Amgen (AMGN)

We see potential in Amgen. It generates heaps of cash that are reinvested into the business, creating a virtuous cycle of returns.― StockStory Analyst Team

1. News

2. Summary

Why Amgen Is Interesting

Founded in 1980 during the early days of the biotechnology revolution, Amgen (NASDAQ:AMGN) is a biotechnology company that discovers, develops, and manufactures innovative medicines to treat serious illnesses like cancer, osteoporosis, and autoimmune diseases.

- Healthy adjusted operating margin shows it’s a well-run company with efficient processes

- Impressive free cash flow profitability enables the company to fund new investments or reward investors with share buybacks/dividends

- One risk is its estimated sales growth of 2.5% for the next 12 months implies demand will slow from its two-year trend

Amgen has some noteworthy aspects. If you believe in the company, the price looks fair.

Why Is Now The Time To Buy Amgen?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Amgen?

Amgen is trading at $341.71 per share, or 15.4x forward P/E. Amgen’s current valuation is below that of most healthcare companies, but this doesn’t make it a bargain. Instead, the price is warranted for the quality you get.

If you think the market is not giving the company enough credit for its fundamentals, now could be a good time to invest.

3. Amgen (AMGN) Research Report: Q4 CY2025 Update

Biotech company Amgen (NASDAQ:AMGN) reported revenue ahead of Wall Streets expectations in Q4 CY2025, with sales up 8.6% year on year to $9.87 billion. The company’s full-year revenue guidance of $37.7 billion at the midpoint came in 1.8% above analysts’ estimates. Its non-GAAP profit of $5.29 per share was 11.9% above analysts’ consensus estimates.

Amgen (AMGN) Q4 CY2025 Highlights:

- Revenue: $9.87 billion vs analyst estimates of $9.47 billion (8.6% year-on-year growth, 4.1% beat)

- Adjusted EPS: $5.29 vs analyst estimates of $4.73 (11.9% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $22.30 at the midpoint, beating analyst estimates by 0.9%

- Operating Margin: 27.6%, up from 25.4% in the same quarter last year

- Free Cash Flow Margin: 9.7%, down from 48.4% in the same quarter last year

- Market Capitalization: $185.6 billion

Company Overview

Founded in 1980 during the early days of the biotechnology revolution, Amgen (NASDAQ:AMGN) is a biotechnology company that discovers, develops, and manufactures innovative medicines to treat serious illnesses like cancer, osteoporosis, and autoimmune diseases.

Amgen's diverse portfolio includes treatments for bone health conditions, inflammatory disorders, cancer, and rare diseases. The company's flagship products include Prolia for osteoporosis, ENBREL for rheumatoid arthritis and psoriasis, and Repatha for reducing cardiovascular risk. Amgen also markets XGEVA for preventing skeletal complications in cancer patients, Otezla for psoriasis, and KYPROLIS for multiple myeloma.

Healthcare providers prescribe Amgen's medications to patients with conditions that often have limited treatment options. For example, a postmenopausal woman with severe osteoporosis might receive Prolia injections twice yearly to reduce her fracture risk, while a patient with treatment-resistant small cell lung cancer might benefit from tarlatamab, one of Amgen's newer therapies.

The company operates through a traditional pharmaceutical business model, selling its products primarily through wholesale distributors who then supply healthcare providers and pharmacies. Three major distributors—McKesson, Cencora (formerly AmerisourceBergen), and Cardinal Health—account for nearly 80% of Amgen's worldwide gross revenues.

Amgen maintains a robust research and development pipeline, investing billions annually to discover new treatments. The company's BiTE (bispecific T-cell engager) technology platform represents one of its innovative approaches to cancer treatment, creating molecules that simultaneously bind to cancer cells and immune cells to help the immune system target cancer more effectively.

In 2023, Amgen expanded its rare disease portfolio by acquiring Horizon Therapeutics, adding treatments like TEPEZZA for thyroid eye disease and KRYSTEXXA for chronic refractory gout. The company has a global presence, marketing its products in approximately 100 countries through its own sales force and partnerships with regional pharmaceutical companies.

4. Therapeutics

Over the next few years, therapeutic companies, which develop a wide variety of treatments for diseases and disorders, face strong tailwinds from advancements in precision medicine (including the use of AI to improve hit rates) and growing demand for treatments targeting rare diseases. However, headwinds such as rising scrutiny over drug pricing, regulatory unknowns, and competition from larger, more resourced pharmaceutical companies could weigh on growth.

Amgen's competitors vary by therapeutic area and include major pharmaceutical companies such as AbbVie, Novartis, and Pfizer in the inflammation space; Regeneron and Sanofi for cholesterol medications; and Bristol Myers Squibb, Janssen, and Takeda in oncology. For its rare disease portfolio, competitors include Alexion (part of AstraZeneca) and Sanofi Genzyme.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $36.75 billion in revenue over the past 12 months, Amgen sports economies of scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Revenue Growth

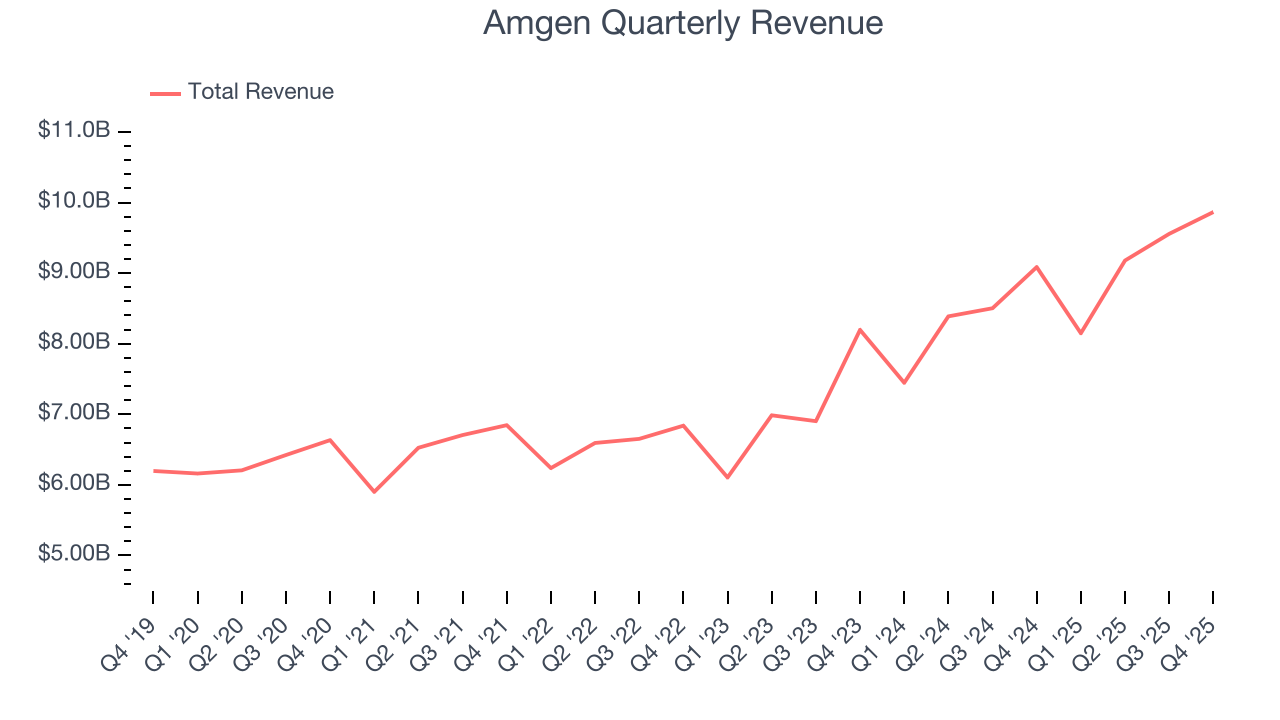

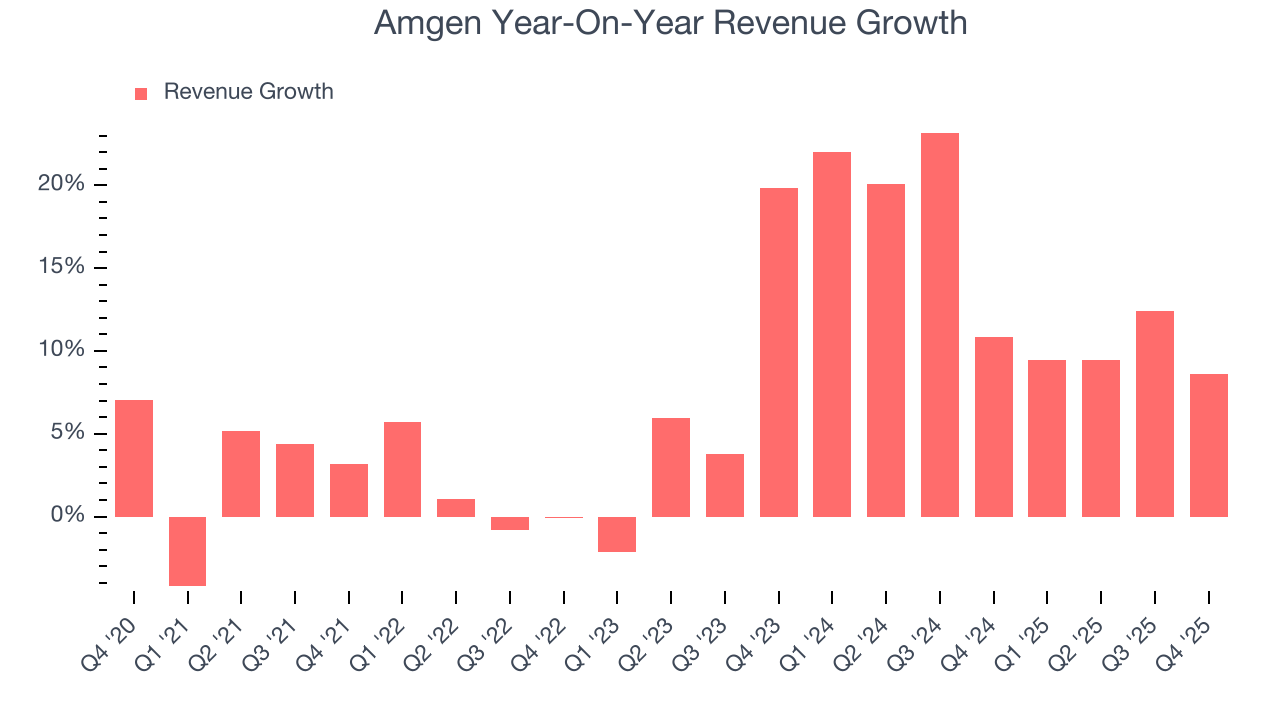

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, Amgen’s 7.6% annualized revenue growth over the last five years was decent. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Amgen’s annualized revenue growth of 14.2% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

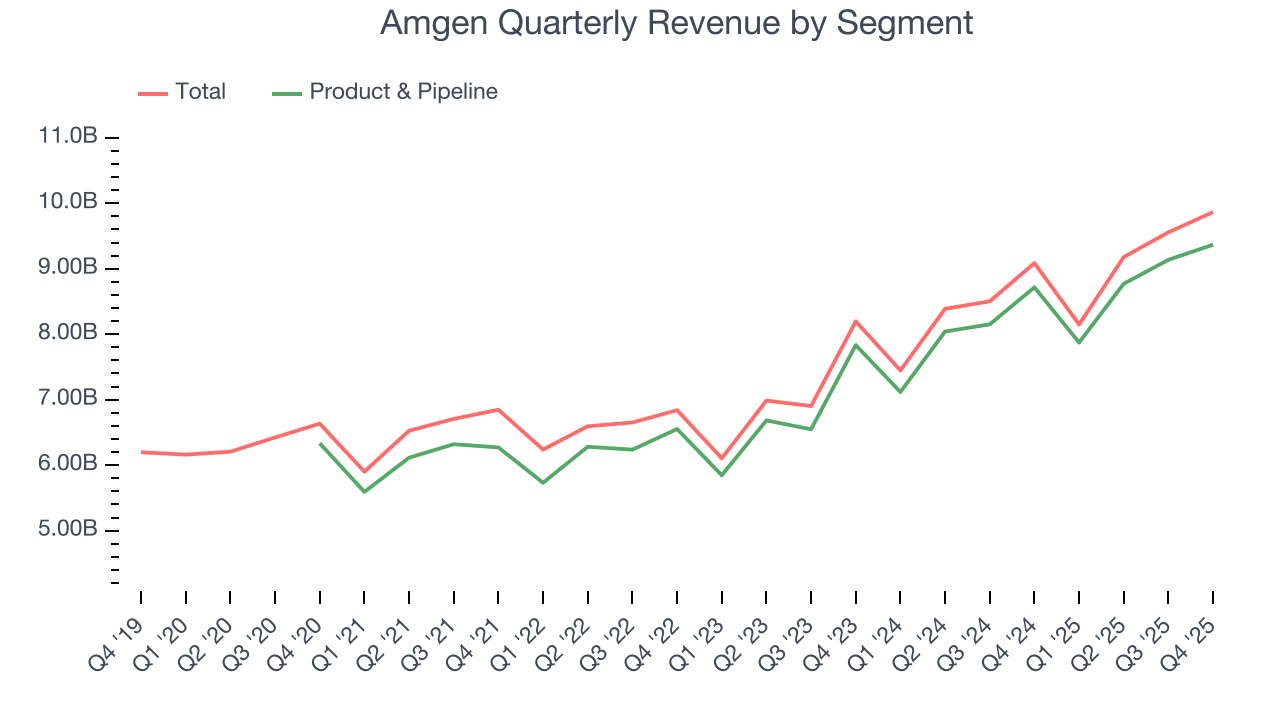

Amgen also breaks out the revenue for its most important segment, Product & Pipeline. Over the last two years, Amgen’s Product & Pipeline revenue averaged 14.6% year-on-year growth.

This quarter, Amgen reported year-on-year revenue growth of 8.6%, and its $9.87 billion of revenue exceeded Wall Street’s estimates by 4.1%.

Looking ahead, sell-side analysts expect revenue to grow 1.3% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and suggests its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

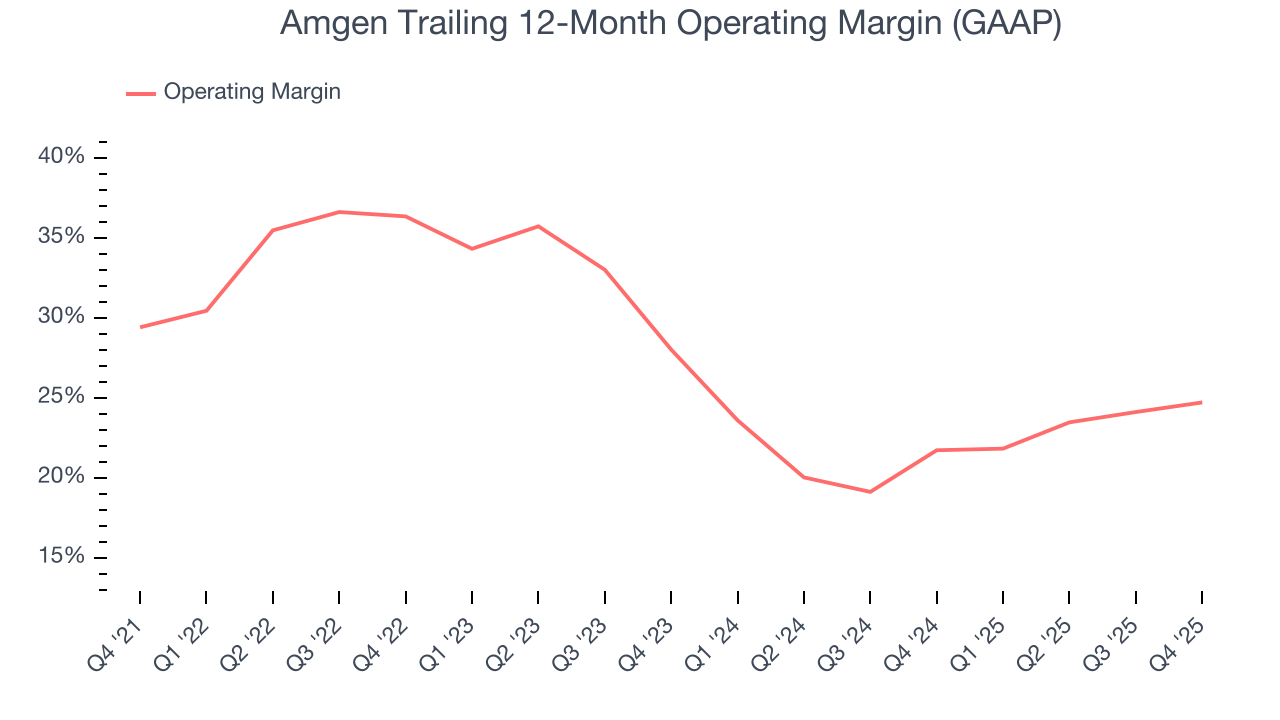

7. Operating Margin

Amgen has been an efficient company over the last five years. It was one of the more profitable businesses in the healthcare sector, boasting an average operating margin of 27.5%.

Looking at the trend in its profitability, Amgen’s operating margin decreased by 4.7 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 3.3 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

In Q4, Amgen generated an operating margin profit margin of 27.6%, up 2.1 percentage points year on year. This increase was a welcome development and shows it was more efficient.

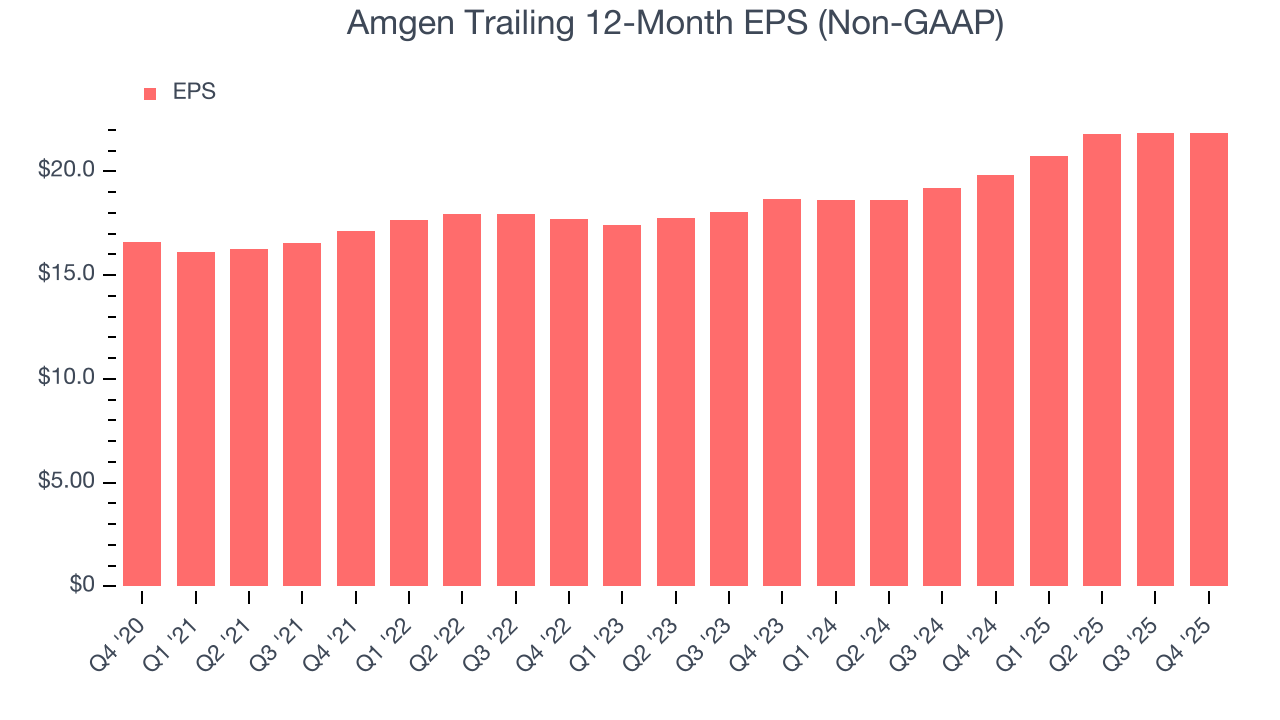

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Amgen’s decent 5.7% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

In Q4, Amgen reported adjusted EPS of $5.29, down from $5.31 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Amgen’s full-year EPS of $21.85 to grow 1.1%.

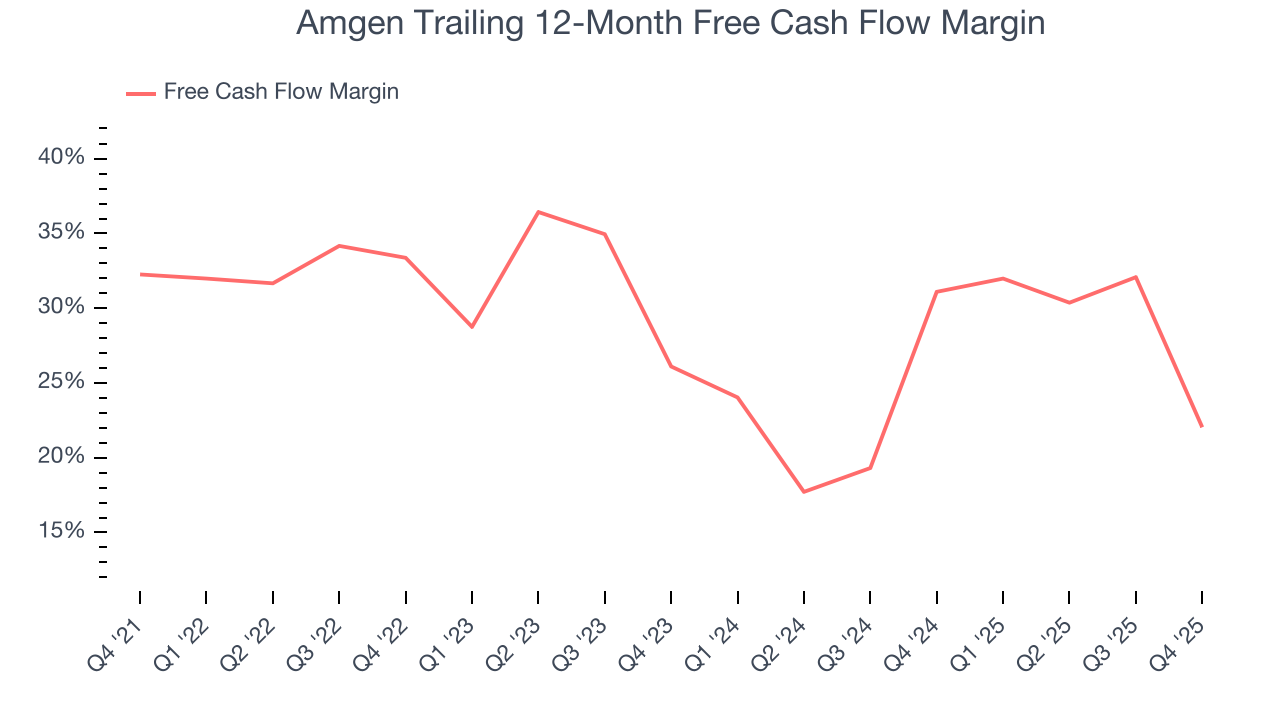

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Amgen has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the healthcare sector, averaging 28.6% over the last five years.

Taking a step back, we can see that Amgen’s margin dropped by 10.2 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

Amgen’s free cash flow clocked in at $961 million in Q4, equivalent to a 9.7% margin. The company’s cash profitability regressed as it was 38.7 percentage points lower than in the same quarter last year, which isn’t ideal considering its longer-term trend.

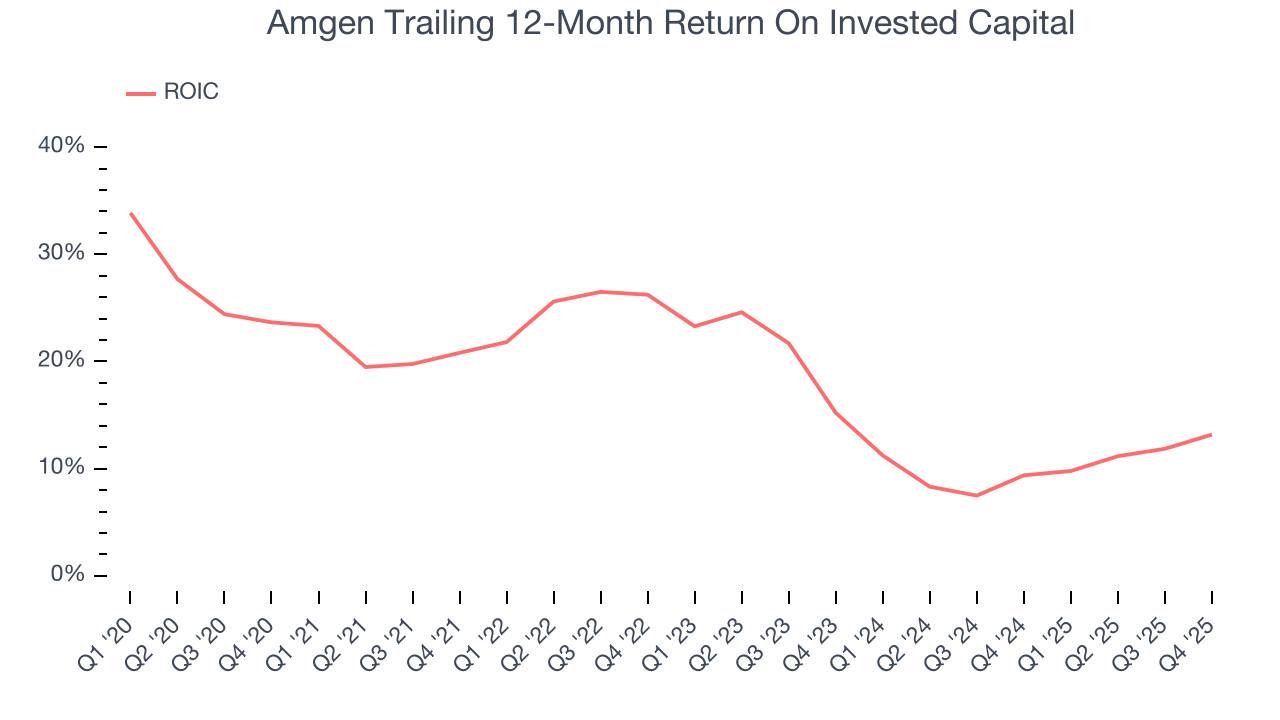

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Amgen’s five-year average ROIC was 17%, beating other healthcare companies by a wide margin. This illustrates its management team’s ability to invest in attractive growth opportunities and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Amgen’s ROIC has unfortunately decreased significantly. Only time will tell if its new bets can bear fruit and potentially reverse the trend.

11. Key Takeaways from Amgen’s Q4 Results

We enjoyed seeing Amgen beat analysts’ revenue expectations this quarter. We were also glad its full-year revenue guidance exceeded Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock remained flat at $339.72 immediately following the results.

12. Is Now The Time To Buy Amgen?

Updated: February 3, 2026 at 10:38 PM EST

Before investing in or passing on Amgen, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

Amgen possesses a number of positive attributes. First off, its revenue growth was decent over the last five years. And while its diminishing returns show management's recent bets still have yet to bear fruit, its impressive operating margins show it has a highly efficient business model. On top of that, its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits.

Amgen’s P/E ratio based on the next 12 months is 15.4x. Looking at the healthcare space right now, Amgen trades at a compelling valuation. If you’re a fan of the business and management team, now is a good time to scoop up some shares.

Wall Street analysts have a consensus one-year price target of $332.89 on the company (compared to the current share price of $341.71).