Caesars Entertainment (CZR)

Caesars Entertainment keeps us up at night. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Caesars Entertainment Will Underperform

Formerly Eldorado Resorts, Caesars Entertainment (NASDAQ:CZR) is a global gaming and hospitality company operating numerous casinos, hotels, and resort properties.

- Sales were flat over the last two years, indicating it’s failed to expand its business

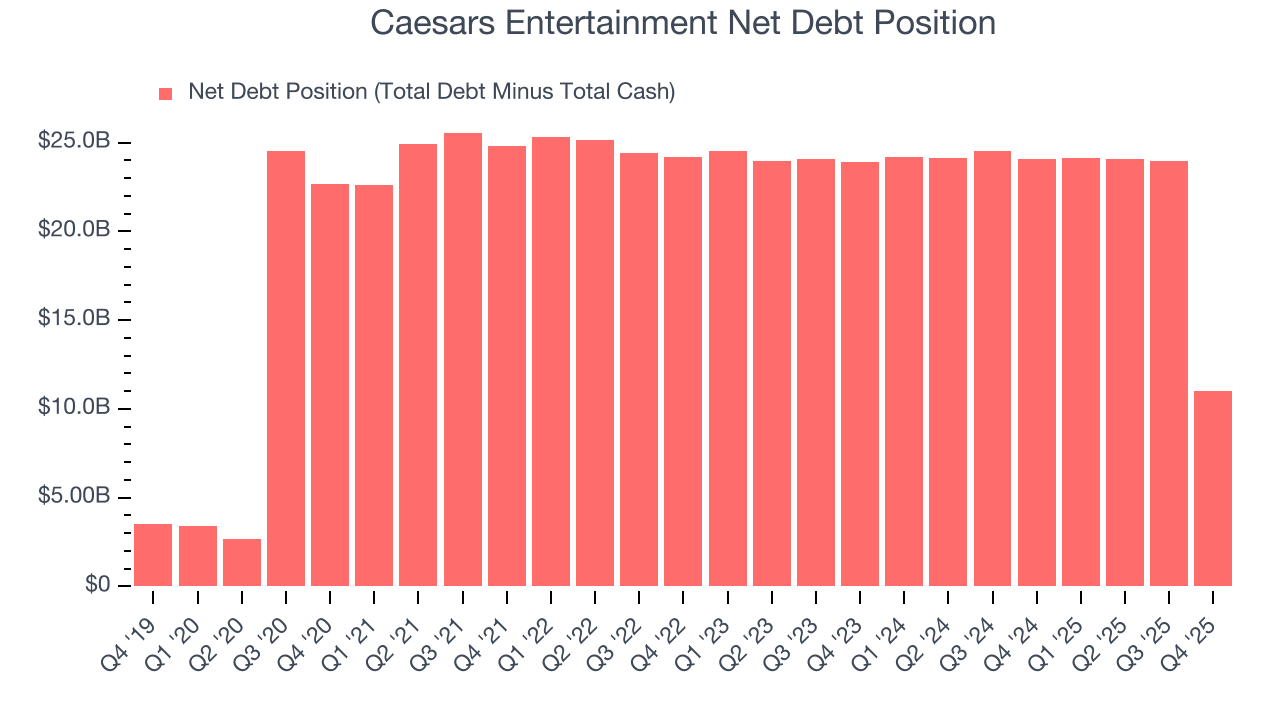

- Lacking free cash flow limits its freedom to invest in growth initiatives, execute share buybacks, or pay dividends

- 7× net-debt-to-EBITDA ratio shows it’s overleveraged and increases the probability of shareholder dilution if things turn unexpectedly

Caesars Entertainment falls short of our expectations. Better businesses are for sale in the market.

Why There Are Better Opportunities Than Caesars Entertainment

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Caesars Entertainment

At $18.31 per share, Caesars Entertainment trades at 7.5x forward EV-to-EBITDA. This sure is a cheap multiple, but you get what you pay for.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Caesars Entertainment (CZR) Research Report: Q4 CY2025 Update

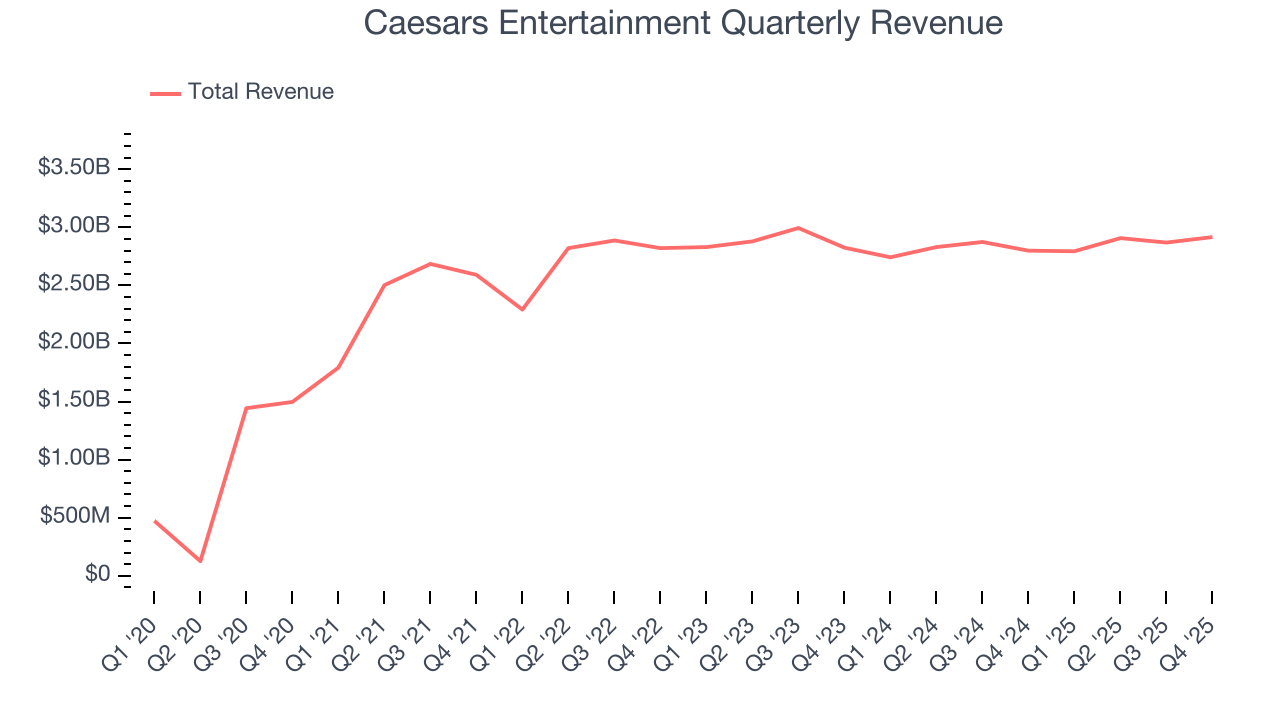

Hotel and casino entertainment company Caesars Entertainment (NASDAQ:CZR) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 4.2% year on year to $2.92 billion. Its GAAP loss of $1.23 per share was significantly below analysts’ consensus estimates.

Caesars Entertainment (CZR) Q4 CY2025 Highlights:

- Revenue: $2.92 billion vs analyst estimates of $2.88 billion (4.2% year-on-year growth, 1.1% beat)

- EPS (GAAP): -$1.23 vs analyst estimates of -$0.19 (significant miss)

- Adjusted EBITDA: $901 million vs analyst estimates of $896.3 million (30.9% margin, 0.5% beat)

- Operating Margin: 11.4%, down from 23.9% in the same quarter last year

- Market Capitalization: $3.70 billion

Company Overview

Formerly Eldorado Resorts, Caesars Entertainment (NASDAQ:CZR) is a global gaming and hospitality company operating numerous casinos, hotels, and resort properties.

The company was founded in 1973 as Eldorado Resorts and rebranded to Caesars Entertainment following a transformative merger with Caesars Entertainment Corporation in 2020. This move marked a key development in its journey, establishing the company as a major player in the gaming and hospitality industry by combining gaming expertise with a broad range of hospitality and entertainment offerings.

Caesars Entertainment oversees an array of properties, including casinos, hotels, and resorts. The company's operations include not only gaming but also hotel services, dining, live shows, and other leisure activities. This multifaceted approach caters to a diverse customer base seeking various entertainment and hospitality experiences, from gaming enthusiasts to vacationers.

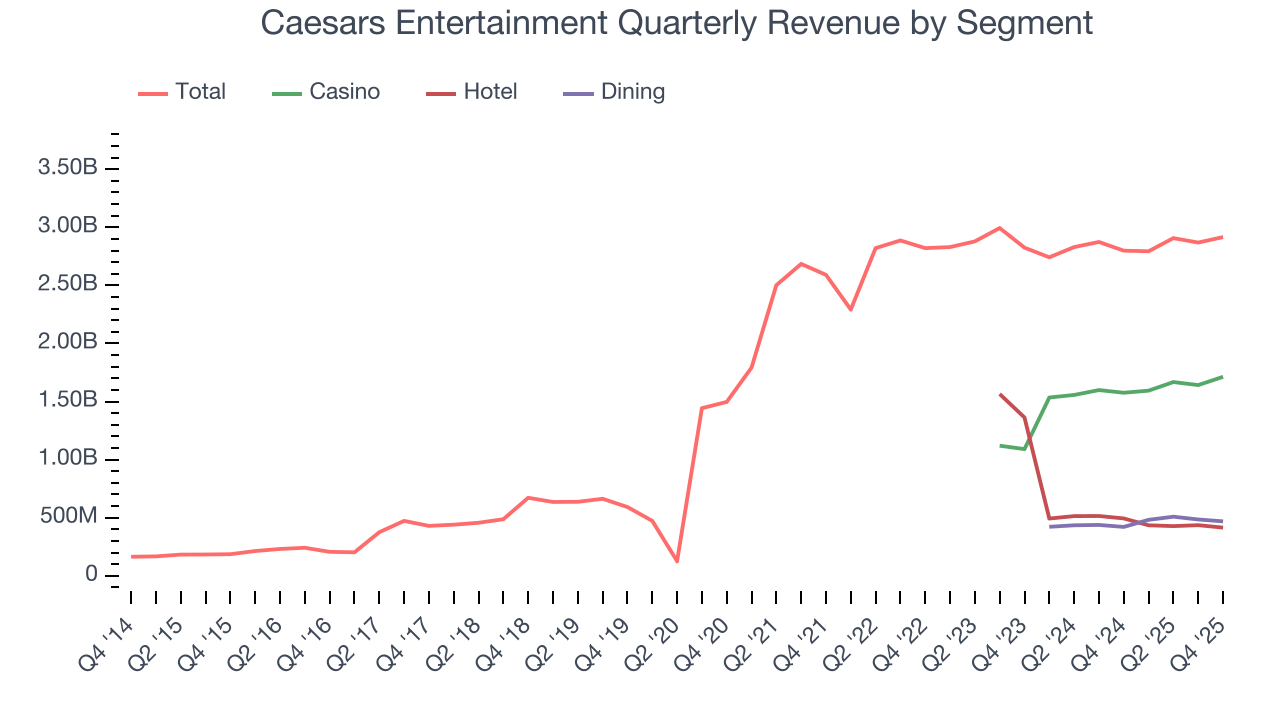

The company's revenue is generated from multiple sources: gaming operations, hotel bookings, food and beverage services, and entertainment ventures. In gaming, the company has both physical and online gaming platforms (iGaming).

4. Consumer Discretionary - Casino Operator

The Consumer Discretionary sector, by definition, is made up of companies selling non-essential goods and services. When economic conditions deteriorate or tastes shift, consumers can easily cut back or eliminate these purchases. For long-term investors with five-year holding periods, this creates a structural challenge: the sector is inherently hit-driven, with low switching costs and fickle customers. As a result, only a handful of companies can reliably grow demand and compound earnings over long periods, which is why our bar is high and High Quality ratings are rare.

Casino operators run gaming resorts and facilities that generate revenue from gambling, hospitality, food and beverage, and entertainment offerings. Tailwinds include pent-up travel demand, expansion into new jurisdictions legalizing gaming, and growing interest in integrated resort developments in Asia and the Middle East. However, the industry faces notable headwinds: heavy regulatory and licensing requirements limit operational flexibility, capital expenditure for property development and renovation is substantial, and revenue is highly sensitive to macroeconomic conditions and consumer confidence. Rising competition from online gambling platforms, regional saturation in mature markets, and geopolitical risks in key international jurisdictions add further uncertainty.

Competitors in the gaming and hospitality sector include MGM Resorts (NYSE:MGM), Las Vegas Sands (NYSE:LVS), and Wynn Resorts (NASDAQ:WYNN).

5. Revenue Growth

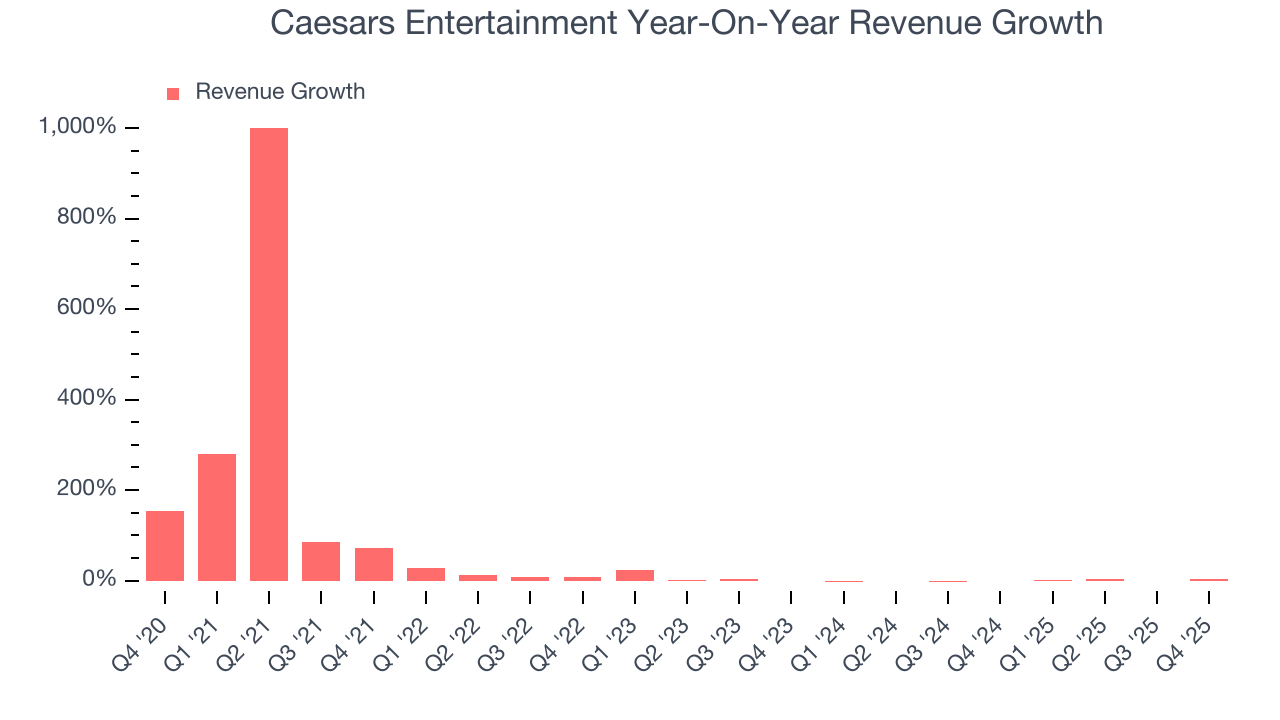

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Caesars Entertainment grew its sales at a 26.5% annual rate. Though this growth is acceptable on an absolute basis, we need to see more than just topline growth for the consumer discretionary sector, which can display significant earnings volatility. This means our bar for the sector is particularly high, reflecting the non-essential and hit-driven nature of the products and services offered. Additionally, five-year CAGR starts around Covid, when revenue was depressed then rebounded.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Caesars Entertainment’s recent performance shows its demand has slowed as its revenue was flat over the last two years. Note that COVID hurt Caesars Entertainment’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

We can better understand the company’s revenue dynamics by analyzing its three most important segments: Casino, Hotel, and Dining, which are 58.7%, 14.2%, and 16.1% of revenue. Over the last two years, Caesars Entertainment’s Casino (Poker, Blackjack) and Dining (food and beverage) revenues averaged year-on-year growth of 18.3% and 13.3%. On the other hand, its Hotel revenue (overnight bookings) averaged 31.8% declines.

This quarter, Caesars Entertainment reported modest year-on-year revenue growth of 4.2% but beat Wall Street’s estimates by 1.1%.

Looking ahead, sell-side analysts expect revenue to grow 2.1% over the next 12 months. While this projection implies its newer products and services will fuel better top-line performance, it is still below the sector average.

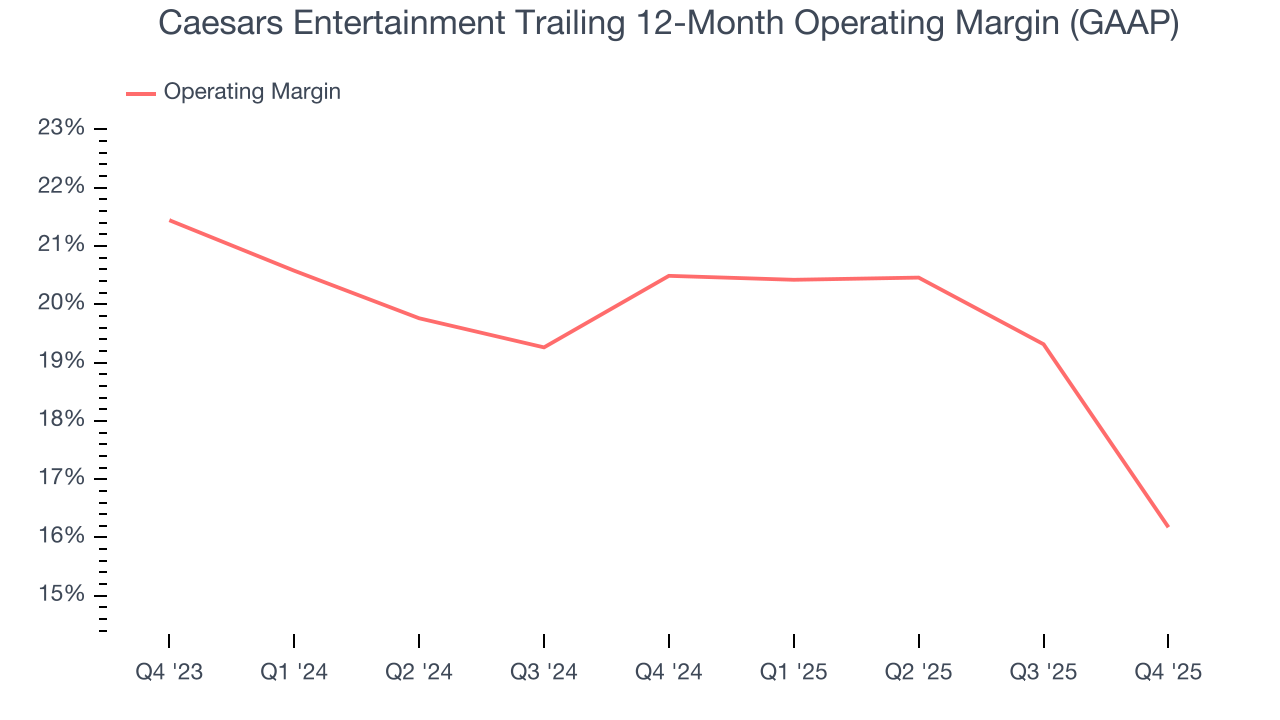

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Caesars Entertainment’s operating margin has been trending down over the last 12 months and averaged 18.3% over the last two years. The company’s profitability was mediocre for a consumer discretionary business and shows it couldn’t pass its higher operating expenses onto its customers.

This quarter, Caesars Entertainment generated an operating margin profit margin of 11.4%, down 12.6 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

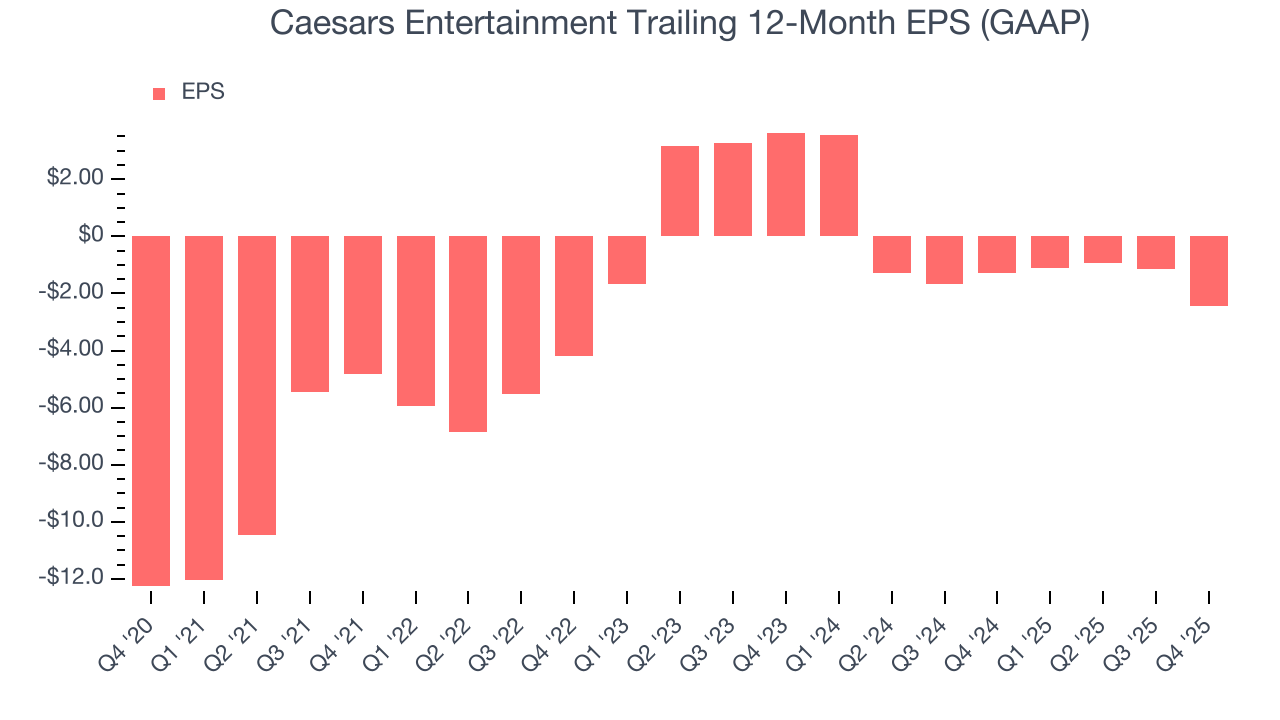

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Although Caesars Entertainment’s full-year earnings are still negative, it reduced its losses and improved its EPS by 27.7% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability.

In Q4, Caesars Entertainment reported EPS of negative $1.23, down from $0.05 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Caesars Entertainment’s full-year EPS of negative $2.43 will flip to positive $0.05.

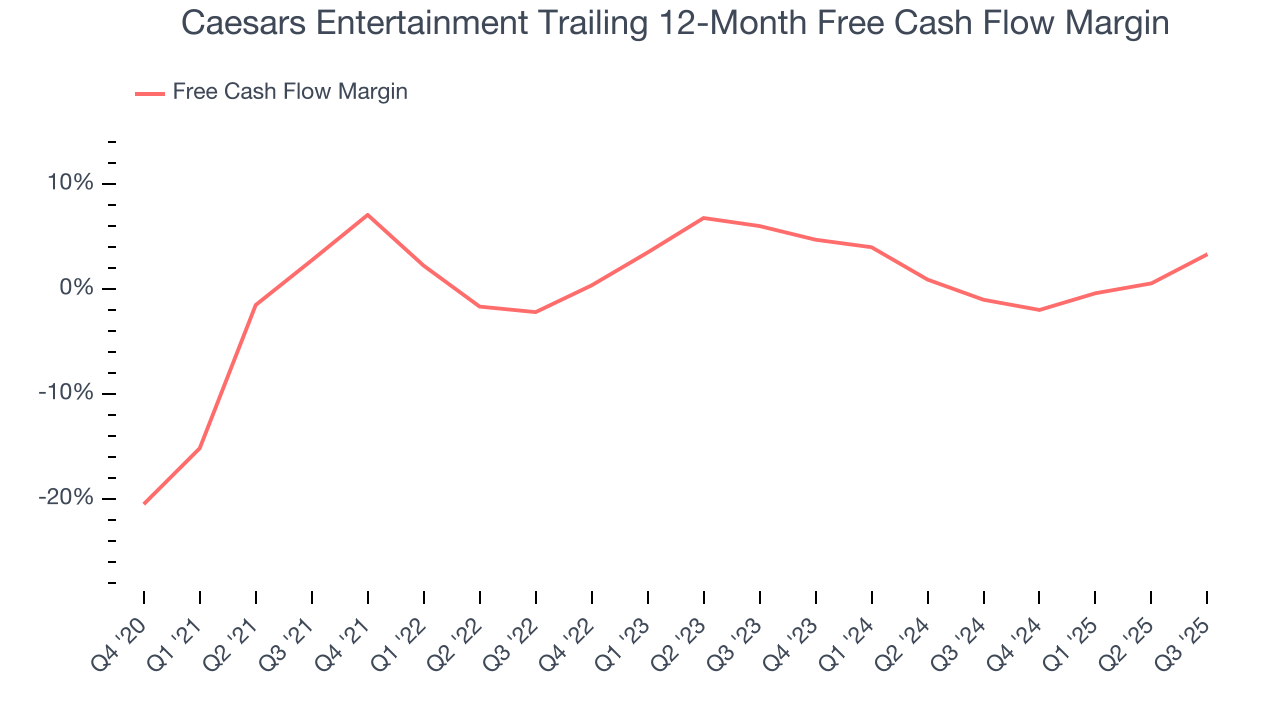

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Caesars Entertainment broke even from a free cash flow perspective over the last two years, giving the company limited opportunities to return capital to shareholders.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Caesars Entertainment historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 13.7%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, Caesars Entertainment’s ROIC averaged 2.7 percentage point increases each year over the last few years. This is a good sign, and we hope the company can continue improving.

10. Balance Sheet Assessment

Caesars Entertainment reported $887 million of cash and $11.91 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $3.50 billion of EBITDA over the last 12 months, we view Caesars Entertainment’s 3.1× net-debt-to-EBITDA ratio as safe. We also see its $2.30 billion of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Caesars Entertainment’s Q4 Results

It was good to see Caesars Entertainment narrowly top analysts’ revenue expectations this quarter. On the other hand, its EPS missed. Overall, this was a softer quarter. The stock traded up 4% to $19.70 immediately following the results.

12. Is Now The Time To Buy Caesars Entertainment?

Updated: February 17, 2026 at 4:22 PM EST

Are you wondering whether to buy Caesars Entertainment or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

We cheer for all companies serving everyday consumers, but in the case of Caesars Entertainment, we’ll be cheering from the sidelines. While its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its relatively low ROIC suggests management has struggled to find compelling investment opportunities. On top of that, its low free cash flow margins give it little breathing room.

Caesars Entertainment’s P/E ratio based on the next 12 months is 1,263.3x. This valuation is reasonable, but the company’s shaky fundamentals present too much downside risk. There are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $32.11 on the company (compared to the current share price of $19.70).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.