Domo (DOMO)

Domo is in for a bumpy ride. Its underwhelming revenue growth and failure to generate meaningful free cash flow is a concerning trend.― StockStory Analyst Team

1. News

2. Summary

Why We Think Domo Will Underperform

Named for the Japanese word meaning "thank you very much," Domo (NASDAQ:DOMO) provides a cloud-based business intelligence platform that connects people with real-time data and insights across organizations.

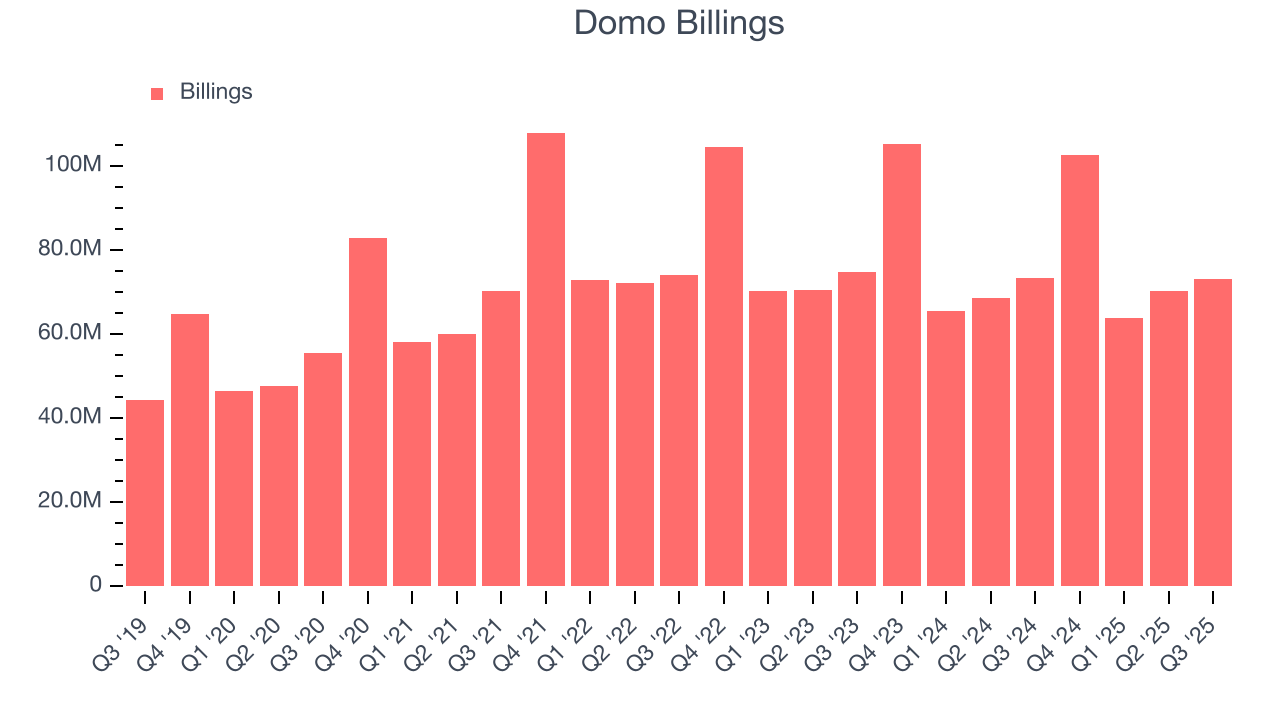

- Billings didn’t grow over the last year, suggesting the company struggled to sell its software and might have to lower prices to stimulate growth

- Projected sales growth of 1.3% for the next 12 months suggests sluggish demand

- Customer acquisition costs take a while to recoup, making it difficult to justify sales and marketing investments that could increase revenue

Domo doesn’t meet our quality standards. We believe there are better opportunities elsewhere.

Why There Are Better Opportunities Than Domo

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Domo

Domo is trading at $4.09 per share, or 0.5x forward price-to-sales. This sure is a cheap multiple, but you get what you pay for.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. Domo (DOMO) Research Report: Q3 CY2025 Update

Business intelligence platform Domo (NASDAQ:DOMO) met Wall Streets revenue expectations in Q3 CY2025, but sales were flat year on year at $79.4 million. On the other hand, next quarter’s revenue guidance of $78.5 million was less impressive, coming in 0.9% below analysts’ estimates. Its non-GAAP profit of $0.01 per share was significantly above analysts’ consensus estimates.

Domo (DOMO) Q3 CY2025 Highlights:

- Revenue: $79.4 million vs analyst estimates of $79.04 million (flat year on year, in line)

- Adjusted EPS: $0.01 vs analyst estimates of -$0.05 (significant beat)

- Adjusted Operating Income: $5.42 million vs analyst estimates of $2.99 million (6.8% margin, 80.9% beat)

- Revenue Guidance for Q4 CY2025 is $78.5 million at the midpoint, below analyst estimates of $79.23 million

- Management lowered its full-year Adjusted EPS guidance to -$0.09 at the midpoint, a 160% decrease

- Operating Margin: -8.7%, up from -13.9% in the same quarter last year

- Free Cash Flow Margin: 2.6%, similar to the previous quarter

- Billings: $73.2 million at quarter end, in line with the same quarter last year

- Market Capitalization: $482.8 million

Company Overview

Named for the Japanese word meaning "thank you very much," Domo (NASDAQ:DOMO) provides a cloud-based business intelligence platform that connects people with real-time data and insights across organizations.

Domo's platform addresses the fragmentation problem in business intelligence by unifying seven core functions into a single solution: data connection, storage, preparation, analysis, visualization, collaboration, and AI-powered insights. The platform can connect to over 1,000 data sources through pre-built connectors, allowing organizations to integrate information from disparate systems without extensive technical knowledge.

What makes Domo particularly valuable is its accessibility across all organizational levels. From C-suite executives to frontline employees, users can access relevant data through intuitive dashboards on both desktop and mobile devices. For example, a retail manager can use Domo on their smartphone to instantly view store performance metrics while walking the sales floor, filtering data to identify specific product line issues and sharing insights with their team in real-time.

Domo's platform includes "Magic ETL," a low-code tool that allows users to transform and blend data without specialized programming skills. The system also features built-in AI capabilities, enabling predictive analytics, anomaly detection, and natural language processing. Customers can deploy these capabilities through a simple drag-and-drop interface or leverage more advanced options like custom Python and R scripting for specialized needs.

The company monetizes its platform through subscription-based pricing, with fees determined by feature packages or usage levels. Typically entering organizations through a specific department or use case, Domo expands its footprint as more users recognize its value and capabilities, following a "land, expand, and retain" business model. Domo also offers embedded analytics through "Domo Everywhere," allowing organizations to securely share data visualizations with external partners and customers.

4. Data Analytics

Organizations generate a lot of data that is stored in silos, often in incompatible formats, making it slow and costly to extract actionable insights, which in turn drives demand for modern cloud-based data analysis platforms that can efficiently analyze the siloed data.

Domo competes with large enterprise software providers like Microsoft, Oracle, SAP, Salesforce, and IBM. In the specialized business analytics space, it faces competition from Tableau (owned by Salesforce), Qlik, Looker (owned by Google), MicroStrategy, ThoughtSpot, Sisense, and Tibco Software.

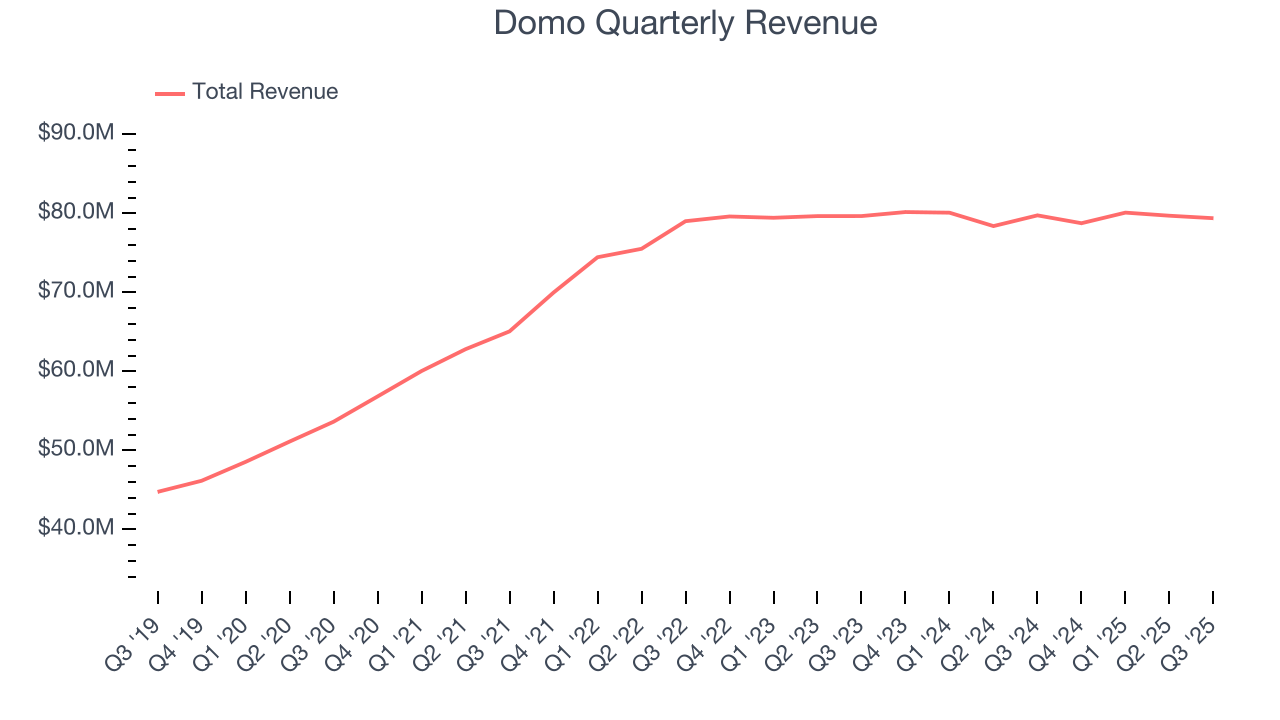

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, Domo’s 9.8% annualized revenue growth over the last five years was sluggish. This fell short of our benchmark for the software sector and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. Domo’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

This quarter, Domo’s $79.4 million of revenue was flat year on year and in line with Wall Street’s estimates. Company management is currently guiding for flat sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 1.3% over the next 12 months, similar to its two-year rate. While this projection implies its newer products and services will fuel better top-line performance, it is still below the sector average.

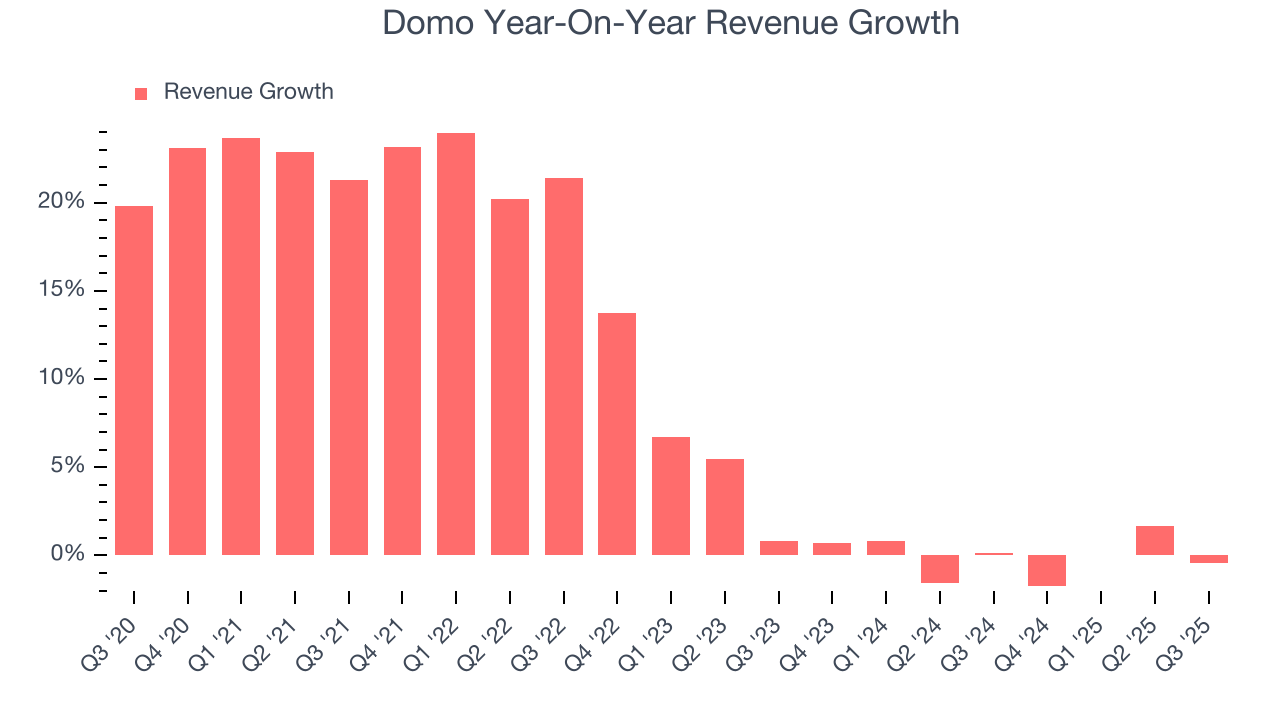

6. Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Over the last year, Domo failed to grow its billings, which came in at $73.2 million in the latest quarter. This performance mirrored its total sales and shows the company faced challenges in acquiring and retaining customers. It also suggests there may be increasing competition or market saturation.

7. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Domo’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its incremental sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a highly competitive environment where there is little differentiation between Domo’s products and its peers.

8. Gross Margin & Pricing Power

For software companies like Domo, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

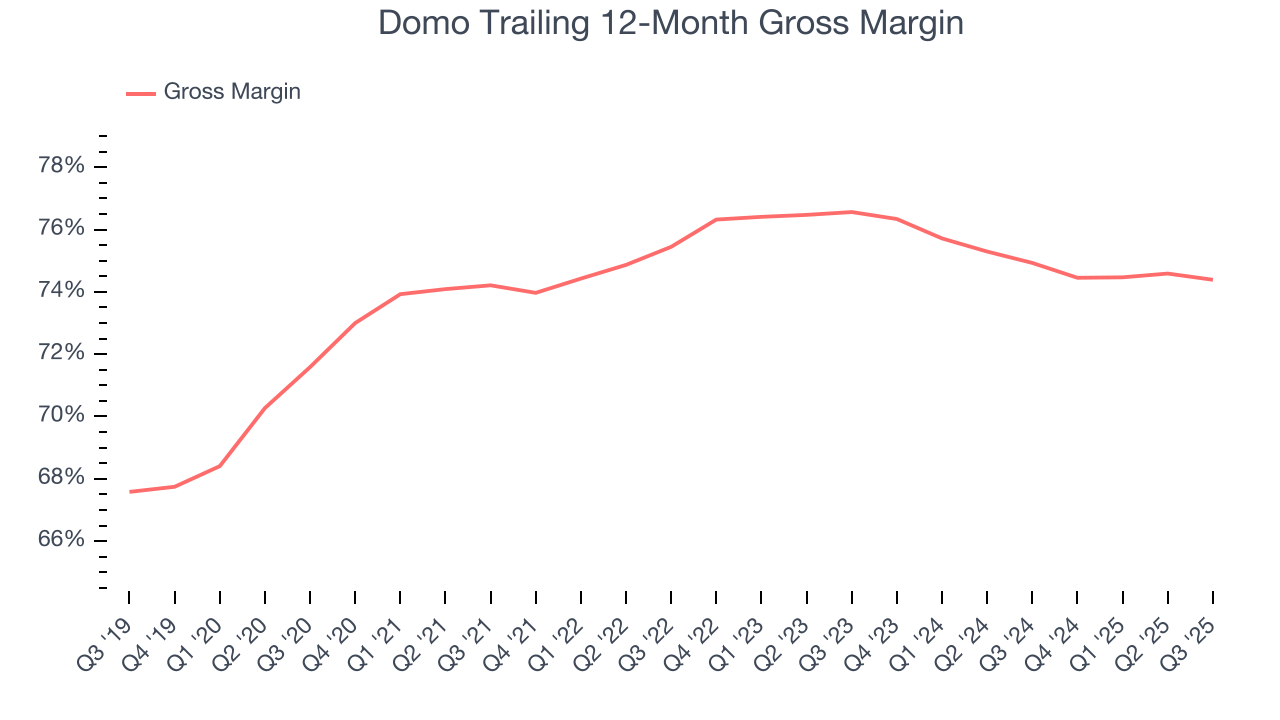

Domo’s gross margin is better than the broader software industry and signals it has solid unit economics and competitive products. As you can see below, it averaged a decent 74.4% gross margin over the last year. Said differently, Domo paid its providers $25.61 for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Domo has seen gross margins decline by 2.2 percentage points over the last 2 year, which is among the worst in the software space.

Domo’s gross profit margin came in at 74.2% this quarter, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs have been stable and it isn’t under pressure to lower prices.

9. Operating Margin

While many software businesses point investors to their adjusted profits, which exclude stock-based compensation (SBC), we prefer GAAP operating margin because SBC is a legitimate expense used to attract and retain talent. This metric shows how much revenue remains after accounting for all core expenses – everything from the cost of goods sold to sales and R&D.

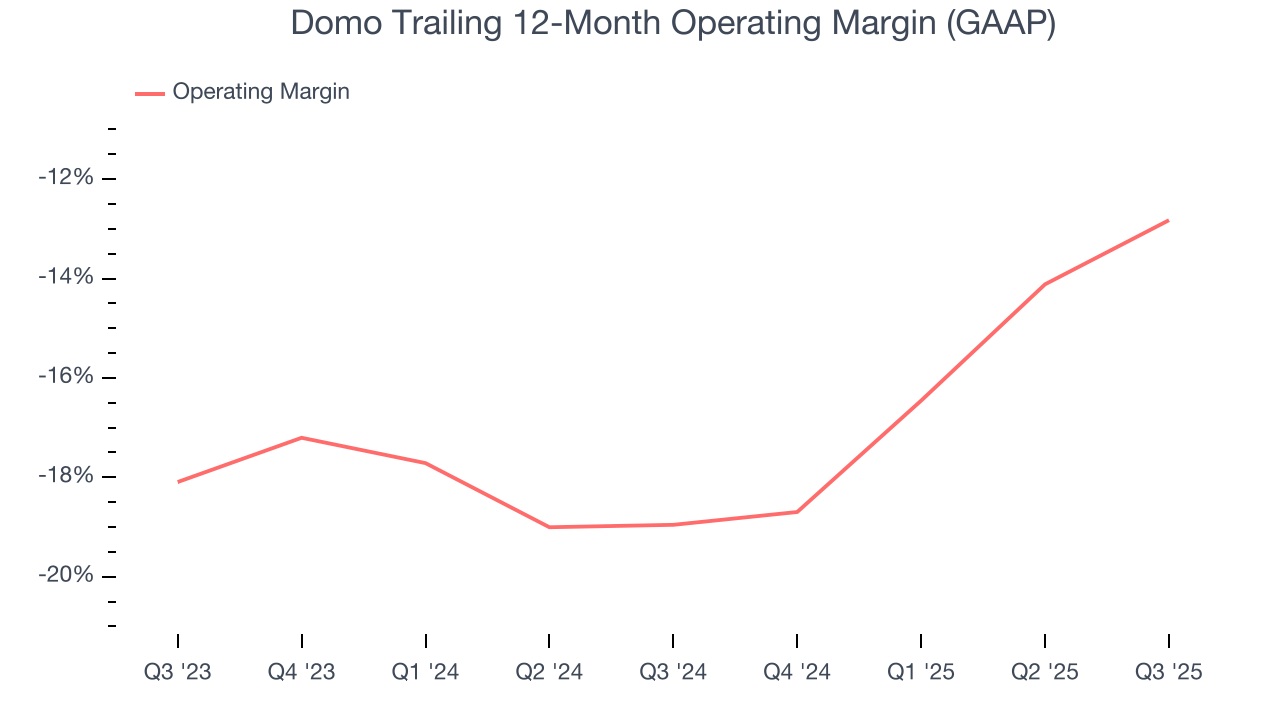

Domo’s expensive cost structure has contributed to an average operating margin of negative 12.8% over the last year. Unprofitable software companies require extra attention because they spend heaps of money to capture market share. As seen in its historically underwhelming revenue performance, this strategy hasn’t worked so far, and it’s unclear what would happen if Domo reeled back its investments. Wall Street seems to think it will face some obstacles, and we tend to agree.

Over the last two years, Domo’s expanding sales gave it operating leverage as its margin rose by 6.1 percentage points. Still, it will take much more for the company to reach long-term profitability.

This quarter, Domo generated a negative 8.7% operating margin. The company's consistent lack of profits raise a flag.

10. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

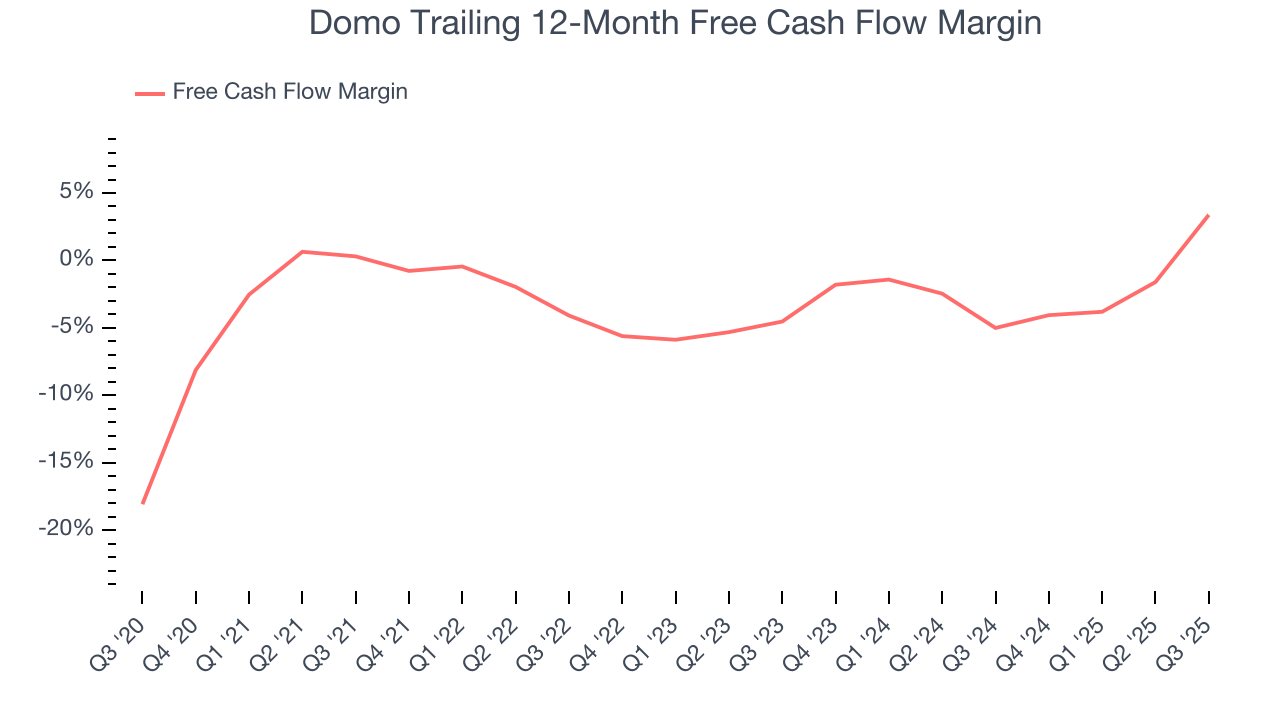

Domo has shown poor cash profitability over the last year, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.4%, lousy for a software business.

Domo’s free cash flow clocked in at $2.07 million in Q3, equivalent to a 2.6% margin. Its cash flow turned positive after being negative in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends trump fluctuations.

Over the next year, analysts predict Domo’s cash conversion will slightly fall. Their consensus estimates imply its free cash flow margin of 3.4% for the last 12 months will decrease to 4.7%.

11. Balance Sheet Assessment

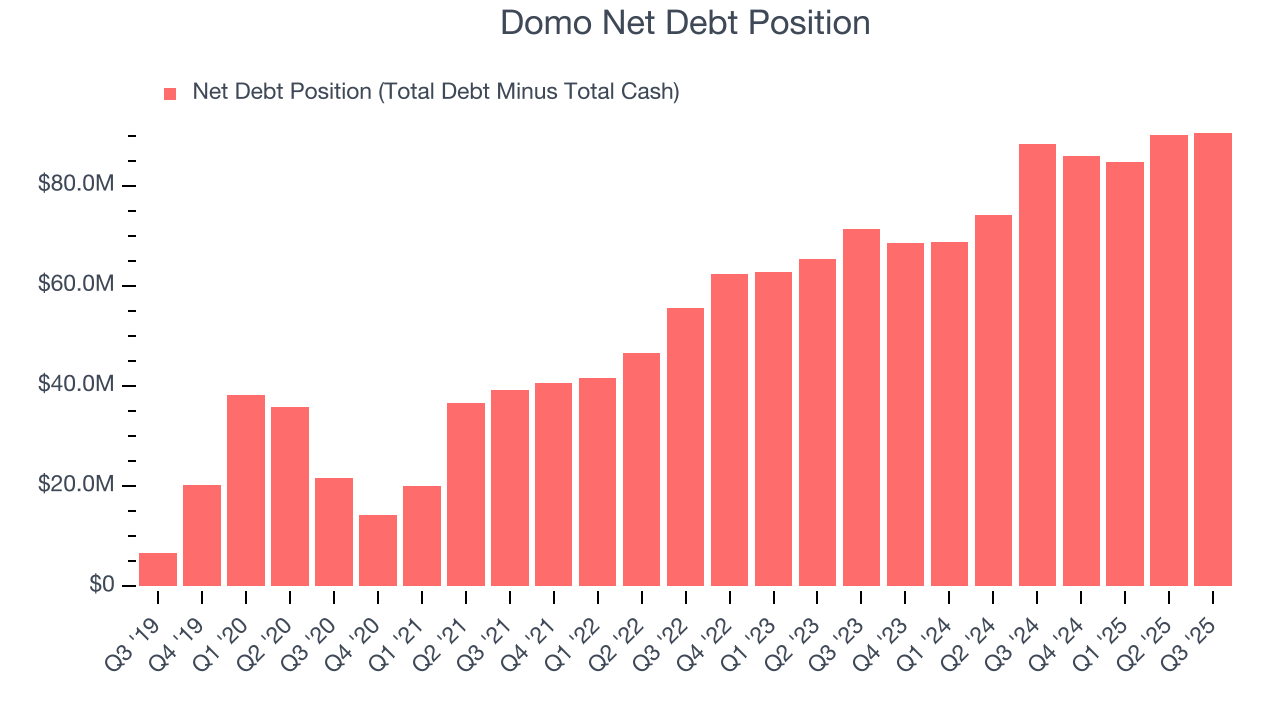

Domo reported $47.87 million of cash and $138.5 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $25.17 million of EBITDA over the last 12 months, we view Domo’s 3.6× net-debt-to-EBITDA ratio as safe. We also see its $14.8 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Domo’s Q3 Results

We were impressed by Domo’s optimistic EPS guidance for next quarter, which blew past analysts’ expectations. We were also glad its full-year EPS guidance trumped Wall Street’s estimates. On the other hand, its billings missed and its revenue guidance for next quarter fell slightly short of Wall Street’s estimates. Zooming out, we think this was a mixed quarter. Investors were likely hoping for more, and shares traded down 9.3% to $10.52 immediately following the results.

13. Is Now The Time To Buy Domo?

Updated: February 16, 2026 at 9:25 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

We see the value of companies addressing major business pain points, but in the case of Domo, we’re out. To begin with, its revenue growth was weak over the last five years, and analysts expect its demand to deteriorate over the next 12 months. While its gross margin suggests it can generate sustainable profits, the downside is its customer acquisition is less efficient than many comparable companies. On top of that, its operating margins reveal poor profitability compared to other software companies.

Domo’s price-to-sales ratio based on the next 12 months is 0.5x. While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $12.25 on the company (compared to the current share price of $4.09).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.