Alignment Healthcare (ALHC)

We love companies like Alignment Healthcare. Its innovative offerings are driving strong demand, as seen by the increase in its customer base.― StockStory Analyst Team

1. News

2. Summary

Why We Like Alignment Healthcare

Founded in 2013 with a mission to transform healthcare for seniors, Alignment Healthcare (NASDAQ:ALHC) provides Medicare Advantage health plans for seniors with features like concierge services, transportation benefits, and technology-driven care coordination.

- Annual revenue growth of 32.7% over the last five years was superb and indicates its market share increased during this cycle

- Earnings per share grew by 27.7% annually over the last four years and trumped its peers

- Expected revenue growth of 31.2% for the next year suggests its market share will rise

Alignment Healthcare is a standout company. This is a fantastic business you don’t see often.

Is Now The Time To Buy Alignment Healthcare?

High Quality

Investable

Underperform

Is Now The Time To Buy Alignment Healthcare?

Alignment Healthcare is trading at $19.70 per share, or 46.7x forward P/E. There are high expectations given this pricey multiple; we can’t deny that.

Do you like the company and believe the bull case? If so, you can own a smaller position, as our work shows that high-quality companies outperform the market over a multi-year period regardless of entry price.

3. Alignment Healthcare (ALHC) Research Report: Q4 CY2025 Update

Health insurance company Alignment Healthcare (NASDAQ:ALHC) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 44.4% year on year to $1.01 billion. On the other hand, next quarter’s revenue guidance of $1.22 billion was less impressive, coming in 1.9% below analysts’ estimates. Its GAAP loss of $0.05 per share was 67.1% above analysts’ consensus estimates.

Alignment Healthcare (ALHC) Q4 CY2025 Highlights:

- Revenue: $1.01 billion vs analyst estimates of $1 billion (44.4% year-on-year growth, 1% beat)

- EPS (GAAP): -$0.05 vs analyst estimates of -$0.15 (67.1% beat)

- Adjusted EBITDA: $11.41 million (1.1% margin, 737% year-on-year growth)

- Revenue Guidance for Q1 CY2026 is $1.22 billion at the midpoint, below analyst estimates of $1.24 billion

- EBITDA guidance for the upcoming financial year 2026 is $148 million at the midpoint, in line with analyst expectations

- Operating Margin: -1%, up from -3.2% in the same quarter last year

- Free Cash Flow was -$55.4 million compared to -$18 million in the same quarter last year

- Customers: 236,300, up from 229,600 in the previous quarter

- Market Capitalization: $4.03 billion

Company Overview

Founded in 2013 with a mission to transform healthcare for seniors, Alignment Healthcare (NASDAQ:ALHC) provides Medicare Advantage health plans for seniors with features like concierge services, transportation benefits, and technology-driven care coordination.

Alignment Healthcare operates at the intersection of healthcare insurance and technology, focusing exclusively on the Medicare Advantage market. The company designs its health plans specifically for seniors, with options tailored to different health conditions, socioeconomic statuses, and ethnic backgrounds. These include plans for healthy members, chronic special needs plans, and dual-eligible special needs products for those qualifying for both Medicare and Medicaid.

What sets Alignment apart is its proprietary technology platform called AVA (Alignment's Virtual Application). This cloud-based system integrates data from hundreds of sources to create comprehensive member profiles, predict health risks, and coordinate care. For example, if AVA detects that a diabetic member is running low on insulin, it can automatically trigger an order from a preferred pharmacy and arrange delivery to the member's home.

Alignment's plans go beyond traditional medical coverage to address broader lifestyle and social determinants of health. Members receive an ACCESS On-Demand Concierge card, a pre-paid debit card for purchasing over-the-counter products at participating retailers like Walgreens and Walmart. Some chronically ill members also receive grocery benefits to address food insecurity. Other innovative benefits include companion care services, transportation to medical appointments, fitness memberships, pet care during hospitalizations, and personal emergency response systems.

For its highest-risk members, Alignment offers its "Care Anywhere" program, which provides in-home or virtual care from Alignment-employed clinicians, including physicians, advanced practice providers, case managers, and social workers. This team creates personalized care plans and coordinates services across medical, social, psychological, and pharmaceutical needs.

Alignment generates revenue through capitated payments from the Centers for Medicare and Medicaid Services (CMS). These payments are risk-adjusted based on the health status of enrolled members, incentivizing the company to effectively manage care for chronically ill seniors. The company has expanded its geographic footprint beyond its initial California market to serve seniors across multiple states, partnering with local healthcare providers and retailers to enhance its service offerings.

4. Health Insurance Providers

Upfront premiums collected by health insurers lead to reliable revenue, but profitability ultimately depends on accurate risk assessments and the ability to control medical costs. Health insurers are also highly sensitive to regulatory changes and economic conditions such as unemployment. Going forward, the industry faces tailwinds from an aging population, increasing demand for personalized healthcare services, and advancements in data analytics to improve cost management. However, continued regulatory scrutiny on pricing practices, the potential for government-led reforms such as expanded public healthcare options, and inflation in medical costs could add volatility to margins. One big debate among investors is the long-term impact of AI and whether it will help underwriting, fraud detection, and claims processing or whether it may wade into ethical grey areas like reinforcing biases and widening disparities in medical care.

Alignment Healthcare competes with larger Medicare Advantage providers like UnitedHealth Group's UnitedHealthcare (NYSE:UNH), Humana (NYSE:HUM), and CVS Health's Aetna (NYSE:CVS), as well as with regional players like Clover Health (NASDAQ:CLOV) and Bright Health Group (NYSE:BHG).

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $3.95 billion in revenue over the past 12 months, Alignment Healthcare has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Alignment Healthcare grew its sales at an incredible 32.7% compounded annual growth rate. Its growth surpassed the average healthcare company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Alignment Healthcare’s annualized revenue growth of 47.1% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

We can better understand the company’s revenue dynamics by analyzing its number of customers, which reached 236,300 in the latest quarter. Over the last two years, Alignment Healthcare’s customer base averaged 25.5% year-on-year growth. Because this number is lower than its revenue growth, we can see the average customer spent more money each year on the company’s products and services.

This quarter, Alignment Healthcare reported magnificent year-on-year revenue growth of 44.4%, and its $1.01 billion of revenue beat Wall Street’s estimates by 1%. Company management is currently guiding for a 31.1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 31.2% over the next 12 months, a deceleration versus the last two years. Still, this projection is commendable and implies the market sees success for its products and services.

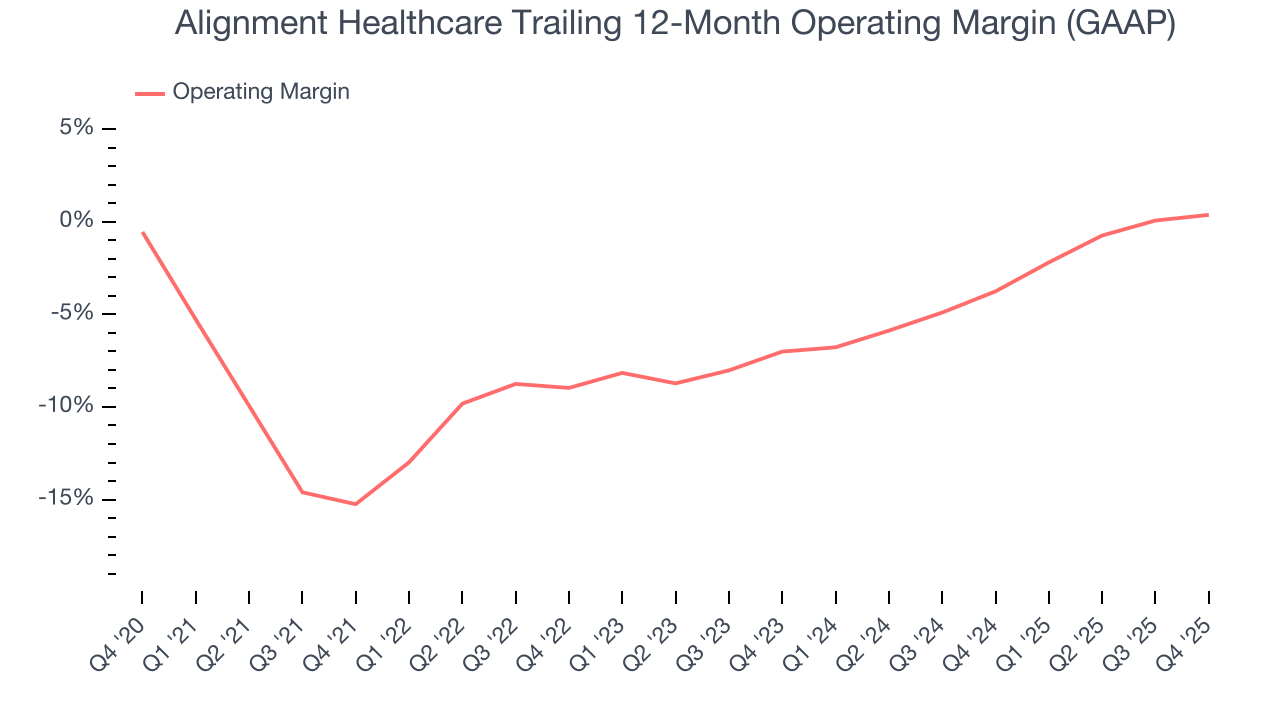

7. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Alignment Healthcare’s high expenses have contributed to an average operating margin of negative 4.7% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out.

On the plus side, Alignment Healthcare’s operating margin rose by 15.6 percentage points over the last five years, as its sales growth gave it operating leverage. Zooming in on its more recent performance, we can see the company’s trajectory is intact as its margin has also increased by 7.4 percentage points on a two-year basis. These data points are very encouraging and show momentum is on its side.

Alignment Healthcare’s operating margin was negative 1% this quarter.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Alignment Healthcare’s full-year EPS flipped from negative to breakeven over the last five years. This is a good sign and shows it’s at an inflection point.

In Q4, Alignment Healthcare reported EPS of negative $0.05, up from negative $0.16 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street is optimistic. Analysts forecast Alignment Healthcare’s full-year EPS of negative $0 will flip to positive $0.10.

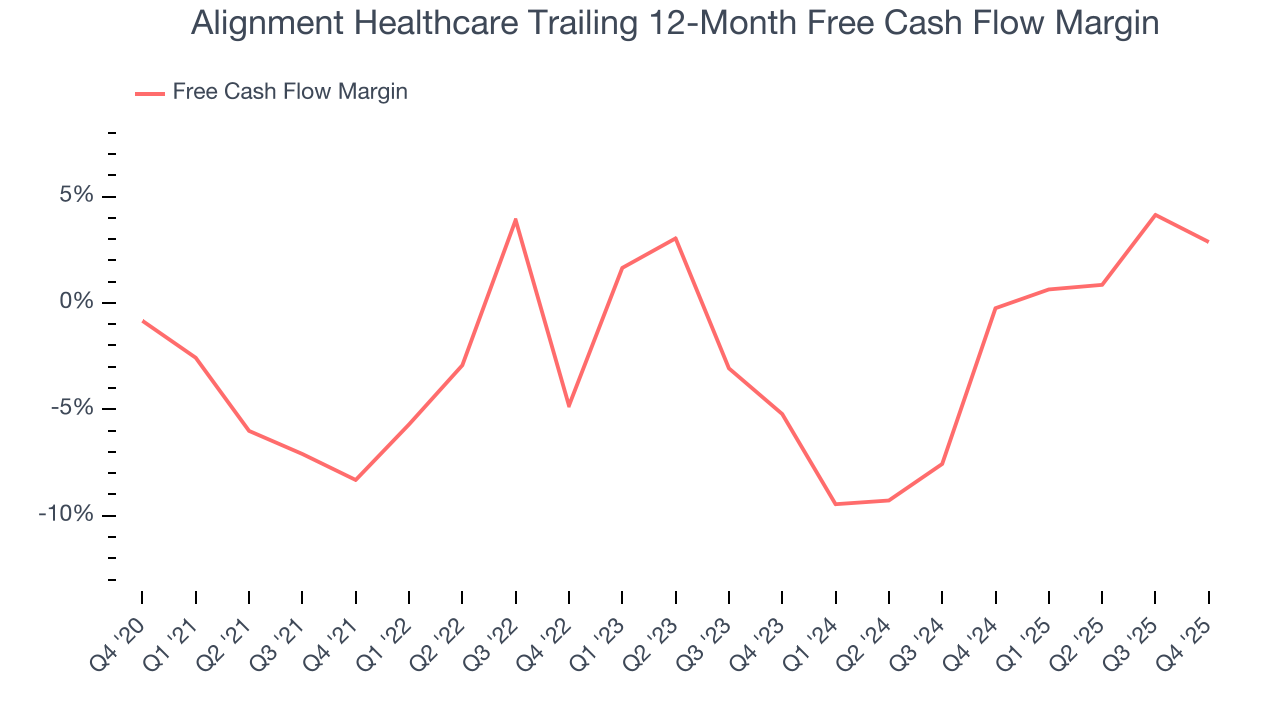

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Alignment Healthcare’s demanding reinvestments have consumed many resources over the last five years, contributing to an average free cash flow margin of negative 1.4%. This means it lit $1.40 of cash on fire for every $100 in revenue.

Taking a step back, an encouraging sign is that Alignment Healthcare’s margin expanded by 11.2 percentage points during that time. The company’s improvement shows it’s heading in the right direction, and continued increases could help it achieve long-term cash profitability.

Alignment Healthcare burned through $55.4 million of cash in Q4, equivalent to a negative 5.5% margin. The company’s cash burn increased from $18 million of lost cash in the same quarter last year.

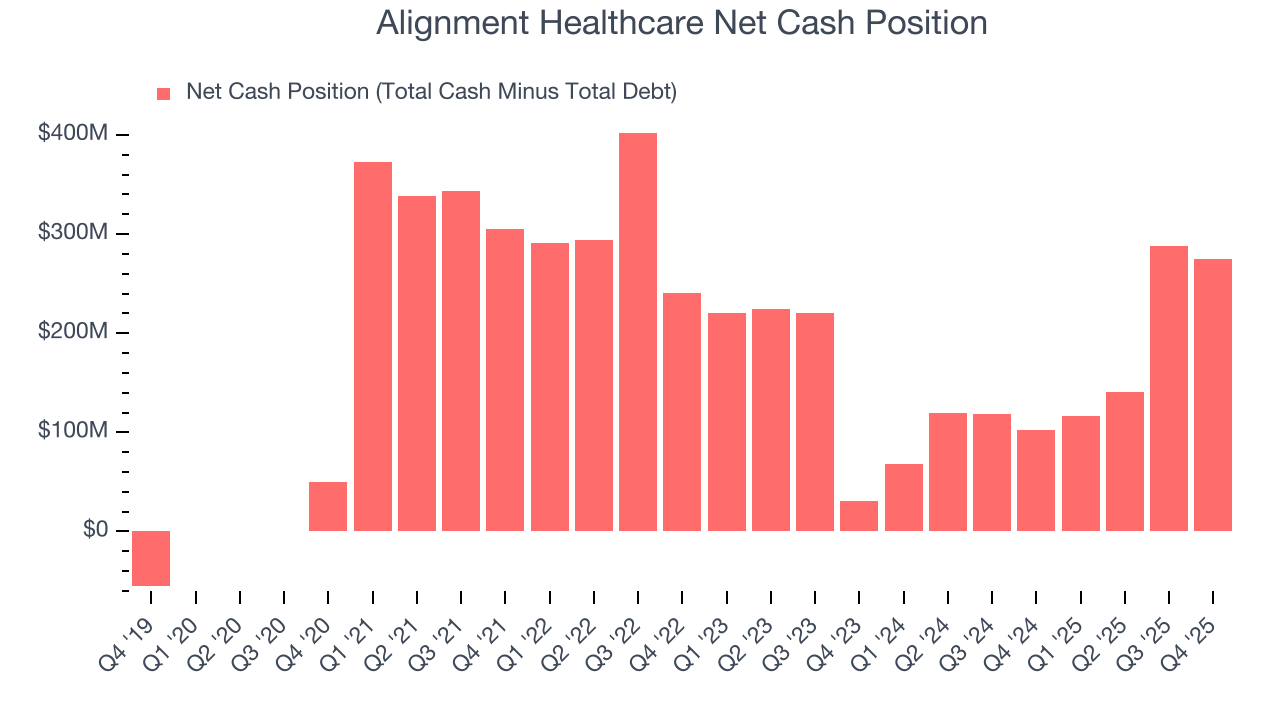

10. Balance Sheet Assessment

Companies with more cash than debt have lower bankruptcy risk.

Alignment Healthcare is a profitable, well-capitalized company with $604.2 million of cash and $329.6 million of debt on its balance sheet. This $274.6 million net cash position is 6.8% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from Alignment Healthcare’s Q4 Results

It was good to see Alignment Healthcare beat analysts’ EPS expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. On the other hand, its revenue guidance for next quarter missed and its EBITDA guidance for next quarter fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 4.5% to $19.50 immediately after reporting.

12. Is Now The Time To Buy Alignment Healthcare?

Before making an investment decision, investors should account for Alignment Healthcare’s business fundamentals and valuation in addition to what happened in the latest quarter.

Alignment Healthcare is a cream-of-the-crop healthcare company. For starters, its revenue growth was exceptional over the last five years. And while its operating margins reveal poor profitability compared to other healthcare companies, its customer growth has been marvelous. Additionally, Alignment Healthcare’s rising cash profitability gives it more optionality.

Alignment Healthcare’s P/E ratio based on the next 12 months is 56.7x. Expectations are high given its premium multiple, but we’ll happily own Alignment Healthcare as its fundamentals illustrate it’s clearly doing something special. Investments like this should be held patiently for at least three to five years as they benefit from the power of long-term compounding, which more than makes up for any short-term price volatility that comes with high valuations.

Wall Street analysts have a consensus one-year price target of $25.17 on the company (compared to the current share price of $19.50).