Acadia Healthcare (ACHC)

Acadia Healthcare doesn’t excite us. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Acadia Healthcare Will Underperform

With a network of over 250 facilities serving patients in 38 states and Puerto Rico, Acadia Healthcare (NASDAQ:ACHC) operates facilities providing mental health and substance use disorder treatment services across the United States.

- Cash burn has widened over the last five years, making us question whether it can reliably generate shareholder value

- Below-average returns on capital indicate management struggled to find compelling investment opportunities, and its decreasing returns suggest its historical profit centers are aging

- On the bright side, its adjusted operating margin of 17% shows it’s one of the more profitable companies in the healthcare space

Acadia Healthcare doesn’t measure up to our expectations. Better businesses are for sale in the market.

Why There Are Better Opportunities Than Acadia Healthcare

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Acadia Healthcare

Acadia Healthcare is trading at $14.40 per share, or 7.2x forward P/E. This is a cheap valuation multiple, but for good reason. You get what you pay for.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Acadia Healthcare (ACHC) Research Report: Q3 CY2025 Update

Behavioral health company Acadia Healthcare (NASDAQ:ACHC) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 4.4% year on year to $851.6 million. On the other hand, the company’s full-year revenue guidance of $3.29 billion at the midpoint came in 0.7% below analysts’ estimates. Its non-GAAP profit of $0.72 per share was 9.1% above analysts’ consensus estimates.

Acadia Healthcare (ACHC) Q3 CY2025 Highlights:

- Revenue: $851.6 million vs analyst estimates of $846 million (4.4% year-on-year growth, 0.7% beat)

- Adjusted EPS: $0.72 vs analyst estimates of $0.66 (9.1% beat)

- Adjusted EBITDA: $173 million vs analyst estimates of $178.4 million (20.3% margin, 3% miss)

- The company dropped its revenue guidance for the full year to $3.29 billion at the midpoint from $3.33 billion, a 1.1% decrease

- Management lowered its full-year Adjusted EPS guidance to $2.40 at the midpoint, a 5.9% decrease

- EBITDA guidance for the full year is $655 million at the midpoint, below analyst estimates of $683.7 million

- Operating Margin: 4.7%, down from 15.8% in the same quarter last year

- Free Cash Flow was -$63.03 million compared to -$27.11 million in the same quarter last year

- Sales Volumes were flat year on year (2.4% in the same quarter last year)

- Market Capitalization: $1.91 billion

Company Overview

With a network of over 250 facilities serving patients in 38 states and Puerto Rico, Acadia Healthcare (NASDAQ:ACHC) operates facilities providing mental health and substance use disorder treatment services across the United States.

Acadia's treatment facilities are organized into four main categories, each addressing different levels of patient needs. Acute inpatient psychiatric facilities provide 24-hour crisis stabilization for patients who may be a danger to themselves or others, with psychiatrists, nurses, and therapists delivering intensive medical and behavioral interventions. Specialty treatment facilities focus on addiction recovery and eating disorders, offering various levels of care from detoxification to outpatient services.

The company's Comprehensive Treatment Centers (CTCs) specialize in medication-assisted treatment for opioid addiction in outpatient settings, combining behavioral therapy with medications that normalize brain chemistry. Residential treatment centers provide longer-term care for children and adolescents with severe psychiatric disorders and trauma histories, often in secure environments with educational programs.

A patient experiencing severe depression might enter Acadia's acute care for immediate stabilization, then transition to a specialty facility for ongoing therapy. Similarly, someone struggling with opioid addiction might receive medication and counseling at a CTC, with treatment potentially lasting a year or longer.

Acadia generates revenue through multiple payment sources, including state Medicaid programs, commercial insurance, Medicare, and direct patient payments. The company pursues growth through five main pathways: expanding existing facilities, forming joint venture partnerships (often with healthcare systems), building new facilities, acquiring other behavioral healthcare providers, and extending its continuum of care offerings.

The behavioral healthcare industry faces significant regulatory oversight, with facilities maintaining accreditations from organizations like The Joint Commission and complying with various healthcare laws including HIPAA privacy regulations and physician self-referral restrictions.

4. Hospital Chains

Hospital chains operate scale-driven businesses that rely on patient volumes, efficient operations, and favorable payer contracts to drive revenue and profitability. These organizations benefit from the essential nature of their services, which ensures consistent demand, particularly as populations age and chronic diseases become more prevalent. However, profitability can be pressured by rising labor costs, regulatory requirements, and the challenges of balancing care quality with cost efficiency. Dependence on government and private insurance reimbursements also introduces financial uncertainty. Looking ahead, hospital chains stand to benefit from tailwinds such as increasing healthcare utilization driven by an aging population that generally has higher incidents of disease. AI can also be a tailwind in areas such as predictive analytics for more personalized treatment and efficiency (intake, staffing, resourcing allocation). However, the sector faces potential headwinds such as labor shortages that could push up wages as well as substantial investments needs for digital infrastructure to support telehealth and electronic health records. Regulatory scrutiny, and reimbursement cuts are also looming topics that could further strain margins.

Acadia Healthcare's primary competitor is Universal Health Services (NYSE:UHS), which operates behavioral health facilities alongside its acute care hospitals. Other competitors include private behavioral health providers and hospital systems with psychiatric units.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $3.27 billion in revenue over the past 12 months, Acadia Healthcare has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Revenue Growth

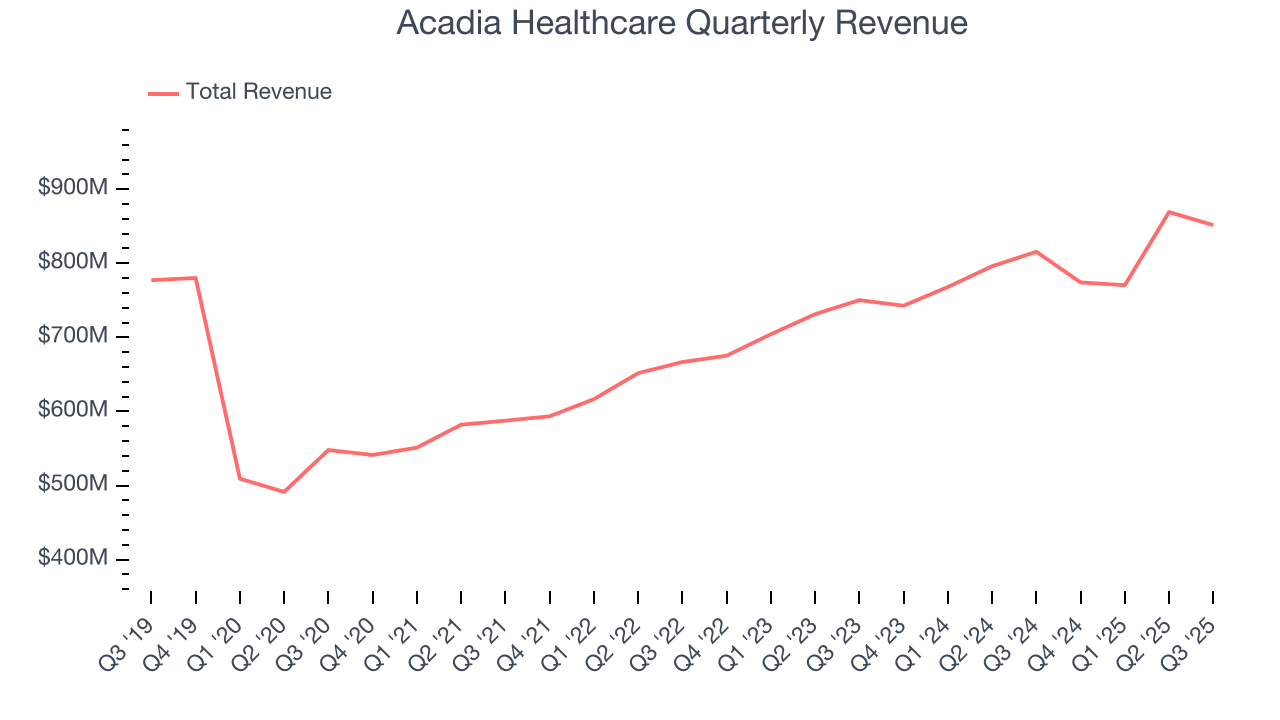

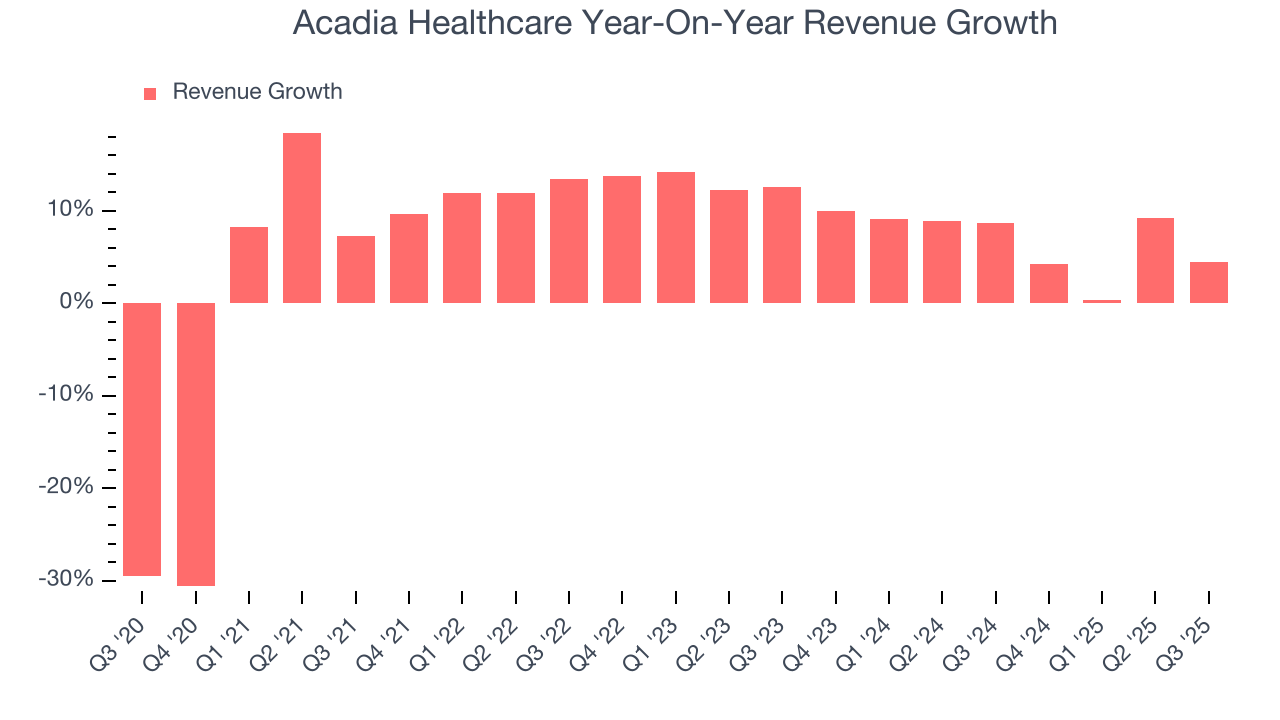

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Acadia Healthcare grew its sales at a mediocre 7% compounded annual growth rate. This was below our standard for the healthcare sector and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Acadia Healthcare’s annualized revenue growth of 6.8% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

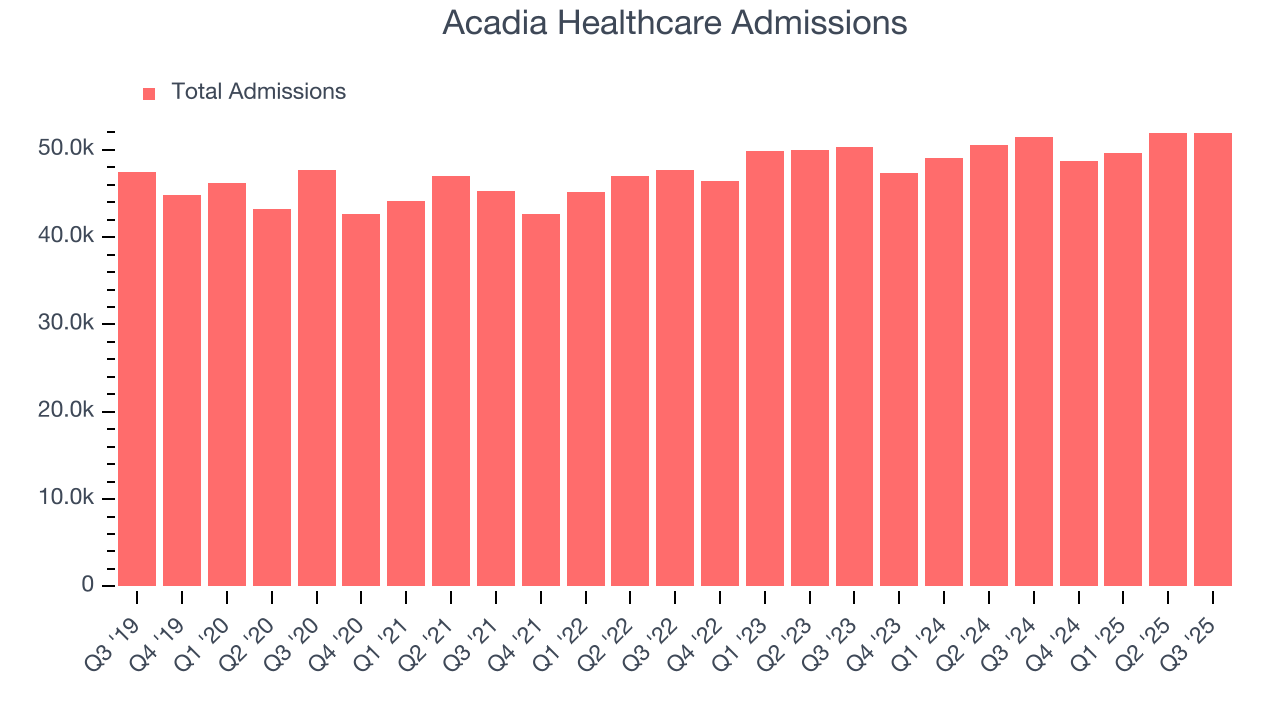

We can better understand the company’s revenue dynamics by analyzing its number of admissions, which reached 51,966 in the latest quarter. Over the last two years, Acadia Healthcare’s admissions averaged 1.4% year-on-year growth. Because this number is lower than its revenue growth, we can see the company benefited from price increases.

This quarter, Acadia Healthcare reported modest year-on-year revenue growth of 4.4% but beat Wall Street’s estimates by 0.7%.

Looking ahead, sell-side analysts expect revenue to grow 6.6% over the next 12 months, similar to its two-year rate. This projection is above average for the sector and suggests its newer products and services will help sustain its recent top-line performance.

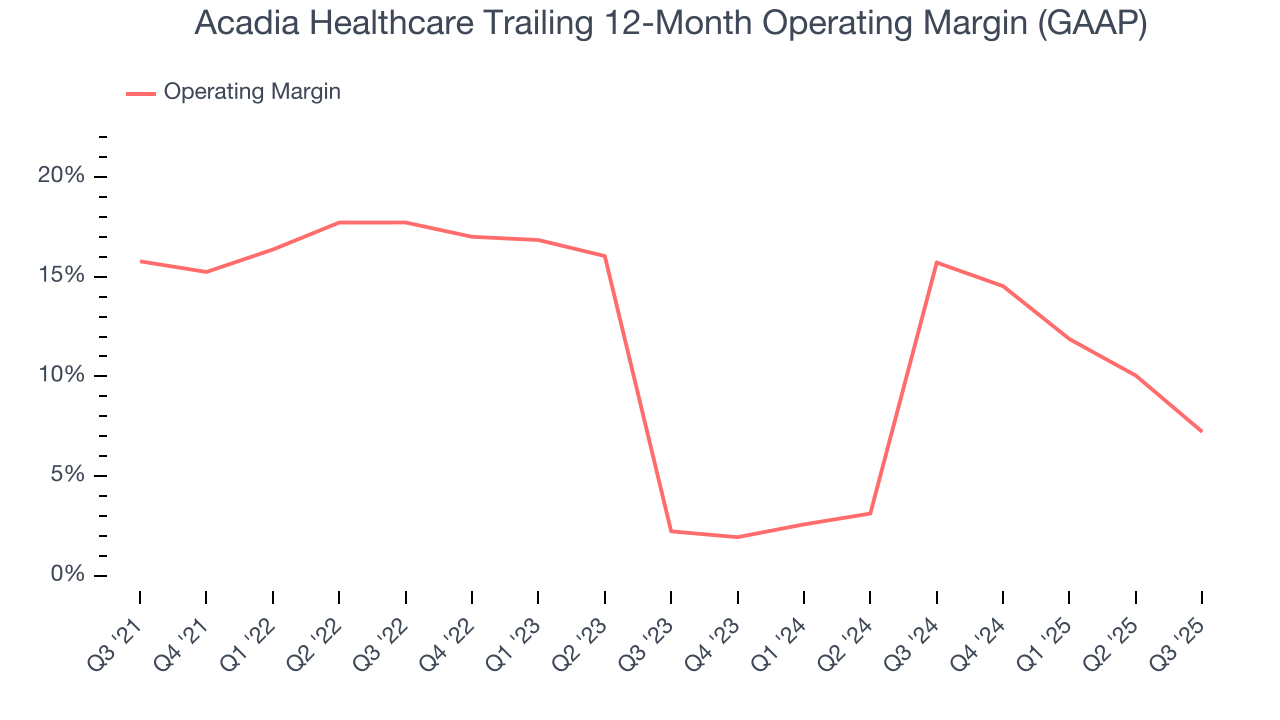

7. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Acadia Healthcare has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 11.4%, higher than the broader healthcare sector.

Analyzing the trend in its profitability, Acadia Healthcare’s operating margin decreased by 8.6 percentage points over the last five years, but it rose by 5 percentage points on a two-year basis. Still, shareholders will want to see Acadia Healthcare become more profitable in the future.

This quarter, Acadia Healthcare generated an operating margin profit margin of 4.7%, down 11.1 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

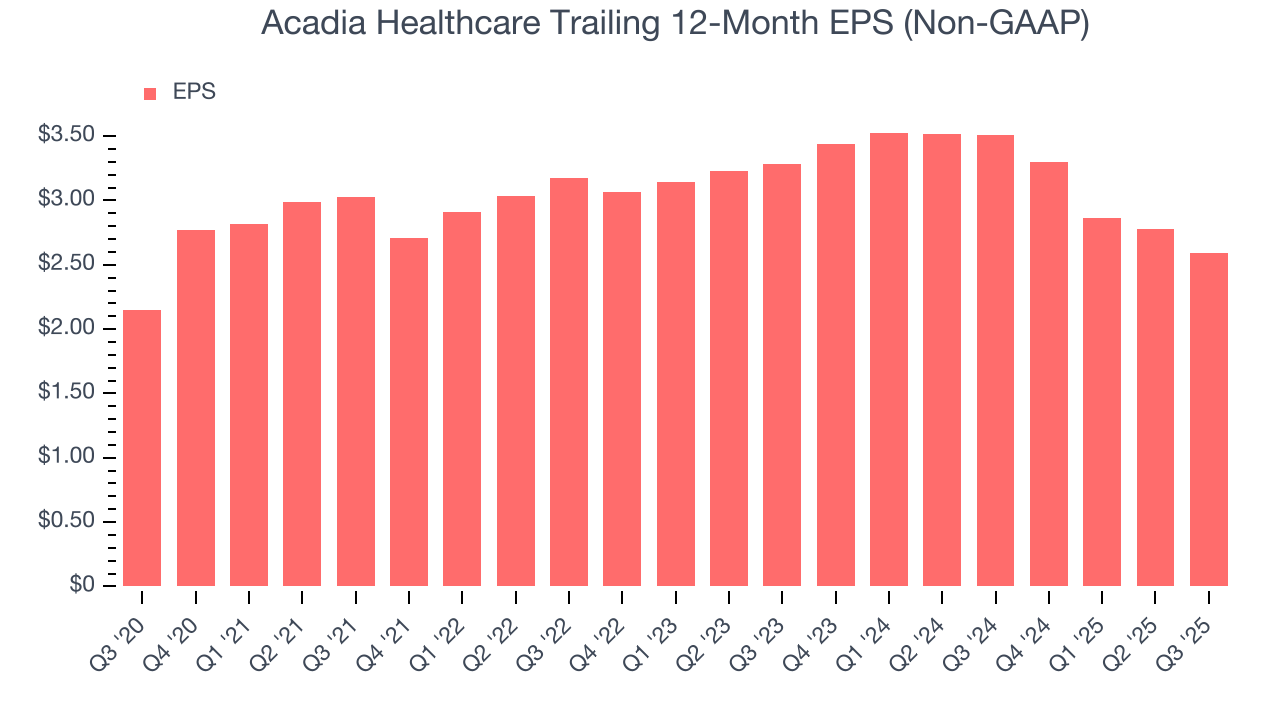

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

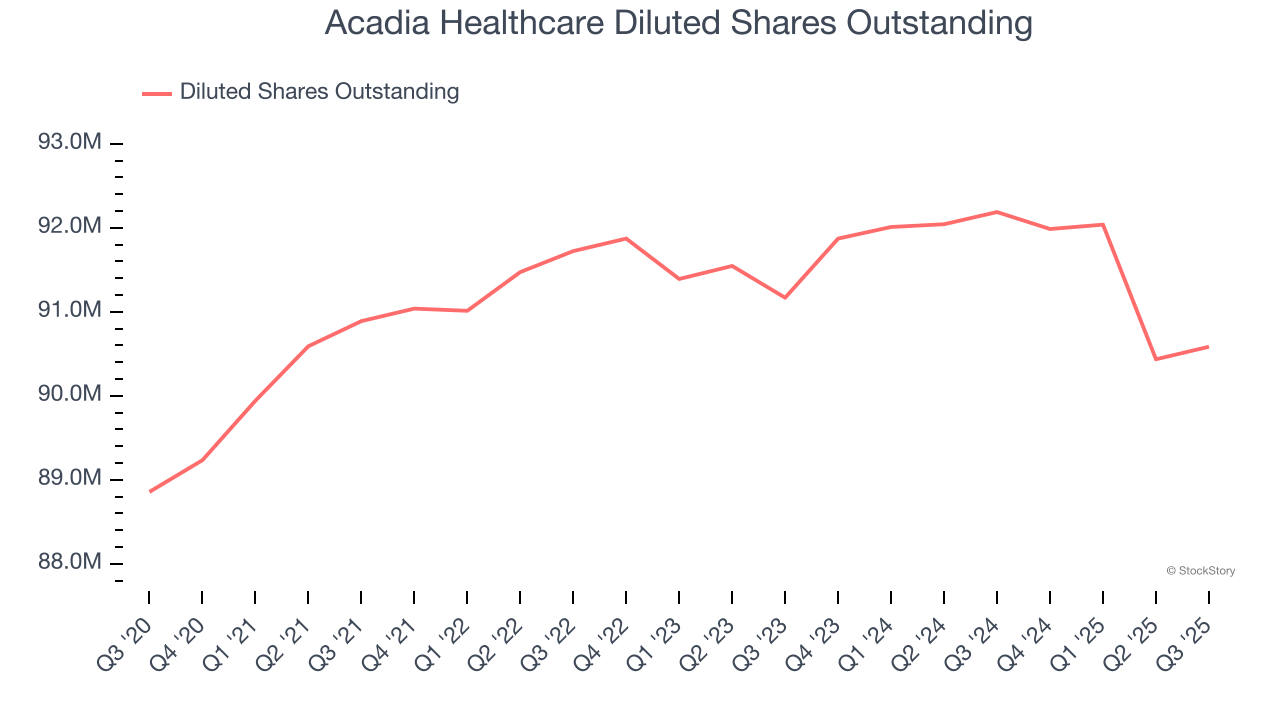

Acadia Healthcare’s EPS grew at an unimpressive 3.8% compounded annual growth rate over the last five years, lower than its 7% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

We can take a deeper look into Acadia Healthcare’s earnings to better understand the drivers of its performance. As we mentioned earlier, Acadia Healthcare’s operating margin declined by 8.6 percentage points over the last five years. Its share count also grew by 1.9%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q3, Acadia Healthcare reported adjusted EPS of $0.72, down from $0.91 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 9.1%. Over the next 12 months, Wall Street expects Acadia Healthcare’s full-year EPS of $2.59 to shrink by 2.5%.

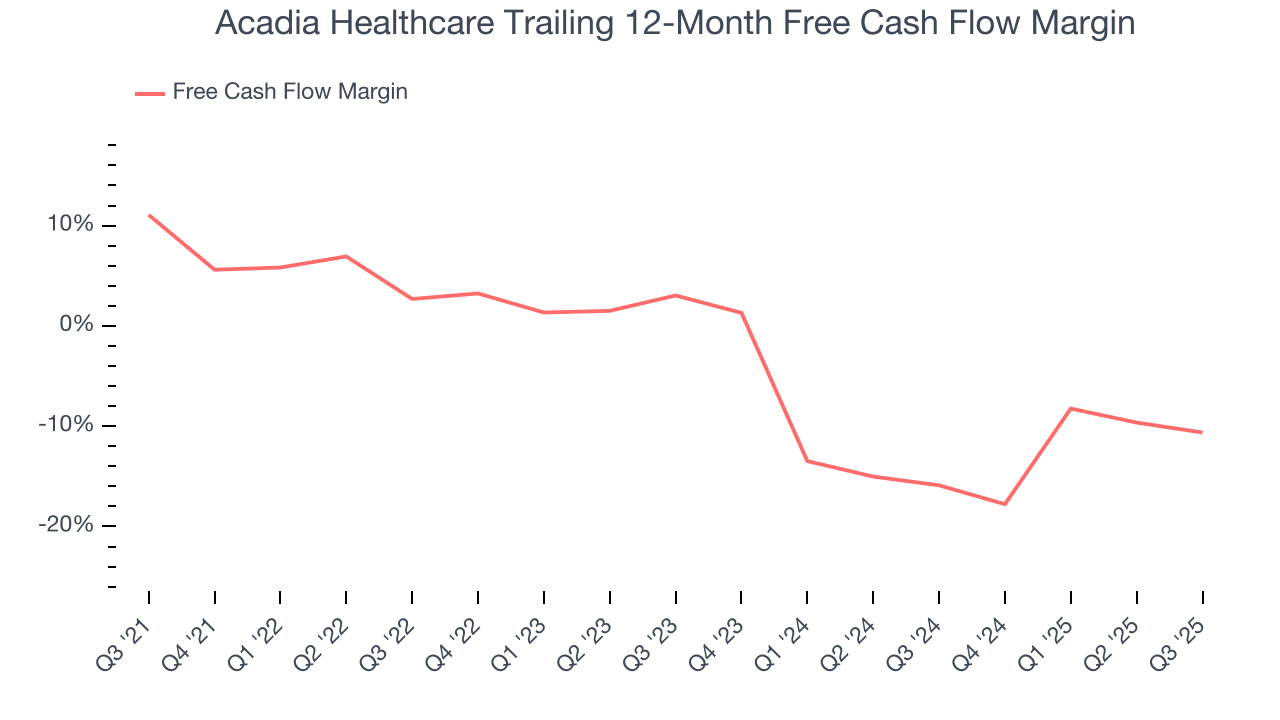

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Acadia Healthcare’s demanding reinvestments have consumed many resources over the last five years, contributing to an average free cash flow margin of negative 3.1%. This means it lit $3.12 of cash on fire for every $100 in revenue.

Taking a step back, we can see that Acadia Healthcare’s margin dropped by 21.7 percentage points during that time. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. Almost any movement in the wrong direction is undesirable because it’s already burning cash. If the longer-term trend returns, it could signal it’s becoming a more capital-intensive business.

Acadia Healthcare burned through $63.03 million of cash in Q3, equivalent to a negative 7.4% margin. The company’s cash burn increased from $27.11 million of lost cash in the same quarter last year.

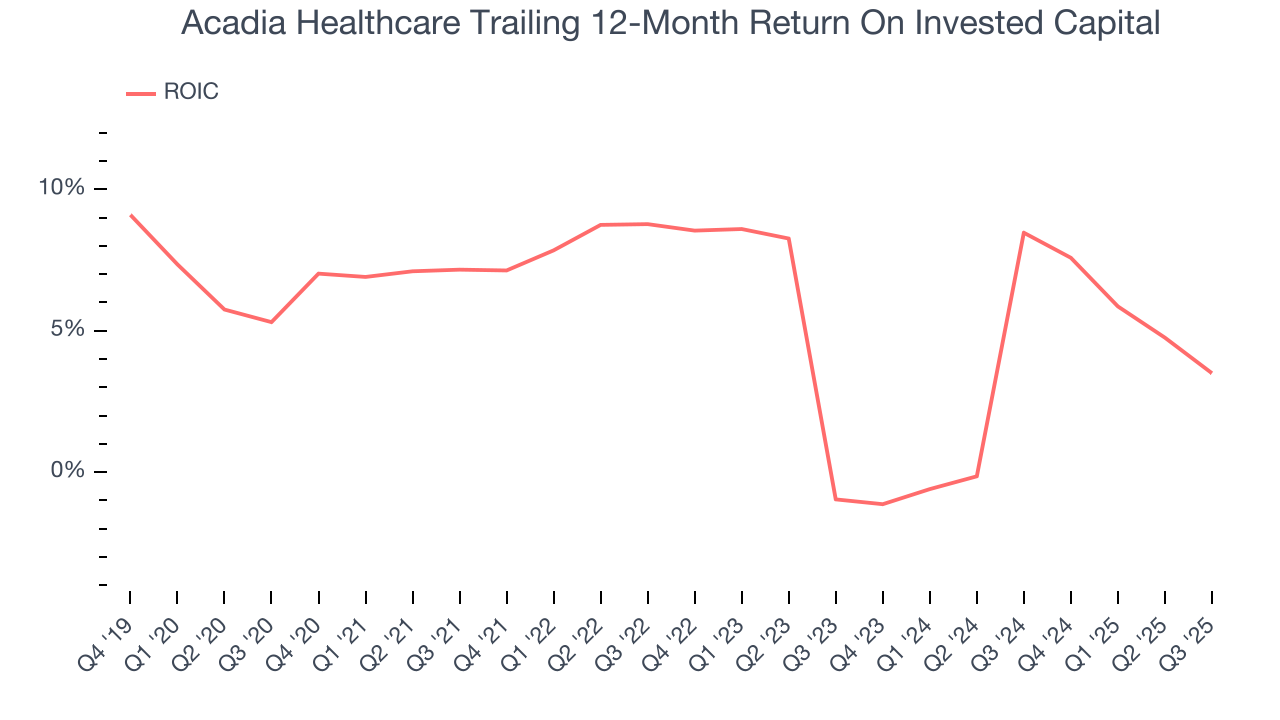

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Acadia Healthcare historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 5.4%, somewhat low compared to the best healthcare companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Acadia Healthcare’s ROIC averaged 2 percentage point decreases each year. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

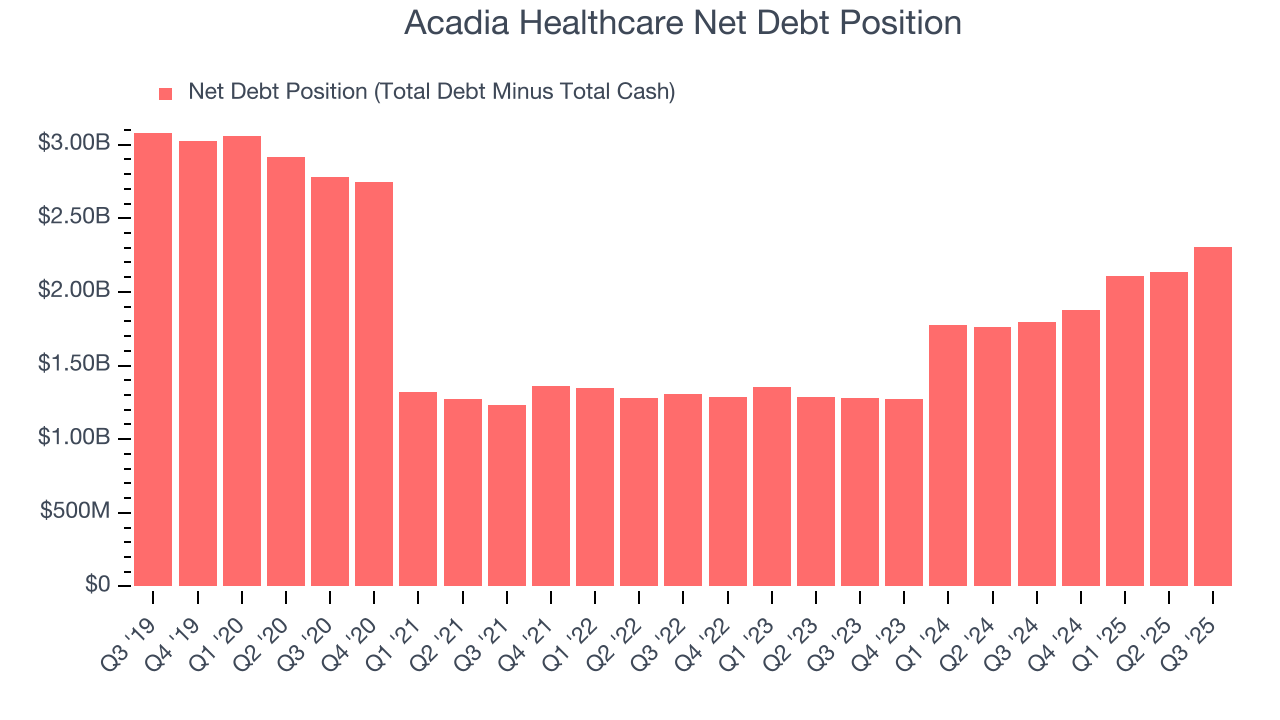

11. Balance Sheet Assessment

Acadia Healthcare reported $118.7 million of cash and $2.43 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $662.2 million of EBITDA over the last 12 months, we view Acadia Healthcare’s 3.5× net-debt-to-EBITDA ratio as safe. We also see its $57.77 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Acadia Healthcare’s Q3 Results

It was good to see Acadia Healthcare beat analysts’ EPS expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. On the other hand, its full-year EPS guidance missed and its full-year EBITDA guidance fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 8.8% to $18.85 immediately following the results.

13. Is Now The Time To Buy Acadia Healthcare?

Updated: January 20, 2026 at 11:18 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Acadia Healthcare.

Acadia Healthcare isn’t a terrible business, but it doesn’t pass our bar. To kick things off, its revenue growth was mediocre over the last five years, and analysts expect its demand to deteriorate over the next 12 months. And while its sturdy operating margins show it has disciplined cost controls, the downside is its cash profitability fell over the last five years. On top of that, its operations are burning a modest amount of cash.

Acadia Healthcare’s P/E ratio based on the next 12 months is 7.2x. While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $20.43 on the company (compared to the current share price of $14.40).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.