BlackLine (BL)

BlackLine doesn’t excite us. Its sluggish sales growth shows demand is soft, a worrisome sign for investors in high-quality stocks.― StockStory Analyst Team

1. News

2. Summary

Why We Think BlackLine Will Underperform

Born from the vision to eliminate tedious manual spreadsheet work for accountants, BlackLine (NASDAQ:BL) provides cloud-based software that automates and streamlines financial close, intercompany accounting, and invoice-to-cash processes for accounting departments.

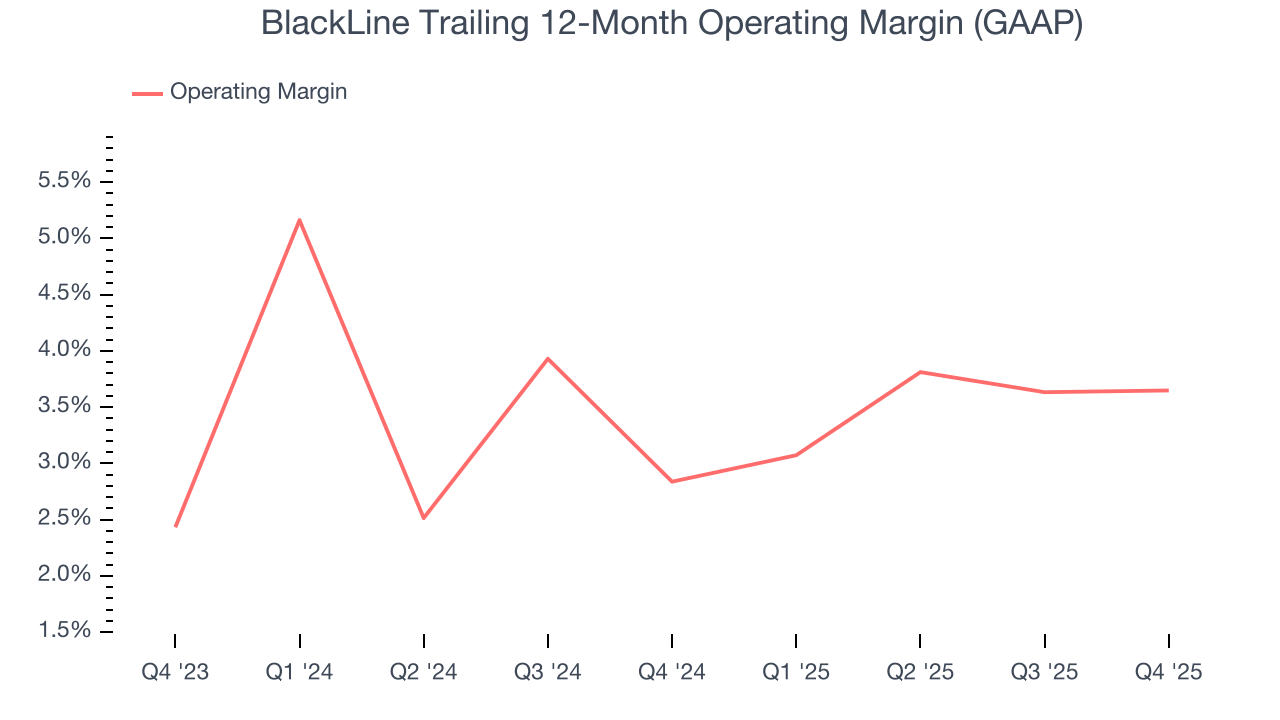

- Static operating margin over the last year shows it couldn’t become more efficient

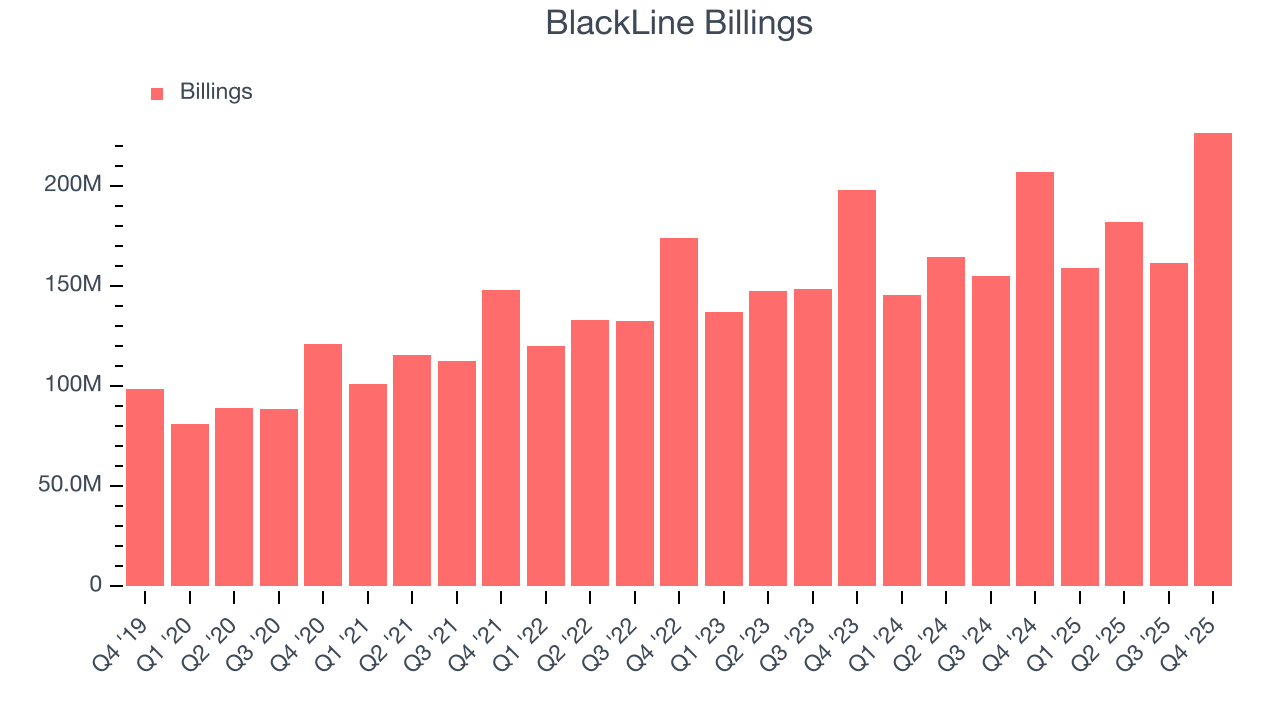

- Customers had second thoughts about committing to its platform over the last year as its average billings growth of 7.2% underwhelmed

- On the bright side, its user-friendly software enables clients to ramp up spending quickly, leading to the speedy recovery of customer acquisition costs

BlackLine is skating on thin ice. We’re redirecting our focus to better businesses.

Why There Are Better Opportunities Than BlackLine

Why There Are Better Opportunities Than BlackLine

At $43.08 per share, BlackLine trades at 3.7x forward price-to-sales. BlackLine’s valuation may seem like a bargain, but we think there are valid reasons why it’s so cheap.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. BlackLine (BL) Research Report: Q4 CY2025 Update

Financial automation software company BlackLine (NASDAQ:BL) met Wall Street’s revenue expectations in Q4 CY2025, with sales up 8.1% year on year to $183.2 million. The company expects next quarter’s revenue to be around $181 million, close to analysts’ estimates. Its non-GAAP profit of $0.63 per share was 7.2% above analysts’ consensus estimates.

BlackLine (BL) Q4 CY2025 Highlights:

- Revenue: $183.2 million vs analyst estimates of $183 million (8.1% year-on-year growth, in line)

- Adjusted EPS: $0.63 vs analyst estimates of $0.59 (7.2% beat)

- Adjusted Operating Income: $45.18 million vs analyst estimates of $44.7 million (24.7% margin, 1.1% beat)

- Revenue Guidance for Q1 CY2026 is $181 million at the midpoint, roughly in line with what analysts were expecting

- Adjusted EPS guidance for the upcoming financial year 2026 is $2.43 at the midpoint, beating analyst estimates by 3.4%

- Operating Margin: 3.7%, in line with the same quarter last year

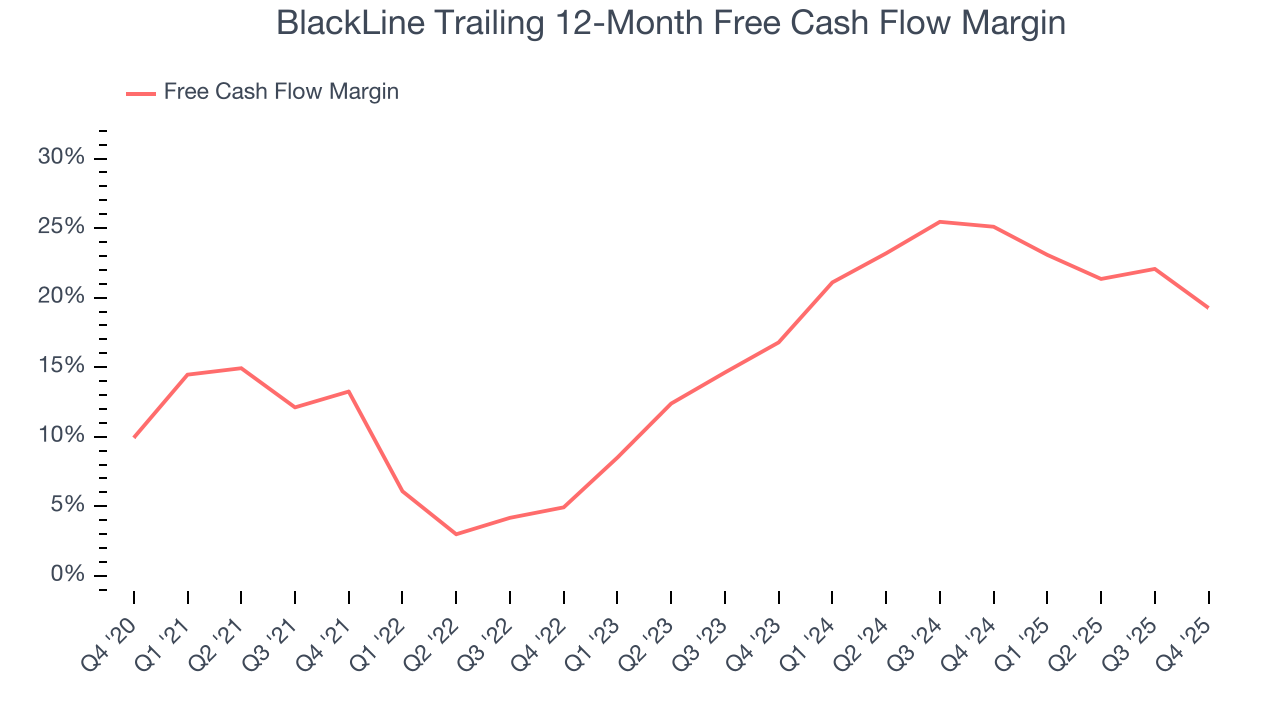

- Free Cash Flow Margin: 10.9%, down from 32% in the previous quarter

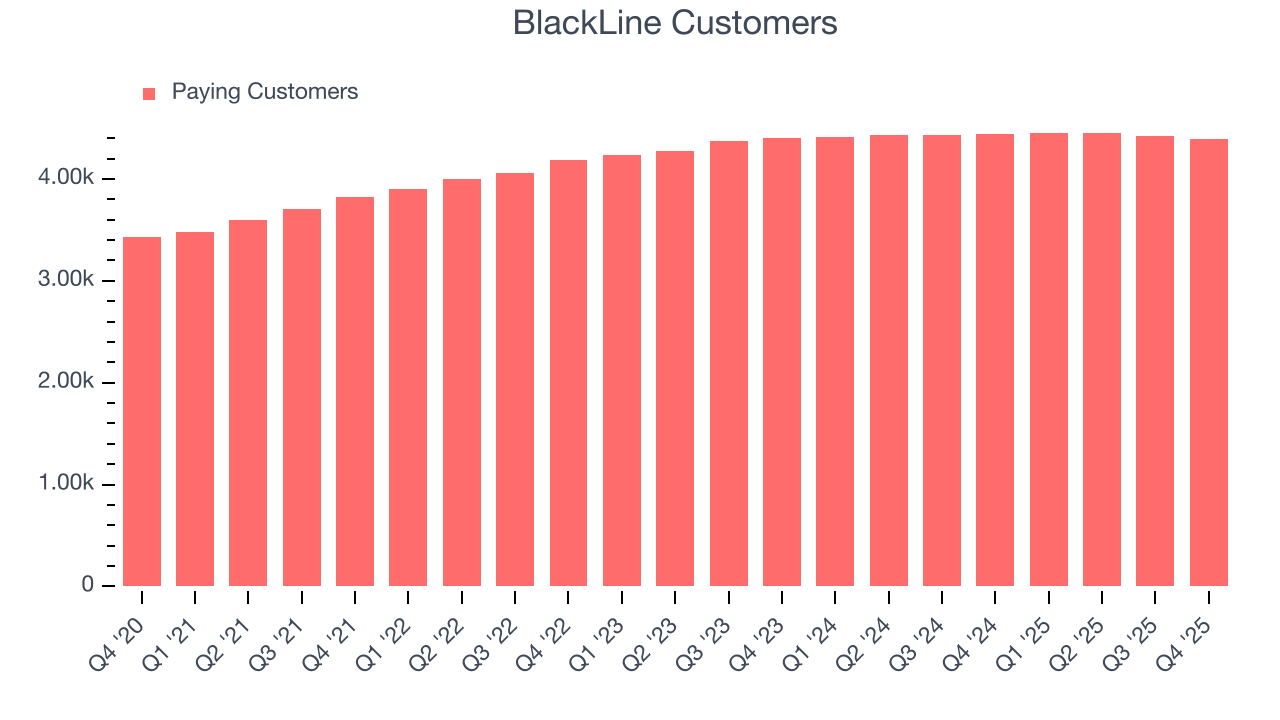

- Customers: 4,394, down from 4,424 in the previous quarter

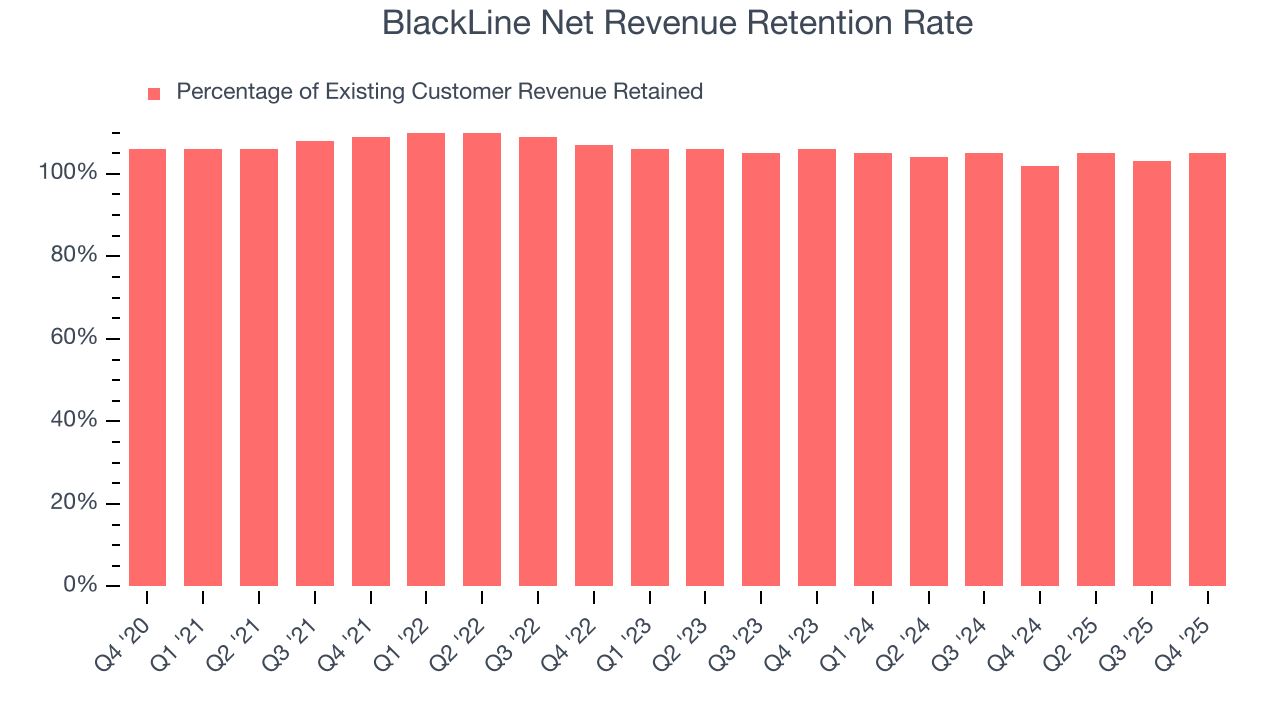

- Net Revenue Retention Rate: 105%, up from 103% in the previous quarter

- Billings: $226.7 million at quarter end, up 9.4% year on year

- Market Capitalization: $2.56 billion

Company Overview

Born from the vision to eliminate tedious manual spreadsheet work for accountants, BlackLine (NASDAQ:BL) provides cloud-based software that automates and streamlines financial close, intercompany accounting, and invoice-to-cash processes for accounting departments.

BlackLine's platform serves as the central nervous system for financial operations, particularly focusing on the month-end close process that traditionally involves countless hours of manual reconciliations and spreadsheet work. The company's solutions allow accounting teams to automate account reconciliations, match transactions, manage journal entries, analyze variances, and coordinate tasks through standardized workflows and approvals.

A typical customer might use BlackLine to transform their month-end close from a two-week sprint of late nights and weekend work into a continuous, automated process with real-time visibility. For example, a multinational corporation with dozens of subsidiaries could use BlackLine to automatically match millions of transactions across different systems, flag exceptions for review, and provide a clear audit trail—replacing what would otherwise require thousands of manual spreadsheet entries.

BlackLine generates revenue through subscription-based pricing models, primarily serving midsize and large enterprise customers across various industries. The company's solutions are ERP-agnostic, meaning they can integrate with virtually any financial system including SAP, Oracle, and Microsoft. This flexibility allows BlackLine to position itself as a complementary layer that enhances rather than replaces existing financial infrastructure, making it attractive to companies with complex, multi-system environments.

Beyond core accounting automation, BlackLine has expanded into intercompany transaction management and accounts receivable automation, including electronic invoicing capabilities acquired through its purchase of Data Interconnect in 2023.

4. Tax Software

The demand for easy to use, integrated cloud based finance software that integrates tax and accounting operations continues to rise in tandem with the difficulty workers find trying to use existing accounting tools like spreadsheets given the growing volume of finance data littered across a multitude of enterprise applications. A related demand driver is the secular increase of e-commerce and rising adoption of modern point of sales and payments platforms which easily integrate with backend financial software.

BlackLine's competitors include enterprise software providers like Oracle (NYSE:ORCL) and SAP (NYSE:SAP) who offer financial close modules within their ERP systems, as well as specialized players like Trintech (private) and FloQast (private) that focus on financial close management solutions.

5. Revenue Growth

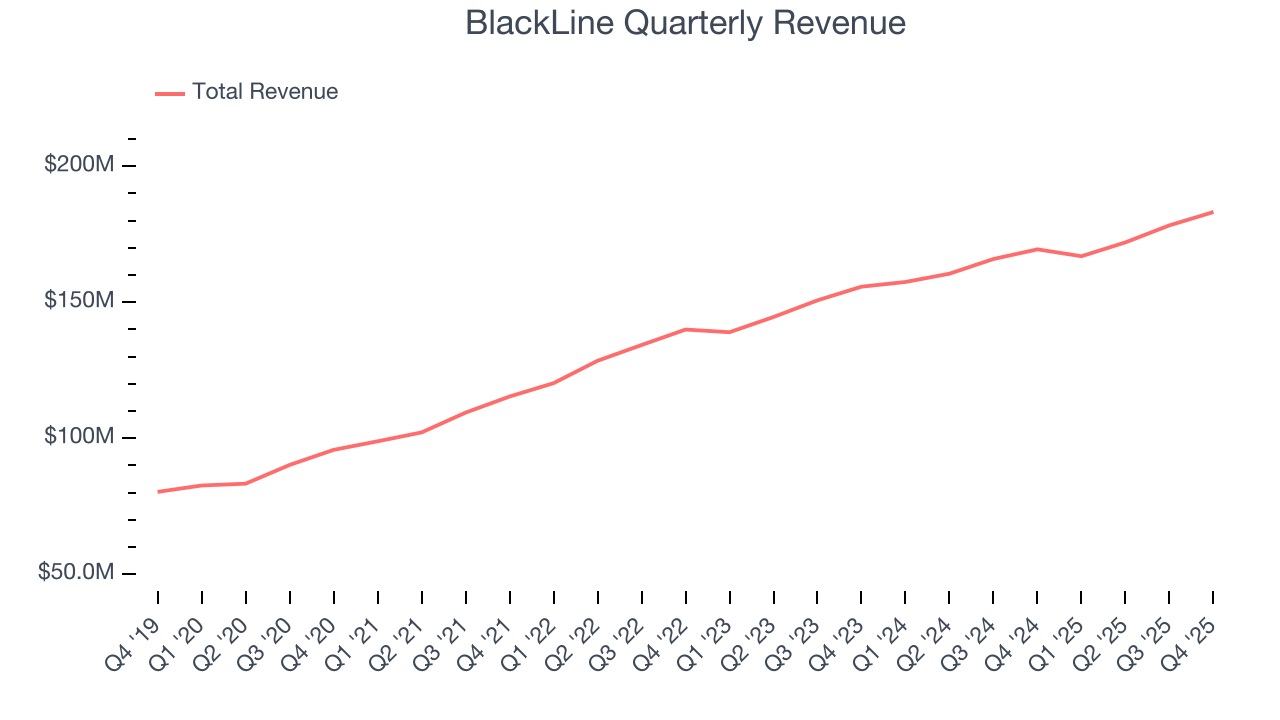

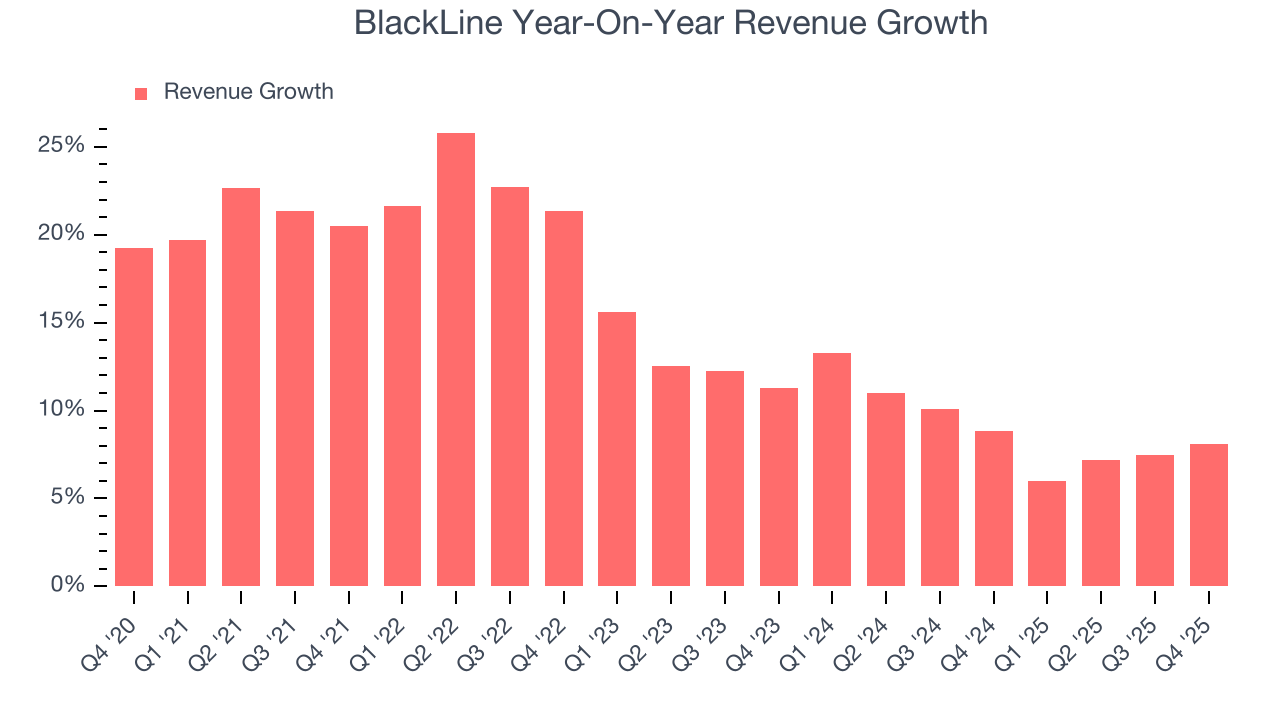

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, BlackLine grew its sales at a 14.8% annual rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the software sector, which enjoys a number of secular tailwinds.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. BlackLine’s recent performance shows its demand has slowed as its annualized revenue growth of 9% over the last two years was below its five-year trend.

This quarter, BlackLine grew its revenue by 8.1% year on year, and its $183.2 million of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 8.4% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 8.6% over the next 12 months, similar to its two-year rate. This projection is underwhelming and implies its newer products and services will not lead to better top-line performance yet.

6. Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

BlackLine’s billings came in at $226.7 million in Q4, and over the last four quarters, its growth was underwhelming as it averaged 8.4% year-on-year increases. This performance mirrored its total sales and suggests that increasing competition is causing challenges in acquiring/retaining customers.

7. Customer Base

BlackLine reported 4,394 customers at the end of the quarter, a sequential decrease of 30. That’s worse than what we’ve observed previously, and we’ve no doubt shareholders would like to see the company accelerate its sales momentum.

8. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

BlackLine is extremely efficient at acquiring new customers, and its CAC payback period checked in at 11 months this quarter. The company’s rapid recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

9. Customer Retention

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

BlackLine’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 104% in Q4. This means BlackLine would’ve grown its revenue by 4.3% even if it didn’t win any new customers over the last 12 months.

BlackLine has an adequate net retention rate, showing us that it generally keeps customers but lags behind the best SaaS businesses, which routinely post net retention rates of 120%+.

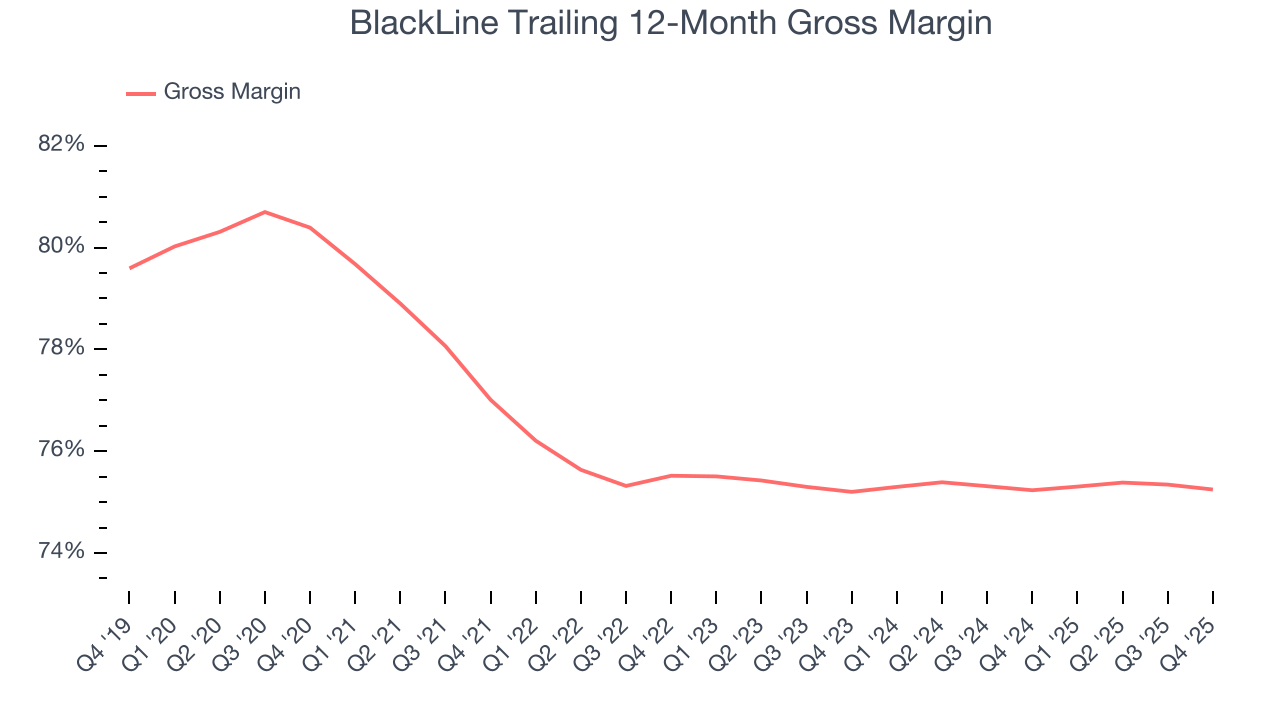

10. Gross Margin & Pricing Power

For software companies like BlackLine, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

BlackLine’s gross margin is good for a software business and points to its solid unit economics, competitive products and services, and lack of meaningful pricing pressure. As you can see below, it averaged an impressive 75.2% gross margin over the last year. That means for every $100 in revenue, roughly $75.25 was left to spend on selling, marketing, and R&D.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. BlackLine has seen gross margins improve by 0 percentage points over the last 2 year, which is slightly better than average for software.

BlackLine produced a 75.2% gross profit margin in Q4, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs have been stable and it isn’t under pressure to lower prices.

11. Operating Margin

While many software businesses point investors to their adjusted profits, which exclude stock-based compensation (SBC), we prefer GAAP operating margin because SBC is a legitimate expense used to attract and retain talent. This is one of the best measures of profitability because it shows how much money a company takes home after developing, marketing, and selling its products.

BlackLine has done a decent job managing its cost base over the last year. The company has produced an average operating margin of 3.6%, higher than the broader software sector.

Looking at the trend in its profitability, BlackLine’s operating margin might fluctuated slightly but has generally stayed the same over the last two years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, BlackLine generated an operating margin profit margin of 3.7%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

12. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

BlackLine has shown impressive cash profitability, driven by its attractive business model and cost-effective customer acquisition strategy that give it the option to invest in new products and services rather than sales and marketing. The company’s free cash flow margin averaged 19.3% over the last year, better than the broader software sector.

BlackLine’s free cash flow clocked in at $19.88 million in Q4, equivalent to a 10.9% margin. The company’s cash profitability regressed as it was 10.7 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Over the next year, analysts predict BlackLine’s cash conversion will improve. Their consensus estimates imply its free cash flow margin of 19.3% for the last 12 months will increase to 25.7%, it options for capital deployment (investments, share buybacks, etc.).

13. Key Takeaways from BlackLine’s Q4 Results

Adjusted operating income and EPS in the quarter beat. We were also impressed by BlackLine’s optimistic full-year EPS guidance, which blew past analysts’ expectations. On the other hand, its EPS guidance for next quarter missed. Zooming out, we think this was a mixed but positive quarter. The stock traded up 1.5% to $45.06 immediately after reporting.

14. Is Now The Time To Buy BlackLine?

Updated: February 10, 2026 at 4:44 PM EST

Are you wondering whether to buy BlackLine or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

BlackLine’s business quality ultimately falls short of our standards. To begin with, its revenue growth was a little slower over the last five years, and analysts expect its demand to deteriorate over the next 12 months. And while its efficient sales strategy allows it to target and onboard new users at scale, the downside is its operating margin hasn't moved over the last year. On top of that, its ARR has disappointed and shows the company is having difficulty retaining customers and their spending.

BlackLine’s price-to-sales ratio based on the next 12 months is 4.2x. While this valuation is fair, the upside isn’t great compared to the potential downside. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $59.69 on the company (compared to the current share price of $45.06).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.