Astrana Health (ASTH)

We see potential in Astrana Health. It’s one of the fastest-growing companies we cover, and there’s a solid chance its momentum will continue.― StockStory Analyst Team

1. News

2. Summary

Why Astrana Health Is Interesting

Formerly known as Apollo Medical Holdings until early 2024, Astrana Health (NASDAQ:ASTH) operates a technology-powered healthcare platform that enables physicians to deliver coordinated care while successfully participating in value-based payment models.

- Annual revenue growth of 33.3% over the last five years was superb and indicates its market share increased during this cycle

- Market share will likely rise over the next 12 months as its expected revenue growth of 34.2% is robust

- A downside is its poor expense management has led to an adjusted operating margin that is below the industry average

Astrana Health has the potential to be a high-quality business. If you believe in the company, the price looks reasonable.

Why Is Now The Time To Buy Astrana Health?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Astrana Health?

At $26.22 per share, Astrana Health trades at 7.6x forward EV-to-EBITDA. After scanning the names across healthcare, we conclude that the multiple is deserved for the revenue growth you get.

It’s an opportune time to buy the stock if you see some misunderstanding of the business that is leading to mispricing in the market.

3. Astrana Health (ASTH) Research Report: Q3 CY2025 Update

Healthcare services company Astrana Health reported revenue ahead of Wall Streets expectations in Q3 CY2025, with sales up 99.7% year on year to $956 million. On the other hand, the company’s full-year revenue guidance of $3.14 billion at the midpoint came in 2.2% below analysts’ estimates. Its GAAP profit of $0.01 per share was 97.6% below analysts’ consensus estimates.

Astrana Health (ASTH) Q3 CY2025 Highlights:

- Closes Prospect Health acquisition

- Revenue: $956 million vs analyst estimates of $950.2 million (99.7% year-on-year growth, 0.6% beat)

- EPS (GAAP): $0.01 vs analyst expectations of $0.43 (97.6% miss)

- Adjusted EBITDA: $68.48 million vs analyst estimates of $67.29 million (7.2% margin, 1.8% beat)

- The company dropped its revenue guidance for the full year to $3.14 billion at the midpoint from $3.2 billion, a 1.9% decrease

- EBITDA guidance for the full year is $205 million at the midpoint, below analyst estimates of $220 million

- Operating Margin: 2%, down from 5.9% in the same quarter last year

- Free Cash Flow Margin: 0.8%, down from 6.6% in the same quarter last year

- Market Capitalization: $1.66 billion

Company Overview

Formerly known as Apollo Medical Holdings until early 2024, Astrana Health (NASDAQ:ASTH) operates a technology-powered healthcare platform that enables physicians to deliver coordinated care while successfully participating in value-based payment models.

Astrana's business model bridges the gap between traditional fee-for-service healthcare and value-based care arrangements where providers are financially rewarded for improving patient outcomes while controlling costs. The company operates through three interconnected segments: Care Partners, Care Delivery, and Care Enablement.

The Care Partners segment builds and manages networks of physicians through independent practice associations (IPAs) and accountable care organizations (ACOs). These networks allow independent physicians to remain autonomous while gaining the scale and support needed to succeed in risk-bearing contracts with Medicare, Medicaid, and commercial insurers.

Through its Care Delivery segment, Astrana operates approximately 60 healthcare facilities across California, Nevada, and Texas. These include primary care clinics, multi-specialty centers, urgent care facilities, imaging centers, and ambulatory surgery centers. This physical footprint serves over 800,000 patients annually and strategically fills gaps in healthcare access within the communities Astrana serves.

The Care Enablement segment provides the technological backbone of Astrana's operations. This proprietary platform offers clinical, operational, and administrative tools that help providers manage population health effectively. For example, a primary care physician using Astrana's system might receive alerts about patients due for preventive screenings or those with chronic conditions requiring follow-up care.

A typical patient experience might involve someone with diabetes being assigned to an Astrana-affiliated primary care physician who coordinates with specialists, monitors medication adherence, and schedules regular check-ups—all supported by Astrana's technology platform that tracks outcomes and identifies opportunities for intervention.

Astrana generates revenue primarily through capitated arrangements where it receives fixed monthly payments per patient and assumes financial responsibility for their healthcare costs. The company also earns shared savings bonuses when its networks successfully reduce costs while maintaining quality standards in programs like Medicare's ACO REACH Model.

4. Healthcare Technology for Providers

The healthcare technology sector provides software and data analytics to help hospitals and clinics streamline operations and improve patient outcomes, often through value-based care models. Future growth is expected as providers prioritize digital transformation to manage rising costs and patient demands. Tailwinds include the adoption of AI-driven tools and government incentives for digitization. There challenges as well, including long sales cycles and slow adoption by providers, who may be resistance to change. Tightening hospital budgets and cybersecurity threats are additional risks that could slow adoption.

Astrana Health competes with other healthcare management organizations including Optum (owned by UnitedHealth Group), Privia Health (NASDAQ:PRVA), Oak Street Health (acquired by CVS Health), and Agilon Health (NYSE:AGL), as well as regional players like Heritage Provider Network in California.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $2.90 billion in revenue over the past 12 months, Astrana Health has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Revenue Growth

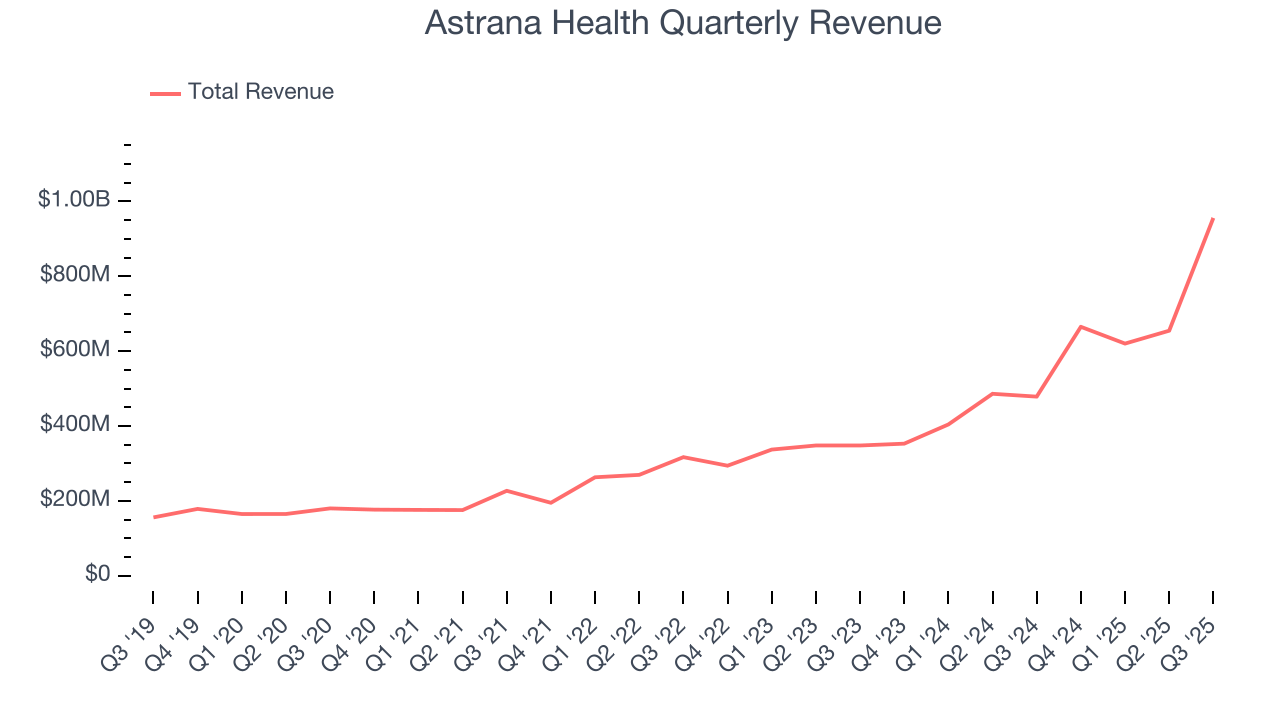

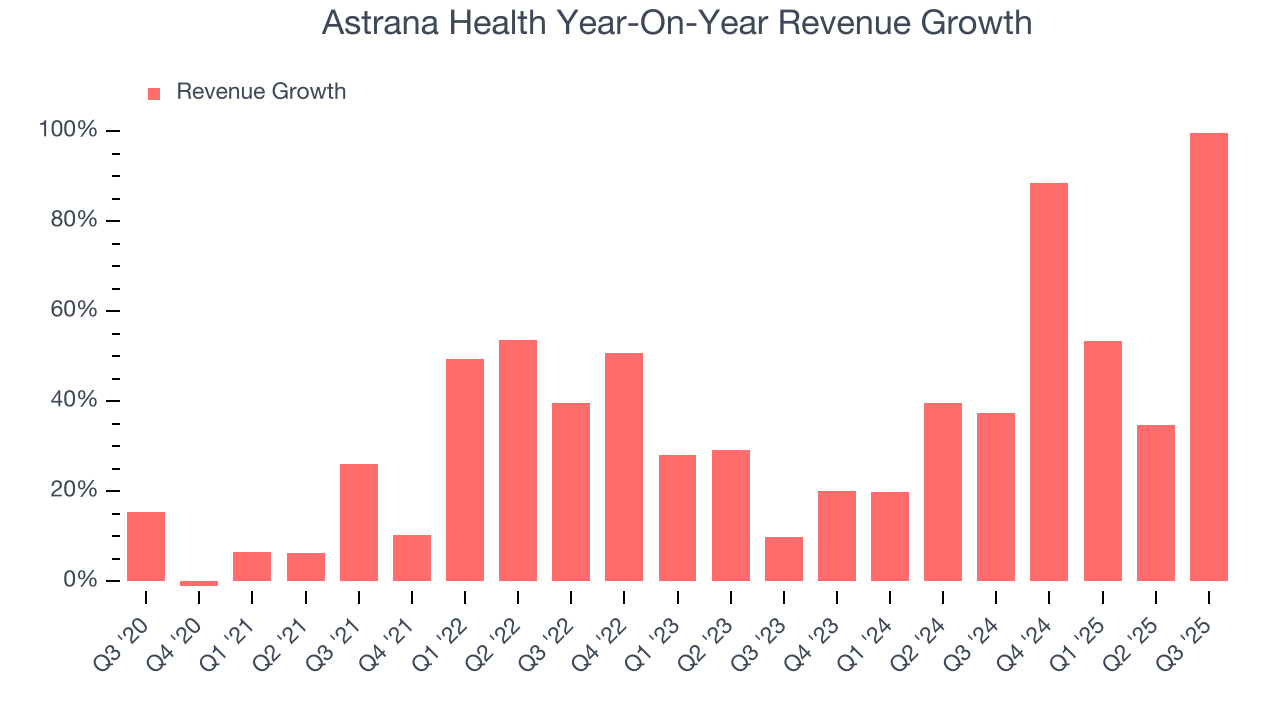

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Astrana Health’s 33.3% annualized revenue growth over the last five years was incredible. Its growth beat the average healthcare company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Astrana Health’s annualized revenue growth of 47.7% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Astrana Health reported magnificent year-on-year revenue growth of 99.7%, and its $956 million of revenue beat Wall Street’s estimates by 0.6%.

Looking ahead, sell-side analysts expect revenue to grow 37.2% over the next 12 months, a deceleration versus the last two years. Still, this projection is healthy and implies the market sees success for its products and services.

7. Operating Margin

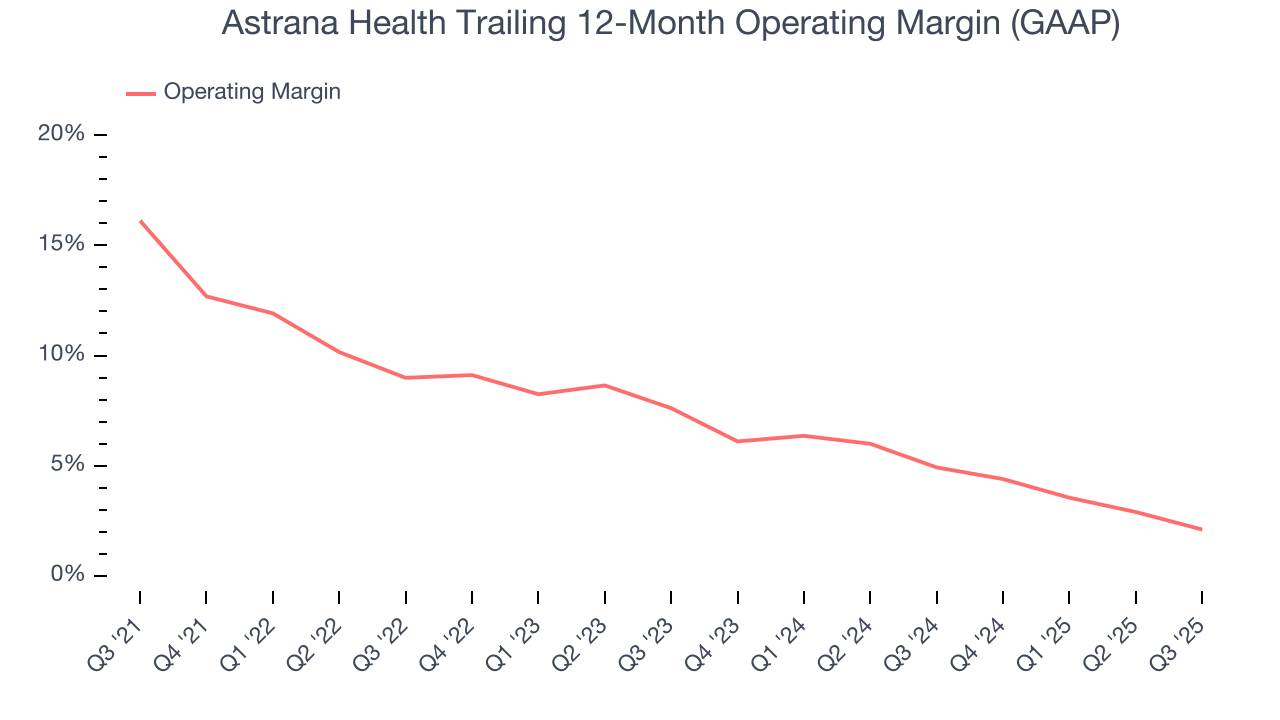

Astrana Health was profitable over the last five years but held back by its large cost base. Its average operating margin of 6% was weak for a healthcare business.

Analyzing the trend in its profitability, Astrana Health’s operating margin decreased by 14 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 5.5 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Astrana Health generated an operating margin profit margin of 2%, down 3.9 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

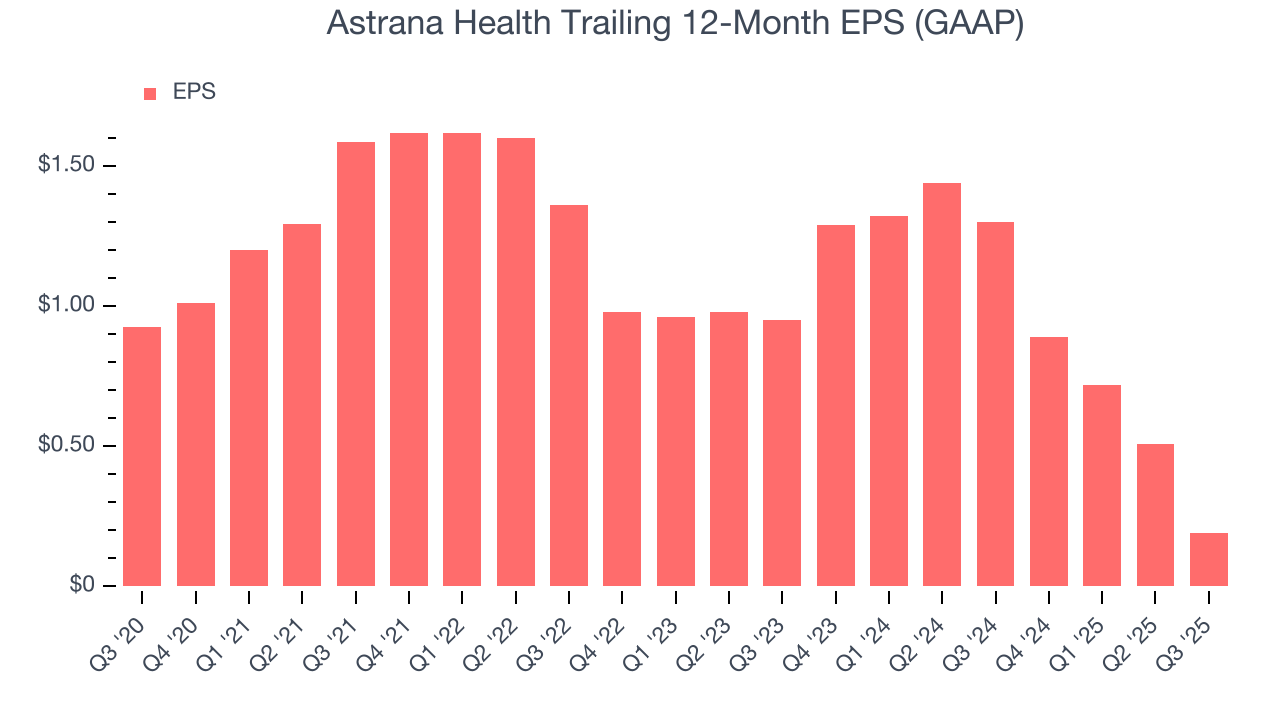

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

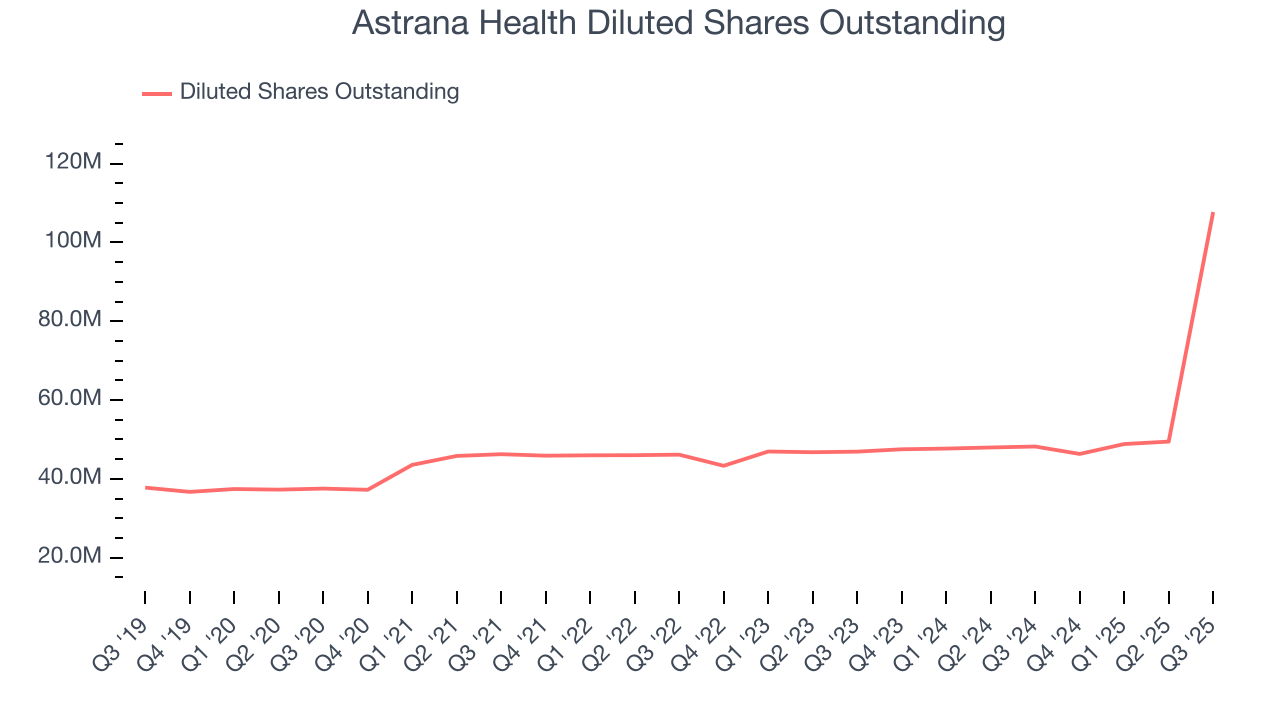

Sadly for Astrana Health, its EPS declined by 27.1% annually over the last five years while its revenue grew by 33.3%. This tells us the company became less profitable on a per-share basis as it expanded.

Diving into the nuances of Astrana Health’s earnings can give us a better understanding of its performance. As we mentioned earlier, Astrana Health’s operating margin declined by 14 percentage points over the last five years. Its share count also grew by 187%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q3, Astrana Health reported EPS of $0.01, down from $0.33 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Astrana Health’s full-year EPS of $0.19 to grow 877%.

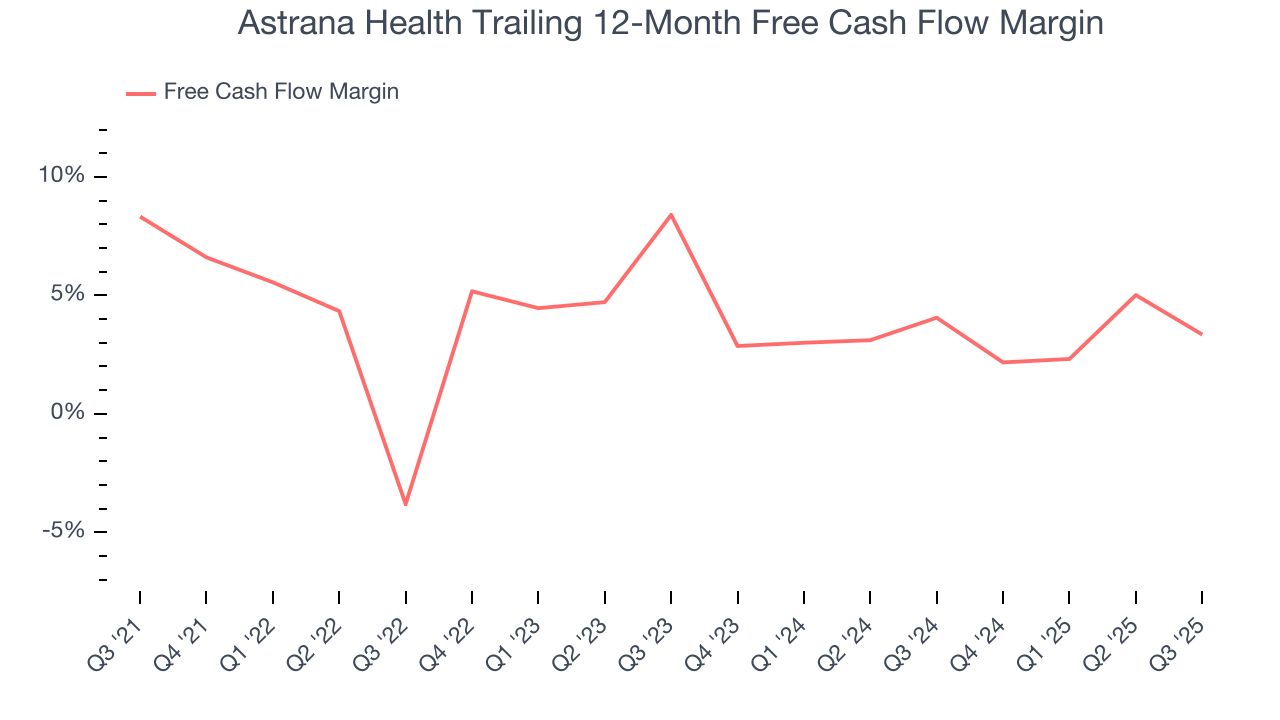

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Astrana Health has shown mediocre cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.9%, subpar for a healthcare business.

Taking a step back, we can see that Astrana Health’s margin dropped by 5 percentage points during that time. If the trend continues, it could signal it’s in the middle of an investment cycle.

Astrana Health broke even from a free cash flow perspective in Q3. The company’s cash profitability regressed as it was 5.8 percentage points lower than in the same quarter last year, suggesting its historical struggles have dragged on.

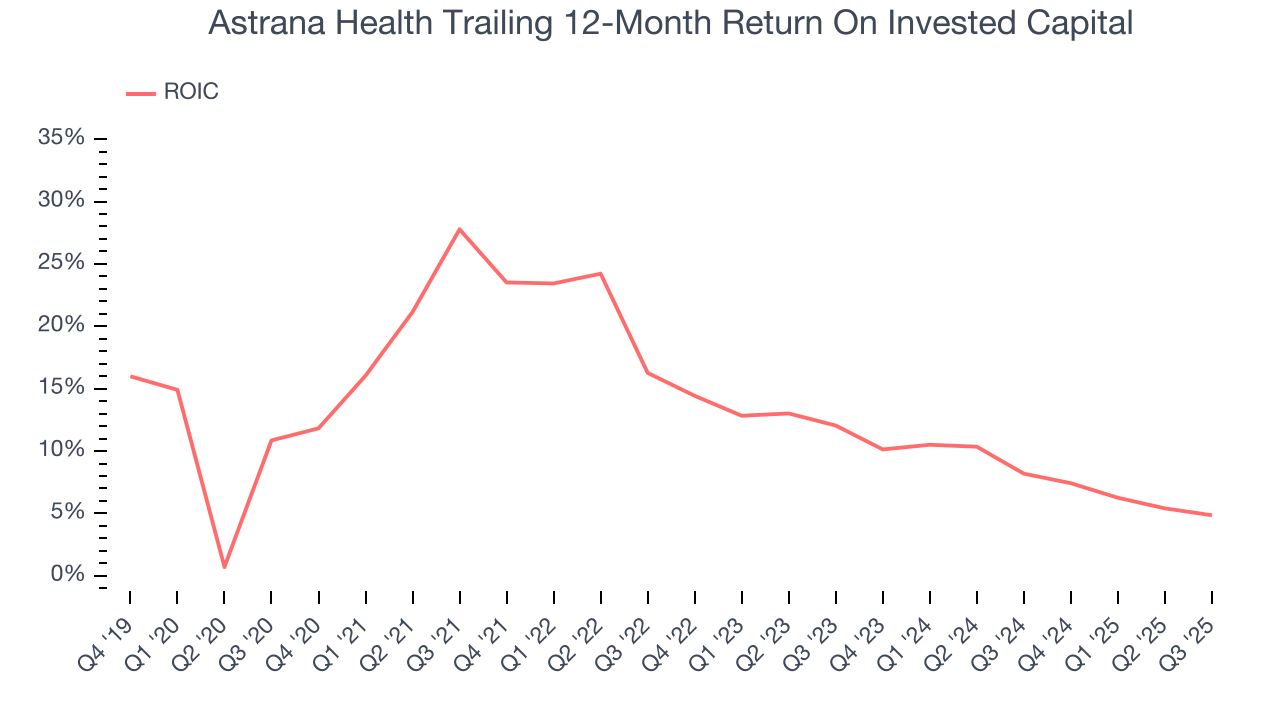

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Astrana Health’s five-year average ROIC was 13.8%, higher than most healthcare businesses. This illustrates its management team’s ability to invest in profitable growth opportunities and generate value for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Astrana Health’s ROIC has unfortunately decreased significantly. Only time will tell if its new bets can bear fruit and potentially reverse the trend.

11. Balance Sheet Assessment

Astrana Health reported $465.5 million of cash and $1.06 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $188 million of EBITDA over the last 12 months, we view Astrana Health’s 3.1× net-debt-to-EBITDA ratio as safe. We also see its $694,000 of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Astrana Health’s Q3 Results

It was good to see Astrana Health narrowly top analysts’ revenue expectations this quarter. On the other hand, its EPS missed and its full-year revenue guidance fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 1.5% to $32.88 immediately following the results.

13. Is Now The Time To Buy Astrana Health?

Updated: January 20, 2026 at 10:20 PM EST

Before making an investment decision, investors should account for Astrana Health’s business fundamentals and valuation in addition to what happened in the latest quarter.

There are some positives when it comes to Astrana Health’s fundamentals. First off, its revenue growth was exceptional over the last five years, and analysts believe it can continue growing at these levels. And while its diminishing returns show management's recent bets still have yet to bear fruit, its remarkable EPS growth over the last five years shows its profits are trickling down to shareholders. On top of that, its solid ROIC suggests it has grown profitably in the past.

Astrana Health’s EV-to-EBITDA ratio based on the next 12 months is 7.6x. When scanning the healthcare space, Astrana Health trades at a fair valuation. For those confident in the business and its management team, this is a good time to invest.

Wall Street analysts have a consensus one-year price target of $36.89 on the company (compared to the current share price of $26.22), implying they see 40.7% upside in buying Astrana Health in the short term.