Amkor (AMKR)

Amkor doesn’t excite us. Its underwhelming revenue growth and failure to generate meaningful free cash flow is a concerning trend.― StockStory Analyst Team

1. News

2. Summary

Why We Think Amkor Will Underperform

Operating through a largely Asian facility footprint, Amkor Technologies (NASDAQ:AMKR) provides outsourced packaging and testing for semiconductors.

- High input costs result in an inferior gross margin of 14.2% that must be offset through higher volumes

- Ability to fund investments or reward shareholders with increased buybacks or dividends is restricted by its weak free cash flow margin of 5.1% for the last two years

- A silver lining is that its annual revenue growth of 5.8% over the last five years was above the sector average and underscores its products and services value to customers

Amkor doesn’t check our boxes. There are more appealing investments to be made.

Why There Are Better Opportunities Than Amkor

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Amkor

Amkor is trading at $48.16 per share, or 31.7x forward P/E. This multiple is high given its weaker fundamentals.

Paying a premium for high-quality companies with strong long-term earnings potential is preferable to owning challenged businesses with questionable prospects. That helps the prudent investor sleep well at night.

3. Amkor (AMKR) Research Report: Q3 CY2025 Update

Semiconductor packaging and testing company Amkor Technology (NASDAQ:AMKR) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 6.7% year on year to $1.99 billion. On the other hand, next quarter’s revenue guidance of $1.83 billion was less impressive, coming in 1.2% below analysts’ estimates. Its GAAP profit of $0.51 per share was 20.7% above analysts’ consensus estimates.

Amkor (AMKR) Q3 CY2025 Highlights:

- Revenue: $1.99 billion vs analyst estimates of $1.94 billion (6.7% year-on-year growth, 2.6% beat)

- EPS (GAAP): $0.51 vs analyst estimates of $0.42 (20.7% beat)

- Adjusted EBITDA: $340 million vs analyst estimates of $315.5 million (17.1% margin, 7.8% beat)

- Revenue Guidance for Q4 CY2025 is $1.83 billion at the midpoint, below analyst estimates of $1.85 billion

- EPS (GAAP) guidance for Q4 CY2025 is $0.43 at the midpoint, beating analyst estimates by 3.8%

- Operating Margin: 8%, in line with the same quarter last year

- Free Cash Flow was -$77.93 million compared to -$31.33 million in the same quarter last year

- Inventory Days Outstanding: 21, down from 26 in the previous quarter

- Market Capitalization: $8.10 billion

Company Overview

Operating through a largely Asian facility footprint, Amkor Technologies (NASDAQ:AMKR) provides outsourced packaging and testing for semiconductors.

Semiconductor manufacturing begins with a silicon wafer upon which circuit patterns are transferred. The fabricated material (the die) is then separated (dicing), typically using automation and precision tools such as lasers. Packaging comes next and serves three key purposes: connects the chip to an external environment (e.g. a circuit board), protects the chips against physical damage, and dissipates excess heat.

Amkor’s customers are semiconductor foundries (manufacturers), fabless semiconductor companies (designers who outsource manufacturing), and original equipment manufacturers (OEMs). The company’s packaging aims to meet customers’ requirements for size, electrical and mechanical performance, and interconnect technology (wiring systems to connect chips). For example, one of Amkor’s key packaging offerings is the ‘Flip-Chip Chip Scale Package’, where the package is no larger than the chip. This supports increasingly small form factors found in smartphones, tablets and other mobile devices. In addition to packaging, Amkor also offers testing services to ensure that semiconductors are defect-free and meet specifications before being deployed or sold.

Other companies offering outsourced semiconductor packaging and testing services include ASE Technology (TWSE:3711), Powertech Technology (TWSE:6239), and Siliconware Technology.

4. Revenue Growth

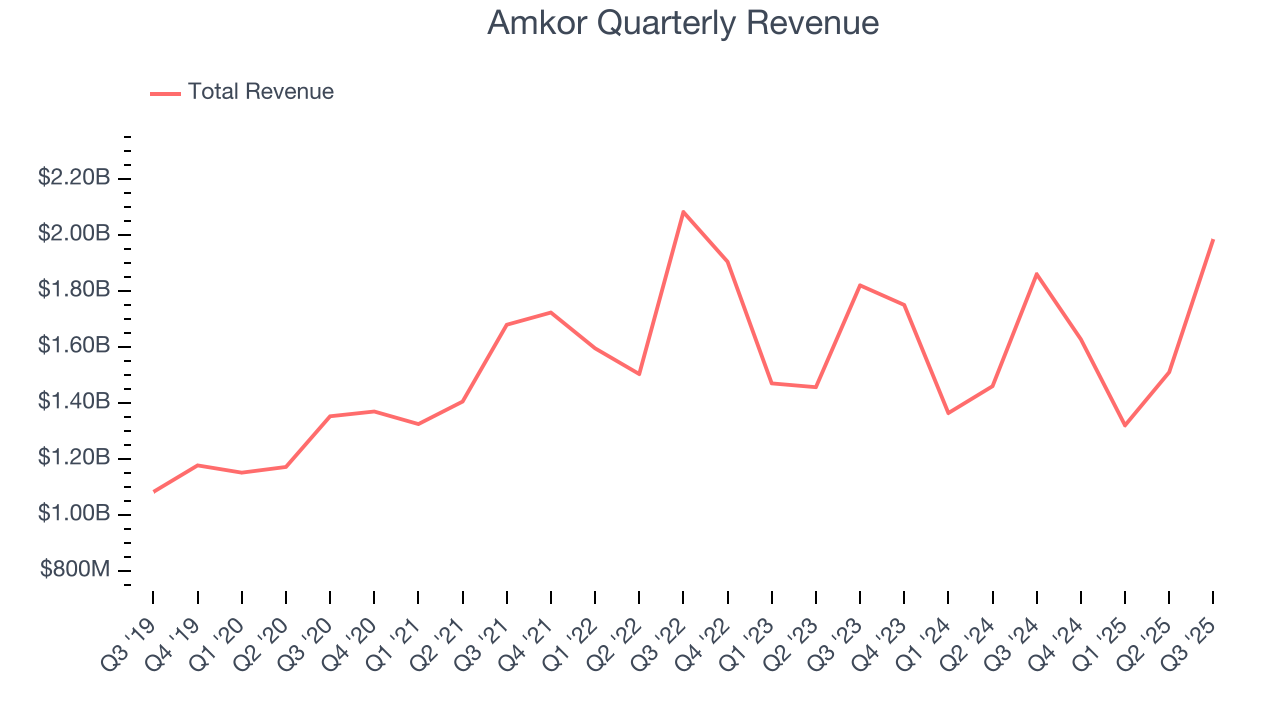

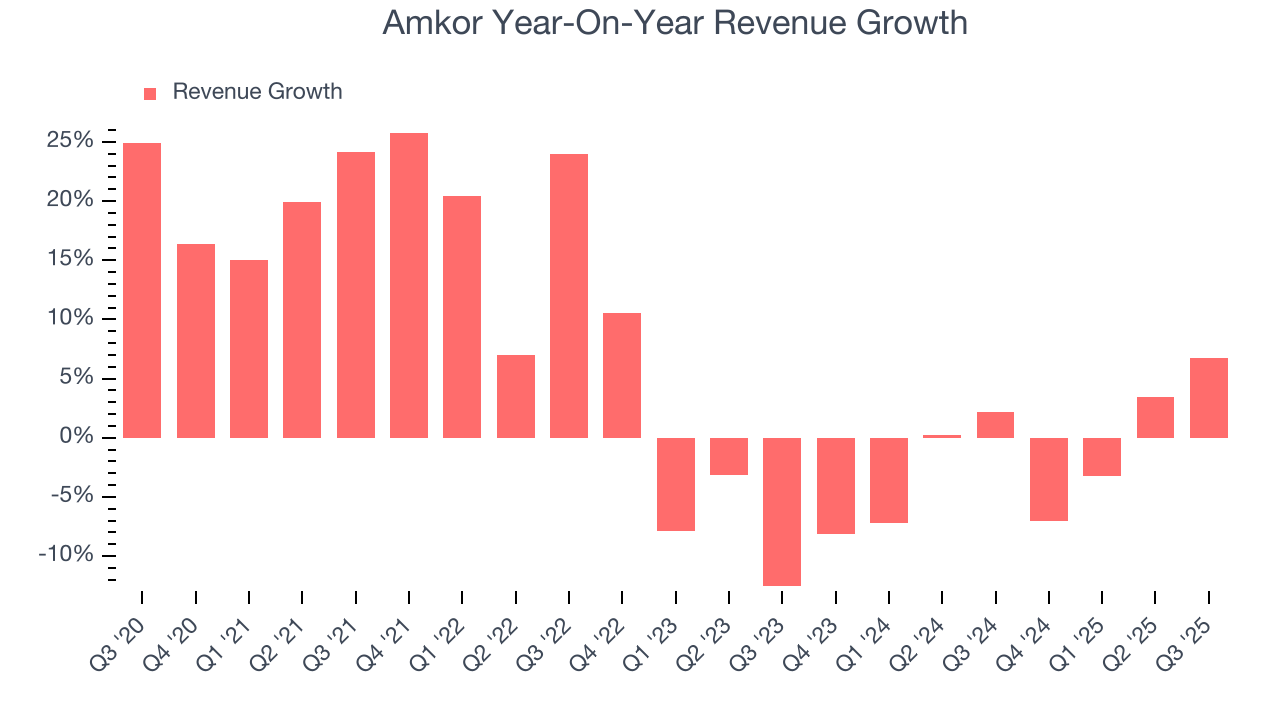

A company’s top-line performance is one signal of its overall business quality. Strong growth can indicate it’s riding a successful new product or emerging trend. Amkor struggled to generate demand over the last two years as its sales dropped by 1.6% annually, a rough starting point for our analysis. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

Long-term growth is the most important, but short-term results matter for semiconductors because the rapid pace of technological innovation (Moore's Law) could make yesterday's hit product obsolete today. Amkor’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 1.6% annually.

This quarter, Amkor reported year-on-year revenue growth of 6.7%, and its $1.99 billion of revenue exceeded Wall Street’s estimates by 2.6%. Company management is currently guiding for a 12% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 9.6% over the next 12 months. Although this projection implies its newer products and services will catalyze better top-line performance, it is still below average for the sector.

5. Product Demand & Outstanding Inventory

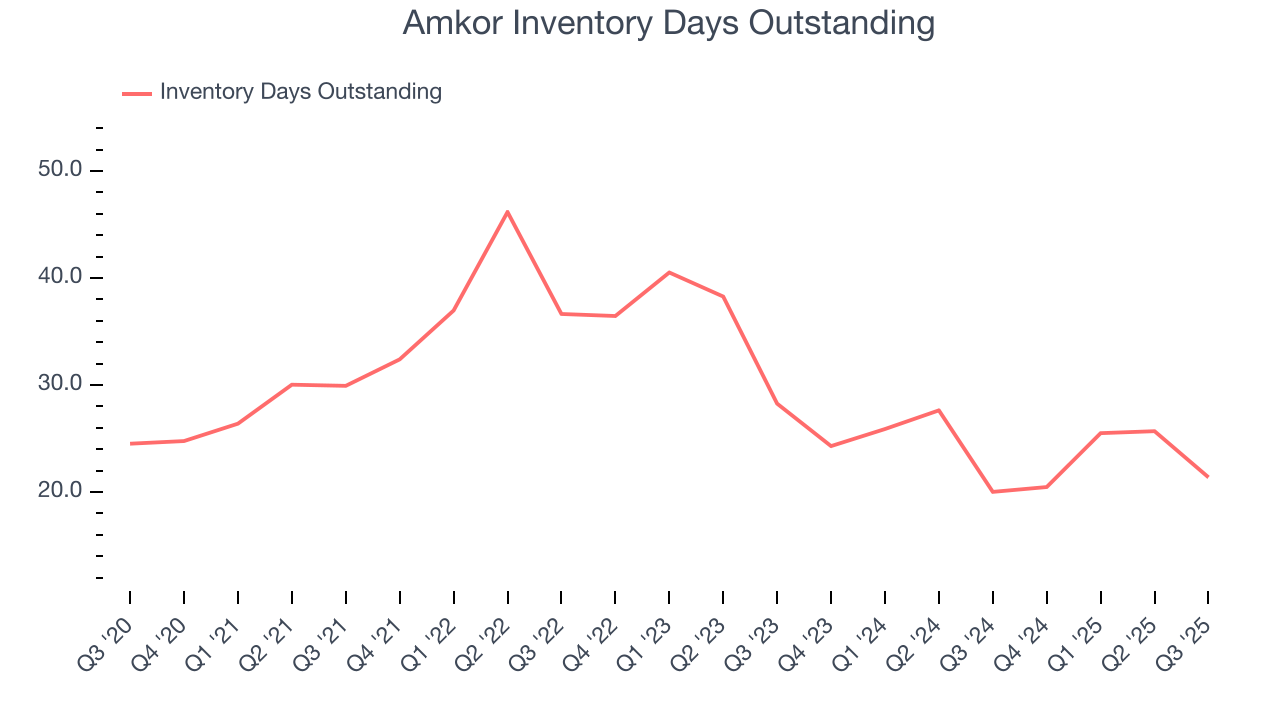

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Amkor’s DIO came in at 21, which is 9 days below its five-year average. At the moment, these numbers show no indication of an excessive inventory buildup.

6. Gross Margin & Pricing Power

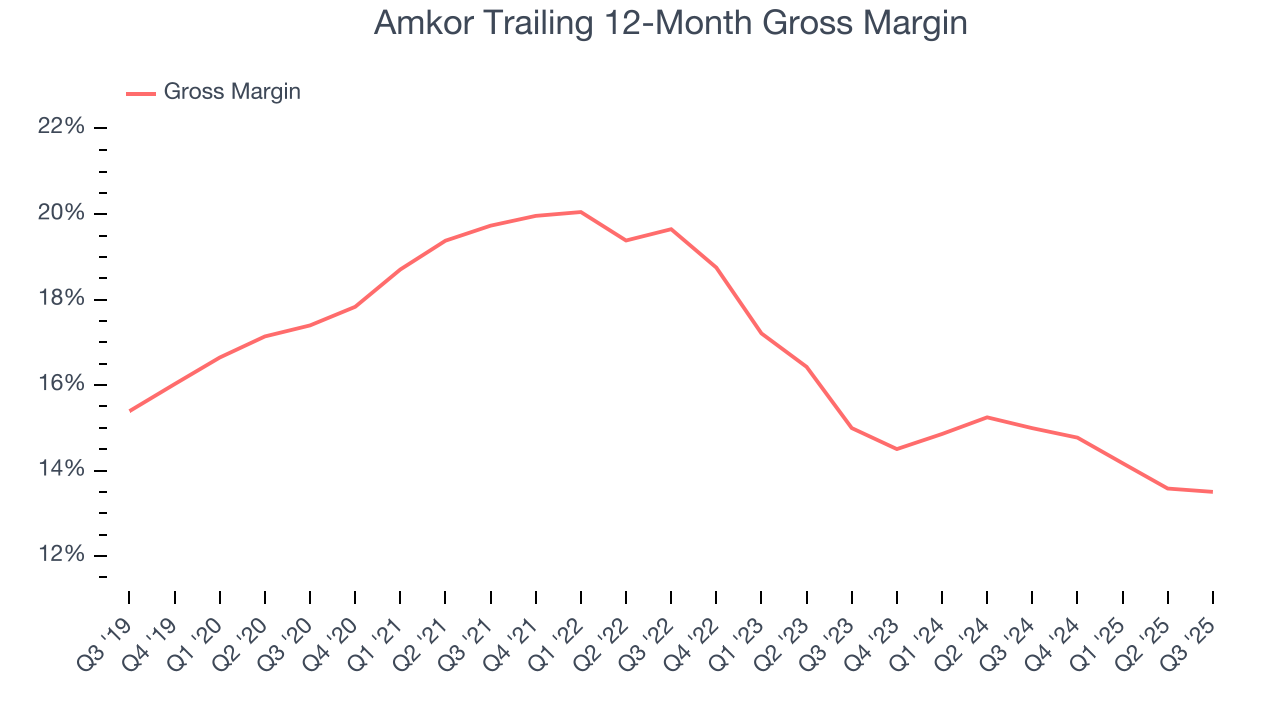

Gross profit margin is a key metric to track because it shows how much money a semiconductor company gets to keep after paying for its raw materials, manufacturing, and other input costs.

Amkor’s gross margin is one of the worst in the semiconductor industry, signaling it operates in a competitive market and lacks pricing power. As you can see below, it averaged a 14.2% gross margin over the last two years. That means Amkor paid its suppliers a lot of money ($85.75 for every $100 in revenue) to run its business.

Amkor produced a 14.3% gross profit margin in Q3, in line with the same quarter last year. On a wider time horizon, Amkor’s full-year margin has been trending down over the past 12 months, decreasing by 1.5 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

7. Operating Margin

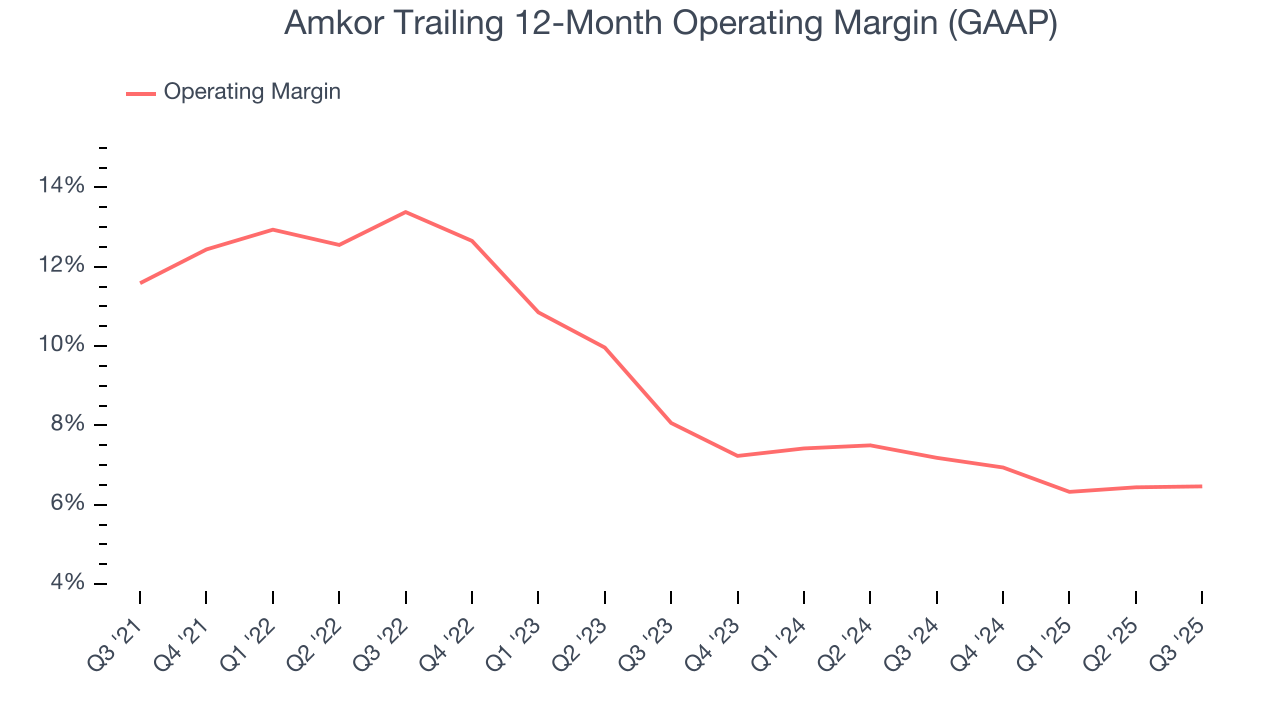

Amkor was profitable over the last two years but held back by its large cost base. Its average operating margin of 6.8% was weak for a semiconductor business. This result isn’t too surprising given its low gross margin as a starting point.

Looking at the trend in its profitability, Amkor’s operating margin decreased by 5.1 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Amkor’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, Amkor generated an operating margin profit margin of 8%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

8. Earnings Per Share

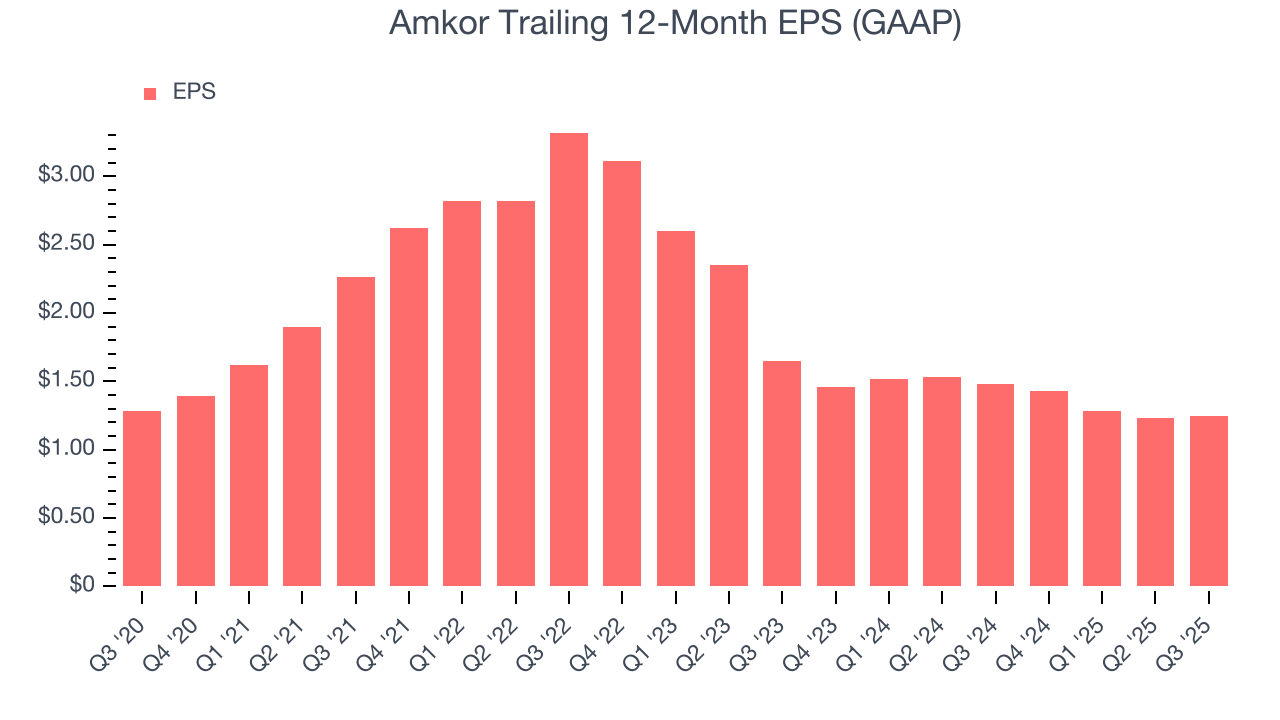

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

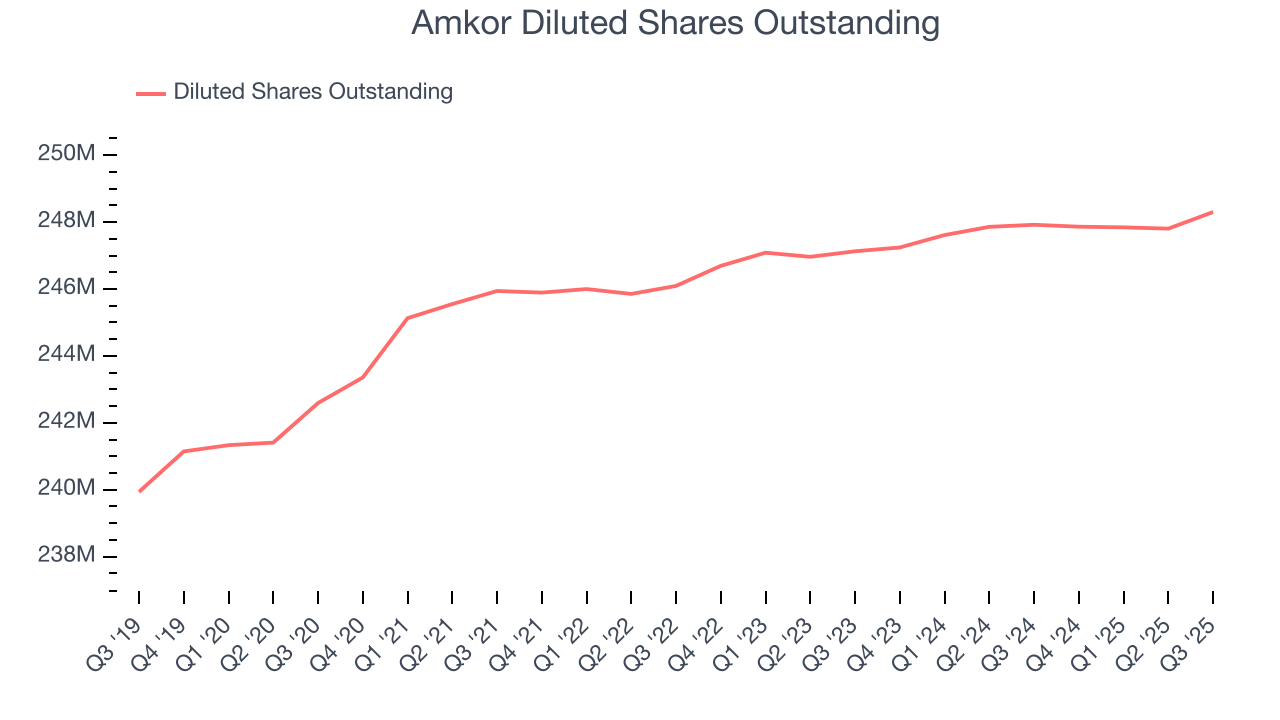

Amkor’s flat EPS over the last five years was below its 5.8% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

We can take a deeper look into Amkor’s earnings to better understand the drivers of its performance. As we mentioned earlier, Amkor’s operating margin was flat this quarter but declined by 5.1 percentage points over the last five years. Its share count also grew by 2.4%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q3, Amkor reported EPS of $0.51, up from $0.49 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Amkor’s full-year EPS of $1.25 to grow 24%.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

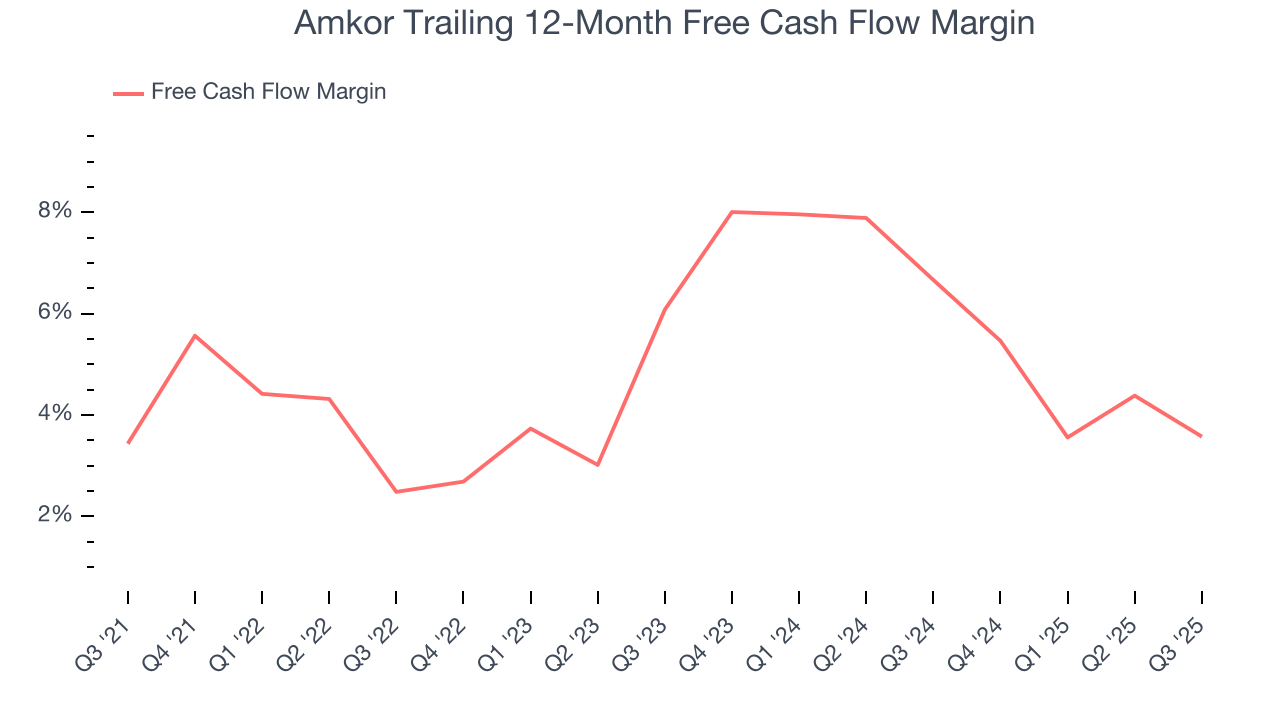

Amkor has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 5.1%, lousy for a semiconductor business.

Taking a step back, we can see that Amkor failed to improve its margin over the last five years. Its unexciting margin and trend likely have shareholders hoping for a change.

Amkor burned through $77.93 million of cash in Q3, equivalent to a negative 3.9% margin. The company’s cash burn increased from $31.33 million of lost cash in the same quarter last year. These numbers deviate from its longer-term margin, indicating it is a seasonal business that must build up inventory during certain quarters.

10. Return on Invested Capital (ROIC)

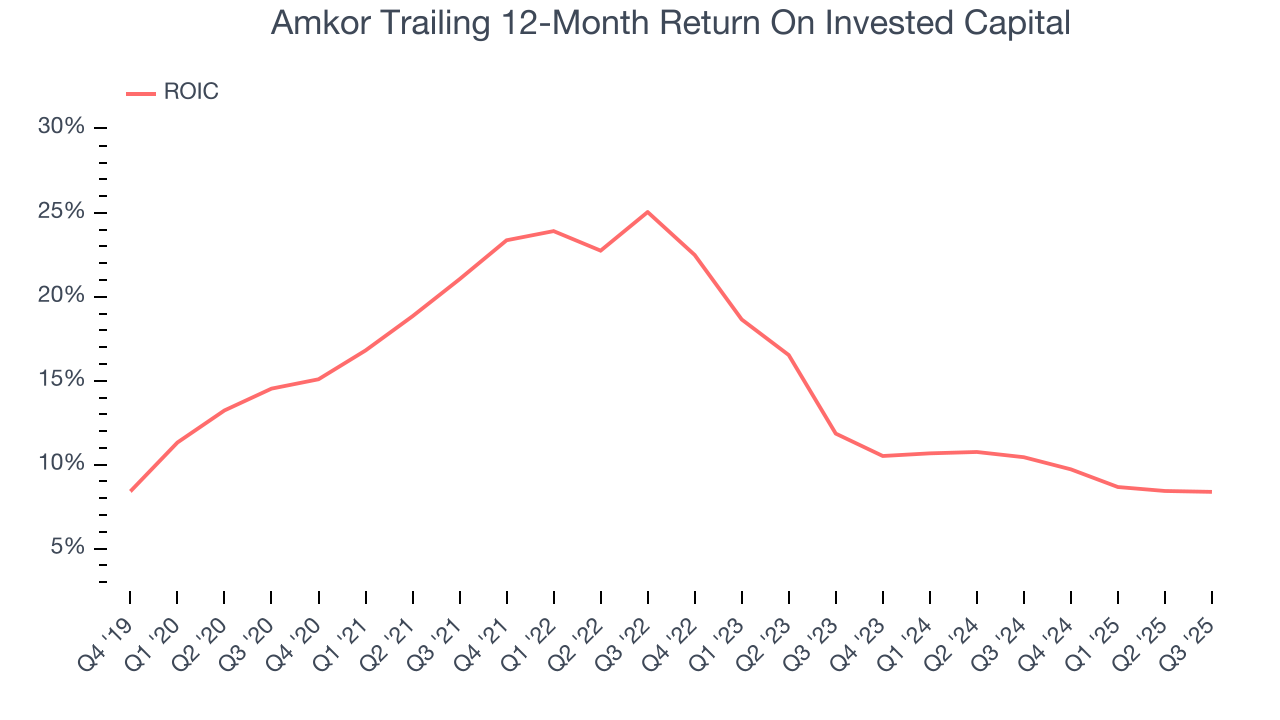

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Amkor historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 15.4%, somewhat low compared to the best semiconductor companies that consistently pump out 35%+.

11. Balance Sheet Assessment

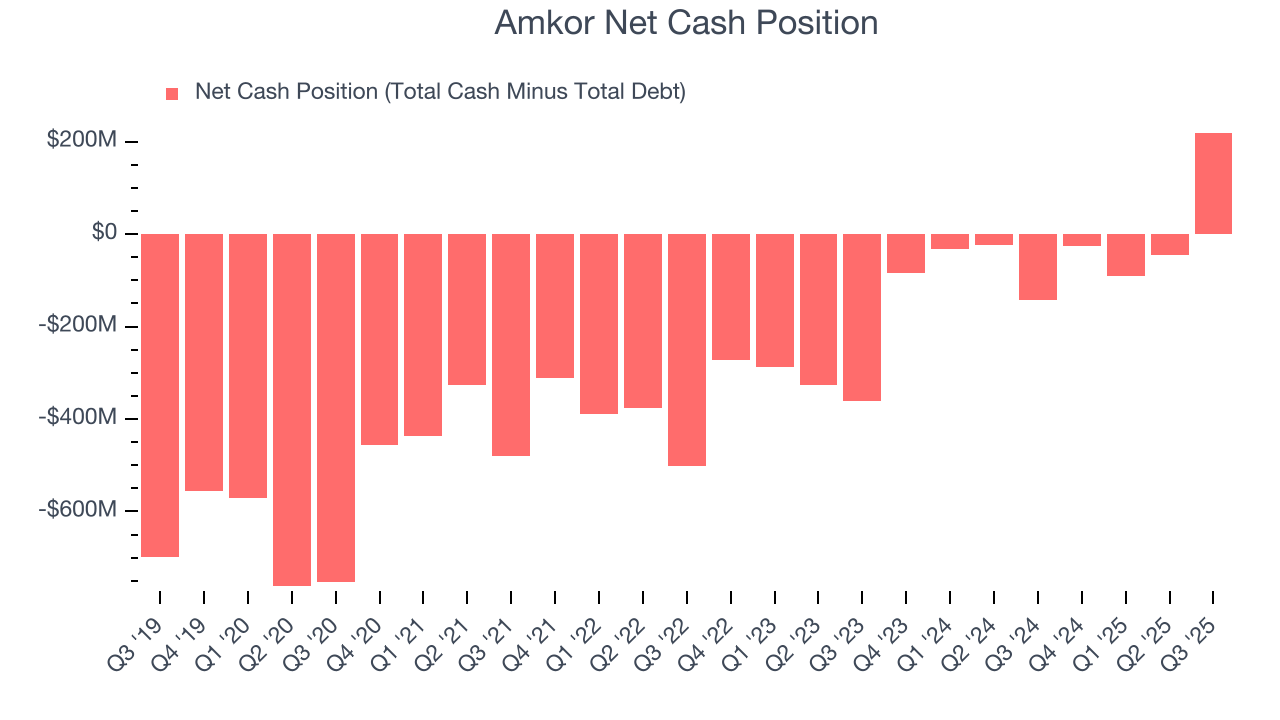

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

Amkor is a profitable, well-capitalized company with $2.11 billion of cash and $1.89 billion of debt on its balance sheet. This $219.3 million net cash position is 2.7% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Amkor’s Q3 Results

We were impressed by Amkor’s strong improvement in inventory levels. We were also glad its EPS outperformed Wall Street’s estimates and EPS guidance beat. On the other hand, its revenue guidance for next quarter slightly missed. Overall, this print was mixed. The stock remained flat at $32.90 immediately after reporting.

13. Is Now The Time To Buy Amkor?

Updated: January 18, 2026 at 9:30 PM EST

Before deciding whether to buy Amkor or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

Amkor isn’t a terrible business, but it isn’t one of our picks. Although its revenue growth was mediocre over the last five years and is expected to accelerate over the next 12 months, its low free cash flow margins give it little breathing room. And while the company’s failed to improve its cash profitability over the last five years, the downside is its low gross margins indicate some combination of pricing pressures or rising production costs.

Amkor’s P/E ratio based on the next 12 months is 31.7x. This multiple tells us a lot of good news is priced in - we think there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $44.75 on the company (compared to the current share price of $48.16), implying they don’t see much short-term potential in Amkor.