Appian (APPN)

We’re wary of Appian. Its growth has decelerated and its failure to generate meaningful free cash flow makes us question its prospects.― StockStory Analyst Team

1. News

2. Summary

Why We Think Appian Will Underperform

Powering billions of transactions daily since its founding in 1999, Appian (NASDAQ:APPN) provides a low-code platform that helps businesses automate complex processes and operationalize artificial intelligence without extensive programming knowledge.

- Customer acquisition costs take a while to recoup, making it difficult to justify sales and marketing investments that could increase revenue

- Estimated sales growth of 12.1% for the next 12 months implies demand will slow from its two-year trend

- A consolation is that its average billings growth of 19.1% over the last year enhances its liquidity and shows there is steady demand for its products

Appian’s quality isn’t up to par. You should search for better opportunities.

Why There Are Better Opportunities Than Appian

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Appian

At $28.67 per share, Appian trades at 2.9x forward price-to-sales. Appian’s valuation may seem like a bargain, but we think there are valid reasons why it’s so cheap.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Appian (APPN) Research Report: Q3 CY2025 Update

Low-code automation software company Appian (NASDAQ:APPN) announced better-than-expected revenue in Q3 CY2025, with sales up 21.4% year on year to $187 million. Guidance for next quarter’s revenue was better than expected at $189 million at the midpoint, 0.9% above analysts’ estimates. Its non-GAAP profit of $0.32 per share was significantly above analysts’ consensus estimates.

Appian (APPN) Q3 CY2025 Highlights:

- Revenue: $187 million vs analyst estimates of $174.1 million (21.4% year-on-year growth, 7.4% beat)

- Adjusted EPS: $0.32 vs analyst estimates of $0.05 (significant beat)

- Adjusted Operating Income: $29.76 billion vs analyst estimates of $7.90 million (15,915% margin, significant beat)

- Revenue Guidance for Q4 CY2025 is $189 million at the midpoint, above analyst estimates of $187.4 million

- Management raised its full-year Adjusted EPS guidance to $0.52 at the midpoint, a 62.5% increase

- EBITDA guidance for the full year is $68.5 million at the midpoint, above analyst estimates of $52.73 million

- Operating Margin: 7%, up from -4.6% in the same quarter last year

- Free Cash Flow was $18.06 million, up from -$3.09 million in the previous quarter

- Net Revenue Retention Rate: 111%, in line with the previous quarter

- Market Capitalization: $2.17 billion

Company Overview

Powering billions of transactions daily since its founding in 1999, Appian (NASDAQ:APPN) provides a low-code platform that helps businesses automate complex processes and operationalize artificial intelligence without extensive programming knowledge.

Appian's platform combines four key capabilities that form the backbone of its offering: process automation, data fabric, total experience, and continuous improvement through process mining. The platform allows organizations to orchestrate workflows involving both AI systems and human workers, encode business rules to reduce risk, and integrate robotic process automation (RPA) to boost efficiency.

At its core, Appian's data fabric technology enables customers to unify disparate data sources across their enterprise into a single virtual model that can be used to train AI models and support informed decision-making. This capability processed billions of queries in 2023 alone, demonstrating its robust adoption.

A financial services company might use Appian to streamline loan processing by connecting customer data across systems, automating approval workflows, and providing visibility into bottlenecks. Government agencies might implement Appian solutions to coordinate citizen services across departments, reducing paperwork and improving response times.

Appian generates revenue primarily through subscription sales, with the U.S. federal government representing over 21% of its total revenue. The company maintains strategic partnerships with major consulting firms like Accenture, Deloitte, and PwC, which often introduce Appian to potential customers during digital transformation projects. Appian serves approximately 1,000 customers across industries including financial services, government, life sciences, insurance, and healthcare.

4. Automation Software

The whole purpose of software is to automate tasks to increase productivity. Today, innovative new software techniques, often involving AI and machine learning, are finally allowing automation that has graduated from simple one- or two-step workflows to more complex processes integral to enterprises. The result is surging demand for modern automation software.

Appian competes with other low-code and business process management platform providers including ServiceNow (NYSE:NOW), Pegasystems (NASDAQ:PEGA), and Microsoft's Power Platform (NASDAQ:MSFT), as well as private companies like OutSystems and Mendix (owned by Siemens).

5. Revenue Growth

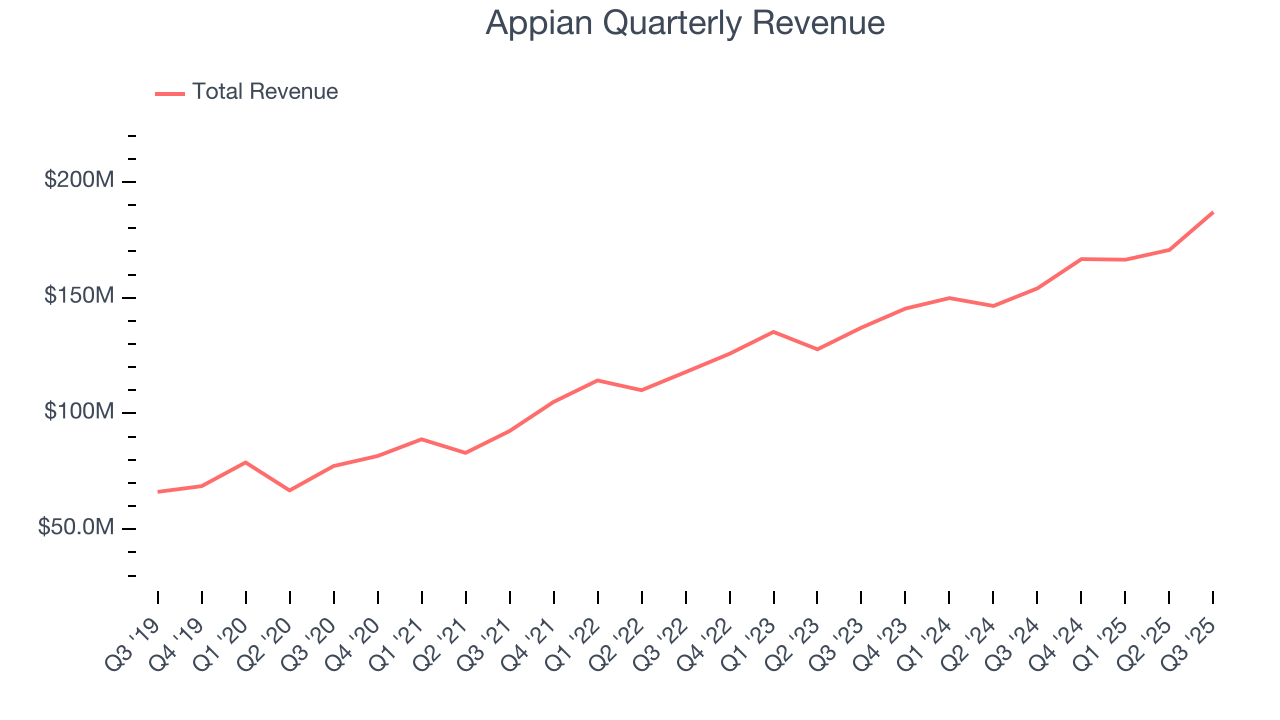

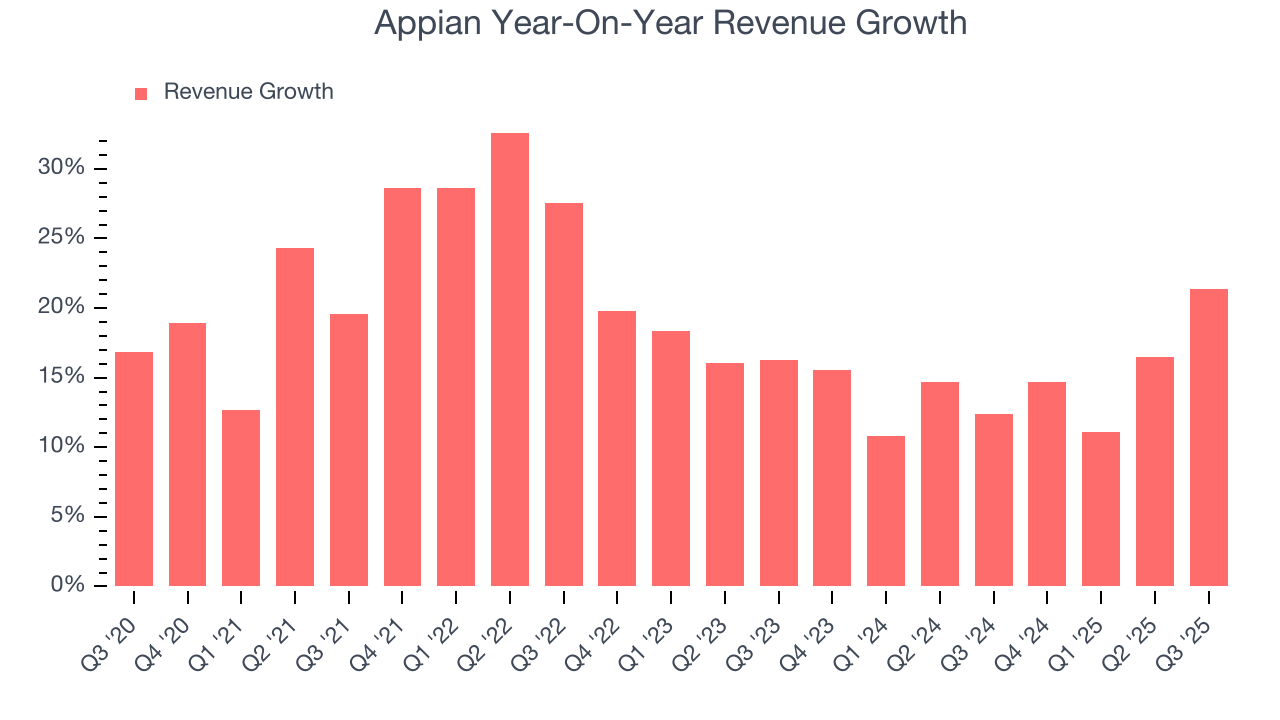

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Appian grew its sales at a decent 18.8% compounded annual growth rate. Its growth was slightly above the average software company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. Appian’s recent performance shows its demand has slowed as its annualized revenue growth of 14.6% over the last two years was below its five-year trend.

This quarter, Appian reported robust year-on-year revenue growth of 21.4%, and its $187 million of revenue topped Wall Street estimates by 7.4%. Company management is currently guiding for a 13.4% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 9% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will face some demand challenges.

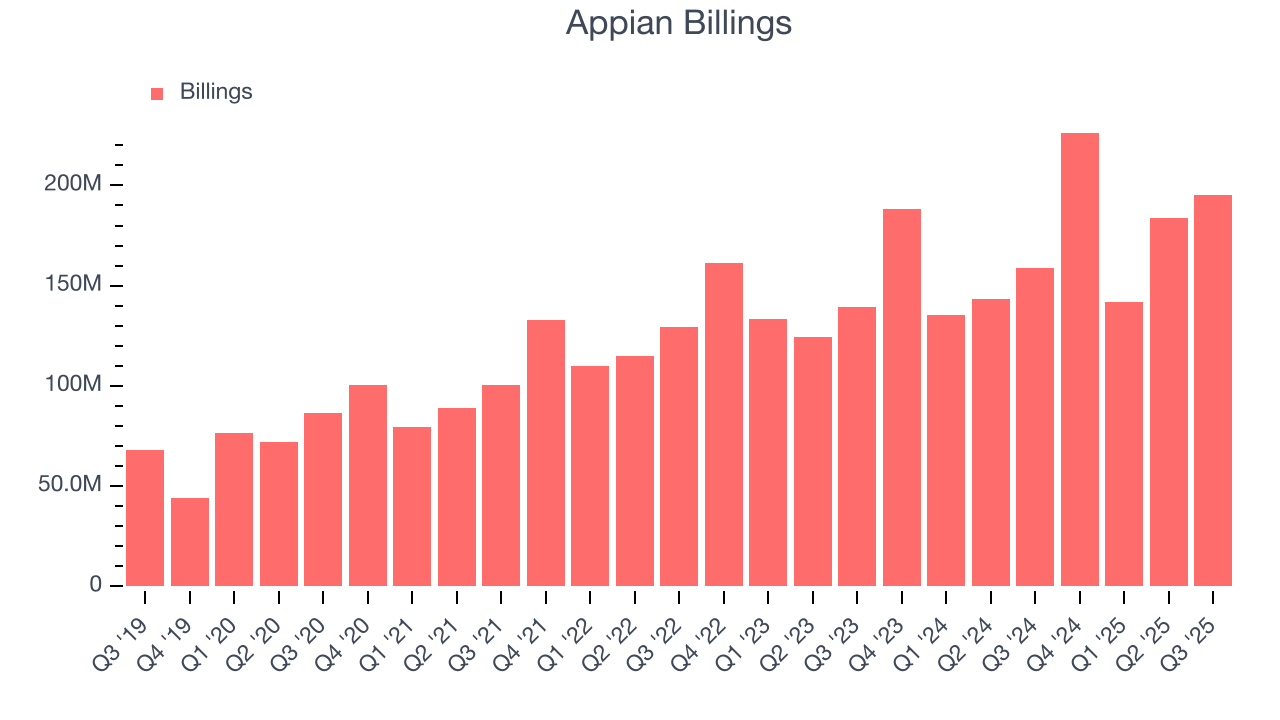

6. Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Appian’s billings punched in at $195.1 million in Q3, and over the last four quarters, its growth was impressive as it averaged 19.1% year-on-year increases. This alternate topline metric grew faster than total sales, meaning the company collects cash upfront and then recognizes the revenue over the length of its contracts - a boost for its liquidity and future revenue prospects.

7. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Appian’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its incremental sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a highly competitive environment where there is little differentiation between Appian’s products and its peers.

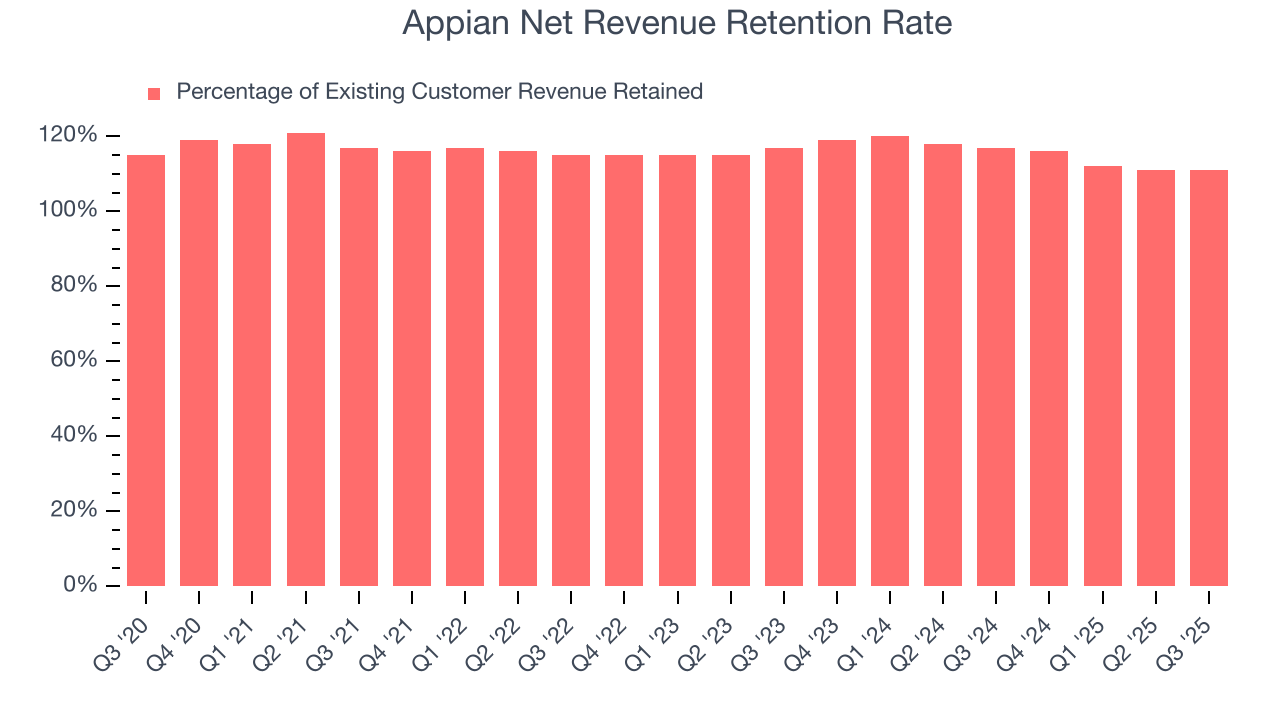

8. Customer Retention

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

Appian’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 113% in Q3. This means Appian would’ve grown its revenue by 12.5% even if it didn’t win any new customers over the last 12 months.

Despite falling over the last year, Appian still has a good net retention rate, proving that customers are satisfied with its software and getting more value from it over time, which is always great to see.

9. Gross Margin & Pricing Power

For software companies like Appian, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

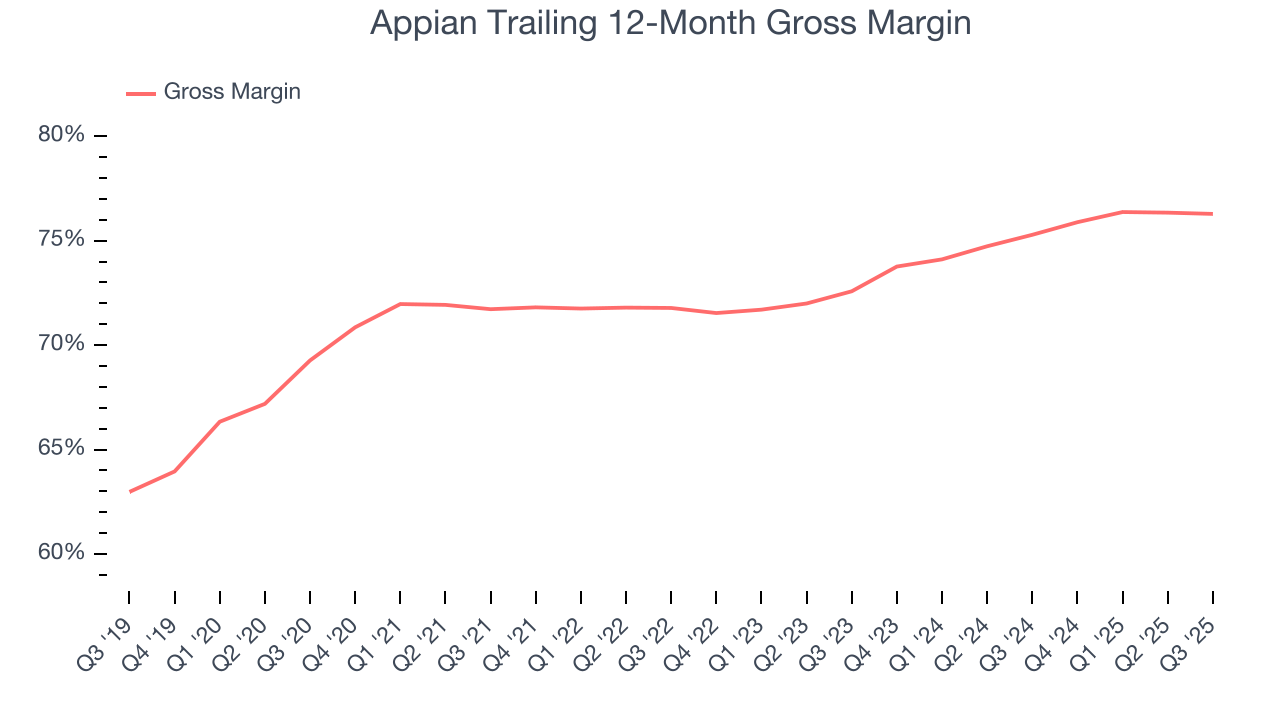

Appian’s gross margin is good for a software business and points to its solid unit economics, competitive products and services, and lack of meaningful pricing pressure. As you can see below, it averaged an impressive 76.3% gross margin over the last year. Said differently, Appian paid its providers $23.72 for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Appian has seen gross margins improve by 3.7 percentage points over the last 2 year, which is very good in the software space.

This quarter, Appian’s gross profit margin was 75.8%, in line with the same quarter last year. On a wider time horizon, Appian’s full-year margin has been trending up over the past 12 months, increasing by 1 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as servers).

10. Operating Margin

While many software businesses point investors to their adjusted profits, which exclude stock-based compensation (SBC), we prefer GAAP operating margin because SBC is a legitimate expense used to attract and retain talent. This metric shows how much revenue remains after accounting for all core expenses – everything from the cost of goods sold to sales and R&D.

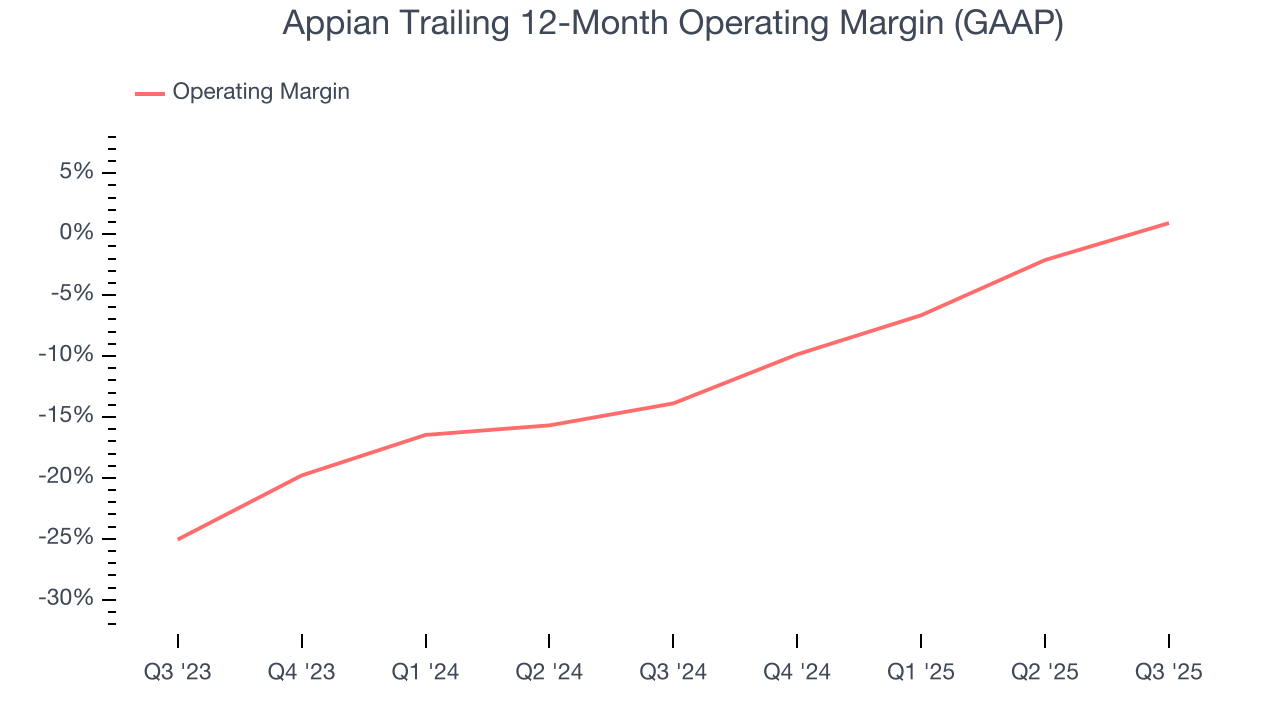

Appian was roughly breakeven when averaging the last year of quarterly operating profits, decent for a software business.

Analyzing the trend in its profitability, Appian’s operating margin rose by 14.8 percentage points over the last two years, as its sales growth gave it operating leverage.

This quarter, Appian generated an operating margin profit margin of 7%, up 11.7 percentage points year on year. The increase was solid, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

11. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

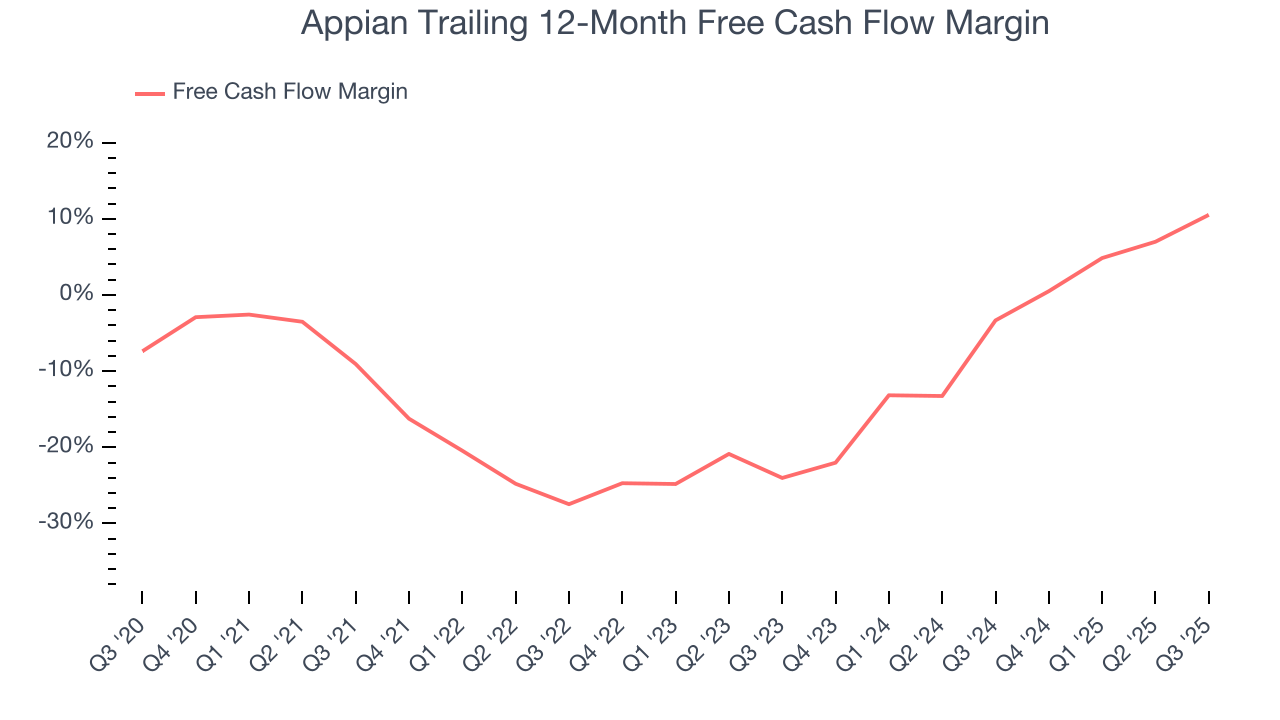

Appian has shown weak cash profitability over the last year, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 10.5%, subpar for a software business.

Appian’s free cash flow clocked in at $18.06 million in Q3, equivalent to a 9.7% margin. Its cash flow turned positive after being negative in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends are more important.

Over the next year, analysts predict Appian’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 10.5% for the last 12 months will decrease to 7.3%.

12. Balance Sheet Assessment

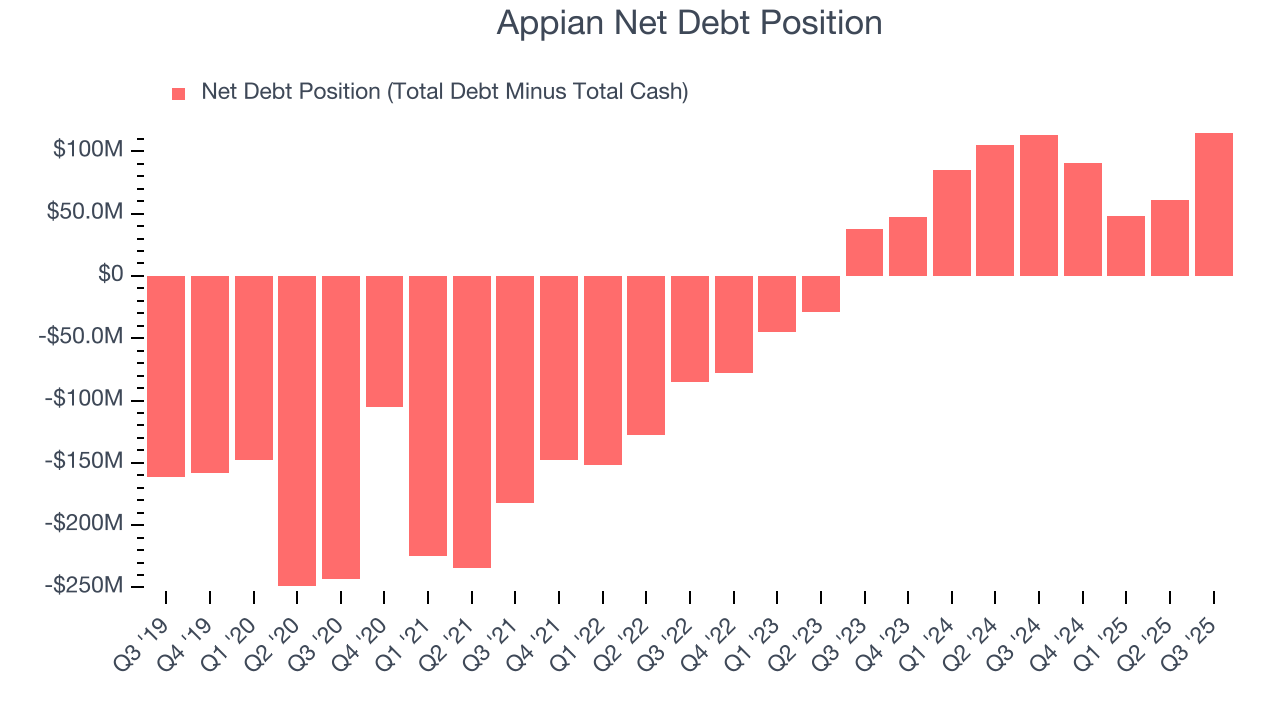

Appian reported $191.6 million of cash and $306.6 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $78.33 million of EBITDA over the last 12 months, we view Appian’s 1.5× net-debt-to-EBITDA ratio as safe. We also see its $10.99 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

13. Key Takeaways from Appian’s Q3 Results

We were impressed by how significantly Appian blew past analysts’ EBITDA expectations this quarter. We were also glad its full-year EBITDA guidance trumped Wall Street’s estimates. On the other hand, its EBITDA guidance for next quarter missed. Overall, we think this was still a solid quarter with some key areas of upside. The stock traded up 10.8% to $32.50 immediately after reporting.

14. Is Now The Time To Buy Appian?

Updated: January 18, 2026 at 9:06 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Appian.

Appian isn’t a terrible business, but it doesn’t pass our quality test. Although its revenue growth was solid over the last five years, it’s expected to deteriorate over the next 12 months and its customer acquisition is less efficient than many comparable companies. And while the company’s expanding operating margin shows it’s becoming more efficient at building and selling its software, the downside is its low free cash flow margins give it little breathing room.

Appian’s price-to-sales ratio based on the next 12 months is 2.9x. This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $41 on the company (compared to the current share price of $28.67).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.