Comcast (CMCSA)

Comcast faces an uphill battle. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think Comcast Will Underperform

Formerly known as American Cable Systems, Comcast (NASDAQ:CMCSA) is a multinational telecommunications company offering a wide range of services.

- Scale is a double-edged sword because it limits the company’s growth potential compared to its smaller competitors, as reflected in its below-average annual revenue increases of 3.6% for the last five years

- Earnings growth underperformed the sector average over the last five years as its EPS grew by just 10.5% annually

- Projected sales decline of 1.5% for the next 12 months points to an even tougher demand environment ahead

Comcast’s quality is inadequate. More profitable opportunities exist elsewhere.

Why There Are Better Opportunities Than Comcast

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Comcast

At $31.70 per share, Comcast trades at 8.6x forward P/E. This sure is a cheap multiple, but you get what you pay for.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Comcast (CMCSA) Research Report: Q4 CY2025 Update

Telecommunications and media company Comcast (NASDAQ:CMCSA) met Wall Streets revenue expectations in Q4 CY2025, with sales up 1.2% year on year to $32.31 billion. Its non-GAAP profit of $0.84 per share was 10.8% above analysts’ consensus estimates.

Comcast (CMCSA) Q4 CY2025 Highlights:

- Revenue: $32.31 billion vs analyst estimates of $32.35 billion (1.2% year-on-year growth, in line)

- Adjusted EPS: $0.84 vs analyst estimates of $0.76 (10.8% beat)

- Adjusted EBITDA: $7.9 billion vs analyst estimates of $7.95 billion (24.5% margin, 0.6% miss)

- Operating Margin: 10.8%, down from 15.6% in the same quarter last year

- Free Cash Flow Margin: 13.5%, up from 10.2% in the same quarter last year

- Domestic Broadband Customers: 31.26 million, down 587,000 year on year (in line)

- Market Capitalization: $103.5 billion

Company Overview

Formerly known as American Cable Systems, Comcast (NASDAQ:CMCSA) is a multinational telecommunications company offering a wide range of services.

Founded in 1963, Comcast emerged to provide comprehensive telecommunications services. The company's inception was driven by a vision to bridge the gap in the market for reliable cable television and high-speed internet services. Comcast recognized the growing demand for advanced communication and entertainment options, setting out to offer solutions that catered to customers' evolving needs and preferences.

The company addresses the challenge of delivering connectivity and entertainment experiences to residential and business customers. Comcast's portfolio of services includes cable television, high-speed internet, digital phone, and home security solutions.

Comcast generates revenue through subscription-based services, advertising sales, and content licensing agreements. The company's business model is founded on technological innovation, customer-centricity, and strategic partnerships, creating value for its stakeholders. Comcast's unique appeal lies in its ability to provide a comprehensive suite of services, ensuring convenience and quality for its broad customer base.

4. Wireless, Cable and Satellite

The massive physical footprints of cell phone towers, fiber in the ground, or satellites in space make it challenging for companies in this industry to adjust to shifting consumer habits. Over the last decade-plus, consumers have ‘cut the cord’ to their landlines and traditional cable subscriptions in favor of wireless communications and streaming video. These trends do mean that more households need cell phone plans and high-speed internet. Companies that successfully serve customers can enjoy high retention rates and pricing power since the options for mobile and internet connectivity in any geography are usually limited.

Competitors in the telecommunications and media services industry include Charter Communications (NASDAQ:CHTR), Altice USA (NYSE:ATUS), Dish Network (NASDAQ:DISH).

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Regrettably, Comcast’s sales grew at a weak 3.6% compounded annual growth rate over the last five years. This was below our standard for the consumer discretionary sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Comcast’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

We can better understand the company’s revenue dynamics by analyzing its number of domestic broadband customers and domestic video customers, which clocked in at 31.26 million and 11.27 million in the latest quarter. Over the last two years, Comcast’s domestic broadband customers averaged 1.3% year-on-year declines while its domestic video customers averaged 11.1% year-on-year declines.

This quarter, Comcast grew its revenue by 1.2% year on year, and its $32.31 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. This projection doesn't excite us and implies its newer products and services will not accelerate its top-line performance yet.

6. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Comcast’s operating margin has shrunk over the last 12 months and averaged 17.8% over the last two years. The company’s profitability was mediocre for a consumer discretionary business and shows it couldn’t pass its higher operating expenses onto its customers.

In Q4, Comcast generated an operating margin profit margin of 10.8%, down 4.8 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

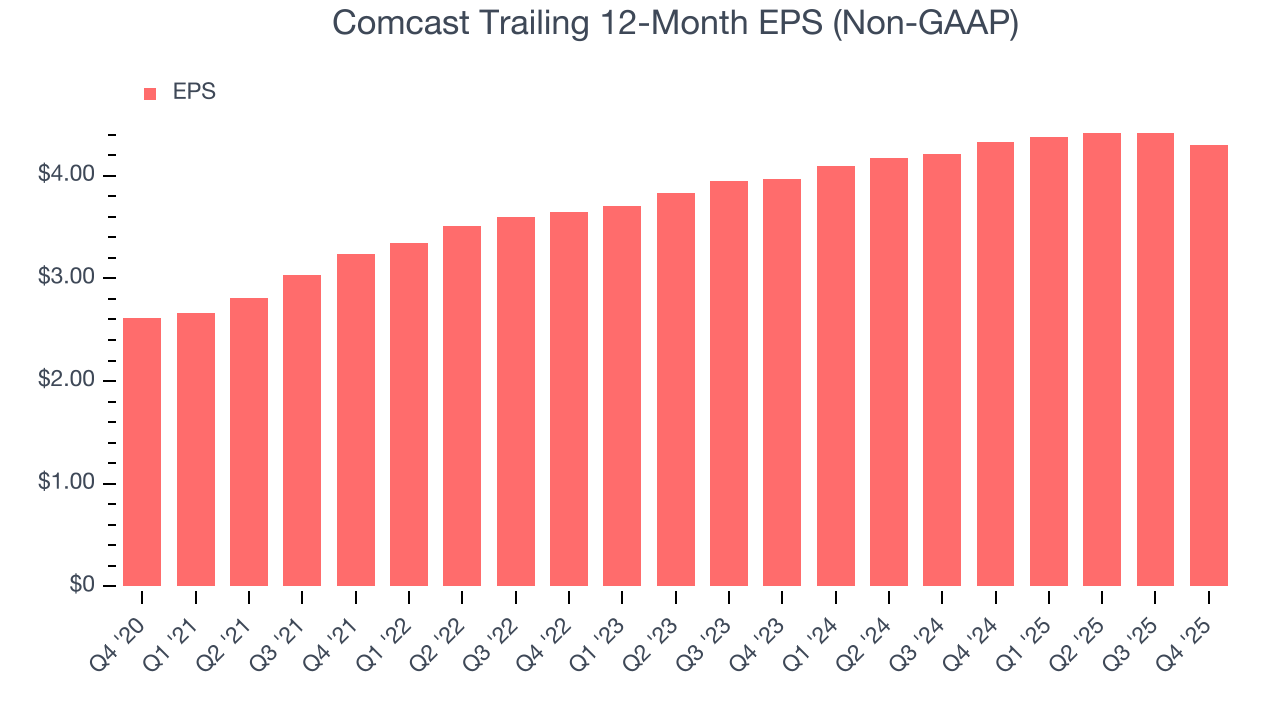

Comcast’s EPS grew at a weak 10.5% compounded annual growth rate over the last five years. This performance was better than its flat revenue but doesn’t tell us much about its business quality because its operating margin didn’t improve.

In Q4, Comcast reported adjusted EPS of $0.84, down from $0.96 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Comcast’s full-year EPS of $4.30 to shrink by 9.3%.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Comcast has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 12.8%, lousy for a consumer discretionary business.

Comcast’s free cash flow clocked in at $4.37 billion in Q4, equivalent to a 13.5% margin. This result was good as its margin was 3.3 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends carry greater meaning.

Over the next year, analysts predict Comcast’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 15.5% for the last 12 months will decrease to 10.1%.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Comcast historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 8.8%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, Comcast’s ROIC increased by 2.9 percentage points annually over the last few years. This is a good sign, and we hope the company can continue improving.

10. Balance Sheet Assessment

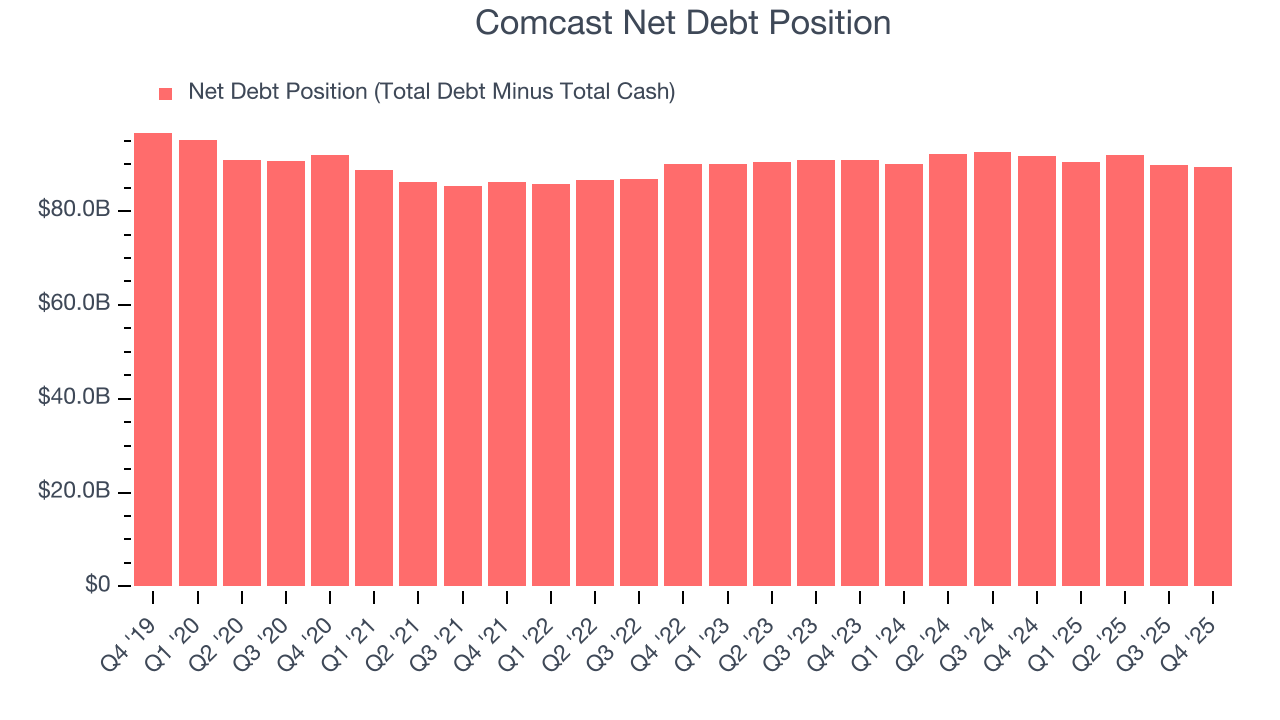

Comcast reported $9.48 billion of cash and $98.94 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $37.38 billion of EBITDA over the last 12 months, we view Comcast’s 2.4× net-debt-to-EBITDA ratio as safe. We also see its $2.16 billion of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Comcast’s Q4 Results

Domestic broadband customers was just in line, same with revenue. Adjusted EBITDA missed, but EPS managed to beat. Overall, this print was mixed. The stock remained flat at $28.39 immediately after reporting.

12. Is Now The Time To Buy Comcast?

Updated: March 8, 2026 at 11:06 PM EDT

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Comcast, you should also grasp the company’s longer-term business quality and valuation.

Comcast doesn’t pass our quality test. On top of that, Comcast’s number of domestic broadband customers has disappointed, and its Forecasted free cash flow margin suggests the company will ramp up its investments next year.

Comcast’s P/E ratio based on the next 12 months is 8.6x. While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $33.01 on the company (compared to the current share price of $31.70).