DraftKings (DKNG)

We wouldn’t buy DraftKings. Its growth has decelerated and its failure to generate meaningful free cash flow makes us question its prospects.― StockStory Analyst Team

1. News

2. Summary

Why We Think DraftKings Will Underperform

Getting its start in daily fantasy sports, DraftKings (NASDAQ:DKNG) is a digital sports entertainment and gaming company.

- Historical operating margin losses point to an inefficient cost structure

- Lacking free cash flow limits its freedom to invest in growth initiatives, execute share buybacks, or pay dividends

- Performance over the past five years shows its incremental sales were less profitable, as its 17.7% annual earnings per share growth trailed its revenue gains

DraftKings doesn’t fulfill our quality requirements. There are more promising alternatives.

Why There Are Better Opportunities Than DraftKings

Why There Are Better Opportunities Than DraftKings

At $22.34 per share, DraftKings trades at 19.2x forward P/E. The current valuation may be fair, but we’re still passing on this stock due to better alternatives out there.

We prefer to invest in similarly-priced but higher-quality companies with superior earnings growth.

3. DraftKings (DKNG) Research Report: Q4 CY2025 Update

Fantasy sports and betting company DraftKings (NASDAQ:DKNG) met Wall Street’s revenue expectations in Q4 CY2025, with sales up 42.8% year on year to $1.99 billion. On the other hand, the company’s full-year revenue guidance of $6.7 billion at the midpoint came in 8.2% below analysts’ estimates. Its non-GAAP profit of $0.36 per share was 12.5% below analysts’ consensus estimates.

DraftKings (DKNG) Q4 CY2025 Highlights:

- Revenue: $1.99 billion vs analyst estimates of $1.99 billion (42.8% year-on-year growth, in line)

- Adjusted EPS: $0.36 vs analyst expectations of $0.41 (12.5% miss)

- Adjusted EBITDA: $343.2 million vs analyst estimates of $269.4 million (17.3% margin, 27.4% beat)

- EBITDA guidance for the upcoming financial year 2026 is $800 million at the midpoint, below analyst estimates of $980.6 million

- Operating Margin: 7.6%, up from -10% in the same quarter last year

- Free Cash Flow Margin: 14%, down from 23.2% in the same quarter last year

- Monthly Unique Payers: 4.8 million, in line with the same quarter last year

- Market Capitalization: $13.09 billion

Company Overview

Getting its start in daily fantasy sports, DraftKings (NASDAQ:DKNG) is a digital sports entertainment and gaming company.

DraftKings was founded in 2012 by Jason Robins, Matthew Kalish, and Paul Liberman to capitalize on sports betting legalization in the United States. On its platform, it offers daily fantasy sports contests across various professional sports leagues as well as sports betting and online casino games.

The company's primary revenue stream comes from its online gaming platforms, including the entry fees for daily fantasy sports contests, sports betting wagers, and online casino gaming. DraftKings also utilizes a technology-driven approach to sports betting and gaming, allowing for scalability and customer convenience. For example, consumers can download the DraftKings app on their mobile devices and instantly place bets from their couches on a user-friendly interface.

A unique aspect of DraftKing's business is that the legalization of sports betting is a major factor, and in the United States, gambling legislation is determined on a state-by-state basis. As such, when a new state "opens" (aka sports betting is legalized), companies like DraftKings typically make huge marketing pushes to win new consumers.

4. Gaming Solutions

The Consumer Discretionary sector, by definition, is made up of companies selling non-essential goods and services. When economic conditions deteriorate or tastes shift, consumers can easily cut back or eliminate these purchases. For long-term investors with five-year holding periods, this creates a structural challenge: the sector is inherently hit-driven, with low switching costs and fickle customers. As a result, only a handful of companies can reliably grow demand and compound earnings over long periods, which is why our bar is high and High Quality ratings are rare.

Gaming solutions companies provide the technology infrastructure behind gambling—slot machines, table game systems, lottery terminals, sports-betting platforms, and back-end software for casinos and online operators. Tailwinds include the ongoing legalization of sports betting across U.S. states and international markets, growing adoption of digital and mobile wagering, and casino operators' demand for data-driven player engagement tools. However, headwinds include stringent and evolving regulatory requirements across jurisdictions, high upfront R&D costs to develop next-generation platforms, and customer concentration risk given the limited number of large casino operators. Increasing competition from in-house technology development by major operators also pressures demand.

Competitors in the digital sports entertainment and gaming sector include Caesars Entertainment (NASDAQ:CZR), PENN Entertainment (NASDAQ:PENN),and Rush Street Interactive (NYSE: RSI).

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Thankfully, DraftKings’s 56.6% annualized revenue growth over the last five years was impressive. Its growth beat the average consumer discretionary company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. DraftKings’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 28.5% over the last two years was well below its five-year trend.

This quarter, DraftKings’s year-on-year revenue growth of 42.8% was magnificent, and its $1.99 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 20.6% over the next 12 months, a deceleration versus the last two years. Still, this projection is admirable and suggests the market is forecasting success for its products and services.

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

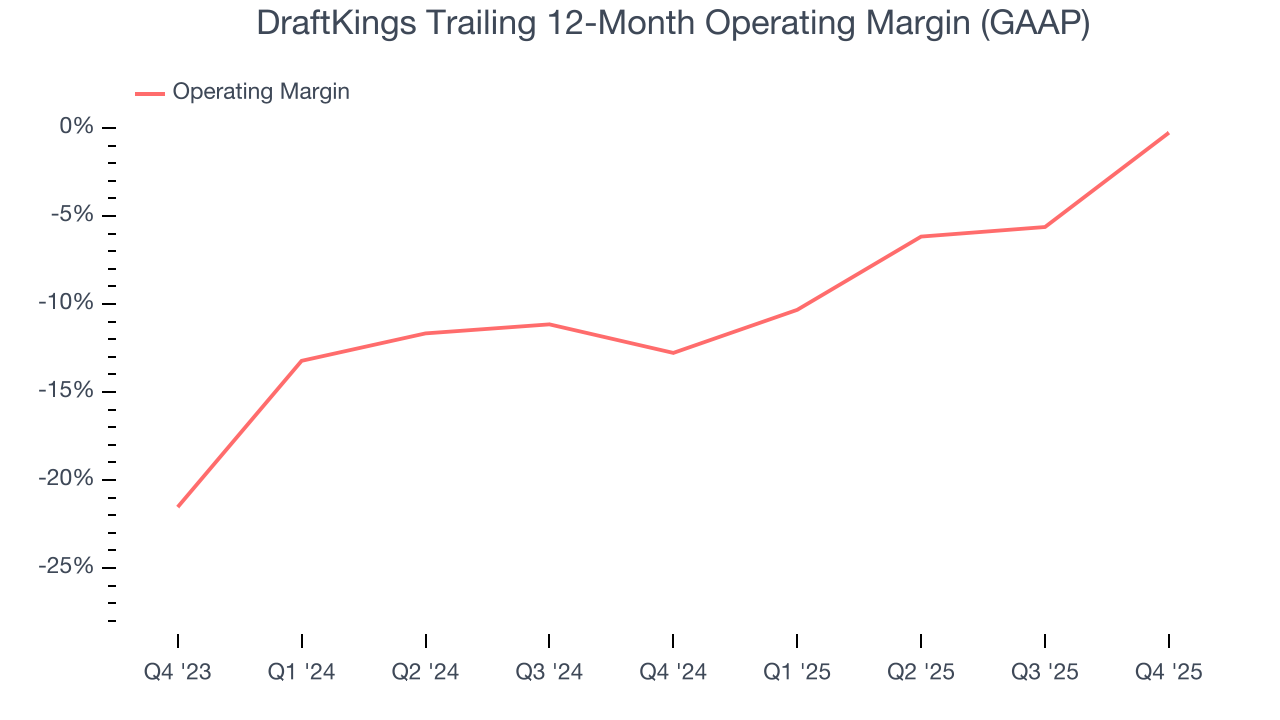

DraftKings’s operating margin has been trending up over the last 12 months, but it still averaged negative 5.8% over the last two years. This is due to its large expense base and inefficient cost structure.

This quarter, DraftKings generated an operating margin profit margin of 7.6%, up 17.6 percentage points year on year. This increase was a welcome development and shows it was more efficient.

7. Earnings Per Share

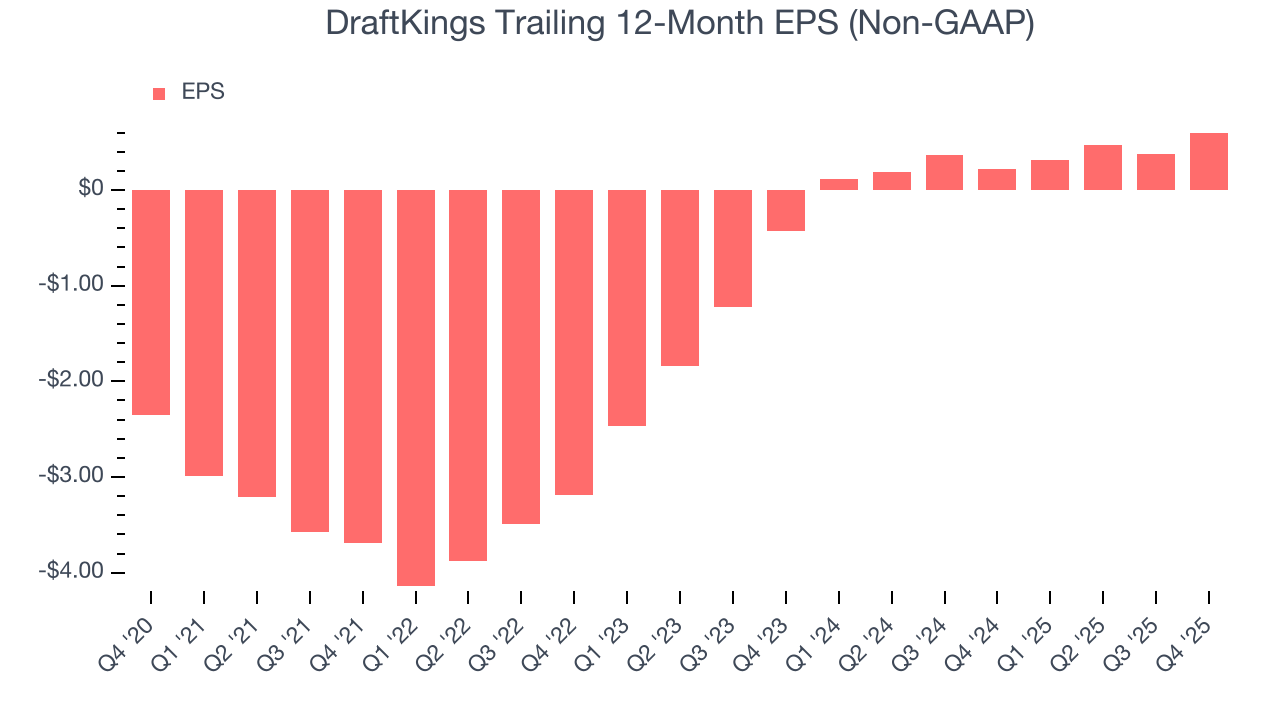

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

DraftKings’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q4, DraftKings reported adjusted EPS of $0.36, up from $0.14 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street expects DraftKings’s full-year EPS of $0.60 to grow 95.3%.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

DraftKings has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 9.4%, lousy for a consumer discretionary business.

DraftKings’s free cash flow clocked in at $278.8 million in Q4, equivalent to a 14% margin. The company’s cash profitability regressed as it was 9.2 percentage points lower than in the same quarter last year, but it’s still above its two-year average. We wouldn’t put too much weight on this quarter’s decline because capital expenditures can be seasonal and companies often stockpile inventory in anticipation of higher demand, causing short-term swings. Long-term trends are more important.

Over the next year, analysts predict DraftKings’s cash conversion will improve. Their consensus estimates imply its free cash flow margin of 10.1% for the last 12 months will increase to 12.5%, it options for capital deployment (investments, share buybacks, etc.).

9. Balance Sheet Assessment

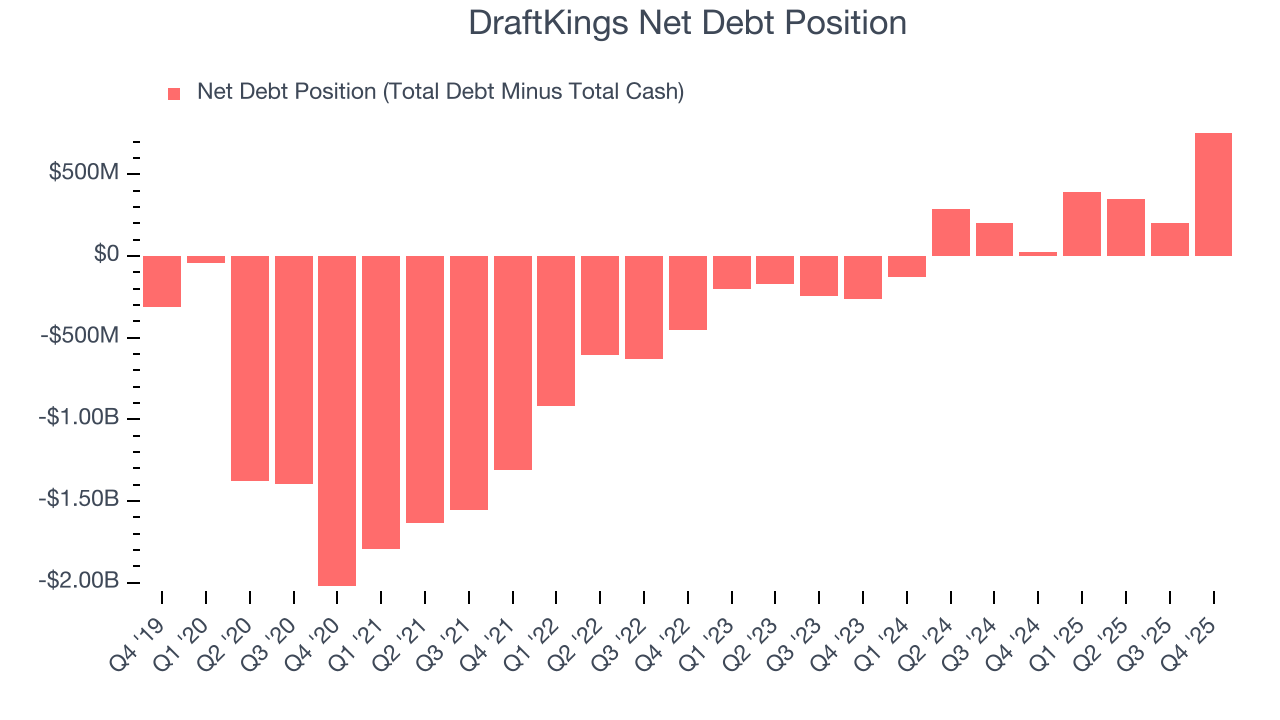

DraftKings reported $1.14 billion of cash and $1.89 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $620 million of EBITDA over the last 12 months, we view DraftKings’s 1.2× net-debt-to-EBITDA ratio as safe. We also see its $19.94 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

10. Key Takeaways from DraftKings’s Q4 Results

We were impressed by how significantly DraftKings blew past analysts’ EBITDA expectations this quarter. On the other hand, its full-year revenue guidance missed and its full-year EBITDA guidance fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 8.5% to $23.02 immediately after reporting.

11. Is Now The Time To Buy DraftKings?

Updated: February 25, 2026 at 9:35 PM EST

Before investing in or passing on DraftKings, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

We see the value of companies helping consumers, but in the case of DraftKings, we’re out. Although its revenue growth was impressive over the last five years, it’s expected to deteriorate over the next 12 months and its Forecasted free cash flow margin for next year suggests the company will fail to improve its cash conversion. And while the company’s projected EPS for the next year implies the company’s fundamentals will improve, the downside is its low free cash flow margins give it little breathing room.

DraftKings’s P/E ratio based on the next 12 months is 19.7x. While this valuation is reasonable, we don’t see a big opportunity at the moment. There are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $36.23 on the company (compared to the current share price of $22.88).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.