Azenta (AZTA)

We wouldn’t recommend Azenta. Not only did its demand evaporate but also its negative returns on capital show it destroyed shareholder value.― StockStory Analyst Team

1. News

2. Summary

Why We Think Azenta Will Underperform

Serving as the guardian of some of medicine's most valuable materials, Azenta (NASDAQ:AZTA) provides biological sample management, storage, and genomic services that help pharmaceutical and biotechnology companies preserve and analyze critical research materials.

- Sales were less profitable over the last five years as its earnings per share fell by 18.8% annually, worse than its revenue declines

- Long-term business health is up for debate as its cash burn has increased over the last five years

- Negative returns on capital show management lost money while trying to expand the business

Azenta falls below our quality standards. We’ve identified better opportunities elsewhere.

Why There Are Better Opportunities Than Azenta

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Azenta

At $37 per share, Azenta trades at 47.6x forward P/E. This valuation is extremely expensive, especially for the weaker revenue growth you get.

There are stocks out there featuring similar valuation multiples with better fundamentals. We prefer to invest in those.

3. Azenta (AZTA) Research Report: Q4 CY2025 Update

Life sciences company Azenta (NASDAQ:AZTA) reported Q4 CY2025 results topping the market’s revenue expectations, but sales were flat year on year at $148.6 million. Its non-GAAP profit of $0.14 per share was in line with analysts’ consensus estimates.

Azenta (AZTA) Q4 CY2025 Highlights:

- Revenue: $148.6 million vs analyst estimates of $147 million (flat year on year, 1.1% beat)

- Adjusted EPS: $0.14 vs analyst estimates of $0.13 (in line)

- Adjusted EBITDA: $12.69 million vs analyst estimates of $17.91 million (8.5% margin, 29.1% miss)

- Operating Margin: -4.9%, up from -7.7% in the same quarter last year

- Free Cash Flow Margin: 9.9%, down from 14.9% in the same quarter last year

- Market Capitalization: $1.7 billion

Company Overview

Serving as the guardian of some of medicine's most valuable materials, Azenta (NASDAQ:AZTA) provides biological sample management, storage, and genomic services that help pharmaceutical and biotechnology companies preserve and analyze critical research materials.

Azenta operates through three main business segments that together form a comprehensive cold chain solution for life sciences research. The Sample Management Solutions segment offers automated storage systems that can maintain millions of biological samples at temperatures ranging from ambient to cryogenic (-190°C), along with the specialized containers, tubes, and tracking systems needed to preserve sample integrity.

The Multiomics segment provides genomic analysis services including gene sequencing, synthesis, and editing that allow researchers to understand genetic material and develop new therapies. Scientists can submit samples to Azenta's network of 13 laboratories worldwide for analysis, with results delivered in as little as 24 hours for simple requests.

The B Medical Systems segment rounds out Azenta's offerings with temperature-controlled storage and transportation solutions that ensure sensitive biological materials remain viable during transit across the global supply chain. These products are particularly critical for vaccine distribution in developing regions, with solutions including solar-powered refrigeration units.

A pharmaceutical company developing a new cancer therapy might store thousands of patient tissue samples in Azenta's automated biorepositories, send portions to Azenta's genomics labs for DNA sequencing to identify biomarkers, and then use Azenta's temperature-controlled shipping containers to transport promising compounds to clinical trial sites worldwide.

Azenta generates revenue through equipment sales, consumable products like specialized storage tubes, and recurring service contracts for sample storage and analysis. The company serves approximately 14,000 customers globally, including major pharmaceutical companies, research hospitals, academic institutions, and biotechnology startups across North America, Europe, and Asia.

4. Drug Development Inputs & Services

Companies specializing in drug development inputs and services play a crucial role in the pharmaceutical and biotechnology value chain. Essential support for drug discovery, preclinical testing, and manufacturing means stable demand, as pharmaceutical companies often outsource non-core functions with medium to long-term contracts. However, the business model faces high capital requirements, customer concentration, and vulnerability to shifts in biopharma R&D budgets or regulatory frameworks. Looking ahead, the industry will likely enjoy tailwinds such as increasing investment in biologics, cell and gene therapies, and advancements in precision medicine, which drive demand for sophisticated tools and services. There is a growing trend of outsourcing in drug development for nimbleness and cost efficiency, which benefits the industry. On the flip side, potential headwinds include pricing pressures as efforts to contain healthcare costs are always top of mind. An evolving regulatory backdrop could also slow innovation or client activity.

Azenta's competitors include Hamilton Company and Liconic AG in the automated storage systems market, Laboratory Corporation of America and Thermo Fisher Scientific in sample storage and services, and genomics service providers like BGI Genomics, Eurofins Scientific, and Twist Bioscience.

5. Revenue Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $595.2 million in revenue over the past 12 months, Azenta is a small company in an industry where scale matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive.

6. Revenue Growth

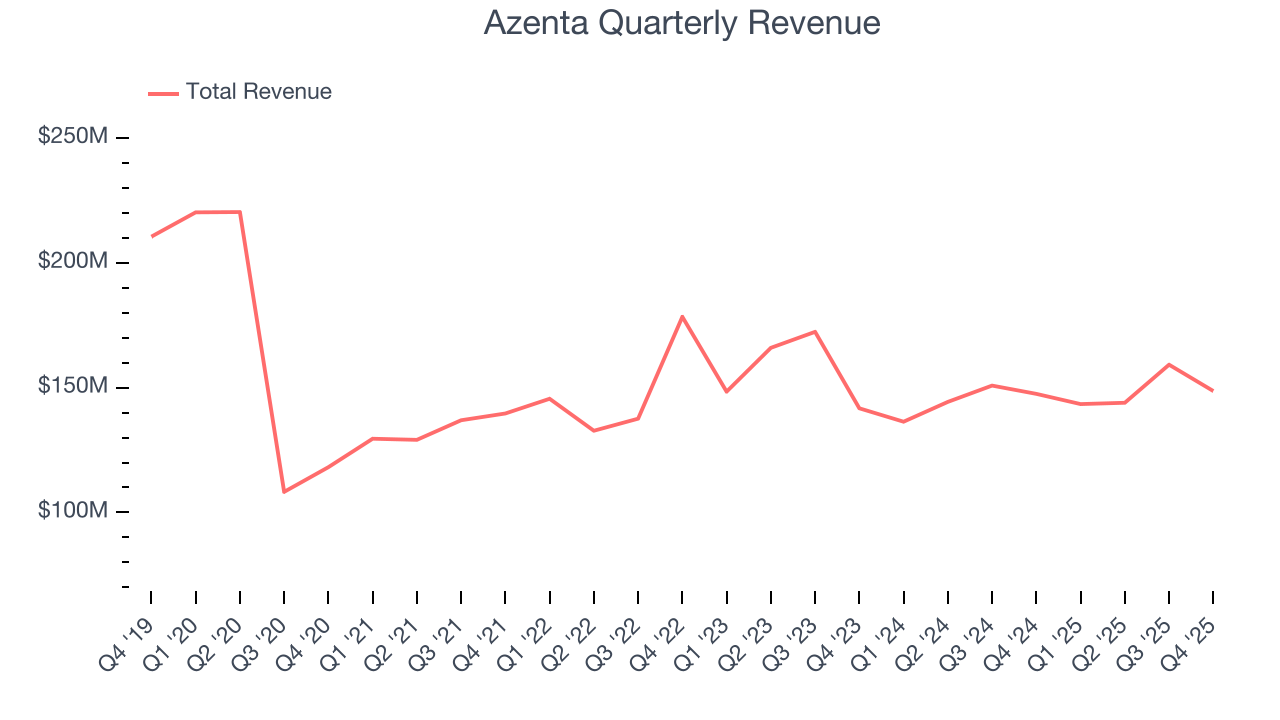

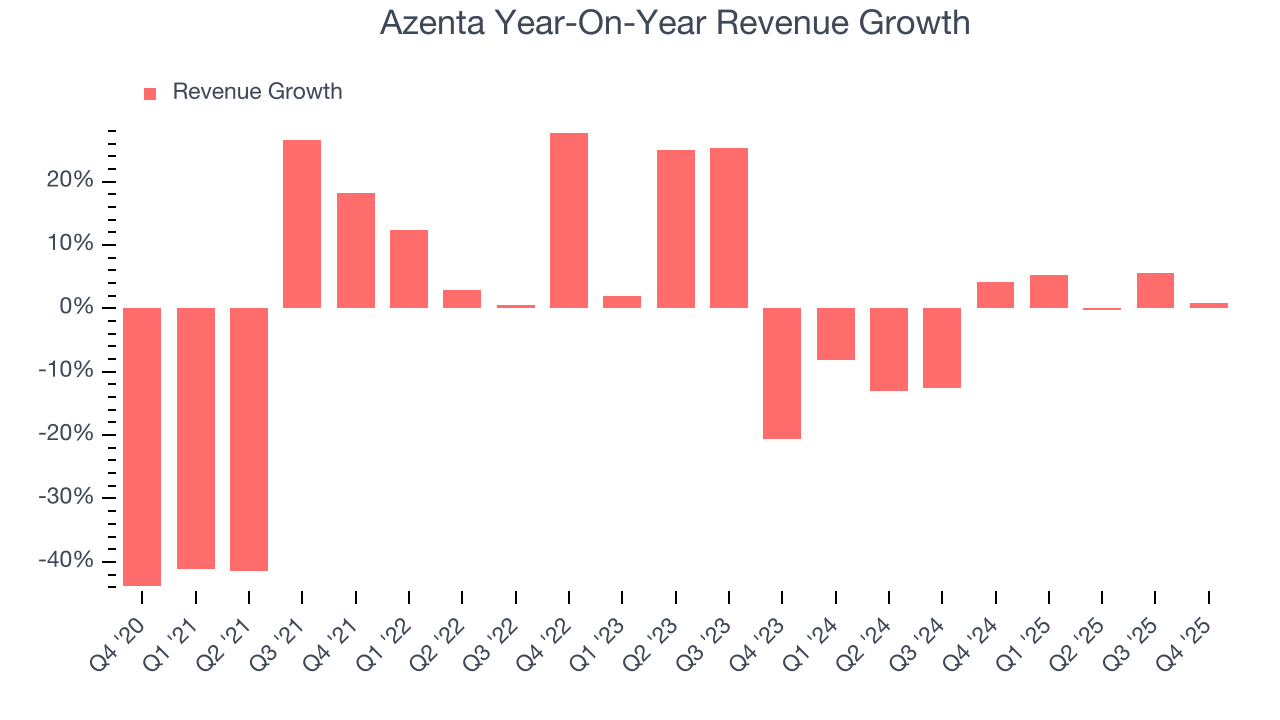

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Azenta struggled to consistently generate demand over the last five years as its sales dropped at a 2.3% annual rate. This wasn’t a great result and suggests it’s a low quality business.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Azenta’s annualized revenue declines of 2.7% over the last two years align with its five-year trend, suggesting its demand has consistently shrunk.

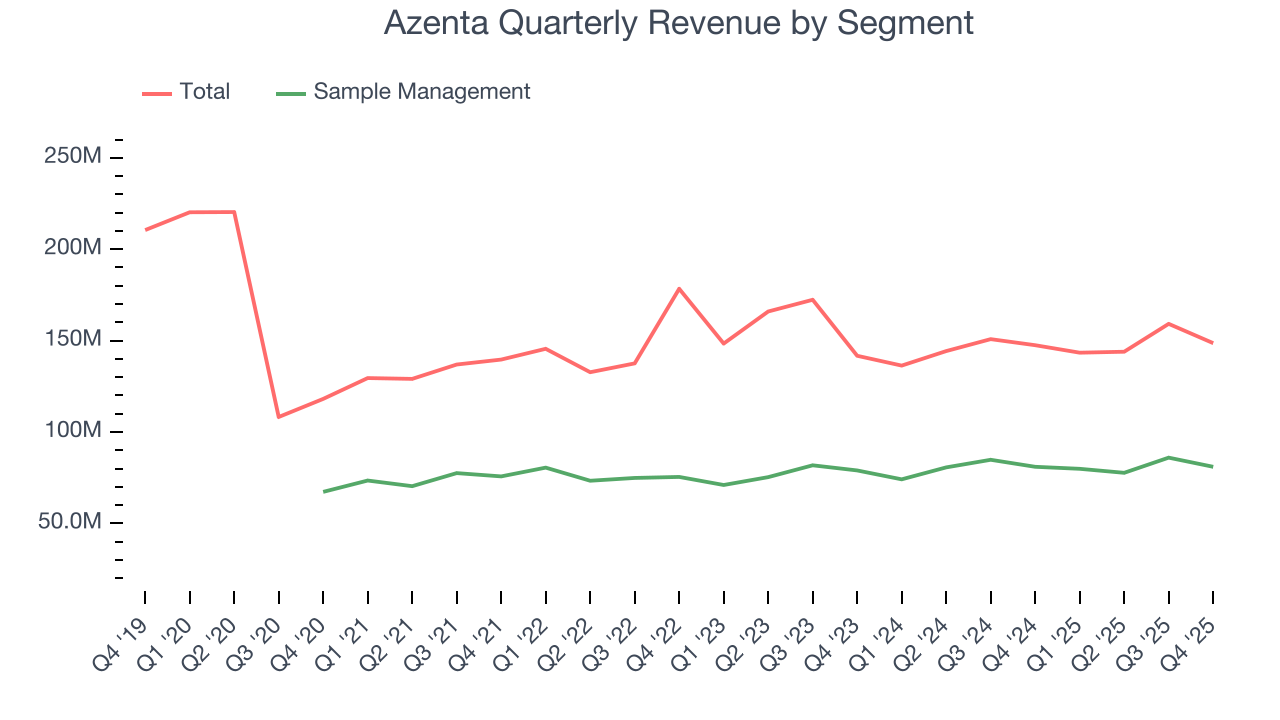

Azenta also breaks out the revenue for its most important segment, Sample Management. Over the last two years, Azenta’s Sample Management revenue averaged 2.9% year-on-year growth. This segment has outperformed its total sales during the same period, lifting the company’s performance.

This quarter, Azenta’s $148.6 million of revenue was flat year on year but beat Wall Street’s estimates by 1.1%.

Looking ahead, sell-side analysts expect revenue to grow 5.4% over the next 12 months, an improvement versus the last two years. This projection is above the sector average and suggests its newer products and services will catalyze better top-line performance.

7. Operating Margin

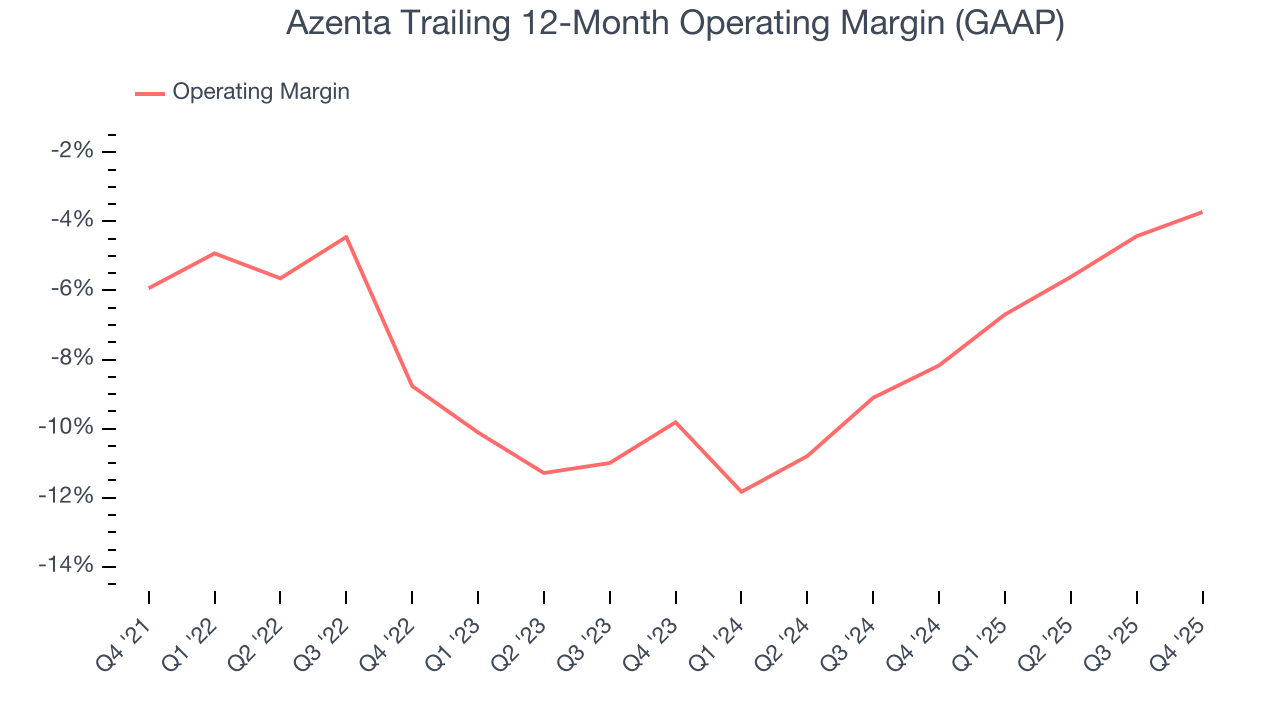

Azenta’s high expenses have contributed to an average operating margin of negative 7.3% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Azenta’s operating margin rose by 2.2 percentage points over the last five years. This performance was mostly driven by its recent improvements as the company’s margin has increased by 6.1 percentage points on a two-year basis.

Azenta’s operating margin was negative 4.9% this quarter. The company's consistent lack of profits raise a flag.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

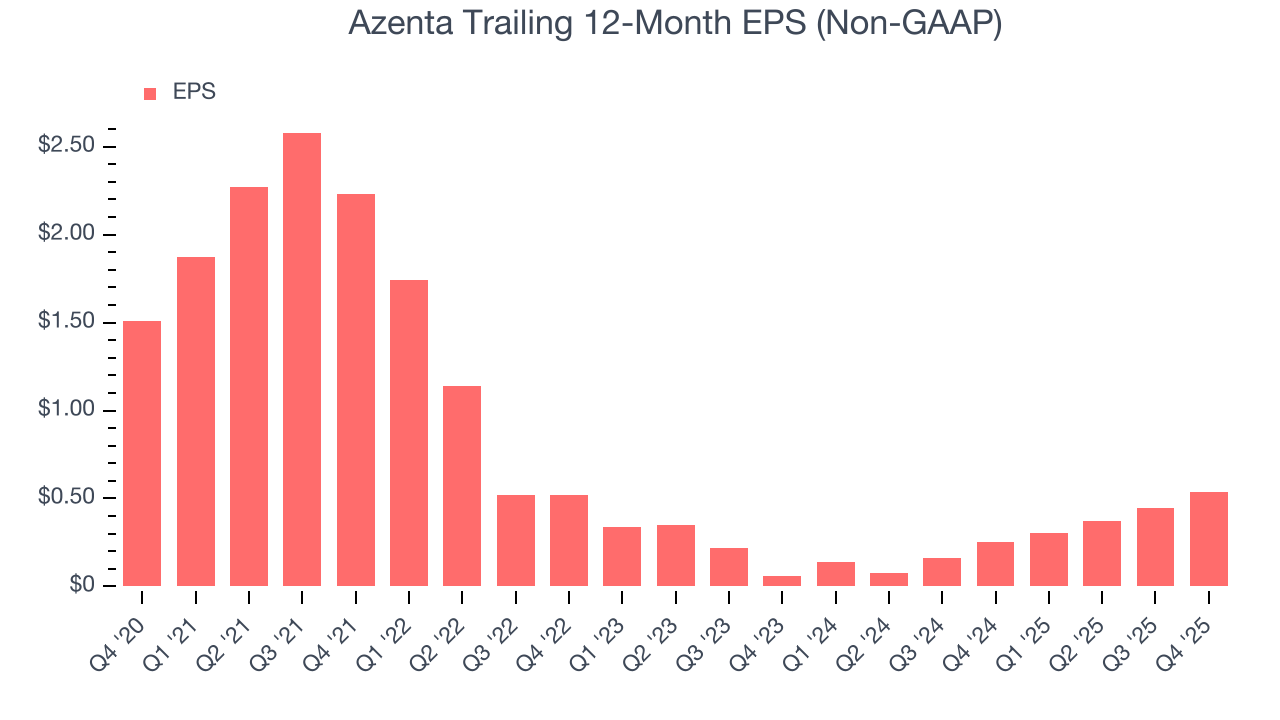

Sadly for Azenta, its EPS declined by 18.7% annually over the last five years, more than its revenue. We can see the difference stemmed from higher interest expenses or taxes as the company actually improved its operating margin and repurchased its shares during this time.

In Q4, Azenta reported adjusted EPS of $0.14, up from $0.05 in the same quarter last year. This print beat analysts’ estimates by 3.3%. Over the next 12 months, Wall Street expects Azenta’s full-year EPS of $0.54 to grow 59.9%.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

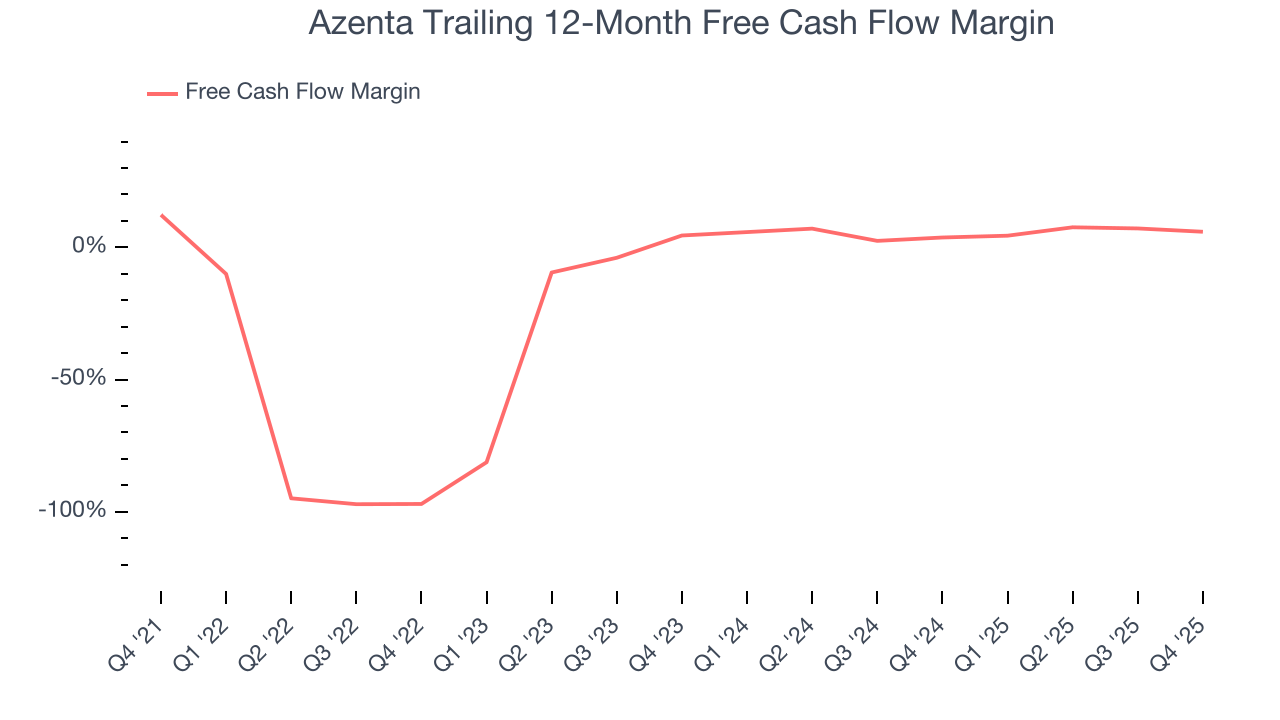

While Azenta posted positive free cash flow this quarter, the broader story hasn’t been so clean. Azenta’s demanding reinvestments have consumed many resources over the last five years, contributing to an average free cash flow margin of negative 14.5%. This means it lit $14.52 of cash on fire for every $100 in revenue.

Taking a step back, we can see that Azenta’s margin dropped by 6.4 percentage points during that time. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. Almost any movement in the wrong direction is undesirable because it’s already burning cash. If the longer-term trend returns, it could signal it’s becoming a more capital-intensive business.

Azenta’s free cash flow clocked in at $14.66 million in Q4, equivalent to a 9.9% margin. The company’s cash profitability regressed as it was 5.1 percentage points lower than in the same quarter last year, but it’s still above its five-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, leading to short-term swings. Long-term trends carry greater meaning.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

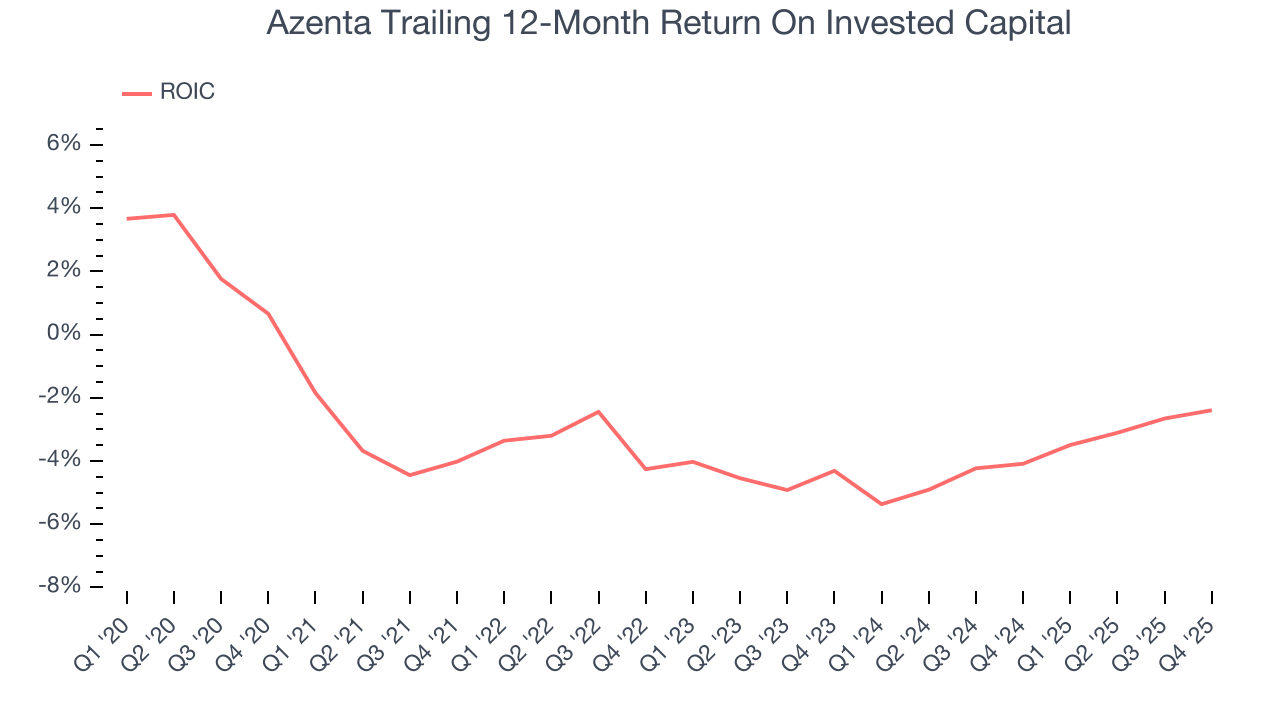

Azenta’s five-year average ROIC was negative 3.8%, meaning management lost money while trying to expand the business. Its returns were among the worst in the healthcare sector.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Azenta’s ROIC has stayed the same over the last few years. If the company wants to become an investable business, it must improve its returns by generating more profitable growth.

11. Balance Sheet Assessment

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

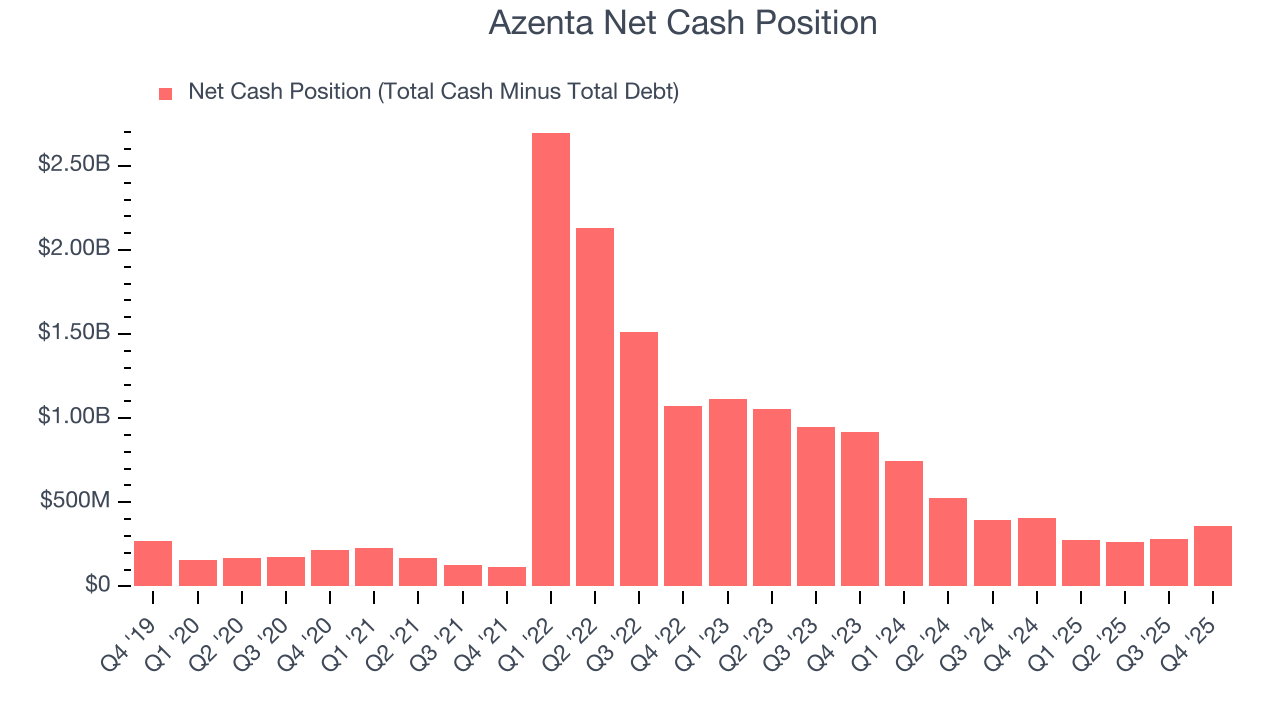

Azenta is a well-capitalized company with $412 million of cash and $54.46 million of debt on its balance sheet. This $357.6 million net cash position is 21.1% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Azenta’s Q4 Results

It was good to see Azenta narrowly top analysts’ revenue expectations this quarter. We were also glad its EPS was in line with Wall Street’s estimates. Overall, this print had some key positives. Investors were likely hoping for more, and shares traded down 3.5% to $35.60 immediately after reporting.

13. Is Now The Time To Buy Azenta?

Are you wondering whether to buy Azenta or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

We see the value of companies making people healthier, but in the case of Azenta, we’re out. To kick things off, its revenue has declined over the last five years. On top of that, Azenta’s declining EPS over the last five years makes it a less attractive asset to the public markets, and its cash burn raises the question of whether it can sustainably maintain growth.

Azenta’s P/E ratio based on the next 12 months is 43.1x. This multiple tells us a lot of good news is priced in - you can find more timely opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $43.50 on the company (compared to the current share price of $35.60).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.