AeroVironment (AVAV)

We’re wary of AeroVironment. Its negative returns on capital raise questions about its ability to allocate resources and generate profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think AeroVironment Will Underperform

Focused on the future of autonomous military combat, AeroVironment (NASDAQ:AVAV) specializes in advanced unmanned aircraft systems and electric vehicle charging solutions.

- Growth came at the expense of profits over the last five years as its operating margin losses have increased

- Long-term business health is up for debate as its cash burn has increased over the last five years

- A consolation is that its annual revenue growth of 29.4% over the last five years was superb and indicates its market share increased during this cycle

AeroVironment is in the penalty box. There are more rewarding stocks elsewhere.

Why There Are Better Opportunities Than AeroVironment

High Quality

Investable

Underperform

Why There Are Better Opportunities Than AeroVironment

At $307.37 per share, AeroVironment trades at 67.6x forward P/E. This valuation is extremely expensive, especially for the quality you get.

We’d rather invest in similarly-priced but higher-quality companies with more reliable earnings growth.

3. AeroVironment (AVAV) Research Report: Q3 CY2025 Update

Aerospace and defense company AeroVironment (NASDAQ:AVAV) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 151% year on year to $472.5 million. On the other hand, the company’s full-year revenue guidance of $1.98 billion at the midpoint came in 1.1% below analysts’ estimates. Its non-GAAP profit of $0.44 per share was 44.2% below analysts’ consensus estimates.

AeroVironment (AVAV) Q3 CY2025 Highlights:

- Revenue: $472.5 million vs analyst estimates of $470.1 million (151% year-on-year growth, 0.5% beat)

- Adjusted EPS: $0.44 vs analyst expectations of $0.79 (44.2% miss)

- Adjusted EBITDA: $44.96 million vs analyst estimates of $69.12 million (9.5% margin, 35% miss)

- The company lifted its revenue guidance for the full year to $1.98 billion at the midpoint from $1.95 billion, a 1.3% increase

- Management lowered its full-year Adjusted EPS guidance to $3.47 at the midpoint, a 4.8% decrease

- EBITDA guidance for the full year is $310 million at the midpoint, below analyst estimates of $312.8 million

- Operating Margin: -6.4%, down from 3.7% in the same quarter last year

- Free Cash Flow was -$69.16 million compared to -$8.66 million in the same quarter last year

- Market Capitalization: $14.04 billion

Company Overview

Focused on the future of autonomous military combat, AeroVironment (NASDAQ:AVAV) specializes in advanced unmanned aircraft systems and electric vehicle charging solutions.

AeroVironment was founded in 1971 by Dr. Paul MacCready, an inventor and aerospace engineer, renowned for developing human-powered flight. The company's early focus was on creating lightweight, and energy-efficient vehicles. AeroVironment gained prominence after creating the Gossamer Condor in 1977, the first human-powered aircraft capable of controlled and sustained flight, which won the prestigious Kremer Prize.

Over the years, AeroVironment expanded its focus to include unmanned aerial vehicles (UAVs), becoming one of the pioneers in the field. The company developed a series of UAVs, including the Global Observer, a high-altitude, long-endurance aircraft powered by hydrogen, and smaller drones widely used by the U.S. military and allied forces.

Today, AeroVironment develops and supports a range of advanced robotic systems and services used by government and commercial sectors. Its products include unmanned aircraft, ground robots, and special missile systems primarily used by the U.S. Department of Defense, other federal agencies, and allied international governments. The company's technologies are designed for use in all kinds of environments, from the earth’s surface to space, offering efficient and sophisticated solutions for complicated operations. Notable products from AeroVironment include high-flying drones, electric propulsion systems, advanced control systems for flight, and interfaces that allow humans to interact smoothly with machines. These products are particularly aimed at improving the safety and effectiveness of critical operations in challenging locations. For example, its small unmanned aircraft systems are often used for surveillance in military operations, providing vital information without putting human lives at risk.

AeroVironment primarily markets its unmanned systems products and loitering munitions to various branches of the U.S. Department of Defense (DoD), such as the Army, Marine Corps, Special Operations Command, Air Force, and Navy. The company also caters to public safety agencies and allied governments worldwide, as well as private sector companies that subcontract for these government entities. Additionally, AeroVironment collaborates with SoftBank Corp to develop High Altitude Pseudo-Satellite (HAPS) systems for commercial use, while retaining the exclusive rights to sell HAPS systems for defense applications outside of Japan. This includes dealing with agencies like NASA and the U.S. DoD. The company's revenue is largely derived from contracts for these specialized unmanned aircraft systems, advanced munitions, and high-altitude platforms, reflecting a diverse but focused customer base in both defense and commercial sectors.

AeroVironment's cost structure is significantly influenced by its substantial investment in research and development (R&D). The company prioritizes R&D to innovate and advance its portfolio of unmanned systems and related technologies. This strategic focus on development is essential for maintaining its competitive edge in designing cutting-edge solutions for its customers. Additionally, AeroVironment enhances its product offerings and expands its technological capabilities through strategic acquisitions, continuously integrating new technology into its product offerings. This is particularly crucial for the defense sector, where maintaining a technological edge is highly valued.

4. Defense Contractors

Defense contractors typically require technical expertise and government clearance. Companies in this sector can also enjoy long-term contracts with government bodies, leading to more predictable revenues. Combined, these factors create high barriers to entry and can lead to limited competition. Lately, geopolitical tensions–whether it be Russia’s invasion of Ukraine or China’s aggression towards Taiwan–highlight the need for defense spending. On the other hand, demand for these products can ebb and flow with defense budgets and even who is president, as different administrations can have vastly different ideas of how to allocate federal funds.

AeroVironment’s competitors include Northrop Grumman (NYSE:NOC), Lockheed Martin (NYSE:LMT), and Textron (NYSE:TXT).

5. Revenue Growth

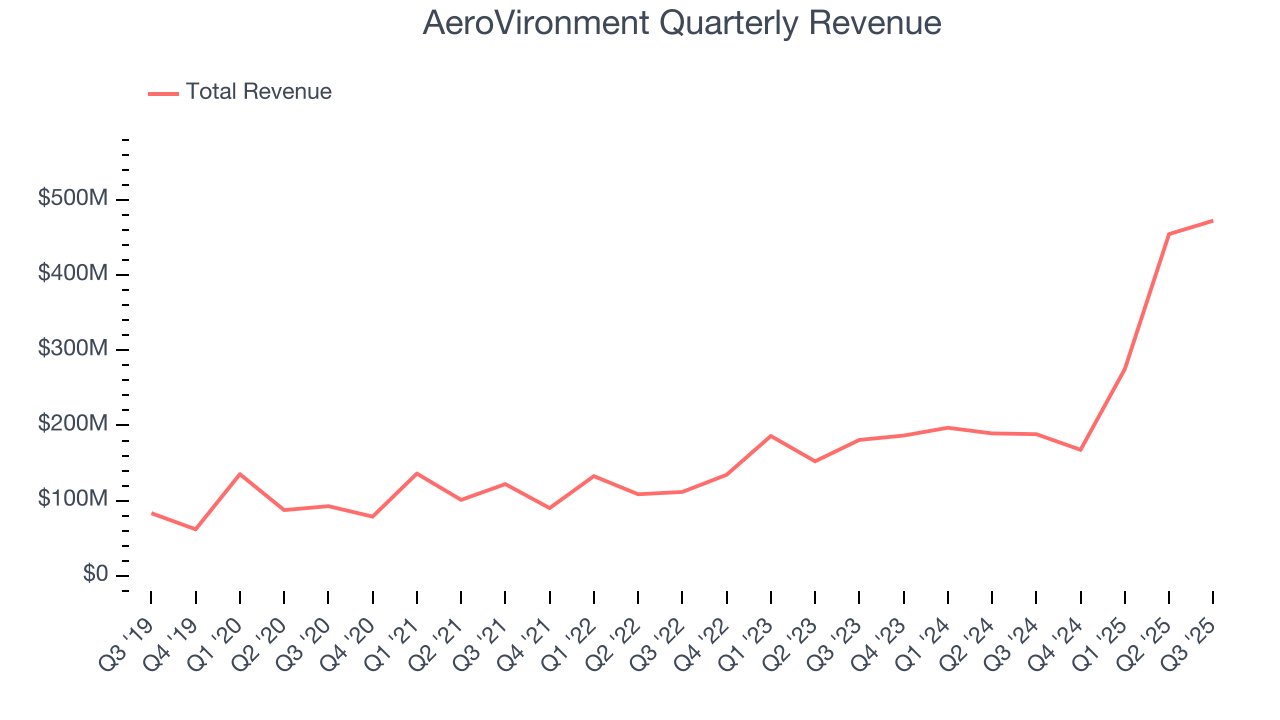

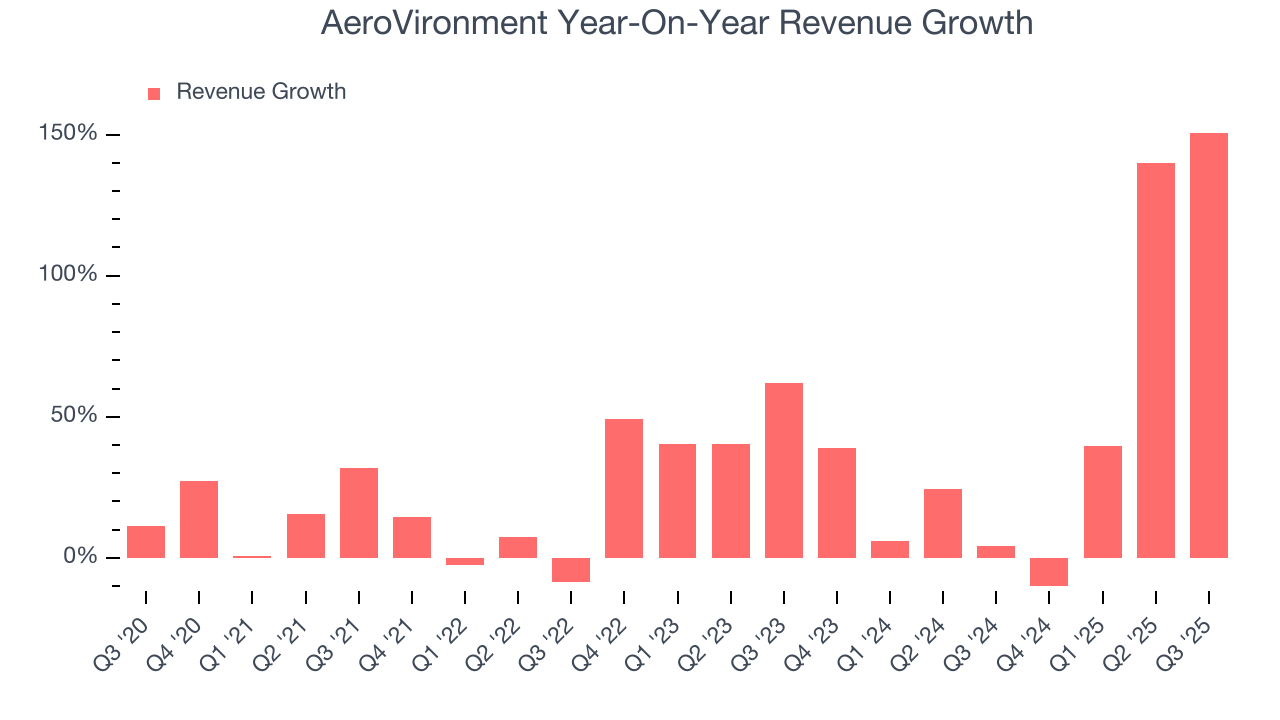

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, AeroVironment’s sales grew at an incredible 29.4% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. AeroVironment’s annualized revenue growth of 44.8% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

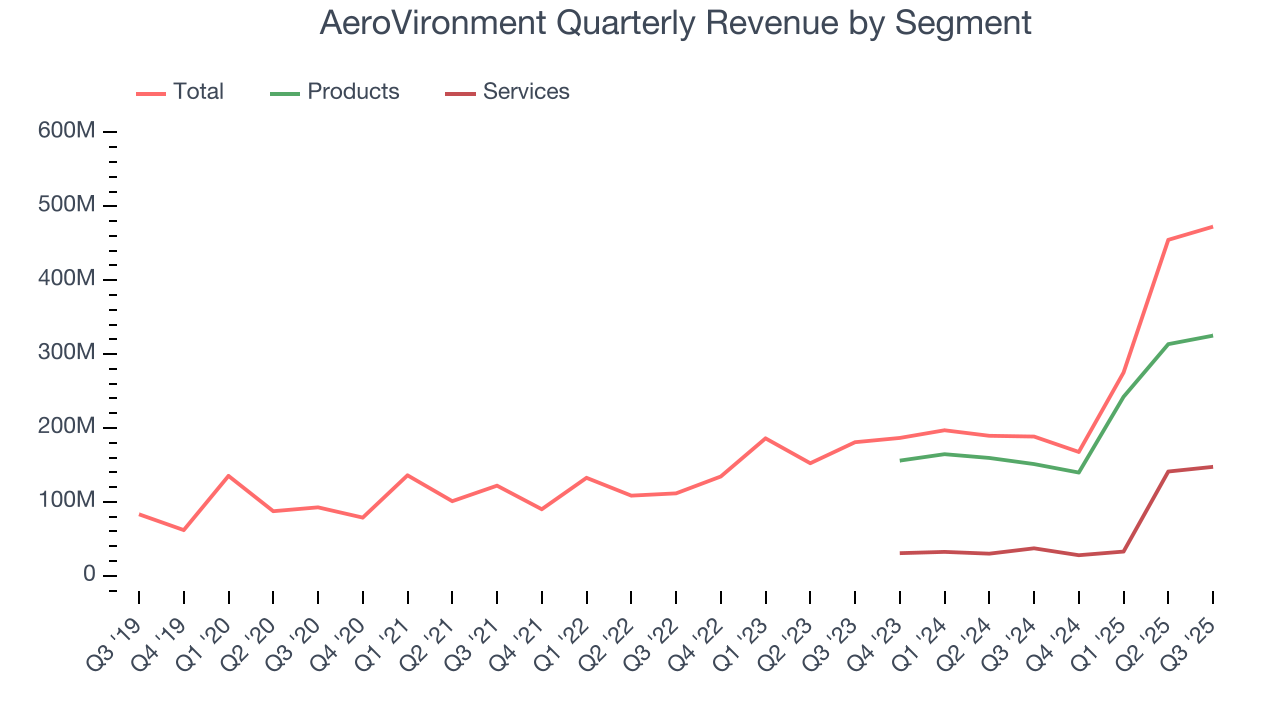

AeroVironment also breaks out the revenue for its most important segments, Products and Services, which are 68.8% and 31.2% of revenue. Over the last two years, AeroVironment’s Products revenue (aircrafts, missile systems, satellites) averaged 62.1% year-on-year growth while its Services revenue (maintenance, training, consulting) averaged 165% growth.

This quarter, AeroVironment reported magnificent year-on-year revenue growth of 151%, and its $472.5 million of revenue beat Wall Street’s estimates by 0.5%.

Looking ahead, sell-side analysts expect revenue to grow 57% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and suggests its newer products and services will fuel better top-line performance.

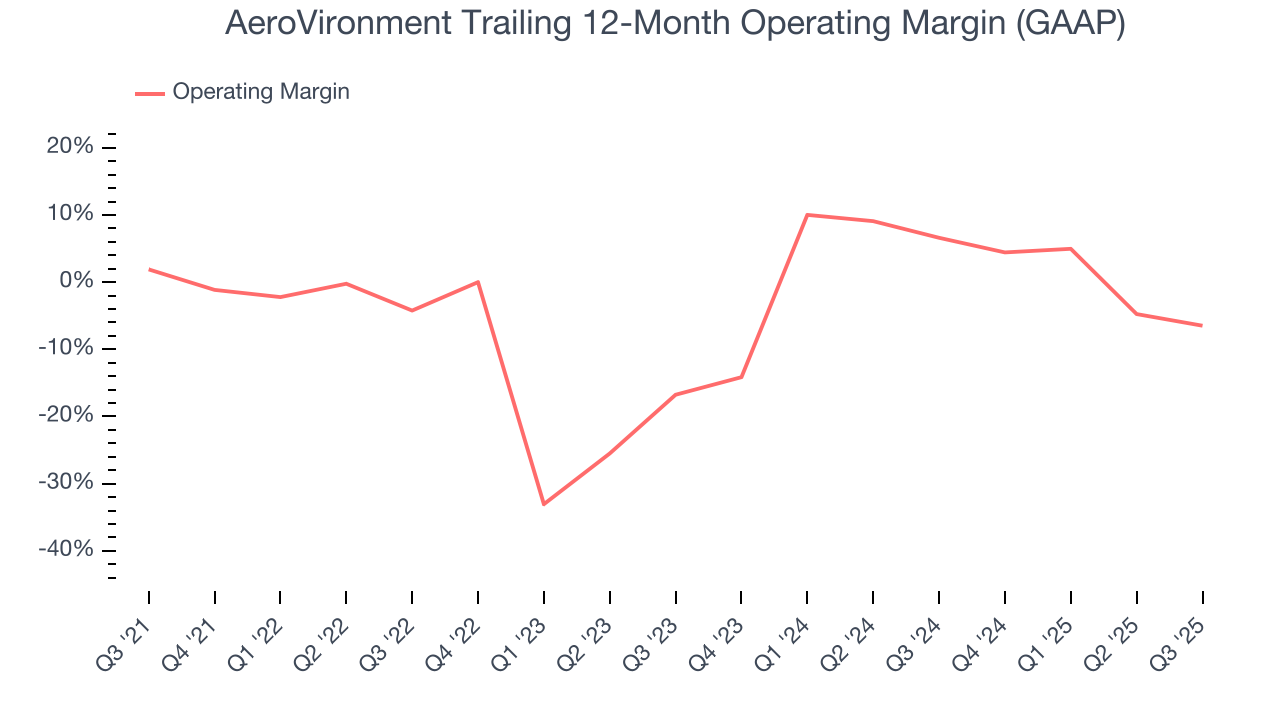

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

AeroVironment’s high expenses have contributed to an average operating margin of negative 4.3% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Looking at the trend in its profitability, AeroVironment’s operating margin decreased by 8.4 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. AeroVironment’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

AeroVironment’s operating margin was negative 6.4% this quarter.

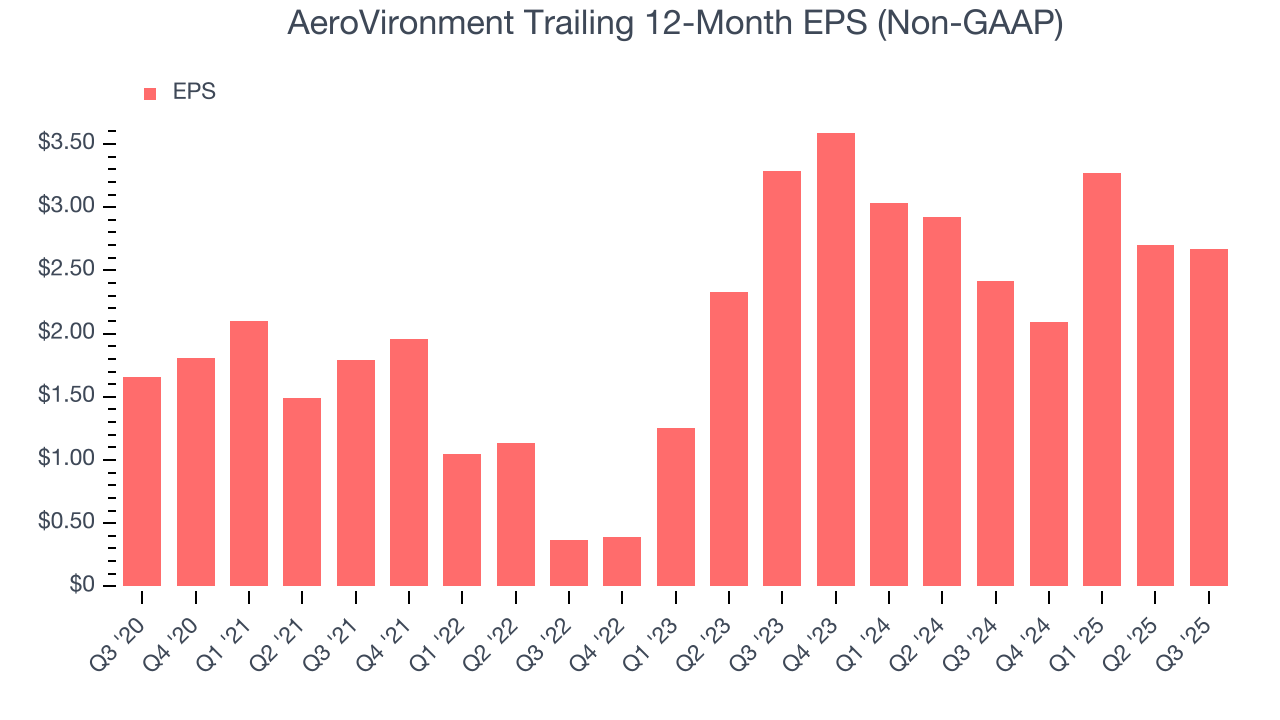

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

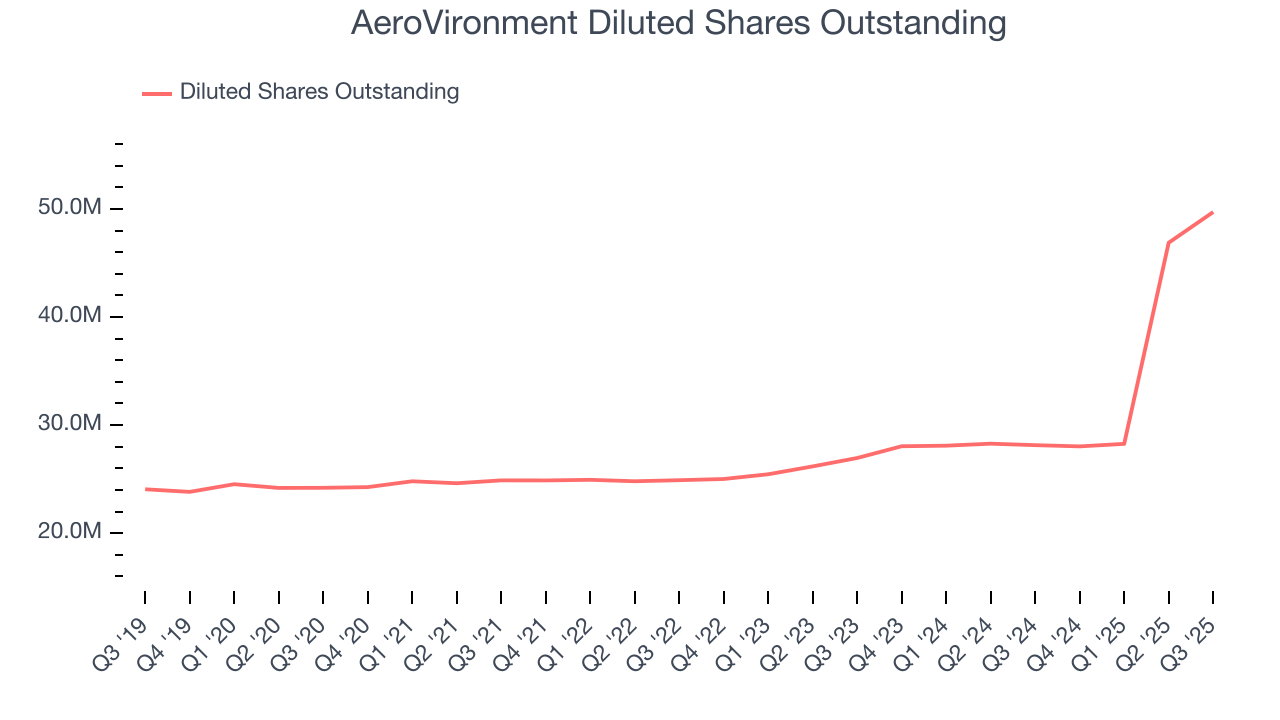

AeroVironment’s EPS grew at a solid 10% compounded annual growth rate over the last five years. However, this performance was lower than its 29.4% annualized revenue growth, telling us the company became less profitable on a per-share basis as it expanded.

We can take a deeper look into AeroVironment’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, AeroVironment’s operating margin declined by 8.4 percentage points over the last five years. Its share count also grew by 105%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For AeroVironment, its two-year annual EPS declines of 9.9% mark a reversal from its (seemingly) healthy five-year trend. We hope AeroVironment can return to earnings growth in the future.

In Q3, AeroVironment reported adjusted EPS of $0.44, down from $0.47 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects AeroVironment’s full-year EPS of $2.67 to grow 70.1%.

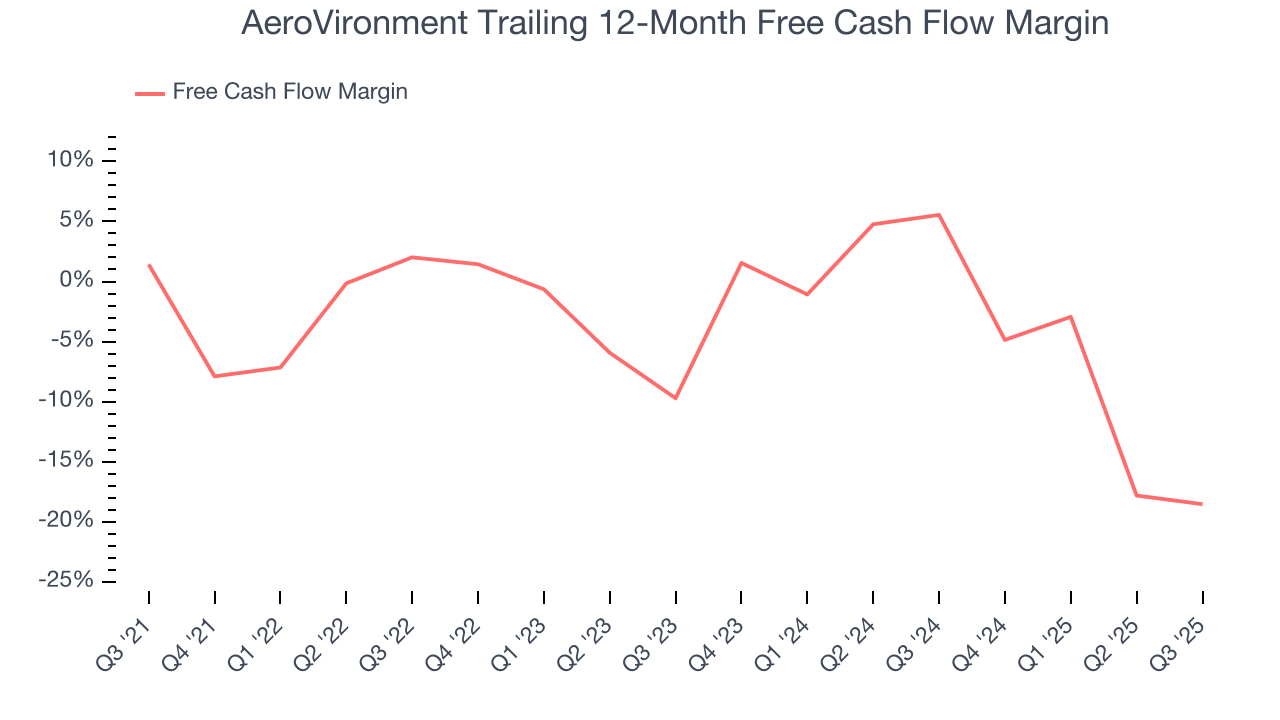

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

AeroVironment’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 7.1%, meaning it lit $7.10 of cash on fire for every $100 in revenue.

Taking a step back, we can see that AeroVironment’s margin dropped by 20 percentage points during that time. Almost any movement in the wrong direction is undesirable because it is already burning cash. If the trend continues, it could signal it’s becoming a more capital-intensive business.

AeroVironment burned through $69.16 million of cash in Q3, equivalent to a negative 14.6% margin. The company’s cash burn increased from $8.66 million of lost cash in the same quarter last year.

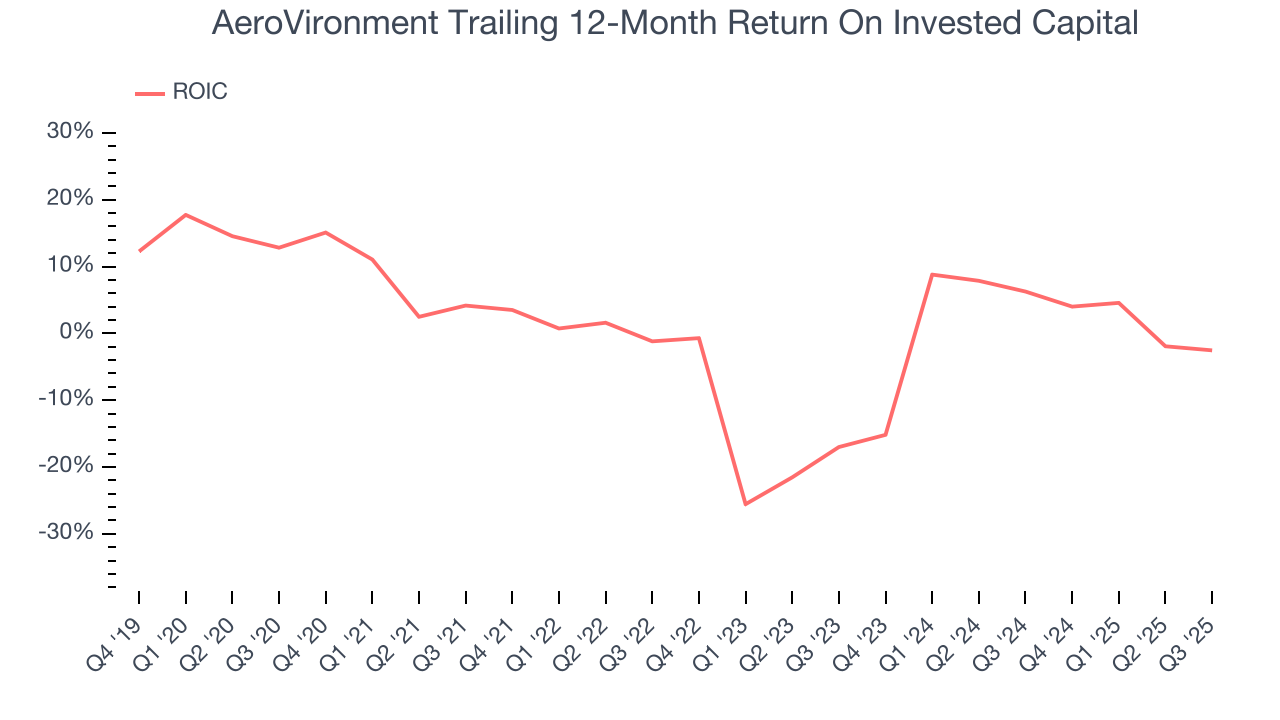

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

AeroVironment’s five-year average ROIC was negative 2.1%, meaning management lost money while trying to expand the business. Its returns were among the worst in the industrials sector.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, AeroVironment’s ROIC has stayed the same over the last few years. If the company wants to become an investable business, it must improve its returns by generating more profitable growth.

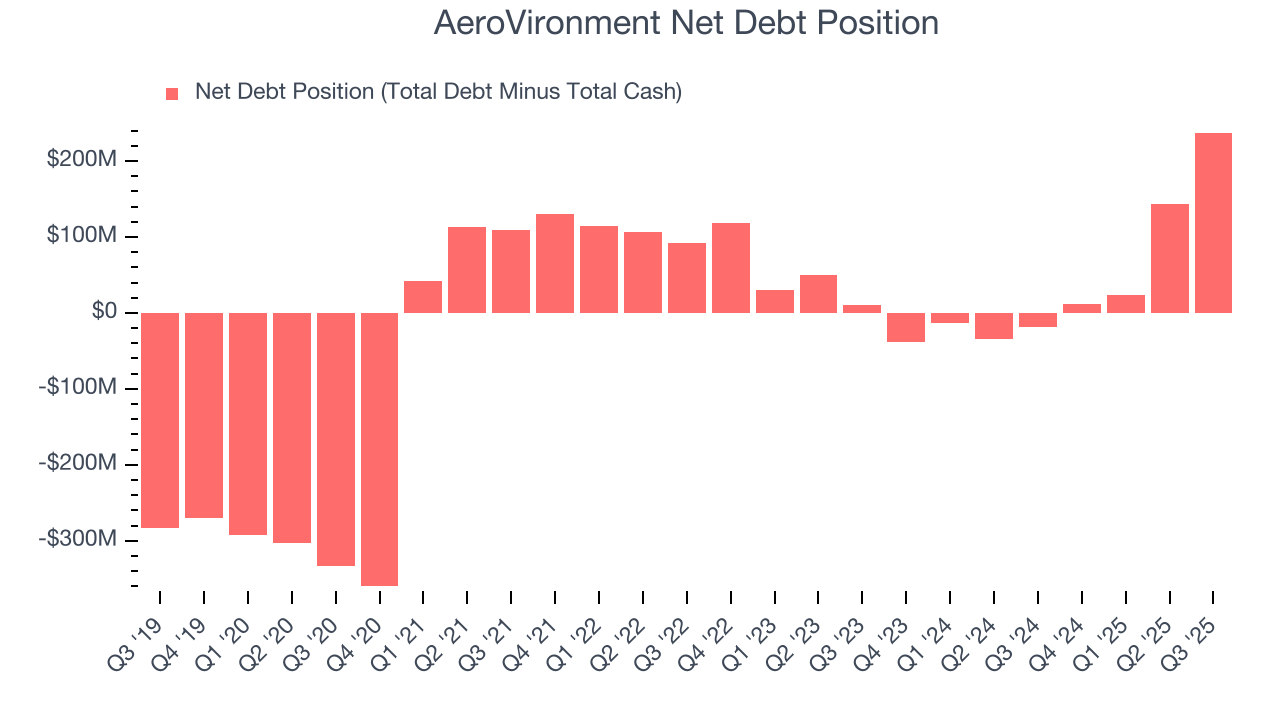

10. Balance Sheet Assessment

AeroVironment reported $588.5 million of cash and $825.9 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $185 million of EBITDA over the last 12 months, we view AeroVironment’s 1.3× net-debt-to-EBITDA ratio as safe. We also see its $13.97 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from AeroVironment’s Q3 Results

It was good to see AeroVironment narrowly top analysts’ revenue expectations this quarter. On the other hand, its EBITDA missed and its EPS fell short of Wall Street’s estimates. Looking ahead, full-year EPS guidance was also lowered, adding to the negatives. Overall, this quarter could have been better. The stock traded down 6.1% to $264.83 immediately after reporting.

12. Is Now The Time To Buy AeroVironment?

Updated: January 25, 2026 at 10:17 PM EST

Before deciding whether to buy AeroVironment or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

AeroVironment isn’t a terrible business, but it doesn’t pass our quality test. Although its revenue growth was exceptional over the last five years and is expected to accelerate over the next 12 months, its relatively low ROIC suggests management has struggled to find compelling investment opportunities. And while the company’s projected EPS for the next year implies the company’s fundamentals will improve, the downside is its declining operating margin shows the business has become less efficient.

AeroVironment’s P/E ratio based on the next 12 months is 67.6x. This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think other companies feature superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $388.62 on the company (compared to the current share price of $307.37).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.