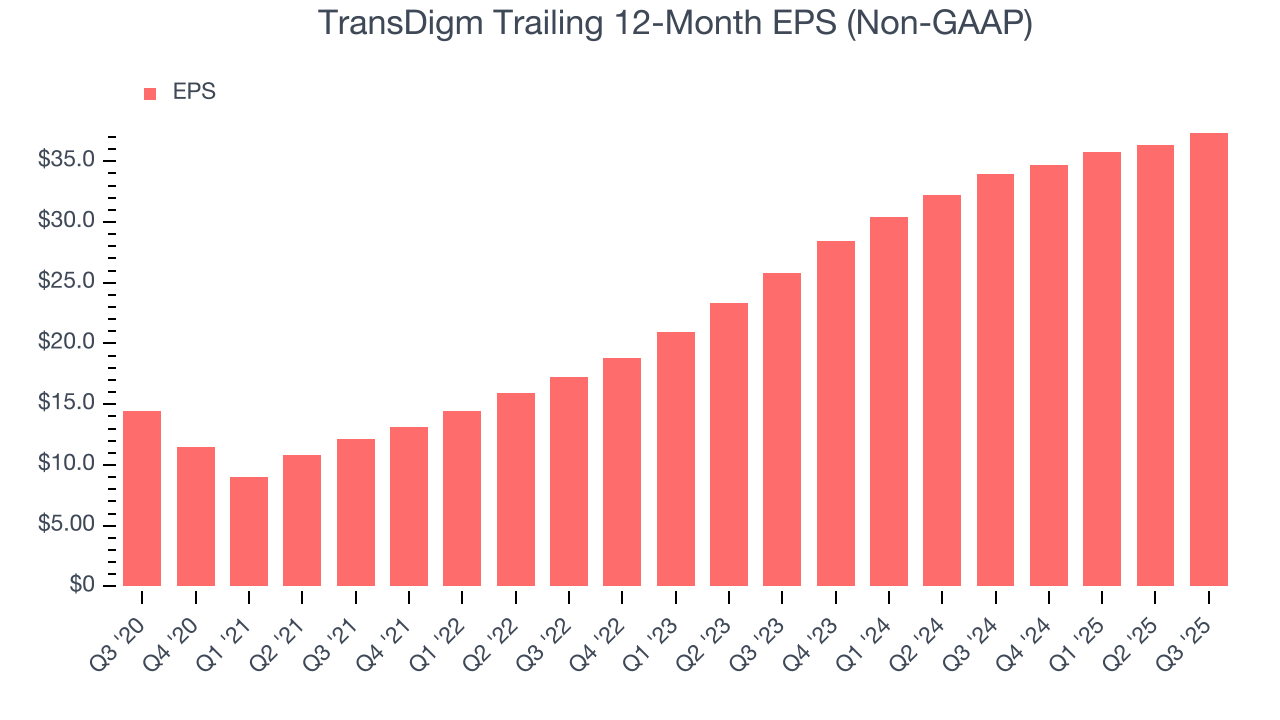

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

TransDigm’s EPS grew at an astounding 20.9% compounded annual growth rate over the last five years, higher than its 11.6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into TransDigm’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, TransDigm’s operating margin expanded by 11.9 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For TransDigm, its two-year annual EPS growth of 20.2% is similar to its five-year trend, implying strong and stable earnings power.

In Q3, TransDigm reported adjusted EPS of $10.82, up from $9.83 in the same quarter last year. This print beat analysts’ estimates by 7.6%. Over the next 12 months, Wall Street expects TransDigm’s full-year EPS of $37.36 to grow 8.6%.

8. Cash Is King

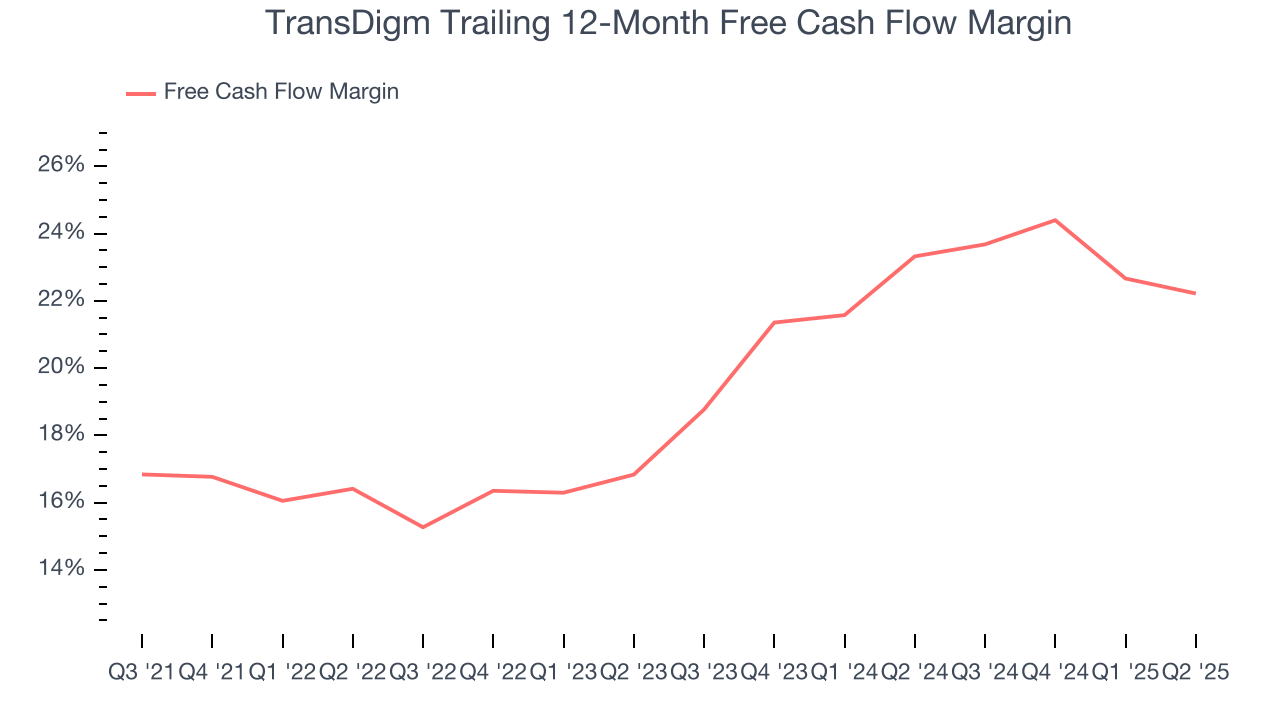

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

TransDigm has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 19.7% over the last five years.

Taking a step back, we can see that TransDigm’s margin expanded by 6.1 percentage points during that time. This is encouraging because it gives the company more optionality.

9. Return on Invested Capital (ROIC)

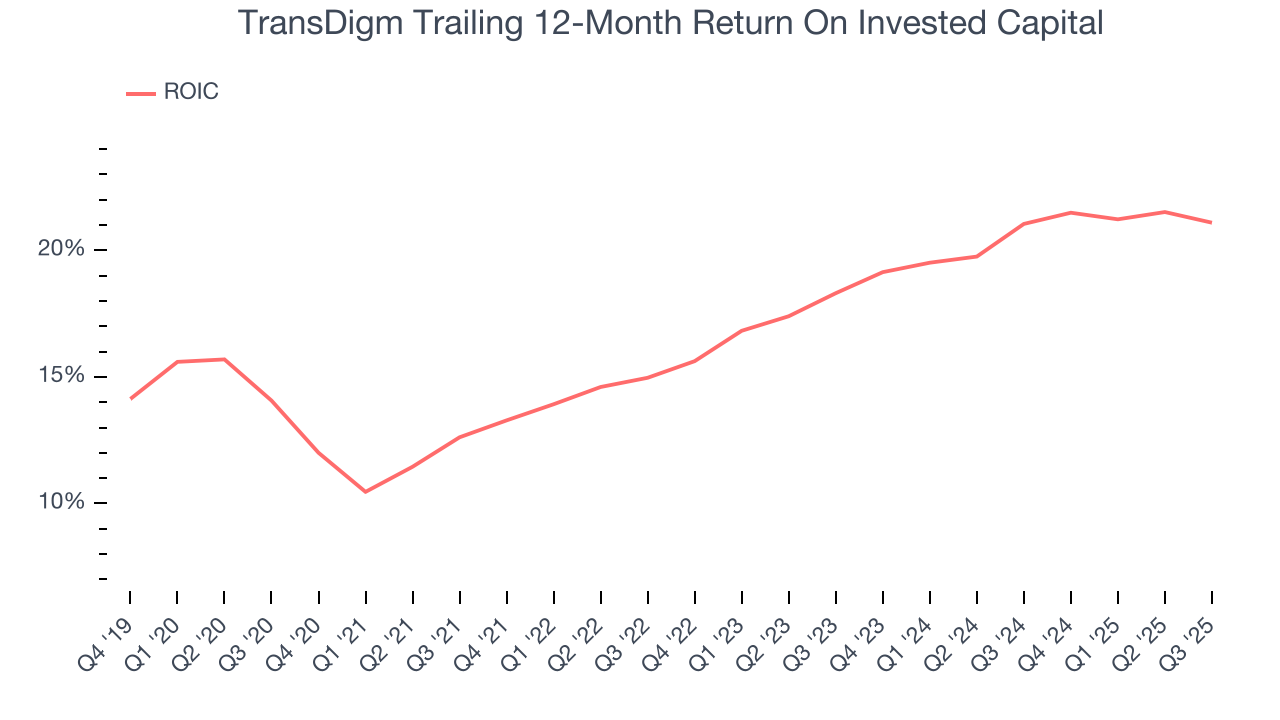

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

TransDigm’s five-year average ROIC was 17.6%, beating other industrials companies by a wide margin. This illustrates its management team’s ability to invest in attractive growth opportunities and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. TransDigm’s ROIC has increased over the last few years. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

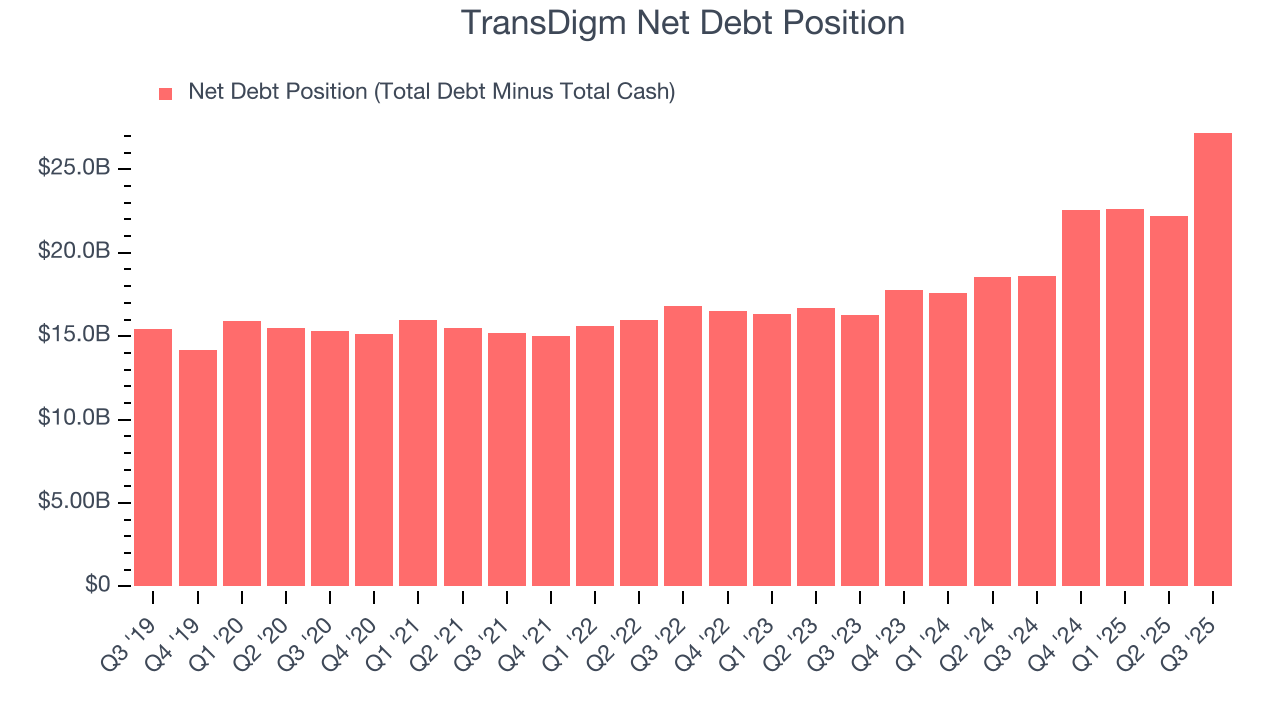

10. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

TransDigm’s $30.02 billion of debt exceeds the $2.81 billion of cash on its balance sheet. Furthermore, its 6× net-debt-to-EBITDA ratio (based on its EBITDA of $4.76 billion over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. TransDigm could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope TransDigm can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

11. Key Takeaways from TransDigm’s Q3 Results

We enjoyed seeing TransDigm beat analysts’ organic revenue expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. On the other hand, its full-year revenue and EBITDA guidance both missed Wall Street’s estimates, and this is weighing on shares. The stock traded down 3.4% to $1,250 immediately after reporting.

12. Is Now The Time To Buy TransDigm?

Updated: January 24, 2026 at 9:57 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own TransDigm, you should also grasp the company’s longer-term business quality and valuation.

TransDigm is truly a cream-of-the-crop industrials company. For starters, its revenue growth was impressive over the last five years, and analysts believe it can continue growing at these levels. And while its projected EPS for the next year is lacking, its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits. On top of that, TransDigm’s impressive operating margins show it has a highly efficient business model.

TransDigm’s P/E ratio based on the next 12 months is 36.8x. Looking at the industrials space today, TransDigm’s qualities as one of the best businesses really stand out, and we like it at this price.

Wall Street analysts have a consensus one-year price target of $1,622 on the company (compared to the current share price of $1,415), implying they see 14.7% upside in buying TransDigm in the short term.