Carlyle (CG)

Carlyle is a great business. Its annual EPS growth of 20% over the last five years has topped its peer group.― StockStory Analyst Team

1. News

2. Summary

Why We Like Carlyle

Founded in 1987 with just $5 million in capital and named after the iconic New York hotel where the founders first met, The Carlyle Group (NASDAQ:CG) is a global investment firm that raises, manages, and deploys capital across private equity, credit, and investment solutions.

- Incremental sales significantly boosted profitability as its annual earnings per share growth of 23.9% over the last two years outstripped its revenue performance

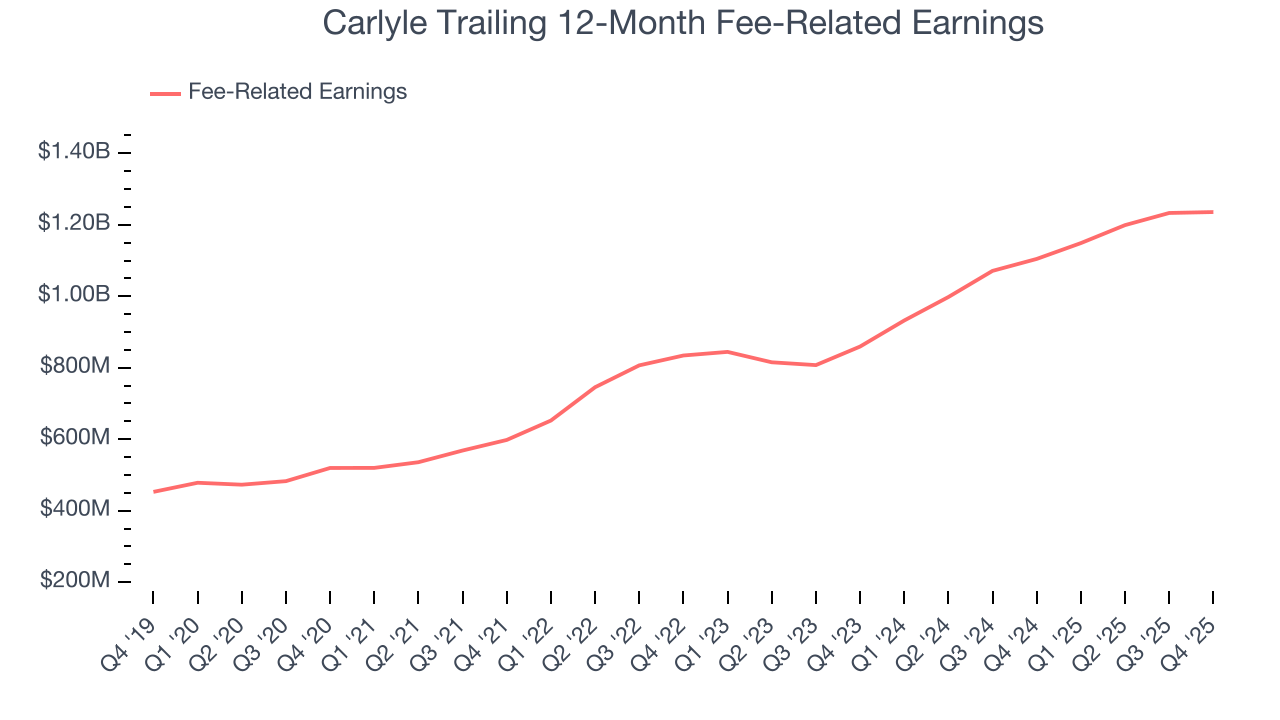

- 23.6% annual growth in fee-related earnings over the last two years shows the firm optimized its expenses

- Fee-related earnings improved by 20.6% annually over the last five years as it eliminated redundant costs

Carlyle is a standout company. The valuation seems reasonable based on its quality, so this might be a good time to buy some shares.

Why Is Now The Time To Buy Carlyle?

Why Is Now The Time To Buy Carlyle?

Carlyle is trading at $55.85 per share, or 13.1x forward P/E. Most financials companies are more expensive, so we think Carlyle is a good deal when considering its quality characteristics.

Entry price matters much less than business quality when investing for the long term, but hey, it certainly doesn’t hurt to get in at an attractive price.

3. Carlyle (CG) Research Report: Q4 CY2025 Update

Private equity firm Carlyle Group (NASDAQ:CG) announced better-than-expected revenue in Q4 CY2025, with sales up 15.1% year on year to $1.09 billion. Its non-GAAP profit of $1.01 per share was 1.7% above analysts’ consensus estimates.

Carlyle (CG) Q4 CY2025 Highlights:

- Assets Under Management: $477 billion vs analyst estimates of $476.4 billion (8.2% year-on-year growth, in line)

- Revenue: $1.09 billion vs analyst estimates of $1.05 billion (15.1% year-on-year growth, 3.7% beat)

- Fee-Related Earnings: $290 million vs analyst estimates of $285.5 million (1.6% beat)

- Adjusted EPS: $1.01 vs analyst estimates of $0.99 (1.7% beat)

- Market Capitalization: $19.97 billion

Company Overview

Founded in 1987 with just $5 million in capital and named after the iconic New York hotel where the founders first met, The Carlyle Group (NASDAQ:CG) is a global investment firm that raises, manages, and deploys capital across private equity, credit, and investment solutions.

Carlyle operates through three business segments that work together to create an integrated platform. Its Corporate Private Equity segment acquires controlling stakes in companies across industries like healthcare, technology, and consumer goods, then works to increase their value through operational improvements, strategic repositioning, and add-on acquisitions. The Global Credit segment provides financing solutions ranging from direct lending to distressed credit opportunities. Its Investment Solutions segment offers investors access to private market strategies through fund-of-funds and co-investment vehicles.

The firm serves a diverse client base that includes pension funds, sovereign wealth funds, financial institutions, and high-net-worth individuals seeking exposure to alternative investments. These clients entrust Carlyle with capital in exchange for investment expertise and access to deals that aren't available in public markets. For example, a state pension fund might allocate hundreds of millions to Carlyle's funds to diversify beyond traditional stocks and bonds while seeking higher returns.

Carlyle generates revenue primarily through management fees (typically 1-2% of committed capital) and performance fees (usually 20% of investment profits above a predetermined threshold). This structure aligns the firm's interests with its investors, as significant portions of Carlyle's earnings depend on successfully growing the value of portfolio companies. With investment professionals across offices spanning six continents, Carlyle leverages its global network to source deals and create value across different economic environments and geographies.

4. Asset Management

Asset management firms oversee investment portfolios for institutions and individuals. The industry benefits from the growing global wealth pool, retirement savings needs, and expansion into alternative investments (private equity, real estate, etc.). However, firms face significant pressure from the shift to lower-cost passive investment products, regulatory requirements for fee transparency, and increasing technology costs to stay competitive in portfolio management and client service.

Carlyle's main competitors include other publicly traded alternative asset managers such as Blackstone (NYSE:BX), KKR (NYSE:KKR), Apollo Global Management (NYSE:APO), and Ares Management (NYSE:ARES), along with other financial institutions that have significant alternative investment divisions.

5. Revenue Growth

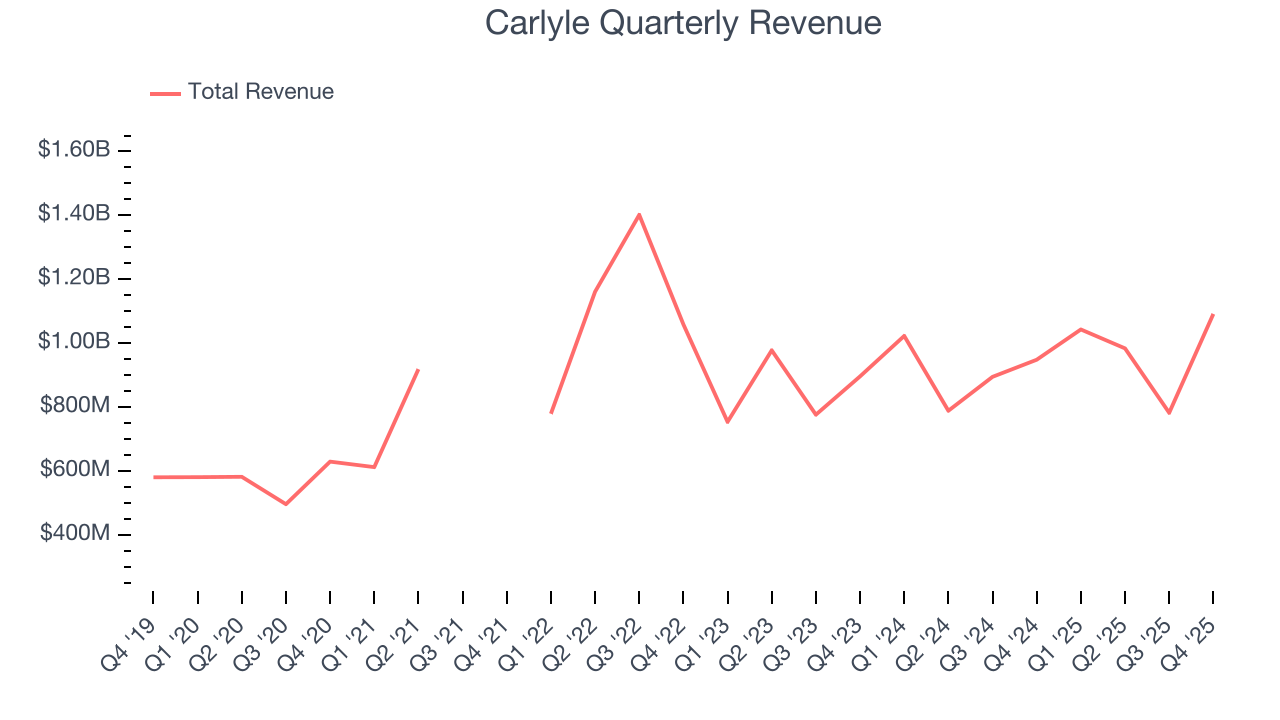

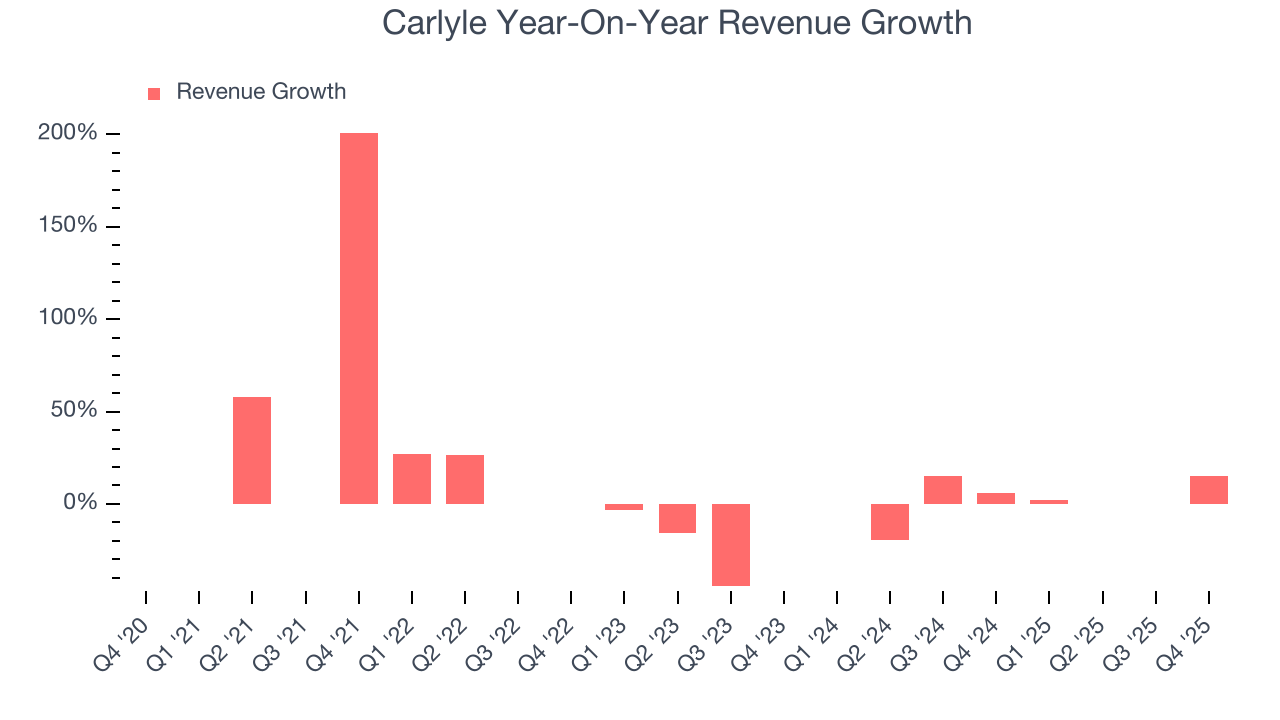

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Carlyle grew its revenue at a solid 11.2% compounded annual growth rate. Its growth surpassed the average financials company and shows its offerings resonate with customers, a great starting point for our analysis.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Carlyle’s recent performance shows its demand has slowed as its annualized revenue growth of 7% over the last two years was below its five-year trend.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Carlyle reported year-on-year revenue growth of 15.1%, and its $1.09 billion of revenue exceeded Wall Street’s estimates by 3.7%.

6. Assets Under Management (AUM)

Assets Under Management (AUM) represents the total value of investments that a financial institution manages for its clients. These assets generate steady income through management fees, creating predictable revenue streams that remain stable so long as clients remain invested with the firm.

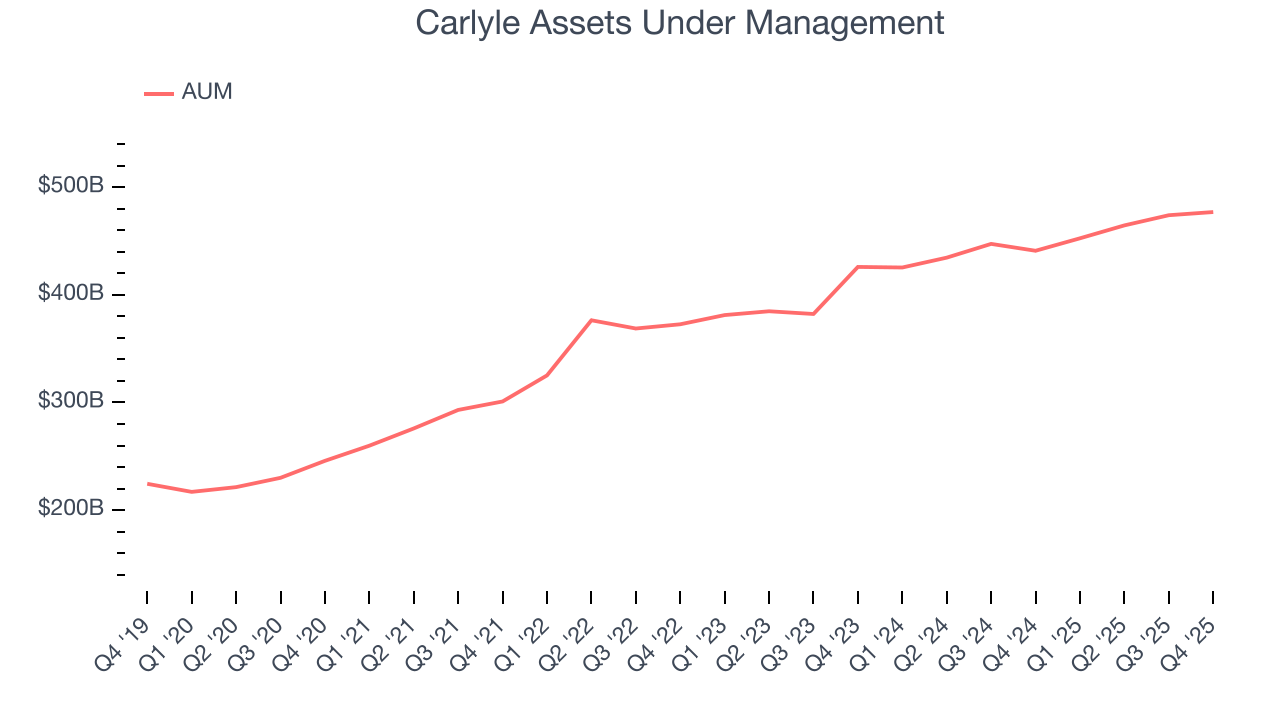

Carlyle’s AUM has grown at an annual rate of 15.4% over the last five years, better than the broader financials industry and faster than its total revenue. When analyzing Carlyle’s AUM over the last two years, we can see that growth decelerated to 8.9% annually. Fundraising or short-term investment performance were net contributors for the company over this shorter period since assets grew faster than total revenue. Just remember that while assets are relevant to watch, we don't place too much emphasis on them because they ebb and flow with the market.

Carlyle’s AUM punched in at $477 billion this quarter, meeting analysts’ expectations. This print was 8.2% higher than the same quarter last year.

7. Fee-Related Earnings

Topline performance tells part of the story, but sustainable profitability is the real measure of success. In the asset management space, fee-related earnings isolate the consistent profits from ongoing fee-based operations, filtering out the volatility of performance fees and investment income. This gives us a clear view of the company’s recurring earnings potential.

Carlyle’s annual fee-related earnings growth over the last five years was 18.9%, a solid result.

As you’ve seen throughout this report, we supplement with a two-year look because a five-year view may miss recent changes in the business. Over the last two years, Carlyle’s fee-related earnings grew at an annualized pace of 19.9%, an impressive result.

Carlyle’s fee-related earnings came in at $290 million this quarter, beating analysts’ expectations by 1.6%. These results represent 0.9% year-on-year growth.

8. Adjusted Net Earnings per Share (ANI per Share)

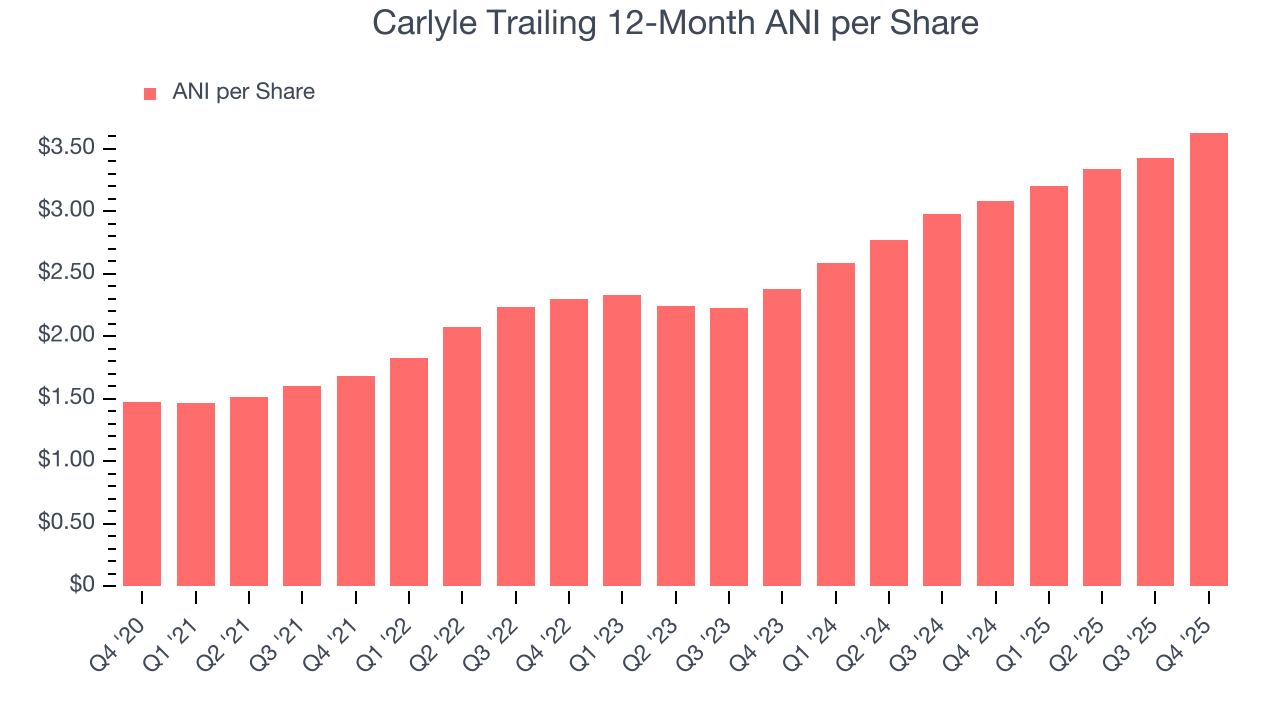

Asset management firms present their profitability through ANI per share, which translates to adjusted net income per share. It’s fundamentally identical to the adjusted EPS metrics investors see from other industries.

By excluding unrealized investment movements and non-recurring costs, ANI per share reveals the underlying profitability of the business. The per-share adjustment is crucial because it shows how earnings translate to individual shareholder ownership after accounting for share count changes.

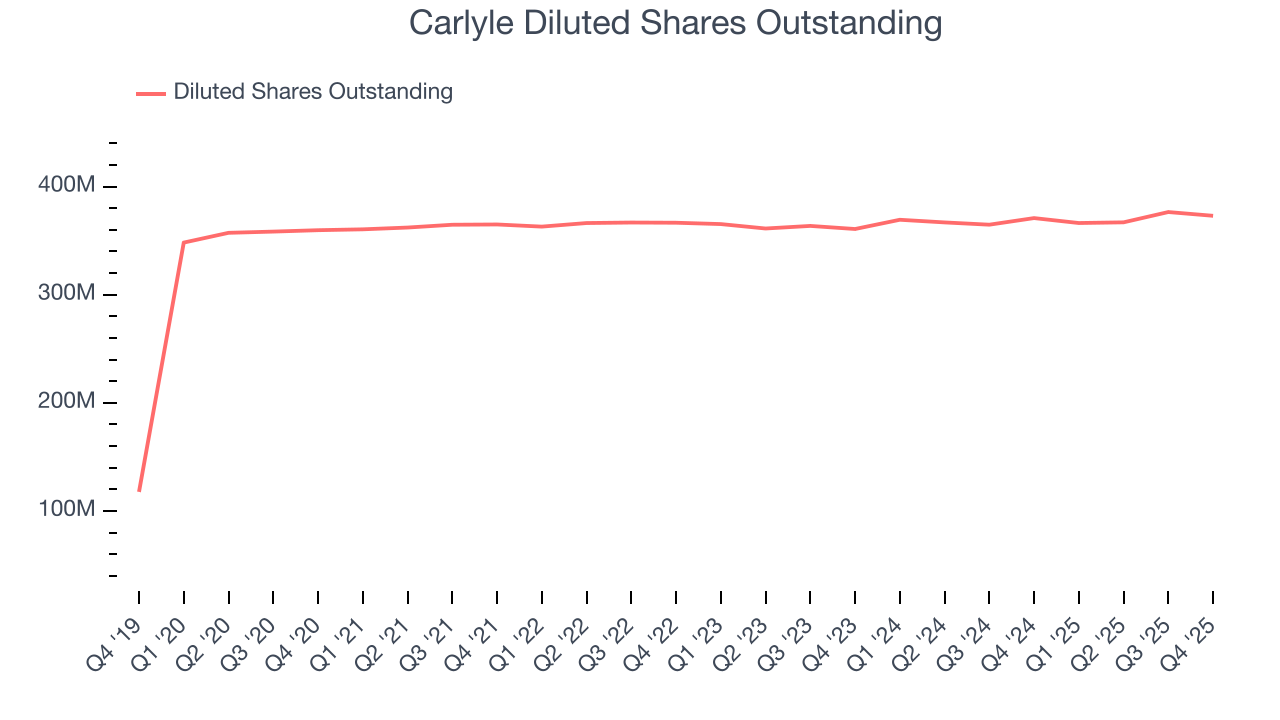

Carlyle’s 19.7% annualized ANI per share growth over the past five years was remarkable and outperformed its 18.9% annual fee-related earnings growth. This dynamic occured despite a general increase in its shares outstanding, meaning other non-core line items such as realized investment income and taxes offset the dilution.

On a two-year basis, Carlyle’s annualized ANI per share growth accelerated to 23.6%. This performance was great and better than its fee-related earnings over the same period. We note the company continued diluting shareholders during this timeframe, suppressing its ANI per share.

In Q4, Carlyle reported ANI per share of $1.01, up from $0.80 in the same quarter last year. This print beat analysts’ estimates by 1.7%.

9. A Word on Book Value and ROE

You may wonder when we will analyze book value and return on equity (ROE) since Carlyle is a financials company. We pay less attention to these metrics for asset managers because they are not great measures of business quality.

Asset managers are fee-based, capital light firms that manage client capital rather than their own, so they are not balance sheet businesses. Additionally, book value fails to capture the value of brands, investment track records, and other intangibles, thus understating intrinsic value, while ROE can look artificially high due to the relatively smaller bases of equity capital needed to operate the business compared to banks and insurers.

10. Balance Sheet Risk

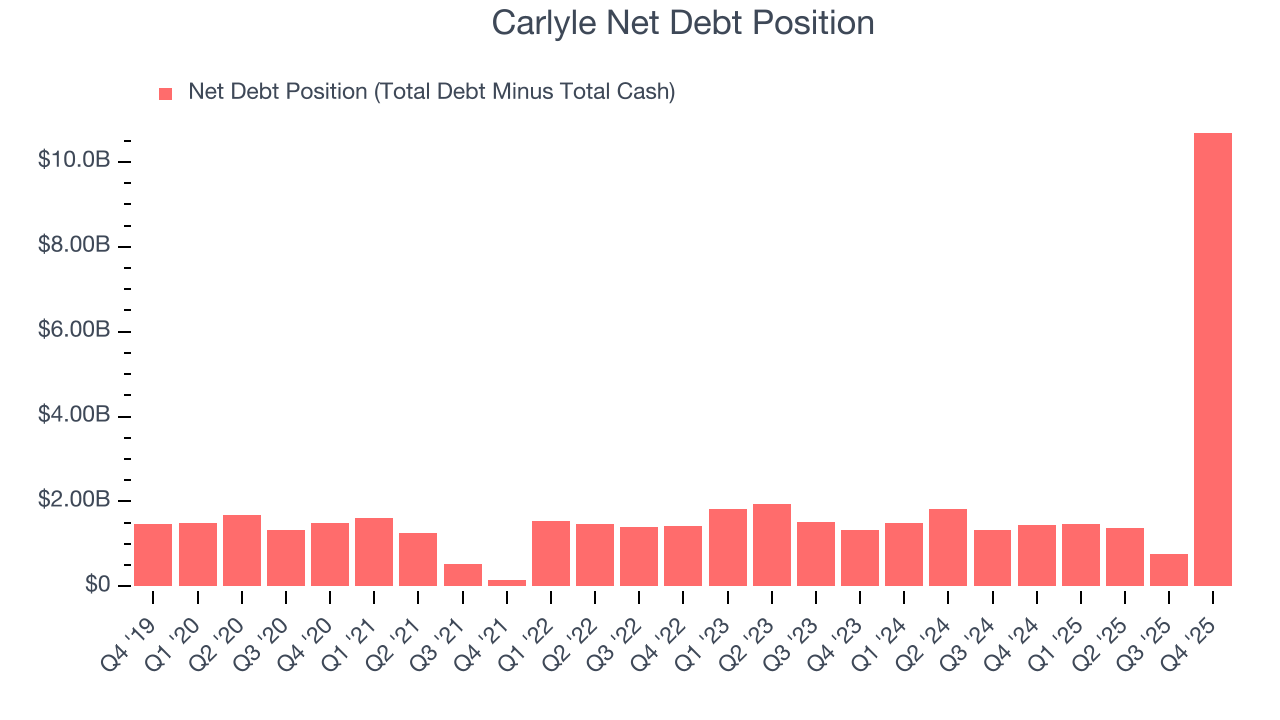

Carlyle reported $3.21 billion of cash and $13.89 billion of debt on its balance sheet in the most recent quarter.

As investors in high-quality companies, we primarily focus on whether a company’s profits can support its debt.

With $1.24 billion of fee-related earnings over the last 12 months, we view Carlyle’s 8.6× net-debt-to-earnings ratio as inadequate. The company’s lacking profits relative to its borrowings give it little breathing room, raising red flags.

11. Key Takeaways from Carlyle’s Q4 Results

It was encouraging to see Carlyle beat analysts’ revenue expectations this quarter. We were also happy its fee-related earnings outperformed Wall Street’s estimates. Overall, this print had some key positives. The stock traded up 1.5% to $56.25 immediately after reporting.

12. Is Now The Time To Buy Carlyle?

Are you wondering whether to buy Carlyle or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

Aside from its balance sheet, Carlyle is a pretty good company. For starters, its revenue growth was solid over the last five years and is expected to accelerate over the next 12 months. On top of that, its remarkable EPS growth over the last five years shows its profits are trickling down to shareholders, and its AUM growth was impressive over the last five years.

Carlyle’s P/E ratio based on the next 12 months is 11.8x. Certain aspects of its fundamentals are attractive, but we aren’t investing at the moment because its balance sheet makes us uneasy. If you’re interested in buying the stock, wait until its debt falls or its profits increase.

Wall Street analysts have a consensus one-year price target of $70 on the company (compared to the current share price of $56.25), implying they see 24.5% upside in buying Carlyle in the short term.