DraftKings (DKNG)

We’re cautious of DraftKings. Its growth has decelerated and its failure to generate meaningful free cash flow makes us question its prospects.― StockStory Analyst Team

1. News

2. Summary

Why We Think DraftKings Will Underperform

Getting its start in daily fantasy sports, DraftKings (NASDAQ:DKNG) is a digital sports entertainment and gaming company.

- Poor expense management has led to operating margin losses

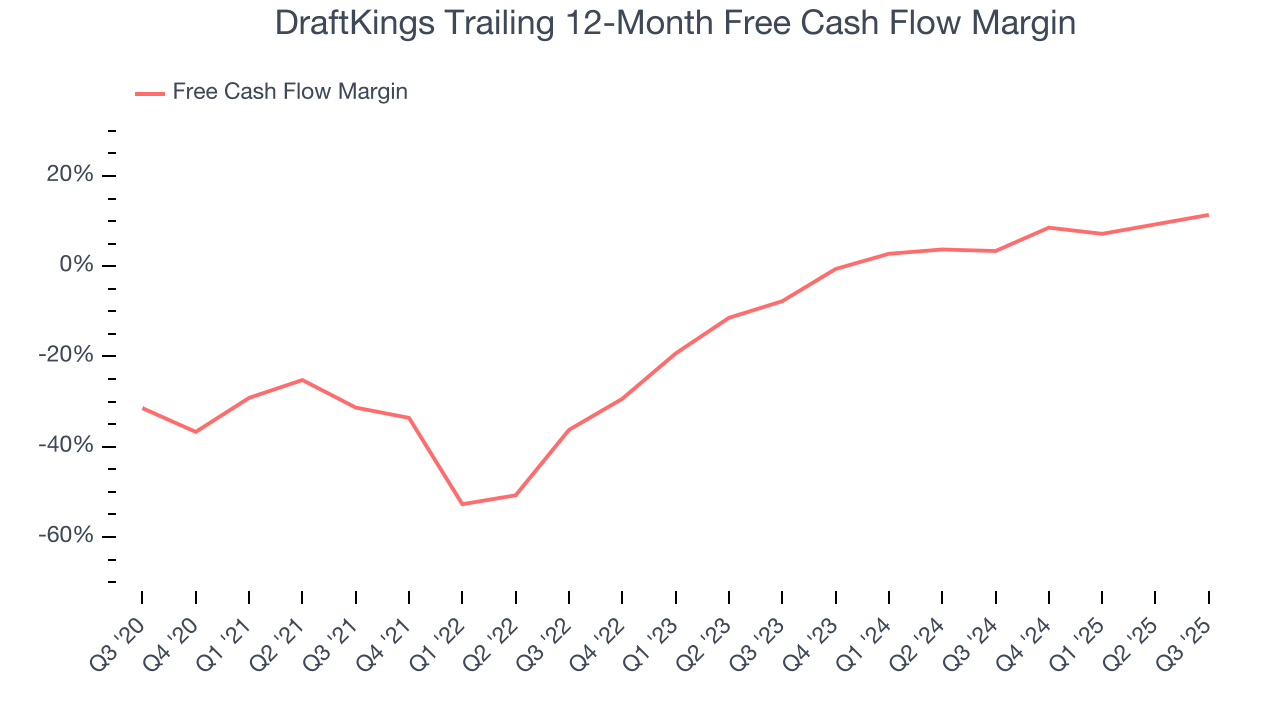

- Low free cash flow margin gives it little breathing room, constraining its ability to self-fund growth or return capital to shareholders

- A consolation is that its expected revenue growth of 26.7% for the next year suggests its market share will rise

DraftKings lacks the business quality we seek. We’d search for superior opportunities elsewhere.

Why There Are Better Opportunities Than DraftKings

Why There Are Better Opportunities Than DraftKings

At $31.58 per share, DraftKings trades at 30.7x forward P/E. This multiple is higher than most consumer discretionary companies, and we think it’s quite expensive for the quality you get.

We prefer to invest in similarly-priced but higher-quality companies with superior earnings growth.

3. DraftKings (DKNG) Research Report: Q3 CY2025 Update

Fantasy sports and betting company DraftKings (NASDAQ:DKNG) missed Wall Street’s revenue expectations in Q3 CY2025 as sales rose 4.4% year on year to $1.14 billion. The company’s full-year revenue guidance of $6 billion at the midpoint came in 3.1% below analysts’ estimates. Its non-GAAP loss of $0.26 per share was in line with analysts’ consensus estimates.

DraftKings (DKNG) Q3 CY2025 Highlights:

- Revenue: $1.14 billion vs analyst estimates of $1.21 billion (4.4% year-on-year growth, 5.6% miss)

- Adjusted EPS: -$0.26 vs analyst estimates of -$0.26 (in line)

- Adjusted EBITDA: -$126.5 million vs analyst estimates of -$68.74 million (-11.1% margin, 84% miss)

- The company dropped its revenue guidance for the full year to $6 billion at the midpoint from $6.3 billion, a 4.8% decrease

- EBITDA guidance for the full year is $500 million at the midpoint, below analyst estimates of $746.3 million

- Operating Margin: -23.8%, up from -27.3% in the same quarter last year

- Free Cash Flow Margin: 21.9%, up from 11.9% in the same quarter last year

- Monthly Unique Payers: 3.6 million, in line with the same quarter last year

- Market Capitalization: $13.86 billion

Company Overview

Getting its start in daily fantasy sports, DraftKings (NASDAQ:DKNG) is a digital sports entertainment and gaming company.

DraftKings was founded in 2012 by Jason Robins, Matthew Kalish, and Paul Liberman to capitalize on sports betting legalization in the United States. On its platform, it offers daily fantasy sports contests across various professional sports leagues as well as sports betting and online casino games.

The company's primary revenue stream comes from its online gaming platforms, including the entry fees for daily fantasy sports contests, sports betting wagers, and online casino gaming. DraftKings also utilizes a technology-driven approach to sports betting and gaming, allowing for scalability and customer convenience. For example, consumers can download the DraftKings app on their mobile devices and instantly place bets from their couches on a user-friendly interface.

A unique aspect of DraftKing's business is that the legalization of sports betting is a major factor, and in the United States, gambling legislation is determined on a state-by-state basis. As such, when a new state "opens" (aka sports betting is legalized), companies like DraftKings typically make huge marketing pushes to win new consumers.

4. Gaming Solutions

Gaming solution companies operate in a dynamic and evolving market, and the digital transformation of the gaming industry presents significant opportunities for innovation and growth, whether it be immersive slot machine terminals or mobile sports betting. However, the gaming solution industry is not without its challenges. Regulatory compliance is a crucial consideration as companies must navigate a complex and often fragmented regulatory landscape across different jurisdictions. Changes in regulations can impact product offerings, operational practices, and market access, requiring companies to maintain flexibility and adaptability in their business strategies. Additionally, the competitive nature of the industry necessitates continuous investment in research and development to stay ahead of competitors and meet evolving consumer demands.

Competitors in the digital sports entertainment and gaming sector include Caesars Entertainment (NASDAQ:CZR), PENN Entertainment (NASDAQ:PENN),and Rush Street Interactive (NYSE: RSI).

5. Revenue Growth

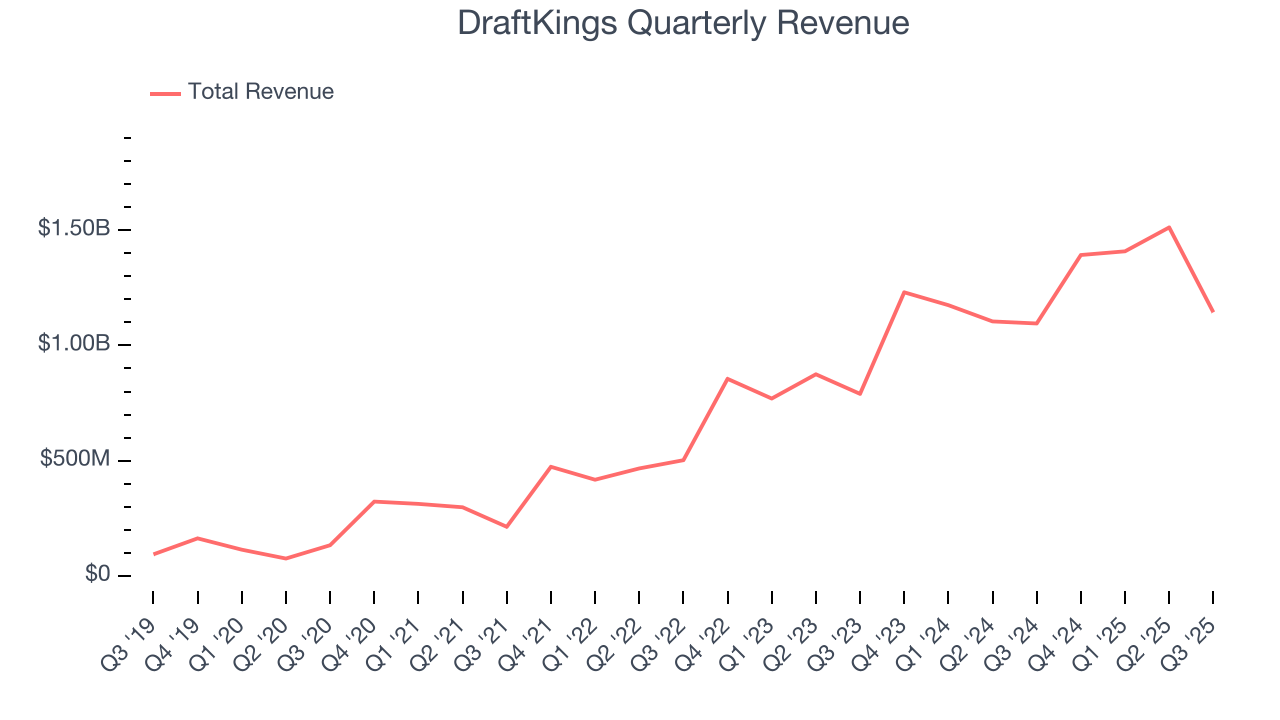

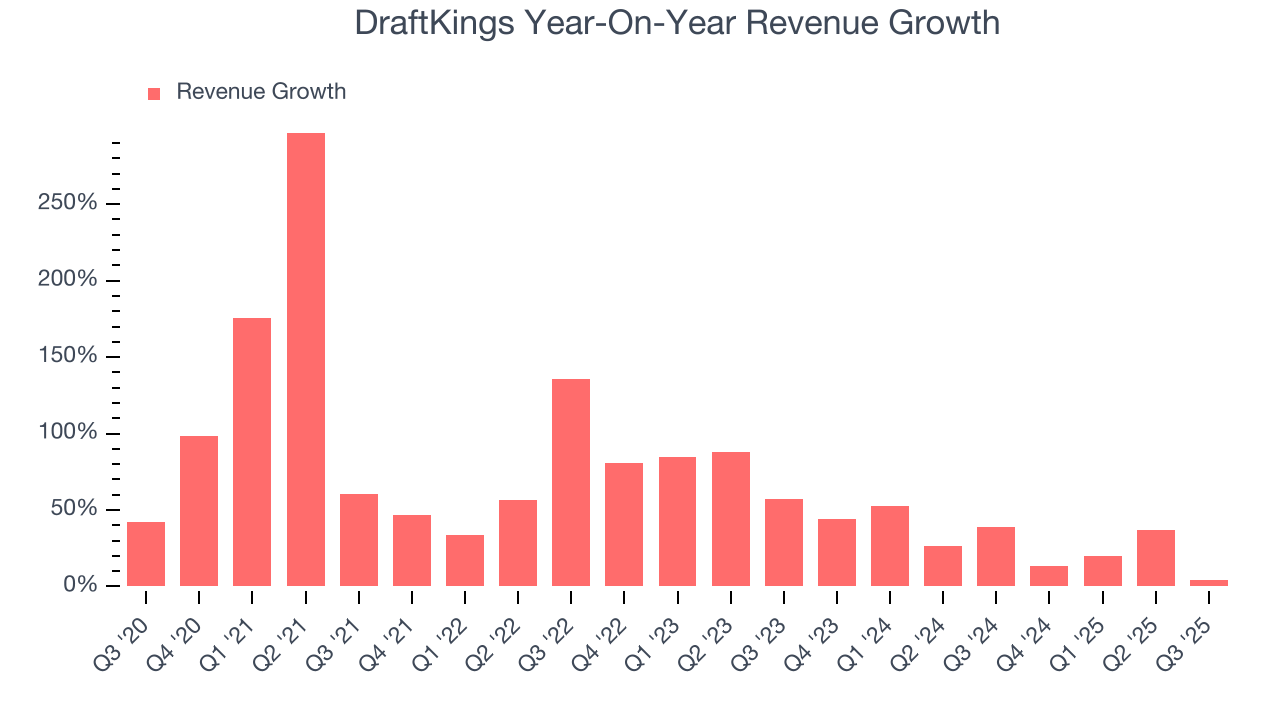

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, DraftKings’s sales grew at an incredible 62.4% compounded annual growth rate over the last five years. Its growth beat the average consumer discretionary company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. DraftKings’s annualized revenue growth of 28.8% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, DraftKings’s revenue grew by 4.4% year on year to $1.14 billion, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 29% over the next 12 months, similar to its two-year rate. This projection is eye-popping and indicates the market is forecasting success for its products and services.

6. Operating Margin

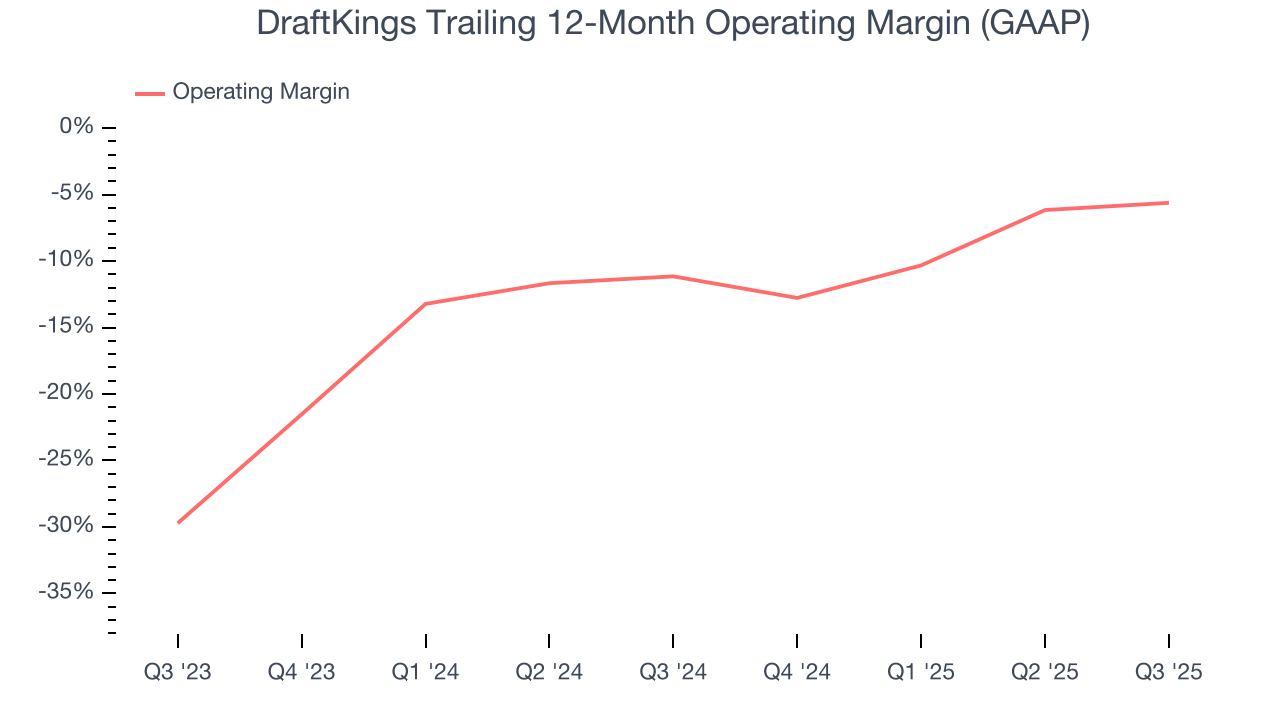

DraftKings’s operating margin has been trending up over the last 12 months, but it still averaged negative 8.2% over the last two years. This is due to its large expense base and inefficient cost structure. It might have a shot at long-term profitability if it can scale quickly and gain operating leverage.

In Q3, DraftKings generated a negative 23.8% operating margin.

7. Earnings Per Share

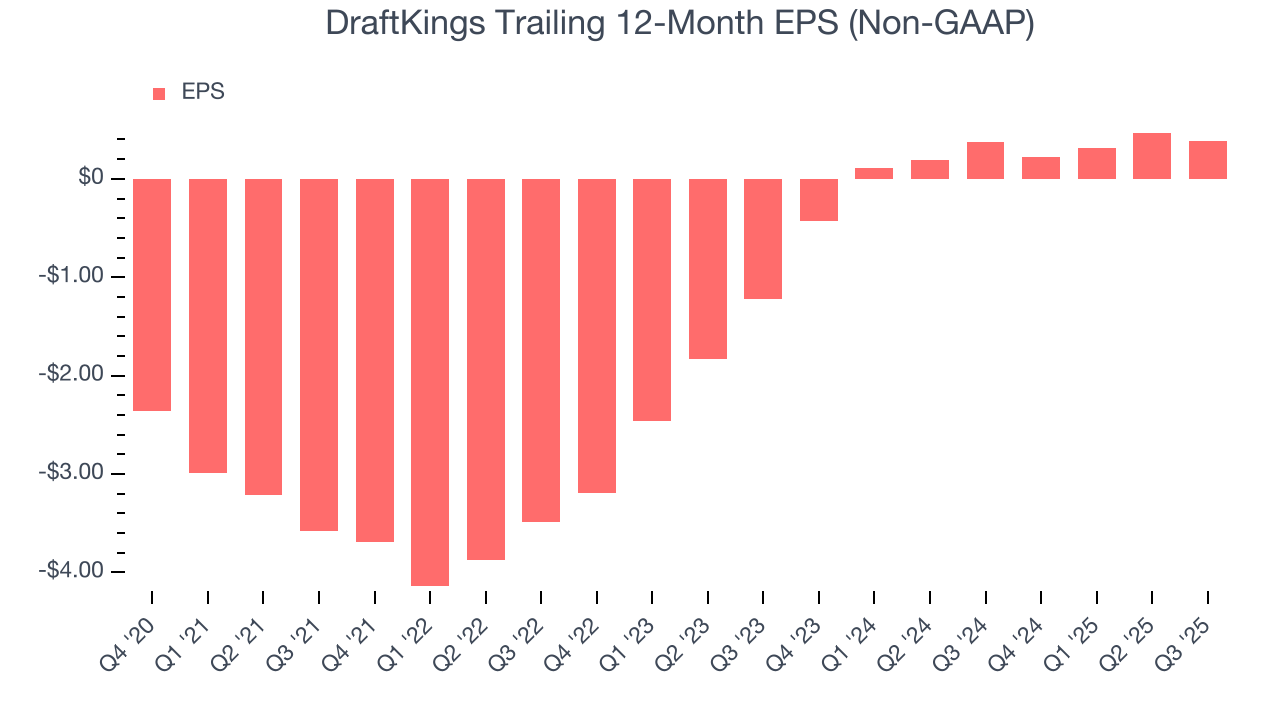

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

DraftKings’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

In Q3, DraftKings reported adjusted EPS of negative $0.26, down from negative $0.17 in the same quarter last year. This print slightly missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects DraftKings’s full-year EPS of $0.38 to grow 325%.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

DraftKings has shown weak cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 7.7%, subpar for a consumer discretionary business.

DraftKings’s free cash flow clocked in at $250 million in Q3, equivalent to a 21.9% margin. This result was good as its margin was 9.9 percentage points higher than in the same quarter last year. Its cash profitability was also above its two-year level, and we hope the company can build on this trend.

Over the next year, analysts predict DraftKings’s cash conversion will improve. Their consensus estimates imply its free cash flow margin of 11.4% for the last 12 months will increase to 14.8%, giving it more flexibility for investments, share buybacks, and dividends.

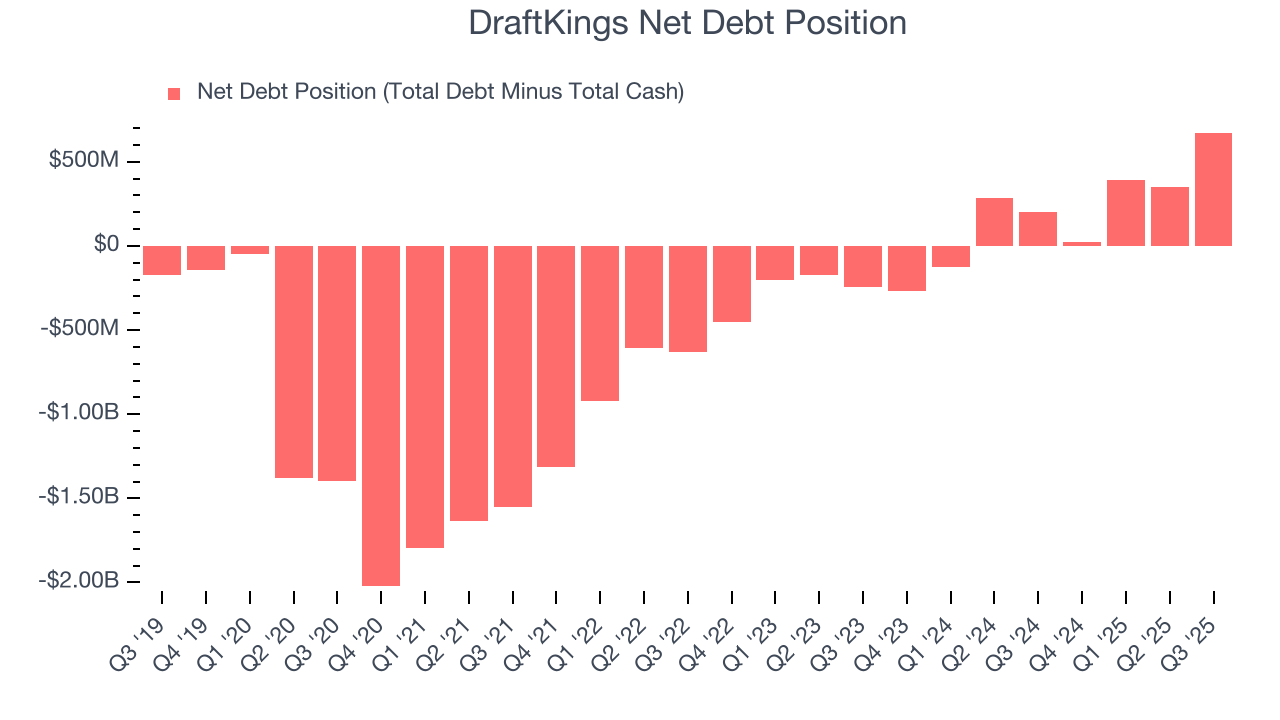

9. Balance Sheet Assessment

DraftKings reported $1.23 billion of cash and $1.91 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $366.2 million of EBITDA over the last 12 months, we view DraftKings’s 1.8× net-debt-to-EBITDA ratio as safe. We also see its $6.49 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

10. Key Takeaways from DraftKings’s Q3 Results

We struggled to find many positives in these results, as its revenue missed and its EBITDA fell short of analysts' expectations by a country mile. Additionally, it lowered its full-year revenue and EBITDA guidance. Overall, this was a softer quarter. The stock traded down 4.9% to $26.60 immediately following the results.

11. Is Now The Time To Buy DraftKings?

Updated: January 21, 2026 at 9:30 PM EST

Are you wondering whether to buy DraftKings or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

DraftKings isn’t a terrible business, but it isn’t one of our picks. Although its revenue growth was impressive over the last five years, it’s expected to deteriorate over the next 12 months and its Forecasted free cash flow margin for next year suggests the company will fail to improve its cash conversion. And while the company’s projected EPS for the next year implies the company’s fundamentals will improve, the downside is its low free cash flow margins give it little breathing room.

DraftKings’s P/E ratio based on the next 12 months is 31.4x. Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $45.47 on the company (compared to the current share price of $31.60).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.