Concrete Pumping (BBCP)

We wouldn’t recommend Concrete Pumping. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think Concrete Pumping Will Underperform

Going public via SPAC in 2018, Concrete Pumping (NASDAQ:BBCP) is a provider of concrete pumping and waste management services in the United States and the United Kingdom.

- Annual sales declines of 5.7% for the past two years show its products and services struggled to connect with the market during this cycle

- Earnings per share decreased by more than its revenue over the last two years, showing each sale was less profitable

- Demand will likely be soft over the next 12 months as Wall Street’s estimates imply tepid growth of 2%

Concrete Pumping doesn’t check our boxes. We see more favorable opportunities in the market.

Why There Are Better Opportunities Than Concrete Pumping

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Concrete Pumping

Concrete Pumping’s stock price of $6.74 implies a valuation ratio of 58.1x forward P/E. This valuation multiple seems a bit much considering the tepid revenue growth profile.

We prefer to invest in similarly-priced but higher-quality companies with superior earnings growth.

3. Concrete Pumping (BBCP) Research Report: Q3 CY2025 Update

Concrete and waste management company Concrete Pumping (NASDAQ:BBCP) reported Q3 CY2025 results topping the market’s revenue expectations, but sales fell by 2.4% year on year to $108.8 million. The company’s full-year revenue guidance of $400 million at the midpoint came in 2% above analysts’ estimates. Its GAAP profit of $0.09 per share was in line with analysts’ consensus estimates.

Concrete Pumping (BBCP) Q3 CY2025 Highlights:

- Revenue: $108.8 million vs analyst estimates of $102.9 million (2.4% year-on-year decline, 5.7% beat)

- EPS (GAAP): $0.09 vs analyst estimates of $0.09 (in line)

- Adjusted EBITDA: $30.67 million vs analyst estimates of $28.9 million (28.2% margin, 6.1% beat)

- EBITDA guidance for the upcoming financial year 2026 is $95 million at the midpoint, below analyst estimates of $102.1 million

- Operating Margin: 15.5%, down from 17.2% in the same quarter last year

- Free Cash Flow Margin: 1.8%, down from 14.4% in the same quarter last year

- Market Capitalization: $386.1 million

Company Overview

Going public via SPAC in 2018, Concrete Pumping (NASDAQ:BBCP) is a provider of concrete pumping and waste management services in the United States and the United Kingdom.

The company operates under several established brands, including Brundage-Bone Concrete Pumping for U.S. concrete pumping, Camfaud Group Limited in the U.K., and Eco-Pan for waste management services in both regions.

The company has expanded its reach through numerous strategic acquisitions, establishing a strong presence across both countries. Concrete Pumping Holdings utilizes a large fleet of specialized pumping equipment, washout pans, and trucks, operated by highly-trained professionals to deliver precise concrete placement and efficient waste management solutions.

Concrete Pumping Holdings operates through three main segments: U.S. Concrete Pumping, U.S. Concrete Waste Management Services, and U.K. Operations. The U.S. Concrete Pumping segment, operating under the Brundage-Bone and Capital Pumping brands, provides operated concrete pumping services across numerous states. The U.S. Concrete Waste Management Services segment, under the Eco-Pan brand, offers full-service, route-based concrete washout solutions. The U.K. Operations segment encompasses both concrete pumping and waste management services in the United Kingdom.

The company's business model is primarily based on negotiated time and volume pricing for concrete pumping services, with additional charges for specific project requirements. For waste management services, Concrete Pumping Holdings utilizes a fixed-fee structure that includes delivery, pickup, and disposal of concrete washout.

4. Construction and Maintenance Services

Construction and maintenance services companies not only boast technical know-how in specialized areas but also may hold special licenses and permits. Those who work in more regulated areas can enjoy more predictable revenue streams - for example, fire escapes need to be inspected every five years. More recently, services to address energy efficiency and labor availability are also creating incremental demand. But like the broader industrials sector, construction and maintenance services companies are at the whim of economic cycles as external factors like interest rates can greatly impact the new construction that drives incremental demand for these companies’ offerings.

Concrete Pumping’s competitors include United Rentals (NYSE:URI), Cemex (NYSE:CX), and Vulcan Materials (NYSE:VMC).

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Regrettably, Concrete Pumping’s sales grew at a tepid 5.2% compounded annual growth rate over the last five years. This fell short of our benchmark for the industrials sector and is a poor baseline for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Concrete Pumping’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 5.7% annually.

This quarter, Concrete Pumping’s revenue fell by 2.4% year on year to $108.8 million but beat Wall Street’s estimates by 5.7%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. While this projection implies its newer products and services will spur better top-line performance, it is still below average for the sector.

6. Gross Margin & Pricing Power

Gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor.

Concrete Pumping’s unit economics are great compared to the broader industrials sector and signal that it enjoys product differentiation through quality or brand. As you can see below, it averaged an excellent 40.3% gross margin over the last five years. That means Concrete Pumping only paid its suppliers $59.73 for every $100 in revenue.

Concrete Pumping’s gross profit margin came in at 39.8% this quarter, marking a 1.7 percentage point decrease from 41.5% in the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Concrete Pumping has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 12.2%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Concrete Pumping’s operating margin decreased by 1.5 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Concrete Pumping generated an operating margin profit margin of 15.5%, down 1.7 percentage points year on year. Since Concrete Pumping’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

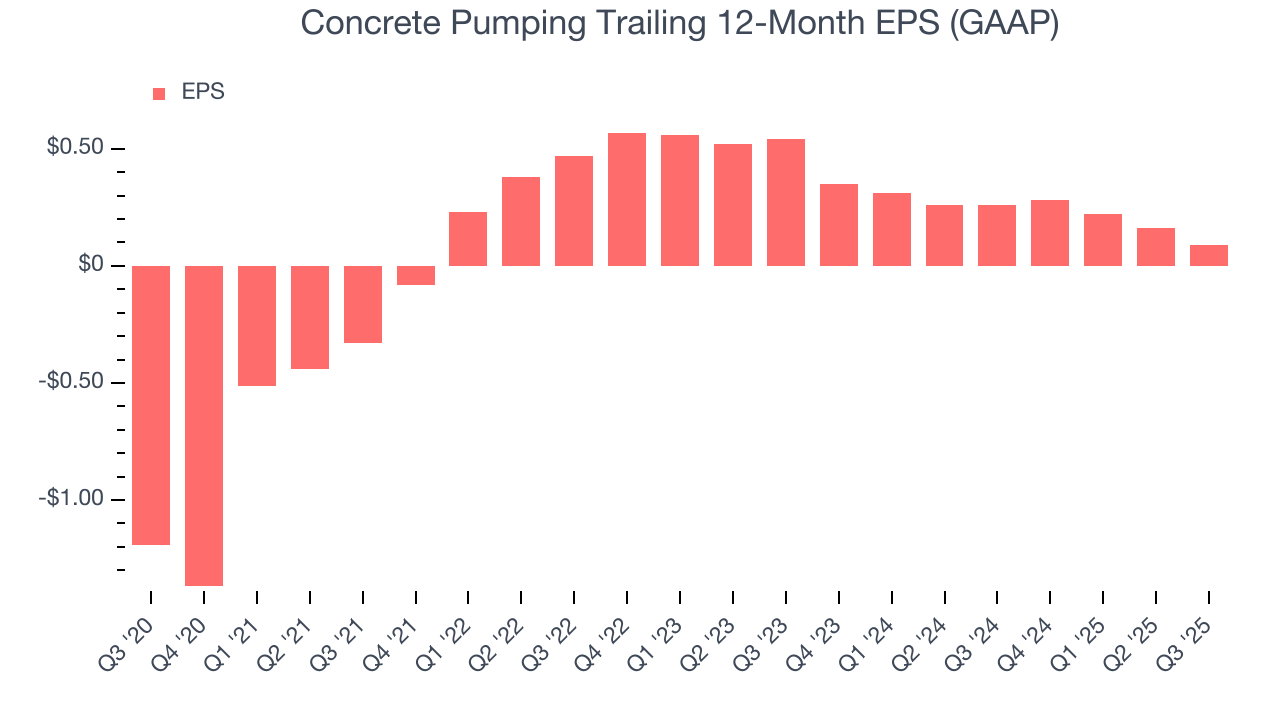

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Concrete Pumping’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Sadly for Concrete Pumping, its EPS declined by more than its revenue over the last two years, dropping 59.2%. This tells us the company struggled to adjust to shrinking demand.

In Q3, Concrete Pumping reported EPS of $0.09, down from $0.16 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Concrete Pumping’s full-year EPS of $0.09 to grow 74.1%.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Concrete Pumping has shown weak cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.6%, subpar for an industrials business. The divergence from its good operating margin stems from its capital-intensive business model, which requires Concrete Pumping to make large cash investments in working capital and capital expenditures.

Concrete Pumping’s free cash flow clocked in at $1.91 million in Q3, equivalent to a 1.8% margin. The company’s cash profitability regressed as it was 12.7 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Concrete Pumping historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 7.6%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Concrete Pumping’s ROIC has stayed the same over the last few years. If the company wants to become an investable business, it must improve its returns by generating more profitable growth.

11. Balance Sheet Assessment

Concrete Pumping reported $44.39 million of cash and $441.4 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $97.02 million of EBITDA over the last 12 months, we view Concrete Pumping’s 4.1× net-debt-to-EBITDA ratio as safe. We also see its $14.02 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Concrete Pumping’s Q3 Results

We were impressed by how significantly Concrete Pumping blew past analysts’ revenue expectations this quarter. We were also glad its EBITDA outperformed Wall Street’s estimates. On the other hand, its full-year EBITDA guidance missed. Overall, we think this was a decent quarter with some key metrics above expectations. Investors were likely hoping for more, and shares traded down 3.4% to $7.16 immediately after reporting.

13. Is Now The Time To Buy Concrete Pumping?

Updated: March 8, 2026 at 10:07 PM EDT

When considering an investment in Concrete Pumping, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

Concrete Pumping doesn’t pass our quality test. To begin with, its revenue growth was uninspiring over the last five years, and analysts expect its demand to deteriorate over the next 12 months. While its astounding EPS growth over the last five years shows its profits are trickling down to shareholders, the downside is its projected EPS for the next year is lacking. On top of that, its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

Concrete Pumping’s P/E ratio based on the next 12 months is 58.1x. This multiple tells us a lot of good news is priced in - you can find more timely opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $7.75 on the company (compared to the current share price of $6.74).