DoorDash (DASH)

DoorDash is an amazing business. Its rare blend of high growth, robust profitability, and a strong outlook makes it a wonderful asset.― StockStory Analyst Team

1. News

2. Summary

Why We Like DoorDash

Founded by Stanford students with the intent to build “the local, on-demand FedEx", DoorDash (NASDAQ:DASH) operates an on-demand food delivery platform.

- Exciting sales outlook for the upcoming 12 months calls for 30.1% growth, an acceleration from its three-year trend

- Orders have increased by an average of 22% annually, giving it the potential for margin-accretive growth if it can develop valuable complementary products and features

- Performance over the past three years shows its incremental sales were extremely profitable, as its annual earnings per share growth of 931% outpaced its revenue gains

We’re optimistic about DoorDash. The valuation seems reasonable relative to its quality, and we think now is the time to buy.

Why Is Now The Time To Buy DoorDash?

High Quality

Investable

Underperform

Why Is Now The Time To Buy DoorDash?

At $178.73 per share, DoorDash trades at 21.8x forward EV/EBITDA. This price is justified - even cheap depending on how much you believe in the bull case - for the business fundamentals.

Our analysis and backtests consistently tell us that buying high-quality companies and holding them for many years leads to market outperformance. Entry price matters less, but if you can get a good one, all the better.

3. DoorDash (DASH) Research Report: Q4 CY2025 Update

On-demand food delivery service DoorDash (NASDAQ:DASH) missed Wall Street’s revenue expectations in Q4 CY2025, but sales rose 37.7% year on year to $3.96 billion. Its non-GAAP profit of $1.27 per share was 1.4% below analysts’ consensus estimates.

DoorDash (DASH) Q4 CY2025 Highlights:

- Revenue: $3.96 billion vs analyst estimates of $4 billion (37.7% year-on-year growth, 1.1% miss)

- Adjusted EPS: $1.27 vs analyst expectations of $1.29 (1.4% miss)

- Adjusted EBITDA: $780 million vs analyst estimates of $773.6 million (19.7% margin, 0.8% beat)

- EBITDA guidance for Q1 CY2026 is $725 million at the midpoint, below analyst estimates of $800.4 million

- Operating Margin: 3.7%, in line with the same quarter last year

- Free Cash Flow Margin: 6.4%, down from 21% in the previous quarter

- Orders: 903 million, up 218 million year on year

- Market Capitalization: $79.71 billion

Company Overview

Founded by Stanford students with the intent to build “the local, on-demand FedEx", DoorDash (NASDAQ:DASH) operates an on-demand food delivery platform.

The company's main product is a mobile application that allows customers to order food from restaurants and have it delivered to their doorstep. Called Marketplace, this platform involves 3 stakeholders: the consumer, the merchant (the restaurant), and the Dasher (the delivery person).

For consumers, DoorDash enables digital ordering that is convenient and addresses the errors that can occur when ordering by phone. For merchants, DoorDash expands the addressable market through efficient customer acquisition. Online ordering has been shown to increase retention and the ability to press “reorder” can remove decision paralysis.

DoorDash generates revenue by charging restaurants a commission for each order on the platform. The company also charges customers a delivery fee and may impose other fees.

The company has also introduced new products to cover different use cases for restaurants that may have their own ordering platforms or want to brand a white-label service. For consumers, DoorDash has the DashPass, which is a subscription product with free unlimited delivery and other perks that aim to increase ordering frequency and eliminate the pesky delivery fees that give users pause.

4. Gig Economy

The iPhone changed the world, ushering in the era of the “always-on” internet and “on-demand” services - anything someone could want is just a few taps away. Likewise, the gig economy sprang up in a similar fashion, with a proliferation of tech-enabled freelance labor marketplaces, which work hand and hand with many on demand services. Individuals can now work on demand too. What began with tech-enabled platforms that aggregated riders and drivers has expanded over the past decade to include food delivery, groceries, and now even a plumber or graphic designer are all just a few taps away.

DoorDash competes in food delivery with UberEats (owned by Uber, NYSE:UBER), Just Eat Takeaway (ENXTAM:TKWY), and Delivery Hero (XTRA:DHER).

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last three years, DoorDash grew its sales at an exceptional 27.7% compounded annual growth rate. Its growth surpassed the average consumer internet company and shows its offerings resonate with customers, a great starting point for our analysis.

This quarter, DoorDash pulled off a wonderful 37.7% year-on-year revenue growth rate, but its $3.96 billion of revenue fell short of Wall Street’s rosy estimates.

Looking ahead, sell-side analysts expect revenue to grow 30.1% over the next 12 months, an acceleration versus the last three years. This projection is eye-popping for a company of its scale and indicates its newer products and services will spur better top-line performance.

6. Orders

Request Growth

As a gig economy marketplace, DoorDash generates revenue growth by expanding the number of services on its platform (e.g. rides, deliveries, freelance jobs) and raising the commission fee from each service provided.

Over the last two years, DoorDash’s orders, a key performance metric for the company, increased by 22% annually to 903 million in the latest quarter. This growth rate is among the fastest of any consumer internet business and indicates its offerings have significant traction.

In Q4, DoorDash added 218 million orders, leading to 31.8% year-on-year growth. The quarterly print was higher than its two-year result, suggesting its new initiatives are accelerating request growth.

Revenue Per Request

Average revenue per request (ARPR) is a critical metric to track because it measures how much the company earns in transaction fees from each request. This number also informs us about DoorDash’s take rate, which represents its pricing leverage over the ecosystem, or "cut" from each transaction.

DoorDash’s ARPR growth has been mediocre over the last two years, averaging 4.2%. This isn’t great, but the increase in orders is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if DoorDash tries boosting ARPR by taking a more aggressive approach to monetization, it’s unclear whether requests can continue growing at the current pace.

This quarter, DoorDash’s ARPR clocked in at $4.38. It grew by 4.4% year on year, slower than its request growth.

7. Gross Margin & Pricing Power

For gig economy businesses like DoorDash, gross profit tells us how much money the company gets to keep after covering the base cost of its products and services, which typically include server hosting, customer support, and payment processing fees. Another cost of revenue could also be insurance to protect against liabilities arising from providing transportation, housing, or freelance work services.

DoorDash’s gross margin is slightly below the average consumer internet company, giving it less room to invest in areas such as product and marketing to grow its presence. As you can see below, it averaged a 50.8% gross margin over the last two years. That means DoorDash paid its providers a lot of money ($49.23 for every $100 in revenue) to run its business.

This quarter, DoorDash’s gross profit margin was 54.3%, in line with the same quarter last year. Zooming out, DoorDash’s full-year margin has been trending up over the past 12 months, increasing by 2.4 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as servers).

8. User Acquisition Efficiency

Consumer internet businesses like DoorDash grow from a combination of product virality, paid advertisement, and incentives (unlike enterprise software products, which are often sold by dedicated sales teams).

DoorDash is efficient at acquiring new users, spending 35.1% of its gross profit on sales and marketing expenses over the last year. This efficiency indicates relatively solid competitive positioning, giving DoorDash the freedom to invest its resources into new growth initiatives.

9. EBITDA

Investors regularly analyze operating income to understand a company’s profitability. Similarly, EBITDA is a common profitability metric for consumer internet companies because it excludes various one-time or non-cash expenses, offering a better perspective of the business’s profit potential.

DoorDash has been a well-oiled machine over the last two years. It demonstrated elite profitability for a consumer internet business, boasting an average EBITDA margin of 19.1%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, DoorDash’s EBITDA margin rose by 14.8 percentage points over the last few years, as its sales growth gave it operating leverage.

In Q4, DoorDash generated an EBITDA margin profit margin of 19.7%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

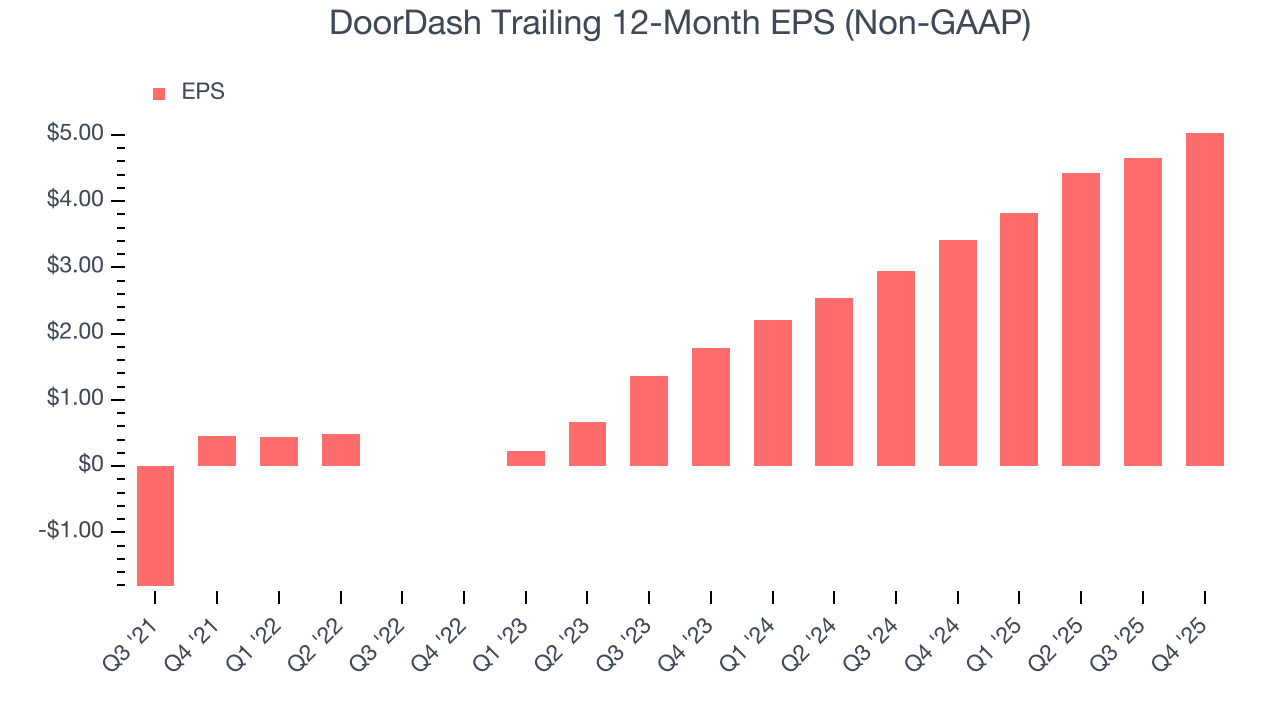

10. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

DoorDash’s EPS grew at 931% compounded annual growth rate over the last three years, higher than its 27.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of DoorDash’s earnings can give us a better understanding of its performance. As we mentioned earlier, DoorDash’s EBITDA margin was flat this quarter but expanded by 14.8 percentage points over the last three years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, DoorDash reported adjusted EPS of $1.27, up from $0.89 in the same quarter last year. Despite growing year on year, this print slightly missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects DoorDash’s full-year EPS of $5.03 to grow 10%.

11. Cash Is King

Although EBITDA is undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

DoorDash has shown robust cash profitability, driven by its cost-effective customer acquisition strategy that enables it to invest in new products and services rather than sales and marketing. The company’s free cash flow margin averaged 14.8% over the last two years, quite impressive for a consumer internet business. DoorDash has shown robust cash profitability relative to peers over the last two years, giving the company fewer opportunities to return capital to shareholders.

Taking a step back, we can see that DoorDash’s margin expanded by 13 percentage points over the last few years. This is encouraging because it gives the company more optionality.

DoorDash’s free cash flow clocked in at $254 million in Q4, equivalent to a 6.4% margin. The company’s cash profitability regressed as it was 8.2 percentage points lower than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends trump fluctuations.

12. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

DoorDash is a profitable, well-capitalized company with $5.51 billion of cash and $3.29 billion of debt on its balance sheet. This $2.22 billion net cash position is 2.8% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

13. Key Takeaways from DoorDash’s Q4 Results

We were very impressed by DoorDash’s number of requests this quarter. We were also happy its EBITDA narrowly outperformed Wall Street’s estimates. On the other hand, its revenue slightly missed and its EBITDA guidance for next quarter fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $184.22 immediately following the results.

14. Is Now The Time To Buy DoorDash?

Updated: March 7, 2026 at 9:37 PM EST

When considering an investment in DoorDash, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

DoorDash is an amazing business ranking highly on our list. For starters, its revenue growth was exceptional over the last three years and is expected to accelerate over the next 12 months. On top of that, its rising cash profitability gives it more optionality, and its EPS growth over the last three years has been fantastic.

DoorDash’s EV/EBITDA ratio based on the next 12 months is 21.8x. Scanning the consumer internet landscape today, DoorDash’s fundamentals clearly illustrate that it’s an elite business, and we like it at this price.

Wall Street analysts have a consensus one-year price target of $258.00 on the company (compared to the current share price of $178.73), implying they see 44.4% upside in buying DoorDash in the short term.