Credit Acceptance (CACC)

Credit Acceptance keeps us up at night. Its revenue and earnings have underwhelmed, suggesting weak business fundamentals.― StockStory Analyst Team

1. News

2. Summary

Why We Think Credit Acceptance Will Underperform

Founded in 1972 by Donald Foss to serve customers overlooked by traditional lenders, Credit Acceptance (NASDAQ:CACC) provides auto financing solutions that enable car dealers to sell vehicles to consumers with limited or impaired credit histories.

- Earnings per share fell by 2% annually over the last two years while its revenue grew, showing its incremental sales were much less profitable

- Tangible book value per share stagnated over the last two years, limiting its ability to leverage its balance sheet to make additional investments

Credit Acceptance fails to meet our quality criteria. We see more attractive opportunities in the market.

Why There Are Better Opportunities Than Credit Acceptance

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Credit Acceptance

Credit Acceptance’s stock price of $498.08 implies a valuation ratio of 10.7x forward P/E. Yes, this valuation multiple is lower than that of other financials peers, but we’ll remind you that you often get what you pay for.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. Credit Acceptance (CACC) Research Report: Q4 CY2025 Update

Auto financing company Credit Acceptance (NASDAQ:CACC) announced better-than-expected revenue in Q4 CY2025, with sales up 46.3% year on year to $579.9 million. Its non-GAAP profit of $11.35 per share was 15.2% above analysts’ consensus estimates.

Credit Acceptance (CACC) Q4 CY2025 Highlights:

- Revenue: $579.9 million vs analyst estimates of $464.5 million (46.3% year-on-year growth, 24.8% beat)

- Pre-tax Profit: $157 million (27.1% margin)

- Adjusted EPS: $11.35 vs analyst estimates of $9.85 (15.2% beat)

- Market Capitalization: $4.78 billion

Company Overview

Founded in 1972 by Donald Foss to serve customers overlooked by traditional lenders, Credit Acceptance (NASDAQ:CACC) provides auto financing solutions that enable car dealers to sell vehicles to consumers with limited or impaired credit histories.

Credit Acceptance operates through two main financing programs: the Portfolio Program and the Purchase Program. Under the Portfolio Program, the company advances money to dealers and receives the right to service the underlying consumer loans. Dealers benefit from an initial cash advance plus future payments after Credit Acceptance recovers its advance. With the Purchase Program, dealers receive a one-time payment when they sell the consumer loan to the company.

The company's business model creates a three-way relationship between Credit Acceptance, auto dealers, and consumers who might otherwise struggle to purchase reliable transportation. For dealers, the programs unlock a customer segment that would typically be turned away, generating additional sales and potential repeat business. For consumers with credit challenges, the financing provides access to vehicles they might not otherwise be able to purchase.

A typical transaction might involve a customer with a 550 credit score who has been rejected by traditional lenders. Through Credit Acceptance's programs, the dealer can sell them a $15,000 used vehicle, with the company providing the financing that makes the purchase possible. The dealer benefits from the sale, while the consumer gains transportation and an opportunity to rebuild their credit history.

Credit Acceptance generates revenue primarily through interest and fees on the loans it services, as well as through ancillary products like vehicle service contracts and Guaranteed Asset Protection (GAP) coverage. The company maintains a nationwide network of market area managers who recruit and support dealers across the United States.

4. Auto Loan

Auto loan providers finance vehicle purchases for consumers and businesses. They benefit from steady vehicle demand, higher average vehicle prices requiring financing, and opportunities in used car financing. Headwinds include economic cycle sensitivity affecting repayment ability, competition from dealership financing programs, and potential disruption from vehicle subscription services reducing traditional ownership models.

Credit Acceptance competes with other subprime auto lenders including Santander Consumer USA (private), CarMax Auto Finance (NYSE:KMX), and regional banks that offer subprime auto loans. The company also faces competition from traditional auto finance companies that have expanded into the non-prime market such as Ally Financial (NYSE:ALLY) and Capital One Auto Finance (NYSE:COF).

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Credit Acceptance’s 4.9% annualized revenue growth over the last five years was tepid. This fell short of our benchmark for the financials sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Credit Acceptance’s annualized revenue growth of 12% over the last two years is above its five-year trend, suggesting its demand recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Credit Acceptance reported magnificent year-on-year revenue growth of 46.3%, and its $579.9 million of revenue beat Wall Street’s estimates by 24.8%.

6. Pre-Tax Profit Margin

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Auto Loan companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

The pre-tax profit margin includes interest because it's central to how financial institutions generate revenue and manage costs. Tax considerations are excluded since they represent government policy rather than operational performance, giving investors a clearer view of business fundamentals.

Over the last five years, Credit Acceptance’s pre-tax profit margin has risen by 7.4 percentage points, going from 77.6% to 31.5%. Luckily, it seems the company has recently taken steps to address its expense base as its pre-tax profit margin expanded by 5.8 percentage points on a two-year basis.

Credit Acceptance’s pre-tax profit margin came in at 27.1% this quarter. This result was 21.3 percentage points worse than the same quarter last year.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Credit Acceptance’s flat EPS over the last five years was below its 4.9% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded due to factors such as interest expenses and taxes.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

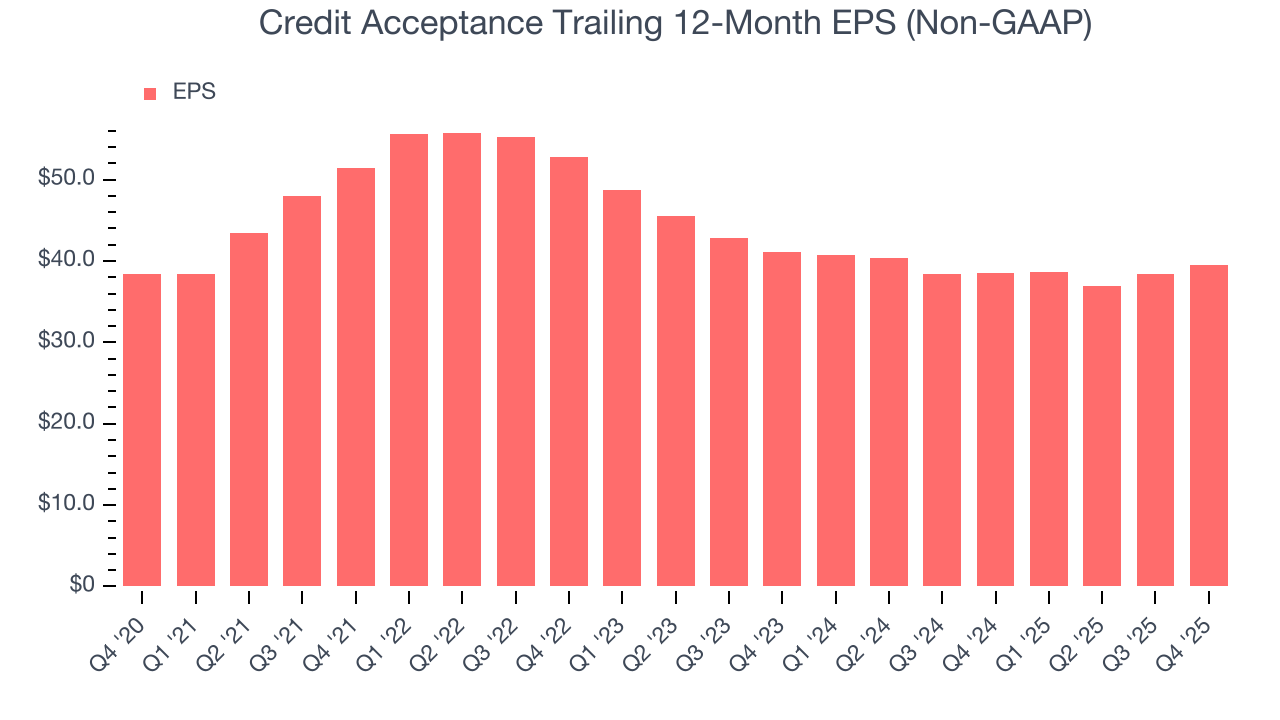

For Credit Acceptance, its two-year annual EPS declines of 2% show its recent history was to blame for its underperformance over the last five years. These results were bad no matter how you slice the data.

In Q4, Credit Acceptance reported adjusted EPS of $11.35, up from $10.17 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Credit Acceptance’s full-year EPS of $39.54 to grow 6.9%.

8. Tangible Book Value Per Share (TBVPS)

Financial firms generate earnings through diverse intermediation activities, making them fundamentally balance sheet-driven enterprises. Investors focus on balance sheet quality and consistent book value compounding when evaluating these multifaceted financial institutions.

This explains why tangible book value per share (TBVPS) is a premier metric for the sector. TBVPS provides concrete per-share net worth that investors can trust when evaluating companies with complex, multi-faceted business models. Traditional metrics like EPS are helpful but face distortion from the complexity of diversified operations, M&A activity, and various accounting rules that can obscure true performance across multiple business lines.

Credit Acceptance’s TBVPS grew at a weak 1.5% annual clip over the last five years. TBVPS growth has also decelerated a bit recently as it was flat over the last two years at roughly $142.66 per share.

9. Return on Equity

Return on equity, or ROE, tells us how much profit a company generates for each dollar of shareholder equity, a key funding source for banks. Over a long period, banks with high ROE tend to compound shareholder wealth faster through retained earnings, buybacks, and dividends.

Over the last five years, Credit Acceptance has averaged an ROE of 26.9%, exceptional for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This is a bright spot for Credit Acceptance.

10. Balance Sheet Risk

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Credit Acceptance currently has $6.35 billion of debt and $1.52 billion of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 4.1×. We think this is dangerous - for a financials business, anything above 3.5× raises red flags.

11. Key Takeaways from Credit Acceptance’s Q4 Results

We were impressed by how significantly Credit Acceptance blew past analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock remained flat at $450.24 immediately after reporting.

12. Is Now The Time To Buy Credit Acceptance?

Updated: March 7, 2026 at 11:53 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

Credit Acceptance falls short of our quality standards. To kick things off, its revenue growth was weak over the last five years. While its stellar ROE suggests it has been a well-run company historically, the downside is its declining pre-tax profit margin shows the business has become less efficient. On top of that, its weak EPS growth over the last five years shows it’s failed to produce meaningful profits for shareholders.

Credit Acceptance’s P/E ratio based on the next 12 months is 10.7x. At this valuation, there’s a lot of good news priced in - we think there are better opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $466.67 on the company (compared to the current share price of $498.08), implying they don’t see much short-term potential in Credit Acceptance.