Columbia Banking System (COLB)

Columbia Banking System faces an uphill battle. It’s recently struggled to grow its revenue, a worrying sign for investors seeking high-quality stocks.― StockStory Analyst Team

1. News

2. Summary

Why We Think Columbia Banking System Will Underperform

Created through the merger of two Pacific Northwest banking institutions with deep regional roots, Columbia Banking System (NASDAQ:COLB) operates Umpqua Bank, providing commercial, consumer, and wealth management services across eight western states.

- Incremental sales over the last five years were less profitable as its 2.3% annual earnings per share growth lagged its revenue gains

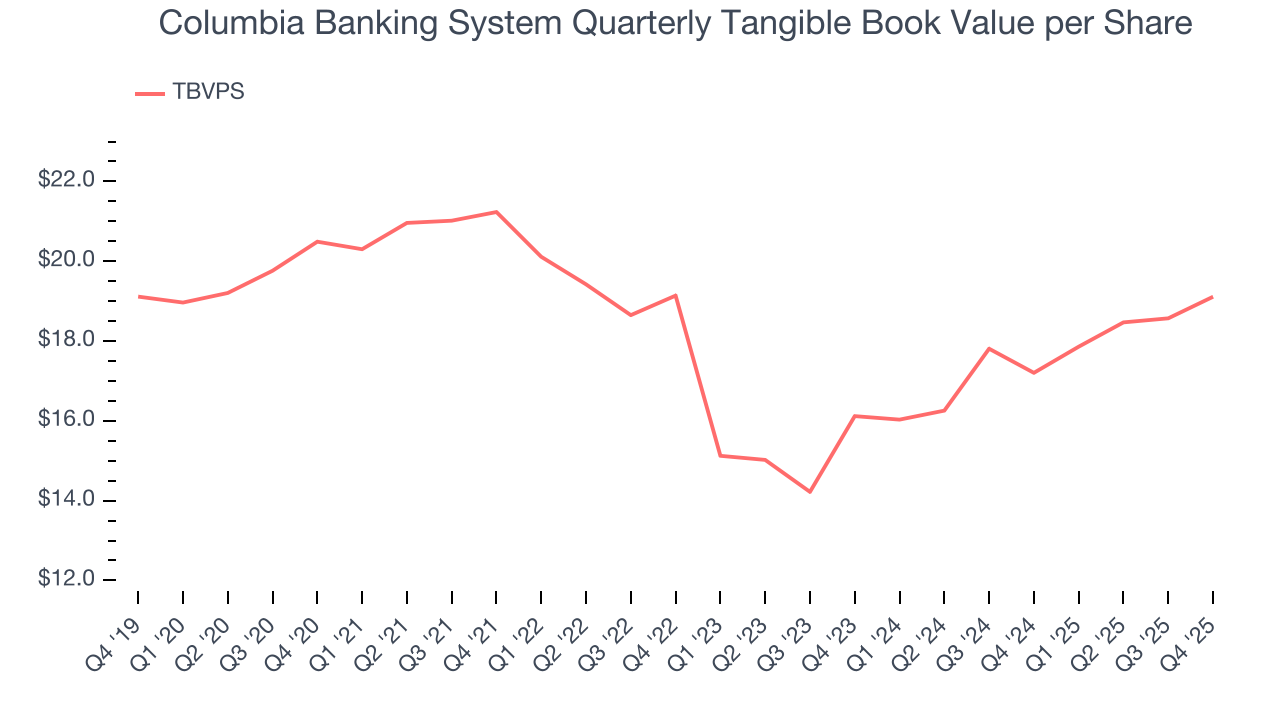

- Loan losses and capital returns have eroded its tangible book value per share this cycle as its tangible book value per share declined by 1.4% annually over the last five years

- Estimated tangible book value per share growth of 6% for the next 12 months implies profitability will slow from its two-year trend

Columbia Banking System’s quality is not up to our standards. We’re redirecting our focus to better businesses.

Why There Are Better Opportunities Than Columbia Banking System

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Columbia Banking System

Columbia Banking System is trading at $31.17 per share, or 1.1x forward P/B. This multiple is cheaper than most banking peers, but we think this is justified.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Columbia Banking System (COLB) Research Report: Q4 CY2025 Update

Regional banking company Columbia Banking System (NASDAQ:COLB) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 45.2% year on year to $717 million. Its non-GAAP profit of $0.82 per share was 14.6% above analysts’ consensus estimates.

Columbia Banking System (COLB) Q4 CY2025 Highlights:

- Net Interest Income: $627 million vs analyst estimates of $609.5 million (43.4% year-on-year growth, 2.9% beat)

- Net Interest Margin: 4.1% vs analyst estimates of 3.9% (13.2 basis point beat)

- Revenue: $717 million vs analyst estimates of $696.2 million (45.2% year-on-year growth, 3% beat)

- Efficiency Ratio: 57.3% vs analyst estimates of 52.7% (462.5 basis point miss)

- Adjusted EPS: $0.82 vs analyst estimates of $0.72 (14.6% beat)

- Tangible Book Value per Share: $19.11 vs analyst estimates of $18.90 (11.1% year-on-year growth, 1.1% beat)

- Market Capitalization: $8.88 billion

Company Overview

Created through the merger of two Pacific Northwest banking institutions with deep regional roots, Columbia Banking System (NASDAQ:COLB) operates Umpqua Bank, providing commercial, consumer, and wealth management services across eight western states.

Columbia Banking System delivers financial services through its primary subsidiary, Umpqua Bank, which maintains branches throughout Oregon, Washington, California, Idaho, Nevada, Arizona, Colorado, and Utah. The bank offers a comprehensive suite of products tailored to different customer segments, from large corporations to small businesses and individual consumers.

For commercial clients, Umpqua provides specialized lending solutions including lines of credit, equipment financing, commercial real estate loans, and international trade services. A business owner might use Umpqua's equipment leasing program to finance new manufacturing equipment while simultaneously managing cash flow through the bank's treasury management services. The bank has developed particular expertise in multifamily property lending, which represents a significant portion of its loan portfolio.

On the consumer side, Umpqua offers traditional banking products like checking and savings accounts, certificates of deposit, and residential mortgages. The bank also provides wealth management services through Columbia Wealth Advisors and Columbia Trust Company, helping clients with financial planning, investments, and estate planning.

Columbia Banking System generates revenue primarily through interest income on loans and investments, as well as fees from various banking services. The company emphasizes relationship banking, using both traditional branch locations and digital channels to serve customers. Its business model focuses on maintaining diversification across loan types, customer segments, and geographic regions to manage risk while pursuing growth opportunities throughout its western U.S. footprint.

4. Regional Banks

Regional banks, financial institutions operating within specific geographic areas, serve as intermediaries between local depositors and borrowers. They benefit from rising interest rates that improve net interest margins (the difference between loan yields and deposit costs), digital transformation reducing operational expenses, and local economic growth driving loan demand. However, these banks face headwinds from fintech competition, deposit outflows to higher-yielding alternatives, credit deterioration (increasing loan defaults) during economic slowdowns, and regulatory compliance costs. Recent concerns about regional bank stability following high-profile failures and significant commercial real estate exposure present additional challenges.

Columbia Banking System competes with large national banks that hold top market positions in its regions, as well as other regional banks operating in the western United States such as First Republic Bank (NYSE: FRC), Western Alliance Bancorporation (NYSE: WAL), and Zions Bancorporation (NASDAQ: ZION).

5. Sales Growth

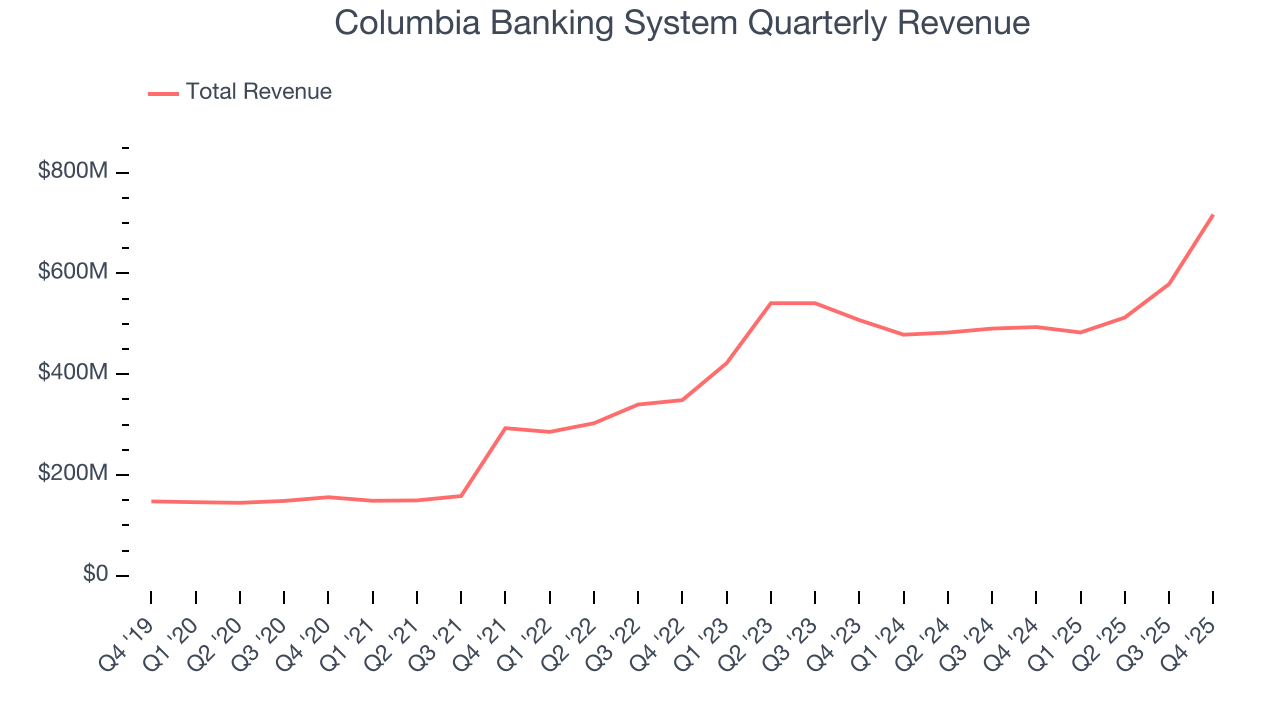

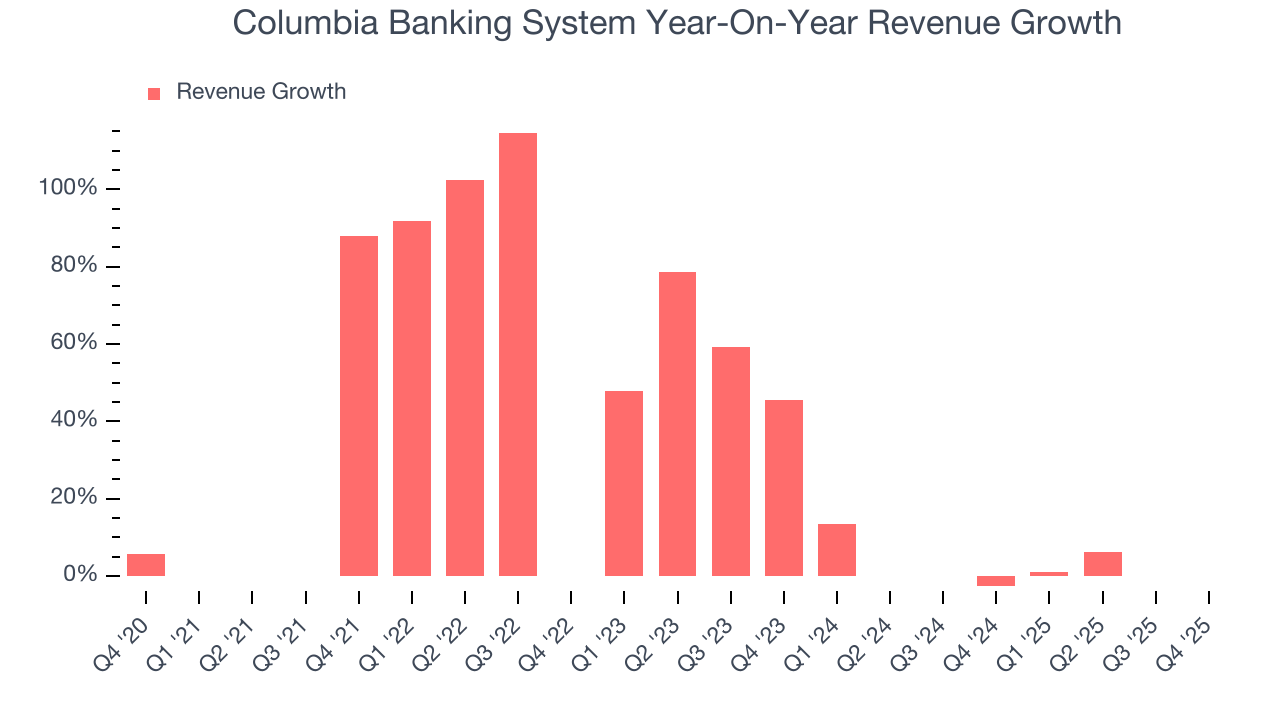

In general, banks make money from two primary sources. The first is net interest income, which is interest earned on loans, mortgages, and investments in securities minus interest paid out on deposits. The second source is non-interest income, which can come from bank account, credit card, wealth management, investing banking, and trading fees. Over the last five years, Columbia Banking System grew its revenue at an incredible 30.9% compounded annual growth rate. Its growth beat the average banking company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Columbia Banking System’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 6.7% over the last two years was well below its five-year trend.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Columbia Banking System reported magnificent year-on-year revenue growth of 45.2%, and its $717 million of revenue beat Wall Street’s estimates by 3%.

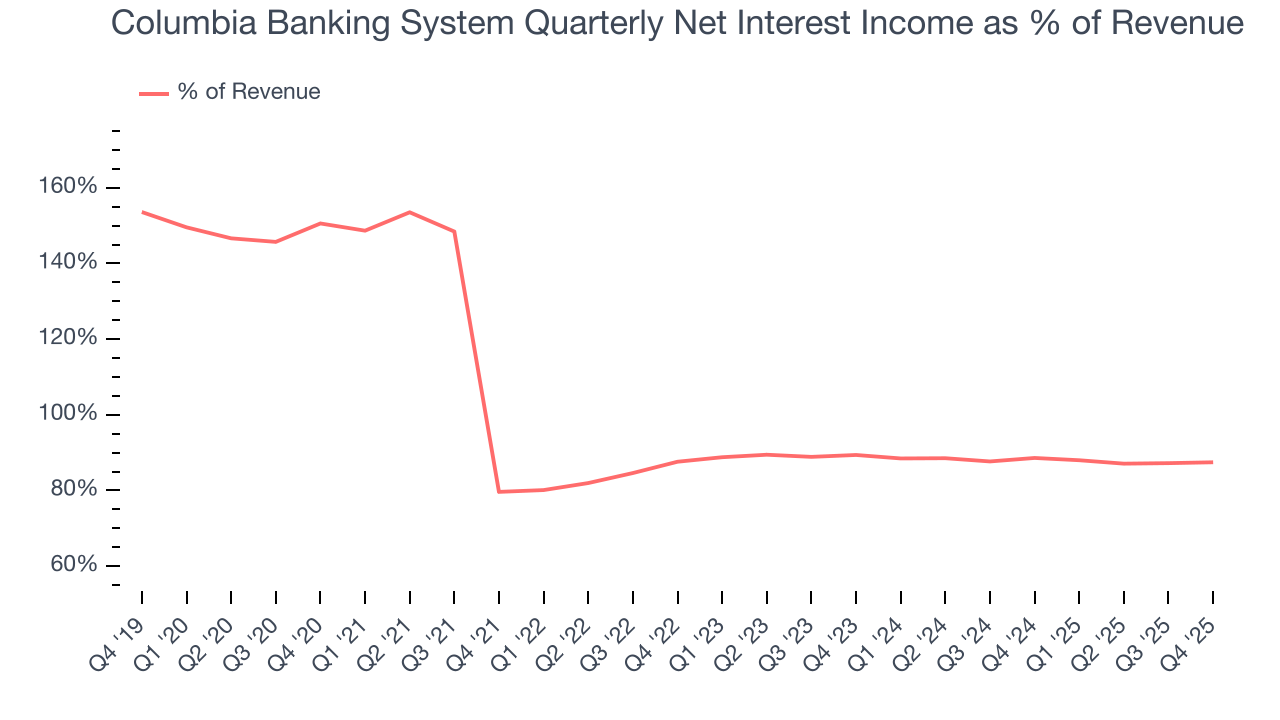

Net interest income made up 96.2% of the company’s total revenue during the last five years, meaning Columbia Banking System lives and dies by its lending activities because non-interest income barely moves the needle.

Net interest income commands greater market attention due to its reliability and consistency, whereas non-interest income is often seen as lower-quality revenue that lacks the same dependable characteristics.

6. Earnings Per Share

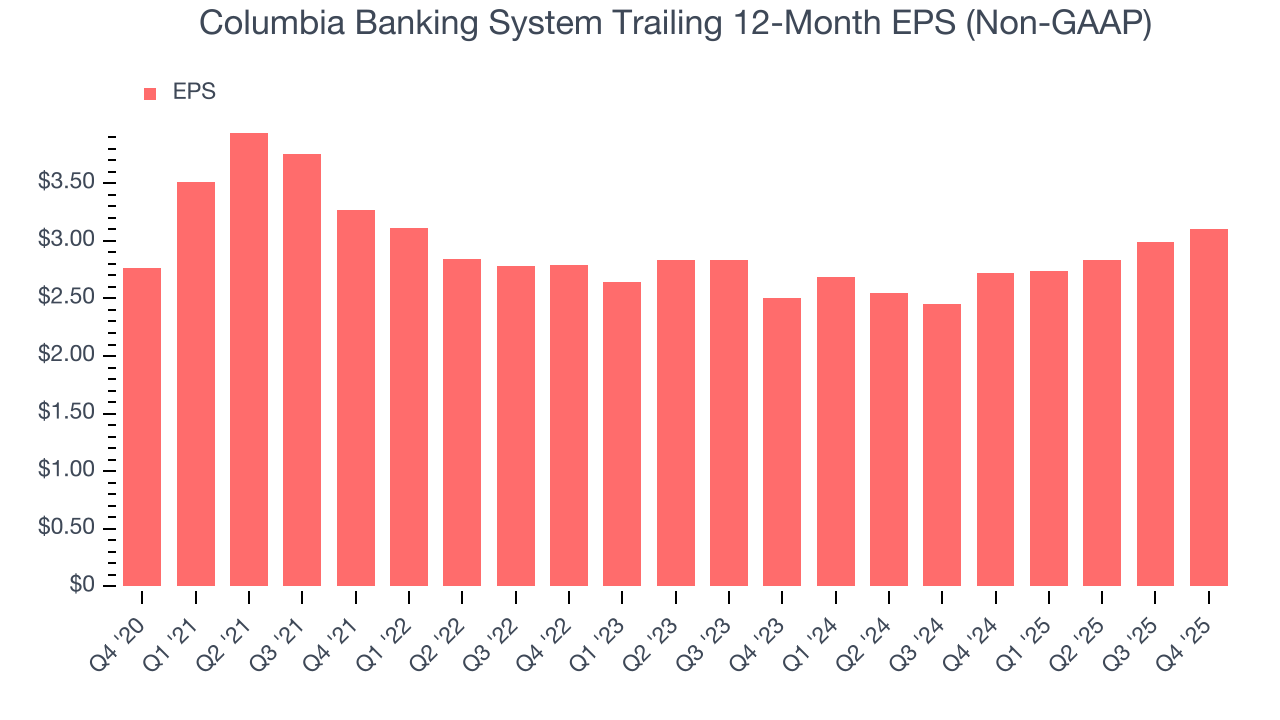

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Columbia Banking System’s EPS grew at a weak 2.3% compounded annual growth rate over the last five years, lower than its 30.9% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Columbia Banking System, its two-year annual EPS growth of 11.4% was higher than its five-year trend. Accelerating earnings growth is almost always an encouraging data point.

In Q4, Columbia Banking System reported adjusted EPS of $0.82, up from $0.71 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Columbia Banking System’s full-year EPS of $3.10 to shrink by 2.6%.

7. Tangible Book Value Per Share (TBVPS)

Banks are balance sheet-driven businesses because they generate earnings primarily through borrowing and lending. They’re also valued based on their balance sheet strength and ability to compound book value (another name for shareholders’ equity) over time.

This is why we consider tangible book value per share (TBVPS) the most important metric to track for banks. TBVPS represents the real, liquid net worth per share of a bank, excluding intangible assets that have debatable value upon liquidation. On the other hand, EPS is often distorted by mergers and flexible loan loss accounting. TBVPS provides clearer performance insights.

Columbia Banking System’s TBVPS declined at a 1.4% annual clip over the last five years. However, TBVPS growth has accelerated recently, growing by 8.9% annually over the last two years from $16.12 to $19.11 per share.

Over the next 12 months, Consensus estimates call for Columbia Banking System’s TBVPS to grow by 6.4% to $20.34, lousy growth rate.

8. Balance Sheet Assessment

Leverage is core to a financial firm’s business model (loans funded by deposits). To ensure economic stability and avoid a repeat of the 2008 GFC, regulators require certain levels of capital and liquidity, focusing on the Tier 1 capital ratio.

Tier 1 capital is the highest-quality capital that a firm holds, consisting primarily of common stock and retained earnings, but also physical gold. It serves as the primary cushion against losses and is the first line of defense in times of financial distress.

This capital is divided by risk-weighted assets to derive the Tier 1 capital ratio. Risk-weighted means that cash and US treasury securities are assigned little risk while unsecured consumer loans and equity investments get much higher risk weights, for example.

New regulation after the 2008 financial crisis requires that all firms must maintain a Tier 1 capital ratio greater than 4.5%. On top of this, there are additional buffers based on scale, risk profile, and other regulatory classifications, so that at the end of the day, firms generally must maintain a 7-10% ratio at minimum.

Over the last two years, Columbia Banking System has averaged a Tier 1 capital ratio of 10.7%, which is considered safe and well capitalized in the event that macro or market conditions suddenly deteriorate.

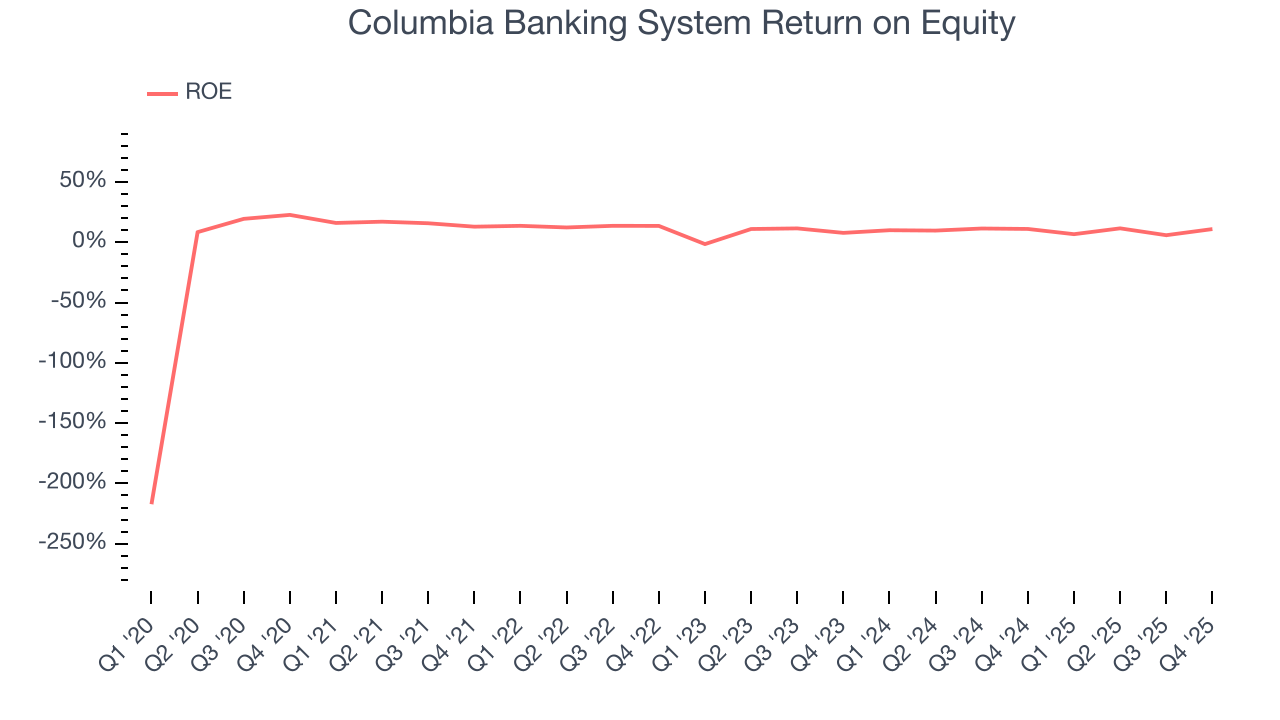

9. Return on Equity

Return on equity, or ROE, quantifies bank profitability relative to shareholder equity - an essential capital source for these institutions. Over extended periods, superior ROE performance drives faster shareholder wealth compounding through reinvestment, share repurchases, and dividend growth.

Over the last five years, Columbia Banking System has averaged an ROE of 11%, respectable for a company operating in a sector where the average shakes out around 7.5% and those putting up 15%+ are greatly admired.

10. Key Takeaways from Columbia Banking System’s Q4 Results

It was good to see Columbia Banking System beat analysts’ EPS expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. Zooming out, we think this was a solid print. The stock traded up 2.4% to $30.35 immediately following the results.

11. Is Now The Time To Buy Columbia Banking System?

Updated: February 5, 2026 at 12:01 AM EST

Before deciding whether to buy Columbia Banking System or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

We see the value of companies driving economic growth, but in the case of Columbia Banking System, we’re out. Although its revenue growth was exceptional over the last five years, it’s expected to deteriorate over the next 12 months and its TBVPS has declined over the last five years. And while the company’s estimated net interest income growth for the next 12 months is great, the downside is its weak EPS growth over the last five years shows it’s failed to produce meaningful profits for shareholders.

Columbia Banking System’s P/B ratio based on the next 12 months is 1.1x. While this valuation is fair, the upside isn’t great compared to the potential downside. There are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $32.58 on the company (compared to the current share price of $31.17).