Clover Health (CLOV)

Clover Health piques our interest, but its cash burn shows it only has 21 months of runway left.― StockStory Analyst Team

1. News

2. Summary

Why Clover Health Is Not Exciting

Founded in 2014 to improve healthcare for America's seniors through technology, Clover Health (NASDAQ:CLOV) provides Medicare Advantage plans for seniors with a focus on affordable care and uses its proprietary Clover Assistant software to help physicians manage patient care.

- Poor expense management has led to adjusted operating margin losses

- Negative free cash flow raises questions about the return timeline for its investments

- Depletion of cash reserves could lead to a fundraising event that triggers shareholder dilution

Clover Health has some respectable qualities, but we’d refrain from investing until its EBITDA can comfortably service its debt.

Why There Are Better Opportunities Than Clover Health

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Clover Health

Clover Health’s stock price of $1.99 implies a valuation ratio of 25.9x forward P/E. This multiple is higher than that of healthcare peers; it’s also rich for the business quality. Not a great combination.

There are stocks out there similarly priced with better business quality. We prefer owning these.

3. Clover Health (CLOV) Research Report: Q3 CY2025 Update

Health insurance company Clover Health (NASDAQ:CLOV) reported revenue ahead of Wall Streets expectations in Q3 CY2025, with sales up 50.1% year on year to $496.7 million. Its GAAP loss of $0.05 per share was $0.02 below analysts’ consensus estimates.

Clover Health (CLOV) Q3 CY2025 Highlights:

- Revenue: $496.7 million vs analyst estimates of $471.1 million (50.1% year-on-year growth, 5.4% beat)

- EPS (GAAP): -$0.05 vs analyst estimates of -$0.03 ($0.02 miss)

- Adjusted EBITDA: $2.11 million vs analyst estimates of $10.83 million (0.4% margin, 80.5% miss)

- EBITDA guidance for the full year is $22.5 million at the midpoint, below analyst estimates of $52.9 million

- Operating Margin: -4.9%, down from -2.7% in the same quarter last year

- Free Cash Flow Margin: 2.3%, down from 15% in the same quarter last year

- Customers: 109,226, up from 106,323 in the previous quarter

- Market Capitalization: $1.8 billion

Company Overview

Founded in 2014 to improve healthcare for America's seniors through technology, Clover Health (NASDAQ:CLOV) provides Medicare Advantage plans for seniors with a focus on affordable care and uses its proprietary Clover Assistant software to help physicians manage patient care.

Clover Health operates primarily in the Medicare Advantage (MA) market, offering both Preferred Provider Organization (PPO) and Health Maintenance Organization (HMO) plans across five states and 200 counties. The company differentiates itself by providing low out-of-pocket costs for primary care and specialist visits, and often offers the same cost-sharing for both in-network and out-of-network primary care providers, giving members greater flexibility in their healthcare choices.

At the core of Clover's business model is its Clover Assistant platform, a cloud-based software tool that synthesizes millions of data points daily from various sources including claims, medical charts, medication data, and diagnostic information. This technology uses machine learning and clinical rules to generate personalized insights for healthcare providers at the point of care. For example, a physician seeing a diabetic patient might receive alerts about missed screenings, medication adherence issues, or potential complications based on the patient's comprehensive health history.

The company also operates Clover Home Care, an in-home primary care program targeting medically complex patients with multiple chronic conditions. This program allows physicians to deliver care directly in patients' homes, using the Clover Assistant to access patient data and receive clinical recommendations during these visits.

Clover Health generates revenue primarily through capitated payments from the Centers for Medicare & Medicaid Services (CMS) for each Medicare Advantage member enrolled in its plans. The company aims to manage healthcare costs by empowering providers with data-driven insights that can lead to earlier disease detection and more effective chronic condition management.

The company has made serving underserved markets a priority, focusing on Medicare beneficiaries who identify as people of color, those with multiple chronic conditions, and those living in areas of socioeconomic deprivation.

4. Health Insurance Providers

Upfront premiums collected by health insurers lead to reliable revenue, but profitability ultimately depends on accurate risk assessments and the ability to control medical costs. Health insurers are also highly sensitive to regulatory changes and economic conditions such as unemployment. Going forward, the industry faces tailwinds from an aging population, increasing demand for personalized healthcare services, and advancements in data analytics to improve cost management. However, continued regulatory scrutiny on pricing practices, the potential for government-led reforms such as expanded public healthcare options, and inflation in medical costs could add volatility to margins. One big debate among investors is the long-term impact of AI and whether it will help underwriting, fraud detection, and claims processing or whether it may wade into ethical grey areas like reinforcing biases and widening disparities in medical care.

Clover Health competes with large national insurers like UnitedHealth, Aetna, Humana, Cigna, Centene, and Elevance Health, as well as regional players such as Blue Cross Blue Shield affiliates. It also faces competition from newer tech-focused Medicare Advantage providers like Alignment Health, Devoted Health, and Oscar Health, as well as provider-sponsored plans.

5. Revenue Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $1.77 billion in revenue over the past 12 months, Clover Health is a small company in an industry where scale matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive.

6. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, Clover Health’s 23.3% annualized revenue growth over the last five years was excellent. Its growth beat the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Clover Health’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 2% over the last two years.

Clover Health also reports its number of customers, which reached 109,226 in the latest quarter. Over the last two years, Clover Health’s customer base averaged 10.3% year-on-year growth. Because this number is better than its revenue growth, we can see the average customer spent less money each year on the company’s products and services.

This quarter, Clover Health reported magnificent year-on-year revenue growth of 50.1%, and its $496.7 million of revenue beat Wall Street’s estimates by 5.4%.

Looking ahead, sell-side analysts expect revenue to grow 31.9% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and indicates its newer products and services will catalyze better top-line performance.

7. Operating Margin

Clover Health’s high expenses have contributed to an average operating margin of negative 14.8% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Clover Health’s operating margin rose by 39.7 percentage points over the last five years, as its sales growth gave it operating leverage. Zooming in on its more recent performance, we can see the company’s trajectory is intact as its margin has also increased by 10.3 percentage points on a two-year basis. These data points are very encouraging and show momentum is on its side.

Clover Health’s operating margin was negative 4.9% this quarter.

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Although Clover Health’s full-year earnings are still negative, it reduced its losses and improved its EPS by 21.4% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability. We hope to see an inflection point soon.

In Q3, Clover Health reported EPS of negative $0.05, down from negative $0.02 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Clover Health’s full-year EPS of negative $0.12 will reach break even.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

While Clover Health posted positive free cash flow this quarter, the broader story hasn’t been so clean. Clover Health’s demanding reinvestments have consumed many resources over the last five years, contributing to an average free cash flow margin of negative 6.9%. This means it lit $6.91 of cash on fire for every $100 in revenue.

Taking a step back, an encouraging sign is that Clover Health’s margin expanded by 16.9 percentage points during that time. The company’s improvement and free cash flow generation this quarter show it’s heading in the right direction, and continued increases could help it achieve long-term cash profitability.

Clover Health’s free cash flow clocked in at $11.41 million in Q3, equivalent to a 2.3% margin. The company’s cash profitability regressed as it was 12.7 percentage points lower than in the same quarter last year, but it’s still above its five-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends are more important.

10. Balance Sheet Assessment

Companies with more cash than debt have lower bankruptcy risk.

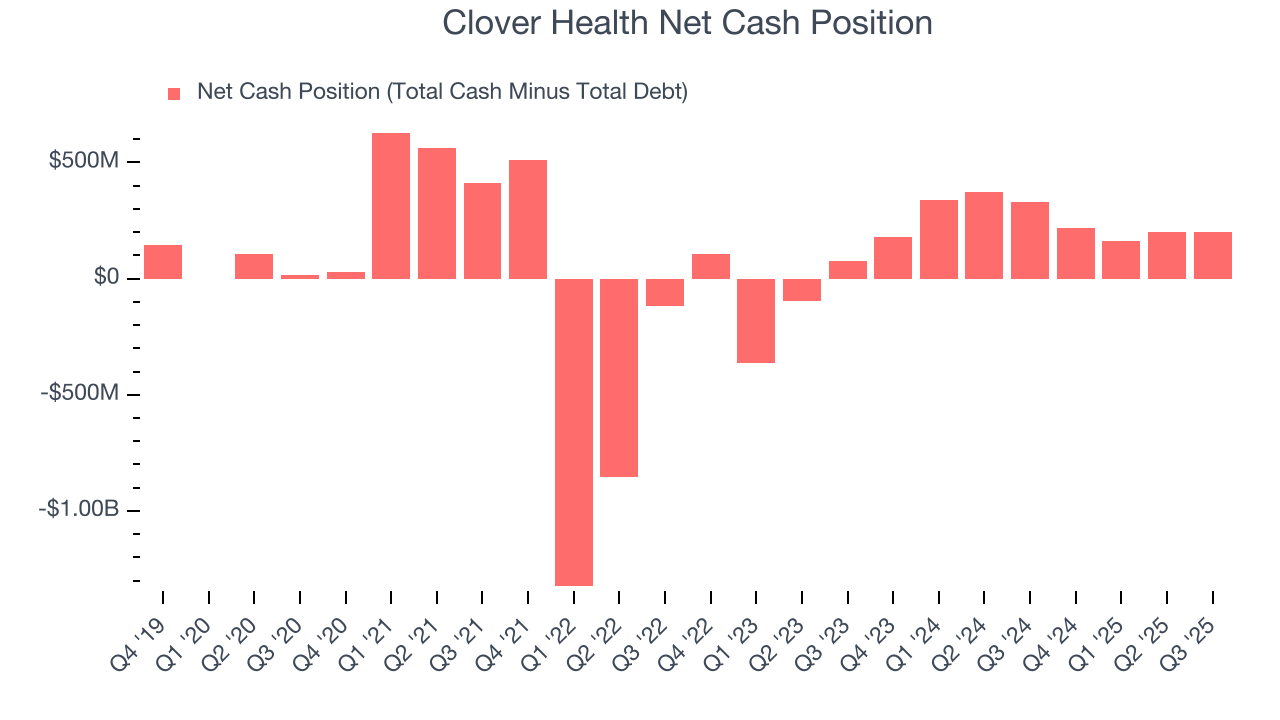

Clover Health is a well-capitalized company with $201 million of cash and no debt. This position is 11.1% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from Clover Health’s Q3 Results

We were impressed by how significantly Clover Health blew past analysts’ revenue expectations this quarter. We were also glad its customer base outperformed Wall Street’s estimates. On the other hand, its full-year EBITDA guidance missed and its EPS was in line with Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 17.5% to $2.90 immediately after reporting.

12. Is Now The Time To Buy Clover Health?

Updated: February 25, 2026 at 11:46 PM EST

When considering an investment in Clover Health, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

Clover Health is a fine business. First off, its revenue growth was impressive over the last five years and is expected to accelerate over the next 12 months. And while its operating margins reveal poor profitability compared to other healthcare companies, its customer growth has been marvelous. On top of that, its rising cash profitability gives it more optionality.

Clover Health’s P/E ratio based on the next 12 months is 28.7x. This valuation tells us that a lot of optimism is priced in. This is a good one to add to your watchlist - there are better opportunities elsewhere at the moment.

Wall Street analysts have a consensus one-year price target of $3.23 on the company (compared to the current share price of $2.11).