Coinbase (COIN)

Coinbase piques our interest. Its marriage of growth and profitability makes it a strong business with attractive upside.― StockStory Analyst Team

1. News

2. Summary

Why Coinbase Is Interesting

Widely regarded as the face of crypto, Coinbase (NASDAQ:COIN) is a blockchain infrastructure company updating the financial system with its trading, staking, stablecoin, and other payment solutions.

- Platform is difficult to replicate at scale and results in a best-in-class gross margin of 85.9%

- Excellent EBITDA margin highlights the strength of its business model, and its rise over the last few years was fueled by some leverage on its fixed costs

- A drawback is its estimated sales growth of 3.2% for the next 12 months implies demand will slow from its three-year trend

Coinbase shows some promise. This is a good stock to keep your eye on.

Why Should You Watch Coinbase

Why Should You Watch Coinbase

At $216.23 per share, Coinbase trades at 17.9x forward EV/EBITDA. This multiple is higher than most consumer internet companies.

Coinbase can improve its fundamentals over time by putting up good numbers quarter after quarter, year after year. Once that happens, we’ll be happy to recommend the stock.

3. Coinbase (COIN) Research Report: Q3 CY2025 Update

Blockchain infrastructure company Coinbase (NASDAQ:COIN) reported revenue ahead of Wall Streets expectations in Q3 CY2025, with sales up 55.1% year on year to $1.87 billion. Its non-GAAP profit of $1.44 per share was 23.2% above analysts’ consensus estimates.

Coinbase (COIN) Q3 CY2025 Highlights:

- Revenue: $1.87 billion vs analyst estimates of $1.78 billion (55.1% year-on-year growth, 4.9% beat)

- Adjusted EPS: $1.44 vs analyst estimates of $1.17 (23.2% beat)

- Adjusted EBITDA: $801 million vs analyst estimates of $716.4 million (42.9% margin, 11.8% beat)

- Operating Margin: 25.7%, up from 14.1% in the same quarter last year

- Free Cash Flow was -$784.5 million, down from $328.5 million in the previous quarter

- Market Capitalization: $89.57 billion

Company Overview

Widely regarded as the face of crypto, Coinbase (NASDAQ:COIN) is a blockchain infrastructure company updating the financial system with its trading, staking, stablecoin, and other payment solutions.

What exactly is the blockchain? Simply put, it’s a technology that makes payments faster, cheaper, and safer while making money independent of governments, central banks, and large financial institutions. Due to its benefits over legacy payment rails, this infrastructure fundamentally improves traditional finance, just like how the internet changed paper-based news and information sharing.

The main player supplying the picks and shovels for this nascent industry is Coinbase, which was founded in 2012 to inject sound financial infrastructure into underdeveloped and corrupt countries.

In its early days, Coinbase primarily acted as a cryptocurrency exchange, facilitating trades and taking a cut of each transaction. The exchange is still its largest source of revenue, but it reinvented itself in 2017/2018 when a protocol named Ethereum surfaced the concept of “smart contracts”, or self-executing programs that automate cryptocurrency creation, distribution, and governance.

Ethereum was pivotal as it enabled much more than speculative trading. For example, USDC, one of Coinbase’s most popular products, is a stablecoin built on Ethereum that tracks the value of the U.S. dollar by backing each newly minted token with U.S. Treasury Bills. It’s revolutionary because it enables faster transfer speeds (instant vs 3 days for banks), cheaper fees (less than one cent), and higher security thanks to the blockchain’s distributed computing system.

Other notable Coinbase products include Prime (institutional trading platform), Digital Wallet (think PayPal for crypto), Developer Platform (helps businesses integrate crypto payments), the Base protocol (makes Ethereum more efficient), and staking services (validates blockchain transactions on behalf of users to generate gas fees). These offerings combined with Coinbase Ventures, its investment arm, amplify the company’s influence over the industry and diversify its business from the violent cyclicality in crypto markets.

4. Financial Technology

Financial technology companies benefit from the increasing consumer demand for digital payments, banking, and finance. Tailwinds fueling this trend include e-commerce along with improvements in blockchain infrastructure and AI-driven credit underwriting, which make access to money faster and cheaper. Despite regulatory scrutiny and resistance from traditional financial institutions, fintechs are poised for long-term growth as they disrupt legacy systems by expanding financial services to underserved population segments.

Coinbase’s competitors include Robinhood (NASDAQ:HOOD) and private companies like Binance, Kraken, Gemini, and Crypto.com.

5. Revenue Growth

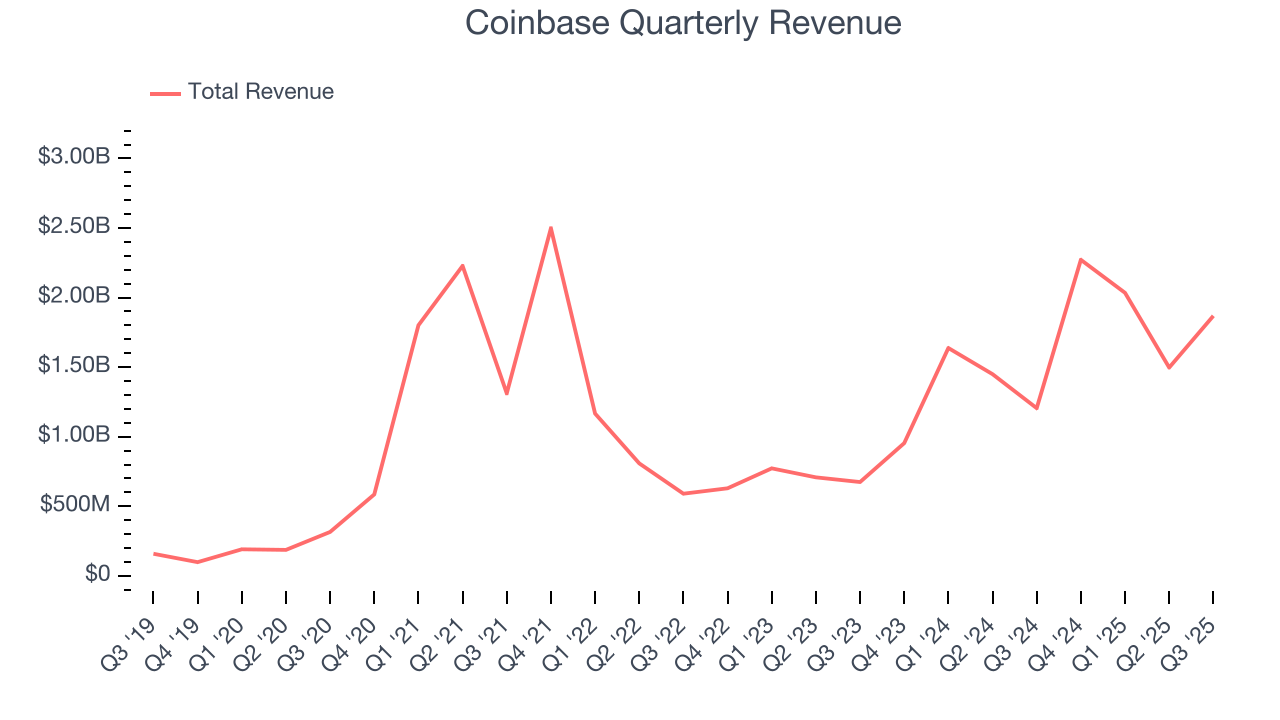

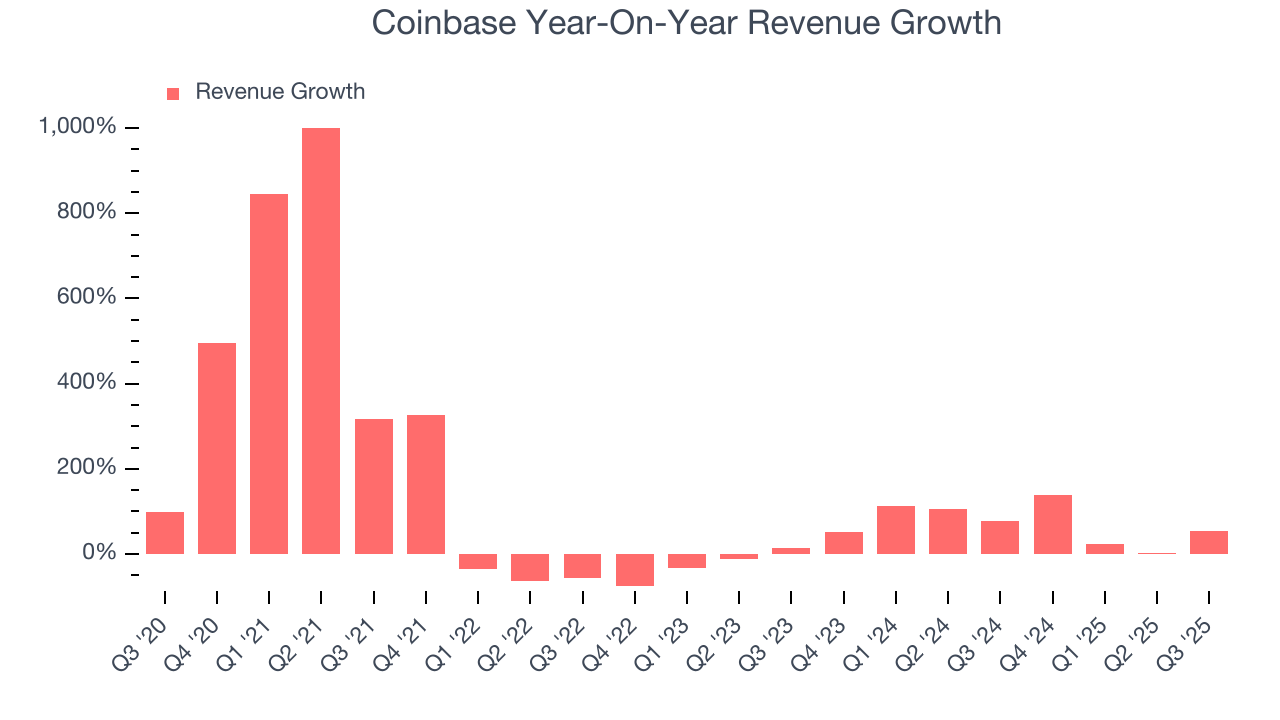

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Coinbase’s 57.5% annualized revenue growth over the last five years was incredible. Its growth surpassed the average consumer internet company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within consumer internet, a half-decade historical view may miss new innovations or demand cycles. Coinbase’s annualized revenue growth of 66% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Coinbase reported magnificent year-on-year revenue growth of 55.1%, and its $1.87 billion of revenue beat Wall Street’s estimates by 4.9%.

Looking ahead, sell-side analysts expect revenue to grow 4.5% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and implies its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

6. Monthly Transacting Users

User Growth

As a fintech company, Coinbase generates revenue growth by increasing both the number of users on its platform and the number of transactions they execute.

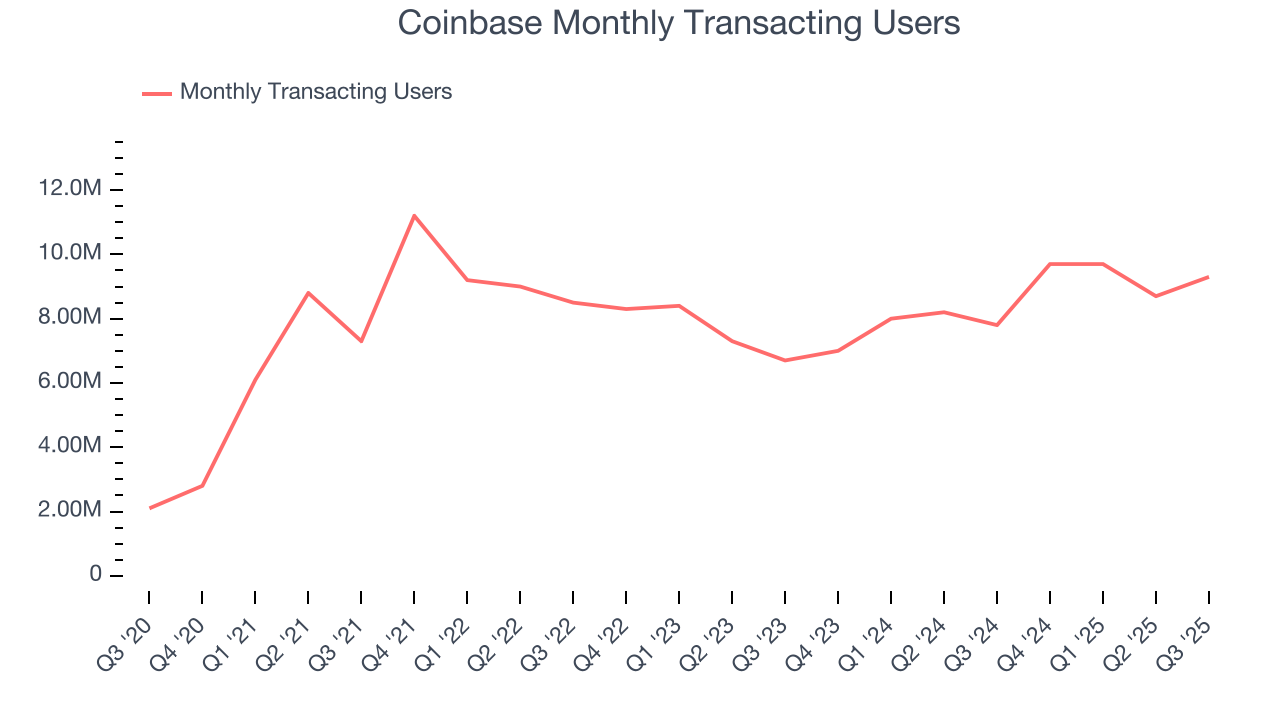

Over the last two years, Coinbase’s monthly transacting users, a key performance metric for the company, increased by 11.7% annually to 9.3 million in the latest quarter. This growth rate is strong for a consumer internet business and indicates people love using its offerings.

In Q3, Coinbase added 1.5 million monthly transacting users, leading to 19.2% year-on-year growth. The quarterly print was higher than its two-year result, suggesting its new initiatives are accelerating user growth.

Revenue Per User

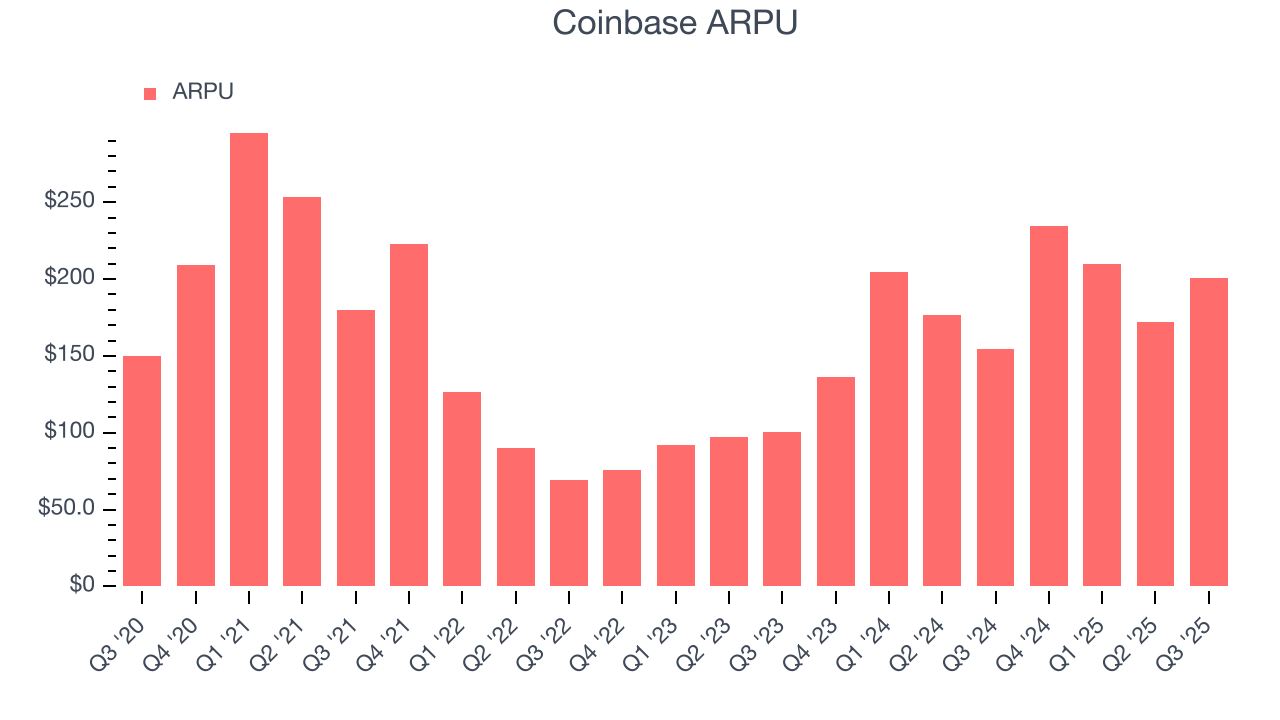

Average revenue per user (ARPU) is a critical metric to track because it measures how much the company earns in fees from each user. ARPU also gives us unique insights into the average transaction size on Coinbase’s platform and the company’s take rate, or "cut", on each transaction.

Coinbase’s ARPU growth has been exceptional over the last two years, averaging 55%. Its ability to increase monetization while growing its monthly transacting users at an impressive rate reflects the strength of its platform, as its users are spending significantly more than last year.

This quarter, Coinbase’s ARPU clocked in at $200.93. It grew by 30% year on year, faster than its monthly transacting users.

7. Gross Margin & Pricing Power

A company’s gross profit margin has a significant impact on its ability to exert pricing power, develop new products, and invest in marketing. These factors can determine the winner in a competitive market.

For fintech businesses like Coinbase, gross profit tells us how much money the company gets to keep after covering the base cost of its products and services, which typically include transaction/payment processing, hosting, and bandwidth fees in addition to the costs necessary to onboard customers, such as identity verification.

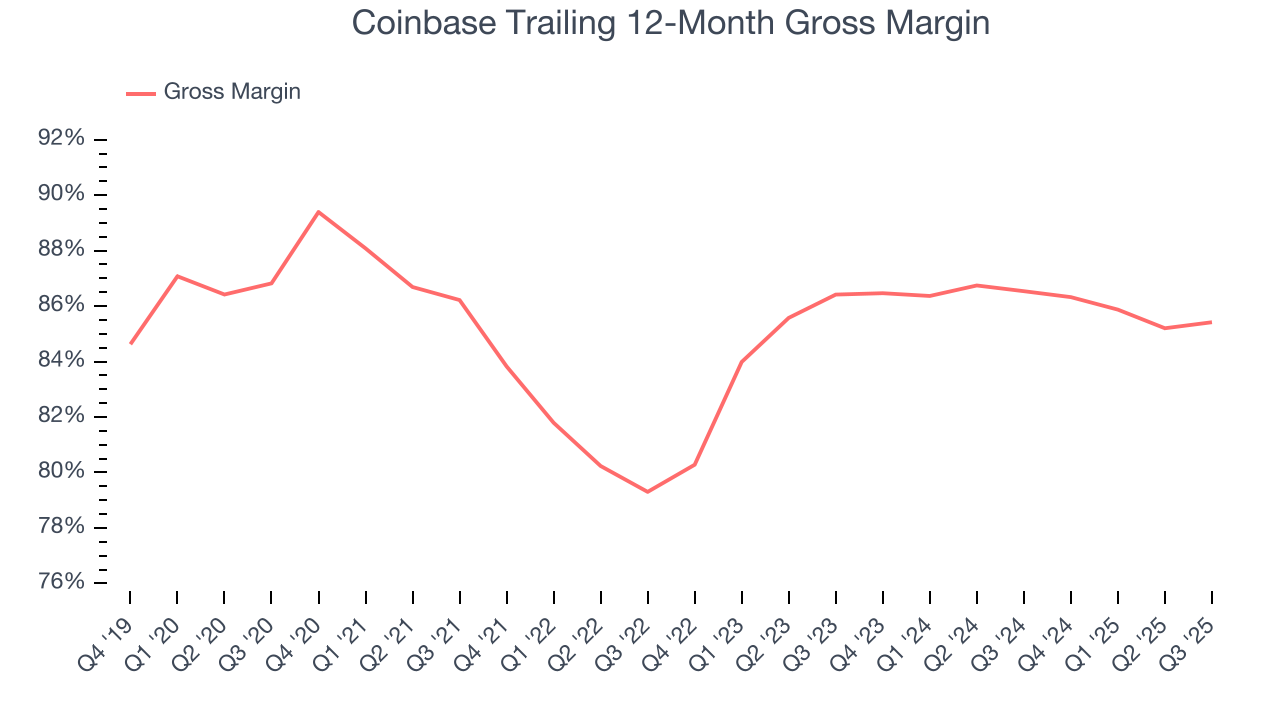

Coinbase’s gross margin is one of the best in the consumer internet sector, an output of its asset-lite business model and strong pricing power. It also enables the company to fund large investments in new products and marketing during periods of rapid growth to achieve higher profits in the future. As you can see below, it averaged an elite 85.9% gross margin over the last two years. That means Coinbase only paid its providers $14.13 for every $100 in revenue.

In Q3, Coinbase produced a 86.4% gross profit margin, in line with the same quarter last year. On a wider time horizon, Coinbase’s full-year margin has been trending down over the past 12 months, decreasing by 1.1 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs.

8. User Acquisition Efficiency

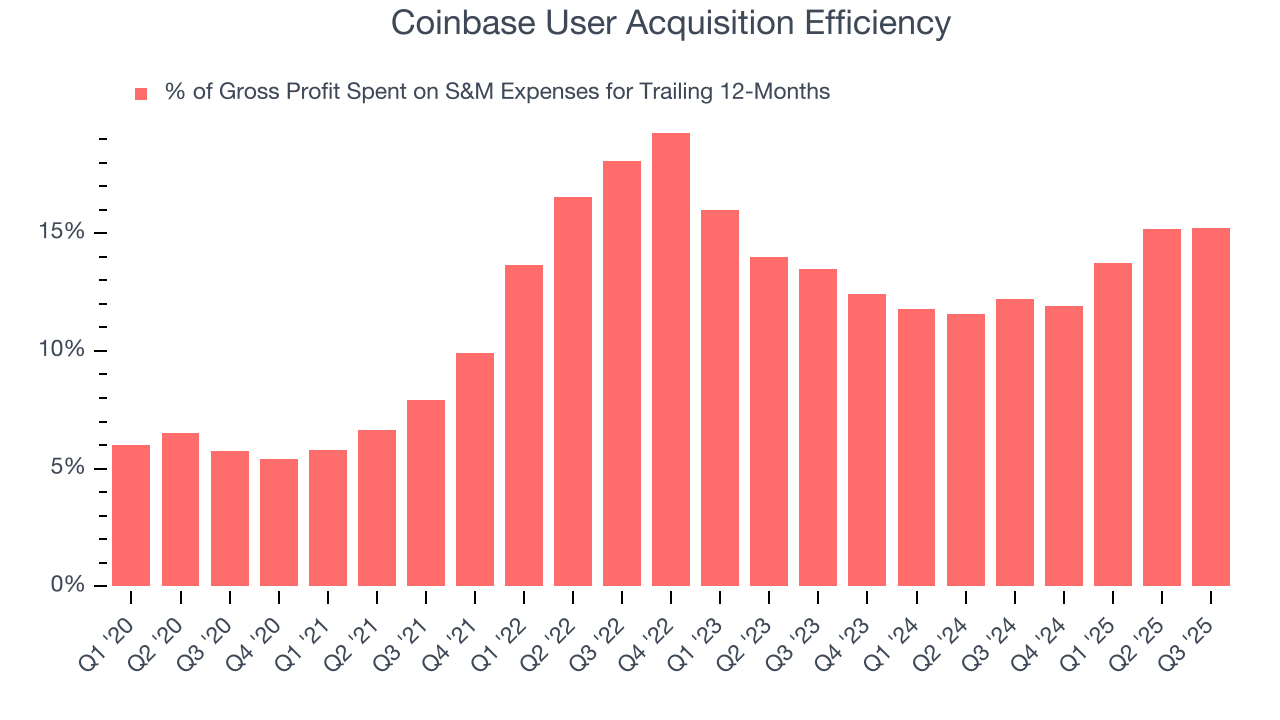

Unlike enterprise software that’s typically sold by dedicated sales teams, consumer internet businesses like Coinbase grow from a combination of product virality, paid advertisement, and incentives.

Coinbase is extremely efficient at acquiring new users, spending only 15.2% of its gross profit on sales and marketing expenses over the last year. This efficiency indicates that it has a highly differentiated product offering and strong brand reputation, giving Coinbase the freedom to invest its resources into new growth initiatives while maintaining optionality.

9. EBITDA

Operating income is often evaluated to assess a company’s underlying profitability. In a similar vein, EBITDA is used to analyze consumer internet companies because it excludes various one-time or non-cash expenses (depreciation), providing a clearer view of the business’s profit potential.

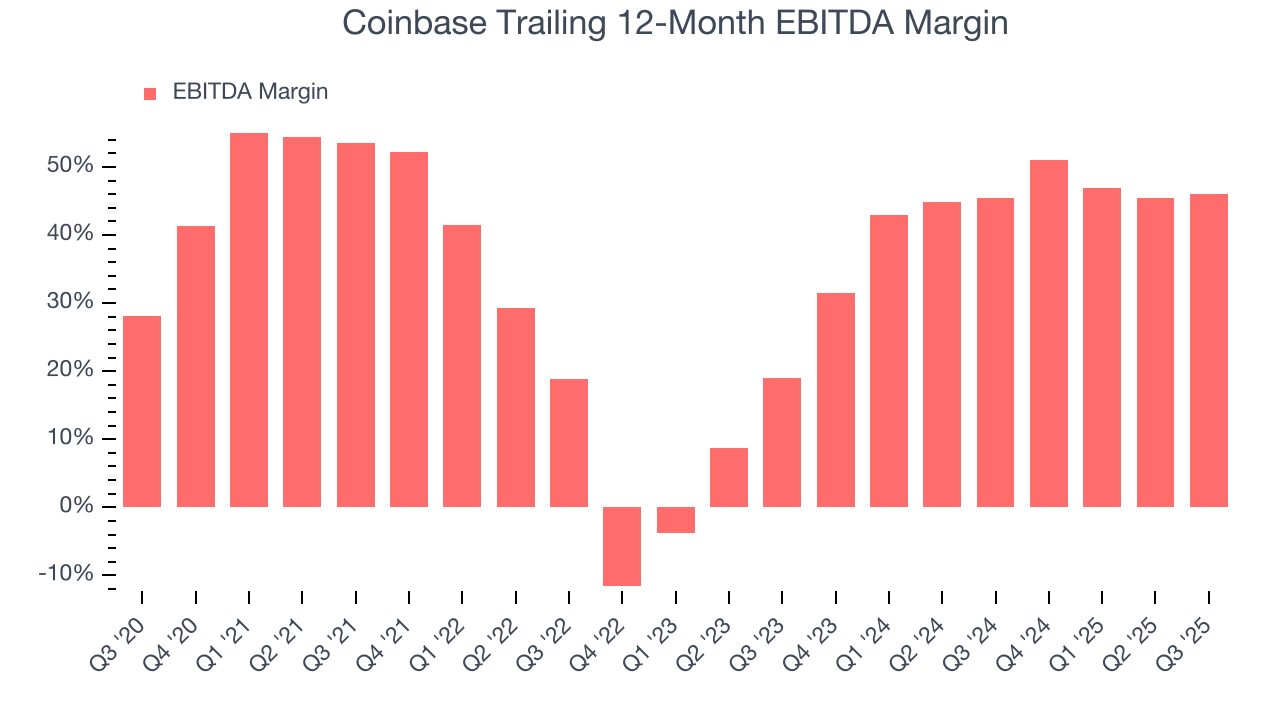

Coinbase has been a well-oiled machine over the last two years. It demonstrated elite profitability for a consumer internet business, boasting an average EBITDA margin of 45.8%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Coinbase’s EBITDA margin decreased by 7.5 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q3, Coinbase generated an EBITDA margin profit margin of 42.9%, up 5.6 percentage points year on year. The increase was solid, and because its EBITDA margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

10. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

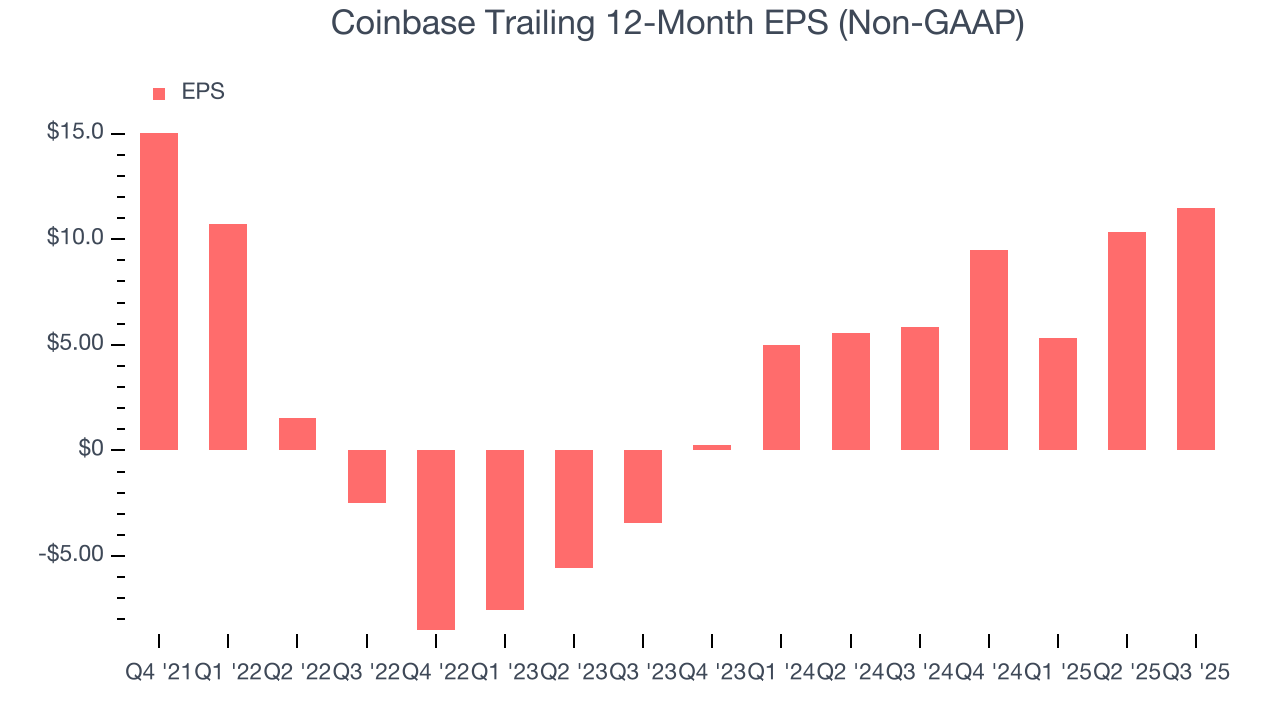

Coinbase’s full-year EPS dropped 60.6%, or 12.6% annually, over the last four years. We’ll keep a close eye on the company as diminishing earnings could imply changing secular trends and preferences.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Coinbase, its two-year annual EPS growth of 131% was higher than its four-year trend. This acceleration made it one of the faster-growing consumer internet companies in recent history.

In Q3, Coinbase reported adjusted EPS of $1.44, up from $0.28 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Coinbase’s full-year EPS of $11.50 to shrink by 39.9%.

11. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

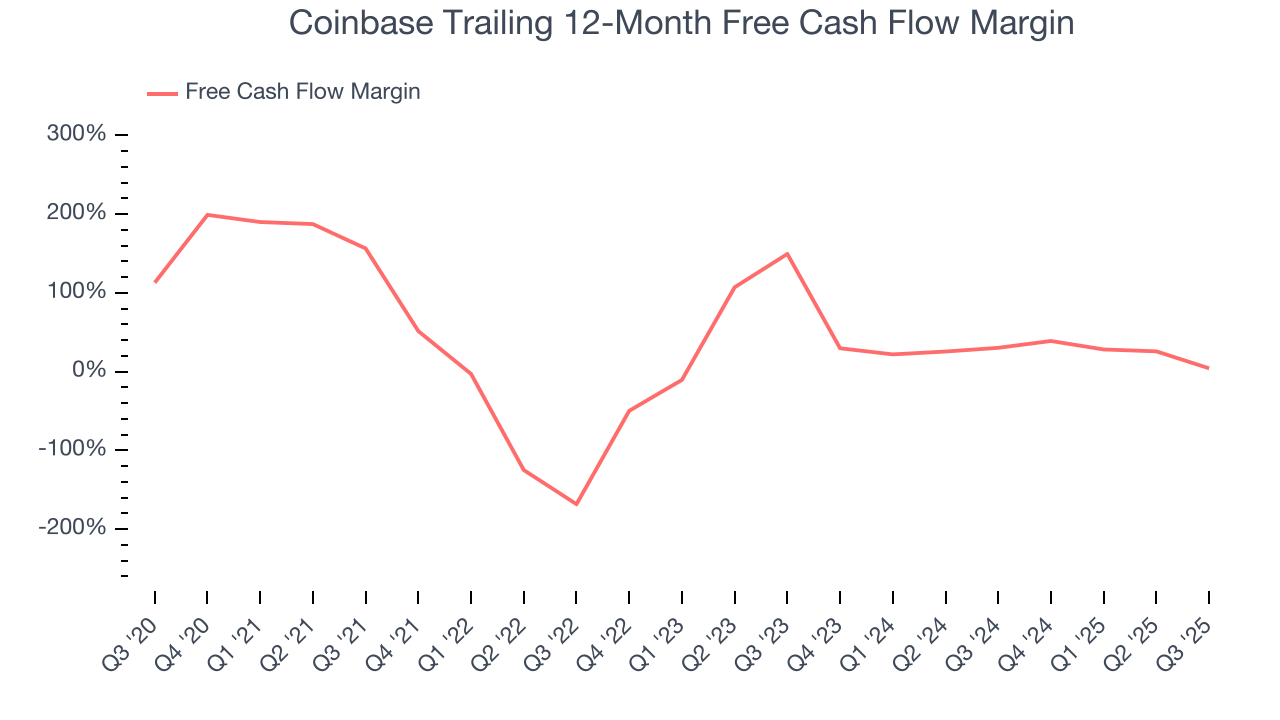

Coinbase has shown robust cash profitability, driven by its attractive business model and cost-effective customer acquisition strategy that enable it to invest in new products and services rather than sales and marketing. The company’s free cash flow margin averaged 14.8% over the last two years, quite impressive for a consumer internet business.

Taking a step back, we can see that Coinbase’s margin dropped meaningfully over the last five years. If its declines continue, it could signal increasing investment needs and capital intensity.

Coinbase burned through $784.5 million of cash in Q3, equivalent to a negative 42% margin. The company’s cash flow turned negative after being positive in the same quarter last year, which isn’t ideal considering its longer-term trend.

12. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

Coinbase is a profitable, well-capitalized company with $8.68 billion of cash and $7.20 billion of debt on its balance sheet. This $1.47 billion net cash position gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

13. Key Takeaways from Coinbase’s Q3 Results

We were impressed by how significantly Coinbase blew past analysts’ revenue, EPS, and EBITDA expectations this quarter. These results were driven by better-than-anticipated trading revenue and continued momentum in USDC, a stablecoin emerging as a payment and treasury tool for financial institutions and corporations. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 1.4% to $333.75 immediately after reporting.

14. Is Now The Time To Buy Coinbase?

Updated: January 24, 2026 at 9:41 PM EST

Before making an investment decision, investors should account for Coinbase’s business fundamentals and valuation in addition to what happened in the latest quarter.

There are definitely a lot of things to like about Coinbase. To kick things off, its revenue growth was exceptional over the last five years. And while its projected EPS for the next year is lacking, its admirable gross margins are a wonderful starting point for the overall profitability of the business. On top of that, its impressive EBITDA margins show it has a highly efficient business model.

Coinbase’s EV/EBITDA ratio based on the next 12 months is 17.9x. This valuation tells us it’s a bit of a market darling with a lot of good news priced in. Coinbase is a good one to add to your watchlist - there are companies featuring superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $344.81 on the company (compared to the current share price of $216.23).